Background Introduction

With the rapid development of DeFi and blockchain technology, many centralized exchanges (CEXs) such as Coinbase, Binance, and Kraken have emerged in the industry. However, these centralized platforms also have some common problems, especially in terms of transparency and asset control. There have been many cases of CEX bankruptcies or running away in history. For example, the bankruptcy of FTX exchange in 2022 resulted in the misappropriation of user assets, leading to a large number of user assets being frozen or lost.

At the same time, early decentralized exchanges (DEXs) have advantages in transparency and decentralization, but they have difficulty competing with centralized platforms in terms of liquidity, transaction speed, and user experience.

Orderly Network was born in such a context, combining the liquidity and transaction speed advantages of CEXs while retaining the transparency, sovereignty, and on-chain settlement characteristics of DeFi. It aims to build an efficient trading ecosystem that can meet users' needs for liquidity and speed while maintaining decentralization and transparency.

Mechanism Explanation

In simple terms, addressing the issue of insufficient liquidity in DEXs, one of the solutions of Orderly Network is its innovative cross-chain liquidity aggregation mechanism: by aggregating liquidity from multiple blockchains, it provides a wider range of asset pools and tighter spreads.

Traditional DEXs are usually limited to a single blockchain, which leads to liquidity being dispersed across different chains and unable to be fully utilized. Orderly Network, on the other hand, aggregates liquidity across chains, consolidating the liquidity of multiple blockchains (such as Arbitrum, Optimism, Polygon, Base, etc.) into a unified order book.

By aggregating liquidity from multiple chains, Orderly Network can provide a wider range of asset pools to meet the trading needs of different users, and it also reduces the spread between buy and sell orders, allowing users to trade in a way that is closer to market prices and reducing slippage.

In addition, Orderly Network adopts a unified order book mechanism, allowing users to trade on different blockchains, but all trades are managed in the same order book. This mechanism eliminates the need for bridge operations that users typically face when conducting cross-chain transactions, making cross-chain transactions more seamless and efficient. By concentrating liquidity on a unified platform, Orderly Network effectively reduces the problem of liquidity fragmentation and improves the overall market depth and trading efficiency.

The Perps aggregator in the on-chain order book system can also record and manage all buy and sell orders in real time. Through the order book, the aggregator can quickly match the trading requests of both buyers and sellers, ensuring fast execution of trades. One of its target audiences is leveraged traders, who can use perpetual contracts for long and short hedging or speculation. With the aggregator providing fast trade execution and deep liquidity, traders can operate with higher efficiency.

It is worth mentioning that such an on-chain order book also provides a flexible and powerful infrastructure for decentralized applications (dApps). Through this on-chain order book, developers can use it to build modular dApps, covering everything from simple trading interfaces to complex financial tools such as perpetual contracts and lending platforms. In addition, Orderly Network also provides plug-and-play SDKs and APIs, allowing developers to easily integrate order book functionality into their dApps without the need to develop complex trading systems from scratch. This significantly reduces development costs and time.

For trading users, dApps can also obtain market prices and order matching information in real time through the on-chain order book, providing users with an efficient and transparent trading experience. By integrating Orderly Network's cross-chain liquidity, dApps can obtain liquidity from multiple blockchains. Whether on Ethereum, BSC, or other blockchains, dApps can utilize liquidity resources from the same order book. In addition, this on-chain order book prioritizes efficient trade execution, allowing user orders to be quickly matched and executed, thereby reducing the risk of trade delays and failures.

Building on the NEAR blockchain also empowers Orderly Network in several ways. One of them is its scalability: the NEAR blockchain uses a sharding technology called "Nightshade," which allows the network to scale horizontally. Each shard handles a portion of the network's transactions and data, so even if the transaction volume in the network increases significantly, NEAR can still operate efficiently. This scalability is crucial for supporting data-intensive platforms like Orderly Network that need to process a large number of orders and transactions.

In terms of transaction speed, the block time of the NEAR blockchain is around 1 second, and transactions are usually confirmed within 1-2 seconds. This ability for fast confirmation allows Orderly Network to provide a near real-time trading experience, reducing the risk of trade delays and failures. The high throughput and low-latency transaction processing capability of NEAR also ensures that the platform can quickly match buy and sell orders, with trades being executed rapidly without being affected by network congestion.

Furthermore, Orderly Network is integrated with both the EVM and non-EVM blockchain ecosystems, supporting popular Layer 2 chains (such as Arbitrum, Optimism, and Polygon PoS) as well as non-EVM NEAR protocols.

$ORDER Token

The native token of Orderly Network is $ORDER, which is also the core driver of the Orderly Network ecosystem.

Its specific functions are as follows:

- Governance: As the governance process formalizes, staking $ORDER allows token holders to participate in decentralized governance of key aspects of the Orderly Network. More details will be announced at the appropriate time.

- Earn VALOR: VALOR measures a user's staked $ORDER based on the amount and duration, giving users the right to obtain corresponding shares of the protocol treasury.

- Increased trading rewards: By staking $ORDER, traders can receive a higher share of trading rewards.

- Increased liquidity provider rewards: Staking $ORDER allows liquidity providers to receive a higher share of liquidity provider rewards.

- Other utilities: Other $ORDER token utilities will be introduced in upcoming products and third-party DeFi protocols within Orderly Network.

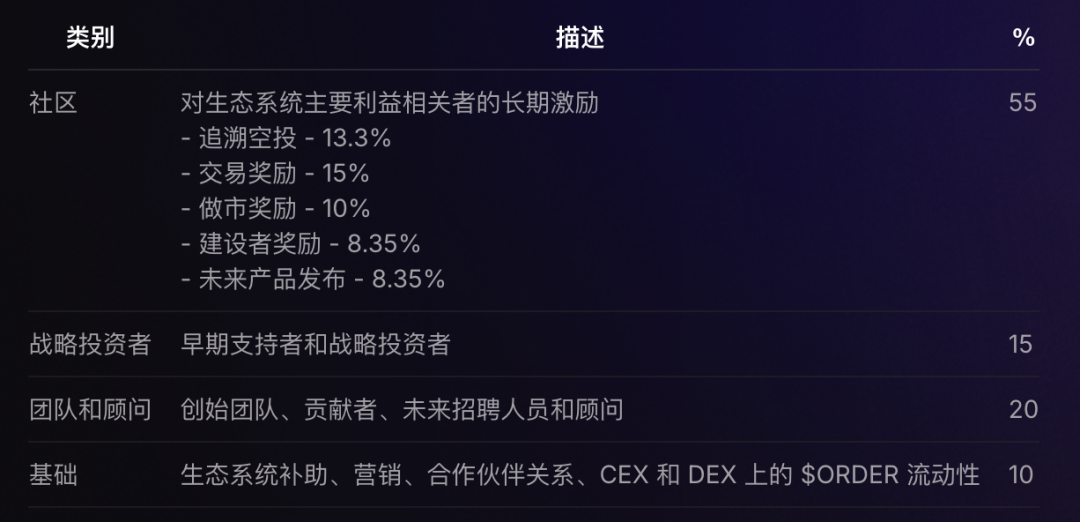

The maximum supply of $ORDER tokens is 1,000,000,000, and the supply is as follows:

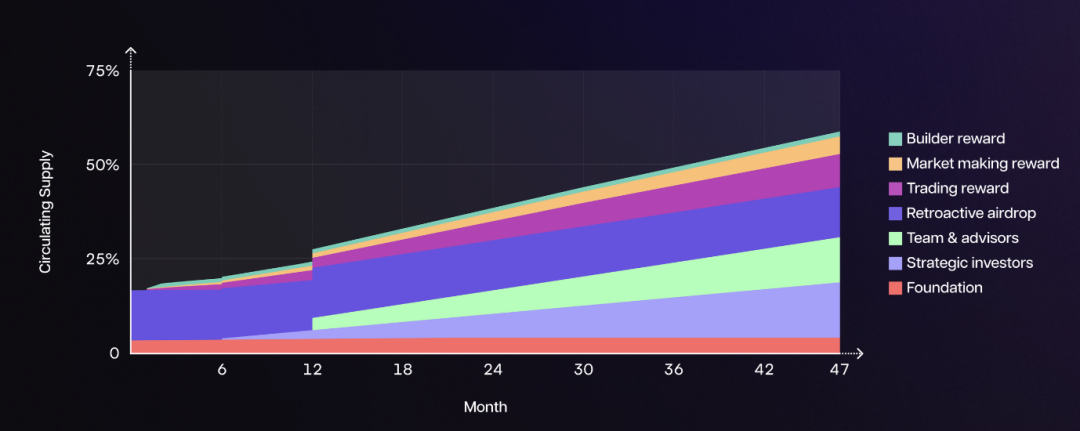

Release time is as follows:

Performance Analysis

According to DeFiLlama data, as of August 20th, the total locked value of Orderly Network is $21.15 million; the 24-hour trading volume is $136,843, and the 24-hour derivatives trading volume has exceeded $190 million. It also has a user base of over 215,000 independent wallets.

In addition, Orderly Network's fundraising achievements are also impressive. According to disclosed information, it has raised a total of $25 million in three rounds of financing, with support from well-known investors such as Pantera, GSR, Dragonfly Capital, Jump Crypto, and others.

In summary, with its innovative infrastructure and strong partnerships, Orderly Network is expected to become a major player in the future of DeFi trading. However, Orderly Network also faces some challenges: while it provides fast trading and deep liquidity, its success largely depends on its ability to continuously attract enough users and liquidity providers. In addition, it is worth paying attention to whether the economic model of the $ORDER token can effectively incentivize long-term participation, or if it is just a short-term speculative tool. Let's wait and see the future development of Orderly Network.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。