2024 July, the first spot Ethereum ETF was approved for listing. Although it provides a new investment channel for retirement account investors, the short-term market response was flat, and it was unable to obtain staking rewards.

Author: Sam Taube

Translated by: Plain Blockchain

About six months ago, the U.S. Securities and Exchange Commission (SEC) approved the first spot Bitcoin ETF. On July 23, 2024, the SEC approved the first spot Ethereum ETF for trading.

1. What is a spot Ethereum ETF?

The spot Ethereum ETF is a trading platform exchange-traded fund used for direct investment in Ethereum, the world's second-largest cryptocurrency by market value, second only to Bitcoin.

Ethereum has many characteristics that distinguish it from Bitcoin. Its blockchain not only carries Ether but also hosts decentralized applications and non-fungible tokens (NFTs) running on the Ethereum protocol. In addition, Ethereum now uses a proof-of-stake system to generate new coins, which is a more energy-efficient mechanism than the proof-of-work system used for Bitcoin mining. (Ethereum had also used a proof-of-work system before 2022, and then switched to a proof-of-stake system.)

Before the approval of the spot ETF, there were Ethereum strategy ETFs in the market, which indirectly tracked the price of Ether through futures contracts. However, these ETFs may not be able to track the cryptocurrency price as accurately as the spot Ethereum ETF and may charge higher fees. The spot Ethereum ETF approved in July 2024 is the first of its kind.

2. Spot Ethereum ETFs

As of now, there are eight different spot Ethereum ETFs trading. Below are the names of each ETF, their trading codes, fee details, and any promotional fee waivers.

3. Ninth Ethereum Fund

Technically, there are currently nine investment funds tracking the spot price of Ethereum, but the ninth is not a traditional ETF. The Grayscale Ethereum Trust (ETHE), not to be confused with its Mini Trust ETF, is an exchange-traded product (ETP) whose market price may deviate from its net asset value, potentially causing a premium or discount on the amount of Ether held by investors.

ETHE is the world's largest spot Ethereum fund, accounting for over 2% of the total Ethereum market value at the time of writing. Its expense ratio is 2.50%, and there are currently no fee waiver promotions. It was also approved for trading on July 23.

4. Ethereum ETF Price War

In the days leading up to the approval of the Ethereum ETF in July 2024, issuing companies engaged in a fee war. Many companies submitted multiple amended registration statements, lowering fees to weaken their competitors. Some companies followed suit, submitting their own revised versions with even lower fees within days.

Some companies also introduced promotions at the last minute, such as announcing full fee waivers for the first six months, to demonstrate that they had the cheapest Ethereum ETF in the market. This trend of rapid fee reductions and promotions continued until the U.S. Securities and Exchange Commission announced its approval, and may continue in the future.

Given this, any information you see about Ethereum ETF fees and promotions is worth double-checking. Any numbers online may be outdated by the time you read them.

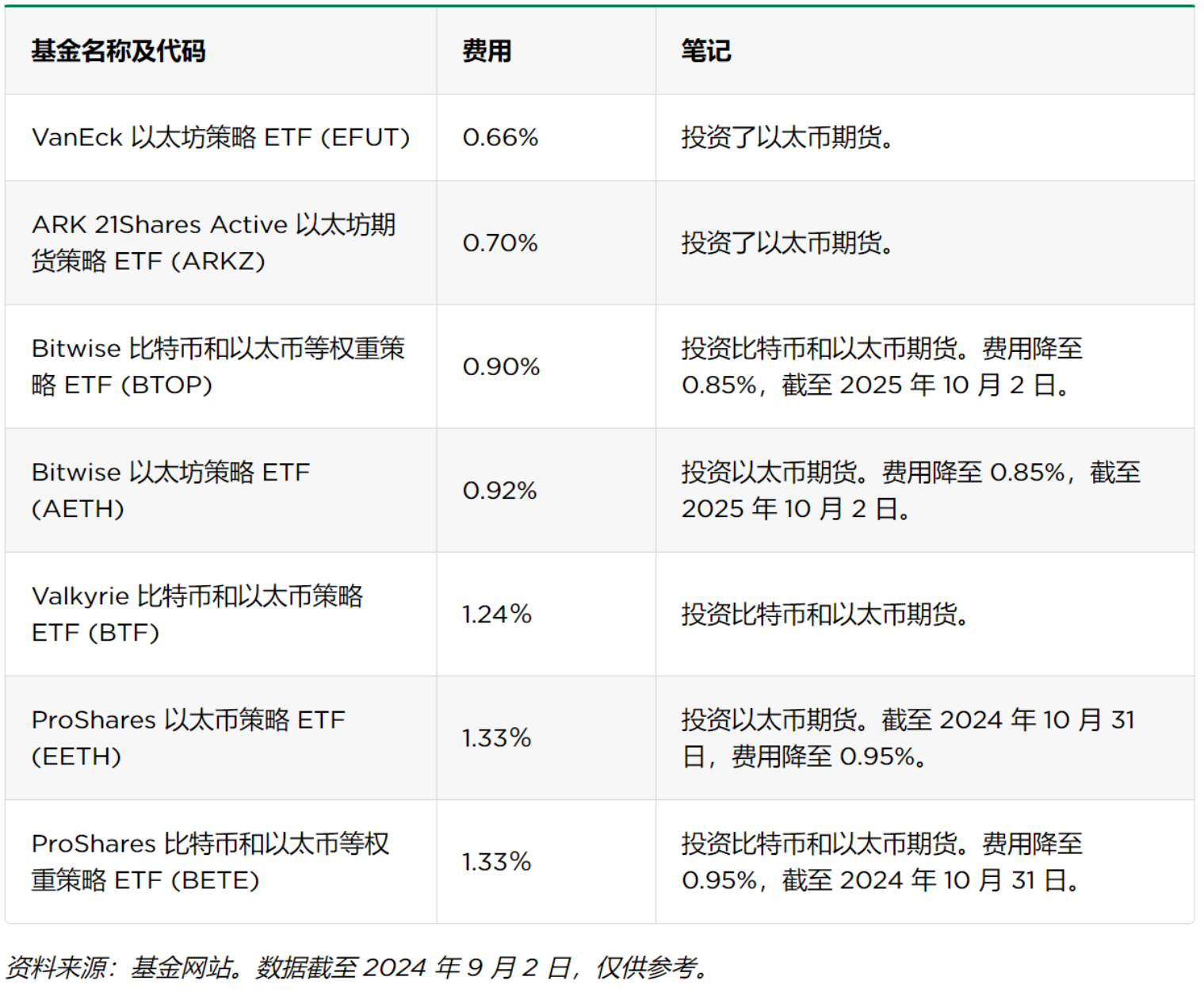

5. Ethereum Strategy ETFs

We define Ethereum strategy ETFs as any ETF that invests at least 50% of its assets in Ethereum futures. There are currently seven such funds in the market, listed below in order of their fees from low to high.

6. What does the approval of ETFs mean for Ethereum?

As of the time of writing, the price of Ether has risen by over 40% this year. Will the recent ETF approval further drive this upward trend? This remains to be seen.

Ethereum ETFs provide a new way for 401(k) and IRA investors to invest in cryptocurrencies. Americans collectively hold nearly $40 trillion in retirement account funds, and many of these accounts do not allow direct cryptocurrency trading. (Note: 401(k) and IRA are common retirement savings accounts in the U.S. They typically do not allow direct purchase of cryptocurrencies, and the Ethereum ETF provides a way for investors in these accounts to indirectly invest in cryptocurrencies.)

However, the short-term market response to the approval of the Ethereum ETF has been relatively flat so far. On July 23, the first trading day of the ETF, the price of Ether actually fell slightly from 9:30 a.m. to 4:00 p.m. Eastern Time.

7. Ethereum ETF vs. Ethereum itself

The spot Ethereum ETF may have some advantages over other ways of investing in Ethereum. As mentioned earlier, for investors who cannot directly purchase Ethereum (such as retirement account investors), the spot Ethereum ETF may provide a cheaper and more reliable investment method than the previous Ethereum strategy ETFs.

However, it is worth noting that compared to directly holding cryptocurrencies, the spot Ethereum ETF also has some disadvantages. Current Ethereum ETF investors do not receive staking rewards (a reward similar to interest or dividends for holding Ether).

If you want to access this feature of Ethereum, you need to invest directly in the cryptocurrency itself.

Original article link: https://www.hellobtc.com/kp/du/09/5399.html

Source: https://www.nerdwallet.com/article/investing/ethereum-etfs

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。