In the simplest way, take you to understand the classic strategy.

OKX, in collaboration with the high-quality data platform AICoin, has initiated a series of classic strategy research, aiming to help users better understand and learn different strategies through data testing and analysis of core dimensions such as strategy characteristics, and to avoid blind use as much as possible.

The Martin Gale strategy, also known as Dollar Cost Averaging (DCA), is a trading method that focuses on position management. The core idea is "add to the position when losing to average down, reset when making a profit." The main feature is that after each loss, the trading amount is doubled until a victory is achieved. The basic assumption of this strategy is that as long as the capital is large enough, the eventual victory will make up for all previous losses and bring profits. As a high-risk strategy, Martin Gale is suitable for traders with sufficient capital and the ability to withstand potentially huge losses.

This strategy is mainly divided into two application forms in the cryptocurrency market: spot Martin Gale and contract Martin Gale.

The 3rd issue introduces the Martin Gale strategy and uses 3 major data models to test the [spot Martin Gale and contract Martin Gale]:

Model 1: Contract DCA and Spot DCA under a 5-minute uptrend running cycle

Model 2: Contract DCA and Spot DCA under a 5-minute downtrend running cycle

Model 3: Contract DCA and Spot DCA under a 5-minute sideways oscillation running cycle

This issue's data testing and running standards:

Long DCA: Open a long position at the start of the market, and when the market falls, carry out additional buying operations, with a maximum of 5 additional purchases, and set a stop-loss line for the 5th additional purchase. When the market rebounds and rises to the target price, sell once to obtain profits.

Contract DCA: Based on the logic of Long DCA, it adds opening short positions. Open a short position at the start of the market, and when the market rises, carry out additional shorting operations, with a maximum of 5 additional shorting operations, and also set a stop-loss line for the 5th additional shorting operation. When the market retraces and falls to the target price, buy once to obtain profits.

One-sentence summary of spot Martin Gale and contract Martin Gale: In a sideways oscillating market, contract DCA is more suitable; in a clearly rising market, spot DCA is more suitable, but both require vigilance against risks.

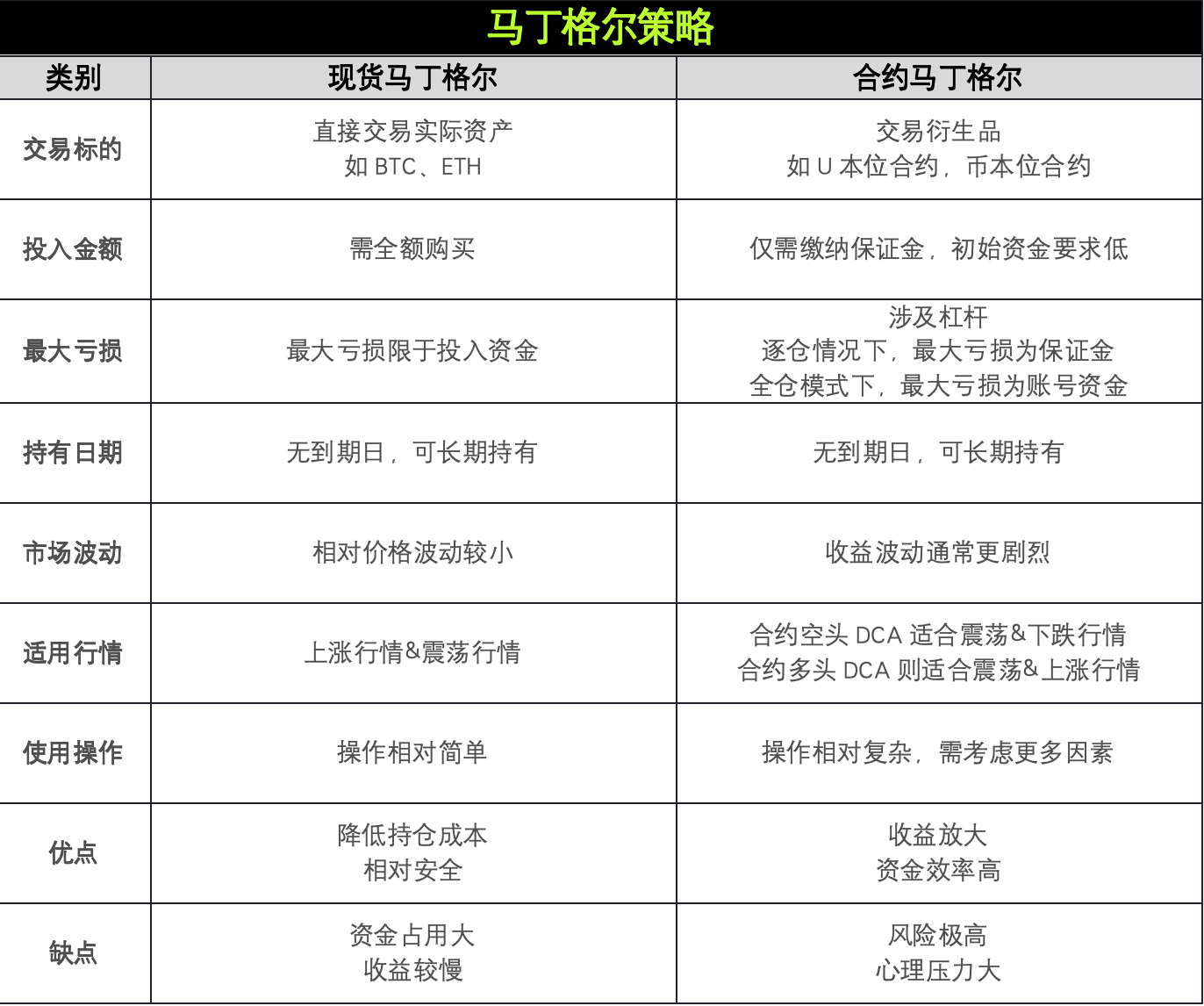

Advantages and Disadvantages Comparison

Both forms of the Martin Gale strategy follow the same basic principles: increasing the trading scale when losing to lower the average price, and expecting the eventual profit to cover the previous losses. However, they have significant differences in specific operations, risk characteristics, and applicable scenarios. The choice of strategy should be dynamically adjusted based on the trader's risk tolerance and market trends, while also paying attention to reasonable risk control measures to reduce potential losses.

Whether it is spot or contract Martin Gale, it is considered a strategy that focuses on position management. The spot Martin Gale strategy lowers the average cost by doubling the buying, but needs to be vigilant against continuous downside risks; while the contract Martin Gale strategy amplifies both profits and risks by doubling the opening positions, and needs to be vigilant against the risk of liquidation.

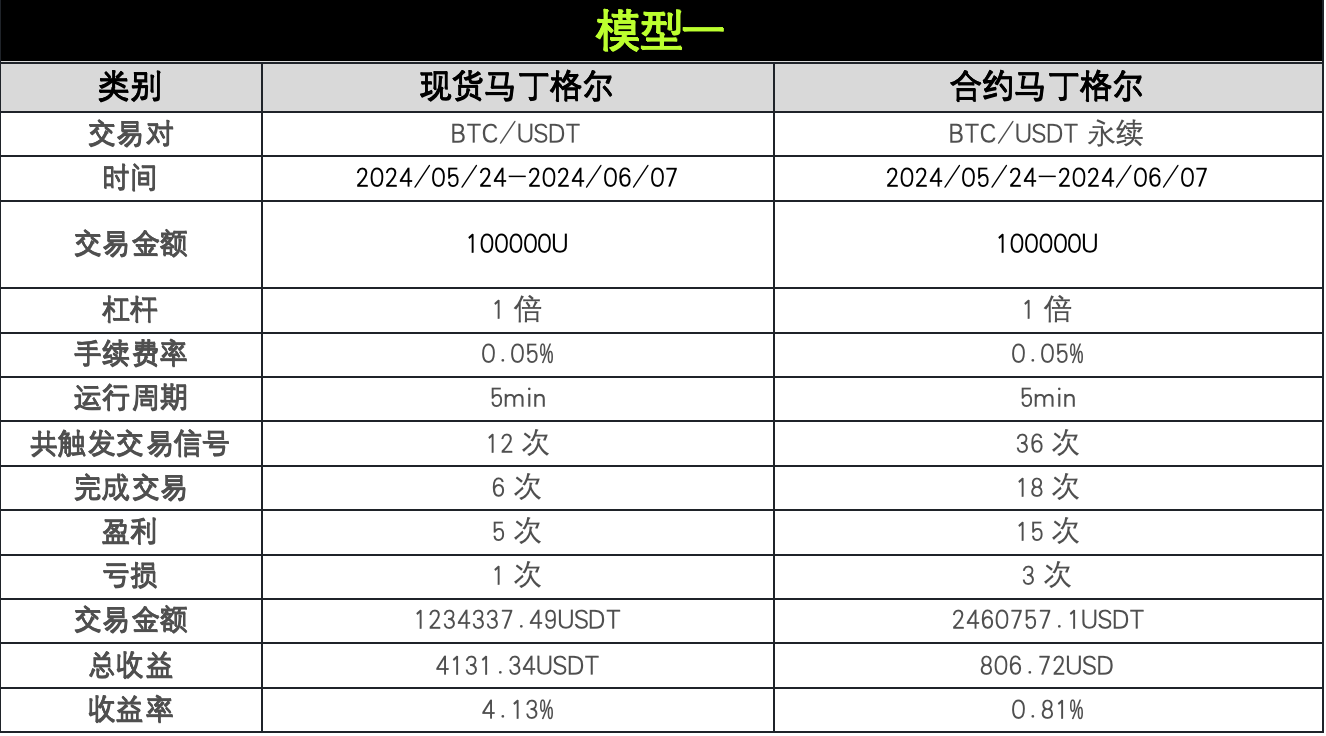

Model One

This model is: Contract DCA and Spot DCA under a 5-minute uptrend running cycle

Image 1: Contract DCA under a 5-minute uptrend running cycle; Source: AICoin

Image 2: Spot DCA under a 5-minute uptrend running cycle; Source: AICoin

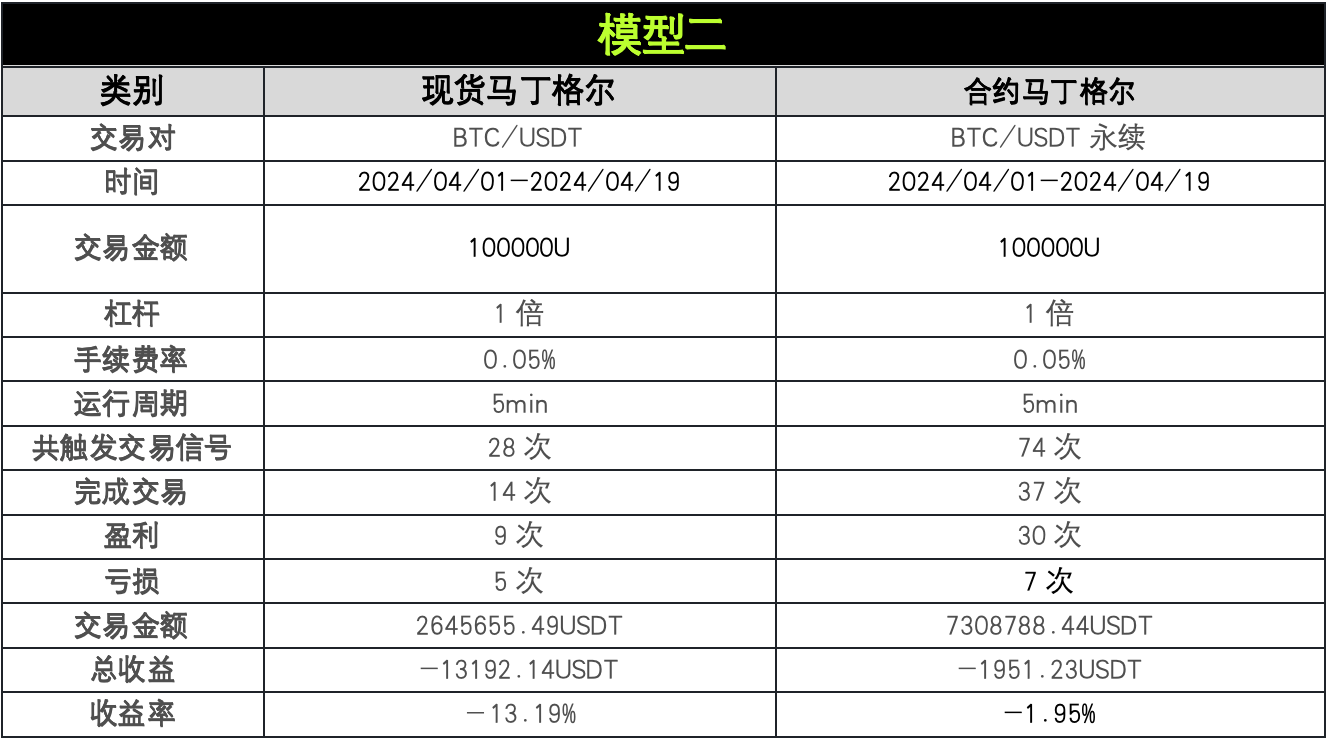

Model Two

This model is: Contract DCA and Spot DCA under a 5-minute downtrend running cycle

Image 3: Contract DCA under a 5-minute downtrend running cycle; Source: AICoin

Image 4: Spot DCA under a 5-minute downtrend running cycle; Source: AICoin

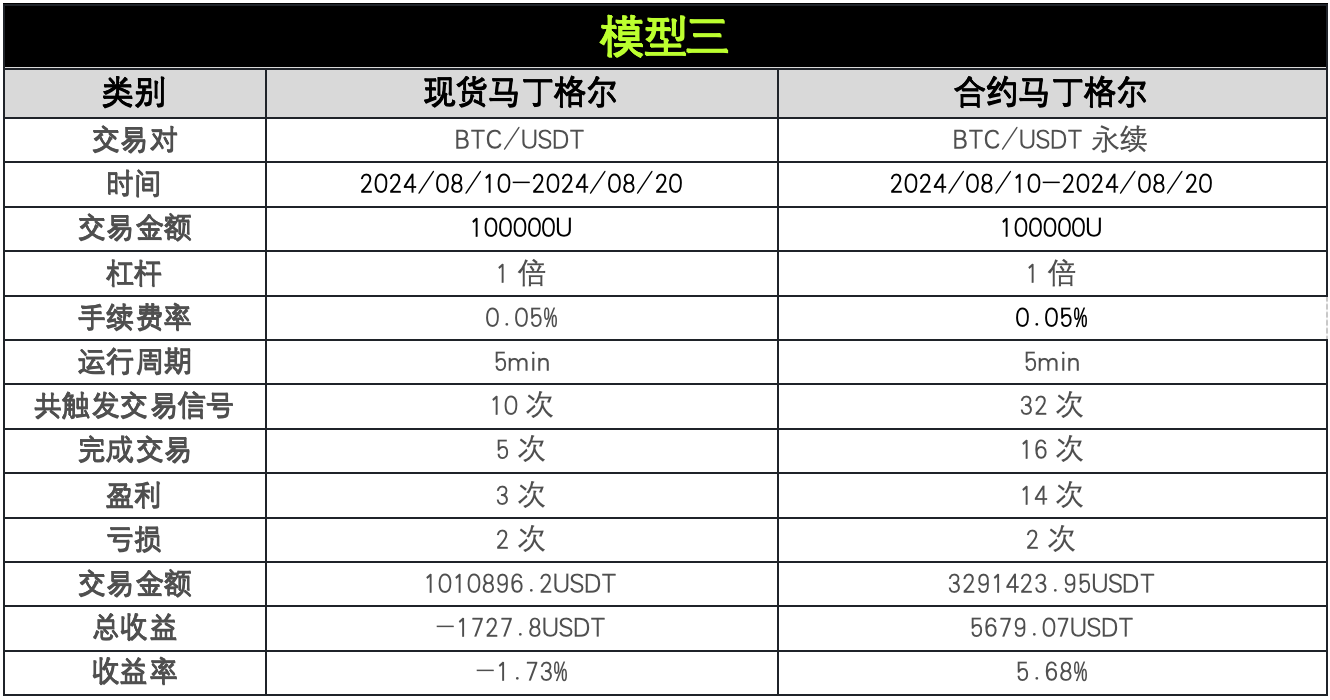

Model Three

This model is: Contract DCA and Spot DCA under a 5-minute sideways oscillation running cycle

Image 5: Contract DCA under a 5-minute sideways oscillation running cycle; Source: AICoin

Image 6: Spot DCA under a 5-minute sideways oscillation running cycle; Source: AICoin

Analysis and Summary

Sharp rises and falls are not conducive to the contract DCA strategy, which is suitable for oscillating markets. Among them, the contract short DCA is suitable for oscillating and downtrend markets, while the contract long DCA is suitable for oscillating and uptrend markets. Spot DCA can gain in a rising market.

The contract DCA strategy shows strong adaptability in different market environments, especially in sideways oscillating markets. Spot DCA performs well in a rising market, but poorly in sideways oscillating and downtrend markets. Contract DCA obtains profits through more frequent trading and a higher win rate, but may also bring higher risks. Spot DCA has a lower trading frequency and may be more suitable for long-term traders or risk-averse traders.

In general, when their additional position parameters are set to 1, they behave very similarly to a grid. However, when the additional position parameters are set to 2 (or larger), they may lead to a sharp increase in capital requirements and bring huge psychological pressure to traders. In particular, contract Martin Gale, due to the leverage effect, has more significant risks and may lead to liquidation.

Specifically:

Choose a strategy based on risk tolerance

High risk tolerance: Consider contract DCA, especially in sideways oscillating markets.

Low risk tolerance: Choose spot DCA, especially in a clearly rising market.

Combine market trends

Rising trend: Both strategies can be considered, but pay attention to taking profits in a timely manner.

In a downtrend: Use with caution, may need to adjust the strategy or temporarily observe.

Sideways oscillation: Contract DCA may have more advantages.

Dynamic Adjustment

Flexibly adjust the strategy according to market changes, do not stick to a single mode.

Risk Management

Set stop-loss points, control the amount of funds for each trade, and diversify trades to reduce risk.

Combination Strategy

Consider combining contract DCA and spot DCA to balance risk and return.

Continuous Learning and Optimization

Regularly backtest and evaluate the effectiveness of the strategy, and continuously optimize trading strategies based on new market data.

Pay Attention to External Factors

In addition to technical analysis, also pay attention to external factors such as macroeconomics, industry news, which may affect the market.

By reasonably applying these strategies and adjusting them according to individual circumstances and market conditions, traders can better manage risk and increase the possibility of returns. However, always remember that the cryptocurrency market is highly volatile, and traders should only invest funds they can afford to lose.

OKX & AICoin Martin Gale Strategy

Currently, OKX strategy trading provides convenient and diversified strategy varieties. The spot and contract versions of the Martin Gale strategy on OKX have been optimized to a greater extent to match the habits and characteristics of cryptocurrency users. Two different creation modes have been set for users with different levels of experience: manual creation and intelligent creation.

Manual creation allows traders to set parameters based on their judgment of the market. This is mainly suitable for experienced traders with strong capital, while ordinary users are advised to use the intelligent creation mode. Intelligent creation allows users to set the trading amount and buying pace based on their risk preferences, using parameters recommended by the OKX system.

It is worth mentioning that the system-recommended parameters are calculated based on historical market conditions and asset volatility, using the authoritative algorithm of the OKX backend, providing reliable trading references for traders. In addition, following the practice of tiered trading in traditional securities, the intelligent creation mode controls risks as much as possible and recommends parameters of different risk levels based on the user's asset status and risk tolerance, including conservative, balanced, and aggressive levels.

How to access more strategy trading on OKX? Users can access the "Strategy Trading" mode in the "Trading" section of the OKX APP or official website, and then click on "Strategy Plaza" or "Create Strategy" to start the experience. In addition to creating strategies on their own, the Strategy Plaza currently also provides "High-quality Strategies" and "Strategies with Copy Traders", allowing users to copy strategies or follow strategies.

OKX strategy trading has multiple core advantages, including easy operation, low fees, and security. In terms of operation, OKX provides intelligent parameters to help users set trading parameters more scientifically, and provides text and video tutorials to help users quickly get started and become proficient. In terms of fees, OKX has comprehensively upgraded its fee rate system, significantly reducing user trading fees. In terms of security, OKX has a security team composed of top global experts, providing bank-level security protection.

How to access AICoin's DCA strategy?

Full-currency DCA strategy: Users can find the "Full-currency DCA" option in the "Strategy" section on the left sidebar of the AICoin product. Click here, and you will find the full-currency DCA strategy recommended by AICoin based on the current market conditions.

Spot DCA strategy: Users can find the "Spot DCA" option in the "Market" section on the left sidebar of the AICoin product. Click here, and you will find the spot DCA strategy recommended by AICoin based on the selected trading pairs.

Contract DCA strategy: Users can find the "Custom Indicators/Backtesting/Live Trading" option in the "Market" section on the left sidebar of the AICoin product. Click here, and search for "Contract DCA" in the "Community Indicators" to find the code for the dollar-cost averaging strategy.

Disclaimer

This article is for reference only, representing the author's views and not OKX's position. This article does not intend to provide (i) trading advice or recommendations; (ii) solicitations to buy, sell, or hold digital assets; (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may experience significant fluctuations. You should carefully consider whether trading or holding digital assets is suitable for your financial situation. For your specific situation, please consult your legal/tax/trading professionals. Please be responsible for understanding and complying with applicable local laws and regulations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。