Maker is a decentralized stablecoin protocol founded by Rune Christensen. With the tokenization and institutionalization of real assets, it has become a giant in the Ethereum DeFi field, despite its complexity, it possesses anti-fragility and substantial sources of income.

Authors: 0xkyle, Jimmy Zheng, and Alex

Translation: Blockchain in Plain Language

1. Introduction

Maker was founded by Danish entrepreneur Rune Christensen in 2014 and officially launched on the Ethereum network in 2017. Maker is a credit protocol with a decentralized stablecoin DAI. This simple concept has evolved over the past 10 years to become the world's largest decentralized stablecoin. With over $10 billion in total locked value (TVL), Maker is currently one of the giants in the Ethereum DeFi space.

We believe that Maker, as a foundational asset, will receive a huge boost from the increasingly institutionalized digital world. Its core idea is simple: with the launch of Bitcoin and Ethereum ETFs, as well as the tokenization of real assets, Maker is at the intersection of institutional adoption and DeFi.

However, as a protocol, Maker is known to be complex, with most research focusing on high-level overviews. At Artemis, we believe the world is moving towards a more fundamentally driven direction, so the purpose of this article is to establish a paper guided by fundamental principles to truly understand Maker's mechanism and further develop its argument.

Note: In this article, Maker will refer to the general protocol, while MakerDAO refers to the decentralized autonomous organization (DAO) that manages the Maker protocol.

2. Analysis of Maker

1) History of Maker

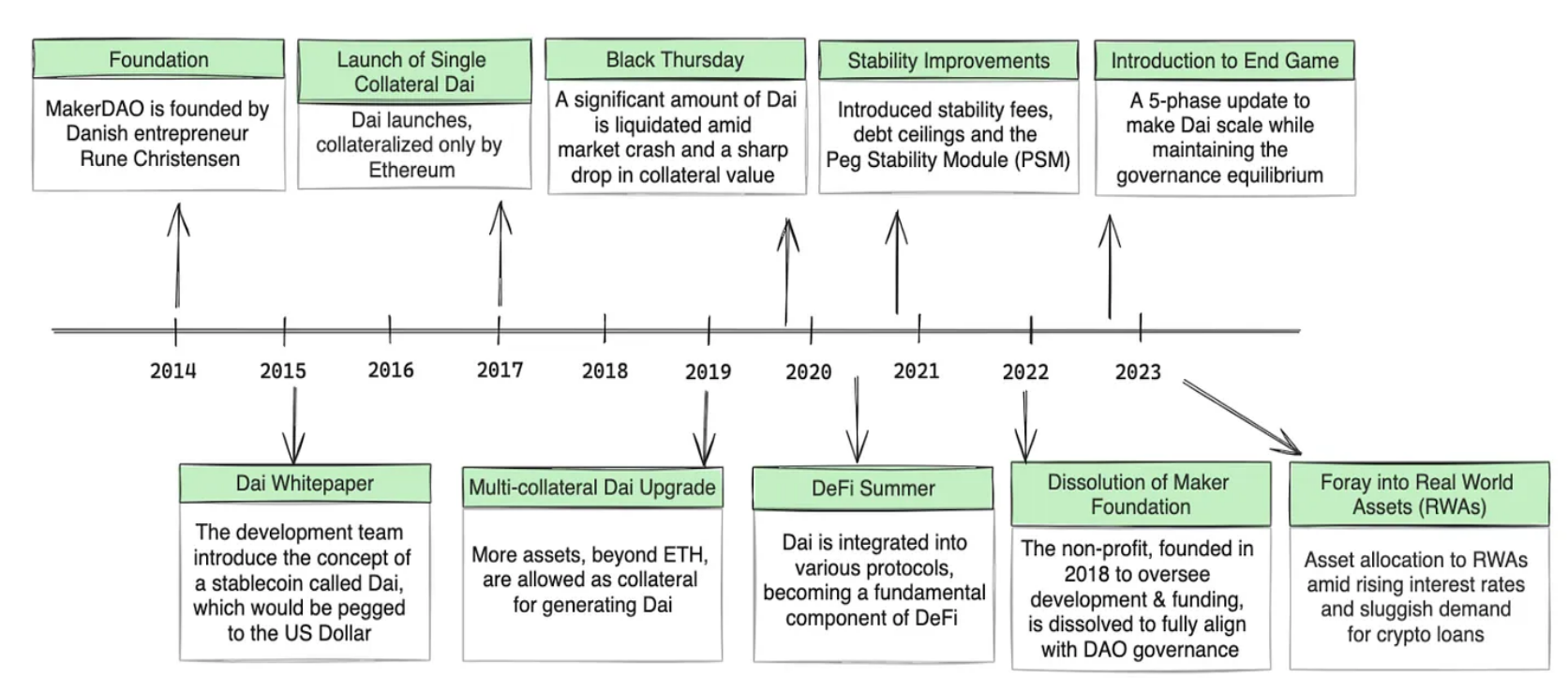

Before we begin, it is worth delving into the background of Maker. MakerDAO was founded in 2014 and is the brainchild of Rune Christensen, who dreamed of a world with a more transparent and accessible financial system. After losing his funds in Mt. Gox, he set out to develop a more stable alternative to replace highly volatile cryptocurrencies, thus creating Maker.

In 2017, DAI was officially launched: a decentralized stablecoin pegged to the US dollar and managed by a DAO. In its first year, despite Ethereum's price dropping by over 80%, DAI successfully maintained its peg to the US dollar. Over the next 7 years, Maker continued to demonstrate resilience to market-wide collapses, such as Black Thursday in 2020, when the entire cryptocurrency market lost one-third of its value.

Christensen's leadership is an undeniable reason for Maker's anti-fragility: his ability to respond to challenges and guide the protocol is crucial to its success. Even today, he continues to contribute to the strategic direction of MakerDAO, proposing the endgame for Maker. He still firmly believes in the decentralized future, stating that he "looks forward to the day he no longer needs it."

History of Maker - Source: Steakhouse Finance

2) Detailed Explanation of How Maker Operates

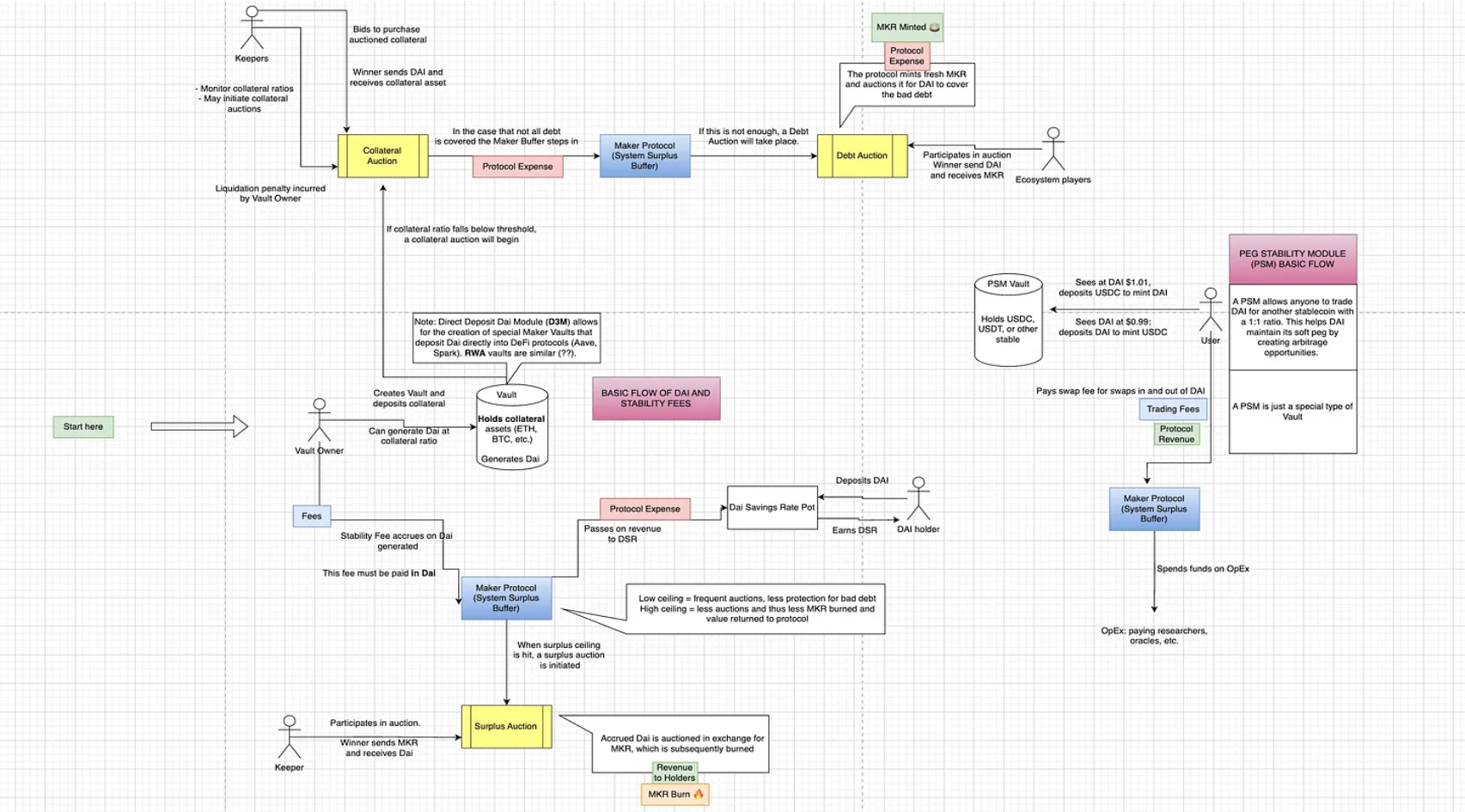

Illustration of How Maker Operates

From Maker's history, it is clear that it has undergone many changes over the past decade: from accepting more assets as collateral to introducing stability mechanisms; each upgrade has brought more complexity. Initially just a simple lending protocol, it has now evolved into something more complex - but at Artemis, we believe in building knowledge from fundamental principles; therefore, we will delve into how it operates.

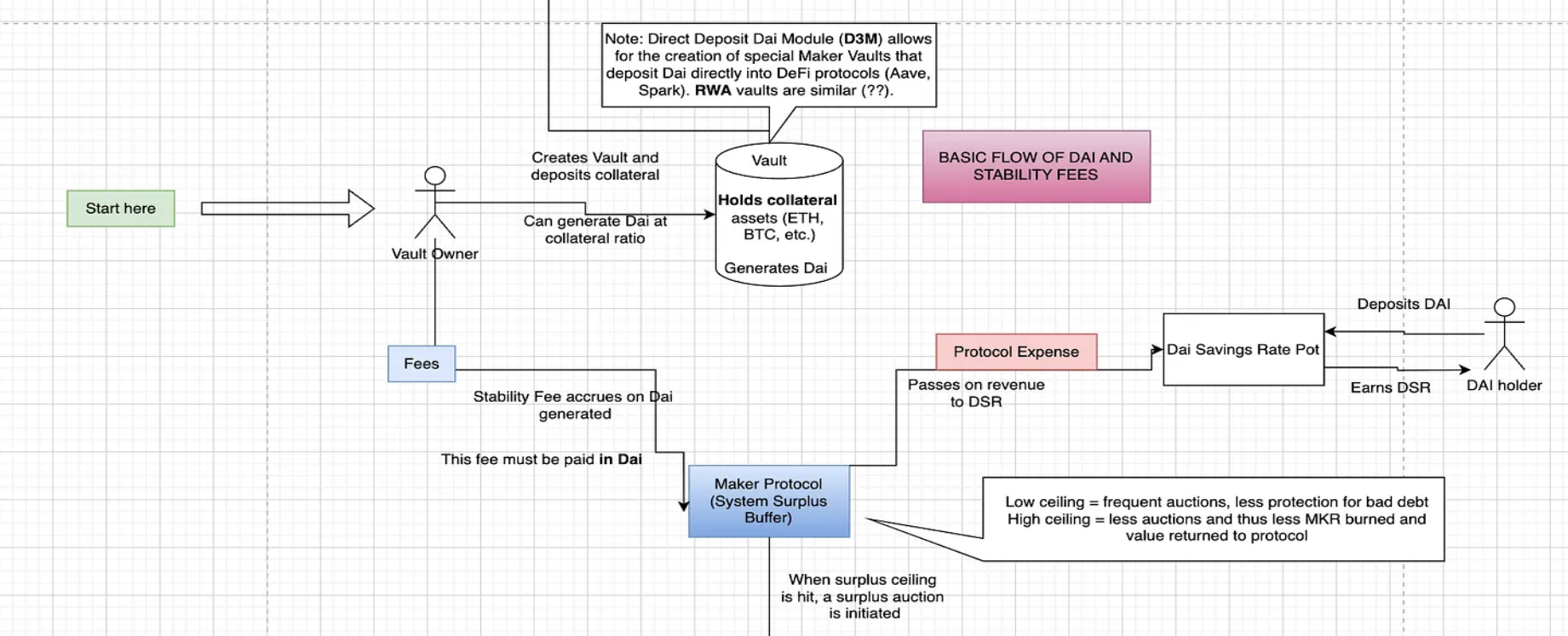

a). Borrowing and Repaying Debt

Borrowing and Repaying Debt

Let's start with an overview. Bitcoin's price is $60,000, and Billy has 1 Bitcoin. He needs liquidity but doesn't want to sell his Bitcoin during a bull market. He goes to Maker for a loan: by collateralizing his Bitcoin, he can borrow against it.

After some time, Billy wants to repay his loan. He must repay the debt he borrowed + the stability fee accumulated on his loan (in DAI). Part of the interest flows into Maker's system surplus buffer, while the remaining portion is paid to DAI savings rate holders - those who deposit DAI into Maker.

However, the buffer has a limit - sometimes, money that should go into the surplus cannot due to the limit - in this case, a surplus auction is initiated, where DAI will be "sold" to obtain Maker, which will then be destroyed.

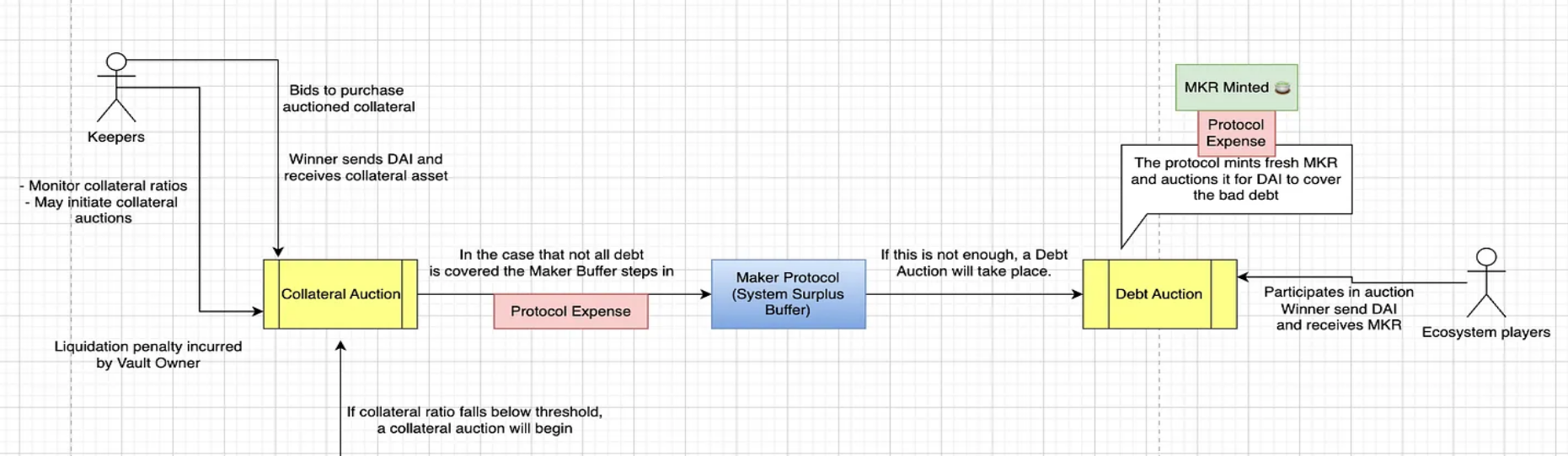

b). Liquidation Auction

Guide to Liquidation Auction Operations

However - what if Billy is unable to repay the debt? Suppose Billy obtained a $30,000 loan when the Bitcoin price was $60,000, with a Loan-To-Value (LTV) ratio of 0.5. The next day, Bitcoin drops to $40,000, and his LTV ratio soars to 0.75 - assume this is the highest LTV ratio allowed before he is liquidated. Billy must also pay the loan interest and liquidation penalty if it occurs.

In a liquidation scenario, the debtor must not only repay the debt but also pay interest and liquidation penalties on the debt. The overview is as follows:

Maker owns 1 Bitcoin (valued at $40,000)

Billy owes $30,000 (debt)

Billy owes $3,000 (stability fee)

Billy owes $2,000 (liquidation fee)

Therefore, the protocol has several ways to handle this:

Collateral auction. The protocol will first sell the collateral (in this case, 1 Bitcoin) to anyone willing to buy at a slight discount. Ideally, someone buys the Bitcoin for $35,000 for a slight arbitrage - this money is used to fill the gap directly.

If the funds raised from the collateral auction are insufficient, Maker will use its system surplus buffer.

If the buffer is insufficient, the final resort is initiated - debt auction, where Maker will mint new MKR and auction it to obtain DAI to cover the bad debt.

It is worth noting that debt auctions only occur in extreme cases, when there is a deficit in the value of collateral supporting DAI loans, and has only occurred once - during the 2020 Black Swan event that caused a market-wide crash.

c). Maintenance of DAI's Peg

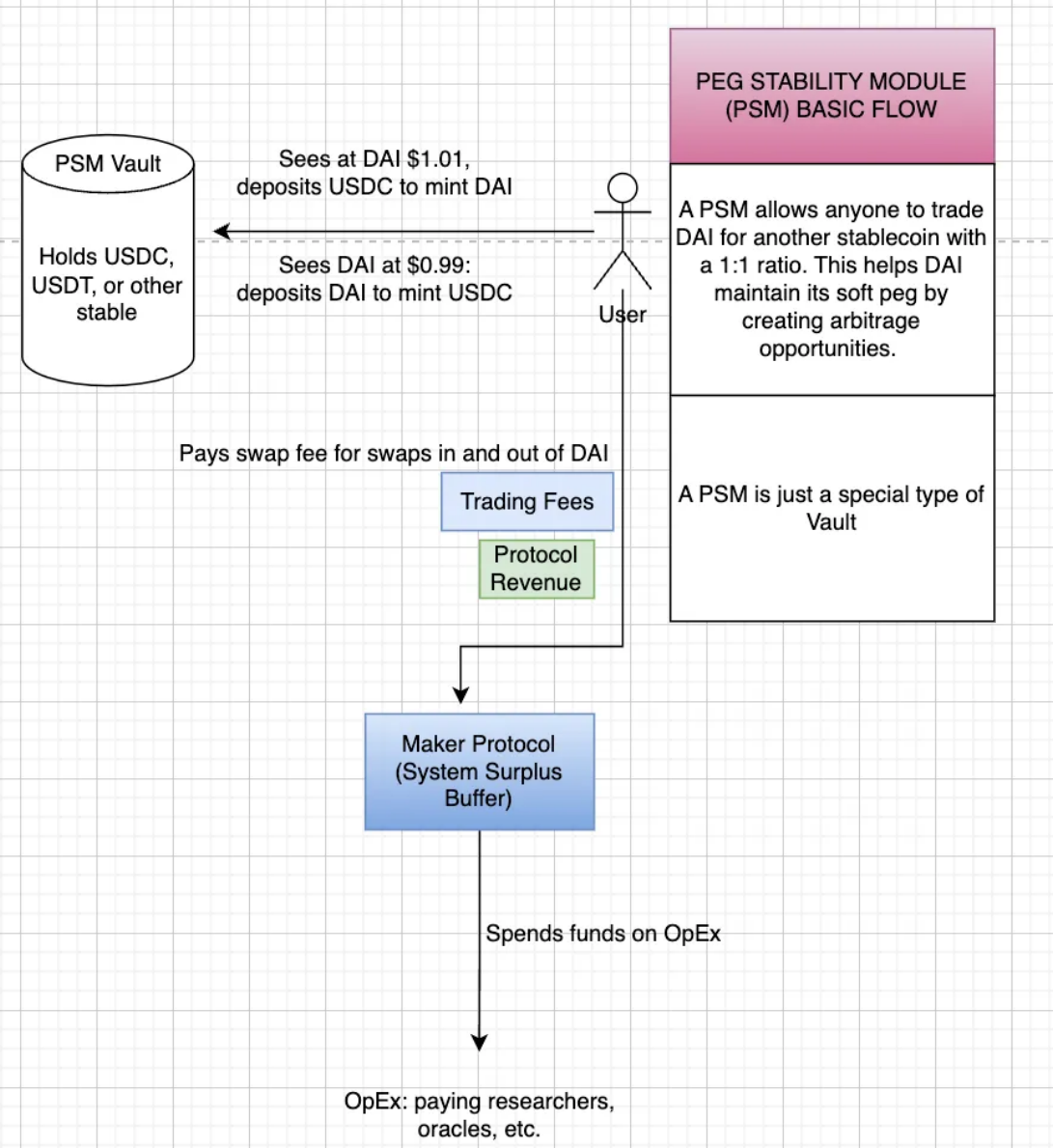

Guide to Peg Stabilization Module (PSM) Operations

Now, suppose Billy is not interested in collateralized debt and wants to engage in arbitrage - as DAI is a decentralized stablecoin, he wants to profit each time it is unpegged. How does Maker incentivize this behavior?

We now have the Peg Stabilization Module (PSM) - a special insurance pool that allows anyone to exchange DAI for another stablecoin at a 1:1 ratio.

If the price of DAI is $1.01, you can deposit 1 USDC to mint 1 DAI, thus profiting $0.01.

If the price of DAI is $0.99, you can deposit DAI to mint 1 USDC, also profiting $0.01.

Therefore, PSM allows arbitrageurs to maintain the price of DAI - without charging any exchange fees.

d). How Regular Users Utilize Maker

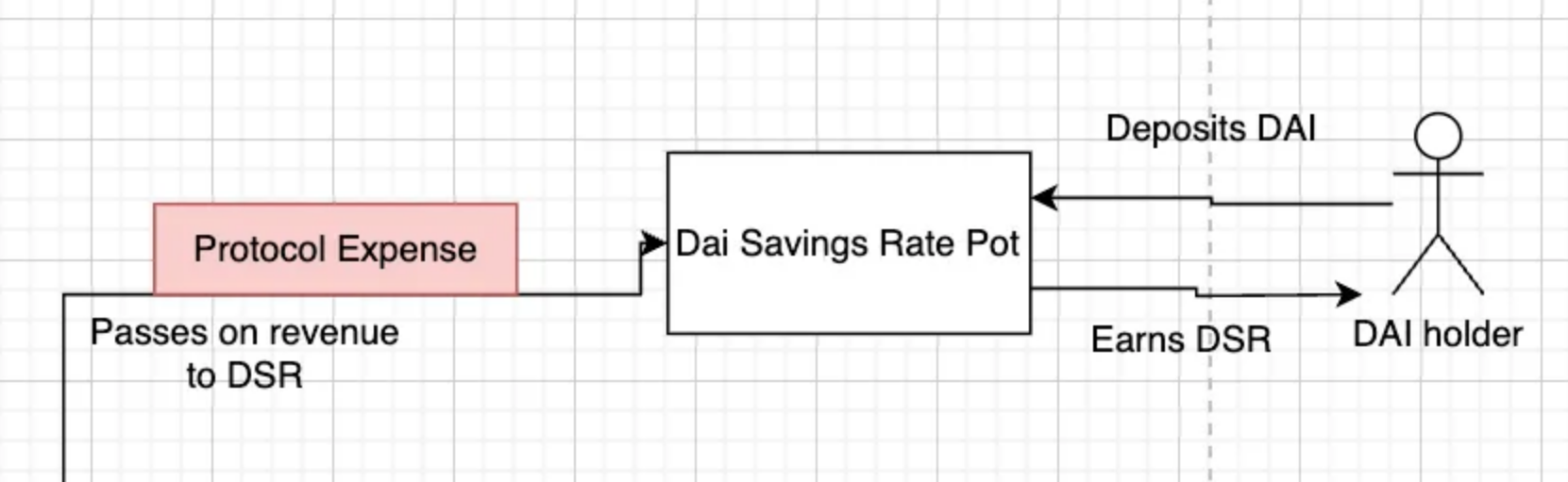

In the final scenario, Billy doesn't want anything complicated, he just wants to collect some earnings. Through the Dai Savings Rate (DSR) pool, Billy can deposit DAI and earn a competitive DAI interest rate. This income comes from multiple sources, with the primary source being the stability fees paid by borrowers on their collateral.

This is the operational guide on how Maker operates. Now that we have a better understanding of its operational highlights, we can delve deeper into its complexity.

3) Mechanisms of Maker

a. Collateral Deposits

Maker allows you to collateralize loans through two main methods:

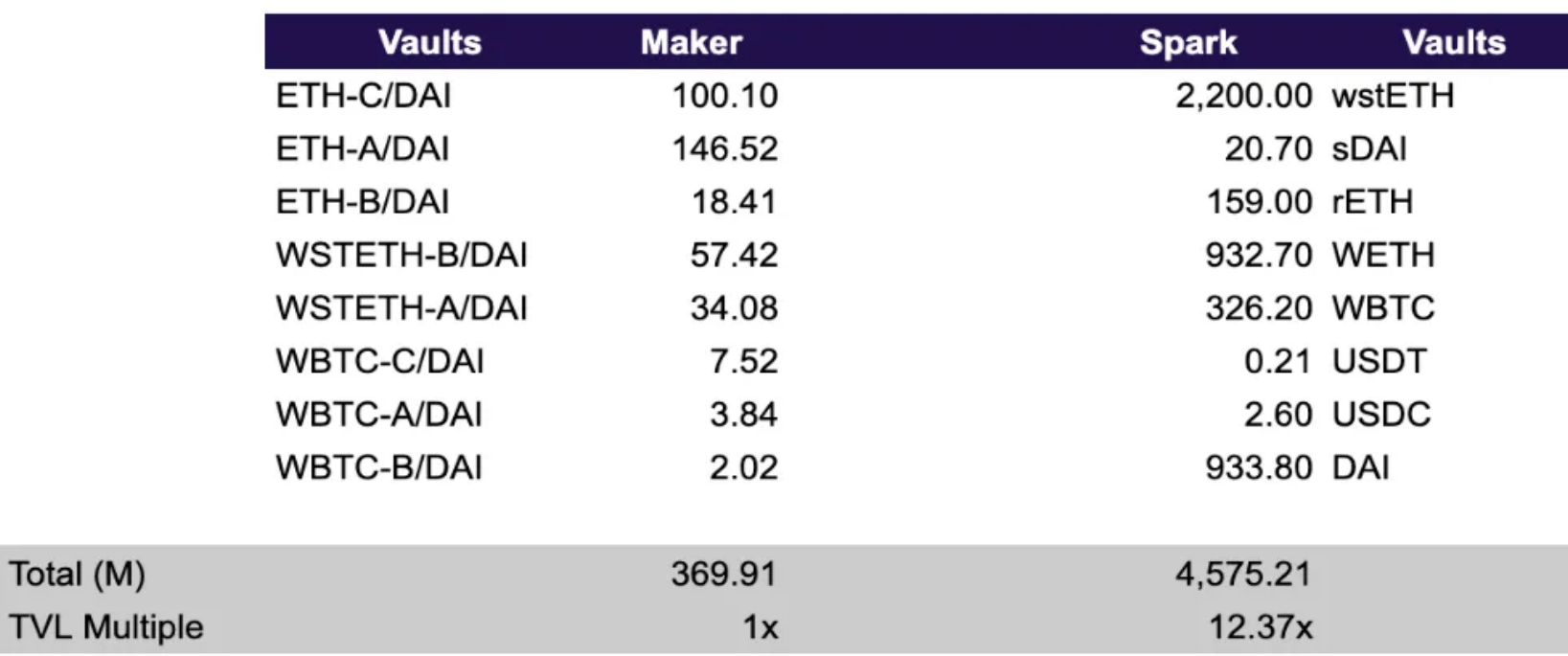

Spark: Maker's website redirects Billy to Spark.fi, which is a sub-DAO of Maker. The difference between Spark and MakerDAO's insurance pools is that Spark can offer loans for a wider range of assets, while MakerDAO's insurance pools are independent, each providing different liquidation ratios and debt ceilings.

sDAI: Spark also introduced sDAI, which is an interest-bearing version of DAI and implements advanced risk management features such as efficiency mode and isolation mode.

D3M: Spark connects to Maker through D3M - a direct liquidity pipeline. It facilitates interaction between the Maker ecosystem and third-party lending protocols.

MakerDAO Insurance Pools - accessible through Summer.fi, allow users to deposit collateral assets to mint new DAI. Therefore, MakerDAO insurance pools are more personalized in nature - for the same asset, there are different insurance pools based on the amount you want to borrow.

Comparison of TVL between insurance pools - Source: Artemis

You can see that the TVL in Maker's insurance pools is significantly lower than in Spark's. The differences between A/B/C insurance pools lie in their stability fees, liquidation ratios, and debt ceilings. One significant reason for this TVL difference may be that Maker has not actively promoted these insurance pools - as mentioned earlier, Maker's insurance pools are hosted on Summer.fi, while Maker's main website directly guides you to Spark.

b. Maker's Auctions

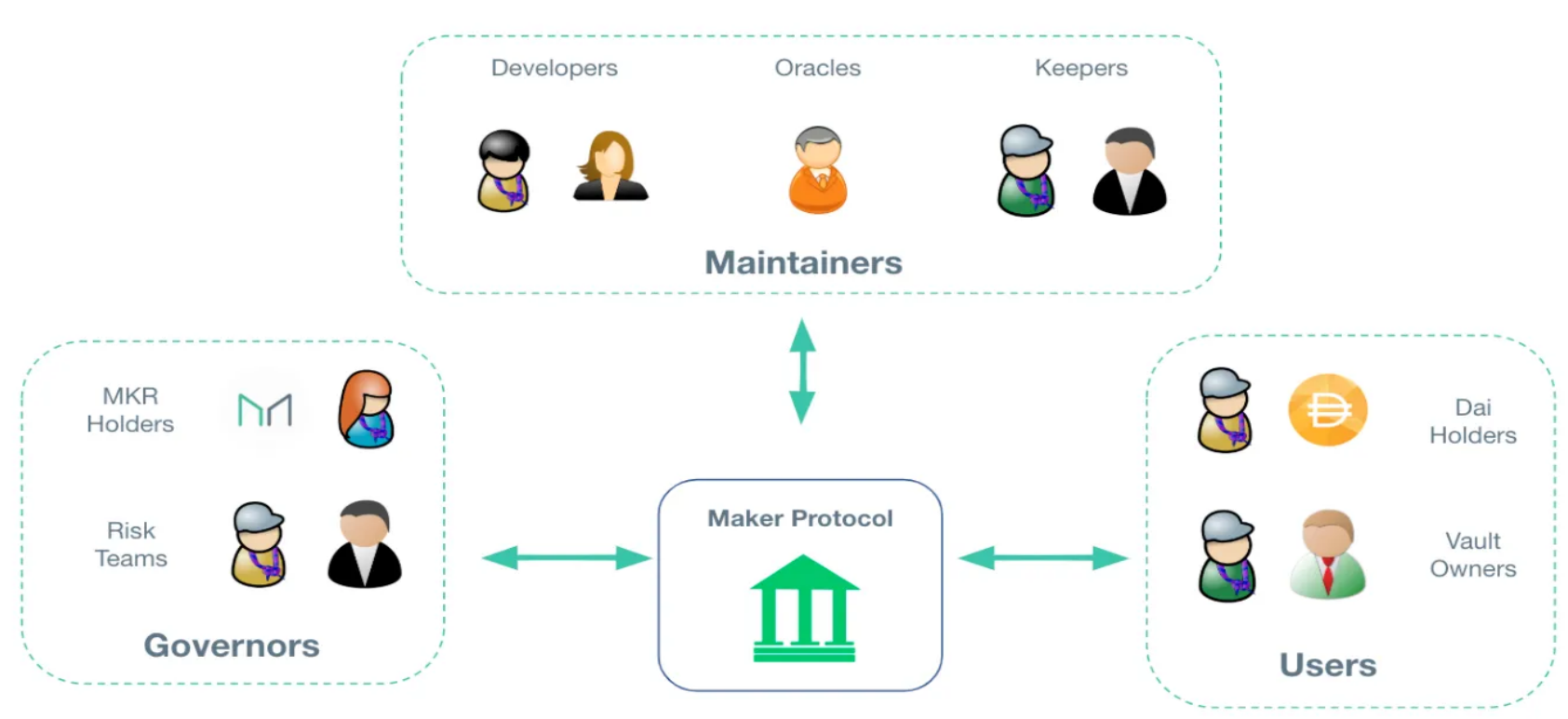

Maker has three main auctions: Surplus Auction, Collateral Auction, and Debt Auction. Market participants involved in these auctions are referred to as "keepers," and each auction serves a different purpose, detailed below:

Surplus Auction

When everything is functioning normally, stability fees are generated through interest paid by borrowers. This interest exists in the form of $DAI and is used to fill Maker protocol's system surplus buffer. The system surplus buffer is used to pay for Maker's operational expenses, such as oracles, researchers, etc. This system buffer can be adjusted through MakerDAO governance, and in a 2021 proposal, it was increased from $30 million to $60 million.

Therefore, the system prioritizes using income to fill the buffer, but once the buffer reaches its limit, the remaining DAI is auctioned to external participants in exchange for MKR. In this auction, bidders bid for a higher amount of MKR. Once the auction ends, the auctioned DAI is sent to the winning bidder, and the system will burn the MKR provided by the winning bidder.

Therefore, this system is called the surplus auction.

Collateral Auction

Collateral auctions are the first line of defense for liquidation. They are used as a means to recover debt in a liquidated insurance pool. There are specific risk parameters for each type of collateral, but the general mechanism is as follows:

When an insurance pool is liquidated, it triggers a collateral auction. Any user can initiate a "bite" transaction to liquidate an unsafe insurance pool by sending it to the insurance pool.

If the amount of collateral in the "bitten" insurance pool is less than the batch size of the auction, then all collateral in that insurance pool will be auctioned off.

If the amount of collateral in the "bitten" insurance pool is greater than the batch size of the auction, then an auction will be initiated for the entire batch of collateral, and the insurance pool can be "bitten" again to start another auction until all collateral in the insurance pool is bid on in the collateral auction.

An important aspect of collateral auctions is that the expiration time and bid expiration parameters depend on the specific type of collateral, with more liquid collateral types having shorter expiration times and vice versa.

At the end of the collateral auction, the winning bidder purchases the collateral from the liquidated insurance pool with DAI. The received DAI is used to repay the outstanding debt in the liquidated insurance pool.

Debt Auction

Finally, the debt auction is only triggered when there is Dai debt in the system that has exceeded a specified debt ceiling, and there is not enough funds in the surplus buffer to cover it.

Debt auctions are used to inject a fixed amount of Dai into the system by auctioning off MKR. This is a reverse auction, where keepers bid how much MKR they are willing to accept in exchange for a fixed amount of Dai.

As this situation is very rare, it has only occurred once in MakerDAO's history: during the Covid crisis in 2020. There, 40 separate batches of 50,000 DAI each were released, and bidders committed to purchase gradually decreasing amounts of MKR in exchange for their 50,000 DAI bid.

Once the auction ends, the Dai paid by the bidders in exchange for the newly minted MKR will reduce the original debt balance in the system, while increasing the circulating supply of Maker.

c. Peg Stabilization Module

Next, we have the Peg Stabilization Module (PSM). This is a key mechanism in the MakerDAO system designed to help maintain the peg of DAI to the US dollar. Due to its decentralized nature, DAI must have some safeguards to maintain its peg, and the PSM has some mechanisms to allow this:

Direct 1:1 Exchange: The Peg Stabilization Module allows users to exchange fiat-backed stablecoins (such as USDC, USDP) for DAI at a 1:1 ratio, with a small fee paid during the exchange process, and vice versa. This essentially aims to create arbitrage opportunities for DAI to maintain its peg and is subject to any fees set by the protocol.

If demand for DAI drives the price > $1, arbitrageurs can deposit 1 USDC into the PSM to mint 1 DAI and sell the DAI.

Conversely, if DAI is $1, arbitrageurs will buy DAI on the open market, deposit it into the PSM, and receive 1 USDC to profit. This will burn DAI (reduce supply) and push it towards $1.

Collateral Support: Users can choose to deposit USDC into the PSM instead of exchanging - in return, they will receive an equal amount of DAI supported by the deposited USDC at a 1:1 ratio.

In addition, Maker has two additional features that, while not core to maintaining the peg of DAI, still contribute to maintaining the price of DAI:

Note: The translation of the additional features was not provided in the original text. If you need the translation of the additional features, please let me know.

MakerDAO can adjust the stability fee through governance voting to maintain the peg of DAI.

If DAI > $1, increasing the stability fee would make borrowing against collateral in the insurance pool more expensive, which would suppress the creation of DAI and reduce supply.

If DAI = $1, lowering the stability fee would stimulate DAI demand by reducing the cost of creation, increasing supply, and pushing the price of DAI towards $1.

The Dai Savings Rate (DSR) is essentially the interest that Dai holders can earn by locking their Dai. While it provides an incentive for holding DAI on the surface, it also helps maintain the peg of Dai to the US dollar, as MKR token holders can adjust the DSR to help guide Dai towards the peg (but in the opposite direction of the stability fee).

The main sources of DSR income include stability fees, protocol revenue, protocol surplus, and general market dynamics. The DSR rate is set by MakerDAO governance as a tool to balance the supply and demand of DAI. When there is a need to increase DAI demand, the DSR may be raised, requiring more funds to support a higher rate. The DSR is not funded by external sources or traditional investment funds. As of July 2024, the DSR is at an annualized 8%.

d. Dai Savings Rate (DSR)

As mentioned above, the Dai Savings Rate (DSR) is a special module where DAI holders can deposit to earn returns on their DAI. Individuals holding Dai can lock and unlock their Dai into the DSR contract at any time. Once locked into the DSR contract, Dai will continuously increase based on a global system variable called the DSR.

Essentially, DSR depositors can earn a portion of the income generated by Maker. DSR income comes from the profits generated by MakerDAO, including stability fees paid by borrowers, liquidation fees, and the yield on T-bills in the Maker insurance pool, among other protocol revenues.

Currently, there is over $2 billion worth of DAI in the DSR, and its annual rate is at 7%.

e. MKR Token

Finally, Maker is governed by its token MKR. Holders of MKR can vote on critical parameters of the system. MakerDAO's governance is community-driven, with decisions made by MKR token holders through a scientific governance system. This includes executing votes and governance polls, allowing MKR holders to manage the protocol and ensure the stability, transparency, and efficiency of DAI.

By leveraging all the mechanisms described above, Maker provides a secure, decentralized, and stable financial system, allowing users to generate and use DAI without relying on traditional financial intermediaries. This approach embodies the core principles of crypto thinking, providing a decentralized alternative to traditional financial systems, enabling permissionless access to various financial services.

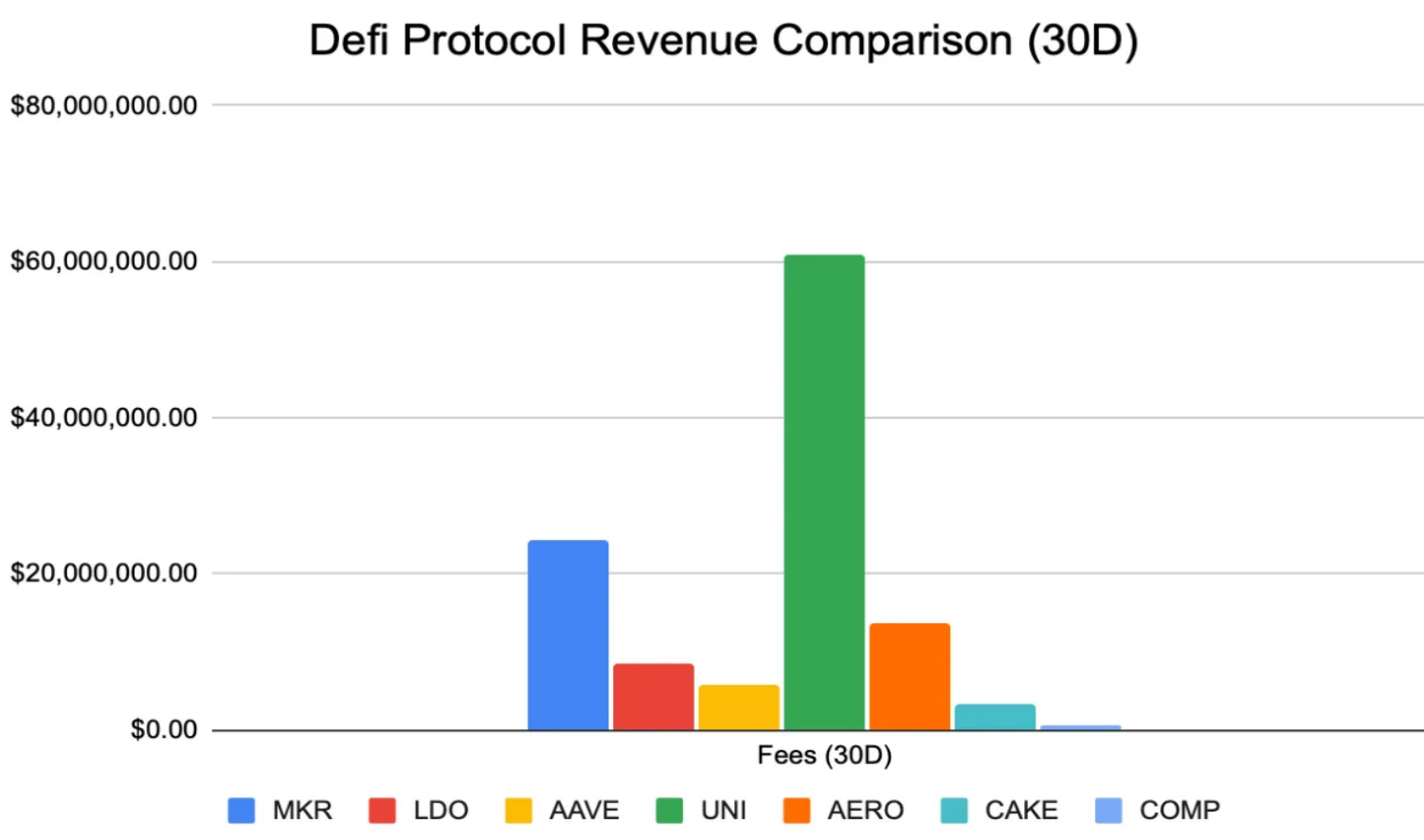

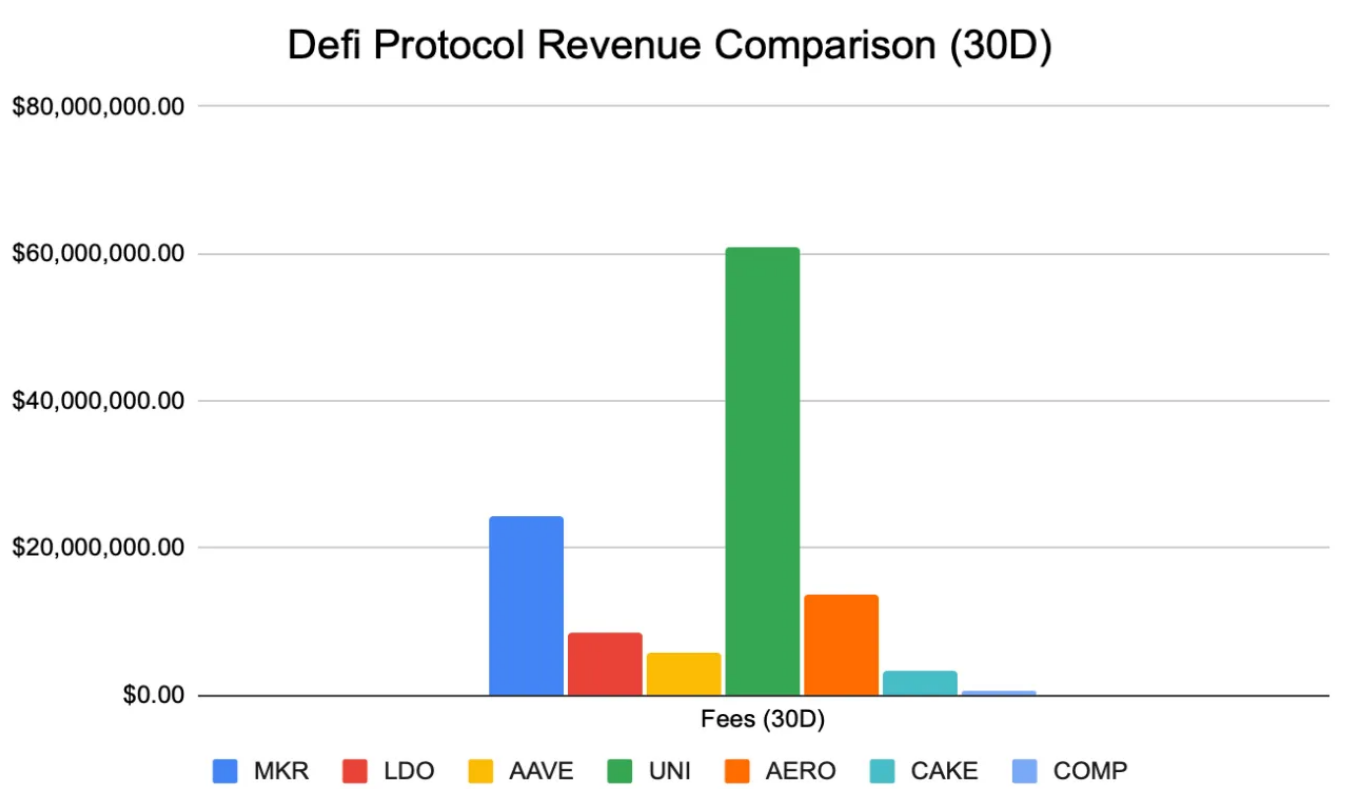

f. Maker's Revenue Sources

Now that we have introduced the various mechanisms of Maker, we can continue to discuss how they primarily generate revenue. Among all DeFi protocols, Maker generates the most income annually. In the charts below, we will compare the income of DeFi protocols to gain a more detailed understanding of the daily performance of the protocols.

It is worth noting that for Uniswap, the numbers provided are the fees they earn - as the generated income goes to liquidity providers, they do not actually earn any income. But for comparison purposes, we use fees as a proxy for income.

Source: Artemis

Among all DeFi protocols, Maker performs the best with a FDMC/fee ratio traded at 9.48 times. In other money markets (such as Aave and Compound), Maker has a significant lead, with the highest fee income among all DeFi protocols except for DEX.

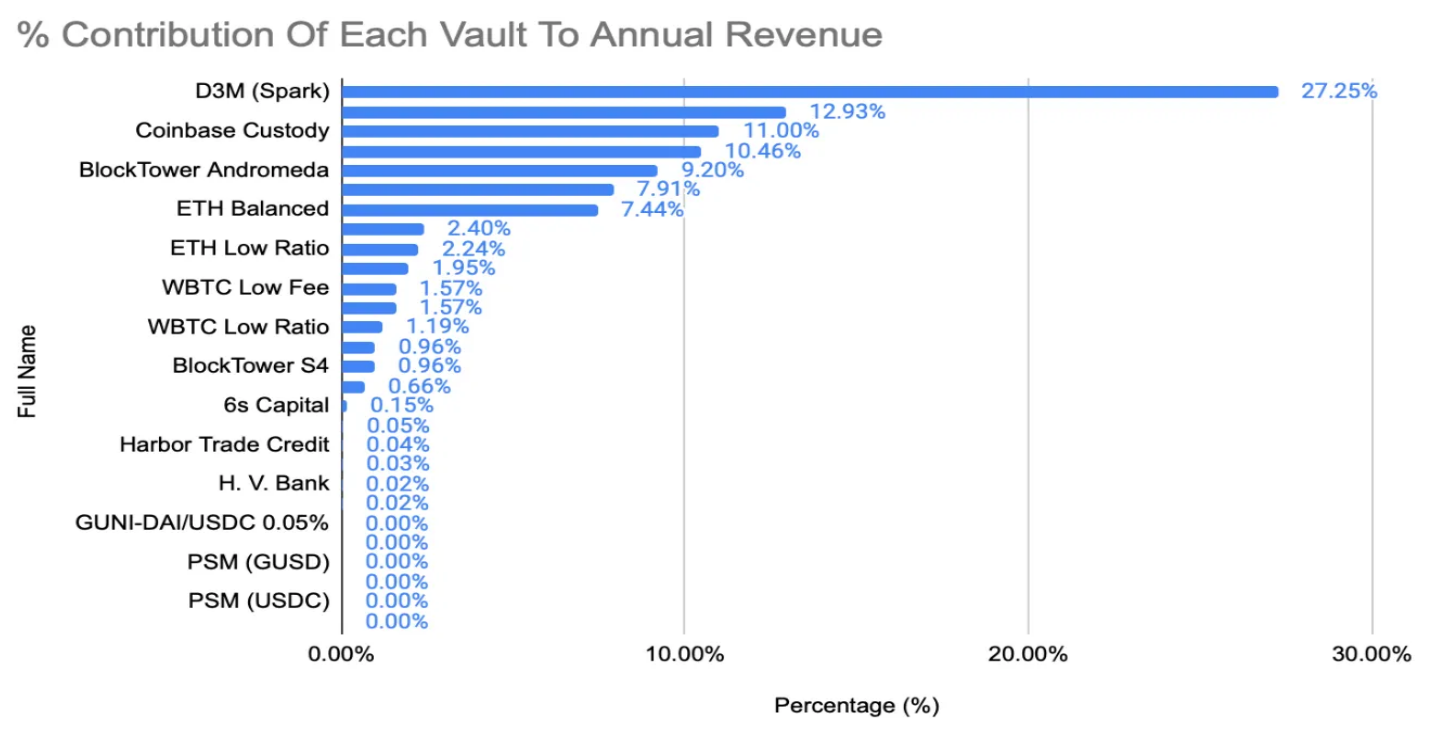

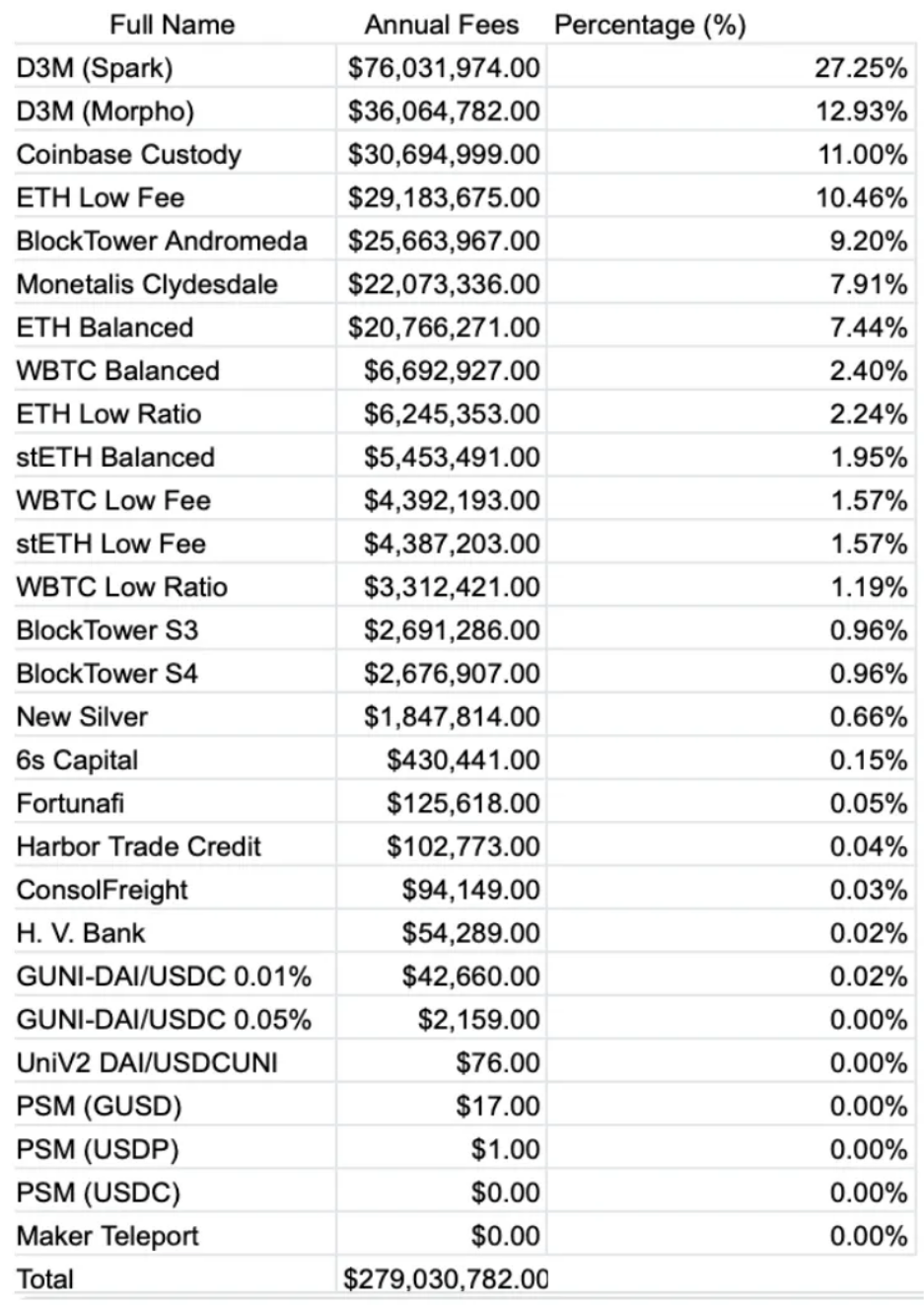

When examining its financials, Maker's annual income of a staggering $274 million makes it one of the top-performing De-Fi protocols. So, where does Maker's income come from?

3. Revenue Sources of Maker

1) Maker has three different sources of income

Interest payments, also known as stability fees: This is Maker's primary source of income. Users pay these fees when borrowing against collateral to obtain DAI. For example, the D3M (Spark) vaults generate over $84 million in income annually.

Real-world assets (RWA): This has become the primary source of income for Maker. Maker holds public credit vaults like Monetalis Clydesdale, a vault worth 1.11 billion DAI collateralized by U.S. short-term bonds.

As of 2023, nearly 80% of Maker's fee income comes from RWA in the past year. Over the past 12 months, this has brought in $13.5 million in income to the protocol's treasury.

In operation, users do not directly deposit RWA into Maker. Instead, vaults like Monetalis Clydesdale (as discussed in MIP65) obtain USDC through the Peg-Stability Module and invest it in liquid bonds.

Liquidation fees: Their third and final source of income comes from liquidation fees charged when collateral is liquidated due to undercollateralization. However, due to the rarity of such events, the income from liquidations is not substantial. It decreased from 28.8 million DAI in 2022 to only 4 million DAI in 2023.

Source: MakerBurn

2) Maker and RWA

Now, let's talk about why Maker became a topic of conversation in the third quarter of 2024. The most notable point about Maker is not their numbers, but it stems from a key moment in Maker's history, when in 2022, they strategically decided to expand into real-world assets.

This move marked a significant shift in the DeFi space, as it was the first time a DeFi protocol integrated real-world financial products on a large scale. Maker, through various initiatives such as:

Deploying $500 million of USDC into short-term bonds, ETFs, and treasuries (Monetalis Clydesdale, Blocktower Andromeda)

A vault of 100 million DAI has been launched to serve Huntingdon Valley Bank, a Pennsylvania financial institution established 151 years ago.

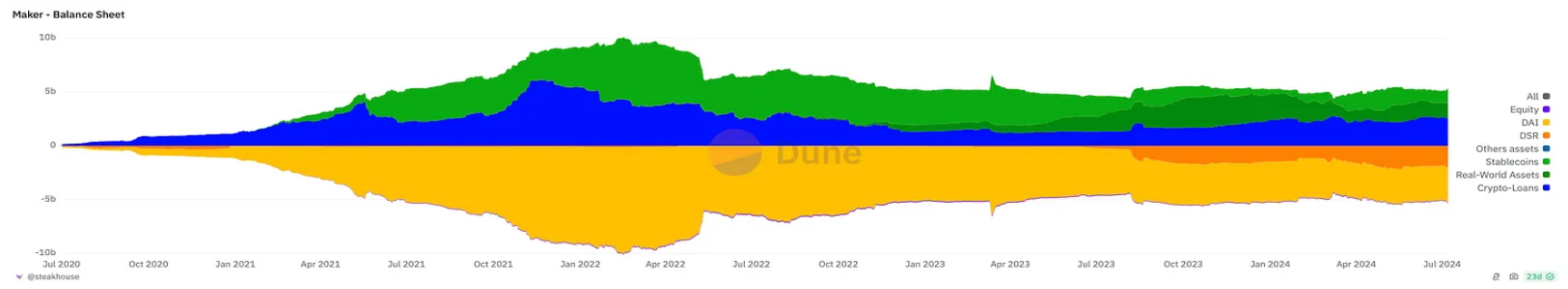

Source: Steakhouse Dune Dashboard

Today, real-world assets account for approximately 25% of Maker's balance sheet and DAI support. Maker's successful integration of real-world assets not only drives overall fees but also enables Maker to leverage more stable and diversified sources of income - crucial for maintaining Maker's moat and solidifying its position as a leading DeFi protocol in challenging market conditions.

This is an underrated perspective that must be articulated, as the crypto market is known to be highly cyclical and reflexive, both upwards and downwards. As the market matures, investors seek safer investments - Maker's foray into real-world assets creates a more stable and consistent source of income, independent of market fluctuations.

Maker now stands as a testament to the potential of DeFi and traditional finance integration and enhancement, setting new standards for innovation and real-world applications in the field. It represents a significant step in bridging decentralized finance and traditional financial products, positioning Maker at the forefront of DeFi innovation to meet the trend of institutional demand for digital assets.

1) Prosperity of RWA in 2024

Now that we have discussed Maker's shift towards RWA, we can explain why RWA is important. 2024 is a year of maturity for the crypto asset market; with the launch of Bitcoin ETFs, we have seen over $14 billion in net inflows into Bitcoin. This surge of institutional participation is not limited to Bitcoin ETFs, as major banks and financial institutions are increasingly embracing crypto assets:

Standard Chartered and Nomura Securities have established digital asset custody solutions through their internal technology, Zodia Custody and Laser Digital.

Citibank, JPMorgan, and BNY Mellon have partnered with crypto companies like Metaco, NYDIG, and Fireblocks to offer cryptocurrency custody services.

Visa and Mastercard have expanded their crypto card programs, partnering with major trading platforms to offer crypto-related cards to retail and institutional customers.

It is evident that the largest institutional players believe in digital assets, not just Bitcoin. Major asset management firms have long talked about tokenization, and the world's largest asset management firm, BlackRock, is currently attempting tokenization:

BlackRock Institutional Digital Dollar Liquidity Fund: Launched in March 2024, the fund is represented by BUIDLToken on the Ethereum network. The fund is fully backed by cash, U.S. Treasury bonds, and repurchase agreements, paying daily returns to token holders through the blockchain network.

$100 trillion Tokenization Vision: BlackRock is undergoing digital transformation in the financial sector, aiming to tokenize various assets such as bonds, stocks, real estate, and cultural assets.

This has sparked a competition among the largest financial institutions to tokenize all assets:

JPMorgan: Introducing programmable payment capabilities through its blockchain platform Onyx, enabling institutional clients to benefit from real-time, programmable financial functions.

HSBC: Launching a blockchain-based platform called Digital Vault, providing custody clients with instant access to their private assets (debts, equities, and real estate).

Goldman Sachs investing in and supporting the USDC stablecoin issued by Circle, allowing large-scale global fund transfers without volatility risk, and exploring the tokenization of physical assets as a new financial instrument.

Clearly, the next decade will be characterized by institutional adoption of cryptocurrencies and tokenization, positioning Maker at a crucial moment in this evolving field. Maker has established a strong presence in RWATokenization and DeFi, while also targeting institutions. In fact, just a few days ago, Maker announced a public competition to invest $1 billion in the tokenization of U.S. Treasury bonds, with top issuers such as BlackRock planning to apply with Securitize, Ondo Finance, and Superstate.

At the end of 2023, real-world assets accounted for 46% of total assets on Maker's balance sheet. Source: Steakhouse Finance

We believe that the proportion of real-world assets in Maker's balance sheet will continue to grow. Therefore, as one of the largest DeFi protocols, Maker's extensive integration with real-world assets places it in a strategic position. Coupled with the potential launch of an Ethereum ETF in the third/fourth quarter of 2024, this provides greater momentum for Maker's long-term bullish case. As Ethereum continues to be a pillar of DeFi, Maker's significant position in this ecosystem further solidifies its role in facilitating institutional adoption.

2) Stability and Resilience of Maker

As major financial institutions increasingly embrace cryptocurrencies and blockchain technology, they are also turning their attention to "mature" brands in this field. In an industry dominated by hackers and pump-and-dump manipulation, protocols like Maker, which have stood the test of time, carry greater legitimacy and traditionalism in leading the upcoming wave of institutional interest.

Furthermore, Maker has demonstrated the ability to handle large-scale financial operations and has shown significant stability and resilience in market downturns - they have proven their ability to adapt to changing market conditions: mitigating the risk of decentralized stablecoins through a diversified collateral pool, building adaptive mechanisms like the Peg Stability Module, and a flexible governance mechanism allowing dynamic adjustments when needed.

This anti-fragility gives Maker the necessary legitimacy, and now, with institutional-grade infrastructure and risk management protocols, it positions Maker as the dominant platform for institutional participation.

3) Ultimate Goal

Maker is positioned as one of the leading decentralized banks, poised to become one of the largest financial institutions globally. With DAI being the most widely used decentralized stablecoin, able to provide cheaper credit than its structural competitors, coupled with its strategic position as a leader in the field, Maker's case has been proven.

However, perhaps the biggest catalyst has yet to be explained - the upcoming "Ultimate Goal" release by Maker will transform it into a more scalable modular protocol ecosystem, potentially making it one of the most important stories in the upcoming crypto cycle. This upgrade is massive and is divided into four main stages:

Phase One: Season Launch - New Tokens and Infrastructure

New Tokens: Introduction of "NewStable" and "NewGovToken" (placeholder names) as optional upgrades to DAI and MKR.

Lockstake Engine (LSE): A new feature allowing NewGovToken and MKR holders to earn returns on locked tokens.

NewBridge: Low-cost bridge connecting Maker ecosystem tokens from Ethereum to major Layer 2 networks.

Tokenomics Update: Modifications to the MKR burn mechanism and new token distribution methods.

Phase Two: New Horizons - Expansion of Maker's Ecosystem

Launch of new sub-DAOs: Creating self-sustaining, specialized DAOs within the Maker ecosystem, starting with SparkDAO.

Phase Three: Launch of a dedicated Layer 1 blockchain to host core tokenomics and governance mechanisms

Phase Four: Core governance aspects of Maker and sub-DAO ecosystems will become final and immutable

Through this plan, Maker's goal is to expand DAI from the current $45 billion market cap to "100 billion or more." To a large extent, we will not focus on many of these initiatives, as we believe the primary initiative driving growth is the addition of SubDAOs.

4) SubDAO

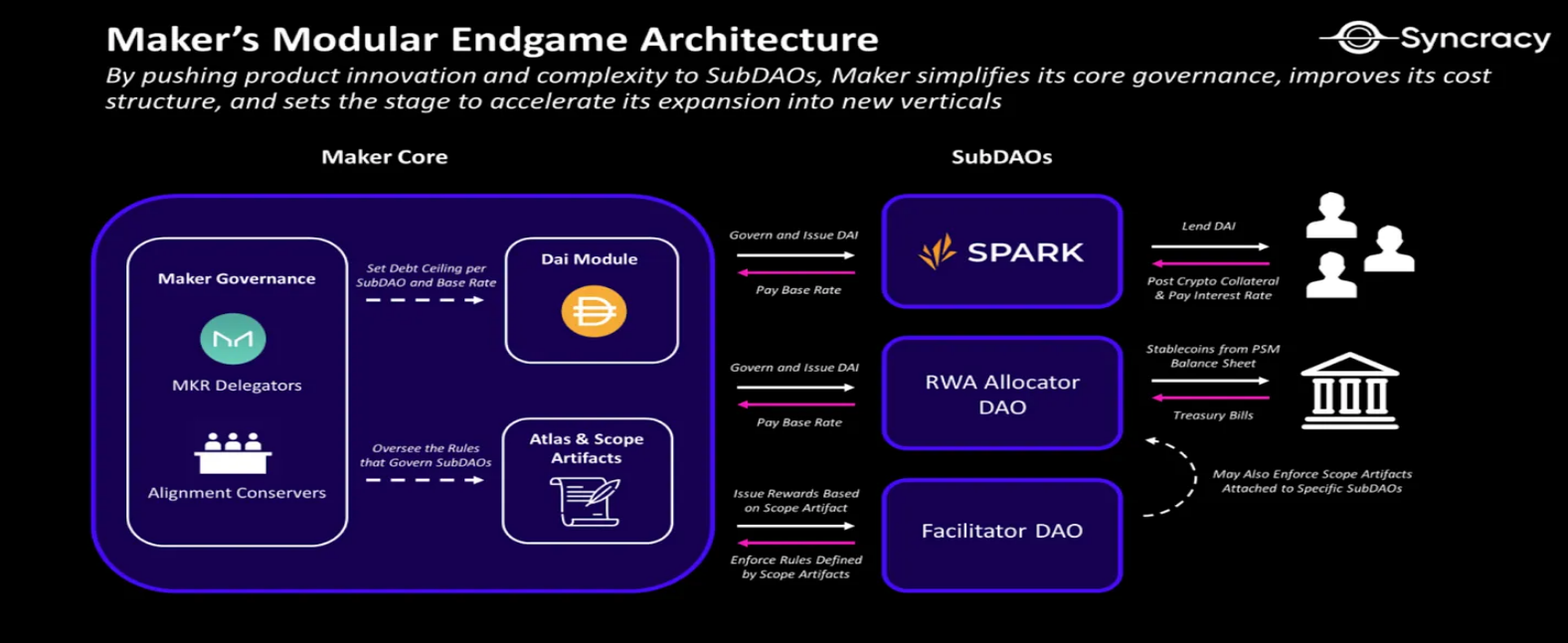

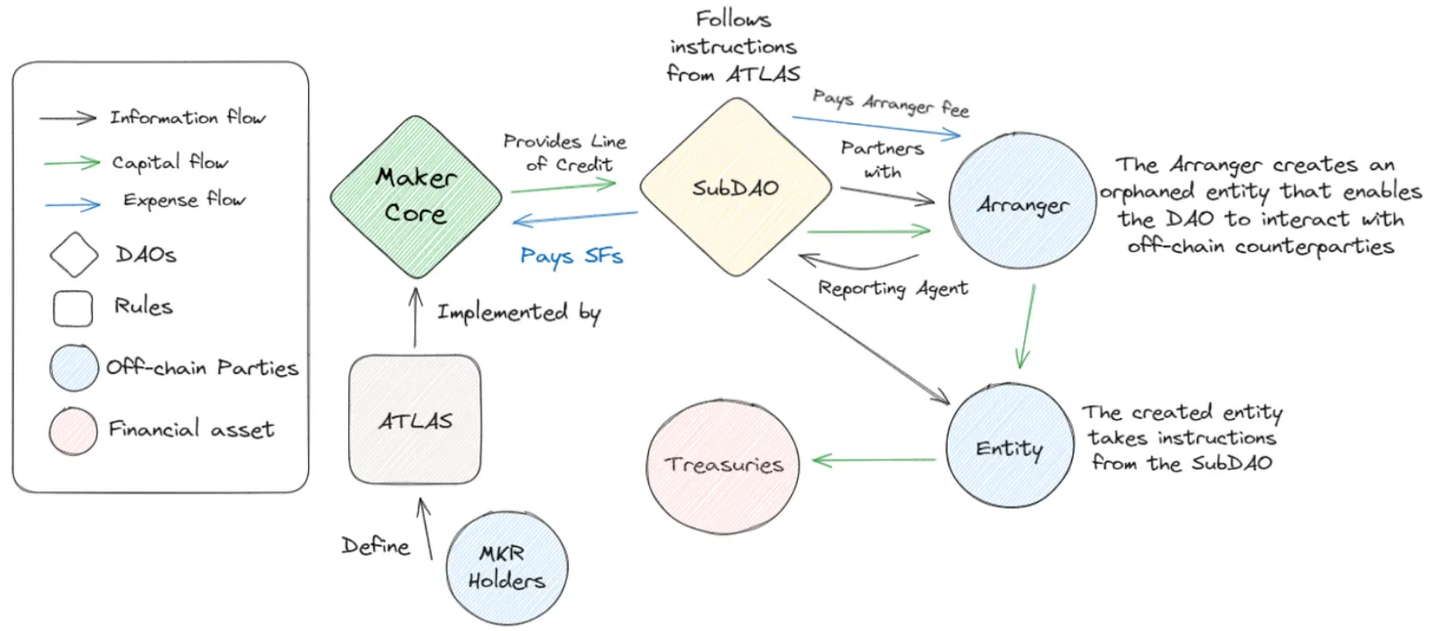

The Ultimate Goal plan represents a comprehensive reorganization of the Maker ecosystem, transforming it into a network of interconnected modular protocols. At its core, this vision introduces SubDAOs. As their name implies, they are projects operating outside of Maker's cost structure, ultimately managed by MakerDAO.

This new architectural approach aims to streamline MakerDAO's operations and enhance its scalability. SubDAOs will be able to rapidly develop and launch new products in parallel, while the Maker core can focus on becoming an efficient Dai minting engine.

The expected outcomes of this reorganization include:

Accelerated ecosystem growth;

Enhanced process automation;

Greater decentralization;

Significant reduction in operational costs.

Source: Syncracy Research

SubDAOs each have unique governance tokens, governance processes, and staff. SubDAOs are divided into three types:

FacilitatorDAOs

They have a managerial nature, used to organize the internal mechanisms of MakerDAO, AllocatorDAOs, and MiniDAOs. FacilitatorDAOs help manage governance processes and execute decisions and rules.

AllocatorDAOs

AllocatorDAOs have three main functions:

Generate Dai from Maker and allocate it to profitable opportunities within the DeFi ecosystem

Serve as an entry point for the Maker ecosystem

Incubate MiniDAOs

MiniDAOs are experimental SubDAOs with no specific mission other than driving growth of the Maker protocol. They are incubated by AllocatorDAOs to further decentralize, promote, or solidify specific ideas or products. Essentially, they act as experimental derivatives with potentially shorter lifespans.

Therefore, SubDAOs are revolutionary for MakerDAO and the broader decentralized finance (DeFi) ecosystem, as they represent a paradigm shift in how large-scale decentralized protocols evolve, innovate, and manage risk.

For example, the chart below provides a simplified illustration of how MakerDAO operates after the Ultimate Goal:

Source: Steakhouse Finance

By introducing a multi-tiered governance structure, SubDAOs enable MakerDAO to experiment and grow rapidly in specialized areas while maintaining core stability.

This approach addresses several key challenges faced by mature DeFi protocols, including governance fatigue, innovation stagnation, and risk concentration. SubDAOs allow decentralized decision-making, empowering small, focused groups to drive innovation in specific areas without jeopardizing the entire ecosystem.

This structure not only enhances the protocol's ability to adapt to changing market conditions but also creates new opportunities for community participation and value creation. Additionally, the SubDAO model extends MakerDAO's influence beyond the traditional boundaries of DeFi, potentially fostering real-world economic impact through localized initiatives and targeted capital allocation. Currently, in addition to existing SubDAOs like Spark (Maker's first SubDAO), a new bridge is planned for transferring DAI between Ethereum Layer 2 networks; while they have not made revolutionary moves (their main product is a borrowing engine), they have demonstrated the effectiveness of SubDAOs. Spark will also have the ability to deploy capital into real-world assets, once again showcasing the incredible flexibility SubDAOs provide to what was originally a single protocol.

By providing a more flexible and scalable governance framework, SubDAOs pave the way for MakerDAO to evolve from a single-purpose stablecoin issuer into a diverse, self-sustaining ecosystem of interconnected financial services and products. This revolutionary approach may set new standards for decentralized organizations in managing growth, innovation, and risk in the ever-evolving blockchain finance space.

5. Conclusion and Reflection

Maker is at the forefront of bringing cryptocurrencies into the traditional world, and seeing this effort to expand its potential to a larger scale is extremely exciting. With the launch of Endgame, it sets an example for the entire cryptocurrency field, and other DAOs are likely to follow suit, as DAOs often suffer from bureaucratic paralysis when there is a voting deadlock.

Furthermore, Maker is at the perfect intersection of RWA and Ethereum DeFi, and with the boost from an Ethereum ETF, Maker is likely to lead the wave of Defi 1.0 asset recovery. Names like Aave and Uniswap bring to mind some "old" protocols that have proven to be resilient under pressure after multiple cycles, while others have even established product-market fit and built sustainable revenue models.

The success of Maker will largely depend on its ability to launch Endgame, while carefully navigating the growing political uncertainty surrounding crypto assets. However, with the increasing interest from institutions in crypto assets, and the potential launch of a Bitcoin (and possibly Ethereum) ETF this year, Maker's future prospects are brighter than ever.

Maker's Endgame plan represents a bold and ambitious vision for the protocol's future, as the world moves towards a cryptocurrency-centric future, Maker stands at the forefront of the industry, poised to help bridge the gap between decentralized assets and the centralized world.

Original article link: https://www.hellobtc.com/kp/du/08/5368.html

Source: https://research.artemis.xyz/p/maker-a-deep-dive-into-the-worlds

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。