Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

Since taking office as the Director of BNB Chain Ecosystem Development, the efforts of BNB Chain in the Meme track have become more visible. For example, the official "Meme Innovation Battle" of BNB Chain, and the Meme ecosystem project Four.meme launched the "Meme Trading Competition".

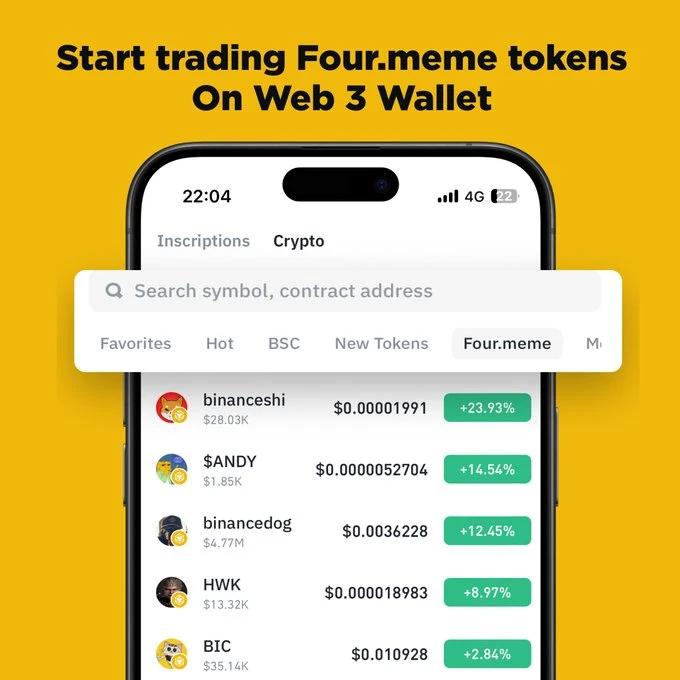

Yesterday, Binance Web3 account also expressed support for Four.meme and the Meme ecosystem, and listed Four.meme on the main page of Binance's Web3 wallet, significantly increasing the expected value of the project itself and its tokens. Odaily will interpret the protocol and its airdrop activities in this article.

Protocol Overview

Four.meme (referred to as Four) is a Pump-type Meme Launch protocol, with similar internal and external plate, Bonding Curve mechanism, which will not be elaborated on. The differences from Pump include:

- Purchase limit: The token deployer can limit the maximum purchase amount of investors (optional) to avoid a few users holding too many tokens;

- Scheduled launch: The token deployer can set the opening time of the internal plate trading for the token (optional);

- Internal plate handling fee: Four transaction fee is 0.5% (minimum 0.001 BNB), Pump is 1%;

- Slightly higher initial liquidity: Four's initial liquidity is 24 BNB (current price about $13,680), Pump's initial liquidity is 85 SOL (current price about $13,430);

- Slightly lower token issuance cost: Four's token issuance cost is 0.005 BNB (current price about $2.85), Pump's token issuance cost is about 0.02 SOL (current price about $3.16).

Interactive Activity Calculation

Four's airdrop points are divided into four parts: pre-airdrop, daily check-in, platform usage, and social media tasks.

Among them, the pre-airdrop is aimed at the issuer and user of Pump; the top traders of the FOUR, ANDY, BIC, and WHY tokens; and the top 500 users of Lista DAO points.

The latter three modules "daily check-in, platform usage, social media tasks" will be broken down into three parts as follows, to quantify the participation value of the airdrop.

Free Points

In addition to the pre-airdrop, completely free points include new user invitations and social media tasks, which include linking X accounts, Telegram accounts, etc.

Inviting a new user will earn 10 points, and the four social media tasks total 40 points, according to the next section's cost calculation, valued at approximately 0.07 USDT per new user and 0.28 USDT for the four social media tasks.

Basic Paid Points

This section will divide "daily check-in," "trading volume," and "first transaction" into basic paid points.

- Daily check-in: 10 points will be obtained, with a cost of Gas fee. After testing, the current check-in fee is about 0.0000223 BNB, so the cost per point is 0.000022332×570÷10=0.0012711 USDT per point.

- Trading volume: The point rule is "40 points for every 0.1 BNB trading volume." Without considering token gains and losses, based on a 0.5% handling fee, the cost per point is 0.1×0.5%×570÷40=0.007125 USDT per point.

- First transaction: Completing the first transaction will earn 100 points. After testing by the author, there is no minimum purchase amount, but the platform's commission minimum is 0.001 BNB. Based on this value and Gas fee, the cost is (0.58+0.07)÷100=0.0065 USDT per point, worth participating.

The current platform's disclosed total number of users is 16,000, with 160,000 daily new check-in points, which can be ignored compared to the total 520 million platform points.

Here is a conclusion: the point cost of trading volume is the most important and reasonable, so the unit cost of points is recorded as 0.007 USDT per point.

Advanced Paid Points

Advanced paid points require users to use the Four platform to issue tokens. Due to legal requirements, mainland users are advised not to attempt this, and this section is only for comparative calculation display.

- First token issuance: Completing the first token issuance will earn 200 points, with a cost of 0.005 BNB (current price about $2.85), a unit cost of 0.01425 USDT per point, not cost-effective on its own.

- First trade: After the user issues tokens, when the tokens are traded by other users for the first time, they will earn 100 points, with the same cost as the "first transaction" in the previous section. Therefore, if the user issues tokens and trades with a secondary account, they can earn 400 points for "first token issuance" + "first transaction" + "first trade," with a total unit cost of (2.85+0.58+0.07+0.58+0.07)/400=0.010375 USDT per point, still not cost-effective.

- Pancake listing: Issuing tokens and fully listing on Pancake will earn the developer 10,000 points, and the top 10 holders will each earn 500 points. Since the platform does not specify the commission and listing ratio, we will calculate based on "Pump.fun is fully listed by the developer, then all external plate sales." Fully listing requires 85 SOL, and there will be 17 SOL remaining in the pool, in addition to the platform extracting about 3 SOL as deployment costs and protocol income, so the loss ratio is about (17+3)/85=23.5%. The unit cost of points is 13680×0.235/(10,000+500*10)=0.21432 USDT per point, self-fulfillment is not cost-effective.

Airdrop and Protocol Value Calculation

Optimistic Assumption

Since there are no reference platform tokens worth considering for Pump-type platforms, except for Pump.fun and SunPump, which also do not have high-income platforms, we will assume that BNB Chain will strongly support Four.meme, and assume the airdrop value to be $10 million.

Multiplying the total platform points of 520 million by a reasonable value of 0.007 USDT per point, the total value is 3.66 million. In the case of a target value of $10 million, it still has interactive value.

However, it should be noted that the points will continue to dilute with the passage of time and the increase of participating users. According to the official document, the first season of the airdrop activity will end at 14:44 on October 20, 2024 (UTC+8), 56 days from the publication of this article.

According to the reverse calculation of $10 million, it corresponds to a required trading volume of (1000-366)×10000÷(0.007×40×0.1)×570=12.9 billion USD, with a daily average of 23 million USD (Pump.fun's daily average is 50 million USD), which is difficult to achieve.

In addition to trading volume, there are also wallet bonuses of 5%, unknown proportions of invitation bonuses, and other tasks, which will dilute the points. Therefore, the conclusion is: if the assumed airdrop value of Four can reach $10 million, it has a certain interactive value, but the risk-reward ratio is generally low.

Actual Data

- Dune statistics show that the trading volume of Four in the past five days is 19,246 BNB, corresponding to 7.698 million points;

- There are a total of 60 fully listed tokens, corresponding to 9 million points;

- The total points are 520 million, with a total of 16,054 addresses, averaging 32,660 points per address. Based on the trading volume, each address traded 81.6 BNB;

- The scores of the top 100 addresses range from 900,000 to 1.1 million, so the total score of the top 100 is approximately 10 million, accounting for 19%.

Conclusion

In summary, the top addresses on Four.meme have obtained a large number of points through unknown means. Based on the current trading volume of the platform, the subsequent growth and proportion of points will not be significant. Therefore, only if the expected airdrop value exceeds $10 million or the platform's trading activity significantly increases, will it have a certain interactive airdrop value.

However, based on the performance of the leading token binancedog and other tokens listed on Pancake, the wealth creation and FOMO rhythm in the Four ecosystem are generally controlled. Apart from the advantage of official support, there is currently no sign of community and emotional momentum. Therefore, participating in volume brushing interactions at the moment does not have a favorable risk-reward ratio.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。