Original Title: "Ansem's Secret To Getting 10x Richer In Crypto NOW"

Guest: Ansem, a well-known trader

Original Translation: zhouzhou, Ismay, BlockBeats

Editor's Note: In this podcast, well-known trader Ansem explains the reasons for his recent bearish market sentiment and shares his insights on how he discovered and is bullish on Solana, as well as his trading strategies on Solana and his views on the current and future status of memecoins. He also discusses the NFT market. In addition, Ansem offers unique insights into the decline of crypto celebrities, crypto investment opportunities, and the relationship between cryptocurrency and sports betting, delving into the future trends of the crypto industry.

In this podcast, Threadguy and Ansem raise and discuss several key questions:

What stage are we currently in the cycle? Are we still in a bull market?

You recently publicly expressed bearish sentiment. What was your logic, and what are your main holdings now?

How do you think SocialFi will develop next? Has Pump.fun "killed" meme coins? Will meme coins surpass Doge's all-time high in this cycle?

Is it wise to focus on meme coin trading? How to root in a bear market, lock in Solana, and stay firm in belief?

Discuss the Neiro incident and your views on celebrities participating in cryptocurrency?

TL;DR

Discussion on the current cycle: Ansem believes that the current cycle is in the early stages of the second or third round, and he believes that the adoption of cryptocurrencies will increase, leading to unprecedented new developments.

Reasons for recent bearish sentiment: The probability of Ethereum ETF approval surged, but the market did not experience significant fluctuations.

How to view the underperformance of L2 tokens: Ansem believes that for a blockchain to be more efficient than Ethereum L1, it should not use EVM anymore, and people underestimate the trend of shifting from CEX to DEX.

How SocialFi will develop next: Meme coins are the original form of SocialFi, and meme coins are not dead. He believes that their super cycle will continue.

Why bet on Solana: Ansem has been paying attention to the Solana ecosystem for a long time, understanding its entire development process. Its characteristics are being cheaper and faster.

Ansem recalls his experience in the Neiro incident: He shared how to deal with the spread of false information on social media and the subsequent "protagonist effect." He also reflected on his responsibility as a public figure in the cryptocurrency field, especially the pressure and challenges he faces when sharing investment opportunities.

Trader's mindset adjustment and turning point: Beginners need to learn to be the first participant in every opportunity.

The following is the original text of the conversation (edited for readability and comprehension):

Discussion on the cycle, expecting new developments

Threadguy: How's your mindset recently?

Ansem: I feel great. This should be the third cycle I've experienced, and trading has been going very smoothly. I've gone from around 100,000 followers last December to almost 500,000 now.

Threadguy: Do you think your number of followers can reflect how many new people are joining this circle?

Ansem: I think so. I gained about 400,000 in the previous six months, and then at some point, the weekly growth started to slow down. When it started to slow down in March and April, I thought it might be because the market was starting to concentrate, but it has recently started to pick up again. This is indeed a good retail market indicator. Looking back at the previous cycle, the growth of some major followers was also quite exaggerated. When their growth stagnates, you know that not many people seem to be entering the market.

Threadguy: What stage do you think we are in this cycle? Are we still in a bull market?

Ansem: I think it's the second or third round, and we're still in the very early stages. The reason I say this is that not many major events have happened yet. In the previous cycle, we would experience various altcoin rotations, but now we haven't seen widespread increases in various areas. Although Solana and some meme coins have performed wildly, there's also some action in the AI field, but DeFi has almost no movement, and L2 hasn't changed much.

The public awareness stage of this cycle will be different. Many mainstream institutions are now actively promoting cryptocurrencies and emphasizing the future of cryptocurrencies. With the passive funds flowing into these ETFs, I believe the market's attention will be more stable.

Threadguy: How do you think the adoption of cryptocurrencies will change?

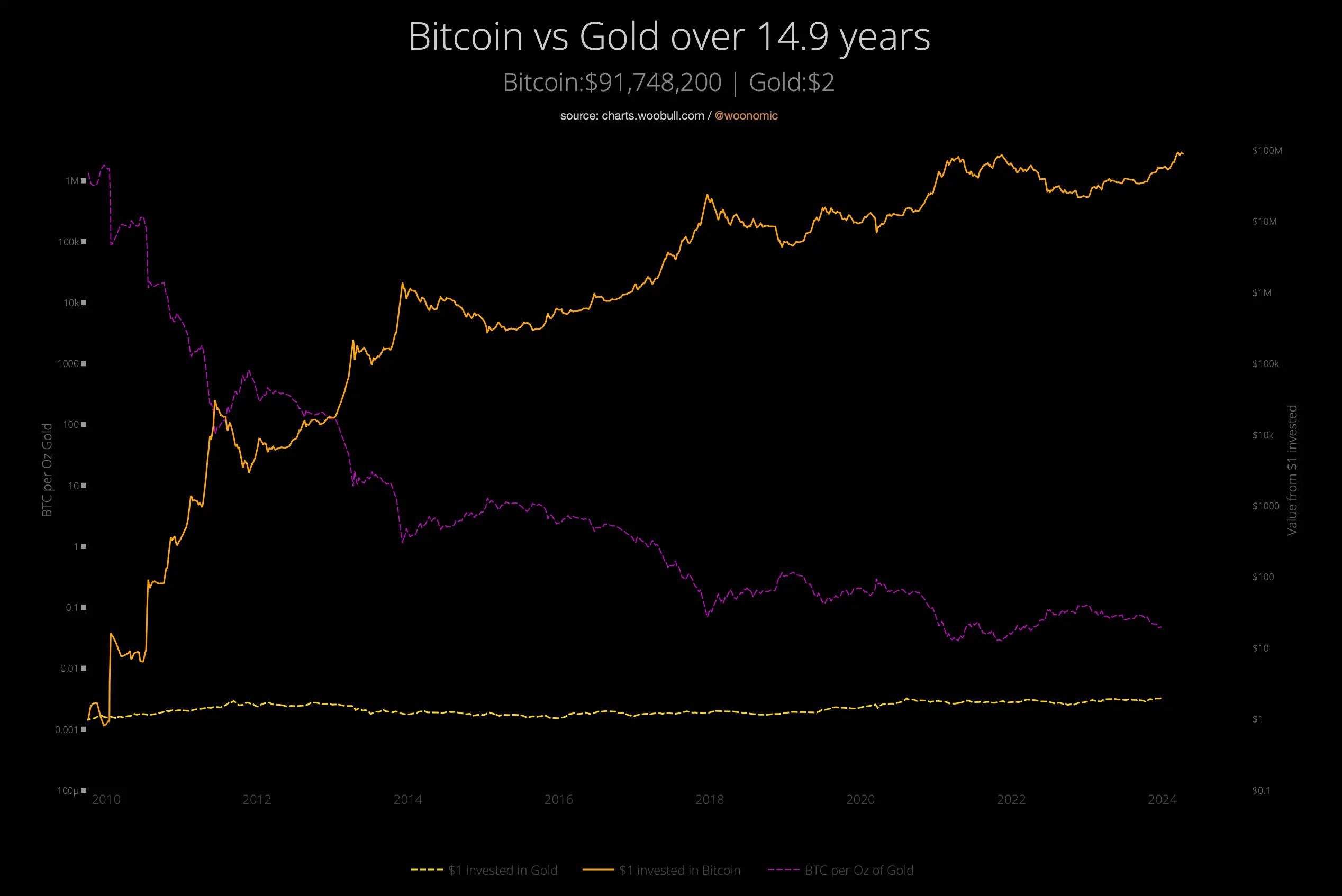

Ansem: The market value of gold is about $13 trillion, while Bitcoin is currently only about $1.2 trillion. The comparison between Bitcoin and gold is quite strong. Stocks have been rising all the way because funds need to find a place to invest, and this situation will also happen in the cryptocurrency field.

Price performance comparison between gold and Bitcoin over the past 15 years, image source: Woobull

Threadguy: Do you have any investments other than cryptocurrencies now?

Ansem: I've made some diversified investments. I recently bought Galaxy's stock and also have some Robinhood and Coinbase stocks, but I haven't diversified my investments too much outside of cryptocurrencies.

Threadguy: How do you view the cycle in 2024?

Ansem: My thoughts have changed many times. The rebound at the beginning of the year was very strong, almost a V-shaped rebound, but not all altcoins hit new highs. I think we may have to wait until later in 2024 for a bigger market.

What I'm really interested in is whether there will be something that suddenly explodes in this cycle, similar to NFT and DeFi. Because every time something like this appears, no one can foresee it. Although meme coins have performed strongly this time, we have seen Dogecoin and Shib have had such situations before.

Threadguy: Do you think unknowns like DeFi and NFT must change in every cycle?

Ansem: I don't think it has to change every cycle, but there will always be some unprecedented new things that will rise wildly. Because there's nothing to reference, no historical data to compare, its potential for growth is unknown. There are indeed many protocols in DeFi now that have decent income, with stable teams and financial support behind them, but their performance is not so outstanding. If we look back to 2019 to 2020, Aave rose about 2000 times at that time, and that was the first time everyone saw something like that.

Reasons for bearish sentiment

Threadguy: You recently publicly expressed bearish sentiment at a good time. What was your logic? How do you view the risks now?

Ansem tweeted that he lost about $250,000 within the past month, which is a quarter of his assets, and is seriously considering cashing out and permanently leaving the cryptocurrency market. Ansem admitted that he has completely lost his edge in the current market, feeling lost and trading at an extremely poor level recently (Trading like dog shit), making a series of wrong decisions.

Ansem: I turned bearish after the probability of Ethereum ETF approval surged from 20% to 80%. When the probability was only 20%, the price of ETH was around $3200 or $3300. When the approval probability surged to 80%, the market sentiment suddenly became optimistic, and ETH immediately rose from $3300 to $3900, close to the annual high.

At that time, I became very bullish, thinking that everything would hit new highs, with Bitcoin rising to $75,000 and Ethereum rising to $4000 or $4500. I thought the entire market, including meme coins, would hit new highs. However, there was not much fluctuation that week, and the market only consolidated in the following week, hovering near the high point.

I thought, it's impossible. There's so much good news, the regulatory environment is improving, presidential candidates are discussing cryptocurrencies, institutions are heavily promoting Bitcoin ETFs, and there's ample liquidity. But the market never managed to break through the high point, and that's when I started to turn bearish. I thought maybe Bitcoin and Ethereum would continue to consolidate, while meme coins would continue to rise.

At that time, my strategy was to hold most of my SOL and meme coins, and then short some ETH to see what happens next. But after meme coins rose a bit, they fell back, and I thought, no, it seems the entire market will decline. After all, at that time, we hadn't seen a major pullback yet. Bitcoin had only pulled back by 15% to 20%, without a significant 30% or 40% retracement.

I wrote a long article at that time, telling everyone that we were approaching the top of the range. You could choose to sell some and wait for it to return to the lower end of the range before buying back in, or hedge the risk through other means. If you did nothing, your investment portfolio could shrink by 40% when the market pulls back, and then you would be in a dilemma of not wanting to sell at the support level. I diversified some risk around early June, bought some assets when the market pulled back, and then shorted again, repeating the process. Now I'm not taking risks, I'm more in a waiting mode. I'm still very optimistic about the end of the year and the end of 2025, and patience is key at the moment.

Threadguy: What are your main holdings now?

Ansem: I am relatively bullish on Solana compared to other currencies. If I am bullish on the SOL/ETH trading pair, then I can hold SOL spot while shorting Ethereum to maintain the proportion of long positions. My current position is leaning towards neutral. Besides Solana, I also have some Helium and meme coins.

The SOL/ETH exchange rate has remained strong since the end of last year.

Threadguy: Are you the number one "enemy" of Ethereum?

Ansem: They really don't like me. When I strongly advocated this point last year, everyone thought it was impossible. Now, look, the market value of SOL has hit a new high.

Which narratives are you bullish on?

Threadguy: If we are currently in the second or third stage of the bull market, what important narratives do you think have not been realized yet?

Ansem: There are several major narratives that have not fully unfolded. One of them is the L2 tokens, which have performed very poorly this year, and the market sentiment for Ethereum is slowly turning negative. I think EVM-based L2 doesn't make much sense. If you want to build a blockchain that is more efficient than Ethereum L1, you shouldn't use EVM anymore, but should use other virtual machines. This way, Rollup can process more transactions and have lower fees, so I think non-EVM L2 tokens have more potential.

I also think DePIN is underrated, which is why I hold Helium. The use cases of these networks are very reasonable for outsiders, using resources from different regions and incentivizing them to work together, which can significantly reduce costs.

Another point is that people underestimate the trend of shifting from centralized exchanges (CEX) to decentralized exchanges (DEX). If you look at the ratio of on-chain transactions to CEX, the difference in this cycle is significant, and many teams are focusing on this area, not just as automated market makers, but also including on-chain perpetual contract trading. This is because we now have good enough infrastructure to compete with CEXs like Binance.

Meme coins are the original form of SocialFi

Threadguy: How will SocialFi develop next?

Ansem: I also really like SocialFi. Meme coins are the original form of SocialFi, showing people's enthusiasm for community trading behavior, competing or collaborating with others in a group. Plus, now everyone wants to issue their own tokens, so there will definitely be a social application that seizes the opportunity to financialize anything that spreads virally. Pump.fun might be that application, but there will certainly be other applications that continue to take advantage of this trend.

Although some people have some objections to these SocialFi applications making too much money from the Solana ecosystem, this situation will always change. In the crypto world, if a platform makes a lot of money, finds a clear product-market fit, and the community feels they are harvesting too aggressively, there will always be competitors or existing teams adjusting their strategies to improve the user experience. This is how the crypto world operates. It's too easy to replicate a product or build a new product in a similar way, and this competition always happens, with the ultimate result being development towards the most efficient direction.

Threadguy: Do you think Pump.fun has "killed" meme coins?

Ansem: I don't think Pump.fun has "killed" meme coins. Meme coins are not dead, and I still believe in the super cycle of meme coins. They will continue to serve as a good risk exposure for all these L1 and L2 tokens. But what people may not realize is how rapid the rise of meme coins has been, and there will be a cooling-off period afterward, with the market consolidating, either the price directly falling back or rising and then consolidating before rising again. Now I believe in this super cycle more than before.

At first, I thought BONK would perform well because at that time, Bonk was the only risk exposure token on Solana, and there were almost no other altcoins on Solana. I always said that if you use DeFi in the Solana ecosystem, you will eventually be rewarded because no one was using these protocols at the time, such as Jupiter, Jito, these protocols were all underrated. At that time, the price of Solana had just broken through $30, and it had been maintained for almost a year. When it broke through, I knew people would start moving to Solana, and when they arrived on Solana, they would buy BONK.

The idea of meme coins as a risk exposure on Solana is not a crazy idea. Since then, my view of the meme coin super cycle has become more firm because their performance has far exceeded that of other altcoins. But that doesn't mean they won't decline; any coin that has risen by a hundred or even a thousand times will experience a decline, which is normal in the cryptocurrency world.

Threadguy: Do you think meme coins in this cycle will surpass Doge's all-time high?

Ansem: If the total cryptocurrency market cap reaches $10 trillion in this cycle, I think it's possible. When the market cap of these coins approaches the level of Ethereum, there will indeed be some very exaggerated situations.

Threadguy: Although DOGE is an old-school coin, it seems a bit outdated now. Do you know anyone who is actively discussing Doge?

Ansem: No one really cares anymore. The influence of old meme coins has decreased significantly compared to new meme coins. There is a lot of old money in the cryptocurrency market, and they usually drive the fluctuations of Doge. But look, Elon Musk posted a meme about Doge two days ago, and the price of Doge didn't move at all. It's like when Bitcoin and Ethereum have good news but no movement. If a major event that should have caused a fluctuation doesn't trigger any response, it means the market sentiment is not very good.

Threadguy: How do you view the extreme bearishness of old players just because of the crazy rise of meme coins?

Ansem: I think their point of view is reasonable. In the past, the skyrocketing of meme coins and small altcoins meant that the market was close to the top. But this cycle is different. Besides meme coins, no other sectors have performed particularly crazily. So I think we are still in the early stages of the cycle. Also, Bitcoin and Ethereum have not yet surpassed their all-time highs. If they are already at the top now, that would be absurd.

Threadguy: What impact does Pump.fun have on the meme coin space?

Ansem: It has definitely diluted those low-market-cap meme coins. When the Solana ecosystem first became popular, some coins could maintain a market cap of $1 million for several days or even weeks, but this situation is almost non-existent now.

Threadguy: How to find the next "WIF" in the current meme coin frenzy?

Ansem: I usually focus on coins with market caps in the range of $5 million to $10 million and look for those unique meme coins. If a coin's theme is a specific animal, its market cap ceiling is usually the highest market cap of similar coins in the current market. If you find a new theme that is different from existing coins and a community forms around it, there may be a "crazy rise" situation.

Threadguy: Will funds move from meme coins to those infrastructure-based, more practical value coins?

Ansem: Personally, I still think meme coins will have another wave of rise. But think about it, if the market cap of meme coins reaches $30 billion, $40 billion, and multiple meme coins reach this level, will they really rise to a trillion? In that case, I'm not sure what percentage meme coins will account for in the entire crypto market, but I think once they account for a large enough percentage, it may be time to consider reducing risk and turning to other areas.

Threadguy: What is the best way to launch a token in 2024?

Ansem: It's good on platforms like Pump.fun, but the key is not to issue tokens with ultra-low market caps. Because once the market cap is too low, there will always be insider trading, leading to a large sell-off on the first day. If you have enough influence, tokens should be issued with a higher market cap. Ideally, even if they really decide to issue tokens, I think they don't necessarily have to be immediately circulated, but the supply should be locked for a period of time. This way, it can at least ensure that they will put more effort into the project, rather than just focusing on the performance of the first day or week.

Threadguy: Recently, because the cryptocurrency market has been a bit sluggish, everyone has started to focus on sports betting. What do you think about cryptocurrency and sports betting, and the future of gambling?

Ansem: I think meme coins are a bit like sports betting. When you buy low-market-cap coins, the hit rate is like placing a bet with a five-fold odds, most of the time you won't win. But the difference with meme coins is that although the hit rate is also very low, the return rate is much higher. As for sports betting, unless you go for compound bets with dozens of times the odds, it is impossible to achieve such a return.

Threadguy: Will meme coins replace low-end sports betting?

Ansem: I wouldn't say replace, but I think they will become just as common. People will "gamble" on low-market-cap coins in the crypto field, just like placing bets in sports betting.

How to find "Solana opportunities"?

Threadguy: If you haven't made a million, or even a million-dollar profit, is it wise to focus on meme coin trading, or should attention be focused elsewhere now?

Ansem: I wouldn't advise you to go all-in on meme coins. For cryptocurrency newcomers, the best investment portfolio should be 70% "safe" assets, for me it's Solana, but it could also be Bitcoin, Ethereum, Coinbase stock, which are relatively safe investments in the cryptocurrency field.

I also think there is a great opportunity now to focus on those altcoins that have experienced a significant decline from their highs or new altcoins that have not received much attention. Because all the attention is on meme coins now, almost no one is paying attention to other areas. If you can do enough research in other areas and find those potential altcoins, that's also a good direction.

My Solana trades last year were like this. Everyone thought Solana was finished after the FTX incident, but a few people seized the opportunity and it turned out to be one of the best trades of this cycle.

And there will always be opportunities like Solana, because many people don't do their own research, but rely too much on market movements and what everyone is discussing. When a certain area receives a lot of attention, prices will rise quickly, and people will act quickly. But if you can find these opportunities before they really explode, that's the time to earn a hundredfold return.

Threadguy: Is Solana your most profitable trade ever? How did you find this opportunity and have such confidence? If you repeat such an operation in this market cycle, what will you focus on?

Ansem: Yes, it's actually a combination of many factors. I was very lucky to have been paying attention to the Solana ecosystem for a long time and to understand its entire development process. I bought SOL when it was only $1.5, and in early January 2021, I saw that Ethereum and DeFi on Ethereum were doing well. I thought if the crypto market is going to get bigger, there will definitely be multiple successful L1s, especially when Ethereum was starting to experience congestion and high fees at the time, and Solana's narrative was "cheaper and faster."

I was involved in a lot of things related to Solana at the time, witnessed the entire ecosystem's growth, and saw the troubles it encountered. I followed all the early technical upgrades of Solana and also attended the 2022 Breakpoint conference. At the conference, I had discussions with many developers and members of the Solana community. Everyone was discussing the progress they had made behind the scenes over the past year. Although some early Solana projects did not perform well, the team was still working hard.

At the end of 2022, the public's view of Solana was very negative, and everyone thought Solana was often crashing. But at the Breakpoint conference, what I saw was completely the opposite of the outside world. I remember they announced a partnership with Google Cloud, and the price of Solana rose to $39. At that time, I attended the last party of Breakpoint and felt everything was going well, so I decided to go all in and thought it was a good opportunity for the next market cycle.

Later, FTX collapsed, and I remember I was still in the club at the time. Someone told me that I needed to withdraw funds from FTX, but I didn't pay much attention at the time. It wasn't until after I got off the plane that I realized the situation was getting worse, and then someone told me that CZ had just bought FTX. SOL dropped from $20 to $8.

After experiencing the Breakpoint conference and the collapse of FTX, I knew that if we were to enter another bull market, the developers who continued to build on the chain would definitely drive the development of the chain, and the negative impact caused by SBF would eventually pass. I thought to myself, if Solana is going to rebound, now is the best time to buy, but I didn't buy at that time. I was waiting, feeling that it might drop to $2 or even lower. I waited until the price returned to around $15 to $20 before starting to buy. Around May 2023, I began to publicly express my optimism about Solana.

Threadguy: What's the next crypto trend that excites you?

Ansem: I think trading meme coins and Pump.fun is like a little game. It's not a complete game, but more like a game where you guess which coin will take off and then quickly enter the liquidity pool. I think in the crypto field, you can be more creative with this kind of little game, and Solana is a great platform to realize these ideas. Because Solana can handle a large number of transactions and is very cheap, users can easily engage in a large number of micro-trades.

Games like Flappy Bird became popular on iPhone and Android, where players were just pursuing high scores without any monetary incentive. But in the crypto field, we can create similar on-chain games and add financial elements. Coupled with community participation, everyone competes with each other on the chain. I think there is a lot of creativity that can be realized in this space, and it has not been fully explored yet.

Threadguy: So you see Pump.fun as one of the millions of apps in the app store, right?

Ansem: Yes, for me, Pump.fun is one of the most obvious examples of Solana's product market fit. Pump.fun's daily revenue even exceeds that of Solana itself. It is able to do this because Solana can easily handle a large number of on-chain transactions, and the transaction fees are very low. There can be many applications similar to Pump.fun because Solana's design supports this parallel processing. Even if there are high fees in a certain area of Solana, it will not affect the operation of applications in other areas. Its parallel processing allows many different applications to coexist.

Threadguy: Did the early iPhone era developers feel like they were in a gold rush, with everyone rushing to develop apps and list them in the app store? Do you think we will see a similar gold rush on high-performance chains like Solana or Monad?

Ansem: I think we will. Cryptocurrency applications and applications in the app store have a significant difference. Although some applications also have financial elements, the potential for financialization of applications in the crypto field is greater.

Threadguy: Indeed, traditional apps are difficult to monetize, either charging 99 cents for downloads or making money through microtransactions like "Clash of Clans," but it's difficult to profit on a large scale.

Ansem: In theory, the profit margin of applications on the blockchain should be much better, especially when running on these high-performance chains. So I think this is indeed a completely open design space that has not been fully explored yet.

Neiro Incident

Threadguy: Tell us about the Neiro incident, how did it happen?

Ansem: At that time, I was on vacation with my family and saw everyone on Twitter discussing Neiro. I was confused about what was happening, so I asked which one was the correct Neiro coin. Someone sent me (lowercase Neiro), and I thought that was the right one, so I shared it. Later, someone told me it was a scam and invited me to join a Space. I joined the discussion and told everyone inside that it didn't matter which coin they bought, because I didn't want to endorse any particular coin and risk making people unhappy. Although I emphasized this multiple times in the discussion space, it obviously had no effect.

Threadguy: Do you think you "killed" Neiro with your own hands?

Ansem: I might have, but I know that if I didn't do anything, the situation would have developed in the same way.

Threadguy: This feels like some kind of "conspiracy group coin" with a crazy narrative, like the second Dogecoin, yet your joke coin Pups had a higher market cap.

Ansem: This was one of the things I mentioned when I tweeted. The second coin reached a certain height, I remember it was either 800 million or 9.8 billion, and my cat coin suddenly rose to a market cap of 10 billion.

Threadguy: This "protagonist" phenomenon is very interesting. It's a very awkward position, and you can't act like a victim. But in fact, when the "protagonist" only has three possible outcomes: first, you create something and become a unicorn, you succeed; second, you collapse under the spotlight and are completely destroyed; third, you disappear.

Ansem: There are hardly any people who have had such an experience, gaining so much attention in a short period of time, with countless eyes watching you, and you have no control over the stories others randomly make up. For example, when the Iggy incident happened, I came out to express support, and then someone released an AI fake video of me chatting with her on the street a week later.

Someone at a party told me they had seen my friend Drew, but I had no idea who Drew was. He said he had talked to Drew for an hour, and Drew kept making up all kinds of stories, saying that I was going to collaborate on this project with him, and he was helping my company with this and that, and this person actually believed Drew. I was thinking, how many times has this kind of thing happened?

Threadguy: Was the interaction between Arthur Hayes and Pups prearranged?

Ansem: I swear it wasn't. I was surprised when he messaged me. We had chatted before, but we didn't plan anything together.

Celebrity Coin Chaos, Being a KOL is Not Easy

Threadguy: How do you view the trend of celebrities launching coins in this cycle?

Ansem: When I first saw celebrities entering the crypto world, I thought it was quite reasonable. Meme coins were taking off, and I already had ideas about social tokens. These celebrities all have a large number of fans, and if they join the cryptocurrency world, they should be able to make a lot of money, and their fan base will be motivated to interact with these artists and celebrities.

I was also very active in tweeting about these things. The first celebrity was Iggy, and I remember she announced her CA, which should have a market cap of around $10 million. I tried to buy, but the first transaction failed. I didn't even realize it failed at the time, and it took a long time for me to notice. Later, when the price dropped, I bought again.

After that, she tweeted asking me how to handle the supply, whether she should burn a portion, and then we had a chat in a Space, where I suggested she burn a portion of the supply. We talked about celebrities joining the cryptocurrency world, her views on cryptocurrency, and her plans. That's when I found out that she told us that someone was maliciously manipulating these coins, talking to people, and trying to launch these coins in her name. She said, "No, I want to do this myself."

Iggy discussed her meme coin MOTHER on a podcast, source: Zach Song Show.

Another one is Caitlyn Jenner. I didn't really get involved in that project, just asked a lot of questions in a Space.

Then there's DeVito, which really hurt me. I was very enthusiastic at the time because he's a super influential artist, and I knew that if he was active in these crypto applications, it could bring in a lot of new users. If he got his whole community into the crypto space, that would be even more powerful.

So I helped him register and co-hosted a Space with them, and then someone said they were selling coins from the developer wallet, right now. I was stunned at the time, I was still talking to him, and this happened. Then I told them in the Space, "If you start selling on the first day of the coin launch, no one will trust you." Many teams don't really understand cryptocurrency, but they know they can make quick money in the crypto space.

Threadguy: If a celebrity enters the crypto space just to issue a meme coin at the risk of their brand, without actually investing any capital, they are likely just in it for the money.

Ansem: I agree. As long as you have even a slight connection or interaction with something, whether or not you are actually involved, everyone will see it as your stamp of approval, and that bothers me.

Even if you think celebrities, social tokens, and social economies have potential, it shouldn't be for those who are eager to issue coins just to make a quick $300,000. So that's where I was wrong. I thought these people, with such influence outside the crypto space, wouldn't just run off after starting a project. But the reality proved otherwise, and the result was the same every time.

NFT Isn't Dead, Ordinals Took a Hit

Threadguy: Is NFT over?

Ansem: I don't think NFT is over. It will rise again with the rise of GameFi. Many long-term developed games will be combined with NFTs, which will either be used in-game or provide additional rewards for the holders. In this cycle, meme coins have performed strongly, and I think they have similarities with NFTs, especially in terms of community interaction and gamified experiences, such as the strategy of buying in early. I believe someone will find a way to combine gamification and NFTs, and in fact, some teams may already be trying to do so.

Threadguy: What are your thoughts on Ordinals and its relation to Bitcoin?

Ansem: I lost a lot on Ordinals. I participated in some projects, and they all got stuck.

Regarding the Bitcoin ecosystem, my view is that the Bitcoin market is very large, and Bitcoin DeFi and other ecosystems will perform well because many Bitcoin holders have a lot of cash. Those old Bitcoin whales, who hold Bitcoin, might use DeFi or something like Ordinals. That was my initial thought, but now I'm not sure if it can attract new markets. Because many old Bitcoin whales are actually participating in various projects on Ethereum and Solana. So the key to the development of the Bitcoin ecosystem is whether it can attract Bitcoin holders who have never operated on the chain.

Threadguy: Have you ever thought about putting all your money into Bitcoin and not touching it for 2 years?

Ansem: I have considered it. Sometimes I just want to tell everyone to sell off other assets and put all the money into Bitcoin's cold wallet.

Rapid Q&A Section

Threadguy: How do you view the current status of angel investments in the crypto field in 2024?

Ansem: I think the current state of angel investments is pretty good. I didn't make any investments in the last cycle, but I heard that many investments in the last cycle were in the infrastructure sector. I think the opportunity for infrastructure projects to reach a valuation of $10 billion has basically passed, unless you can prove that it's worth that price.

In the last cycle, if you invested in an L2 project at a super low price, you almost certainly knew it would rise in value because someone would find it. But in terms of applications, it's much more difficult to invest. You need to know if the founders are excellent, if the application has potential, and this thought process is more complex for people. But if you can access these kinds of trades, you might do very well, because this is the area most likely to explode in this cycle.

Threadguy: A few months ago, there was a popular saying - the only way to make money is to participate in secret trading flows. Do you think you can still make money without participating in angel investments?

Ansem: I think you definitely can, especially now that this idea has become a consensus. Many people are now unwilling to invest in overvalued infrastructure projects, and when these projects go public, the valuation will decrease. If a team is building an ecosystem, while the valuation is decreasing, some products will explode, and you can buy in at a price lower than its initial issuance.

Threadguy: When do you think a new chain can surpass Solana?

Ansem: I think time is the biggest factor. Even if a powerful L1 chain like Solana is launched now, and it can build applications similar to those on Solana, it still needs an active developer community, users, and traders on the chain.

This cycle, I've been thinking about a question - I think Solana will perform better than people expect, and in fact, it's already happening. And once it performs well, there will be many projects launching in the later stages of the cycle, and many new projects that haven't gone live yet. If Solana rises to $1000 or even higher, and then new projects are launched at one-tenth of its valuation, many people will want to lock in those profits and look for new investment opportunities.

In the last cycle, all projects were almost launched simultaneously, and I could quickly rotate between Solana, Luna, Avalanche, and others. But this cycle is different. Solana might explode first, and then it might be Monad or other L2 chains that explode, and these new projects won't all appear at the same time.

Threadguy: Do you really think Solana can rise to $1000?

Ansem: I really think it can.

Threadguy: How much do you think Bitcoin will rise to?

Ansem: I think around $250,000.

Threadguy: Is it time to readjust, reset your mindset, and change your perspective to embrace the mid-late stage?

Ansem: I think so, especially if you feel you haven't performed well before. We are currently in a sideways phase, with little major fluctuation for several months. Most altcoins peaked in March, and even Bitcoin, Ethereum, and Solana haven't hit new highs in five months. I really think now is a good time to rethink.

Threadguy: Assuming you start from scratch and have all cash, how would you allocate your assets in the crypto field?

Ansem: Without considering "it has already risen 7 times, 10 times," and instead considering how to allocate assets based on the current market environment.

Threadguy: By the way, how did it feel when Vitalik retweeted your tweet?

Ansem: I've never met him or talked to him, and I was really shocked when he retweeted it. I thought, it can't be, why would Vitalik pay attention to me? He never gets involved in anything.

Threadguy: Is now a good time for novice traders to learn leveraged trading?

Ansem: If you have a little capital, of course.

Threadguy: You previously mentioned turning $3,000 into $100,000, was that through leveraged trading?

Ansem: Actually, most of my money was made through contract trading, and I also made quite a bit on Luna, which rose about 10 times at the time.

Threadguy: Do you think excellent on-chain traders should transition to contract trading?

Ansem: No, I don't think so. If you want to survive in this field long-term, you need to be good at both. Spot trading is definitely better than others, but managing risk is also very important.

Threadguy: What are the best and worst trades you've made?

Ansem: The best one was Solana, I made a lot of profit on Solana in this cycle. The worst was a short trade on Luna, I lost a lot that time.

Threadguy: Which coin do you think will "die" in this cycle?

Ansem: It might be Cardano, because there are now many powerful L1 chains with strong communities and technology, and Cardano hasn't kept up.

Threadguy: Which coin do you think is the most underrated?

Ansem: I think it's MetaPlex. People might only see it as an NFT platform, but it has many application standards in the entire ecosystem. Additionally, the team is very stable and has been operating on Solana for some time. They may be conducting a token buyback, making it a very underrated project.

Another one is Kamino, also a good project that everyone has been talking about recently. If Solana continues to rise, people will continue to use its DeFi applications. Although most funds are currently concentrated in meme coins, Solana's DeFi sector has not really exploded yet.

Threadguy: Do you think you are a hero or a villain in this cycle?

Ansem: I think it's probably fifty-fifty right now, but in the end, I will be the hero. The problem is that there is a big gap between the public perception and what I actually do.

Threadguy: What advice do you have for young crypto players on how to "turn the tables" in this cycle?

Ansem: Like my previous example, if you want to go from zero to a thousand times or ten thousand times in returns, you have to be the first participant in every opportunity. If you are always the first one on the scene, you will eventually catch a big opportunity. Also, staying active is important. Find a small group of like-minded people to research with, they will see things that you haven't noticed. Lastly, don't rely solely on information from CT, it's usually already outdated.

Be active in the project's community, join Discord groups, various chat groups, and even reach out to people you don't know but want to connect with. That's what I did in the first cycle, trying to interact with many people. No one knew who I was at the time, I just interacted with others on Twitter, leaving comments. To be honest, this kind of interaction will bring you a lot of opportunities.

Threadguy: In the last cycle, you were almost the first participant in every new project. How do you balance personal life and work when deeply involved in a bull market?

Ansem: It's really impossible. The hardest part for me in the last cycle was staring at charts all day, almost not living in the real world. This was one of the reasons I lost money in 2022. Even if you are very active in the crypto field, you still need to maintain some real-world relationships.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。