This article assesses the price position from 7 perspectives, worth bookmarking!

Author: Biteye core contributor Viee

Editor: Biteye core contributor Crush

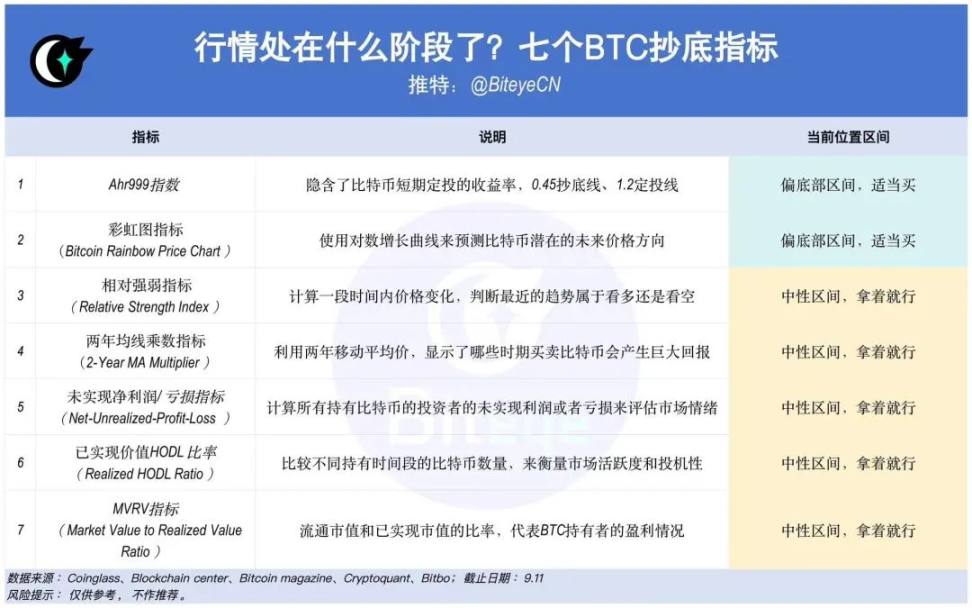

What stage is the market at?

Is the market bullish or bearish? Is it still possible to buy the dip?

Is the panic selling over, and is the bull market still intact?

To better analyze the current trend, Biteye has compiled 7 BTC bottom-fishing indicators.

Helping you judge market sentiment and coin price fluctuations from multiple perspectives! Share and bookmark for gradual learning!

01 Ahr999 Index

✅ Current value: 0.6, in the dollar-cost averaging range

✅ Interpretation: The index implies the return on short-term dollar-cost averaging of Bitcoin and the deviation of Bitcoin price from the expected valuation.

0.45 bottom-fishing line, 1.2 dollar-cost averaging line

- When the AHR999 index is 0.45, the indicator suggests bottom-fishing

- When the AHR999 index is between 0.45 and 1.2, the indicator suggests dollar-cost averaging

- When the AHR999 index >1.2, the coin price is relatively high and not suitable for trading

✅ Trend review: Since mid-April, the index has been oscillating around 1.2, and has fallen below 1.2 since June, entering the dollar-cost averaging range. In the past three months, it has been approaching the bottom-fishing line of 0.45.

02 Rainbow Chart Indicator (Bitcoin Rainbow Price Chart)

✅ Current value: in the relatively cold market range, suitable for buying

✅ Interpretation: Predicts the potential future price direction of Bitcoin using a logarithmic growth curve. There are a total of 10 color bands, with warmer colors at the top indicating an overheated market, which is a good selling point; cooler colors indicate a low market sentiment, which is a good buying point.

✅ Trend review: Since the beginning of the year, the Bitcoin price has mostly been in the cooler color range, and the market has not reached an overheated state, making the current price suitable for buying.

03 Relative Strength Index (RSI)

✅ Current value: 58.41, not yet in the bottom-fishing range

✅ Interpretation: The RSI indicator calculates the price changes over a period of time to determine whether the recent trend is bullish or bearish. The score is evaluated relative to the previous 12 months.

- High RSI indicates a very positive price trend compared to the previous 12 months

- Low RSI indicates a very negative price trend compared to the previous 12 months

- RSI >70: Bitcoin is overbought and may soon decline, suitable for selling

- RSI 30: Bitcoin is oversold and may reverse its uptrend, suitable for bottom-fishing

✅ Trend review: Based on historical prices, the RSI indicator has not dropped below 30. When referring to this indicator, one can judge based on how close it is to 30 for oversold conditions, or how close it is to 70 for overbought conditions.

04 2-Year MA Multiplier (2-Year MA Multiplier)

✅ Current value: BTC 57604, in the neutral price range

- 2-Year Moving Average (2YMA): 38,018

- 2-Year Moving Average Multiplied by Five (2YMA x5): 190,092

✅ Interpretation:

It uses the 2-year moving average (green line) and the 5x multiple of the moving average (red line) to highlight when buying and selling Bitcoin will yield significant returns.

- Price 2YMA (green line): Buying at historical lows

- Price > 2YMA x5 (red line): Selling at historical highs

- Price between the averages indicates a neutral position

✅ Trend review: Currently in the neutral range, not yet at the bottom for bottom-fishing. From May 2022 to October 2023, this indicator was in the bottom-fishing range.

05 Net Unrealized Profit/Loss (Net-Unrealized-Profit-Loss)

✅ Current value: 45.33%, not the best buying range

✅ Interpretation: Evaluates market sentiment by calculating the unrealized profits or losses of all Bitcoin holders.

- NUPL 0: Market in extreme fear of losses, suitable for bottom-fishing

- NUPL 0-0.25: Slight profit zone, also suitable for buying

- NUPL 0.25-0.5: Bull-bear transition, gradually entering a bull market

- NUPL 0.5-0.75: Strong bull market sentiment

- NUPL 0.75-1: Extreme greed, consider selling at the peak

In other words, the further NUPL deviates from 0, the closer the market trend is to the bottom or top.

✅ Trend review: Since January 2023, the market has moved away from the loss zone and gradually become profitable. From February to July this year, RSI was above 0.5, indicating strong bull market sentiment. However, in the past two months, RSI has dropped to the 0.25-0.5 range, and market sentiment has also declined.

06 Realized HODL Ratio (Realized HODL Ratio)

✅ Current value: 2689.22, in the neutral range

✅ Interpretation: Measures market activity and speculation by comparing the amount of Bitcoin held for different periods, such as short-term (within 1 month) and long-term (over 1 year) Unspent Transaction Outputs (UTXO). A high value indicates a high proportion of short-term holders and strong market speculation; a low value means a high proportion of long-term holders and a relatively stable market.

- When approaching the red zone, the market is overheated, suitable for taking profits

- When approaching the green zone, the coin price is relatively low, suitable for bottom-fishing

✅ Trend review: Since January 2023, the RHODL Ratio has gradually moved away from the green zone and shown an upward trend. In the past few months, it has been in a declining oscillation trend, reflecting a cooling market, but has not yet fully entered the cooling phase.

07 MVRV Ratio (Market Value to Realized Value Ratio)

✅ Current value: 1.83, the market has not entered the bottom range

✅ Interpretation: MVRV is a relative indicator that represents the ratio of the circulating market value (Market Cap, MV) to the realized market value (Realized Cap, RV), i.e., the ratio of BTC's total market value to the market value calculated from the last activity price of BTC, representing the profitability of BTC holders.

- MVRV > 3.5: Market at the top, holders have made significant profits and are inclined to sell

- MVRV 1: Market at the bottom, most holders are at a loss, with a higher probability of price increase due to increased holding willingness

✅ Trend review: Over the past three to four months, this indicator has been on a downward trend, with holders' profits gradually decreasing. The closer it gets to the bottom range, the easier it is for the market to rebound and rise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。