【On-chain Analysis of Sats, More Obvious Absorption than Ordinance, More Comprehensive Chip Interaction】

- Exchange Data Analysis

From the perspective of on-chain holdings, in centralized exchanges, Binance holds the vast majority.

From Binance's perspective, it held 625T on March 1st, and 923T on August 19th.

From Bybit's perspective: it held 3T on March 1st, and 19T on August 19th.

So, it is very obvious that during the past half year of adjustment, a large amount of Sats on-chain has been transferred to centralized exchanges, with 300T transferred to Binance alone. From a normal logic perspective, the majority of chips transferred from on-chain to exchanges will be sold. In other words, there has been a large amount of chip turnover in the past half year.

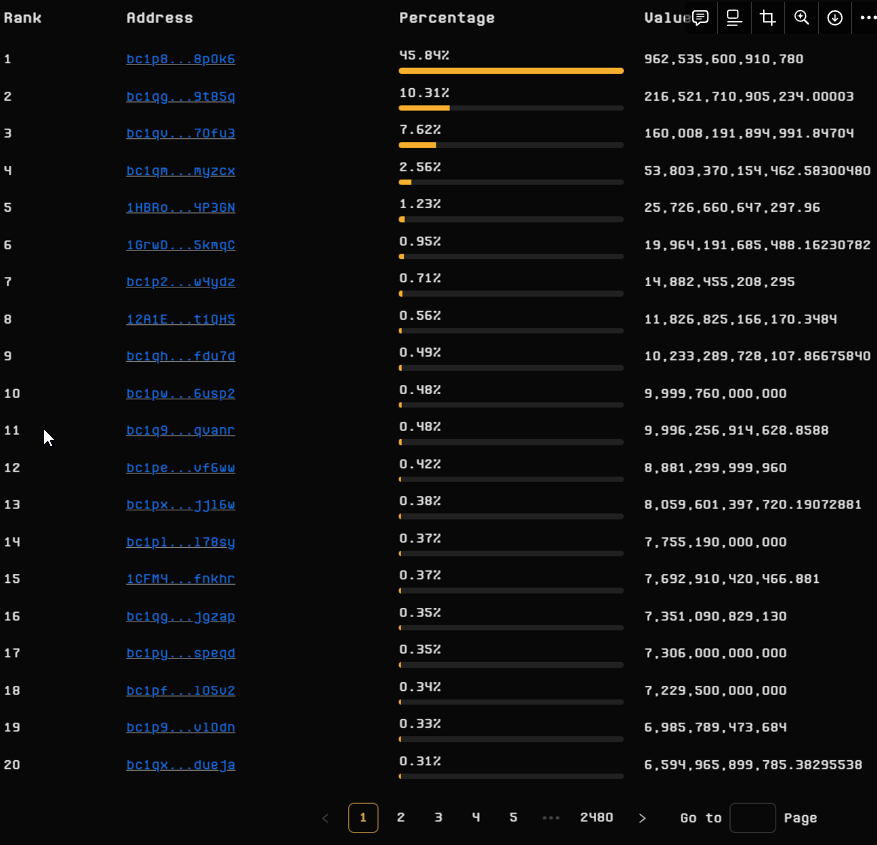

- Analysis of Special Addresses

The common characteristics of holding addresses 2, 3, and 8 are:

1) The addresses withdraw from exchanges every few days. 2) Multiple withdrawals per day, with each withdrawal falling within a certain range. For example, address 2 withdraws 4-11 times per day, with each withdrawal being around 0.1-0.5T. 3) The exchanges involved in the withdrawals are mainly Binance, Bybit, KuCoin, and Gate. 4) Holding addresses 2 and 3 have no withdrawal records.

In fact, it can be confirmed from the distribution of ordi tokens that holding address 2 is an OKX address. Therefore, it can be inferred that addresses 3 and 8 are also exchange addresses. However, this situation is not uncommon. Because there are no withdrawal records, the accumulation continues. Moreover, most of the incoming addresses are from relatively small exchanges. More importantly, these incoming transfers are definitely the actions of users, as the difference in transfer amounts from users can vary greatly, with one retail investor possibly transferring 100u, while a large investor may transfer 1 million u, with the amounts differing by tens of thousands of times.

- On-chain Absorption Addresses

In the top 20 rankings, individual holding addresses occupy the majority, including some old individual holding addresses, which refer to those minted in 23 or purchased and held for a long time. For example, holding addresses 7, 14, 17, 18, and 19. There are also many new absorption addresses, such as holding addresses 10, 11, 12, and 16. In fact, in the addresses ranked 21-40, there are also many addresses with significant increases in holdings. From experience, the holdings of new absorption addresses that can enter the top 20 are already very, very large.

So, overall, in the past half year of adjustment, a large amount of on-chain chips has been transferred to centralized exchanges, and a significant amount of turnover has actually taken place. At the same time, large investors can also absorb chips.

- Specific Address Analysis

Holding Address 1: Binance cold wallet, holding a total of 962T Sats.

Increased by 50T in the past month.

Holding Address 2: OKX wallet. Inferred from the distribution of ordi.

Holding Address 3: Possibly an OKX wallet, with on-chain behavior similar to address 2.

This address has similar patterns to holding address 2. It withdraws from exchanges every few days and has never made any withdrawals. The difference is that: 1) The average amount withdrawn each time is larger, around 0.4-1T. 2) The absorption started on December 21, 23, and ended on March 8, 24. 3) The first batch of transfers started on December 18, which is when Sats was listed on OKX.

The other analyses are similar to holding address 2.

bc1qve2xyhd2mghz02uq20v4k0ctjd0p9dlhud8kss68laad2an7hq3sr70fu3

Holding Address 4: Merlin Chain.

Holding Address 5: Institutional investor, with a low probability of being a Gate cold wallet, and a new absorption address.

It still makes withdrawals every few days, with each withdrawal being in the tens of B. It is transferred from different wallet addresses, while holding address 2 mainly receives transfers from wallet addresses of exchanges. The low probability of it being a Gate cold wallet is because the only three transfers from this address were all transferred to the Gate exchange.

Holding Address 6: Bybit exchange.

Holding Address 7: Old individual holding investor.

Minted 5T, and transferred in 9T in September 23, with the transfer possibly being a purchase, or it may belong to other wallets of this large investor. There have been no transfers since September 23.

bc1p2hvrv6z4vskcfg8el747q2gdl0d563hj5ksxhaluy3s3qzrrlamq3w4ydz

Holding Address 8: Possibly Gate's cold wallet.

This address behaves similarly to addresses 2 and 3, constantly receiving Sats every few days. It mainly receives transfers from Binance exchange addresses, with a small portion coming from other addresses.

The only withdrawal is to the Gate wallet.

So, it may belong to an individual Sats holding investor, or it may be Gate's cold wallet.

Holding Address 9: Binance hot wallet.

Holding Address 10: New individual holding investor.

Transferred in 5T from Binance addresses on August 11 and 14, with only two records for this address.

bc1pw7z5w00rennhl55zf09m3j57k333v3hx8wgc44zz3rjwtcwv6l6q86usp2

Holding Address 11: New individual holding investor.

This investor is quite unfortunate, having bought a total of 16.5T in December 23 and February 24, and sold 6.5T in May. This resulted in at least a halving of the holdings, leaving 10T.

Holding Address 12: New individual holding investor, possibly a Sun cut address.

This address received 11T from Binance on February 24, and then transferred to Huobi exchange in April and June, each time worth millions of dollars. Considering that Huobi exchange currently has relatively poor liquidity, it is hard to imagine a large investor transferring to Huobi exchange for selling, except for a Sun cut.

Holding Address 13: Bitget exchange.

Holding Address 14: Old individual holding investor.

Purchased chips from on-chain between June and August 23, with no transfers or sales after August 29.

Holding Address 15: New individual holding investor.

Previously bought a small amount, with the main position transferred from Binance exchange on June 10.

Holding Address 16: New individual holding investor.

Transferred in three times from Binance exchange on April 14, 15, and May 4, with the cost being similar to the current price.

Holding Address 17: Old individual holding investor, bought between June and August 23, with a relatively low cost, and no sales or transfers.

Holding Address 18: Old individual holding investor, bought in June and August 23, with a relatively low cost, and no sales or transfers. Except for the purchase time, it is very similar to address 17, and it is possible that it is controlled by the same person.

Holding Address 19: Old individual holding investor, minted, and not moved.

Holding Address 20: KuCoin exchange.

SATs

If you find my article helpful, feel free to follow, like, and share.

About Riyuexiaochu: A trend trader, sharing daily investment insights. The core four things:

- Cycle and trend analysis

- Research on high-quality projects

- Buying and selling points

- Risk control

All articles are available on the Notion website: https://riyuexiaochu.vip

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。