Returning to the original vision of Bitcoin, a P2P system that empowers individuals and achieves true decentralization.

Author: CKB Eco Fund

* This article is a collective effort of CKB Eco Fund, with many insights gained from discussions with Jan Xie, Cipher Wang, Han Tang, Baiyu, and Chester Chen. Author of this article: Dr. Hongzhou Chen, Research Director, hongzhou@ckbeco.fund

1 Introduction

In recent years, the blockchain industry has been filled with a sense of nihilism, with many believing that it has deviated from the original vision of a "P2P electronic cash system" outlined in the Bitcoin whitepaper[1]. Innovation has stagnated, with little real value creation or widespread adoption. Instead, the field has been dominated by speculative gambling, as noted by Peter Szilagyi.

The root of this dilemma lies in the Ethereum model, which has led the entire industry astray. Undoubtedly, Ethereum has ushered in a new era for programmable blockchains and has driven the prosperity of the entire industry in recent years. However, Ethereum has now gone astray. Attempting to turn blockchain into a universal "world computer," Ethereum not only faces serious scalability challenges but has also given rise to a plethora of "nominally decentralized" (DINO) or pseudo-decentralized applications and platforms. This flawed approach has reintroduced the rent-seeking intermediaries and centralized bottlenecks that blockchain was supposed to eliminate. However, all is not lost. By critically examining Ethereum's mistakes and reigniting the P2P vision of Bitcoin, the industry can still get back on track. Accordingly, this article believes that the correct P2P vision will lead the future of Web5, which is the fusion of the best aspects of Web2 and Web3, with Bitcoin as its pillar (Web5 = Web2 + Web3).

First, from a socio-technical perspective, we will analyze three key dimensions of Ethereum's pseudo-decentralized model: Participation, Ownership, and Distribution, and how they lead to results contrary to Bitcoin's P2P vision. Next, we will re-examine the architecture of Bitcoin and how its design avoids or mitigates these issues. Then, we propose the "Public Lightning Network Scheme" as a roadmap to achieve a truly P2P value network based on Bitcoin. Finally, we will illustrate our understanding of concepts such as BTCFi, P2P economy, and Web5 through use cases.

The road ahead will not be smooth. But by rediscovering the fundamentals of Bitcoin (Proof of Work (PoW) + Unspent Transaction Output (UTXO)) and leveraging emerging technologies such as the Lightning Network, we can lay the foundation for Web5. Let us work together to reclaim the P2P vision and embrace the innovation-unimpeded, empowering future of Web5.

2 Ethereum's Pseudo-Decentralization Trap

2.1 Distinguishing Decentralization from P2P

First, we must acknowledge Ethereum's significant contributions to the development of the blockchain industry. As the first platform to introduce smart contract functionality, Ethereum paved the way for programmable blockchains and decentralized applications (DApps). Its innovative Ethereum Virtual Machine and Solidity programming language enabled developers to build complex, Turing-complete smart contracts, opening up endless possibilities beyond simple value transfer. Additionally, Ethereum's controversial initial coin offering (ICO) model democratized the fundraising process and accelerated the development of the blockchain ecosystem. When criticizing Ethereum's current state, we cannot overlook these achievements. However, as the inventor of the concept of smart contracts, Nick Szabo, criticized, Ethereum, which once seemed so promising, has degenerated into a centralized cult and become a garbage coin. What exactly happened?

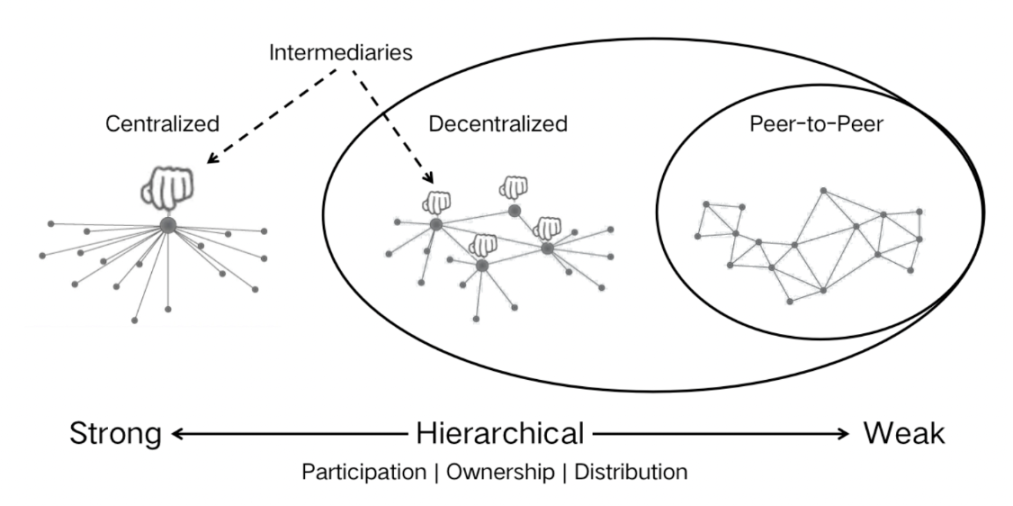

Figure 1: P2P aims to avoid centralization in participation, ownership, and distribution.

To understand the reasons for Ethereum's deviation, it is crucial to distinguish between decentralization and peer-to-peer (P2P) architecture. Although these two terms are often used interchangeably, there are significant differences between them. A decentralized system may still include hierarchies or intermediaries, while a true P2P system aims to eliminate them, enabling direct interaction among participants[2].

This distinction also has profound social and economic implications. Economists argue that hierarchical systems, as opposed to P2P, may lead to power concentration and the emergence of new intermediaries, which subsequently capture rents, restrict access, and influence the evolution of the system[3],[4]. Hierarchy in social-technical systems is primarily manifested in three dimensions: Participation, Ownership, and Distribution[5],[6]. A true P2P system minimizes these hierarchical aspects to ensure fair access, control, and rewards.

From this perspective, the industry's emphasis on "decentralization" actually aligns more closely with the principles of P2P rather than its literal meaning. Figure 1 illustrates how P2P systems avoid centralization in participation, ownership, and distribution. However, while Ethereum claims decentralization (we know it actually refers to P2P), it has led to power concentration and the emergence of new intermediaries in these dimensions, deviating from the P2P vision outlined in Satoshi Nakamoto's Bitcoin whitepaper. By analyzing pseudo-decentralization, we can identify where Ethereum deviates from the original P2P vision and how to realign with it.

2.2 Pseudo-Decentralization in Participation: The Fallacy of "Everything on the Chain"

Ethereum has ushered in a new era for programmable assets and decentralized applications, attracting numerous developers and users. However, Ethereum's pursuit of becoming a "world computer," extreme adherence to the big block principle, has led to concerning centralization trends[7]. The mindset of "everything on the chain" has overwhelmed Ethereum's base layer, resulting in network congestion, slow transaction speeds, and increased fees. This has forced Ethereum to transition from Proof of Work (PoW) to Proof of Stake (PoS), compromising the security of the ledger and concentrating power in the hands of a few large stakeholders[8]. The rise of the staking model has exacerbated centralization, as seen in projects like Merlin Chain, which introduced the PoS mechanism to Bitcoin, proving to be disastrous. Additionally, projects like Babylon attempted to use Bitcoin's security to safeguard PoS-based blockchains instead of enhancing Bitcoin's security, undermining the principle of decentralization and raising concerns about its effectiveness.

The attempt to turn blockchain into a "world computer" is misleading. In fact, blockchain enhances social circulation rather than creating it; it is a technological advancement in the relations of production rather than the means of production[9]. Even Vitalik admits that blockchain is inefficient in computation and storage, trading performance for censorship resistance and trustless consensus[10]. Ironically, Ethereum, by putting everything on the chain, has fallen into its own known trap. Blockchain should focus on its socio-technical mission: providing a neutral, censorship-resistant settlement layer, rather than attempting to be everything. Most computation and data storage should occur off-chain, with only critical state updates being on-chain.

2.3 Pseudo-Decentralization in Ownership: The Trap of Blockchain as an "Intermediary"

In the 1970s, Chile's Project Cybersyn attempted to manage the economy through central computer control but failed due to elitism and centralization[11]. Ethereum's development is similar in this regard, as its account-based model and smart contract-centric design have fostered new technological bureaucratic elites, especially among L2 solution providers and core developers of the Ethereum Foundation (EF). These groups control critical infrastructure, capture economic rents, and gradually concentrate power and wealth. The account model abstracts and conceals true asset ownership, creating the illusion of decentralization. Furthermore, the revolving door between EF and prominent L2 projects, such as EF researchers "re-staking" to projects like EigenLayer, exacerbates conflicts of interest and perpetuates a culture of sponsorship, where projects approved by Vitalik and EF are seen as legitimate, while others are marginalized[13].

From a technical perspective, Ethereum's account model and state design have fostered this centralization. The account model tightly integrates asset ownership with application layer logic, transforming peer-to-peer interactions into peer-to-contract relationships[14]. This global state model not only introduces central control points but also leads to rapid state growth with increasing transactions and smart contracts, further concentrating power. The extraction of MEV (Maximal Extractable Value) through L2 solutions further demonstrates this centralization. Initially viewed as an attack, MEV has been legitimized through "democratic" distribution among major stakeholders, making Ethereum increasingly resemble a traditional financial system[15]. Additionally, most Ethereum L2 solutions currently rely on multi-signature wallets or committee-authorized upgradable contracts, introducing centralization risks[15]. The rise of enterprise-led chains like Soneium serves as a stern warning of a potential future where decentralization becomes a facade, concealing the fact that power is concentrated in the hands of a few.

To avoid this dystopian future, we must transcend Ethereum's flawed model. Returning to the original P2P vision emphasizes individual sovereignty over centralized intermediaries, providing a path to build a more open and fair system.

2.4 Pseudo-Decentralization in Distribution: Speculation-Driven Token Economy

Launched in 2015, Ethereum sparked a wave of ICOs, allowing projects to issue tokens for democratized fundraising and value distribution. While this brought broader opportunities for new ventures, it also led to the emergence of numerous utility and low-value "junk coins"[16]. Token-centric business models blur the line between speculation and genuine value creation. Many ICOs turned out to be get-rich-quick schemes. Even legitimate projects face distorted incentives, as the criteria for evaluating projects are more focused on token price performance rather than actual adoption or impact.

Centralized control by project teams over token minting and distribution further weakens decentralization. As scholar Angela Walch pointed out, this creates severe information asymmetry, giving insiders an advantage over ordinary users[17]. Token concentration in the hands of early investors has led to wealth inequality and centralized governance, critiquing Ethereum's value proposition as a "decentralization veil"[18], similar to the hierarchical system and intermediaries we discussed earlier.

However, we cannot generalize all ICOs, and it is important to recognize that ICOs marked a significant shift in the cryptocurrency space from traditional equity financing to a token economy. ICOs provided crucial seed funding for developing decentralized protocols and applications, offering investment opportunities to a broader audience[19]. The issue lies in the abuse of ICOs, where tokens are forcibly integrated into business models, leading to speculative bubbles and misaligned incentives. To give tokens genuine value, the industry must transition from a token-centric model to a service-centric one. Stablecoins are key to this transition. Stablecoins act as a bridge between the traditional financial system and the crypto economy, providing a stable medium of exchange that supports collaboration and economic specialization[20],[21]. This reflects a broader historical shift from focusing on asset price appreciation to prioritizing utility and user experience. We believe that Bitcoin-native stablecoins will further advance this, realizing an innovative P2P economy.

3 Returning to Bitcoin: The True Path of the P2P Paradigm

To achieve the original P2P vision and address the flaws in the Ethereum model, we must return to the roots of Bitcoin and build upon its powerful technical stack. The unique combination of Bitcoin's PoW consensus, programmable UTXO model, Lightning Network, and native stablecoins provides a strong foundation for realizing the true potential of cryptocurrency and blockchain systems. By leveraging these key components, we can create a more open, secure, and scalable ecosystem, empowering users and enabling genuine P2P interactions.

3.1 Empowering Participation: PoW and Programmable UTXO Model

A key advantage of the Bitcoin technical stack is the ability to achieve true decentralization (or P2P, as we should call it), allowing users to participate in the network on equal terms. This is achieved through the combination of PoW consensus and the programmable UTXO model.

PoW consensus is not only the most secure but also the most economically efficient mechanism for achieving distributed consensus in a decentralized network, and even the most cost-effective way to implement protocols against 51% attacks [22]. PoS systems suffer from a range of issues, including "nothing at stake" attacks, long-range attacks, and stake centralization, while PoW ensures that the cost of attacking the network is directly proportional to the computational power an attacker must acquire. In contrast, PoS suffers from a circular logic flaw, where the largest holder determines the state of the ledger, and the state of the ledger determines who the largest holder is. Additionally, cooperation is fundamentally based on trust, and trust needs to be achieved through labor and commitment. Participation is not just about being involved or having a voice; it also involves contributing real value[23],[24]. PoW consensus is not just a technical mechanism but also a social contract that aligns the incentives of participants with the security and stability of the network. This social science perspective explains why PoW is so powerful. It ensures that participants have a real stake in the system and incentivizes them to act in the best interest of the network. PoW ensures that participation in the network is open to anyone willing to contribute computational power and energy, ensuring the security of the blockchain in what is possibly the only fair dimension (the time dimension, as the nature of energy is also time), thus achieving a more decentralized and democratic form of participation. This aligns with the fundamental principles of P2P systems, which aim to minimize reliance on trusted intermediaries and enable direct interaction among participants.

2.4 Pseudo-Decentralization in Distribution: Speculation-Driven Token Economy

In 2015, Ethereum sparked a wave of ICOs, allowing projects to issue tokens for democratized fundraising and value distribution. While this brought broader opportunities for new ventures, it also led to the emergence of numerous utility and low-value "junk coins" [16]. Token-centric business models blur the line between speculation and genuine value creation. Many ICOs turned out to be get-rich-quick schemes. Even legitimate projects face distorted incentives, as the criteria for evaluating projects are more focused on token price performance rather than actual adoption or impact.

Centralized control by project teams over token minting and distribution further weakens decentralization. As scholar Angela Walch pointed out, this creates severe information asymmetry, giving insiders an advantage over ordinary users [17]. Token concentration in the hands of early investors has led to wealth inequality and centralized governance, critiquing Ethereum's value proposition as a "decentralization veil" [18], similar to the hierarchical system and intermediaries we discussed earlier.

However, we cannot generalize all ICOs, and it is important to recognize that ICOs marked a significant shift in the cryptocurrency space from traditional equity financing to a token economy. ICOs provided crucial seed funding for developing decentralized protocols and applications, offering investment opportunities to a broader audience [19]. The issue lies in the abuse of ICOs, where tokens are forcibly integrated into business models, leading to speculative bubbles and misaligned incentives. To give tokens genuine value, the industry must transition from a token-centric model to a service-centric one. Stablecoins are key to this transition. Stablecoins act as a bridge between the traditional financial system and the crypto economy, providing a stable medium of exchange that supports collaboration and economic specialization [20],[21]. This reflects a broader historical shift from focusing on asset price appreciation to prioritizing utility and user experience. We believe that Bitcoin-native stablecoins will further advance this, realizing an innovative P2P economy.

3 Returning to Bitcoin: The True Path of the P2P Paradigm

To achieve the original P2P vision and address the flaws in the Ethereum model, we must return to the roots of Bitcoin and build upon its powerful technical stack. The unique combination of Bitcoin's PoW consensus, programmable UTXO model, Lightning Network, and native stablecoins provides a strong foundation for realizing the true potential of cryptocurrency and blockchain systems. By leveraging these key components, we can create a more open, secure, and scalable ecosystem, empowering users and enabling genuine P2P interactions.

3.1 Empowering Participation: PoW and Programmable UTXO Model

A key advantage of the Bitcoin technical stack is the ability to achieve true decentralization (or P2P, as we should call it), allowing users to participate in the network on equal terms. This is achieved through the combination of PoW consensus and the programmable UTXO model.

PoW consensus is not only the most secure but also the most economically efficient mechanism for achieving distributed consensus in a decentralized network, and even the most cost-effective way to implement protocols against 51% attacks [22]. PoS systems suffer from a range of issues, including "nothing at stake" attacks, long-range attacks, and stake centralization, while PoW ensures that the cost of attacking the network is directly proportional to the computational power an attacker must acquire. In contrast, PoS suffers from a circular logic flaw, where the largest holder determines the state of the ledger, and the state of the ledger determines who the largest holder is. Additionally, cooperation is fundamentally based on trust, and trust needs to be achieved through labor and commitment. Participation is not just about being involved or having a voice; it also involves contributing real value[23],[24]. PoW consensus is not just a technical mechanism but also a social contract that aligns the incentives of participants with the security and stability of the network. This social science perspective explains why PoW is so powerful. It ensures that participants have a real stake in the system and incentivizes them to act in the best interest of the network. PoW ensures that participation in the network is open to anyone willing to contribute computational power and energy, ensuring the security of the blockchain in what is possibly the only fair dimension (the time dimension, as the nature of energy is also time), thus achieving a more decentralized and democratic form of participation. This aligns with the fundamental principles of P2P systems, which aim to minimize reliance on trusted intermediaries and enable direct interaction among participants.

In terms of programmability, the UTXO model provides a unique way to build certain types of applications and services on top of the base layer. Unlike Ethereum's account-based model (which maintains a global state and requires all nodes to process all transactions), the UTXO model treats each transaction output as a discrete "First-class" asset [25]. While this model may be less flexible for complex smart contracts, it can provide a more scalable and privacy-preserving method for transaction verification, as nodes only need to verify specific UTXOs they are interested in, rather than the entire global state. Additionally, the concept of "First-class" assets gives users greater control and ownership of their digital assets, similar to cash or coins. In the UTXO model, users can directly custody their assets, as each UTXO is controlled by a specific set of private keys. This contrasts sharply with the account model, where assets are typically held by contracts controlled by third parties, similar to traditional banks. To fully realize the potential of the programmable UTXO model, new protocols such as RGB++ Layer [26] are being developed to extend Bitcoin's capabilities without compromising its base layer's security. RGB++ introduces the concept of "homomorphic bindings," allowing smart contracts to execute off-chain while still being anchored to the Bitcoin base layer through UTXOs. This enables more complex computations and data storage without adding burden to the base layer, thus improving Bitcoin's scalability and flexibility [27].

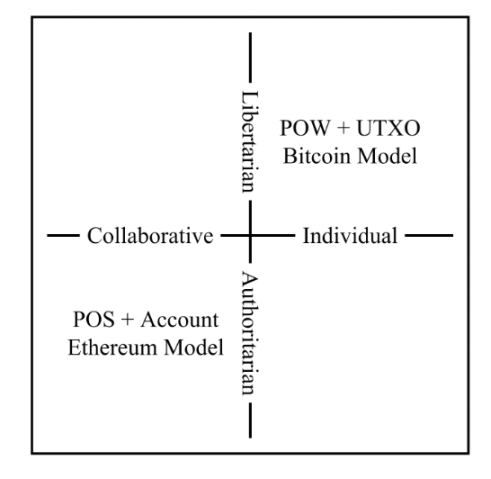

Combining PoW with the programmable UTXO model also enables a unique governance form that emphasizes individual freedom and competition. In the PoW mode, miners compete for rewards through individual effort. This is different from PoS, which requires a cooperative collective entity for voting or staking. Additionally, since each UTXO is a discrete asset, users can freely transfer and interact without the need for central authority. In contrast, the account model manages assets in a centralized manner, similar to authoritarianism, where a few large stakeholders influence the direction of the network. Therefore, as shown in Figure 2, we can place POW + UTXO and POS + Account on the political spectrum. POW + UTXO belongs to the libertarian-individual quadrant. POS + Account belongs to the authoritarian-collaborative quadrant. The stark contrast between these two approaches highlights their fundamental differences in ideology and the types of systems they belong to. The POW + UTXO combination aligns with Bitcoin's P2P vision, advocating for individual freedom, decentralization, and direct interaction among participants, while the POS + Account model differs significantly from these principles. By understanding the political and philosophical foundations of different blockchain designs, we can make wiser decisions about which system to build and participate in, ensuring that we remain faithful to the transformative potential of the P2P model.

Figure 2: Comparison of Governance Models

3.2 Eliminating Intermediaries: Lightning Network

Bitcoin's base layer provides a secure, decentralized foundation for storing and transferring value. However, it faces limitations in scalability and transaction speed. To address these challenges and achieve genuine P2P interactions without relying on intermediaries, the Bitcoin community introduced the Lightning Network, a second-layer solution running on top of the Bitcoin blockchain [28]. The Lightning Network enables instant, low-cost, and scalable micropayments while maintaining the core principles of decentralization and security. By using off-chain payment channels and smart contracts, users can transact directly without broadcasting every transaction to the main chain. This approach significantly reduces the load on the Bitcoin network, making transactions faster, cheaper, and more private, suitable for various use cases.

The design of the Lightning Network perfectly aligns with the concept of a P2P electronic cash system. By enabling direct bilateral payment channels between users, the Lightning Network eliminates the need for intermediaries at the most fundamental level of blockchain transactions—value transfer—a crucial step in realizing a truly P2P societal technology system. To truly achieve the vision of a P2P system, solutions must possess four key characteristics: high throughput, low latency, low cost, and privacy protection. The Lightning Network excels in all these aspects and is the most feasible approach to achieving encrypted payments. In contrast, while Ethereum's L2 solutions aim to improve scalability and reduce transaction costs, they even introduce new intermediaries, as we discussed in section 2.3. Additionally, compared to fully centralized systems, the inherent multi-node consensus of blockchain systems makes them more costly and slower, especially in payment scenarios. Considering a global population of 8 billion, the Ethereum model is unlikely to replace traditional payment systems like VISA, as it has inherent limitations in scalability and transaction costs.

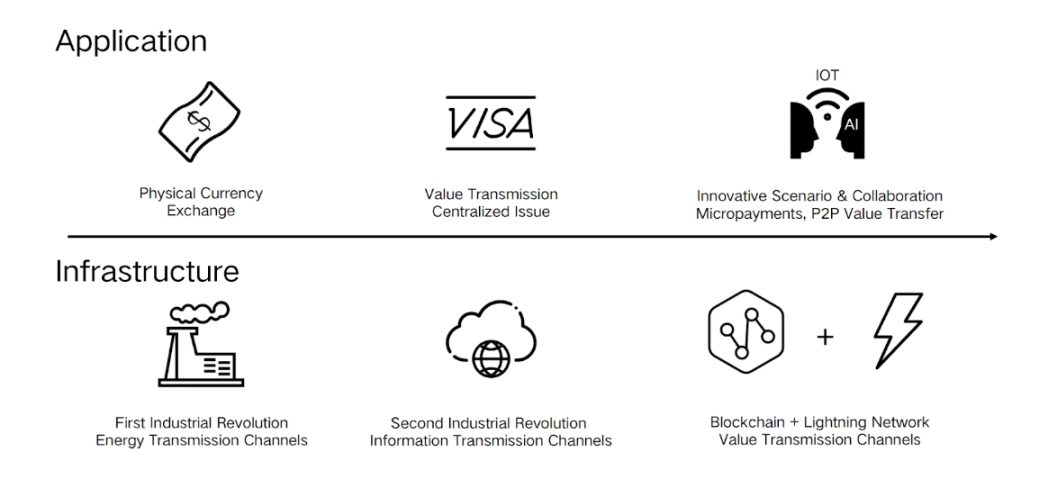

Figure 3: Evolution of Energy, Information, and Value Channels

The first industrial revolution established global energy transmission channels, and the second industrial revolution established information transmission channels. However, we still lack a dedicated value transmission channel. Existing value transmission methods, such as the VISA system, are built on top of application layers of information channels. Blockchain has the potential to fill this missing value channel, but blockchain alone is not enough. To truly revolutionize value transmission, we need to combine blockchain and the Lightning Network. In this value network, the blockchain handles large transactions, while the Lightning Network handles small, high-frequency transactions. Just as information channels have expanded globally, value channels should also be built in sync with them, reaching wherever information channels reach.

As shown in Figure 3, introducing a dedicated value channel outside of existing energy and information channels is a significant leap. The innovation in this payment method is fundamentally a revolution in production relations, with the potential to change business models and modes of collaboration. Just as using shells could not create a modern financial system, the fundamental impact of the Lightning Network is its ability to change pricing models and expand the imagination. Many scenarios that are difficult to price based on subjective human judgment can now be transformed into more atomized and granular pricing mechanisms. This transformation is particularly relevant to Internet of Things (IoT) and artificial intelligence (AI) applications, as the Lightning Network's ability to handle small transactions can enable new forms of machine-to-machine (M2M) interaction and data monetization [29].

Another key advantage of the Lightning Network is its ability to protect transaction privacy. Traditional payment systems have become a "digital panopticon," with users' financial activities under surveillance and potential abuse [30], while the Lightning Network's off-chain payment channels allow for private transactions that are not broadcast to the public blockchain. This privacy feature is crucial for many real-world payment scenarios, as businesses and individuals often require confidentiality for their financial transactions. While privacy-focused cryptocurrencies like Zcash and Monero attempt to address privacy issues, they are often associated with illicit activities [31]. In contrast, the privacy feature of the Lightning Network is built on payment channels, allowing users to benefit from enhanced privacy infrastructure without bearing the stigma or risk associated with specific privacy coins. Additionally, the Lightning Network has the potential to promote financial inclusion, narrowing the digital divide in accessing financial services. All these measures to eliminate intermediaries could have a significant impact on remittances, e-commerce, and access to digital goods and services in emerging economies.

3.3 Shifting from Token-Centric to Service-Centric: Bitcoin-Native Stablecoins

The RAND Corporation has pointed out that Bitcoin and stablecoins are sufficient to support the widespread adoption of cryptocurrencies and drive industry development [32],[33]. While this may be somewhat subjective, this combination is crucial for overcoming financial speculation and keeping the industry aligned with the original P2P vision.

It is well known that one of the biggest challenges for Bitcoin to become a universal medium of exchange is its volatility. This is where stablecoins come into play. By pegging to a reference asset (such as fiat currency), stablecoins provide a price-stable asset that can serve as a bridge between the traditional financial system and the crypto economy [20]. Like fiat currency, stablecoins provide a stable medium of exchange, which is the foundation of cooperation, specialization, and organization in human history [21]. In this historical development, the focus has shifted from asset price appreciation to actual utility and experience, giving birth to the fundamental paradigm of the modern economy: using stable mediums to exchange others' services [34],[35].

The history of stablecoins is marked by the development of various types of stablecoins, each with its unique features and challenges. Tether (USDT) and USD Coin (USDC) have gained significant traction but face criticism regarding transparency and centralization issues. On the other hand, decentralized stablecoins (such as MakerDAO's DAI) were once considered a promising alternative. However, most existing decentralized stablecoins are built on the Ethereum model and face pseudo-decentralization issues, as discussed earlier. In particular, MakerDAO's recent rebranding and introduction of account freezing functionality further underscore the need for a truly decentralized, censorship-resistant stablecoin solution.

To realize the potential of stablecoins in a service-centric P2P economy [36], we need Bitcoin-native stablecoins that align with the core principles of the Bitcoin network. These stablecoins, such as Stable++ (RUSD), can be built on the RGB++ Layer, leveraging Bitcoin's security and decentralization while providing a stable medium of exchange and unit of account. By eliminating the need for centralized platforms or institutions to manage issuance, redemption, and account freezing, Bitcoin-native stablecoins foster a more inclusive and censorship-resistant ecosystem. It is worth noting that in the Bitcoin ecosystem, there is space for both decentralized and centralized stablecoin solutions. Decentralized stablecoins have stronger censorship resistance and align more with the spirit of Bitcoin, while centralized solutions can provide more convenience and liquidity. The coexistence of these different solutions reflects the dynamic and competitive nature of the Bitcoin community, where multiple approaches can thrive and cater to different user preferences.

Furthermore, integrating Bitcoin-native stablecoins with the Lightning Network will unleash powerful synergies, enabling a wide range of P2P financial services and applications. The Lightning Network's instant, low-cost, and scalable micropayments, combined with the stability of Bitcoin-native stablecoins, create an ideal environment for everyday transactions, remittances, and complex financial products. This combination allows entrepreneurs to focus on building valuable services and user experiences without the need to issue tokens or face potential security compliance risks.

In summary, from a distribution perspective, the success of Bitcoin-native stablecoins and the Lightning Network will have a broader impact on power distribution and control in the cryptocurrency industry. By providing a stable and accessible infrastructure for P2P transactions, this approach empowers individuals and businesses to interact directly without relying on centralized intermediaries. This service-centric paradigm shift aligns with the original P2P vision, promoting greater financial inclusion, innovation, and value creation.

3.4 Conclusion

In this section, we have explored Bitcoin's technical stack, including PoW, programmable UTXO model, Lightning Network, and Bitcoin-native stablecoins, and how they provide a strong foundation for realizing the true potential of cryptocurrencies and blockchain systems. By examining these components, we have demonstrated how they address the flaws of Ethereum's pseudo-decentralized model in the dimensions of participation, belonging, and distribution. Table 1 summarizes the core technologies of Bitcoin and how CKB's innovations contribute to realigning the blockchain industry with the P2P vision.

Table 1: Advantages of Bitcoin and Innovations of CKB in Achieving the P2P Vision

The progress of society depends on reducing cognitive costs, increasing the value of information flow, minimizing vulnerabilities, and discovering new mutually beneficial participants. The foundation of this process is minimal trust [37]. As human society has evolved, from kinship and race to legal systems, this minimal trust has undergone a series of transformations. However, even the widely recognized legal frameworks today are still fragile and difficult to universally apply on a global scale.

This is where blockchain technology's social-technical mission lies. The ultimate goal of blockchain is to achieve genuine P2P interactions, allowing two individuals without any other trust mechanism to establish secure and efficient transactions. However, Ethereum's pursuit of becoming a world computer has to some extent deviated from this original vision. Ethereum emphasizes on-chain computation and smart contracts but sacrifices decentralization and social scalability. In contrast, the technical stack of Bitcoin was designed from the beginning to minimize trust in P2P scenarios. Indeed, Bitcoin faces challenges such as slow confirmation times, limited programmability, and price volatility. However, as technology continues to evolve and mature, these issues are gradually being addressed. Innovative projects like Nervos CKB are further optimizing and expanding the Bitcoin model. The Bitcoin ecosystem is moving towards greater social scalability and realizing the P2P vision.

4 Embracing the Future of Web5: Solutions, Trinity, Use Cases, and Web5

4.1 Common Lightning Initiative

The Common Lightning Initiative is an ambitious plan aimed at realigning the blockchain industry with Satoshi Nakamoto's original vision of a P2P electronic cash system. Bitcoin has proven that a blockchain network built on P2P mining nodes can establish a solid foundation for achieving consensus on digital gold. The decentralized nature of the Bitcoin network, achieved through its globally distributed mining nodes, ensures the security, immutability, and censorship resistance of the blockchain. For the Lightning Network, a large and widely distributed network of nodes is also crucial for its security, capacity, and resilience.

However, the current Bitcoin Lightning Network has only about 15,000 nodes and has seen limited growth since 2022. Due to insufficient infrastructure, its capacity is only about 5000 BTC, supporting few assets, and cannot replace the traditional financial system on a global scale. Therefore, based on the Fiber Network, we propose to combine the Lightning Network with DePIN hardware infrastructure. By using DePIN hardware to produce dedicated Lightning Network nodes, we can create a powerful and geographically widespread infrastructure to support the continued growth and use of the Lightning Network.

The term "common" in this initiative represents a more inclusive Lightning Network that promotes participation in two key dimensions: cross-chain compatibility and diverse implementations. Firstly, the initiative aims to expand the Lightning Network beyond Bitcoin, encouraging other blockchains to develop their own Lightning Network implementations. For example, CKB has introduced the Fiber Network (CFN), Liquid also has Lightning channels, and Cardano is developing Hydra, all inspired by payment channel solutions. Secondly, the initiative emphasizes interoperability between different implementations. For example, CFN is designed to be compatible with the Bitcoin Lightning Network, allowing seamless cross-network transactions. Its goal is to create a globally interconnected Lightning Network, where Bitcoin's Lightning Network is one of many subnetworks. By promoting interoperability, the initiative envisions establishing a highly liquid global value network, facilitating seamless asset transfers across various channels.

The Common Lightning Initiative consists of three key components:

Comprehensive development of CFN: CFN is a high-performance, multi-asset Lightning Network designed to enhance the scalability, interoperability, and user experience of the existing Bitcoin Lightning Network. CFN will support multiple assets, including BTC, stablecoins, and RGB++ assets, enabling seamless cross-chain exchanges and multi-asset transactions within a single payment channel. CFN will also implement advanced features such as channel factories, watchtowers, and multi-path payments to improve the network's efficiency, security, and reliability. In short, CFN is the Lightning channel on CKB.

Integrated with DePIN hardware: To ensure the decentralization and robustness of the Lightning Network, we will integrate CFN with the DePIN hardware ecosystem. By significantly increasing the number of DePIN hardware nodes, we aim to create a globally distributed, censorship-resistant network capable of supporting the growing demand for fast and low-cost payments. More importantly, by leveraging the security and reliability of DePIN hardware, we can provide Bitcoin-native yield opportunities for end users contributing BTC, stablecoins, or RGB++ assets to the network liquidity pool.

Building a P2P application ecosystem: The ultimate goal of the Common Lightning Initiative is to establish a thriving P2P application ecosystem using the Lightning Network and DePIN hardware. By providing fast, low-cost, and scalable payment infrastructure, we aim to enable a wide range of innovative applications and services, reshaping traditional business models and creating new opportunities for value creation and exchange. This may include Lightning Network-based DEX, content platforms based on microtransactions, and more. We will actively support and incentivize developers and entrepreneurs to build on the CFN and DePIN infrastructure, creating a vibrant, self-sustaining P2P ecosystem that drives the application and development of the Lightning Network.

By focusing on these key aspects, the Common Lightning Initiative aims to lay a solid foundation for a thriving P2P economy, enabling individuals and businesses to trade directly, securely, and efficiently without relying on centralized intermediaries.

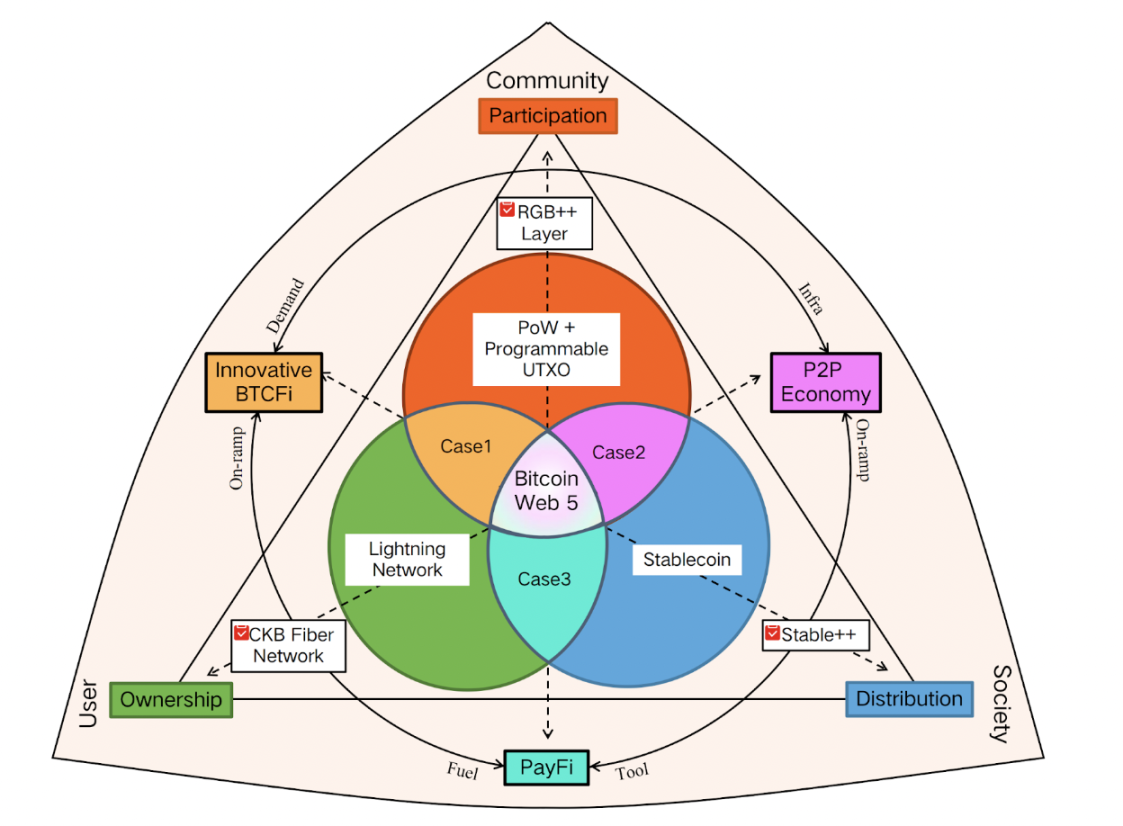

4.2 Achieving Trinity

It is worth noting that the Common Lightning Initiative is not just an isolated project. It is the final piece of a comprehensive, interconnected trinity ecosystem aimed at addressing the core challenges facing the blockchain industry and realigning it with Bitcoin's original P2P vision. This trinity consists of three key components, each addressing specific industry challenges: participation, belonging, and distribution. As shown in Figure 4, the core part resembles a pizza (the Venn diagram looks like a pizza), with three overlapping circles representing the key elements of the solutions. The first circle is PoW + programmable UTXO, addressing the participation issue. The second represents stablecoins, the primary solution for addressing the distribution issue. The third represents the Lightning Network, a key innovation for addressing the belonging issue.

Figure 4: Bitcoin P2P Trinity, a people-centric framework

The intersection of the PoW + programmable UTXO and Lightning Network circles forms the foundation of BTCFi. BTCFi unlocks a wide range of decentralized financial applications and services, driving innovation and value creation within the Bitcoin ecosystem. The intersection of the PoW + programmable UTXO circle with the stablecoin circle gives rise to a new P2P economy supported by Bitcoin [36], driving the industry towards a service-centric approach. The intersection of the stablecoin and Lightning Network circles gives birth to PayFi, a Bitcoin-native P2P payment infrastructure. PayFi leverages the stability of stablecoins and the efficiency of the Lightning Network to facilitate smooth, low-cost, and secure P2P transactions, enabling users to participate in direct economic interactions without relying on traditional financial intermediaries. These intersections mutually reinforce each other, creating a cycle of positive growth and adoption. BTCFi provides the financial infrastructure and tools needed to support the development of the P2P economy, while the P2P economy creates demand for BTCFi services and drives the development of PayFi. In turn, PayFi serves as a crucial gateway for users to access BTCFi and participate in the P2P economy, further driving adoption and network effects.

It is worth noting that from the description, it is evident that in our framework, people (users, communities, society) are always the primary consideration, the foundation of all components and processes. In other words, the Bitcoin P2P "marketplace" [38] can accommodate diverse voices and ideas, demonstrating the infinite power of the community. This is fundamentally different from the Ethereum model, where smart contracts are at the core, and people are secondary.

4.3 Web5 = Web2 + Web3

At the center of this trinity, where the three circles intersect, is our ultimate goal: to realize Bitcoin's P2P vision and usher in a new era of Web5, a paradigm that combines the best aspects of Web2 and Web3. Web5 is built on the solid foundation of Bitcoin, representing the future of P2P, where users can freely, directly interact, trade, and create value without the limitations of centralized platforms or intermediaries. While the term "Web5" was initially proposed by Jack Dorsey [39], our understanding and vision of Web5 go beyond his definition. While Jack Dorsey's proposal may have been somewhat tongue-in-cheek, we take the concept of Web5 seriously because it fully aligns with our vision for the future of the internet.

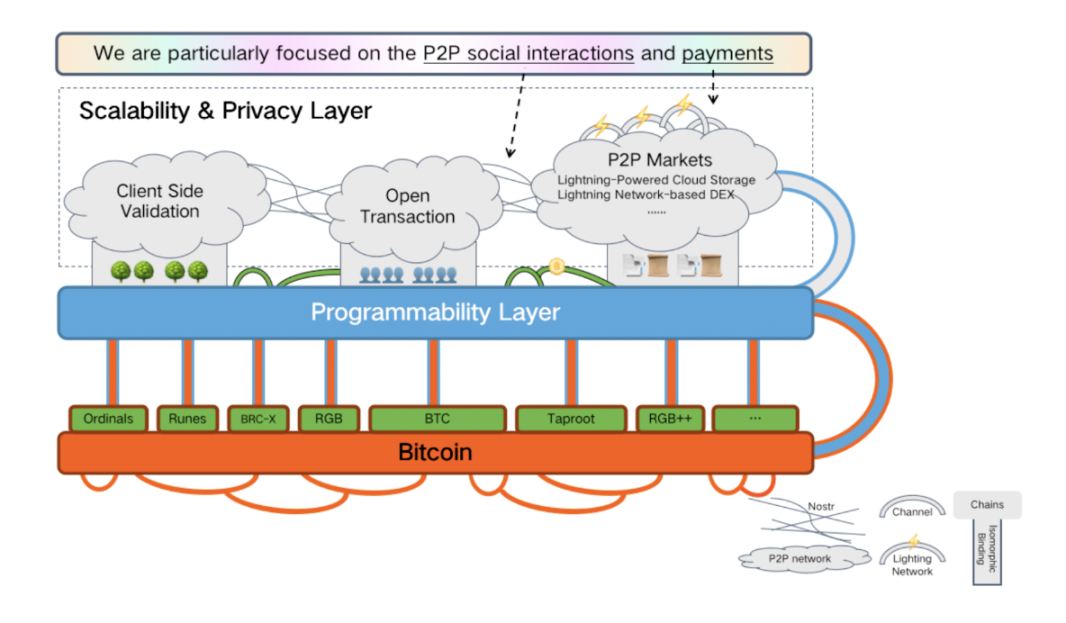

Figure 5: Layered approach to Web5 and our focus areas

For a long time, we have been striving to find a term that accurately conveys the ecosystem we are building, one that should be fundamentally different from Ethereum's approach. Before Jack Dorsey proposed Web5, we lacked a suitable term to express our goal of creating a decentralized future distinct from Web3. The emergence of Web5 aptly describes our vision. The equation "Web5 = Web2 + Web3" succinctly summarizes our belief that the future lies not in putting everything on the blockchain, but in combining the best aspects of Web2 and Web3. Furthermore, there are many ways to achieve this integration. For example, account abstraction (AA) and passkey are one method, while Nostr is another way to bridge Web2 and Web3. If there is a spectrum with P2P at one end and centralization at the other, these solutions occupy the middle ground of the spectrum. Lastly, the term "Web5" is not only profound but also engaging and thought-provoking. At first glance, it may seem like a lighthearted joke. However, upon further reflection, the concept reveals its profound meaning and potential, making "Web5" an ideal slogan for our vision.

Regarding the implementation of Web5, Nervos Chief Architect Jan Xie has proposed a layered approach [40], built on the unique combination of Bitcoin's core features and innovative technologies developed within the CKB ecosystem. As shown in Figure 5, the foundation of this stack is the Bitcoin base layer, the most secure and reliable platform for asset issuance. However, Bitcoin's limited programmability means that users cannot fully utilize these assets beyond simple ownership and transfer. To unlock the full potential of Bitcoin-based assets, we introduce a programmable layer above the base layer. This is where the RGB++ Layer comes into play, serving as the financial center for issuing assets on the Bitcoin chain. To ensure a secure and efficient connection between the base layer and the programmable layer, we adopt the homomorphic binding technology of the RGB++ protocol, achieving seamless cross-chain interoperability without the need for bridges, eliminating a major pain point in current cross-chain solutions.

Building on this, we can now construct additional layers focusing on scalability, privacy, and usability. One solution is the use of client-side validation (CSV) technology, which processes transactions and updates states off-chain by creating "Merkle trees" while still maintaining the security guarantees of the underlying blockchain. Other technologies, such as Open Transactions, Chaumian e-cash, and P2P markets, can further enhance the functionality of the Web5 stack, supporting a wide range of use cases and applications. To tie all these components together and provide a smooth user experience, we introduce channels. Channels serve as bridges between the components of the Web5 protocol stack and as connections between Web2 and Web3 technologies, with the Lightning Network being one type of channel.

The main advantage of Web5 lies in P2P payments and social networks. With the next-generation Common Lightning Initiative (CFN), we can achieve fast, secure, and low-cost P2P payments across different blockchains and assets. By integrating CKB with Nostr through RGB++, we can create a smooth and user-friendly experience for P2P social interactions and micro-payments [41]. We believe that these areas will create countless opportunities.

4.4 Use Cases

To achieve Web5, we have built the RGB++ Layer and stablecoins. CFN and the Common Lightning Initiative are the final pieces that bring these elements together. Additionally, we have witnessed the growth of the first RGB++ asset, Seal, and the Seal community has driven the adoption and development of the trinity. Let's further illustrate this with three use cases:

P2P Economy — Decentralized cloud storage with Lightning Network incentives. In this business model, users in need of storage services can sign smart contracts with cloud storage providers on the RGB++ Layer, agreeing to pay for storage capacity and bandwidth usage. The platform leverages CFN to facilitate fast, low-cost payments between users and cloud storage providers, automatically triggering payments based on actual usage. In turn, cloud storage providers are incentivized to offer reliable, high-quality storage services, as they can directly receive compensation from users via the Lightning Network. This creates a virtuous cycle of supply and demand, benefiting users with low-cost, secure storage solutions, while cloud storage providers earn income from their contributions to the network. Users retain full control over their data and can grant or revoke access as needed. This decentralized cloud storage platform addresses the limitations of traditional P2P file-sharing networks, such as lack of incentives, free-riding, performance issues, and the dilemma between centralized platform control [42], [43]. It harnesses the power of the Lightning Network and smart contracts to establish a robust, self-sustaining P2P economic system.

BTCFi — Capturing market opportunities with "UTXO Lego." Imagine a scenario where users see a significant market opportunity with the price of Seal soaring on the Bitcoin network. To capitalize on this opportunity, users want to use their ccBTC (pegged 1:1 to BTC and issued on CKB) as collateral to borrow stablecoin RUSD and immediately purchase Seal. Security is crucial, so users cannot accept centralized cross-chain bridges, and RGB++ addresses this pain point. Executing this transaction within a single block is also an innovation. Here, "UTXO Lego" refers to the modular and programmable nature of UTXO, allowing for complex automated transactions across different blockchains. Based on UTXO, we can securely connect operations between CKB and the Bitcoin network, ensuring collateral locking, stablecoin borrowing, and Seal purchase occur in an atomic swap manner: either all operations succeed, or none do. This programmability is a notable feature of UTXO, allowing for finer control over transaction execution compared to the account-based model used by Ethereum. Finally, the UTXO model is more efficient in processing transaction data in parallel, especially when interacting with multiple blockchains, often reducing transaction costs. This approach demonstrates how BTCFi can provide a more powerful, secure, and cost-effective alternative to current DeFi solutions.

PayFi — Achieving smooth P2P payments with a Lightning Network-based DEX. One of the most promising applications resulting from the fusion of the Bitcoin Lightning Network and CKB CFN is the creation of a Lightning Network-based DEX for BTC, stablecoins, and RGB++ assets. By leveraging CFN to facilitate trustless, cross-Lightning Network atomic swaps, users can easily exchange between BTC and stablecoins like USDT or RUSD within the CKB ecosystem without the need for centralized exchanges or KYC procedures. Essentially, this Lightning Network-based DEX can be seen as a decentralized, P2P alternative to traditional financial networks like VISA, where nodes act as "bank branches" and earn rewards from the liquidity they provide. This DEX enables users to conduct fast, secure, and private P2P transactions (without interacting with smart contracts), allowing them to seamlessly convert between the stability of stablecoins and the digital gold standard of BTC. The atomic swap mechanism ensures that both parties receive their respective assets simultaneously, eliminating counterparty risk and enhancing the overall security and reliability of the platform. Additionally, CFN's multi-asset capabilities offer exciting possibilities for instant, fee-free transactions of RGB++ assets within Lightning channels. For example, users can create markets for trading RGB++ NFTs (DOB) or RGB++ tokens. These markets provide real-time, frictionless trading experiences, enabling creators, collectors, and traders to directly exchange value without incurring high transaction fees or waiting for lengthy confirmation times.

5 Conclusion

The blockchain industry is at a crossroads. One path leads to the continuation of the Ethereum model, which is rife with centralization and rent-seeking, deviating from the core principles of blockchain. The other path leads back to Bitcoin's original vision, an empowering and truly decentralized P2P system.

The choice is clear. We must embrace the revival of Bitcoin and the innovations it brings. This includes the RGB++ Layer, CKB Fiber Network, and native stablecoins. We must strive to create a fairer, more sustainable model for value creation and distribution, moving away from the token-centric model of the past and towards a service-oriented future. This future is the future of Web5, combining the strengths of Web2 and Web3.

The road ahead will be challenging, but the rewards will be immense. Therefore, let us unite as a community and work together towards the vision of Bitcoin P2P. Let us build, innovate, and create with the passion and foresight of early pioneers. Let us show the true power of the P2P future to the world.

The power is in our hands. The future is in our hands.

Let's get started.

References

[1] S. Nakamoto, “Bitcoin: A peer-to-peer electronic cash system,” 2008.

[2] A. Oram, Peer-to-peer: harnessing the benefits of a disruptive technology. " O’Reilly Media, Inc.", 2001.

[3] S. Barile, C. Simone, and M. Calabrese, “The economies (and diseconomies) of distributed technologies: The increasing tension among hierarchy and p2p,” Kybernetes, vol. 46, no. 5, pp. 767–785, 2017.

[4] C. Rossignoli, C. Frigerio, and L. Mola, “Le implicazioni organizzative di una intranet adot- tata come tecnologia di coordinamento,” Sinergie Italian Journal of Management, no. 61-62, pp. 351–369, 2011.

[5] R. Peeters, The algorithmic society: technology, power, and knowledge. Routledge, 2020.

[6] P. Baran, “On distributed communications networks,” IEEE transactions on Communications Systems, vol. 12, no. 1, pp. 1–9, 1964.

[7] Bitstamp. “What was the blocksize war?” (2023), [Online]. Available: Bitstamp - Blocksize War.

[8] R. Zhang and B. Preneel, “Lay down the common metrics: Evaluating proof-of-work consensus protocols’ security,” in 2019 IEEE Symposium on Security and Privacy (SP), IEEE, 2019, pp. 175–192.

[9] H. Chen, H. Duan, M. Abdallah, et al., “Web3 metaverse: State-of-the-art and vision,” ACM Transactions on Multimedia Computing, Communications and Applications, vol. 20, no. 4, pp. 1–42, 2023.

[10] V. Buterin. “The limits to blockchain scalability.” (2021), [Online]. Available: Vitalik Buterin - Blockchain Scalability.

[11] R. Espejo, “Cybernetics of governance: The cybersyn project 1971–1973,” Social systems and design, pp. 71–90, 2014.

[12] Y. Zhang. “Comparison between the utxo and account model.” (2018), [Online]. Available: Medium - UTXO and Account Model Comparison.

[13] J. Coghlan. “Ethereum dev’s paid eigenlayer role sparks debate on ‘conflicted incentives’.” (2024), [Online]. Available: Cointelegraph - Ethereum Researcher.

[14] G. Wood et al., “Ethereum: A secure decentralised generalised transaction ledger,” Ethereum project yellow paper, vol. 151, no. 2014, pp. 1–32, 2014.

[15] L2beat. “Upgradeability of ethereum l2s.” (2024), [Online]. Available: L2beat - Ethereum L2s Upgradeability.

[16] U. W. Chohan, Initial coin oflerings (ICOs): Risks, regulation, and accountability. Springer, 2019.

[17] A. Walch, “Deconstructing’decentralization’: Exploring the core claim of crypto systems,” 2019.

[18] P. Baehr, “The image of the veil in social theory,” Theory and Society, vol. 48, pp. 535–558, 2019.

[19] BitcoinMagazine. “What is an ico?” (2017), [Online]. Available: BitcoinMagazine - What is an ICO?.

[20] D. W. Arner, R. Auer, and J. Frost, “Stablecoins: Risks, potential and regulation,” 2020.

[21] P. Howitt, “Beyond search: Fiat money in organized exchange,” International Economic Review, vol. 46, no. 2, pp. 405–429, 2005.

[22] P. Sztorc. “Nothing is cheaper than proof of work.” (2015), [Online]. Available: Truthcoin - Proof of Work.

[23] C. Acedo-Carmona and A. Gomila, “Personal trust increases cooperation beyond general trust,” PloS one, vol. 9, no. 8, e105559, 2014.

[24] T. A. Han, L. M. Pereira, and T. Lenaerts, “Evolution of commitment and level of participation in public goods games,” Autonomous Agents and Multi-Agent Systems, vol. 31, no. 3, pp. 561–583, 2017.

[25] J. Xie. “First-class asset.” (2018), [Online]. Available: Medium - First-Class Asset.

[26] Cipher. “RGB++ Protocol Light Paper.” (2024), [Online]. Available: RGB++ Protocol Light Paper.

[27] UTXOStack. “RGB++ Layer: Pioneering a New Era for the Bitcoin Ecosystem.” (2024), [Online]. Available: UTXOStack - RGB++ Layer.

[28] J. Poon and T. Dryja, The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments, 2016.

[29] J. Robert, S. Kubler, and S. Ghatpande, “Enhanced Lightning Network (Off-Chain)-Based Micropayment in IoT Ecosystems,” Future Generation Computer Systems, vol. 112, pp. 283–296, 2020.

[30] T. Brignall, “The New Panopticon: The Internet Viewed as a Structure of Social Control,” Theory & Science, vol. 3, no. 1, pp. 1527–1558, 2002.

[31] E. Silfversten, M. Favaro, L. Slapakova, S. Ishikawa, J. Liu, and A. Salas, Exploring the Use of Zcash Cryptocurrency for Illicit or Criminal Purposes. RAND Santa Monica, CA, USA, 2020.

[32] K. Stewart, S. Gunashekar, and C. Manville, Digital Currency: Transacting and Value Exchange in the Digital Age. Rand Corporation, 2017.

[33] J. Baron, A. O’Mahony, D. Manheim, and C. Dion-Schwarz, “National Security Implications of Virtual Currency,” Rand Corporation, 2015.

[34] J. M. Carroll and V. Bellotti, “Creating Value Together: The Emerging Design Space of Peer-to-Peer Currency and Exchange,” in Proceedings of the 18th ACM Conference on Computer Supported Cooperative Work & Social Computing, 2015, pp. 1500–1510.

[35] P. Dalziel, “On the Evolution of Money and Its Implications for Price Stability,” Journal of Economic Surveys, vol. 14, no. 4, pp. 373–393, 2000.

[36] UTXOStack. “P2P Economy: Leading a Blockchain Renaissance.” (2024), [Online]. Available: UTXOStack - P2P Economy.

[37] N. Szabo. “Money, Blockchains, and Social Scalability.” (2017), [Online]. Available: Money, Blockchains, and Social Scalability.

[38] E. Raymond, “The Cathedral and the Bazaar,” Knowledge, Technology & Policy, vol. 12, no. 3, pp. 23–49, 1999.

[39] M. Abiodun. “Jack Dorsey’s Concept of Web5: How Does It Evolve from Web3?” (2023), [Online]. Available: Jack Dorsey’s Concept of Web5.

[40] J. Xie. “Bitcoin Renaissance: Why and How?” (2024), [Online]. Available: Bitcoin Renaissance.

[41] R. Su. “Nostr Binding Protocol.” (2024), [Online]. Available: Nostr Binding Protocol.

[42] D. Guo, Y.-K. Kwok, X. Jin, and J. Deng, “A Performance Study of Incentive Schemes in Peer-to-Peer File-Sharing Systems,” The Journal of Supercomputing, vol. 72, pp. 1152–1178, 2016.

[43] L. Ramaswamy and L. Liu, “Free Riding: A New Challenge to Peer-to-Peer File Sharing Systems,” in 36th Annual Hawaii International Conference on System Sciences, 2003. Proceedings of the, IEEE, 2003, 10–pp.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。