Author: Nancy, PANews

As the stablecoin market continues to expand, it is welcoming more new competitive variables. On August 30, Bridge, a stablecoin payment company founded by former Coinbase and Square employees, announced the completion of a $58 million financing round with participation from Sequoia Capital and others. What is the background behind Bridge's substantial financing? How does this latecomer establish itself?

Stablecoin API for Developers with Compliance

Bridge is seen as the Web3 version of Stripe. According to its official website, Bridge is a stablecoin-based payment platform aimed at innovating global fund flows to challenge traditional payment systems such as Swift and credit cards.

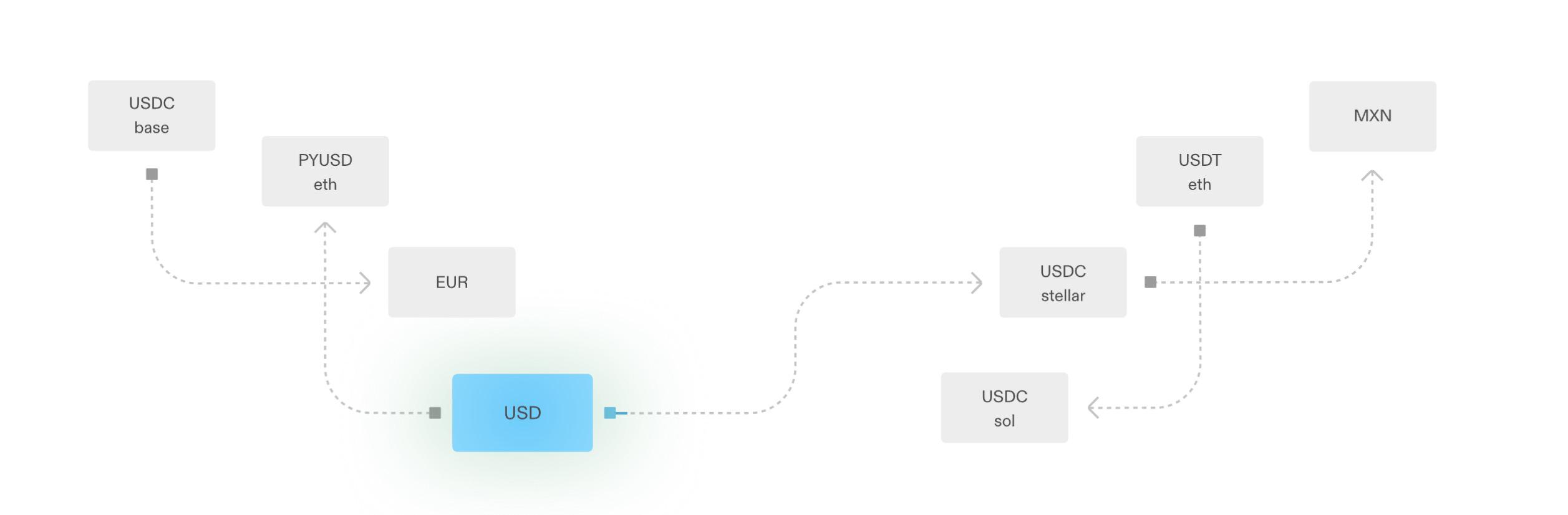

"If there is only one stablecoin on a single blockchain, then Bridge is not necessary. The value of Bridge lies in allowing developers to seamlessly convert between fiat and stablecoins and flow between different blockchains," said Chris Ahn, partner at Haun Ventures, in an interview with Fortune.

In simple terms, Bridge is a stablecoin API for developers. The official website states that Bridge provides services such as cross-border payments and foreign currency exchange, allowing users to seamlessly convert between fiat and stablecoins using Bridge's Orchestration APIs. Bridge can provide global consumers with USD and EUR accounts, and support the transfer of USD, EUR, USDC, USDT, or any other stablecoin on blockchains such as Ethereum, Base, and Solana. Bridge then invests reserve funds in US Treasury bonds with an annual yield of over 5%. According to the official website, the entire fund transfer process takes only a few minutes and costs only a few cents.

At the same time, compliance is a competitive focus for stablecoins, and Bridge has obtained licenses in 48 states and holds a VASP license from Poland, and is currently applying for further licenses in New York and Europe.

Since its launch 18 months ago, Bridge has processed over $5 billion in annual payment volume and has expanded its application scenarios through various collaborations. For example, Bridge has partnered with Bitso to conduct stablecoin-based B2B cross-border payments in Latin America, at a cost much lower than SWIFT; collaborated with Chipper Cash, one of the largest fintech companies in Africa, and Dolar App to provide the ability for consumers in Africa and Latin America to save and spend in USD, respectively; collaborated with crypto companies such as Stellar and Strike to provide infrastructure for their stablecoin payment functions, and partnered with Coinbase to help users transfer between Tether on Tron and USDC on Base. Other collaborative clients include SpaceX, where Bridge helps it receive payments in different jurisdictions and currencies.

$58 Million Financing, Team Members with Top Financial Technology Experience

Compared to other stablecoin ecosystem companies that have received investment mainly from native crypto VCs, Bridge has also received support from top Silicon Valley VCs. According to official disclosures, Bridge has raised $58 million, including a $40 million financing round led by Sequoia Capital and Ribbit Capital, with participation from Index Ventures, Haun Ventures, 1confirmation, and BEDROCK.

Behind the capital favor, the background of Bridge's team is also an important reason. An investor stated in an interview with Fortune, "Bridge stands out from other native crypto companies because its founders have financial technology experience, having worked in startups including Brex and Square."

Left: Zach Abrams Right: Sean Yu

According to LinkedIn profiles, Bridge's co-founder Zach Abrams previously served as the Head of Consumer Products at Coinbase, leading the development, launch, and promotion of USDC, and also served as the Chief Product Officer at the US enterprise payment unicorn Brex. The peer-to-peer payment company he founded, Evenly, was acquired by the mobile payment unicorn Square and became the General Manager of its Square Customers business unit.

Co-founder Sean Yu previously worked as a senior engineer at Coinbase and Airbnb, as well as co-founder of Evenly and a software engineer at Square.

BD Ben O'Neill previously served as Vice President of Business Development and Operations at Messari, and also worked at Deutsche Bank, Uber, and Satis Group, among other companies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。