Why Usual?

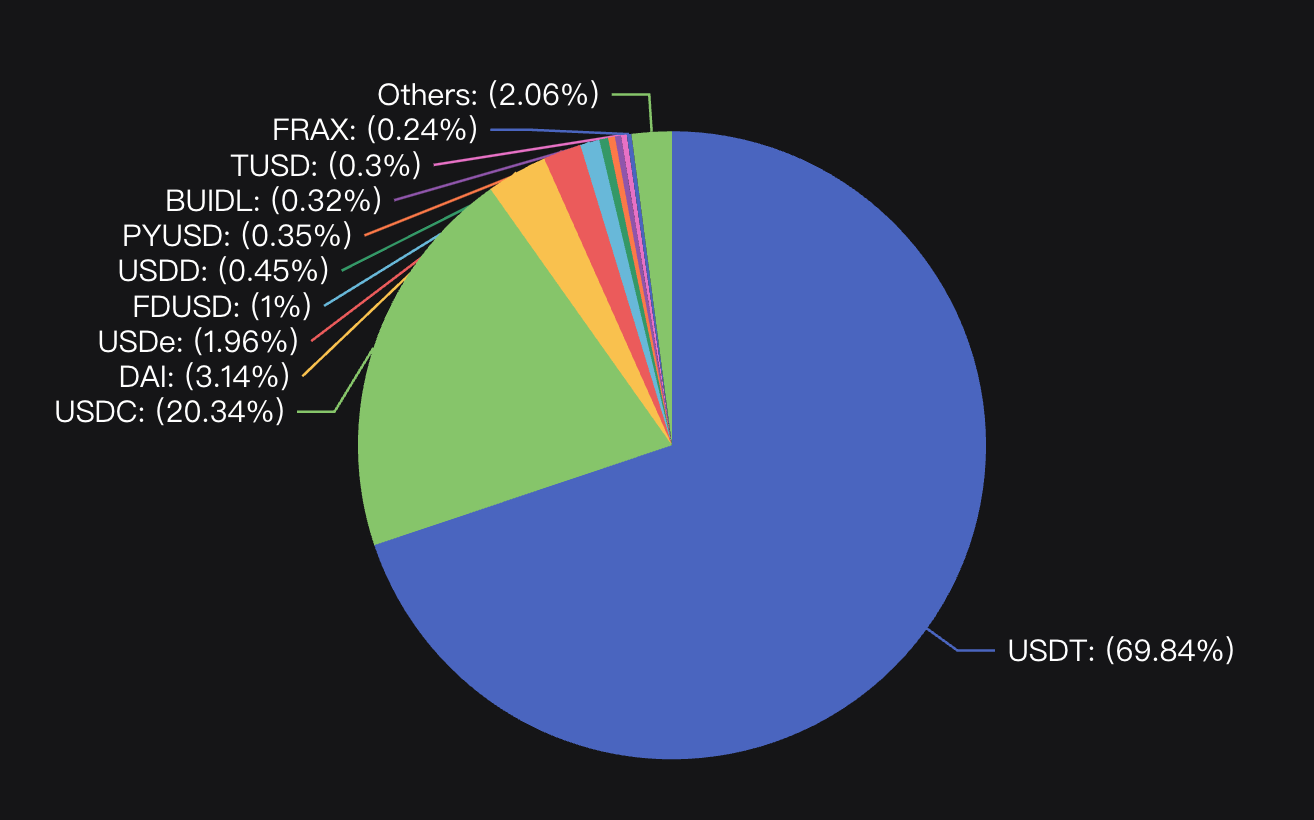

Stablecoins can be said to be the foundation of the cryptocurrency industry. People need stablecoins for use cases such as large-scale payments, and stablecoins also play a key role in the mass adoption of the industry. As of July 30, 2024, the total market value of stablecoins is $168 billion. From the following overview of stablecoin market value, it can be seen that the two major centralized stablecoins, USDT and USDC, together account for approximately 90% of the total stablecoin market value.

Image source: Defillama, data as of July 30, 2024

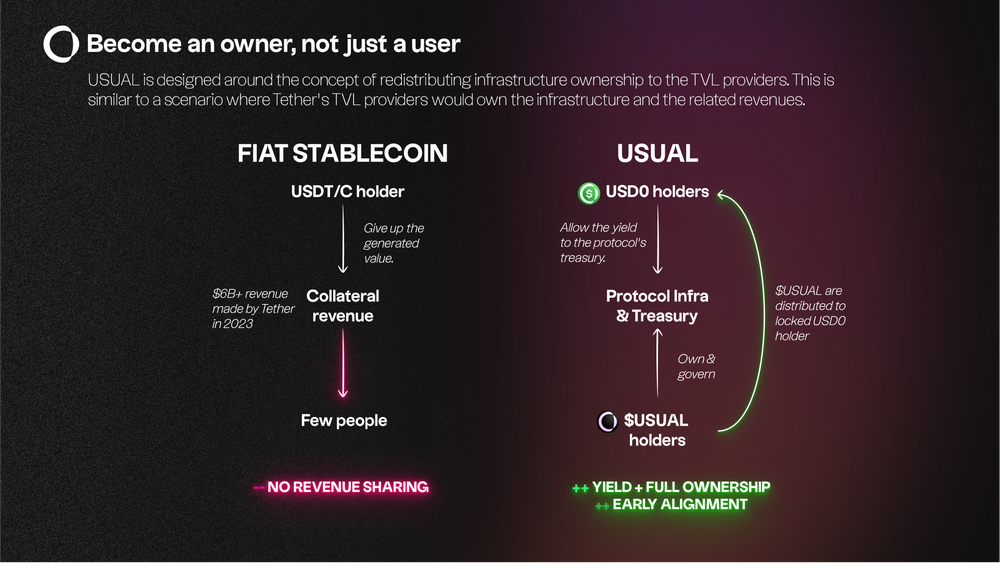

Stablecoins are the money printing machines of the crypto world. The two giants, Tether and Circle, generated over $10 billion in revenue in 2023, with a valuation exceeding $200 billion. Tether made a record profit of $4.52 billion in Q1 2024. Such massive profit monopolies are clearly contradictory to the spirit of crypto, hence various decentralized stablecoin projects continue to emerge. Based on the collateral amount, decentralized stablecoins can be divided into over-collateralized represented by MakerDAO (DAI), equal-collateralized represented by Ethena (USDe), and under-collateralized (currently no projects with large market value).

There have been quite a few successful projects of decentralized stablecoins, but the collateral for these projects is generally crypto assets, so a sophisticated mechanism is needed to counter the price volatility. However, if Real World Assets (RWA) are introduced, this problem will be solved. RWAs are growing and thriving, with RWA on the blockchain growing by over 800% in 2023. Usual.money introduces US Treasury bonds as collateral, while providing transparency and security based on Ethereum smart contracts, returning profits to the community and contributors. This design can be said to be tether-on-chain, combining the 1:1 RWA feature of centralized stablecoin protocols with on-chain security and transparency.

Image source: https://docs.usual.money/start-here/why-usual

Background

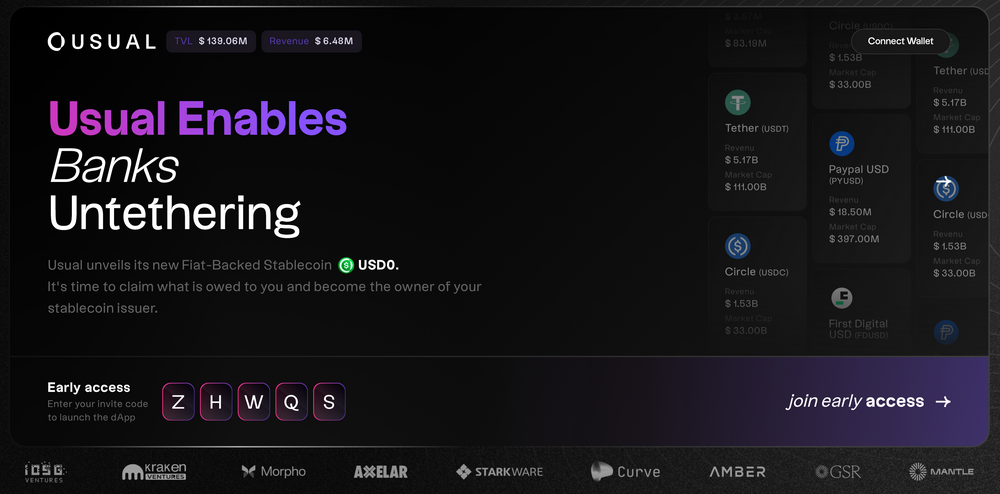

On April 17, 2024, Usual Labs completed a $7 million financing round, led by IOSG and Kraken Ventures, with participation from GSR, Mantle, Starkware, Flowdesk, Avid3, Bing Ventures, Breed, Hypersphere, Kima Ventures, Psalion, Public Works, and X Ventures.

Founder Pierre Person was a former French politician, a member of the National Assembly, and recently served as the vice president of the presidential party, leading the country's cryptocurrency legislation.

On July 10, Usual announced the launch of its mainnet. As of August 6, the project's Total Value Locked (TVL) is $146 million.

According to Coinmarketcap data on August 6, nearly 95% of USD0 trades are in Curve's USD0/USDC pool, with $11.33 million in liquidity. Additionally, on the Maverick Protocol, there are stablecoin GHO and USD0 LPs from Aave, with a TVL of $100,000.

Currently, USD0 has a treasury planned by MEV Capital on the lending project Morpho, with liquidity pools for USD0USD0++/USDC and USD0++/USDC, with nearly $30 million in collateral at an 86% Liquidation Loan-to-Value (LLTV) ratio. Through this pool, users can receive rewards in Usual's Pills (see interactive section at the end of the document) and Morpho tokens.

The $USUAL Token Generation Event (TGE) is expected in Q4 2024, with 90% of USUAL tokens allocated to the community.

Mechanism Analysis

Collateralization and Minting

$USD0 is the first RWA stablecoin that aggregates various US Treasury bond tokens, and it can be minted on Usual in two different ways:

Direct RWA Deposit: Users deposit eligible RWAs into the protocol and receive an equivalent amount of USD0 at a 1:1 ratio.

Indirect USDC/USDT Deposit: Users deposit USDC/USDT into the protocol and receive USD0 at a 1:1 ratio. This indirect method involves third-party collateral providers who supply the necessary RWA collateral. This allows users to obtain USD0 without directly dealing with RWA.

RWAs are growing significantly, but still only represent a small portion of the underlying assets in the cryptocurrency market. The main challenge lies in liquidity issues, including difficulties faced by institutions in liquidating RWA holdings in the secondary market, and retail investors' inability to obtain RWA returns in the core DeFi ecosystem. Through USD0, Usual can seamlessly integrate RWA token liquidity from platforms like Hashnote.

Earnings

$USD0++ is an appreciating US Treasury bond, where USD0++ is a wrapped and locked version of USD0.

$USUAL is the governance and reward token of the Usual protocol.

Earnings come from staking: Users lock their USD0 in the USD0 Liquid Bond (USD0++) for a period of time. Earnings can be obtained in one of the following two ways:

USUAL Earnings: Holders of the Liquid Bond can receive their earnings in the form of USUAL tokens daily (calculated per block).

Basic Interest Guarantee: Ensures that USD0++ holders receive at least the equivalent of the earnings from USD0 collateral (risk-free earnings). To achieve this, users must lock their USD0++ for a specified period (currently designed for a 6-month period). At the end of this period, users can choose to receive the basic interest guarantee in the form of USUAL tokens or risk-free earnings in USD0.

It is important to note that regardless of whether USD0++ is obtained through primary issuance or the secondary market, holders automatically have the right to receive USUAL tokens.

Interaction

Pills Activity Overview

Pre-launch stage starts from 00:00 on July 10 and lasts for 4 months.

Airdrop amount: 7.5% of the total $USUAL supply minted at the Token Generation Event (TGE).

Users can receive $USUAL airdrop allocations through the referral program and TVL contributions, similar to Ethena's farming pills activity.

Linear distribution: The more deposited, the more received.

Detailed Interaction Guide

- Open the Usual Money dApp: https://app.usual.money/#ZHWQS or enter the early access code "ZHWQS" on the official website.

Deposit USDC, USDT, ETH to mint USD0 (Ethereum mainnet). Click the link to mint: https://app.usual.money/counter/deposit

Ways to earn Pills:

- Minting: Users can earn 5 Pills each time they lock USD0 as USD0++.

- Holding: Users holding USD0++ can earn 3 Pills per day.

- USD0/USDC Pool: Providing liquidity in Curve's USD0/USDC pool can earn 1 Pill per day.

- USD0/USD0++ Pool:

- Users contributing USD0 to this pool can earn 3 Pills per day.

- For each USD0++ minted, 5 Pills can be earned, proportionally distributed to the USD0 LP in the pool.

- Note: Providing USD0++ to this pool does not generate any Pills.

Additionally, there is a time multiplier starting at 1, increasing by 2% each day. It resets to 1 if the user exits their position.

Add liquidity to earn pills: Select the USD0/USD0++ option, enter the USD0 quantity. Link: https://app.usual.money/desk/liquidity

Pills Activity Phase 2

- On August 4, Usual announced the second phase of the activity, allowing users to earn Pills by completing tasks on Galxe. Activity link: https://app.galxe.com/quest/usual/GCsgvtvTNA

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。