Introduction

LayerZero is a full-chain interoperability protocol designed for lightweight cross-chain messaging. Stargate is the official bridge introduced by the LayerZero team.

deBridge is the liquidity internet of DeFi, focusing on speed, security, and user experience, driving real-time value and information transfer across the entire DeFi space. By achieving unified liquidity, free information exchange, and open access, deBridge transforms DeFi into a unified open market.

This article will provide an in-depth analysis of LayerZero and its cross-chain products Stargate and deBridge, including technical models, TVL models, protocol activity, revenue, protocol activity level, and other comparisons.

Regarding Trading Volume and TVL

First, it is important to understand that Total Value Locked (TVL) and trading volume are not the most accurate indicators of value capture for the following reasons:

Bridge operators must continuously distribute incentive measures to maintain TVL in the pools.

Fee-less bridges can attract arbitrary trading volume.

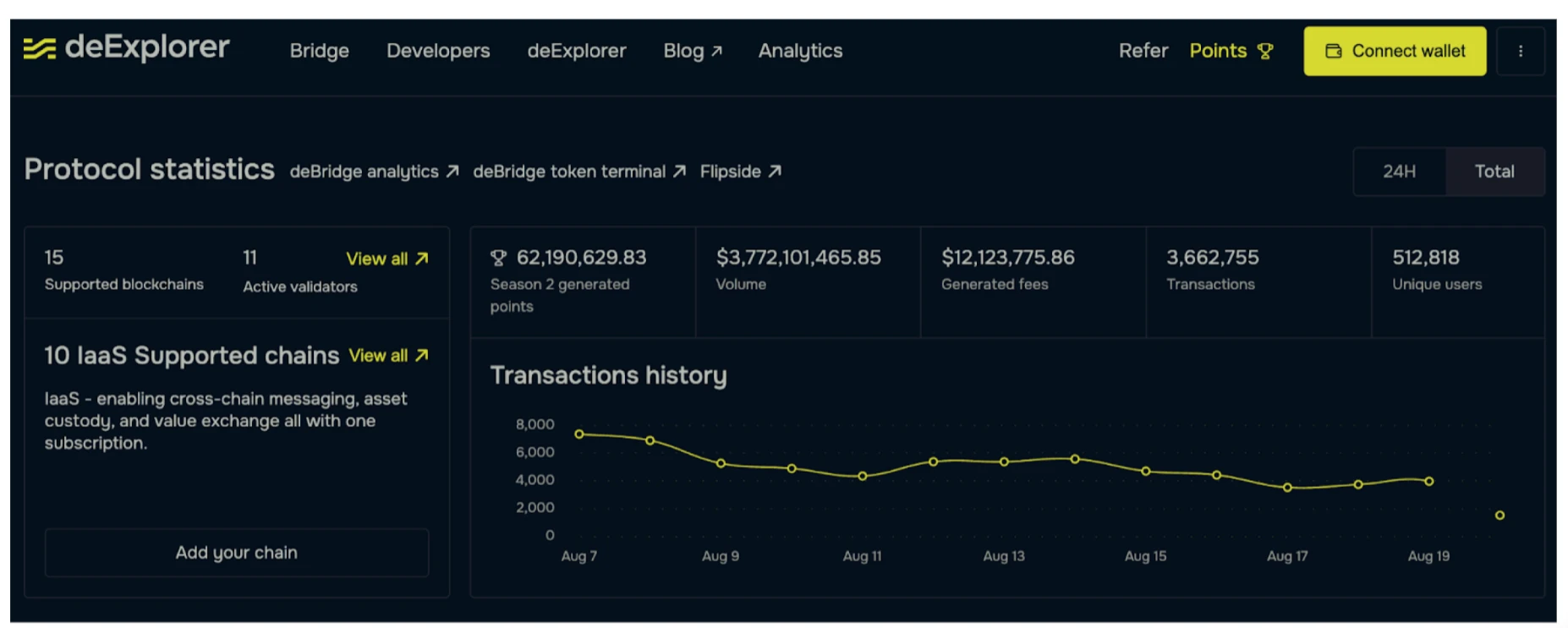

Therefore, protocol profit is a more useful metric. When compared to other projects, deBridge is the only scalable and profitable infrastructure that has earned $12 million through transaction fees so far without any liquidity incentives. They intentionally chose not to engage in liquidity mining activities to ensure a focus on building sustainable revenue sources and believe this approach will bring long-term success to the project.

deBridge's lack of TVL allows it to design a more secure architecture and have a scalable business model, entering the entire non-custodial spot trading and OTC trading market.

To provide some insight into potential returns:

Currently, Stargate is valued at $3.3 billion FDV, LayerZero's valuation exceeds $30 billion, with a total FDV of $33 billion, and the upcoming valuation of deBridge is only $250 million.

deBridge has the following advantages:

Scalability (unlimited throughput)

Security (shared security model, off-chain verification, 0 TVL)

Gas efficiency

Compared to LayerZero, deBridge offers the following advantages over Stargate:

Capital efficiency (lowest cost of 4bps)

Zero slippage and MEV protection

Instant settlement

deBridge allows for rapid scaling of trading volume and creates significant network effects.

How to Achieve Zero TVL?

deBridge is an asynchronous value transfer protocol that uses a new paradigm called "on-demand liquidity," through which any cross-chain transaction can settle natively without the need for TVL.

deBridge consists of two types of market participants: market makers (users and protocols wanting to conduct cross-chain transactions) and takers (liquidity providers motivated to fulfill cross-chain orders).

It can be seen as a cross-chain limit order protocol or a cross-chain exchange that simply matches cross-chain orders and incentivizes takers to fulfill market makers' orders.

Through deBridge, liquidity is more sustainable and efficient than any locked liquidity pool method because any order can be fully or partially fulfilled by any market participant. Takers can efficiently rebalance liquidity between chains using centralized exchanges and private liquidity networks to quickly meet demand and fulfill cross-chain limit orders.

With this design, there is no longer a need to continuously lock liquidity in a liquidity pool, thus achieving "zero TVL." Liquidity is directly owned by its owner rather than being pooled in a shared state.

How does deBridge's "on-demand liquidity" model address the challenges brought by the traditional "continuous liquidity locking" approach in cross-chain value transfer? What benefits does this paradigm shift bring to market makers and takers in the DeFi ecosystem?

To answer this question, bridges can be roughly divided into two categories: normative and non-normative. It is widely believed that both types of bridges must custody assets in liquidity pools to facilitate cross-chain transfers. This is not only considered incorrect but also dangerous.

All non-normative bridges attempt to solve custody and value transfer issues simultaneously, inevitably locking liquidity in smart contracts and channeling all value transfers through their shared liquidity pools. In addition to ecosystem risks, the TVL of these bridges increases additional security assumptions for the underlying cross-chain infrastructure and creates a honeypot for hackers, as the attack surface is amplified.

The liquidity pool method also brings sustainability issues. Classic cross-chain protocols must continuously incentivize all liquidity providers in the pool, regardless of the liquidity utilization rate. Once incentive measures cease, liquidity will leave to seek higher-yield opportunities.

Rethinking the current space and bridge issues fundamentally, avoiding the use of liquidity pools for bridges leads to inefficiency and security risks.

deBridge is an asynchronous value transfer protocol that uses a new paradigm called "on-demand liquidity," through which any cross-chain transaction can settle natively without the need for TVL.

This eliminates attack vectors that have led to over $20 billion being hacked in the past 12 months, providing a fundamentally more secure, faster, more scalable, and more capital-efficient liquidity transfer protocol, bringing a user experience similar to CEX to cross-chain liquidity transfer.

In addition to security, deBridge's performance advantages include:

Native assets (no wrapped asset risk)

High-speed transactions (no need to wait for finality on the target chain)

Ultra-high capital efficiency (no AMM fees)

No AMM slippage or MEV

Rapid scalability (deBridge can support new chains without running liquidity mining activities)

Deep liquidity (not limited by TVL in target chain pools)

deBridge provides infrastructure for the non-custodial spot trading market, including all types of market participants such as users, protocols, wallets, centralized exchanges, market makers, arbitrageurs, MEV searchers, hedge funds, and OTC desks, offering a way to realize liquidity in a non-custodial manner without the risk of locking liquidity.

An Unreplicable Feature, deBridge's P2P Platform

Powerful new primitives designed for advanced users and institutions

deBridge P2P makes fully non-custodial cross-chain OTC trading possible, allowing anyone to choose their counterparty for their cross-chain transfers.

Users and institutions can also conduct compliant cross-chain transactions, needing to understand the liquidity source used to complete the transaction and confirm the counterparty.

Through P2P, deBridge ensures that users never lose custody of their assets in trades or OTC transactions. This is particularly helpful for traders and holders who wish to sell assets cross-chain to specific counterparties at agreed prices without involving the liquidity pools of CEX or DEX (anonymity).

P2P Use Cases

Institutions conducting compliant trades with known counterparties

Anyone can engage in OTC trading without worrying about counterparty risk, as parties never lose custody of their assets

Anyone can participate in OTC trading for any asset before it is listed on any exchange. For example, you can exchange newly created tokens on Solana for illiquid tokens on Arbitrum without relying on written agreements or OTC desks

Privacy-focused large trades, where users do not want to disclose trading data to centralized counterparties, can be conducted through P2P on-chain transactions

Non-custodial P2P OTC business remains a blank in other bridges, but it is a very necessary platform. Decentralized OTC is crucial for the development of DeFi, as it provides a more convenient, secure, and controllable path for traditional large funds and more capital to flow into the Web3 industry. This helps bridge the gap between traditional finance and the decentralized ecosystem, promoting greater liquidity and adoption of DeFi solutions.

Comparison of Security Models

deBridge Isolation Security Model:

- Risk Propagation Prevention: deBridge adopts an isolation security model, which means that issues in one supporting chain (such as vulnerabilities or consensus issues) will not affect the liquidity or integration on other chains. This isolation ensures that if a hack occurs on a particular chain, the impact will be contained, and only orders from the affected chain may not be completed or require a higher premium to compensate for increased risk.

LayerZero/Stargate Shared Security Model:

- Cross-Chain Risk Propagation: LayerZero/Stargate uses a shared security model, where issues on one chain may result in the loss of liquidity on all chains, as security is interdependent.

- 2/2 Consensus Mechanism: LayerZero's validation layer relies on a 2/2 consensus mechanism, requiring both oracles and relayers to agree. However, this setup poses the risk of collusion between oracles and relayers, which could compromise security.

deBridge Validator Consensus:

- 12 Validators with Financial Risk: Compared to LayerZero, deBridge uses a consensus model consisting of 12 validators. These validators gain financial risk and rewards through delegated staking and penalty mechanisms, making the consensus more robust and secure.

- Off-Chain Verification: deBridge validators sign messages off-chain, providing three main advantages:

- Unlimited Throughput: No intermediate consensus layer (such as a blockchain), hence no throughput limitations.

- Final Security: Validators do not communicate with each other or expose IP addresses, reducing the risk of attacks.

- High Gas Efficiency: Validators do not broadcast transactions, thus incurring no gas fees, while LayerZero's gas fees are borne by the message sender.

Scalability and Non-EVM Chain Compatibility

- Support for Solana: deBridge's validation layer is designed to easily expand to non-EVM chains like Solana. It enables seamless interaction between EVM smart contracts and Solana programs, while LayerZero faces challenges in this regard due to the need to modify its validation layer or wait for new Ethereum improvements (such as EIP-665) to be implemented.

- Challenges of the LayerZero Model:

- Gas Price Fluctuations: LayerZero's model requires oracles and relayers to relay proofs and broadcast transactions, exposing them to risks associated with gas price fluctuations. These costs are ultimately borne by the message sender, increasing the cost per message.

Summary

Compared to LayerZero/Stargate, deBridge provides a more secure, efficient, and scalable cross-chain trading solution. deBridge's isolation security model prevents risk propagation, and its off-chain verification mechanism offers high throughput, enhanced security, and lower costs. deBridge also demonstrates its ability to support non-EVM chains like Solana, while LayerZero, relying on a 2/2 consensus mechanism and a shared security model, falls short in terms of security and gas efficiency compared to deBridge.

Protocol Activity

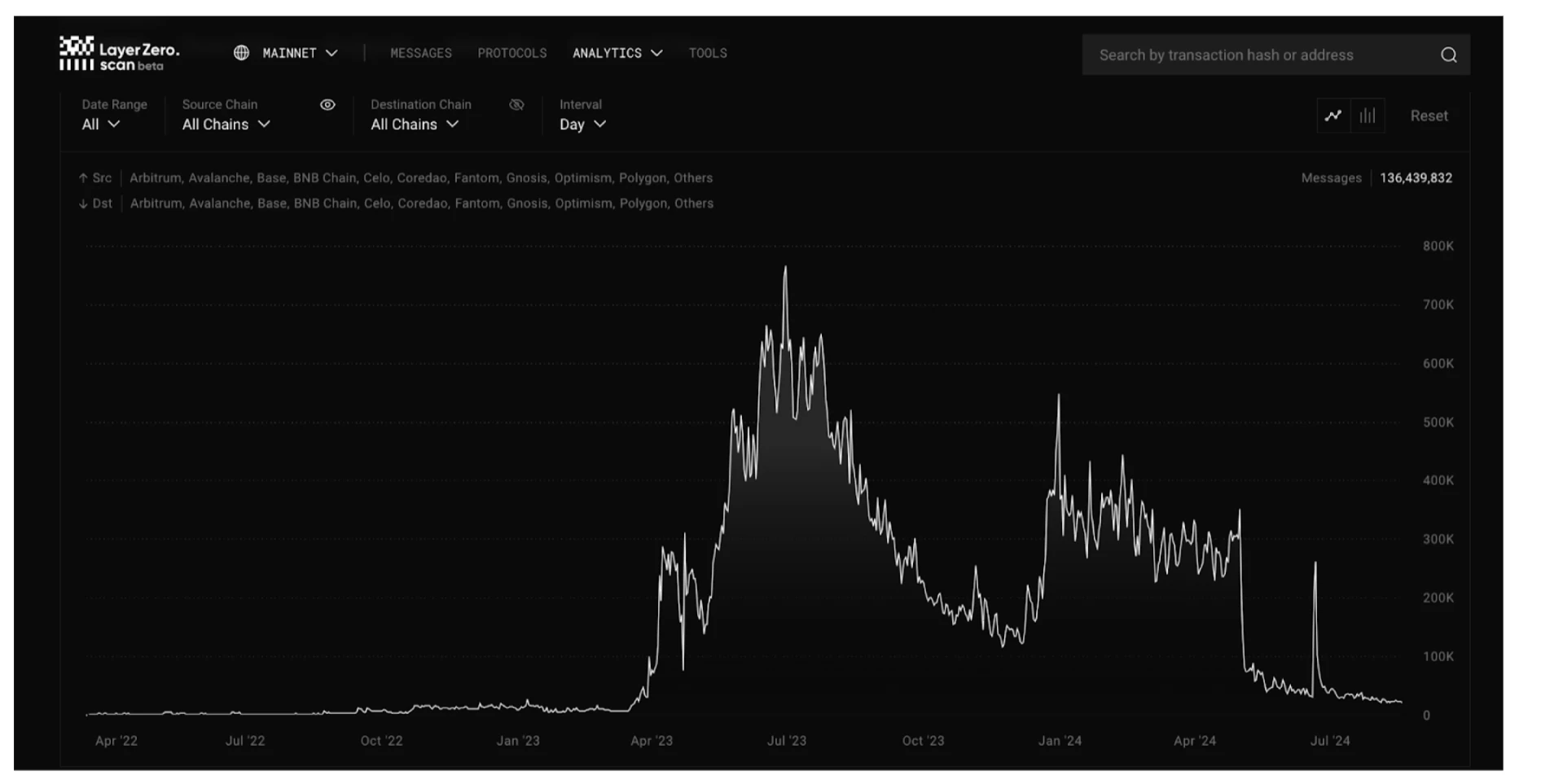

Layer Zero Protocol Activity

Data Source: LayerZeroScan Analytics Overview

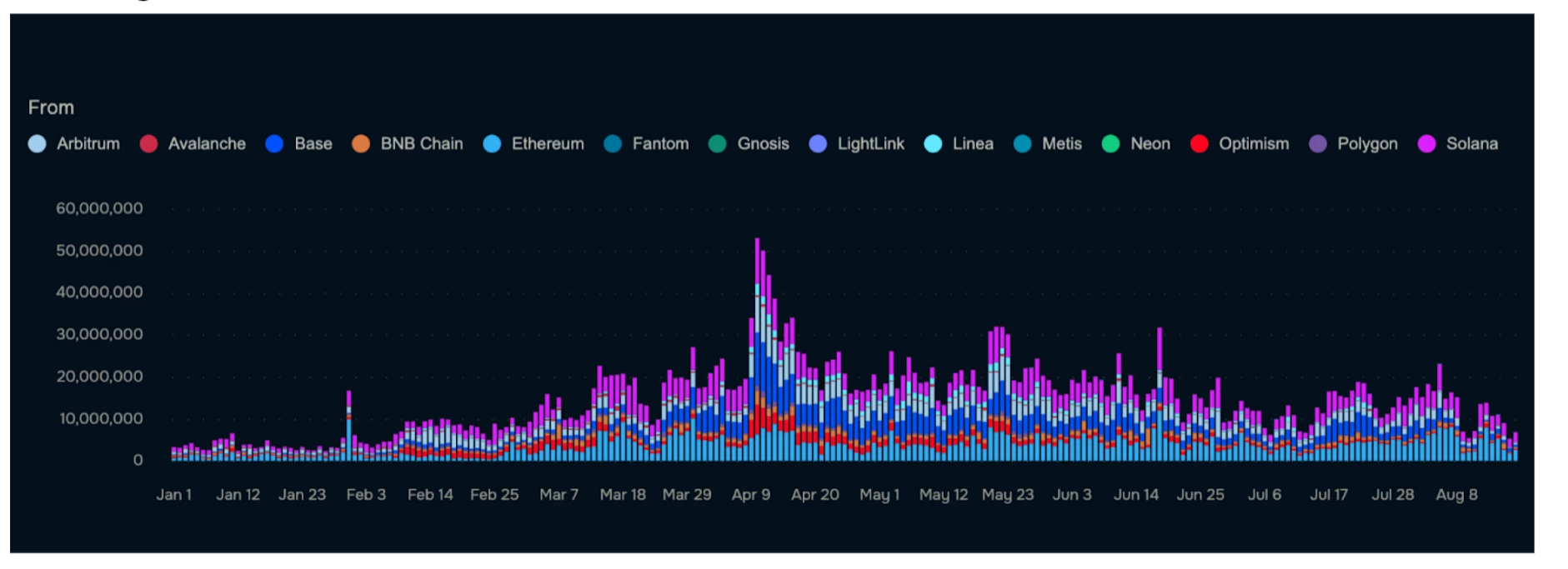

deBridge Protocol Activity

Data Source: deBridge Analytics

From the charts, it can be observed that deBridge has maintained stable trading volume over a longer period, with relatively minor fluctuations in trading volume during overall market volatility. In contrast, LayerZero's trading activity has shown a significant decline after several peak periods, indicating that its trading activity may be more susceptible to market changes.

The stability of deBridge's trading volume implies a more solid user base, broader application scenarios for the protocol, and greater market adaptability.

Due to deBridge's on-demand liquidity model, capital efficiency has been greatly improved without the need for continuous liquidity mining incentives. This makes deBridge more sustainable in the long run. In contrast, LayerZero may need to maintain its liquidity through continuous incentive measures, leading to inefficient use of funds and potential risks of liquidity depletion.

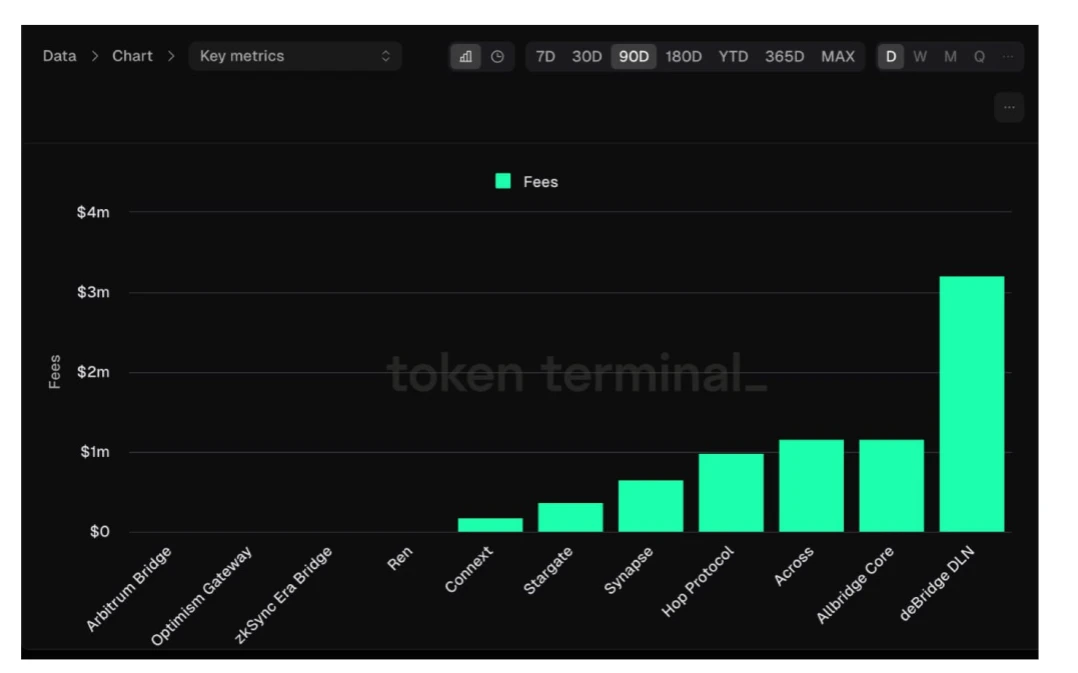

Cross-Chain Fee Comparison

We all know that stable revenue is the cornerstone for cross-chain protocols to survive, develop, and establish themselves in a fiercely competitive market.

Products with long-term profitability are particularly crucial for the bridge ecosystem and product iterations.

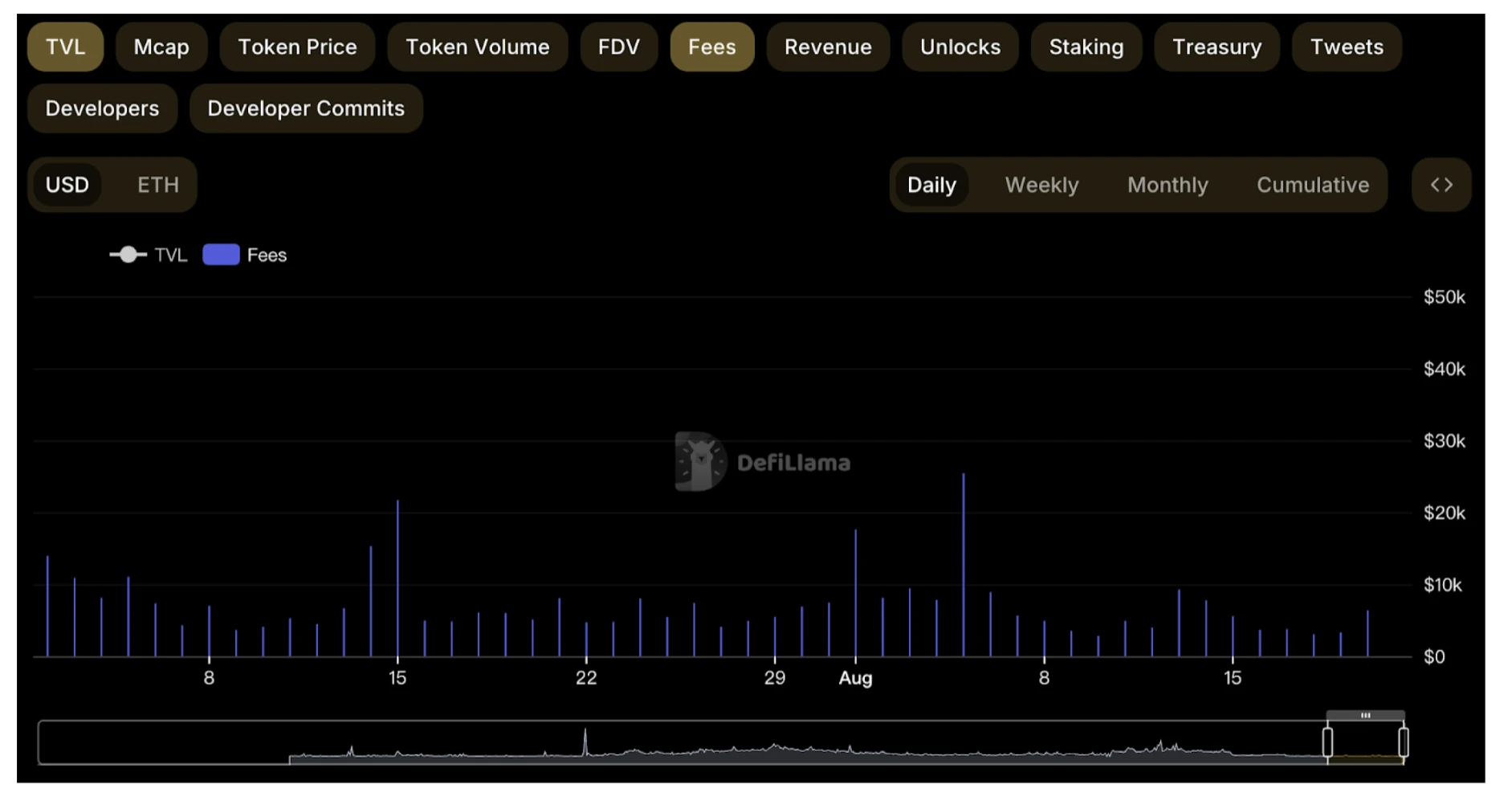

Stargate User Cross-Chain Fees (60 days)

The translation is complete.

Data Source: Stargate Finance Cross-Chain Fees

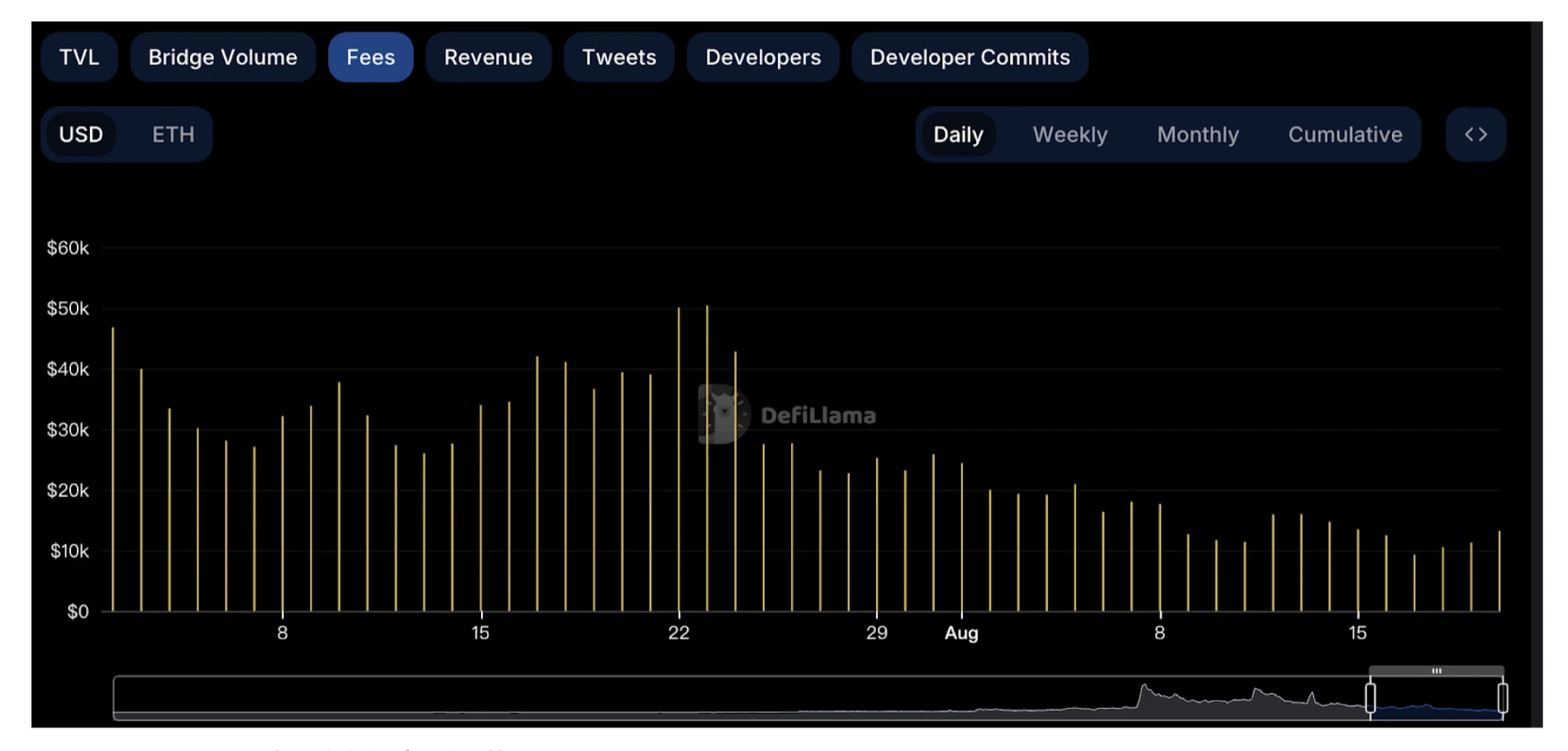

deBridge User Cross-Chain Fees (60 days)

The two charts clearly show significant differences in cross-chain fee revenue between deBridge and Stargate over the past 60 days.

deBridge: The chart shows that deBridge's fees have remained at a stable level, and the higher average fees indicate the stability and long-term profitability of its product.

Stargate: The cross-chain fee revenue chart for Stargate shows significant fluctuations in fees. Despite occasional peaks, the average value is lower than deBridge.

Analysis:

- Stability: Compared to the significant fluctuations in Stargate, deBridge demonstrates a more stable income trend, indicating a more stable user base or greater resilience to risks.

- Potential Income Advantage: Although deBridge's peak is lower than Stargate, its stable and sustained income may be advantageous for long-term growth.

This chart shows the fee revenue of various cross-chain bridging protocols over the past 90 days, with deBridge's DLN product significantly outperforming its competitors. DLN's fee revenue exceeds $3 million, far surpassing the second-ranked Altbridge Core. Other well-known protocols such as Synapse and Stargate have significantly lower revenue, highlighting DLN's dominant market position and strong growth potential in the cross-chain bridging field.

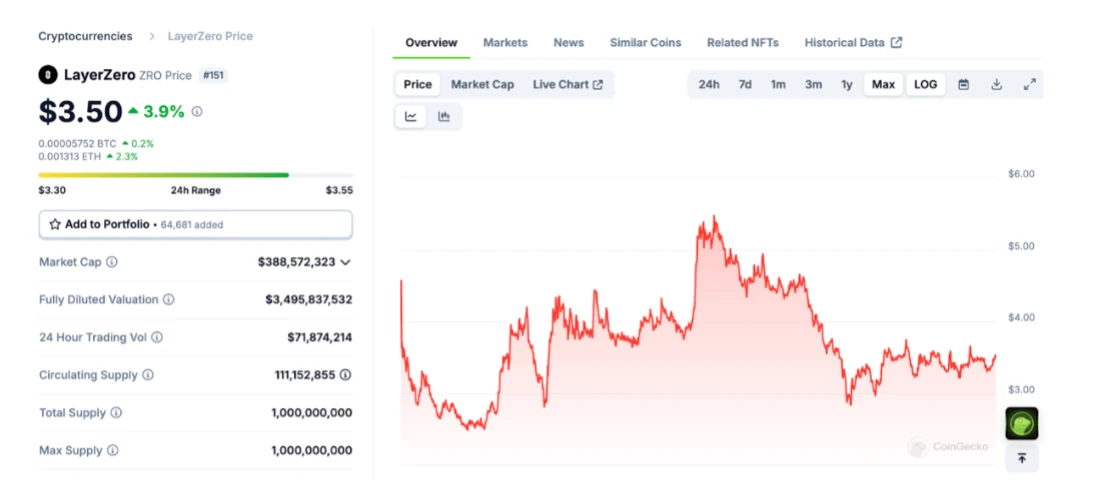

Token FDV Comparison

Layer Zero

FDV: $3,495,837,532

Total Supply: 1,000,000,000

Data Source: LayerZero Token Information

Stargate

FDV: $324,111,490

Max Supply: 1,000,000,000

Data Source: Stargate Finance Token Information

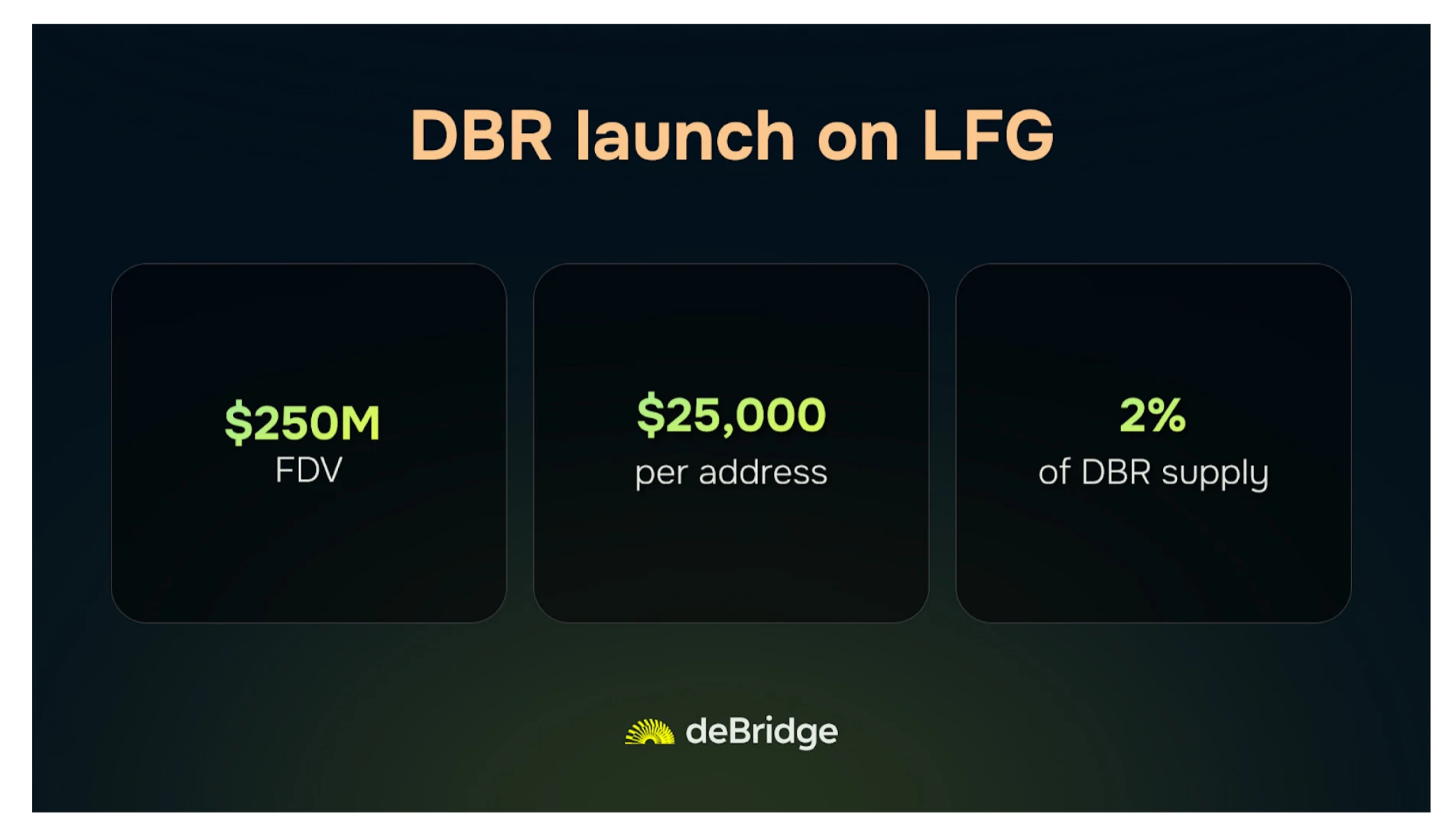

deBridge

FDV at launch: $250,000,000

Max Supply: 10,000,000,000

Data Source: Everything You Need to Know About DBR's Launch on LFG

The fully diluted valuation (FDV) of LayerZero's $ZRO token is $3.4 billion, while the FDV of the cross-chain product Stargate's $STG token is $320 million. Together, they represent significant value. However, deBridge's $DBR token FDV is only $250 million, yet it demonstrates superior protocol activity and stable cross-chain fee revenue.

It is worth noting that while LayerZero raised $315 million through three rounds of funding, deBridge raised less than $10 million in the early stages and did not accept further investment. Nevertheless, deBridge's protocol revenue has reached $12 million, highlighting its lower FDV and higher intrinsic value.

When comparing the LayerZero and deBridge projects, the lower FDV highlights deBridge's advantages:

- Stability and Efficiency: Despite an FDV of only $250 million, deBridge's protocol activity and cross-chain fee revenue surpass those of LayerZero and Stargate, indicating that $DBR may be undervalued and has greater growth potential.

- Prudent Financing: deBridge initially raised less than $10 million, demonstrating its efficiency and independence, avoiding the risk of price decline due to a large token release.

- Revenue Performance: With protocol revenue reaching $12 million, the actual market value of $DBR is more attractive.

deBridge's unique approach emphasizes efficiency and value creation, rather than high valuation. Unlike LayerZero, which raised a large amount of funds and has a high FDV, deBridge raised less than $10 million. This streamlined financing model allows deBridge to establish a stable and efficient protocol that outperforms its peers in activity and revenue. Despite an FDV of only $250 million, deBridge's strong revenue and controlled token supply highlight the intrinsic value of the $DBR token, indicating significant long-term growth potential.

deBridge's protocol has achieved remarkable revenue milestones with minimal funding, highlighting the project's inherent strength. As more users and developers recognize the embedded value of deBridge, its market position is expected to improve, offering greater potential for investment returns compared to other capital-intensive projects. This makes $DBR a high-potential asset with considerable upside potential in the secondary market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。