On the afternoon of August 19th, AICoin researchers conducted a live graphic and text sharing session titled "Newbies, Come Quickly - High Winning Rate TD Strategy (Free Membership)" in the AICoin PC-end Group Chat Live. Below is a summary of the live content.

I. Basic Concepts and Meanings of the TD Strategy

TD, also known as the DeMark sequence, is a technical indicator mainly used to identify potential opportunities for price trend reversals. This indicator is suitable for novice traders to build their own trading systems, especially known as the "Magical Nine Reversals" among Chinese investors.

Open the indicator library and search for "TD":

Working Principle of TD:

This indicator helps traders judge potential highs and lows in the market through a specific counting method, enabling them to make buying or selling decisions. Specifically, the indicator uses a series of numerical labels (from 1 to 9 and 13) to mark various points on the price trend chart, identifying potential trend reversals.

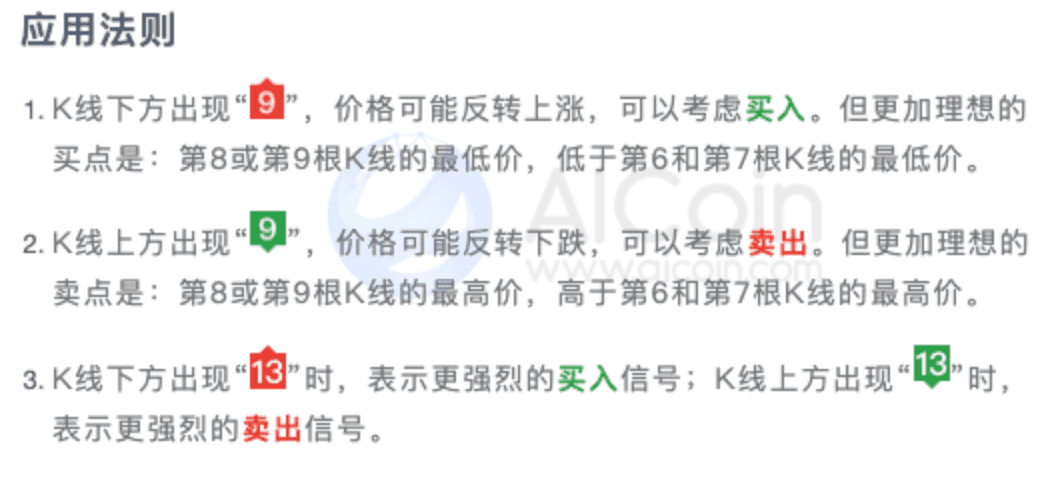

II. Application of TD

Conditions for forming a buy TD:

(1) The closing price of one candlestick is lower than the closing price of the previous 4 candlesticks, triggering a buy structure and starting the count.

(2) When 9 consecutive candlesticks appear, with their closing prices all lower than the closing prices of their respective previous 4 candlesticks, a TD buy structure is formed. (During the process, if any candlestick does not meet the conditions, the count needs to be restarted.)

Conditions for forming a sell TD:

Have you seen the numbers 9 and 13 on your candlestick chart?

When the closing price of one candlestick is higher than the closing price of the previous 4 candlesticks, triggering a sell structure and starting the TD count; when 9 consecutive candlesticks appear, with their closing prices all higher than the closing prices of their respective previous 4 candlesticks, a TD sell structure is formed. In simple terms, if a 9 appears, it may indicate a market top or bottom, and if it's a 13, the market's turning point is more obvious.

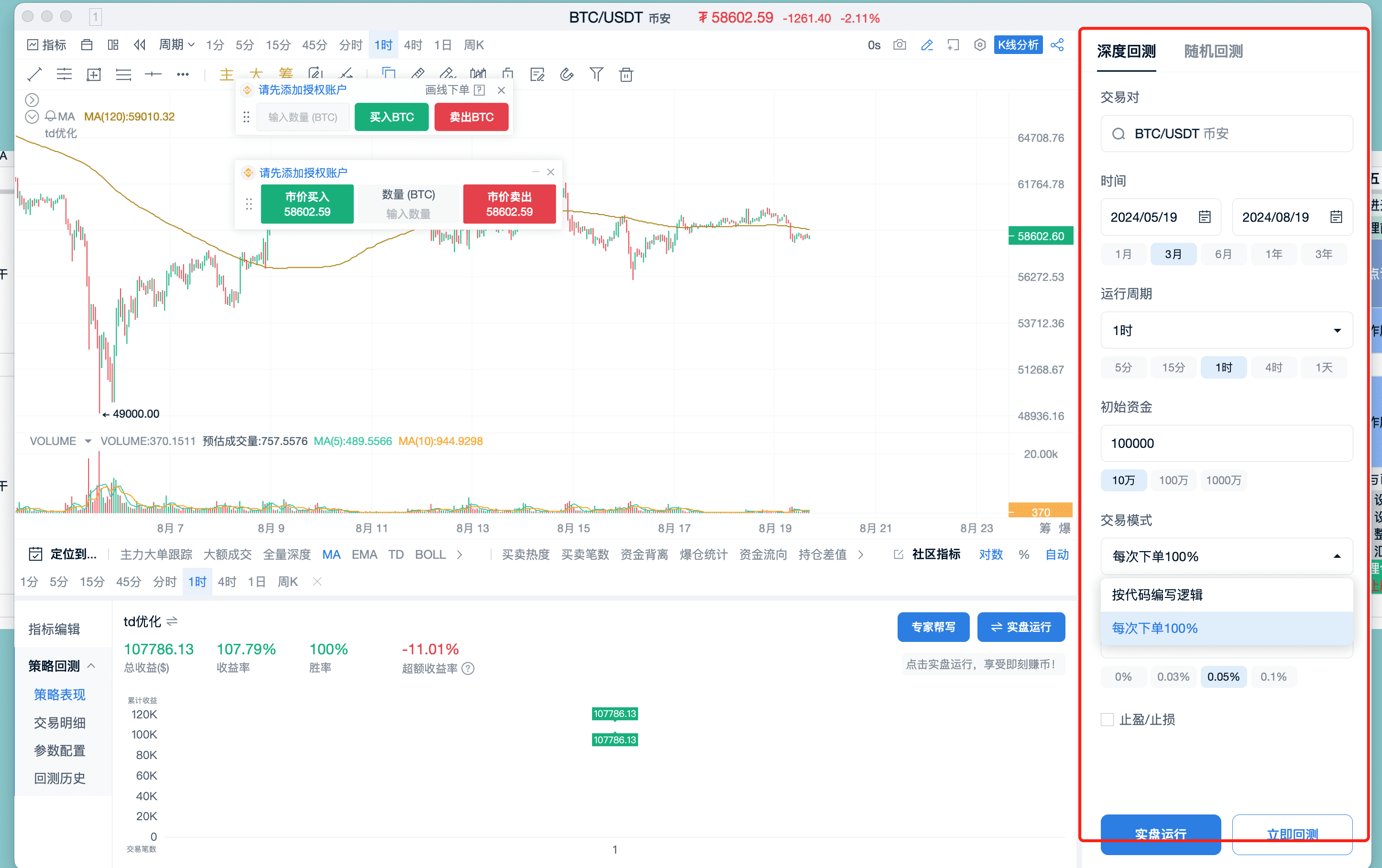

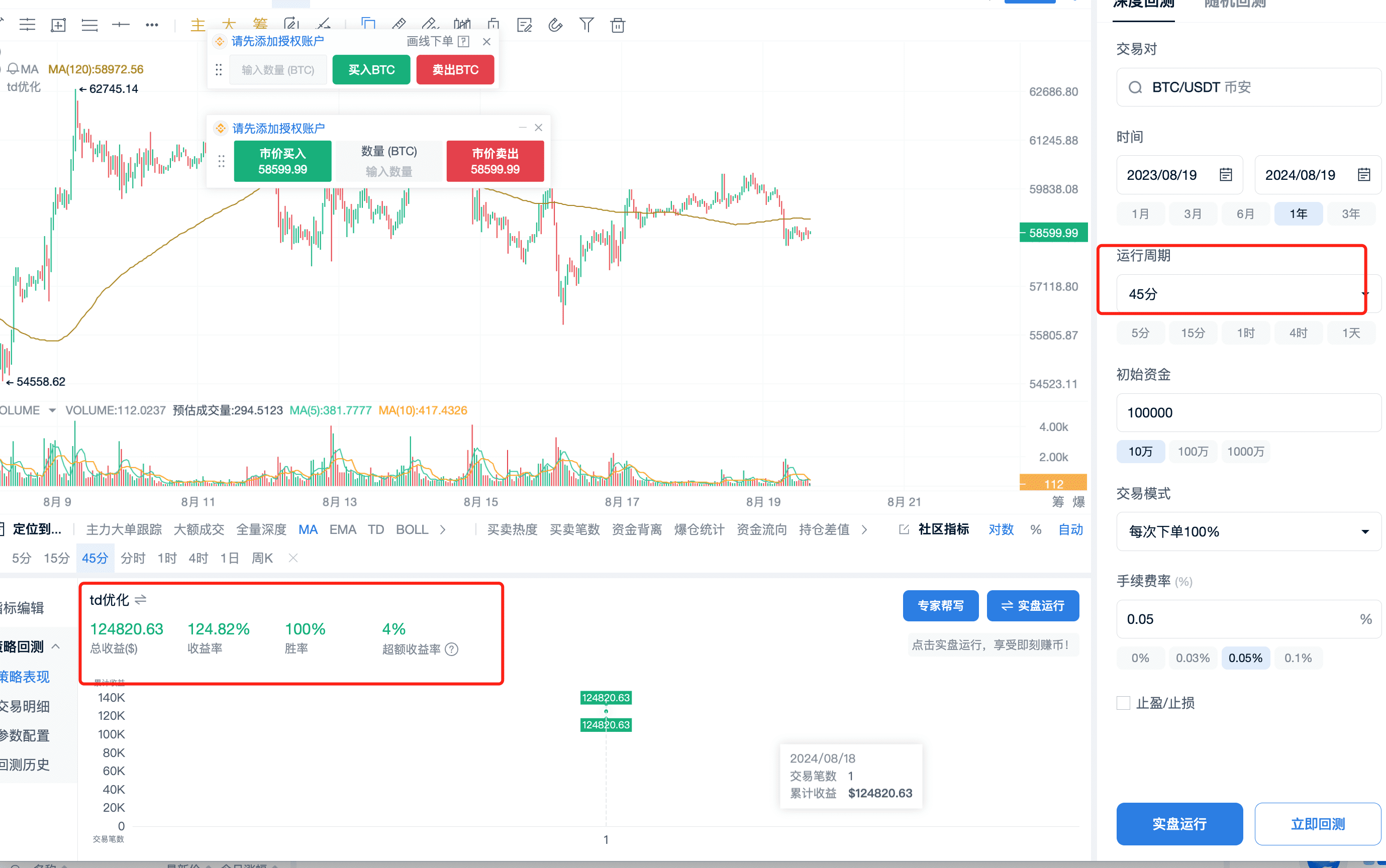

Based on my backtesting across multiple periods, the success rate reached 100% for the 45-minute period.

Although AICoin's 45-minute period requires membership, I am not emphasizing the profitability of the membership period here. In live trading, a membership is not required for the 45-minute period.

The maximum count is generally 9, but a 13 may also appear, which represents a reinforced buy/sell structure. This sentence is the core of TD.

The market is formed by the joint action of buyers and sellers. When the buying force is greater than the selling force, the price shows an upward trend; when the selling force is greater than the buying force, the price shows a downward trend. After a period of upward (downward) trend, the previously dominant party gradually weakens, leading to a reversal to a downward (upward) trend. The TD indicator is designed to discover trend reversal areas.

Buy signals: Appearance of buy structure TD-9, buy structure TD-13 (red TD9, red TD13);

Sell signals: Appearance of sell structure TD-9, sell structure TD-13 (green TD9, green TD13);

In simple terms, TD9 can be used to enter the market at the bottom, and if it reaches TD13, you can continue to enter to lower the cost.

III. Advanced Backtesting Function

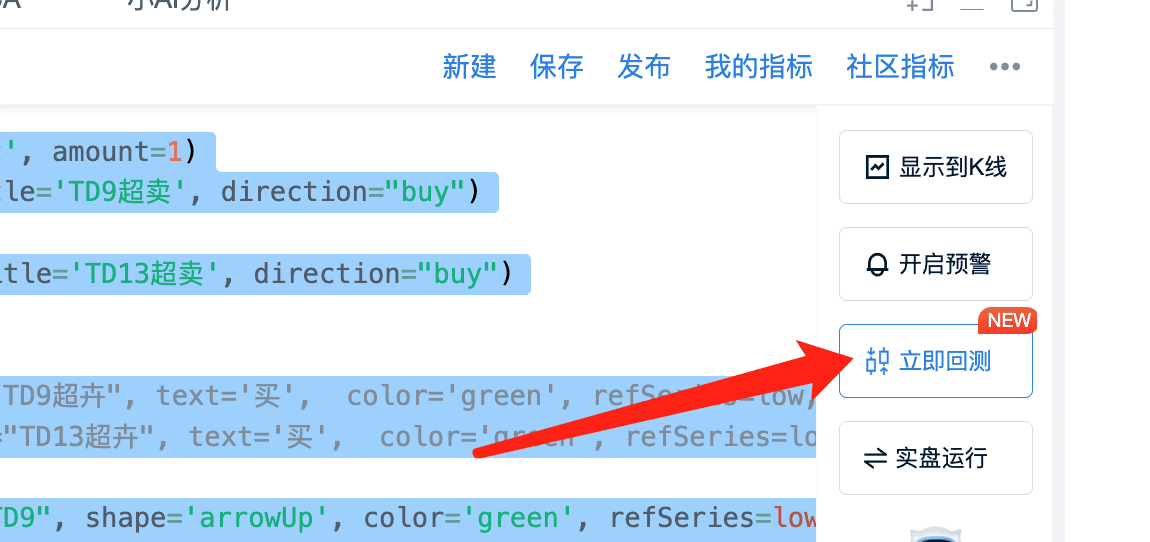

If you want to know which period is most suitable for TD, you can write a custom TD indicator for backtesting. Green high TD 9 and TD 13 can be used for selling. The TD indicator is designed to discover trend reversal areas.

To find out which period is the most profitable, it's not based on the director's words, but on data. Let's use deep backtesting together.

// Code example

// @version=2

// Calculate the value of TD

[td]=td(close)

buy = td == -9 || td == -13

// TD9 in a downtrend

enterLong(buy, price='market', amount=1)

alertcondition(td == -9, title='Oversold TD9', direction="buy")

alertcondition(td == -13, title='Oversold TD13', direction="buy")

// Plot on the chart

//plotText(td == -9, title="Oversold TD9", text='Buy', color='green', refSeries=low, placement='bottom')

//plotText(td == -13, title="Oversold TD13", text='Buy', color='green', refSeries=low, placement='bottom')

// Sample code

plotShape(td == -9, title="TD9", shape='arrowUp', color='green', refSeries=low, placement='bottom', fill=true)

plotShape(td == -13, title="TD13", shape='arrowUp', color='green', refSeries=low, placement='bottom', fill=true)

Create a custom indicator, copy the above code

Save, click Backtest Now

Backtesting can be done according to "Code Writing Logic" or "100% Order Placement Each Time"

After the backtesting results appear, click Professional Backtest

Indicator library:

This is the pop-up window for professional backtesting, where you can switch trading pairs, time, periods, funds, and trading modes. If you are given an indicator, you can use professional backtesting data to see which period and which currency is most profitable.

You can see the performance of the 45-minute period:

Try using several indicators to find out. The 45-minute period performs well in many indicators, so many traders will use it for monitoring and trading. From the backtesting data, it can also be seen that the 45-minute period is better than the 90-minute period.

Precautions and Main Advantages of Using the TD Indicator:

In most cases, the TD indicator performs better in markets with clear trends. In a volatile market environment, the TD indicator may generate too many signals, increasing trading costs and risks.

The main advantage of the TD indicator is its ability to effectively identify price reversal points, which is helpful for capturing market reversals.

IV. Advanced Usage: TD + MA120

During the live session, a student raised a very valuable question: Sometimes TD only reaches 9, and sometimes it continues to 13. So, should we use 9 as a trading point, or do we have to wait for 13?

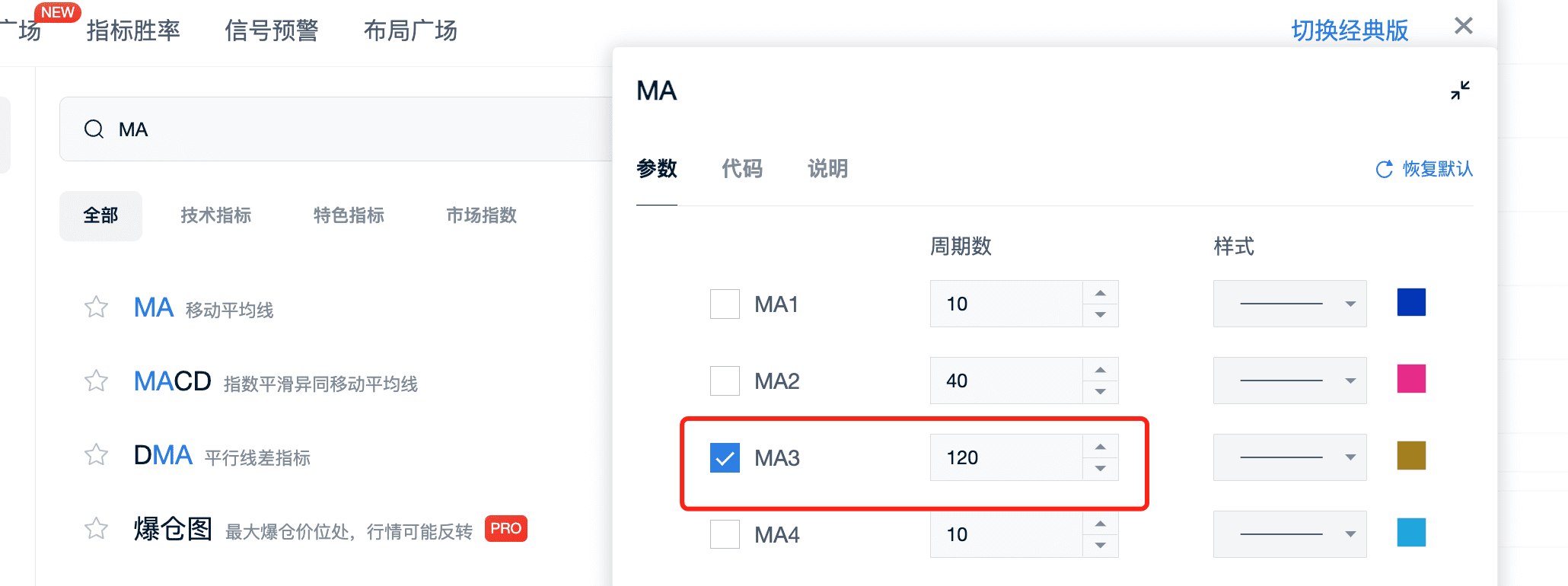

This depends on the situation. The simplest way is to find a supplementary indicator: TD + a moving average, with the moving average parameter set to MA120.

The 120-day moving average (Simple Moving Average, SMA) refers to the average of the closing prices of the previous 120 trading days, calculating a smooth price curve. It is one of the commonly used trend-tracking indicators in technical analysis, especially suitable for medium to long-term investors.

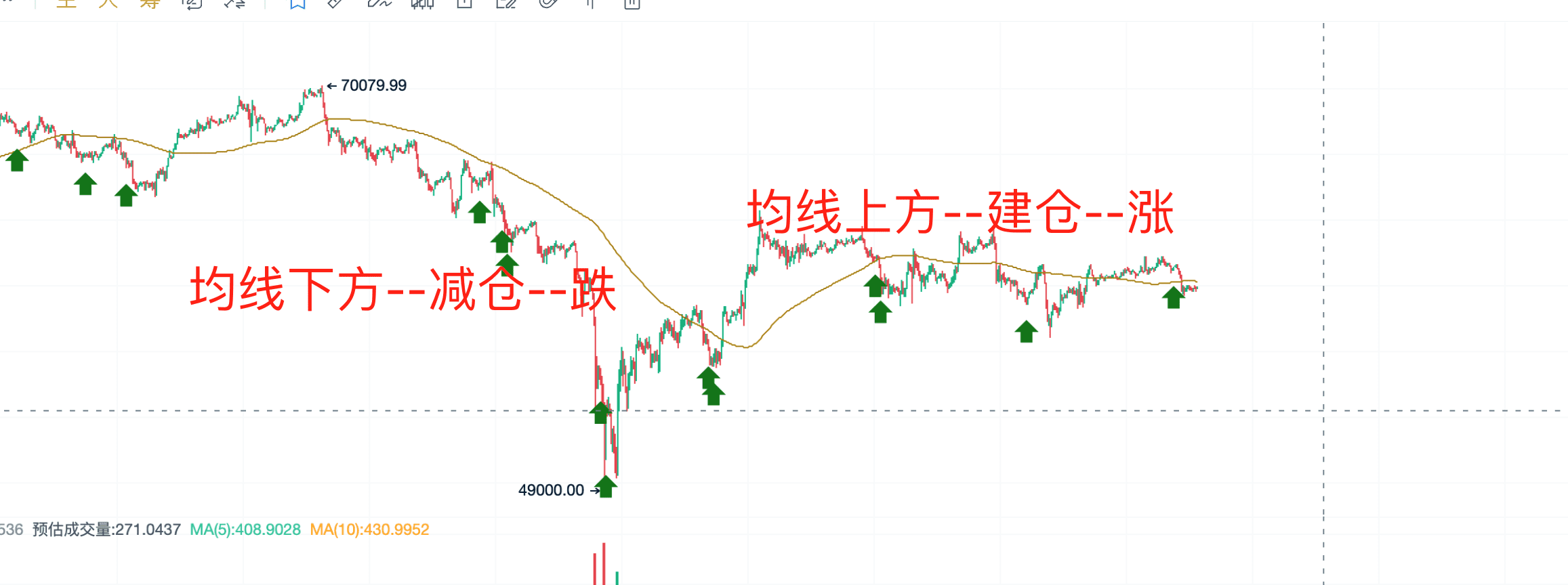

Let's take a look at the chart for Bitcoin:

It's not necessary to buy when 9 or 13 appears. You can use the MA120 moving average as a reference. If there is a breakout above the 120-period moving average and a TD signal, you can open a position.

Reducing positions is done below the moving average, while opening positions can be considered above it.

Today's BTC candlestick chart shows a crossover of TD + MA120:

Currently, it is below the moving average and a TD signal has appeared. If it continues to fall below 58000 and breaks the support level;

It's bearish. Trading requires multiple confirmations of information.

From the chart, it can be seen that it is in a consolidation phase, with repeated crossovers of the 120-period moving average. The summary of pressure and support levels from the market information should also be used more.

Right-click to view the full depth and check the pressure and support levels.

Search for MA:

That's all the content of this live session. Building and improving one's own trading system is a key factor in successful investment. We hope that every AICoin user will further understand and apply the TD indicator, gaining investment inspiration!

Recommended Reading

For more live session content, please follow the AICoin "News/Information - Live Review" section, and feel free to download AICoin PC-end.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。