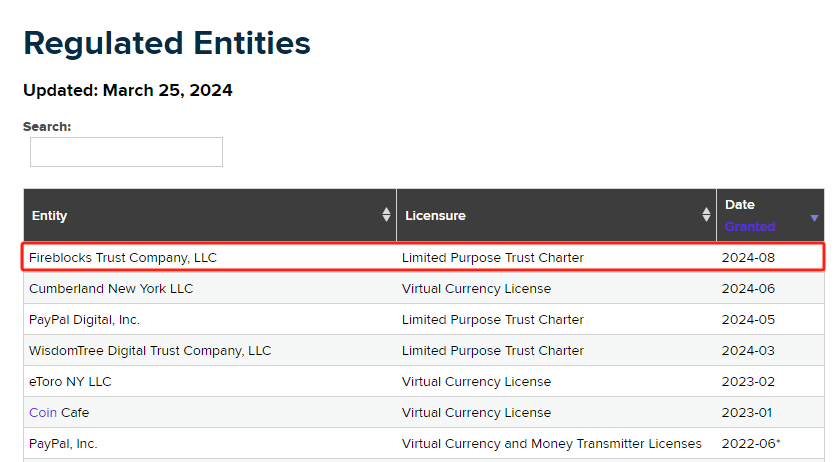

According to Aiying's official website, the latest announcement reveals that the Web3 infrastructure provider, Fireblocks, has obtained a Limited Purpose Trust Charter, allowing it to provide cryptocurrency custody services to clients in the United States. This charter permits the company to engage in virtual currency business and is expected to soon offer cold storage custody solutions based on Fireblocks technology to its U.S. clients.

Fireblocks' trust company is part of its global plan to establish a regulated cryptocurrency custody network. In June, Fireblocks launched a global digital asset custody network, with these custody companies using Fireblocks' technology and connecting with clients through the Fireblocks platform.

Obtaining the Limited Purpose Trust Charter provides an alternative for cryptocurrency companies to operate in New York State, offering additional benefits compared to the BitLicense in New York State. According to NYDFS regulations, "a limited purpose trust company can exercise trustee powers, including custody services, and can engage in money transmission business in New York State without the need for a separate New York money transmission license."

In the United States, federal and state laws form a delicate "concurrent" relationship in cryptocurrency regulation. Federal regulation is primarily overseen by FinCEN, the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC). FinCEN regulates cryptocurrency transactions through the BSA, requiring companies to register as MSBs and comply with strict anti-money laundering (AML) and know your customer (KYC) requirements. The SEC focuses on whether cryptocurrencies constitute securities and manages their issuance and trading. The CFTC is responsible for regulating the cryptocurrency futures and derivatives markets.

State-level regulation presents a diverse landscape. New York State's BitLicense is currently the most stringent state-level cryptocurrency regulatory system, requiring companies to obtain a license to operate within the state. The process of obtaining a BitLicense is very complex and expensive. Companies not only need to pay high application fees but also need to invest a significant amount of resources to meet strict compliance requirements. However, companies that obtain a BitLicense often gain higher market trust and recognition. For example, companies such as Coinbase and Gemini, which have obtained BitLicenses, enjoy high credibility among users and investors, helping them attract more customers and funds.

Today, Aiying mainly wants to introduce the two licenses that Web3 enterprises need to conduct virtual currency business in New York State: BitLicense and Limited Purpose Trust Charter.

BitLicense - New York Virtual Currency License

The full name of BitLicense is "New York State Department of Financial Services Virtual Currency License," a regulatory framework introduced by the New York State Department of Financial Services (NYDFS) in 2015 specifically for companies engaging in virtual currency-related business in New York State. In other words, if you want to buy, store, or transfer Bitcoin or other virtual currencies in New York State, you need to obtain this license. Here are the detailed introductions to BitLicense:

1. Scope of Application

BitLicense applies to all entities engaging in virtual currency business within New York State, including:

- Receiving, storing, and transferring virtual currency, such as providing virtual currency wallet services.

- Virtual currency exchange: exchanging virtual currency for US dollars or other currencies, or vice versa.

- Virtual currency trading: buying and selling virtual currencies such as Bitcoin.

- Payment processing: services using virtual currency for payments.

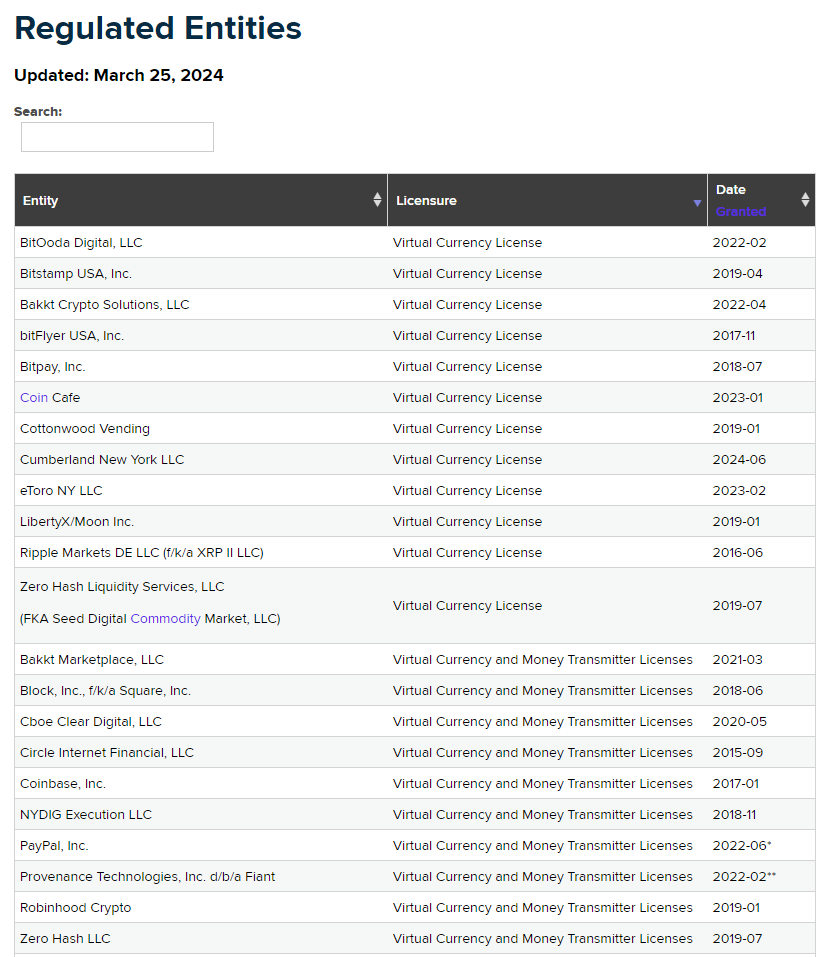

BitLicense is a broad term, but it actually covers licenses for different types of businesses. Depending on the specific business a company engages in, the application is divided into the following two types:

- Virtual Currency License: describes the license for basic virtual currency business (such as storage, transfer) that does not involve fiat currency transmission. It can be understood as a virtual exchange license.

- Virtual Currency and Money Transmitter License: this is more complex and applies to companies that not only deal with virtual currencies but also involve exchanging virtual currencies for fiat currency or conducting transfers. It can be understood as a virtual currency over-the-counter trading license.

2. Main Requirements

Companies applying for BitLicense must meet a series of strict requirements, including but not limited to:

- Capital requirements: companies must maintain sufficient capital reserves to ensure financial health.

- Compliance requirements: companies must develop and implement anti-money laundering (AML) and know your customer (KYC) procedures to prevent illegal activities.

- Network security: companies must establish a network security plan to ensure the security of customer data and funds.

- Consumer protection: companies must take measures to protect consumer rights and fully disclose relevant risks before transactions.

- Reporting and record-keeping: companies must regularly submit financial statements to NYDFS and retain all relevant business records for at least seven years.

According to official website data, 22 institutions have obtained BitLicense, including familiar companies such as PayPal, Robinhood, Bitstamp USA, Ripple, and Coinbase, among others. The following is the list of the 22 institutions:

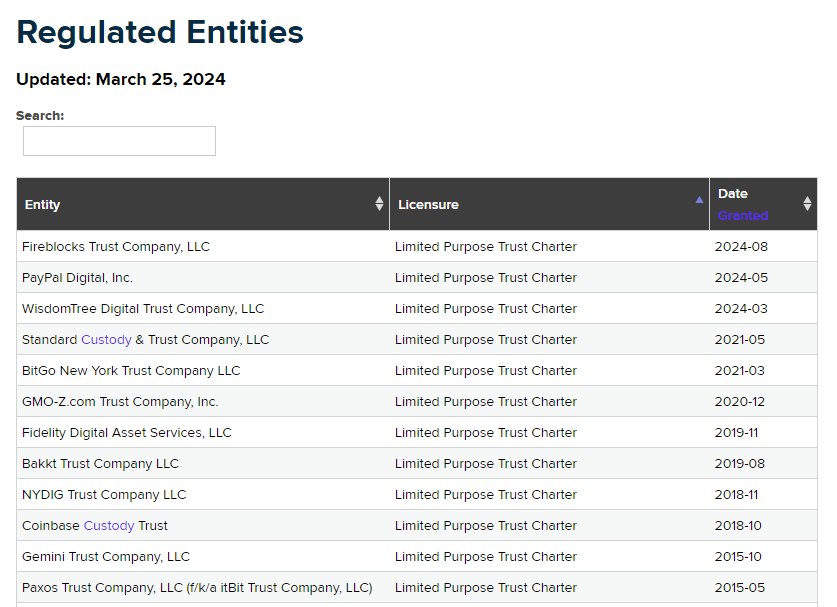

Limited Purpose Trust Charter

The Limited Purpose Trust Charter is a license issued by the New York State Department of Financial Services (NYDFS) specifically for trust and asset custody. This license allows companies to act as trustees to manage and custody clients' assets in New York State, which can include traditional financial assets (such as cash, securities, etc.) as well as virtual currencies. Here are the detailed introductions to this charter:

1. Definition and Purpose

- Definition: The Limited Purpose Trust Charter allows companies to act as trustees to provide asset custody and management services to clients. This type of charter is typically issued to institutions focused on providing trust services, asset management, and custody services.

- Purpose: Companies holding this charter can manage various types of assets, including but not limited to cash, securities, precious metals, and virtual currencies. This enables them to provide more specialized services to clients, such as asset management, financial planning, and estate management.

2. Application Requirements

Companies applying for the Limited Purpose Trust Charter must meet a series of strict requirements, which typically include:

- Capital requirements: companies need to maintain sufficient capital to ensure their financial stability and service capabilities. Capital requirements are usually adjusted based on the scale of assets managed by the company and the risk situation.

- Background checks on management: NYDFS requires strict background checks on the company's executives and board members, including their legal compliance, financial status, and professional qualifications.

- Business plan: companies need to submit detailed business plans, outlining the scope of their trust and custody services, target markets, operating models, etc.

- Compliance plan: applicants need to develop comprehensive compliance plans to ensure that their business activities comply with relevant laws and regulations, especially anti-money laundering (AML) and know your customer (KYC) requirements.

Network security measures: companies must demonstrate their network security capabilities to protect the security of customer data and custodied assets.

3. Regulation and Compliance

After obtaining the Limited Purpose Trust Charter, certified companies must continue to comply with NYDFS regulatory requirements, including but not limited to:

- Regular audits: Companies need to undergo regular audits, including financial reports, compliance procedures, risk management measures, etc.

- Reporting obligations: Certified companies must regularly submit financial statements and other relevant reports to NYDFS to ensure transparent and compliant operations.

- Consumer protection: Companies need to establish and enforce strict consumer protection measures to ensure the safety of customer assets and provide adequate risk disclosure during the service process.

Currently, a total of 12 institutions have obtained this charter, including Coinbase Custody Trust, a subsidiary of Coinbase, which has provided custody services for 8 Bitcoin ETFs in the United States. The following is the list of licensed institutions:

References:

https://www.dfs.ny.gov/industryguidance/industryletters/il20200624adoptionlisting_vc

https://www.dfs.ny.gov/virtualcurrencybusinesses#bitlicense-faqs

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。