In July last year, Paradigm's article "10 Most Interesting Areas" ranked "Intent-centric protocols and infra" at the top. A year has passed, and this article will summarize the current development status of related projects centered around intent.

Author: Nicky, Foresight News

In June last year, shortly after Paradigm's article "Intent-Based Architectures and Their Risks" was released, the concept of "intent" became increasingly popular. In July of the same year, "Intent-centric protocols and infra" topped the list of the 10 most interesting areas published by Paradigm, indicating the importance institutions place on this concept.

Concept of "Intent" and "Intent-centric"

The "intent" simplifies the operation process by specifying the starting intent and the desired outcome, thereby improving the user experience.

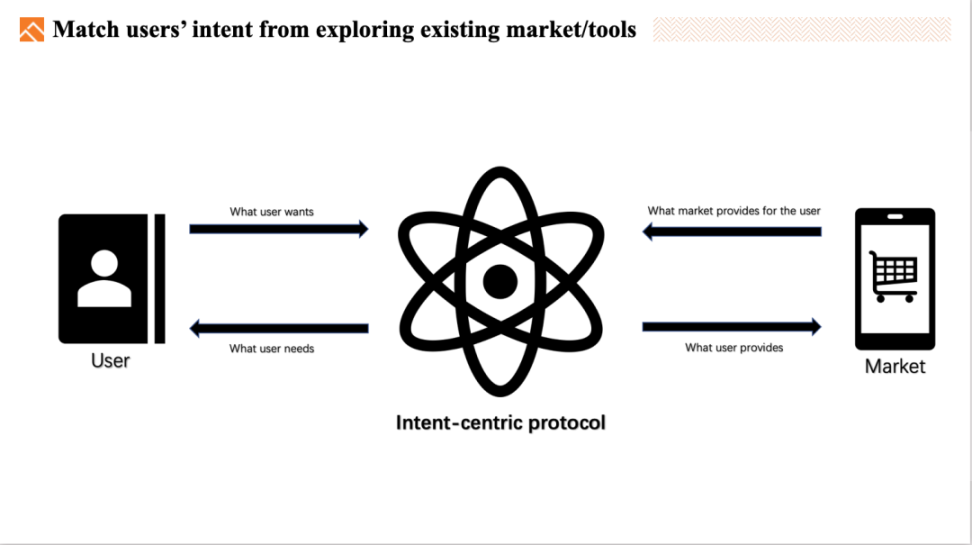

An intent-based application provides a method for digital users to execute applications, reducing costs and improving efficiency. Essentially, intent can be seen as a digital matching mechanism. Its principle is to connect the user's needs with feasible solutions, simplify the complex intermediate processes, and provide a concise final result.

Source: Foresight Ventures

Built on this foundation is "Intent-centric," which refers to protocols and applications centered around intent. This helps users in the process of using DApps to simply state their goals or intentions, allowing the system to automatically interpret and execute the corresponding operations, and achieve the desired results. This design greatly simplifies the interaction process between users and DApps, reduces the barriers to use, and enables even non-Degen users to easily experience the convenience and advantages of decentralized applications, thereby lowering the entry barriers for Web3 and attracting more users.

Inventory of "Intent-centric" Projects

I. General Intent Network Solutions

Across Protocol

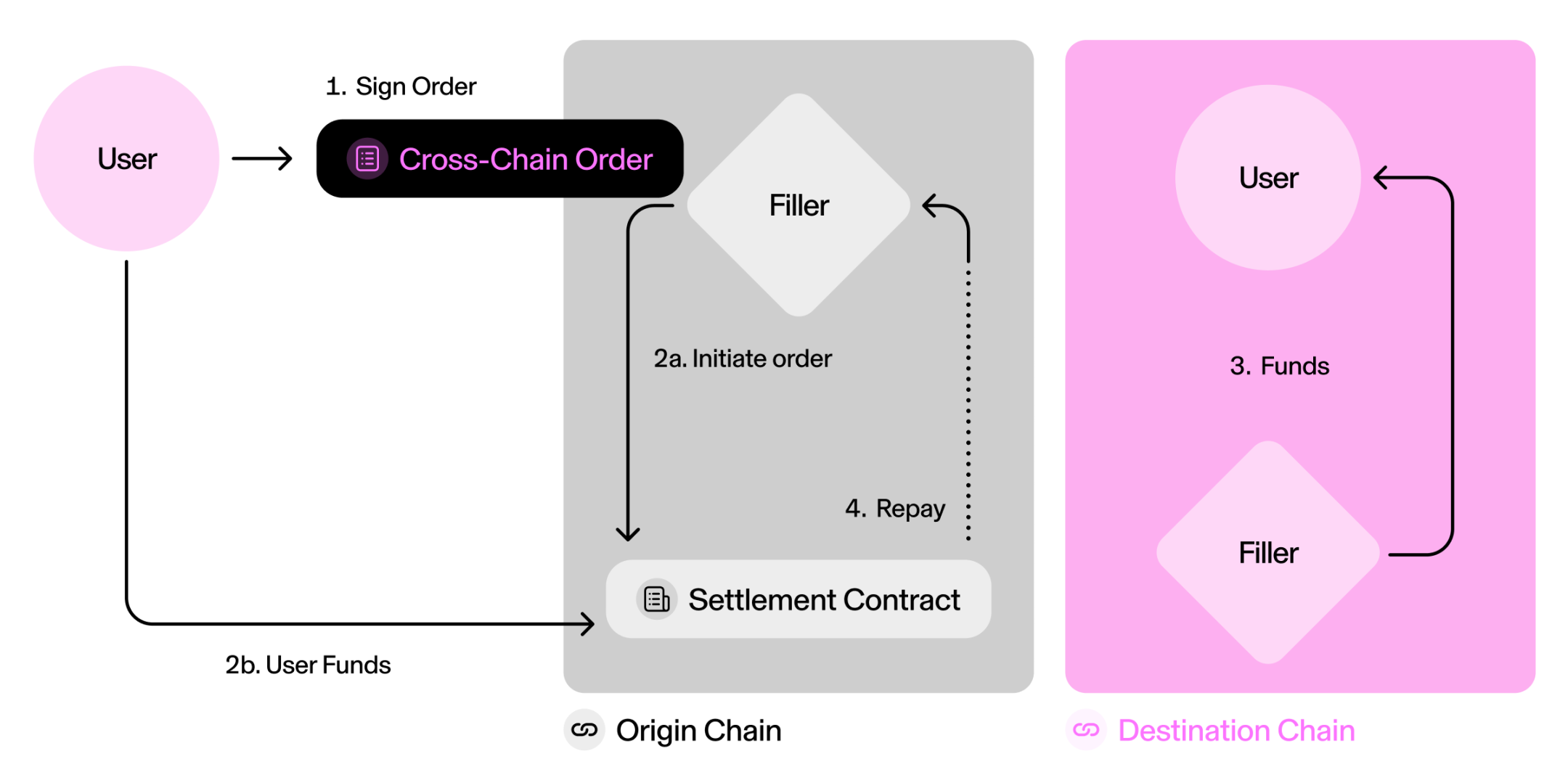

Across is an intent-driven interoperability protocol. It is currently the only cross-chain intent protocol in use, capable of achieving value transfer in the fastest and most cost-effective manner without sacrificing security. Across collaborated with Uniswap Labs to develop the first cross-chain intent standard, ERC-7683, which aims to enhance the connectivity, user experience, and cost-effectiveness between blockchain networks. In August of this year, Optimism announced the adoption of the ERC-7683 cross-chain intent standard, aiming to achieve high-speed ETH and USDC transfers on Superchain and further promote application layer interoperability within the wider Ethereum ecosystem.

In August of this year, the cryptocurrency exchange platform Coinbase included Across Protocol's native token ACX in its listing roadmap.

Anoma

Anoma is a general intent machine that changes the way decentralized applications (DApps) are built. It abandons the traditional transaction-based model in favor of an intent-driven approach, allowing users to directly define the desired outcome without delving into complex computational steps. This declarative feature simplifies the user interaction process, making the process of building DApps more intuitive. Anoma's intent machine is not only a supplement to existing virtual machines but also provides a high-level abstraction layer, enabling users to interact with the blockchain easily without delving into technical details. Its generality ensures compatibility with any blockchain, opening new doors for developers to build intent-driven applications.

In addition, Anoma introduces unique features such as permissionless intent infrastructure, intent-level composability, information flow control, and heterogeneous trust, unlocking new application scenarios that traditional virtual machines find difficult to reach and further driving the development of the ecosystem.

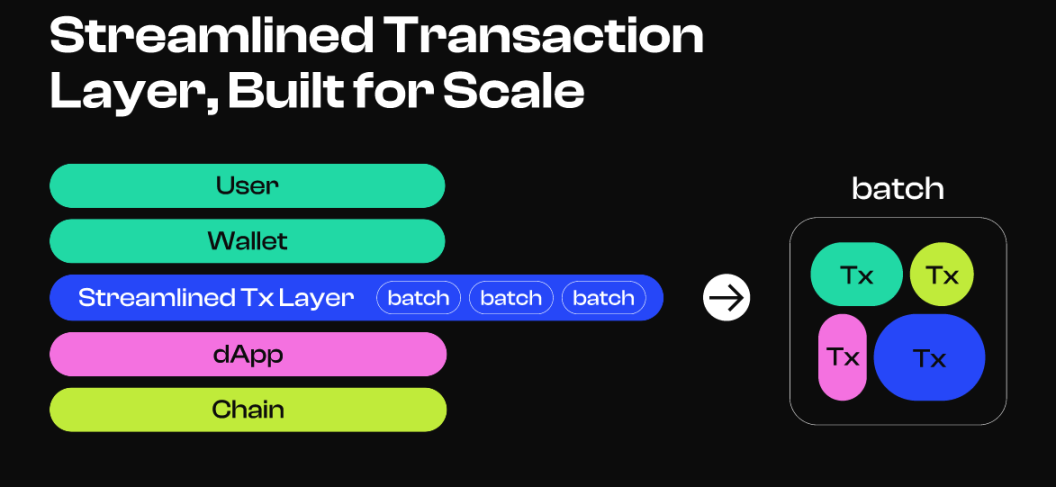

Bento Batch

Bento Batch is an Intent Transaction Layer (ITL) designed to enhance the efficiency of blockchain. This layer redefines the interaction between wallets and decentralized applications (DApps). In this intent transaction layer, transactions are optimized to directly achieve the expected results of various operations. Users no longer need to sign each transaction one by one or delve into the details of each transaction. Instead, they only need to clarify their goals and requirements, and the intent transaction layer efficiently meets these needs. This approach greatly simplifies the transaction process, reducing gas fees while enhancing the user experience.

Cowswap

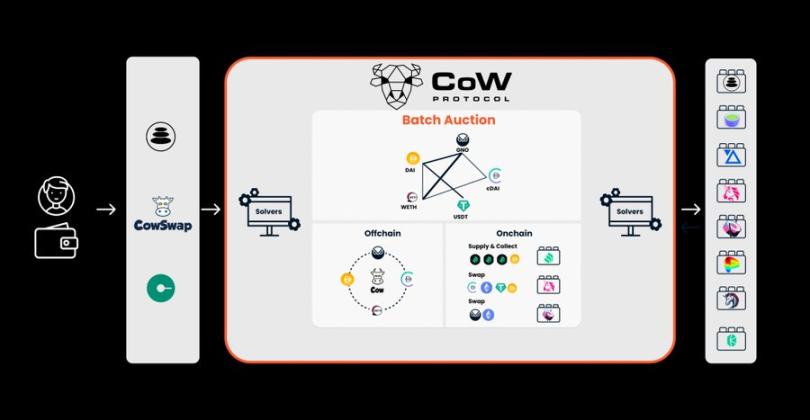

Cow Protocol is a permissionless trading protocol that maximizes liquidity through batch auctions to discover prices. It aggregates all available on-chain liquidity sources by finding "coincidence of wants," where two users each have what the other wants. Unlike traditional trading protocols, Cow Protocol's handlers compete to provide the best solutions to achieve the user's intent.

Cow Swap is the frontend interface of Cow Protocol, serving as a decentralized exchange (DEX) that helps users find the lowest trading prices across all DEXs and aggregators through an intent-centric model. Its design centered around intent protects users from front-running trades and other harmful MEV effects. The new feature of Cow Swap, Cow Hooks, allows developers and advanced traders to write custom operations (such as trading, cross-chain, staking, deposits, etc.) and execute these operations within a single transaction, better realizing the user's trading intent.

Source: @definaly_

dappOS

dappOS is an intent execution network, with a recent valuation of $3 billion, making it one of the leading projects in the current intent race. In March of this year, dappOS completed a $15.3 million Series A financing round, led by Polychain with participation from Nomad Capital, IDG, and others. In July last year, dappOS announced a seed round financing at a valuation of $50 million, led by IDG Capital and Sequoia Capital China, with participation from OKX Ventures, HashKey Capital, and others. In addition, dappOS was selected for the fifth season incubation program by Binance Labs in November 2022 and received Pre-Seed financing from Binance Labs in June 2023.

dappOS recently launched Intent Assets, aiming to address the rapid loss of TVL after airdrop rewards are released.

Enso Finance

Enso Finance is an intent engine aimed at driving the future centered around "intent." As an independent L1 Tendermint blockchain, Enso is collectively driven by network participants, providing efficient execution and broad integration. Previously, Enso Finance announced the launch of the shared network state Enso Intent Engine, aiming to simplify smart contract interactions on the blockchain and support the construction of tradable data across various blockchain frameworks. The Enso Intent Engine constructs tradable data across various blockchain frameworks through a shared map of smart contract interactions, allowing developers to automatically handle complex blockchain interactions by simply expressing their intent. This simplifies the integration of smart contracts with the blockchain and better addresses requests such as state changes, token transfers, NFT transactions, and DeFi strategy execution.

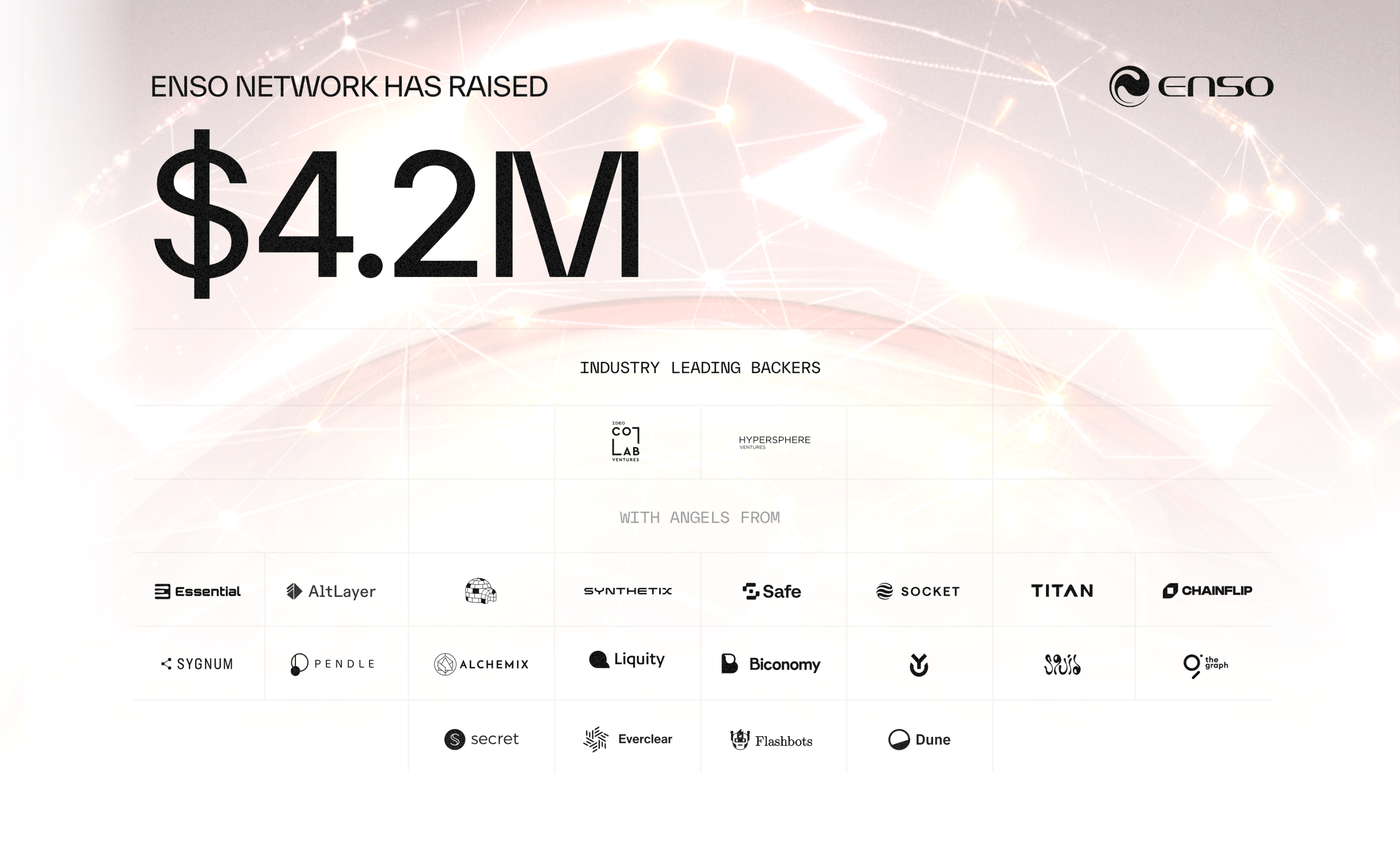

In June of this year, ENSO announced the completion of a $4.2 million financing round, led by Ideo Ventures and Hypersphere, with participation from over 60 angel investors. The new funds will be used to launch a Cosmos-based L1 blockchain later this year and for ongoing product development.

Essential

Essential is a blockchain infrastructure company using a declarative, intent-based architecture to redesign blockchain interactions from first principles, making blockchain technology more intuitive and user-friendly for global developers and users. In August of this year, intent-based crypto infrastructure company Essential completed a $11 million Series A financing round, led by Archetype, with participation from IOSG, Spartan, and others. In September of last year, Essential completed a $5.15 million seed financing round, led by Maven11, with participation from Robot Ventures, Karatage, and others.

Recently, Essential launched the Pint language as a declarative smart contract language for Essential, using a constraint modeling approach directly applied to blockchain state changes. It combines modern programming features such as type safety, user-defined types, and scalability to simplify protocol logic implementation through an intuitive interface. Unlike imperative languages, Pint's declarative contracts allow developers to see what they get, greatly simplifying smart contract development and understanding.

FluxLayer

FluxLayer is a full-chain intent liquidity layer supported by EigenLayer. In August of this year, Binance Labs Fund announced the second batch of projects incubated in the seventh season, with FluxLayer included.

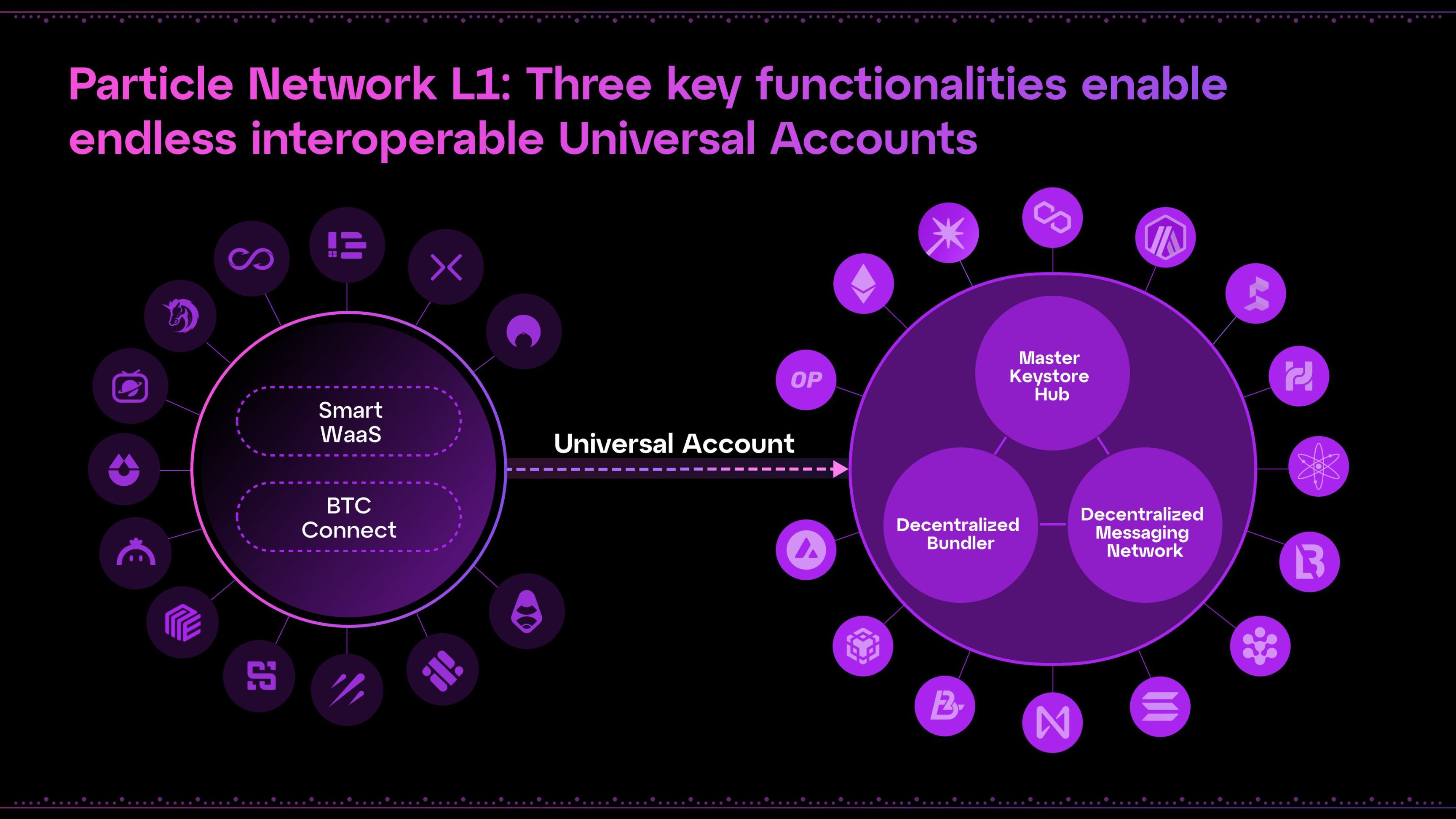

Particle Network

Particle Network is the first "intent-centric" Web3 modular access layer, aiming to drive the efficiency of user-chain interactions from the perspective of user convenience, efficient interaction, data autonomy, and modular adaptability covering the entire user interaction cycle. Particle's main product is the "Universal Account," allowing users to interact with funds from different blockchains.

In June of this year, Particle Network announced the completion of a $15 million Series A financing round, with Spartan Group and Gumi Cryptos Capital co-leading, and SevenX Ventures participating. This round of financing brings Particle's total funding to $25 million. In August of this year, Binance Labs announced an investment in Particle Network, with the new funds to be used for global team expansion, enhancing the functionality and integration of its chain abstraction ecosystem, and ensuring the launch of its L1 mainnet later this year.

Ruby Protocol

Ruby Protocol is an "intent-centric" account and access layer dedicated to building an "intent-centric," privacy-focused, and interoperable Web3 infrastructure. Ruby Protocol provides account abstraction (AA), asset bridging (AB), access control (AC), and other services, aiming to accelerate the development and large-scale application of Web3. By integrating with platforms such as LayerZero Labs, Arbitrum, and Optimism, it provides a chain abstraction layer that supports scalability, interoperability, and privacy protection for Web3.

In June of this year, Ruby Protocol's native token RUBY was listed on trading platforms such as Bybit.

Self Chain

Self Chain is a modular, "intent-centric" Layer 1 blockchain and keyless wallet infrastructure that implements multi-chain Web3 access through MPC-TSS/AA technology. The system uses large language models (LLM) to interpret user intent, simplifying the user experience, and ensures asset security and autonomous management through keyless wallets. Self Chain combines account abstraction with MPC-TSS technology to provide secure signatures and low-cost transactions, enhancing the security and usability of blockchain interactions.

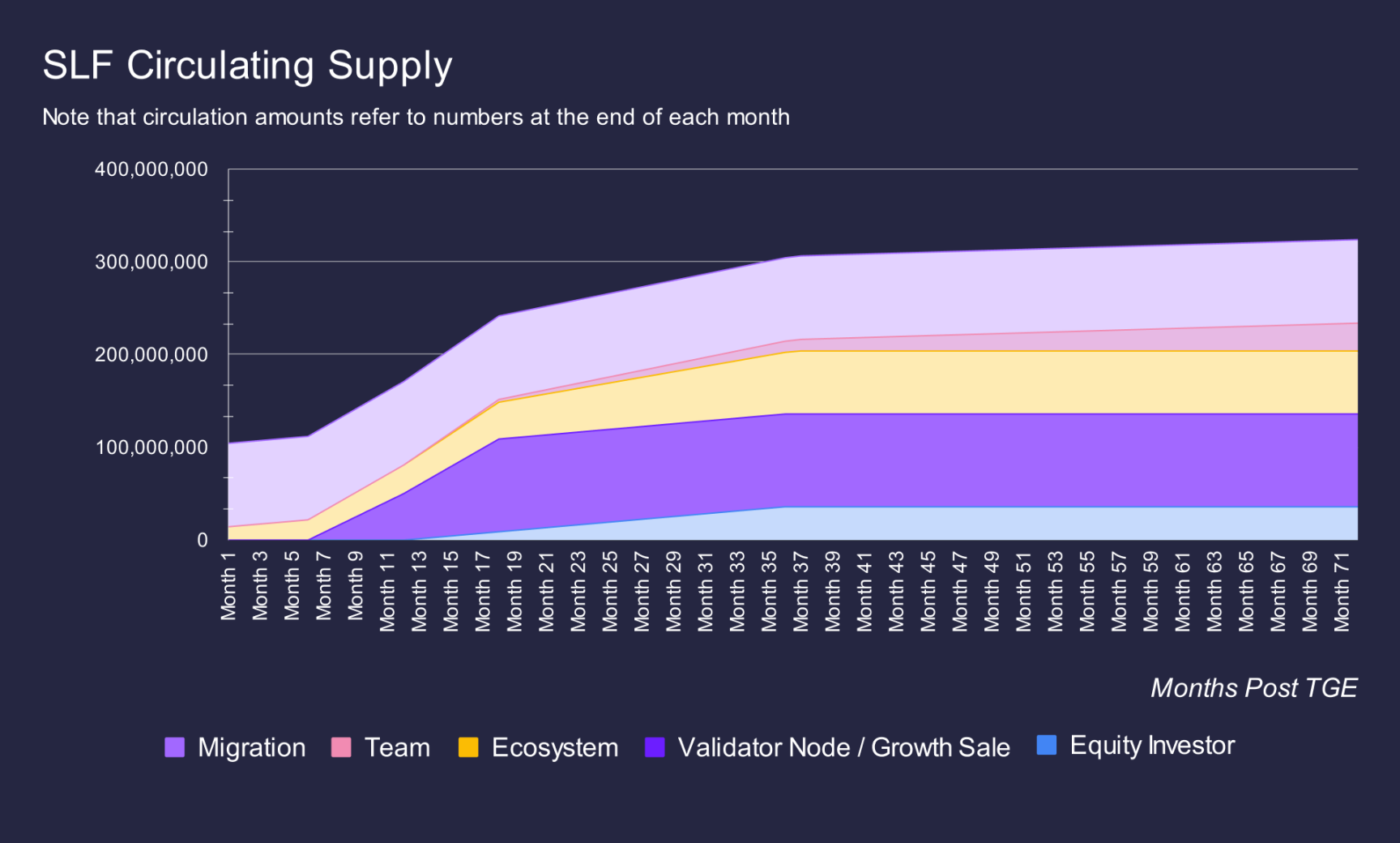

Self Chain (SLF) is a rebranding of Frontier (FRONT), expanding from a wallet project to a Layer 1 blockchain based on Cosmos-SDK, and designing a new token economy. SLF has a total of 360 million tokens, with 36 million permanently locked for foundation nodes, 90 million migrated from FRONT to SLF, 10 million allocated to new investors as validators (with an 18-month lock-up period), 36 million allocated to equity investors (with a 36-month lock-up period), 30 million allocated to the core team (with a 6-year lock-up period), and 68 million for the ecosystem (releasing 1.5 million per month).

Solvers Protocol

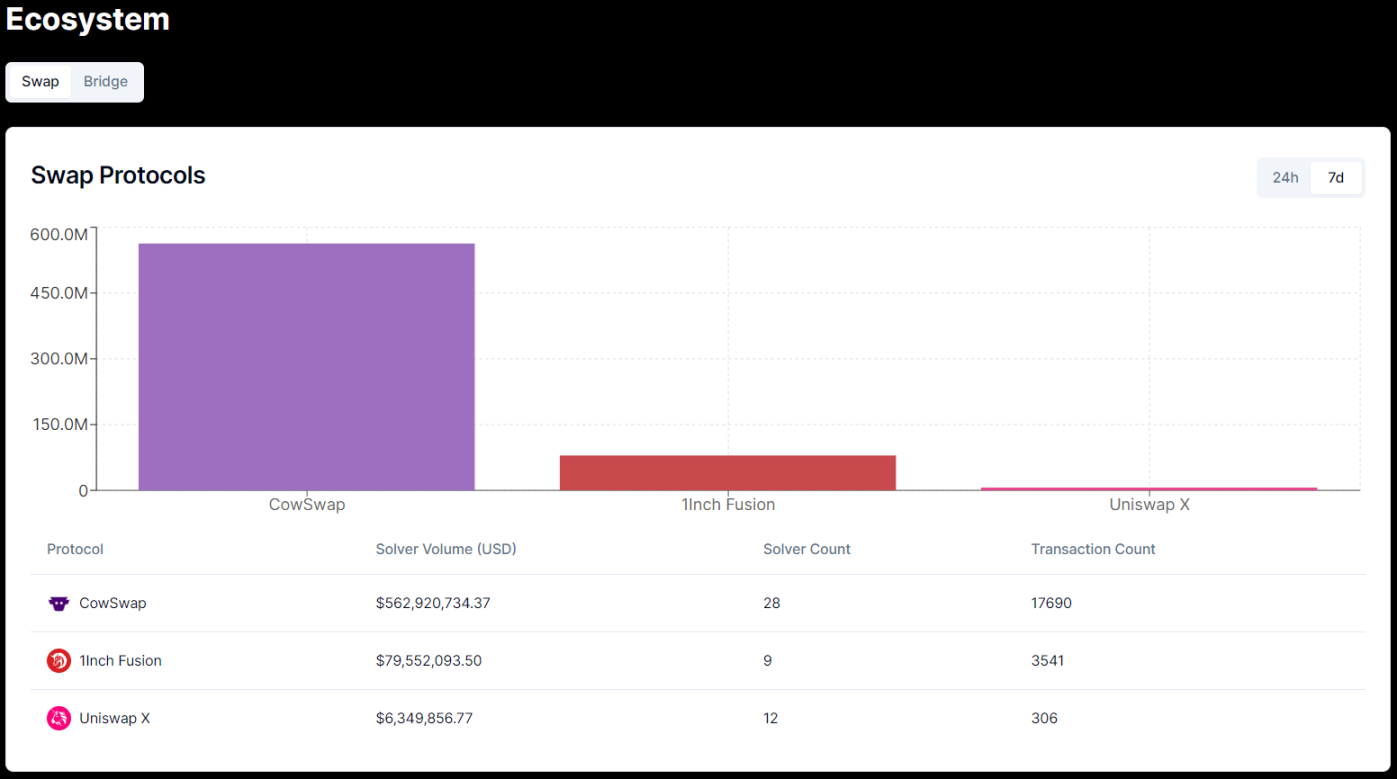

Solvers Protocol is an infrastructure that provides cross-chain support for solvers and intent protocols. Solverscan has been launched, a data retrieval platform designed specifically for solvers and intent protocols. It currently supports CoWSwap, Uniswap X, and 1Inch Fusion. Each solver has its dedicated analytics dashboard to track the performance of solvers over time. More intent protocols will be included in the ecosystem in the future.

SUAVE

SUAVE

SUAVE, developed by Flashbots, is committed to achieving fully decentralized block construction by separating the roles of the memory pool and block builders in the blockchain. SUAVE will gradually implement its strategic goals in three stages to ultimately achieve an "intent-centric" blockchain ecosystem. In July of last year, Flashbots completed a $60 million Series B financing round at a valuation of $1 billion, with the funds being used to develop the Suave platform, allowing users to "trade more cheaply and privately on the blockchain."

In August of this year, SUAVE launched the first public testnet, Toliman, through which developers can build intent systems, auctions, AI agents, and utilize two new features: EIP-712 signature transactions and high-performance computing capabilities provided by TEE Kettle. These features not only enhance user experience but also provide decentralized application developers with more flexible order flow control and privacy protection.

II. Intent Solutions for Specific Functions

DeFi

Aperture Finance

Aperture Finance is a platform driven by AI to simplify DeFi operations through "intent." In May of this year, Aperture Finance completed a $6.7 million Series A financing round at a valuation of $250 million, led by Skyland Ventures, with participation from Alchemy and others. The new funds will be used to develop infrastructure, expand the network, and enhance user experience. Its native token, APTR, was listed on trading platforms such as Bybit at the end of May this year.

According to Aperture Finance's roadmap, it is expected to provide comprehensive liquidity tool support for Aerodrome Slipstream on the Base network in the third quarter of this year and provide intent functionality. Additionally, a system will be developed to provide data analysis for liquidity positions managed by Aperture at both position and cross-position levels to better understand and optimize liquidity conditions.

DEX

1Inch Fusion

1Inch Fusion is a "intent-based" trading model launched by 1Inch Network, which transforms users' trading needs (i.e., intent) into actual trades without the need for users to manually set up complex trade details.

The Fusion mode combines 1Inch's limit order protocol and aggregation protocol, introducing professional market makers (Resolvers) to provide centralized and decentralized liquidity through a decentralized trading and matching system. In Fusion mode, users' orders are completed by Resolvers, and the gas fees are also paid by Resolvers. Users sign off-chain orders (intents) through the 1Inch platform, including assets, quantity, price, and time range, and then their intent is sent to the Resolvers network, where Resolvers compete to execute these orders through a Dutch auction, starting with a high price and gradually decreasing. The first Resolver to accept the order wins. Once the order is executed, the transaction result is settled on-chain without the need for manual intervention by the user.

UniswapX

UniswapX introduces an intent-centric trading architecture, focusing on simplifying user experience: users only need to specify their trading objectives (e.g., "exchange as much X token for Y token as possible") without delving into the complex process of trade execution. This architecture combines off-chain smart matching with on-chain direct trading, achieving an efficient and transparent trading process. After users submit their trading intent, the system publishes it to the order book service cluster, where professional builders (Fillers) scan multiple liquidity pools, analyze data in real-time, and predict price trends to provide the best quote and execute on-chain trades. This mechanism not only improves trading efficiency but also ensures the transparency of the trading process.

Shogun

Shogun is an "intent-centric" DeFi protocol aimed at maximizing trader's extractable value (TEV) through optimized order flow and complete chain abstraction. In May of this year, Shogun developer Intensity Labs completed a $6.9 million seed financing round, led by Polychain Capital and DAO5, with participation from Arrington Capital, Arthur Hayes, and others. This financing round was conducted using a Simple Agreement for Future Equity (SAFE) structure and included token warrants, resulting in a fully diluted token valuation of $69 million for Shogun. In February of the same year, Binance Labs announced the first batch of incubated projects for its S6 (Incubation Season 6), with Shogun included.

Derivatives

IntentX

IntentX, as the next-generation OTC derivatives trading platform, offers perpetual futures trading. The platform integrates cutting-edge technologies such as cross-chain communication, account abstraction, and SYMMIO to achieve full-chain deployment, reduce costs, improve liquidity and capital efficiency, and enhance scalability. IntentX adopts an "intent-based" architecture, abandoning traditional order books and vAMM models, allowing traders to express their trading intent, which is then executed by external solvers. In February of this year, IntentX announced the completion of a strategic financing round, raising a total of $1.8 million. Selini Capital led this round, with participation from Orbs, Mantle Ecofund, and others. This financing aims to strengthen IntentX's collaboration with market makers and the DeFi ecosystem.

According to IntentX's official roadmap, future features will include account abstraction and real-time trading.

Perpetual Hub

In May of this year, Layer3 blockchain Orbs launched the intent-based on-chain perpetual futures trading solution, Perpetual Hub. Developed in collaboration with THENA, SYMMIO, and IntentX, Perpetual Hub utilizes Orbs' L3 technology to provide traders with the tools needed to execute on-chain perpetual futures at a CeFi level. Perpetual Hub supports on-chain perpetual futures trading, including Hedger, Liquidator, and Price Oracle services.

SYMMIO

SYMMIO is a global derivatives settlement layer designed with a modular and "intent-centric" approach. Through bilateral isolated instances, SYMMIO enables builders and market makers to issue highly liquid derivatives on-chain, mitigating systemic risks. The design optimizes pre-trade quotes without locking up capital, and the execution layer operates based on intent operations, ensuring a highly secure settlement process. SYMMIO creates a free market environment, allowing market makers, solvers, oracles, intent providers, and DEX to compete and collaborate, collectively building a global risk settlement layer.

Wallet

MetaMask

In January of this year, MetaMask was testing a feature called "transaction routing," aimed at providing optimal execution and improving user experience. The technology was developed by Special Mechanism Group, a company acquired by MetaMask's parent company Consensys last year. "Transaction routing" can transform the MetaMask wallet into an "intent-centric" protocol, meaning that users will be able to rely on third parties to find the best path for their transactions.

Cross-Chain Interoperability Protocol

Owlto Finance

Owlto Finance is an "intent-centric" cross-chain interoperability protocol and a full-chain interoperable cross-chain bridge, currently integrated with over 45 networks within the BTC, ETH, and SOL ecosystems. In May of this year, Owlto Finance announced the completion of an $8 million strategic financing round, led by Bixin Ventures and CE Innovation Capital, with participation from Presto, GSR, and others. In July of this year, Owlto Finance announced a new round of financing at a valuation of $1.5 billion, with participation from Matrixport and others.

AI

Optopia

Optopia is an AI-driven, "intent-centric" Layer 2 network that supports permissionless intent creation. By using token economics to drive AI agents to execute intents, Optopia has built an intelligent and active Layer 2 network, simplifying Web3 operations, lowering the barrier to entry for users, and unleashing the potential of Web3. In May of this year, Optopia completed a seed financing round, with participation from G·Ventures, Kucoin Ventures, and others. In July of the same year, Optopia announced the OPAI token economics, with a total supply of 10 billion OPAI tokens, of which 50% is reserved for the Booster Event, 25% is allocated for ecosystem rewards, 10% is allocated for the community, 7% is allocated for early investors, 5% is allocated for the market, and 3% is allocated for liquidity. 10% of the total supply will be allocated to participants in the first phase of the Booster Event at TGE.

On-Chain Tools

Khalani Network

Khalani is a decentralized solver platform aimed at enhancing the experience of Web3 users in the blockchain ecosystem. Through a multi-chain collaborative network, Khalani connects solvers and intent applications, addressing issues such as fragmented liquidity, complex user experience, and inefficient transaction execution. The platform significantly reduces the construction and operation costs of solvers, empowering developers to build intent applications. In August of this year, Khalani completed a $2.5 million seed financing round, led by Ethereal Ventures, with participation from Nascent, Arthur Hayes, and others.

Conclusion

The concept of "intent-centricity" is gradually expanding in the blockchain field, covering various aspects such as cross-chain transactions, encrypted infrastructure, DeFi, modular blockchain, data sharing, wallets, and cross-chain interoperability. Based on intent, projects are driving innovation and development in the Web3 ecosystem by simplifying processes, optimizing user experience, and improving efficiency. In the future, with the emergence of more projects and the continuous maturation of technology, the "intent-centric" concept is expected to play a greater role in the Web3 domain, providing digital users with a more convenient and efficient application experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。