1. RWA

RWA—Real World Assets

RWA, short for Real World Assets, refers to assets in the real world that are represented and traded in a digital and tokenized manner within the blockchain or Web3 ecosystem. These assets include but are not limited to real estate, commodities, bonds, stocks, art, precious metals, and intellectual property. The core idea of RWA is to bring traditional financial assets into the decentralized finance (DeFi) ecosystem through blockchain technology, thereby achieving more efficient, transparent, and secure asset management and trading.

The significance of RWA lies in its ability to bring relatively illiquid real-world assets into liquidity through blockchain technology and to participate in the DeFi ecosystem for activities such as lending, staking, and trading. This connection of real-world assets with the blockchain world is becoming an important development direction in the Web3 ecosystem.

RWA—Special Asset Status

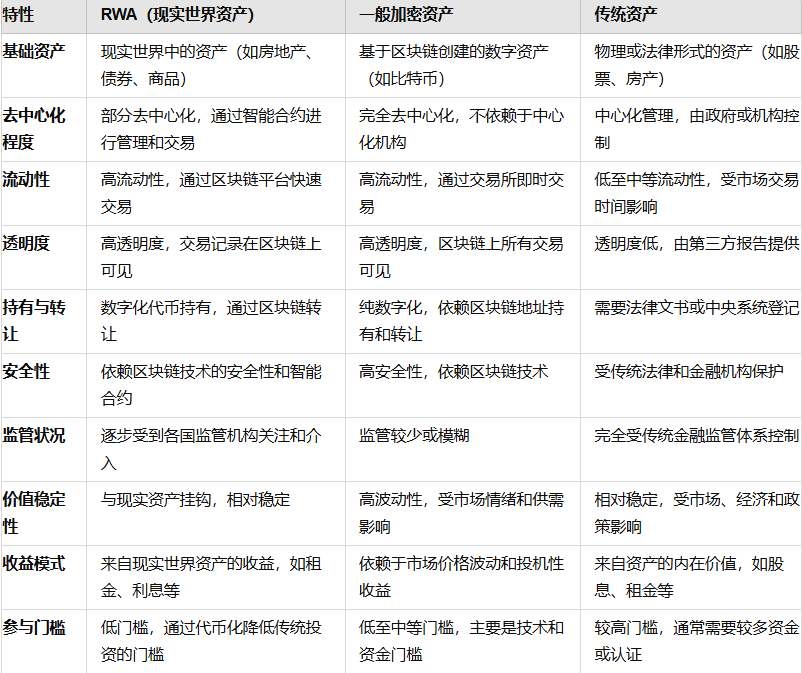

RWA tokenizes real-world assets, making them digital assets with utility in the blockchain, serving as a bridge between encrypted native assets and traditional assets. Encrypted native assets are generally implemented through smart contracts, with all business logic and asset operations completed on the chain, following the "Code is Law" principle. On the other hand, traditional assets such as bonds, stocks, and real estate operate under the legal framework of the real society and are protected by government laws. The tokenization rules proposed by RWA require both on-chain technical support from smart contracts and legal protection of underlying assets such as stocks and real estate in the real society.

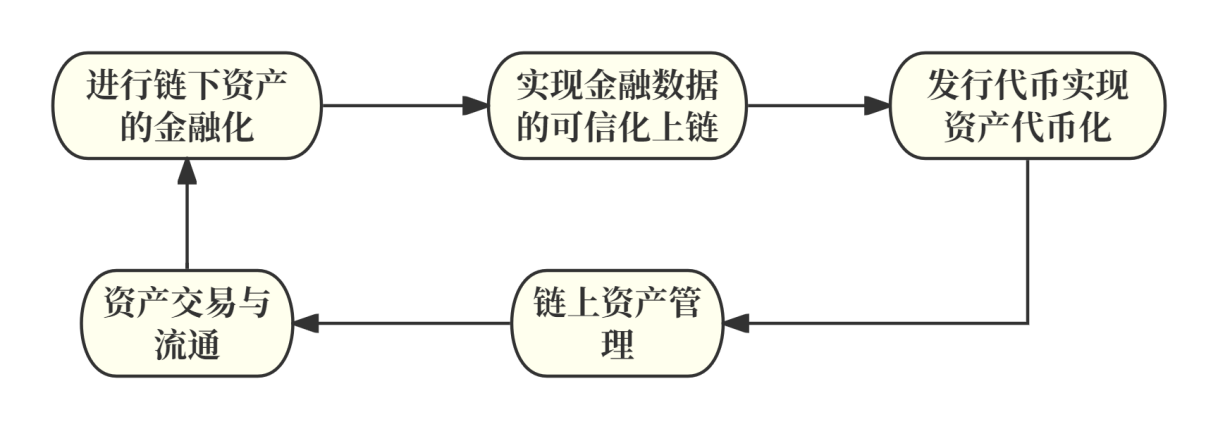

In fact, within the framework of RWA, tokenization is not simply the process of issuing a token on the blockchain; it involves a complex set of processes that relate to the asset relationships in the real world. The tokenization process typically includes the purchase and custody of underlying assets, the establishment of a legal framework linking tokens to these assets, and the eventual issuance of tokens. Through this tokenization process, off-chain legal regulations and related product operation processes are combined, enabling token holders to have legal claims to underlying assets.

Figure 1

Figure 2

RWA—Historical Origins

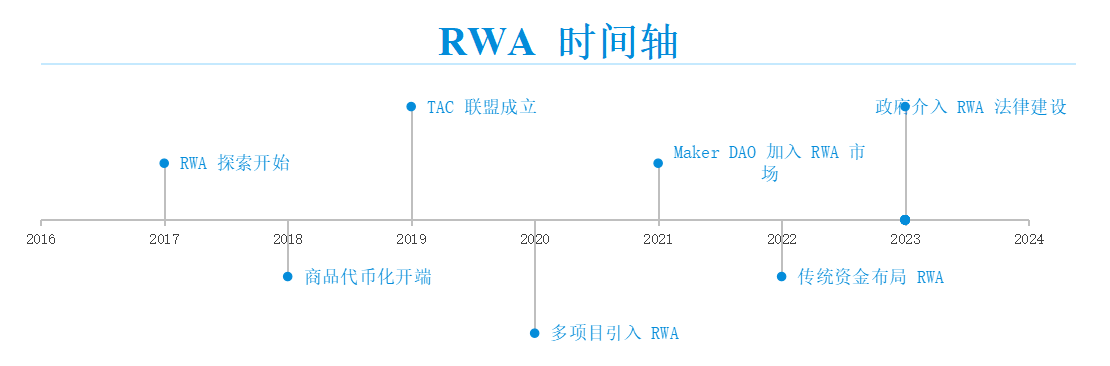

The development of RWA can be divided into three stages: early exploration, initial development, and rapid expansion.

Early Exploration Stage (2017-2019)

2017: Start of RWA Exploration

With the gradual maturation of the concept of decentralized finance (DeFi), the concept of Real World Assets (RWA) began to emerge. Pioneering projects such as Polymath and Harbor began to explore the feasibility of tokenizing securities. Polymath focused on creating a platform for issuing security tokens, dedicated to solving legal compliance issues, while Harbor aimed to provide a compliance framework that allows securities to flow on the blockchain.

2018: Commencement of Commodity Tokenization

In the field of real estate and commodity tokenization, some pilot projects began to emerge. For example, the RealT project in the United States attempted to tokenize real estate, allowing global investors to acquire partial ownership and rental income from U.S. real estate by purchasing tokens.

2019: Formation of the TAC Alliance

The TAC Alliance was established to promote the standardization and cross-platform interoperability of RWA, and to facilitate cooperation and development among different projects. In addition, platforms such as Securitize and OpenFinance were launched during this period, focusing on providing compliance solutions for tokenized assets for enterprises.

Initial Development Stage (2020-2022)

2020: Introduction of RWA by Multiple Projects

The Centrifuge project gained significant attention by tokenizing real-world accounts receivable and invoices, enabling small and medium-sized enterprises to obtain financing on the blockchain. In addition, well-known DeFi projects such as Aave and Compound began to introduce RWA as collateral to expand their lending business.

2021: MakerDAO Joins the RWA Market

Centrifuge introduced RWA as collateral into MakerDAO's lending platform, allowing users to obtain the stablecoin DAI by holding RWA.

2022: Traditional Funds Layout for RWA

Large financial institutions such as JPMorgan Chase and Goldman Sachs began to conduct research and pilot projects related to RWA, exploring how to digitize traditional assets through blockchain; the Real World Asset Alliance (RWA) was established to promote the standardization and global promotion of RWA.

Rapid Expansion Stage (2023-Present)

2023: Government Involvement in RWA Legal Construction

Large asset management companies such as BlackRock and Fidelity began to attempt managing part of their assets through tokenization to increase liquidity and transparency; the U.S. Securities and Exchange Commission (SEC) and the European Securities and Markets Authority (ESMA) also began to gradually intervene, attempting to establish regulatory frameworks related to RWA.

Figure 3

2. RWA Track Directions

Given the diversity of traditional asset forms, the RWA track has shone in different fields. From tangible assets such as real estate, commodities, precious metals, art, and luxury goods, to intangible assets such as bonds and securities, intellectual property, carbon credits, insurance, non-performing assets, and fiat currency, RWA (Real World Assets) has demonstrated its potential applications in various fields.

Figure 4

Real Estate Industry

In traditional finance, real estate is usually considered a relatively stable asset for long-term investment, with strong potential for capital appreciation in normal market conditions. However, the low liquidity and high leverage characteristics of real estate raise the threshold for real estate transactions and increase the investment risk for individual investors in the real estate sector. In RWA projects related to real estate, tokenizing real estate will significantly increase asset liquidity and reduce the risk borne by individual investors.

Tangible: Focuses on the tokenization of physical assets (such as real estate and precious metals), enabling these traditionally illiquid assets to achieve liquidity on the blockchain.

Landshare: Through tokenization, Landshare allows small investors to participate in the real estate market, especially through its blockchain-based real estate fund model.

PropChain: Provides a blockchain-based global real estate investment platform, allowing investors to gain exposure to the global real estate market through tokens without the need to purchase actual properties.

RealT, RealtyX: Allow investors to acquire partial ownership of U.S. real estate and receive rental income by purchasing tokens.

Fiat to Stablecoin

In the stablecoin field, there are USDT (Tether), FDUSD, USDC, and USDE, among others. These stablecoins are pegged to the value of fiat currency, providing a low-volatility asset in the crypto market, with USDT (Tether) being the most famous. Tether is currently the largest stablecoin in terms of market share, with its value pegged to the US dollar at a 1:1 ratio. This means that the value of each USDT corresponds to one US dollar.

In traditional financial markets, fiat currency itself is a real-world asset (RWA), maintaining its value through reserve and regulatory mechanisms. When fiat currency enters the blockchain in the form of stablecoins, it is repackaged as a programmable digital asset that can directly participate in various operations within the decentralized finance (DeFi) ecosystem, such as lending, payments, and cross-border transfers. Tether directly associates the value of USDT with real-world assets priced in US dollars, significantly enhancing the stability of USDT and providing a relatively safe and stable environment for the introduction and use of RWA.

Operating Mechanism of USDT

Tether company supports the value of USDT by holding a basket of reserve assets. These reserve assets include cash, cash equivalents, short-term government securities, commercial paper, secured loans, and a small amount of precious metals. When users deposit fiat currency (such as US dollars) into Tether's account, the company issues an equivalent amount of USDT to the users, thereby achieving a 1:1 pegging of USDT to the US dollar.

Stability and Risks of USDT

Systemic Risk: Since the value of USDT is directly pegged to the US dollar, its users need to bear systemic risks and market fluctuations related to the US dollar. For example, if the US dollar experiences significant depreciation in the global market, the purchasing power of USDT will also decrease.

Regulatory Risk: Regulatory scrutiny or actions against Tether's operating model may affect the issuance and use of USDT.

Collateral Risk: Although Tether claims that USDT is fully backed by reserve assets, there have been ongoing questions about the transparency and adequacy of these reserve assets. If Tether company fails to maintain sufficient reserves or if the quality of the reserve assets deteriorates, it could lead to USDT price decoupling, meaning USDT may no longer maintain a 1:1 value with the US dollar.

Liquidity Risk: Under extreme market conditions, Tether may face liquidity shortages. If a large number of users simultaneously request to convert USDT back to US dollars, Tether company may struggle to fulfill these requests in a short period, leading to market panic and price fluctuations.

The challenges and issues faced by Tether are not unique to the stablecoin market but are issues that affect the entire RWA market. The security of RWA is closely related to the quality of its underlying assets and is highly susceptible to the impact of different legal regulations in various countries and regions.

Lending Market

The combination of RWA with the credit lending market can bring more collateral options and higher loan amounts. In DeFi protocols such as Maker and AAVE, borrowers need to provide encrypted assets as collateral that exceed the loan amount to ensure the safety of the loan. With the introduction of RWA, traditional assets such as real estate and accounts receivable are included in the collateral category, expanding the range of assets that can be used as collateral. This allows not only encrypted assets but also assets from the real economy to participate in this system. This initiative can bring more public funds for the development of small and micro-enterprises, provide more loan channels for large enterprises, and allow ordinary investors to invest in companies and gain future returns.

Bonds and Securities

In the traditional financial market, bonds and securities are the most widely used investment vehicles, often with comprehensive financial regulatory systems. Therefore, in RWA projects related to bonds and securities, alignment with real-world legal regulations is the most important step.

Maple Finance: Provides a way for enterprises and borrowers to create and manage loan pools on the blockchain, making bond issuance and trading more efficient and transparent.

Securitize: Provides services for the issuance, management, and trading of tokenized securities. The platform allows companies to issue bonds, stocks, and other securities on the blockchain and provides a set of compliance tools to ensure that these tokenized securities comply with the legal and regulatory requirements of various countries.

Ondo Finance: Offers products including tokenized short-term government bond funds, which provide stable returns, further blurring the line between DeFi and traditional finance.

3. RWA Market Size

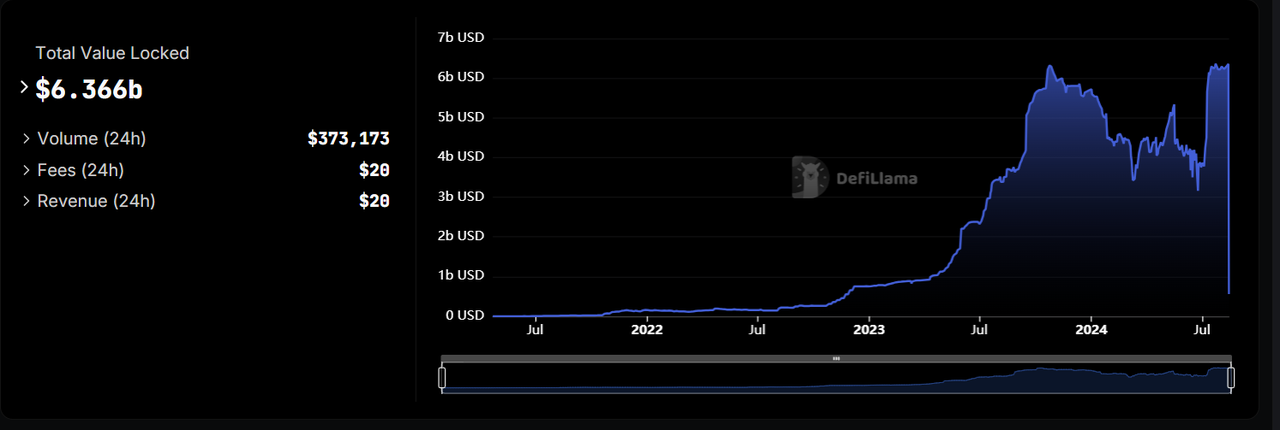

Since May 2023, RWA has experienced a major explosion. As of the time of writing, according to defillama, the total value locked (TVL) related to RWA remains as high as $6.3 billion, a 6000% increase year-on-year.

Figure 5

According to data from RWA.xyz, the number of RWA-related asset holders reaches as many as 62,487, and the number of asset issuers is 99, with the total value of stablecoins reaching $169 billion.

Figure 6

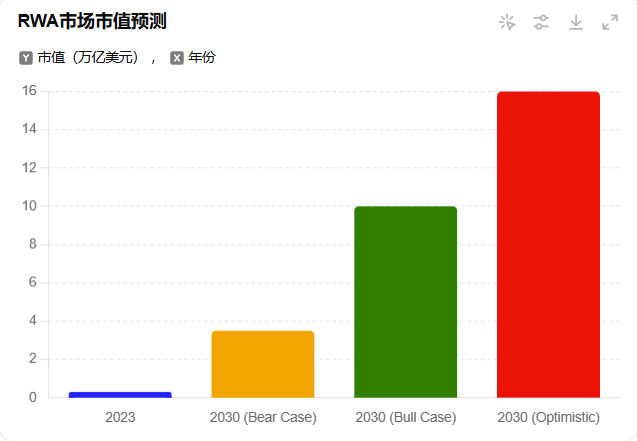

Several well-known Web3 companies, including Binance, are also very optimistic about the future market value of RWA, even estimating that its total market value could reach $16 trillion by 2030.

Figure 7

As an emerging track, RWA is changing the DeFi market in unprecedented ways, and its enormous potential is worth investors' expectations. However, the development of RWA projects is highly correlated with reality, and the different legal regulations in various countries and regions can easily become constraints on its development.

4. RWA Ecosystem Development

With the entry of traditional capital such as Goldman Sachs and SoftBank, as well as well-known Web3 companies such as Binance and OKX, strong projects in the RWA track are gradually emerging. Both new and established projects such as Centrifuge, Maple Finance, Ondo Finance, and MakerDAO are showing their strength in this blue ocean, becoming true leaders in RWA in terms of technology and ecosystem layout.

Centrifuge: On-Chain Protocol for Real-World Assets

Concept

Centrifuge is a platform for tokenizing real-world assets on the chain, providing decentralized asset financing protocols, and uniting well-known DeFi lending protocols in the encrypted market such as MakerDAO, Aave, and borrowers with collateralizable assets in the real world (usually startups), to facilitate the circulation of DeFi assets and real-world assets.

Financing Development

Since its inception, Centrifuge has been highly sought after by capital. In five rounds of financing from 2018 to 2024, it has received a total of $30.8 million in funding, with well-known VCs such as ParaFi Capital and IOSG Ventures standing behind it. The project itself has also achieved remarkable results, tokenizing 1,514 assets, with a total financing asset value of $636 million, a 23% year-on-year increase in TVL.

Figure 8

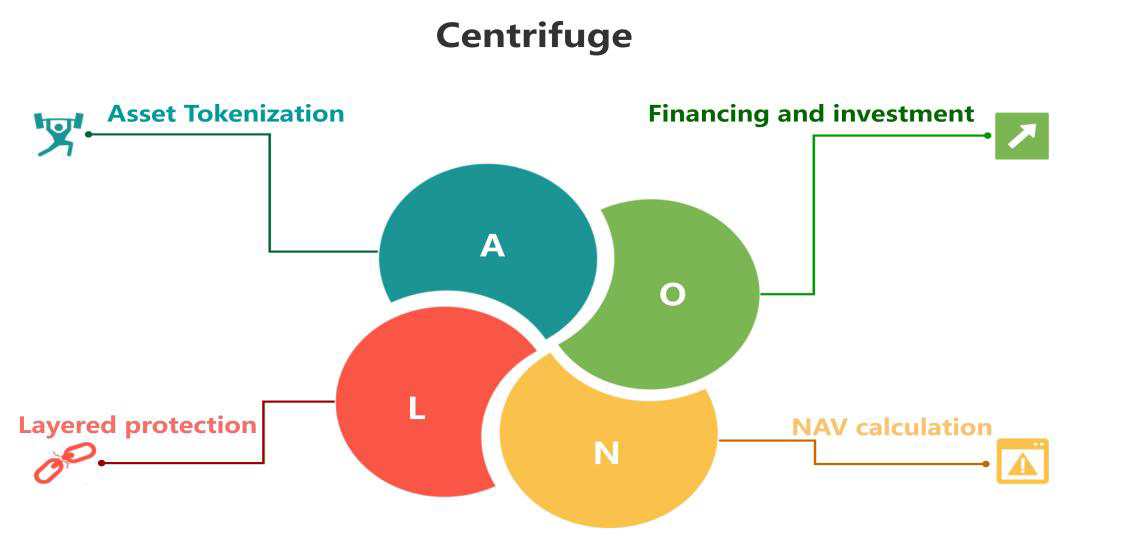

Technical Architecture

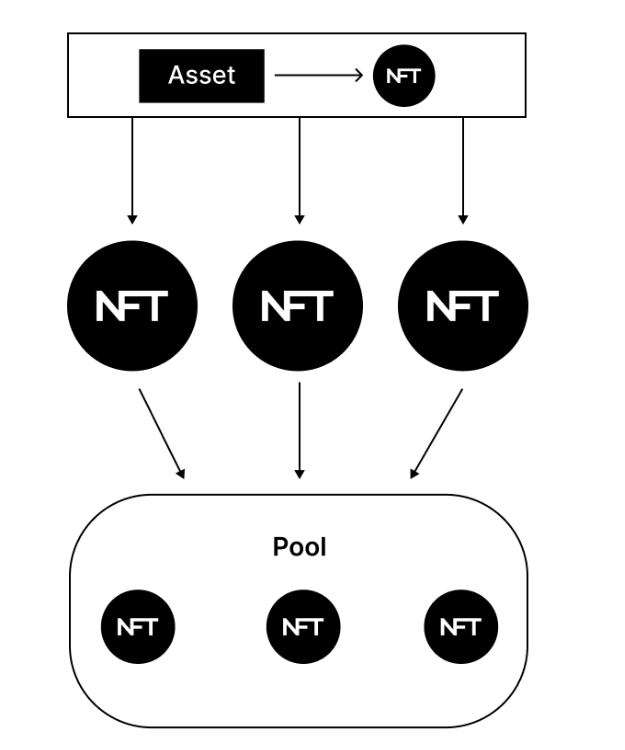

The core architecture of Centrifuge consists of Centrifuge Chain, Tinlake, on-chain Net Asset Value (NAV) calculation, and layered investment structure. Centrifuge Chain is an independent blockchain built on Substrate (part of the Polkadot parachain), specifically designed to manage the tokenization of assets and privacy protection. Tinlake is a decentralized asset financing protocol that allows issuers to generate assets as NFTs and use these NFTs as collateral to obtain liquidity.

Figure 9

In a complete lending operation, real-world assets are tokenized into NFTs through the Tinlake protocol, which are used as collateral. The issuer obtains liquidity from the pool, and investors provide funds to the pool. Through on-chain NAV calculation models, transparency is ensured for investors and issuers to see the pricing and status of assets. The layered investment structure allows for three different lending levels: junior tranche (high risk, high return), mezzanine tranche, and senior tranche (low risk, low return).

Figure 10

Development Challenges

Although the Centrifuge project ranks first in RootData's RWA project attention, core data such as TVL has been declining due to the combined effects of the bear market in 2022 and unmet expectations in 2024, currently standing at only $497,944.

Figure 11

ONDO Finance: Leader in Tokenizing US Bonds

Concept

Unlike Centrifuge's focus on building a platform for the circulation of DeFi funds and real-world assets, ONDO Finance is a decentralized institutional-grade financial protocol aimed at providing institutional-grade financial products and services, creating an open, permissionless, and decentralized investment bank. Currently, ONDO Finance focuses on introducing stable asset choices beyond stablecoins, bringing risk-free or low-risk, stable, and scalable fund products (such as US Treasury bonds, money market funds, etc.) into the blockchain, allowing holders to have relatively stable assets while enjoying most of the underlying asset's returns.

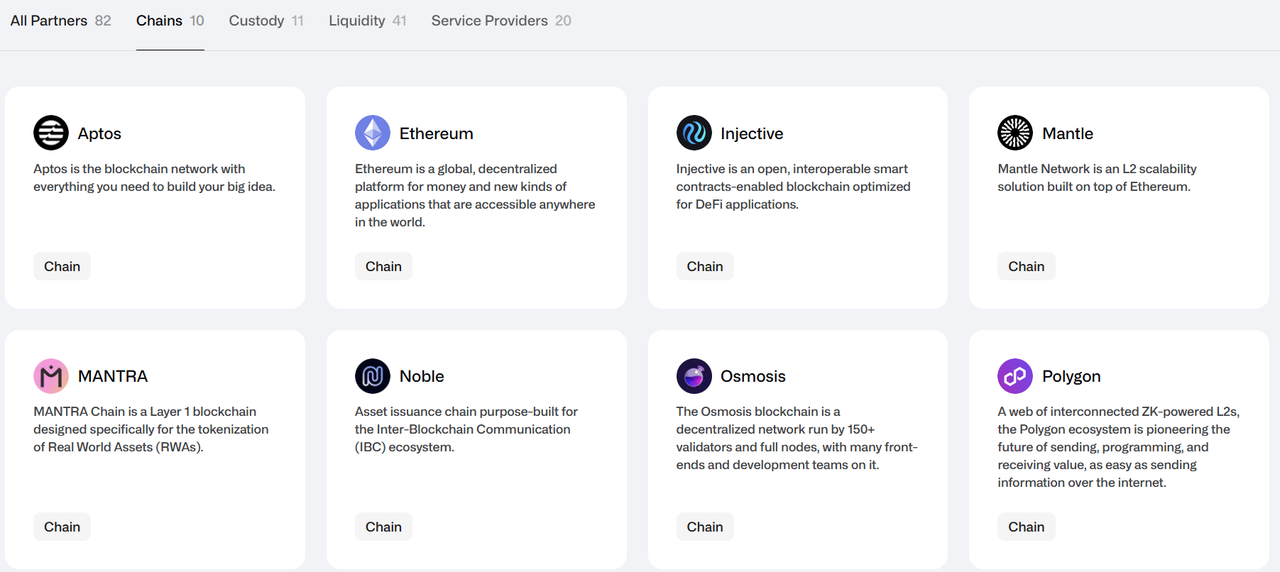

Financing Development

ONDO Finance has undergone three rounds of financing in its history, raising a total of $34 million, with investors including Pantera Capital, Coinbase Ventures, Tiger Global, Wintermute, and other well-known institutions. In addition, ONDO Finance has up to 82 partners in areas such as chain support, asset custody, liquidity support, and service facilities.

Figure 12

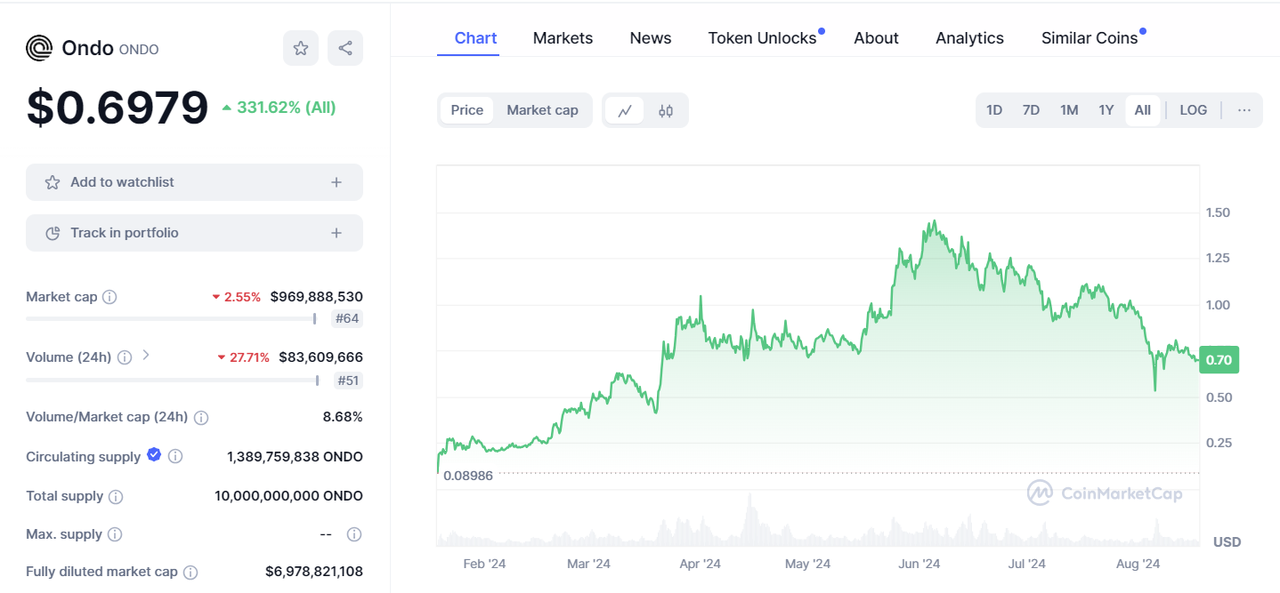

ONDO Finance's market performance is also impressive, with the current price of the project's token ONDO at $0.6979, showing a distribution increase of 2448%, 1270%, and 784% compared to the Series A financing price of $0.0285, ICO financing of $0.055, and opening price of $0.089.

Figure 13

In key data such as TVL, ONDO Finance has seen significant growth since April this year, currently reaching as high as $538.97 million, ranking third in the RWA track.

Figure 14

Product Architecture

ONDO Finance's main targets are USDY and OUSG.

USDY (US Dollar Yield Token) is a new financial instrument issued by Ondo USDY LLC, combining the accessibility of stablecoins and the yield advantage of US Treasury bonds. Unlike many other blockchain yield instruments, USDY's architecture design complies with US laws and regulations and is backed by short-term US Treasury bonds and bank demand deposits.

USDY includes two types: USDY (Accumulative) and rUSDY (Rebase). The token price of USDY (Accumulative) increases with the yield of the underlying assets, suitable for long-term holders and cash management needs. rUSDY (Rebase) maintains a token price of 1.00 US dollars, with returns achieved by increasing the token quantity, suitable as a settlement or exchange tool.

OUSG (Ondo US Short Government Bond) is an investment instrument issued by Ondo Finance that provides liquidity exposure through tokenization, aiming to provide investors with ultra-low-risk and high-liquidity investment opportunities. OUSG tokens are pegged to US short-term government bonds, and holders can obtain liquidity returns through instant minting and redemption.

Tokenization Structure: The underlying assets of OUSG are mainly held in the BlackRock US Dollar Institutional Digital Liquidity Fund (BUIDL), with other parts held in BlackRock's Treasury Fund (TFDXX), bank deposits, and USDC to ensure liquidity. Through blockchain technology, OUSG shares have been tokenized and can be transferred and traded 24/7.

Minting and Redemption Mechanism: Investors can immediately obtain OUSG tokens with USDC or exchange OUSG tokens for USDC.

Token Versions: Similar to USDY, OUSG is also divided into OUSG (Accumulative) and rOUSG (Rebase).

Both OUSG and USDY require user KYC support, so Ondo has partnered with the backend DeFi protocol Flux Finance to provide stablecoin collateral lending services for tokens that require permission, such as OUSG, to achieve permissionless participation in the protocol backend.

BlackRock BUIDL: Ethereum's First Tokenized Fund

Concept

BlackRock BUIDL is an ETF (Exchange-Traded Fund) jointly launched by the globally renowned asset management company BlackRock and Securitize. Its full name is "iShares U.S. Infrastructure ETF," with the code BUIDL. Similar to USDY, BUIDL is essentially a security. When a user invests $100 in BUIDL, they will receive tokens worth $1, maintaining a stable value, and can enjoy the financial returns of the $100 investment.

Regulatory Compliance

Unlike many RWA track projects, BUIDL has a more comprehensive compliance framework. The BUIDL fund is operated by a special purpose vehicle (SPV) established by BlackRock in the British Virgin Islands (BVI), and the SPV is an independent legal entity used to isolate the fund's assets and liabilities. The BUIDL fund has also applied for Reg D exemption under the US securities laws and is only open to qualified investors.

Underlying Assets

BlackRock Financial is responsible for managing the fund's assets. The fund invests in cash equivalents such as short-term US Treasury bonds and overnight repurchase agreements to ensure that each BUIDL token maintains a stable value of 1 US dollar. Securitize LLC is responsible for the tokenization process of the BUIDL fund, including converting the fund's shares into on-chain tokens. On-chain returns are generated by smart contracts.

Market Response

With the backing of BlackRock's strength and reputation, the BUIDL fund has received good market recognition and has a stable TVL of $502.41 million, ranking 4th in RWA TVL Ranking.

Figure 15

Figure 16

In terms of technical architecture, BUIDL's innovation is not as extensive as other projects, but BlackRock's long-standing reputation in the crypto market is enough to secure a place for the project in the RWA track.

In the RWA ecosystem, in addition to the integration of traditional lending and DeFi by Centrifuge, the integration of securities and DeFi by ONDO Finance, and BlackRock BUIDL, there have also been breakthroughs in the integration of real estate and DeFi, such as Propbase directly tokenizing real estate assets for circulation, and PARCL allowing token investments in neighborhoods or plots.

5. Conclusion

RWA is essentially real-world assets, and the fundamental purpose of the entire track is to achieve interoperability between real-world assets and on-chain assets, allowing more real funds to flow into the blockchain and gradually blur the boundaries between DeFi and traditional finance.

The RWA track includes both tangible and intangible assets, currently focusing on securities, real estate, credit lending, and stablecoins.

Compared to other tracks, the RWA track is subject to greater regulatory scrutiny and stricter compliance requirements, giving well-known companies a greater advantage.

Despite the strong narrative and prospects of the RWA track, the uncertainty of its compliance requires caution when investing in related projects and being prepared to address potential risks at any time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。