Although the cost of on-chain operations has been significantly reduced, Web2 founders still need to conduct a thorough cost-benefit analysis before deciding to launch their own chains.

Author: Sharanya Sahai

Translation: DeepTechFlow

In the past year, the introduction of new Layer 2 (L2) solutions has significantly increased due to technological advancements, the development of unique market entry strategies, focus on specific use cases, and strong community participation. While this development is exciting, the main challenge remains how to scale these blockchains in a more cost-effective manner. Running application chains has become a key solution, as application chains can manage the operational costs of blockchains through various measures in a modular infrastructure stack.

Although specific initiatives on L1 such as Ethereum have significantly reduced transaction costs on the blockchain, major rollups and infrastructure providers are also vigorously pushing for further scalability and unlocking use cases that are currently too costly to execute on-chain.

We can classify and analyze these developments from the following perspectives: a) L1 initiatives, b) L2 initiatives, and c) modular infrastructure initiatives, all of which are meaningfully reducing the barriers to on-chain transactions.

Recently, we have seen Ethereum make some upgrades, such as EIP 1559 and 4844, which have reduced costs and improved scalability.

Let's first look at L1 initiatives, which rationalize the costs of on-chain transactions on Ethereum through forms such as EIP 1559 and EIP 4844 (Dencun upgrade). EIP 1559 introduces the concept of base fee plus tip/priority fee and a dynamic pricing mechanism based on congestion, providing users with a better mechanism to estimate costs and conduct transactions based on their priority and network congestion. EIP 4844 introduces the concept of Blobs (Binary Large Objects), bringing a new type of transaction to Ethereum. This provides L2 with an extremely cheap alternative, allowing them to store data in Blobs when settling transactions on L1, rather than in expensive callData.

Figure 1: The average gas price for base fee and priority fee on July 19th was 8 gwei, Source: Etherscan

The implementation of Blobs has significantly reduced transaction costs, as the storage cost per byte decreases, while the capacity per block is also increasing. Unlike callData, Blobs do not compete for gas with Ethereum transactions and are not permanently stored, being removed from the blockchain approximately 18 days later.

A Blob consists of 4096 field elements, with each field element being 32 bytes, and each block can contain a maximum of 16 Blobs, providing a maximum additional capacity of approximately 2 MB (4096 * 32 bytes * 16 Blobs per block). The capacity can start from a lower level (currently 0.8 MB, with a target size of 3 Blobs per block after EIP 4844, and a maximum of 6 in the future) and can be increased through multiple network upgrades in the future.

Considering the historical baseline of 2-10KB callData per block, EIP 4844 theoretically can achieve up to 384 times growth.

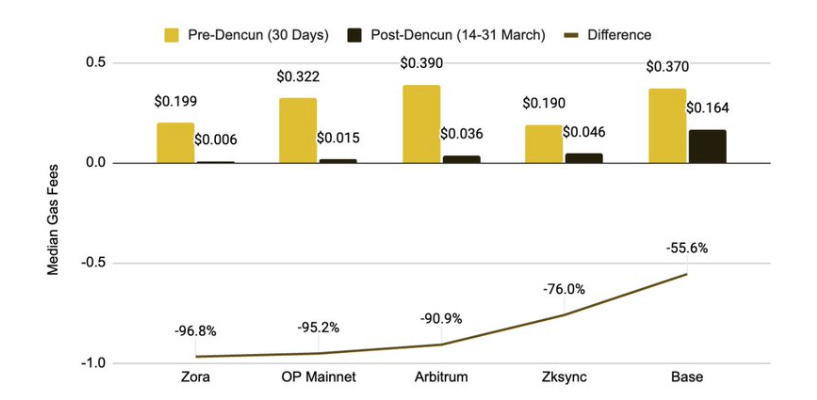

In fact, many L2 fees have decreased by over 90% after the implementation of EIP 4844 (see Figure 2). However, relying solely on these upgrades is not enough to achieve greater scalability for Ethereum. In a world with thousands of rollups, as on-chain adoption increases, the demand for storage space may increase, leading to a surge in transaction costs.

Figure 2: After the implementation of EIP 4844, the median gas fees of major L2 networks have decreased, Source: Binance

As L2 moves execution off-chain to reduce costs and maintain security, industry initiatives such as open-source frameworks and revenue-sharing models are shaping the fiercely competitive "L2 stack war."

In the previous cycle, the emergence of rollups aimed to significantly reduce the costs of on-chain operations by moving execution off the main chain, while still maintaining security by using various types of proofs from the main chain. Optimistic rollup allows a single honest entity to submit "fraud proofs" and identify misbehavior by sequencers to receive rewards, while ZK (Zero-Knowledge) rollup uses zero-knowledge proofs to verify the correct updates of the L2 chain.

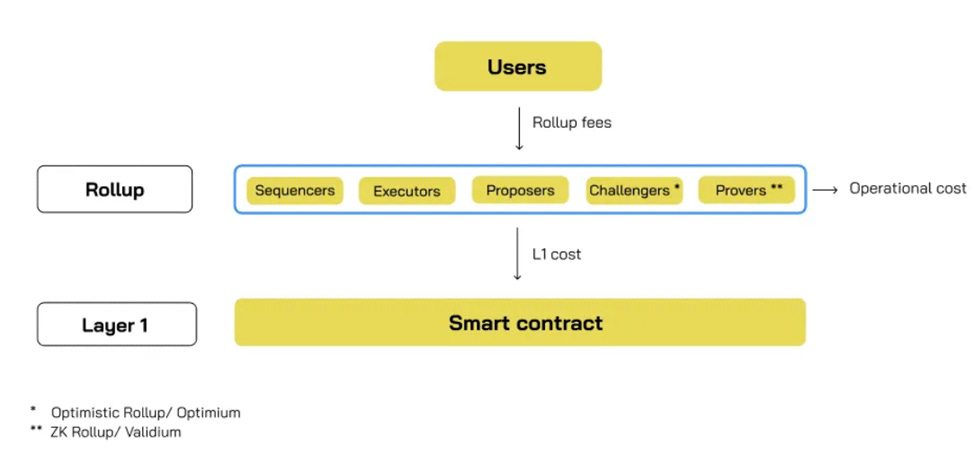

Rollup operators need to perform various tasks, including:

- Sequencing: Organizing transactions from end users in order, grouping them, and occasionally publishing batches of these groups to L1.

- Execution: Storing and executing operations, and updating the state of the rollup.

- Proposing: Proposing regular updates of the rollup's state root on Layer 1, which is crucial for ensuring the blockchain remains trustless and verifiable by everyone.

- State root challenges: Submitting evidence of state root fraud and challenging state roots on Layer 1 (only applicable to optimistic rollup).

- Proofs: Generating verifications for each state root update from rollup to L1 (only applicable to ZK Rollup).

Their revenue comes from user-paid transaction fees (sequencer revenue) and potential MEV that can be extracted, although it is important to note that MEV has not yet been extracted as a strategic choice. Their costs mainly come from L2 (operational costs) and L1 (data availability and settlement) costs (see Figure 3). Organizations looking to launch their own chain ideally only do so when the expected transaction fees exceed the planned costs.

Figure 3: Rollup business model, Source: Exploring the Rollup Ecosystem

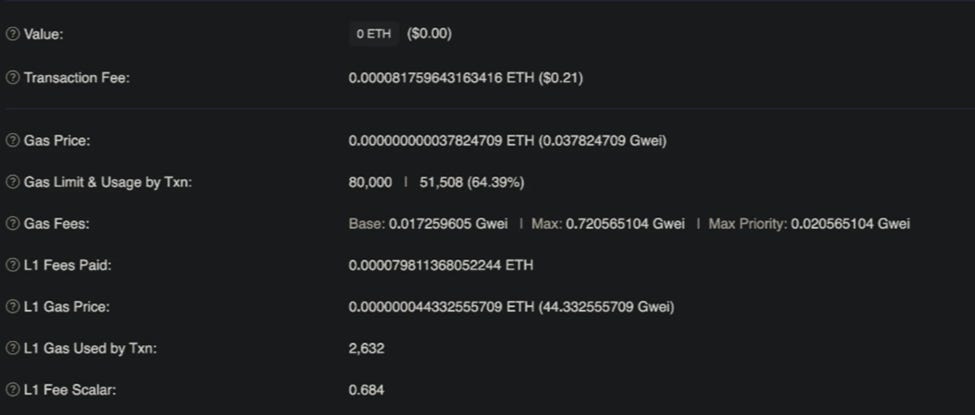

Base layer networks like Ethereum typically charge high fees for computation and storage because most nodes need to sync and verify the chain. However, in rollups, as long as there is an honest entity able to verify the chain, the chain is considered secure. Therefore, rollups have lower fees for computation and storage, but higher fees for "batching" transactions and publishing them to L1. Thus, before the introduction of EIP 4844, L1 costs accounted for as much as 98% of the L2 cost base (see Figure 4).

Figure 4: Fee breakdown of a typical transaction on Optimism prior to EIP 4844, Source: Biconomy

OP Stack and Arbitrum Orbit, other mature L2s including Polygon (Polygon CDK), ZK Sync (ZK Stack), and Starkware (Madara Stack)

In addition to foundational optimizations, L2 is actively driving further cost reductions, which are the Layer 2 initiatives mentioned at the beginning of the article, mainly categorized into two types—industry alignment or company alignment.

Industry alignment initiatives include allowing new players to build their own chains through open-source L2 technology stacks (rollup frameworks). While this wave of initiatives is led by optimistic rollup through the introduction of OP Stack and Arbitrum Orbit, other mature L2s, including Polygon (Polygon CDK), ZK Sync (ZK Stack), and Starkware (Madara Stack), are also driving mass adoption by providing or announcing the open-sourcing of their proprietary technologies.

Company alignment initiatives include these chains' efforts to accumulate value for their tokens through direct income/profit-sharing models or through the indirect effects of expanding the ecosystem. Examples of this include Optimism's Superchain vision, Arbitrum's Expansion Program, Polygon's Aggregation Layer, and ZK Sync's Elastic Chain. While the specific details of these plans may differ, their common theme is a universally present interconnected network, providing enhanced interoperability and communication between multiple rollups, and increasing capital efficiency through sharing critical infrastructure in the form of the base layer (such as data availability, shared bridges, aggregation proofs, applicable only to ZK chains). This addresses the issues of liquidity dispersion and insufficient interoperability between rollups in the current Ethereum ecosystem. However, these technology stacks also allow each chain to maintain its unique customization based on its needs in parameters such as block time, extraction period, finality, token usage, gas limits, etc., eliminating the disadvantages of public chains such as high gas costs and delays caused by traction from other applications.

While these independent ecosystems focus on growth and adoption, we have already begun to see more mature participants, such as Optimism and Arbitrum, achieving profitability.

Optimism charges participants in its Superchain 2.5% of the overall sequencer revenue or 15% of sequencer profit (i.e., sequencer revenue minus L1 settlement and data availability costs). Arbitrum charges participants using its stack to launch L2 a 10% sequencer profit fee. Meanwhile, ZK rollup stacks, including Polygon CDK and ZK Stack, are currently free to use, but as they mature and gain traction, they may incorporate sustainable economic models.

The formal "L2 stack war" has begun, with ecosystems vying for the onboarding of key projects through unique strategies (see Figure 5). Optimism announced a 22 million USD grant for Superchain builders, with retroactive airdrops based on usage and participation, while ZK Sync offers 22 million USD to bring Lens from Polygon into its stack. Arbitrum allows anyone to use its stack for free as long as they launch as an L3 chain on Arbitrum (an L3 chain uses L2 as the settlement layer instead of Ethereum's chain), as it benefits from the increase in L3 activity, with these L3 chains ultimately paying Arbitrum's settlement costs over their lifecycle.

Figure 5: Distribution of projects using L2 stacks across the ecosystem

RaaS and alternative settlement and data availability solutions are redefining the cost structure of blockchain, and future innovations in modular infrastructure are expected to bring further savings.

Despite the support of these stacks, running a blockchain still requires significant operational expenses, manpower, expertise, and resources. Developers looking to attract on-chain end-users are unwilling to be distracted by handling the operation and maintenance of chain infrastructure and would rather focus on core business activities.

This issue has led to a rapid increase in Rollup as a Service (RaaS) providers, who collaborate with developers to simplify the complexity of chain operations using the mature L2 frameworks/stacks discussed earlier. These providers offer services including node operations, software updates, infrastructure management, as well as products for sequencing, indexing, and analysis. RaaS providers employ different strategies in capturing market share, with some aligning with specific L2 ecosystems, while others take a framework-agnostic approach, offering integration across all ecosystems. Conduit and Nexus Network align with optimistic rollups (such as Optimism and Arbitrum), while Truezk, Karnot, and Slush focus on ZK chains. Meanwhile, Caldera, Zeeve, Alt Layer, and Gelato offer integration across optimistic and ZK rollups.

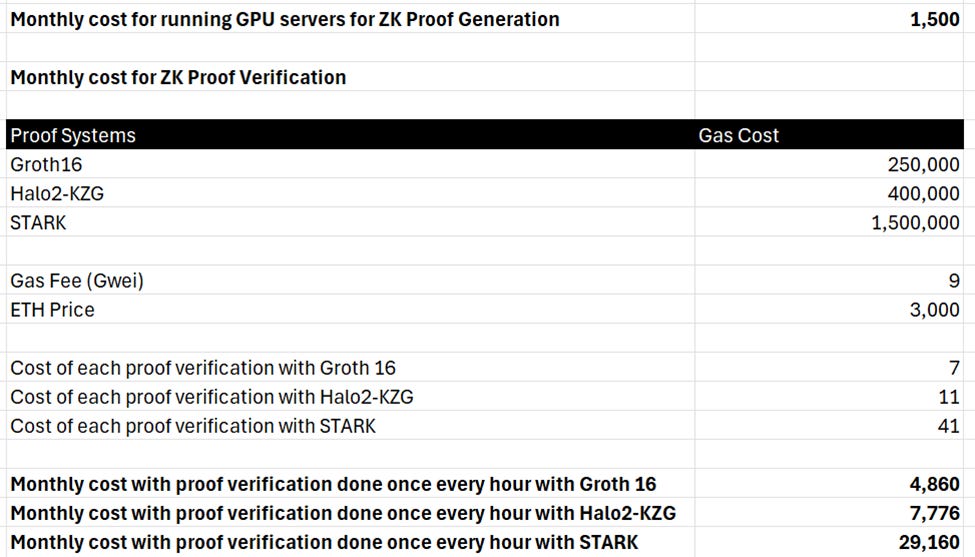

Typical business models for these providers include charging fixed fees and a portion of sequencer profit. Monthly subscription fees for running optimistic rollups typically range from 3,000 to 4,000 USD, while running ZK rollups, due to the intensive computation required for generating ZK proofs and the high cost of proof verification, may double to 9,500 to 14,000 USD (see Figure 6 for details). Additionally, they collect a 3-5% sequencer profit share to ensure alignment of incentives between RaaS providers and rollups, allowing them to benefit economically as these chains develop.

Caldera is exploring a different model, with its Metalayer vision charging only a 2% variable sequencer profit share, with no fixed costs, aimed at achieving interoperability across optimistic and ZK stacks using Caldera.

Figure 6: Cost of ZK proof verification Source: Nebra

It is worth noting that due to the dynamic nature of the industry and especially the efforts in the ZK space, subscription fees for RaaS providers may further decrease. Additionally, due to the lack of strong consumer Web3 businesses, applications targeting large consumers may negotiate more favorable economic sharing agreements with infrastructure providers, resulting in non-uniform initial pricing across applications.

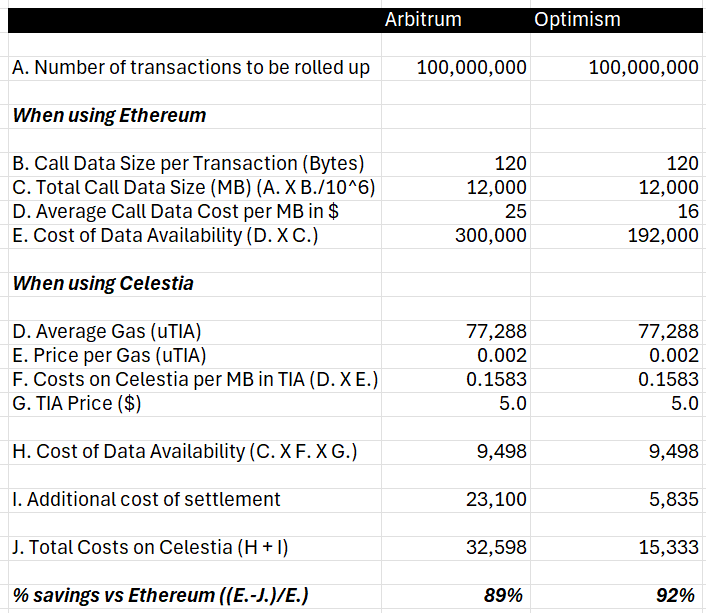

As mentioned earlier, the biggest expense for rollups is L1 costs, including data availability and settlement fees. A standard rollup processing 100 million transactions could incur monthly L1 costs as high as 25,000 USD, making L1 settlement feasible only for the largest or most frequently used chains in the ecosystem. The demand for alternative settlement and data availability solutions has prompted participants focused on these layers to optimize costs and performance. In terms of data availability, Ethereum's alternative solutions include Celestia, Near, EigenDA, while the mature L2s discussed earlier are designed to serve as the settlement layer for rollups, which can be classified as L3. These participants have reduced the settlement and data availability costs for rollups by several orders of magnitude. Figure 7 roughly illustrates the cost savings when rollups publish callData to Celestia instead of Ethereum. It is worth noting that as transaction volume increases, the magnitude of cost savings grows exponentially.

```

```

Figure 7: Cost Savings of Rollups using Celestia vs. Ethereum Source: Lenses

In addition to data availability costs, there are additional settlement costs, i.e., Celestia publishing a pointer on Ethereum to trace back to the relevant blocks on Celestia, ensuring the sequencing and integrity of data published on Celestia.

Within the modular infrastructure stack, the specialized participants in alternative data availability and RaaS providers' development are collectively referred to as modular infrastructure initiatives. In this category, there are other verticals exploring further cost optimizations, including shared sequencing (such as Espresso, Astria, Radius), proof aggregation (such as Nebra, Electron), and others. These are currently in early stages of development, and costs are expected to continue to decrease as the industry matures.

Despite the significant reduction in on-chain operations costs, Web2 founders still need to conduct a thorough cost-benefit analysis before deciding to launch their own chains.

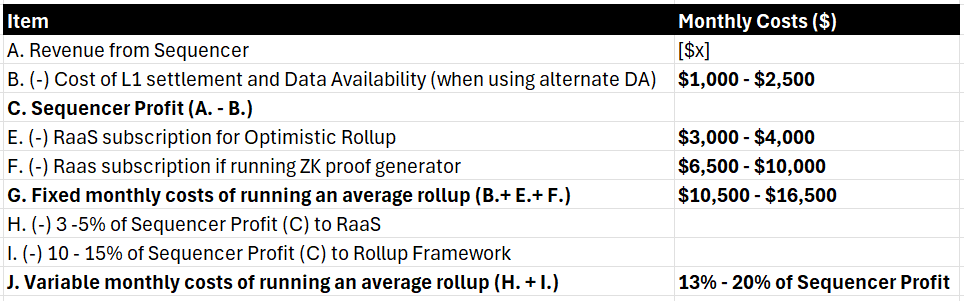

Web2 founders need to carefully assess the cost-benefit of launching their own chain, as despite the reduction in on-chain costs, these costs may still be benchmarked against Web2 standards. The total cost of running a chain depends on the specific usage requirements of each chain, but we can roughly estimate the cost of an average optimistic or ZK chain processing 2 million transactions per month using alternative data availability solutions, as shown in Figure 8.

Figure 8: Example cost structure of rollups

Despite various optimizations at the industry and chain levels, the monthly capital required includes total costs for ZK rollups of 10,500 USD to 16,500 USD, and for optimistic rollups of 4,000 USD to 6,500 USD. Additionally, once the chain becomes profitable, up to 20% of sequencer profit must be allocated.

The three categories highlighted in this article are key drivers for industry adoption, with the ultimate goal of narrowing the cost and convenience gap between decentralized applications and Web2. For developers, conducting a cost-benefit analysis for independent chains versus building on existing chains is crucial based on end-user needs, product priorities, performance metrics required for use cases, and the existing market attractiveness.

We recognize the need to build solutions to narrow the cost and performance gap between Web3 and Web2 infrastructure, as societal preference for decentralized systems is not yet sufficient to drive widespread adoption of Web3. This challenge remains a major bottleneck for the widespread adoption of blockchain, and we look forward to meeting with founders innovating in this area!

We thank Dr. Ravi from Zeeve, Mayank from Nexus Network, Raghu from Rabble, Rafael from Numia, Apoorv from Karnot, Shumo from Nebra, Garvit from Electron, and Yush from Lysto for generously sharing valuable insights, which have been integrated into this article.

Hashed Emergent may have already or may in the future invest in the companies mentioned in this article. The content of this article is for informational purposes only and should not be considered as investment advice. Please conduct your own research before making any investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。