Introduction

Stablecoins play a crucial role in the cryptocurrency industry. As of July 25, 2024, the market value of stablecoins is approximately $165 billion, accounting for nearly 7% of the entire cryptocurrency market of $24.17 trillion. Among them, the leading stablecoin Tether (USDT) is currently the third largest cryptocurrency by market value, following only Bitcoin and Ethereum.

This article will delve into stablecoins, including their definition, classification, and the important role of stablecoins in the digital currency field. We will explore the operational mechanism, potential risks, and whether USDe can be considered an "upgraded version" of Luna through a case study of Ethena USDe.

Definition: What is a Stablecoin?

According to the Financial Stability Board and the Bank for International Settlements, a stablecoin is "a cryptocurrency that aims to maintain a stable value relative to a specified asset, or a pool or basket of assets." Typically, stablecoins are pegged to fiat currencies, with the US dollar being the representative.

Motivation: Why Do We Need Stablecoins?

There is no shortage of discussions about stablecoins in the market. However, the primary question is: Why do we need stablecoins?

- Compared to Traditional Assets

Firstly, in the context of the widespread application of Web3, digital assets provide more convenient tradability than traditional assets. Stablecoins, as a medium of exchange with stable value, facilitate daily transactions and also enable fast and low-cost cross-border payments, avoiding the processing delays and high fees of traditional banking systems.

- Compared to Other Cryptocurrencies

Secondly, stablecoins help reduce the impact of value fluctuations. Since mainstream cryptocurrencies like BTC or ETH inherently exhibit price volatility, they are not suitable as stablecoins. During market fluctuations, stablecoins provide unique value stability, serving as a safe haven for preserving value.

Classification: How Do Stablecoins Maintain "Stability"?

- Collateralized Stablecoins

Collateralized stablecoins are fully backed by other assets, ensuring their value is supported by other forms of collateral. Assuming these collaterals are managed properly and have viable redemption mechanisms, the value of these stablecoins is unlikely to fall below the value of their collateral assets due to potential arbitrage opportunities. Typical collateralized stablecoins include:

- Fiat-collateralized stablecoins: backed by fiat currency reserves, such as the US dollar. Typical examples include Tether USD (USDT) and USD Coin (USDC), which are the top two stablecoins by market value. As of July 2024, their combined market value accounts for over 90% of the total stablecoin market value.

- Commodity-collateralized stablecoins: backed by commodity reserves, such as gold or other real-world assets. A typical example is Tether Gold (XAUt), which uses gold as collateral.

- Cryptocurrency-collateralized stablecoins: backed by reserves of other cryptocurrencies, such as BTC or ETH. A typical example is DAI developed by MakerDAO, which uses ETH and other approved Ethereum assets as collateral.

- Algorithmic Stablecoins

Algorithmic stablecoins use algorithms to ensure the security of collateral or adjust market circulation (supply-demand status) to maintain stability. Typical methods include:

- Liquidation: To ensure the full collateralization of all outstanding stablecoin debts, some stablecoins employ a liquidation mechanism, auctioning off under-collateralized risk assets at a price lower than their corresponding issued stablecoins. This mechanism typically includes initial over-collateralization (e.g., a 150% ratio), providing a buffer between the value of collateral and the value of the corresponding stablecoins. A typical example is the largest algorithmic stablecoin, DAI.

- Burn and mint: This method, assuming total demand remains constant, involves burning existing tokens to reduce the total supply or minting new tokens to increase the total supply. If a stablecoin drops from the target price of $1 to $0.9, the algorithm will automatically burn a portion of the tokens to introduce more scarcity, leading to a decrease in circulation and thus driving up the price of the stablecoin. A typical example is TerraUSD (UST), which utilizes an embedded fixed-rate exchange mechanism to create potential arbitrage opportunities for users. However, during a significant market downturn, the protocol failed to maintain stability, resulting in over $40 billion in losses, the largest loss in Web3 history.

- Adjusting borrowing rates: Assuming people are generally profit-seeking, this method controls the supply of stablecoins within the "borrowing yield framework" by raising or lowering central borrowing rates. If a stablecoin drops from the target price of $1 to $0.9, the algorithm will automatically raise borrowing rates to attract (i.e., lock in) more circulation, thus driving up the price of the stablecoin. A typical example is Beanstalk (BEAN), which manages the circulation of BEAN by adjusting the amount available for borrowing (referred to as Soil).

Note

It is worth noting that these classification methods are not mutually exclusive. Stablecoins can simultaneously implement multiple mechanisms to maintain stability. For example, DAI is supported by cryptocurrency collateral while also employing algorithmic adjustments (i.e., liquidation). This combination strategy can leverage the advantages of multiple mechanisms to mitigate potential weaknesses, thereby enhancing the overall stability and reliability of stablecoins.

Security Risks and Solutions

Collateral Transparency

For stablecoins collateralized by fiat currency or commodities, users may be concerned about the safety and availability of the collateral for redemption. Many stablecoins address this issue by placing collateral with third-party custodians (such as banks), conducting regular audits, and publishing reserve proof reports. These measures can enhance the transparency of collateral management, thereby alleviating public suspicion to some extent.

Collateral Value Fluctuations

For stablecoins collateralized by cryptocurrencies, their underlying assets exhibit greater volatility compared to fiat currency or commodities. Significant fluctuations in collateral value may lead to unexpected collateral value shortfalls. To address this issue, many stablecoins implement over-collateralization and liquidation mechanisms to mitigate the potential negative impact of collateral value fluctuations. Over-collateralization to some extent ensures that the value of collateral remains within a safe range during market fluctuations, as the initial value of the cryptocurrency reserves exceeds the value of the issued stablecoins. The liquidation mechanism allows other users to liquidate under-collateralized stablecoins, thereby maintaining the stability of the stablecoin's value.

Smart Contract Vulnerabilities

Stablecoins, especially algorithmic stablecoins, rely on complex smart contracts to implement their stability mechanisms. However, these smart contracts may introduce new risks at the code level, such as reentrancy attacks, logic errors, or governance vulnerabilities. Therefore, rigorous security audits and continuous security monitoring are crucial to ensuring the security and reliability of these protocols.

Market Fluctuations

Sharp fluctuations in stablecoins and tokens related to stablecoins (such as sudden collapses in a short period) can undermine public trust in stablecoins and affect their value stability. In rapidly changing market environments (such as during black swan events), the originally designed stability mechanisms may not be able to respond and adjust quickly, leading to significant price deviations. During periods of high demand or panic, automated market maker (AMM) designs may also cause a shortage of stablecoin liquidity in exchange liquidity pools, further exacerbating price fluctuations. Markets with insufficient liquidity are particularly susceptible to manipulation. Additionally, stablecoins rely on oracles to determine external prices (such as the US dollar or Ether), and incorrect oracle data may result in mispricing of stablecoins, creating a new attack surface.

Mainstream Stablecoins

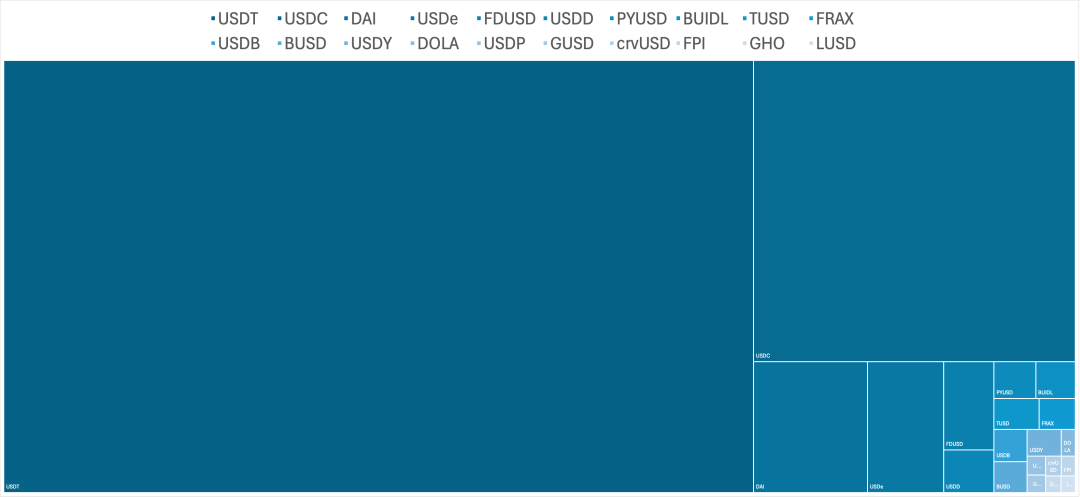

We have selected the top 20 stablecoins from DefiLlama, which account for over 99% of the total market value of stablecoins (as of July 2024 data), as shown in the following figure.

Figure 1: Top 20 stablecoins by market value; Source: DefiLlama

The market value of these stablecoins shows a high degree of concentration, with the top 5 stablecoins (USDT, USDC, DAI, USDe, and FDUSD) accounting for 96% of the total market value, and the top 20 stablecoins accounting for 99% of the total market value. This indicates that the market is dominated by a few key players, consistent with the Pareto Principle.

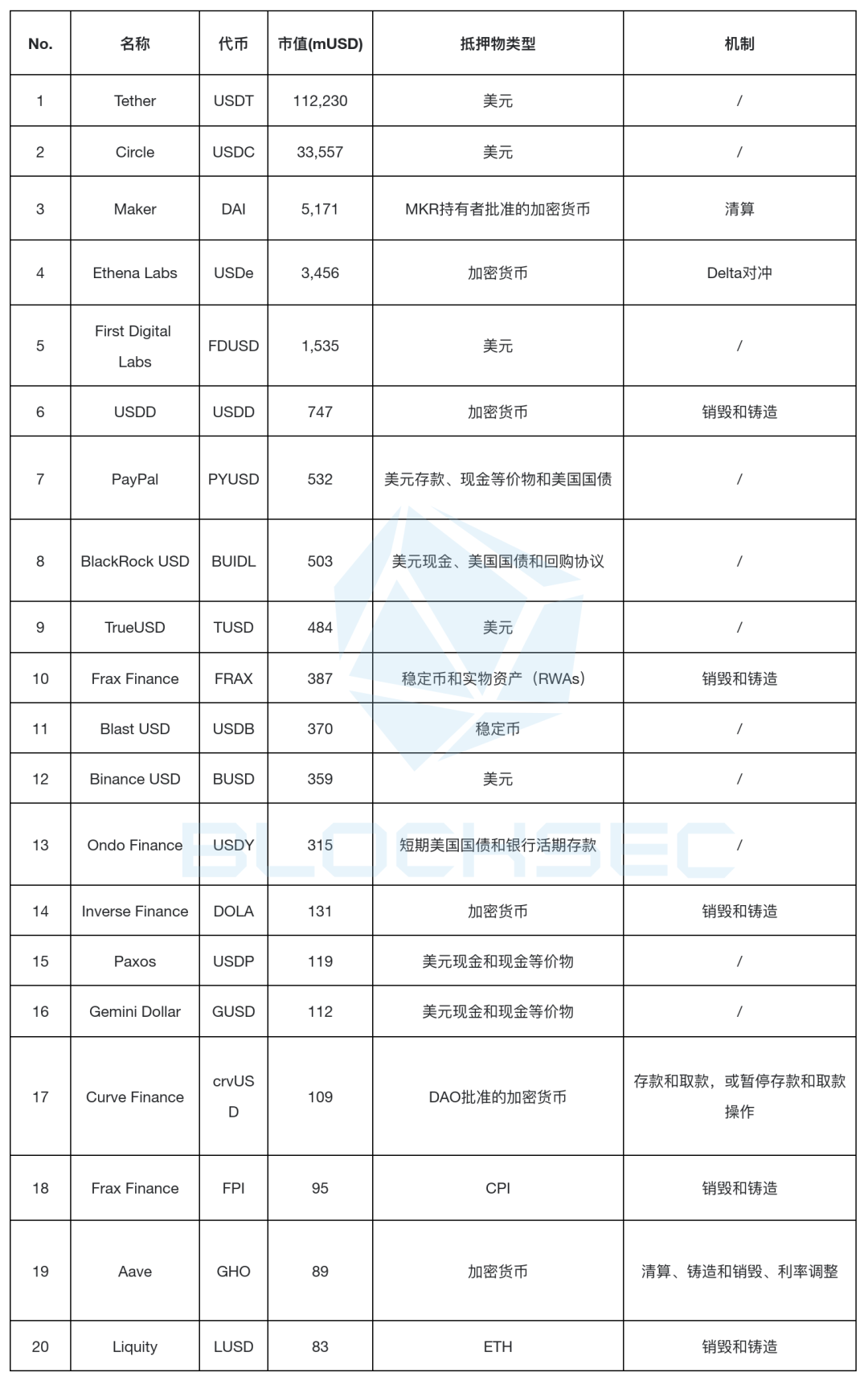

Among the top 20 stablecoins, all stablecoins are collateralized by certain assets such as the US dollar, US Treasury bonds, or other cryptocurrencies. Additionally, 9 of these stablecoins also incorporate algorithmic stability mechanisms to adjust circulation supply or ensure collateral safety.

Figure 2: Comparison of the top 20 stablecoins by market value; Source: BlockSec

This phenomenon indicates that despite claims of excellent stability mechanism design by algorithmic stablecoins, users show a clear preference for fully collateralized stablecoins, especially those backed by fiat currencies. As Frax founder Sam Kazemian said, "If you want to create a very large stablecoin, you want to become safer as you get bigger, not the other way around; as people use money, you want it to be safer."

Case Study: Ethena Labs - USDe

Over the past year, USDe issued by Ethena Labs has gained widespread attention. As of July 2024, according to DefiLlama's data, it has become the fourth largest stablecoin by market value. This section will use USDe as a case study to explore its design principles and potential risks.

Design Principles

USDe can be considered a centralized exchange (CEX)-based stablecoin, with its stability mechanism currently relying mainly on the operational stability of CEX. Specifically, USDe uses mainstream cryptocurrencies as collateral and employs a "delta hedging" strategy to maintain the stability of the collateral assets.

So, what is "delta hedging"? We can illustrate this with the following example. If 1 ETH is used to mint USDe, then we say the stablecoin is exposed to a "positive delta of 1 ETH," meaning the stablecoin's value is fully sensitive to the spot market price of ETH. Ideally, the goal of the stablecoin is to minimize this sensitivity, i.e., to ensure a "delta of 0" as much as possible, to maximize stability. To achieve this goal, Ethena conducts delta hedging by "shorting" a nominal position of 1 ETH in a perpetual contract. This strategy offsets the exposure of collateral value to market fluctuations. Therefore, regardless of how the ETH market price changes, the value of the collateral remains stable.

Additionally, USDe's revenue consists of two main parts: staking revenue, derived from ETH staking; and revenue from the delta hedging derivative position. The second part is further divided into two parts: 1) revenue from funding rates, i.e., periodic payments between long and short positions on CEX; and 2) revenue from basis spread, i.e., profits generated from price differences between the spot market and futures contracts. According to historical data analysis by Ethena, this revenue combination remains positive even during market downturns (such as the Terra event and FTX event).

Security Risks

- Centralization Risk

The primary security issue arises from the reliance on CEX for delta hedging and off-exchange custody. We refer to this issue as centralization risk. This dependency creates a vulnerability, as any disruption to these exchanges—whether due to operational issues or bank runs—could jeopardize the stability of the stablecoin. Although the collateral is distributed across multiple exchanges, over 90% of the collateral is still concentrated in three major exchanges: Binance, OKX, and Bybit.

- Market Risk

Furthermore, market risk cannot be overlooked. The revenue mechanism of USDe may encounter persistently negative funding rates, which could turn certain parts of Ethena's revenue design into negative values. Although historical data indicates that these periods of negative revenue are relatively short (less than two weeks), the possibility of long-term adverse conditions in the future must be considered. Therefore, adequate measures should always be prepared, such as sufficient reserve funds, to address these challenging periods.

Conclusion

In conclusion, stablecoins provide stability in market fluctuations and facilitate transactions, playing a crucial role in the cryptocurrency ecosystem. The classification of stablecoins, from fiat-collateralized to algorithmic mechanisms like Ethena USDe, and to RWA-backed stablecoins like Ondo, meets various needs in the crypto community, but also presents risks such as collateral transparency, value fluctuations, and smart contract vulnerabilities.

As Ethena Labs continues to improve and innovate USDe, a key question arises: Can USDe maintain stability in market fluctuations and avoid experiencing a collapse similar to Luna's? The underlying assets and economic model design of USDe are vastly different from Luna, but close attention should also be paid to whether USDe can truly maintain stability and potentially take a leading position in the competitive stablecoin field.

The substantial market value and influence of stablecoins compel us to pay attention to their security risks. Continuous security audits and monitoring are indispensable for maintaining market stability and trust.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。