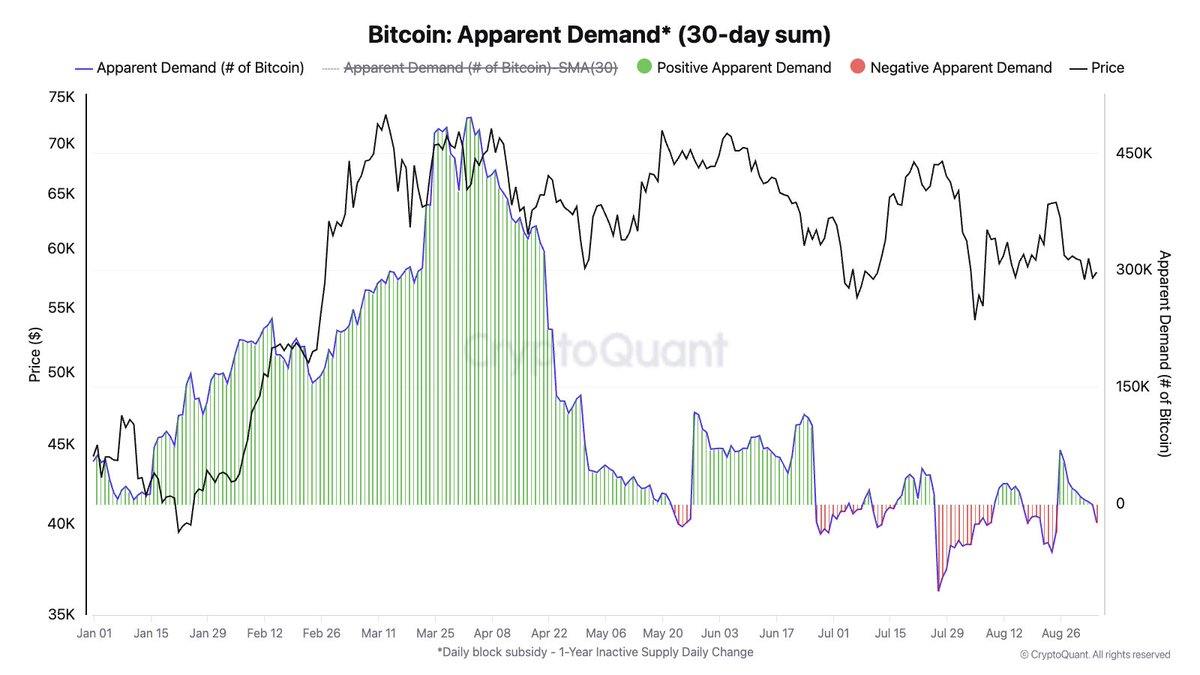

September hasn’t been kind to bitcoin (BTC) this year, continuing a trend that stretches back to 2013 as the month often proves to be a tough one for the top crypto asset. BTC wrapped up August in negative territory, and Google Trends data suggests that public interest in bitcoin is lagging significantly. On Thursday, Julio Moreno, head of research at cryptoquant.com, shared his thoughts on X, pointing out that demand has dropped significantly.

“Bitcoin price is down simply because there is no demand growth. Indeed, demand is declining right now. Basically, all valuation metrics are in bearish territory,” Moreno wrote. “Price levels to watch: $55.5K – trader’s Onchain realized price lower band,” the researcher added.

Chart shared on X by Cryptoquant’s head of research Julio Moreno.

When asked whether he believed BTC would hit all-time highs in Q4, Moreno responded:

Unfortunately, nobody knows that. That’s why we monitor demand and other metrics. Yes, seasonality is positive in Q4. But it also depends on the overall economic and bitcoin market conditions.

Meanwhile, as bitcoin continues to languish with its value slipping further, some are confident that an unexpected twist could be just around the corner. “Crypto Twitter feels like a ghost town, and most of the big Youtube influencers have finally turned bearish. That’s exactly when bitcoin might surprise everyone and do bitcoin things,” the X account Cryptomoon remarked. “Bitcoin Long Term Holder Supply is trending up. Not the time to be bearish,” another X account said.

Sharing a chart, the X account called The Gold Prairie wrote:

I’m sick of this range, just like you. But maaaaan, does this look good. How can you be bearish on this setup?

As bitcoin hovers in a critical price range, the market remains divided between bearish caution and bullish optimism. While some await further decline, others believe a breakout may be imminent. With uncertainty looming, the coming weeks could reveal whether bitcoin will defy historical trends or remain constrained by stagnant demand and fading interest. Many wholeheartedly believe Q4 will bring some excitement, as past trends suggest a strong possibility, especially during bull run years, just as Moreno mentioned.

However, as the Cryptoquant researcher also stressed, no one can predict the future with certainty. While data and charts provide useful hints, the market has a way of catching even the experts off guard. In the unpredictable world of crypto assets, surprises are always around the corner, and you can never truly know what’s coming next.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。