The U.S. presidential candidates have become an increasingly important indicator for cryptocurrency investors.

By Climber, Golden Finance

The impact of the U.S. election on the cryptocurrency market is growing, from the accelerated approval of Ethereum spot ETFs to the recent divergence of cryptocurrency trends from the U.S. stock market, all indicating that the U.S. presidential candidates have become an increasingly important indicator for cryptocurrency investors.

Since the probability of Harris being elected first exceeded that of Trump on Polymarket, the cryptocurrency market has started to decline continuously. As of the writing of this article, BTC has dropped from around $62,000 to the $56,000 mark. The main reason behind this is that Harris, since being nominated, has not clearly expressed her personal attitude towards cryptocurrency. As the successor to the Biden camp, she is likely to continue the former's strict regulatory policies.

Trump and Harris often have conflicting opinions as political opponents, and personal preferences are likely to give way to votes under the pressure of the election. While Trump previously did not trust cryptocurrency, he is now openly supporting Bitcoin. On the other hand, Harris is currently leading Trump in three key states in the U.S., five swing states, and even on Polymarket, and she did not attend the "Crypto4Harris" event. Therefore, Harris may hold opposing views to the policies that Trump supports.

Market downturns and frequent exits under election fog

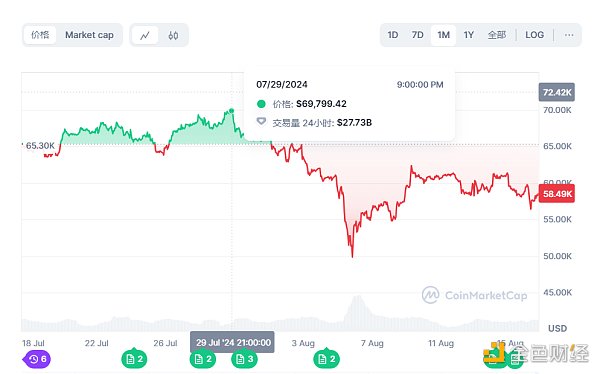

Influenced by the rise in support for Trump after the assassination attempt on July 13, the cryptocurrency market experienced a wave of increases, with BTC rising from around $57,500 to $68,500. Especially, Trump's speech at the Bitcoin conference led BTC to return to the $70,000 range.

On July 22, after Biden withdrew from the election and nominated Harris as the Democratic presidential candidate for 2024, her poll support continued to rise and surpassed Trump at the end of July. In addition, the U.S. government transferred $2 billion worth of BTC, leading analysts to speculate that the Biden administration would sell all Bitcoin before Trump took office. Coupled with the impact of Japan's interest rate hike, the cryptocurrency market experienced a sharp decline, with BTC dropping from $70,000 to $49,000.

On August 8, the Democratic Party of the United States launched the "Harris's Cryptocurrency" campaign, and the cryptocurrency market rebounded in sync, with BTC rising by over 10% throughout the day. However, it was revealed on the same day that Harris did not attend a later cryptocurrency roundtable meeting, and as Polymarket predicted that her election probability was equal to Trump's and then significantly surpassed it, the cryptocurrency market once again experienced a turbulent decline.

Especially when news broke that Harris was leading Trump in three key states and five swing states, the decline in BTC was most pronounced. Currently, there are reports that Harris was absent from the online "Crypto4Harris" meeting organized by the Democratic Party on August 15, and her digital advertising spending exceeds Trump's by tenfold.

In contrast, the U.S. stock market has been rising continuously since August 8, with the Dow Jones Industrial Average reaching 40,500 points and the Nasdaq approaching 17,600 points.

Regarding the above impact, the brokerage firm Bernstein stated in a research report that Trump winning the U.S. election would be favorable for the cryptocurrency market, while Harris winning would be unfavorable. The report also pointed out that Bitcoin weakened after the odds on Polymarket and the polls shifted in favor of Harris.

Harris's unclear attitude towards cryptocurrency has also made investors worried about potential risks. Even on Trump's side, some institutions have expressed doubts about whether he will actually take action.

Jeremy Allaire, CEO of Circle, stated that cryptocurrency is an issue of common concern for both parties, but more action needs to be taken to consolidate this position. In addition, he expressed doubts about Trump's commitment to these ideas.

The competition between Trump and Harris has indirectly caused turmoil in the cryptocurrency market, with large-scale contract liquidations occurring multiple times during the volatile market. On August 16, the total amount of liquidations across the network exceeded $200 million, on August 9, it exceeded $200 million, and on August 5, it exceeded $1 billion…

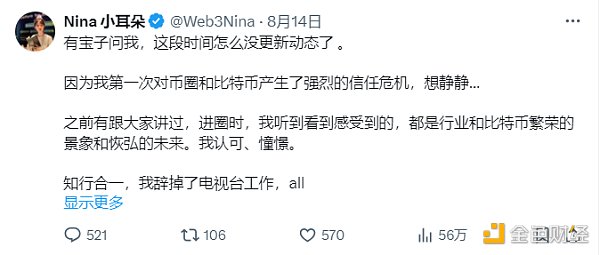

The continuous decline in the market has also wiped out the gains of many blue-chip altcoins over the past year, leading many OGs to start doubting the correctness of entering the Web3 industry and considering exiting the market.

Well-known cryptocurrency KOL Xiao Erduo stated that he has developed a strong crisis of trust in the cryptocurrency circle and has already sold off his principal and cleared all coins except for Bitcoin.

Well-known trader Ansem also stated that his recent trading performance has been extremely poor and he is seriously considering permanently exiting the market.

Harris's undecided attitude and political disputes conceal investment risks

Looking back at the recent market downturn in the cryptocurrency market, it is closely related to the increase in Harris's probability of being elected and her unclear attitude towards the cryptocurrency market.

Earlier, there were reports that Harris's campaign team was seeking to re-engage with the Bitcoin and cryptocurrency community, such as with Coinbase, Circle, and other cryptocurrency companies. However, the team stated that re-establishing contact with the cryptocurrency industry was not for the purpose of donations, but to pave the way for reasonable regulation.

As for Harris herself, she did not attend cryptocurrency-related events such as the Bitcoin conference, cryptocurrency roundtable meetings, and the online "Crypto4Harris" meeting.

In addition, Harris has not publicly committed to supporting the cryptocurrency industry and may instead continue the Biden administration's strict regulatory policies on cryptocurrency.

Alex Thorn, the research director at Galaxy Research, previously analyzed that Harris has close cooperation with key anti-cryptocurrency officials such as Brian Deese and Bharat Ramamurti. Deese had published an article on the White House website emphasizing the risks of cryptocurrency, while Ramamurti is considered a top cryptocurrency critic at the White House. Their involvement suggests that the Harris administration is unlikely to soften its stance on cryptocurrency policies and will continue to support strict regulatory measures to protect consumer and financial system security.

Harris's running mate, Walz, has explicitly advocated for stricter regulation of cryptocurrency, and not long ago, he even returned a $4,000 political donation from a former FTX executive.

On August 10, the Federal Reserve took enforcement action against Customers Bancorp, leading the community to question Harris's sincerity in trying to repair relations with the cryptocurrency industry.

All signs indicate that Harris is not eager to show goodwill to the cryptocurrency market, and given that Harris was already leading Trump before expressing her stance on the cryptocurrency market, she may not urgently need funding and voter support from the cryptocurrency field unless necessary.

In terms of fundraising, Trump's campaign team announced that it raised $138.7 million in July, but Harris raised $200 million in her first week of the campaign. As of August, Trump's cash reserves were $327 million, and considering that there are only three months left until the election, they are facing certain financial pressure.

On the other hand, as political opponents, Trump and Harris often attack each other and have divergent political views. For example, on August 10, Harris stated that the actions of the Federal Reserve should be independent of the president. But previously, Trump stated that if elected, he would seek to influence U.S. monetary policy.

This means that in their attitudes towards cryptocurrency, Harris is entirely likely to take a different stance from Trump and continue to strengthen the regulation of the cryptocurrency market. This is also the potential risk that many institutions and ordinary investors are concerned about.

At the current stage, the competition between Trump and Harris has indeed increased the uncertainty of the cryptocurrency market. However, the good news is that there are increasingly more topics and news surrounding "Harris's cryptocurrency-friendly" stance, especially with rumors or actions from both of them that are friendly to cryptocurrency.

Regarding Harris:

On August 15, the CEO of Circle stated that Harris's campaign team is actively engaging with the cryptocurrency industry, and mentioned that representatives from Harris's campaign attended the previous cryptocurrency roundtable meeting.

On August 8, the Democratic Party of the United States launched the "Crypto for Harris" campaign. The campaign aims to attract 40 million American voters who own digital assets and indicates the Democratic Party's position on promoting the blockchain and cryptocurrency industry.

On August 1st, it was reported that Harris's team contacted individuals from Coinbase, Circle, Ripple Labs, and other cryptocurrency companies to ease the tension between the Democratic Party and the cryptocurrency industry.

There are also reports that Harris's husband is a "cryptocurrency enthusiast."

Regarding Trump:

Trump has repeatedly criticized cryptocurrency during his term, calling it "not money," based on "castles in the air," and "likely to promote illegal activities," and he believed that Bitcoin is a "scam." However, during this year's U.S. presidential election, his attitude made a 180-degree turn.

Representative declarations and commitments made by Trump to the cryptocurrency market include: if re-elected, he will replace Gary Gensler, the chairman of the Securities and Exchange Commission (SEC), who holds a critical attitude towards cryptocurrency, if elected, the government will retain 100% of its Bitcoin holdings, and keeping the U.S. in a leading position in the cryptocurrency field.

The official Trump store also supports Bitcoin payments, including items such as shoes and perfume.

In addition, Trump's eldest son, Donald Trump Jr., has stated that Bitcoin is a hedge against inflation and authoritarian governments, and recently announced the launch of the Telegram channel "The DeFiant Ones," and he will also launch a cryptocurrency project.

Trump's second son, Eric Trump, stated that he is about to launch a cryptocurrency project related to "digital real estate," and he has previously written that he has really fallen in love with cryptocurrency/DeFi.

Conclusion

At the current stage, the U.S. presidential competition is becoming increasingly heated, and the upcoming debate between Trump and Harris is making the future of the cryptocurrency market even more uncertain. Especially since Harris has not made a statement about the cryptocurrency market, many investors have chosen to wait and see. Once cryptocurrency regulations become stricter, the risk will obviously outweigh the opportunity for the already volatile cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。