For blockchain networks, income and profit data reveal their economic performance and potential growth opportunities.

Author: @BanklessHQ

Translation: Plain Blockchain

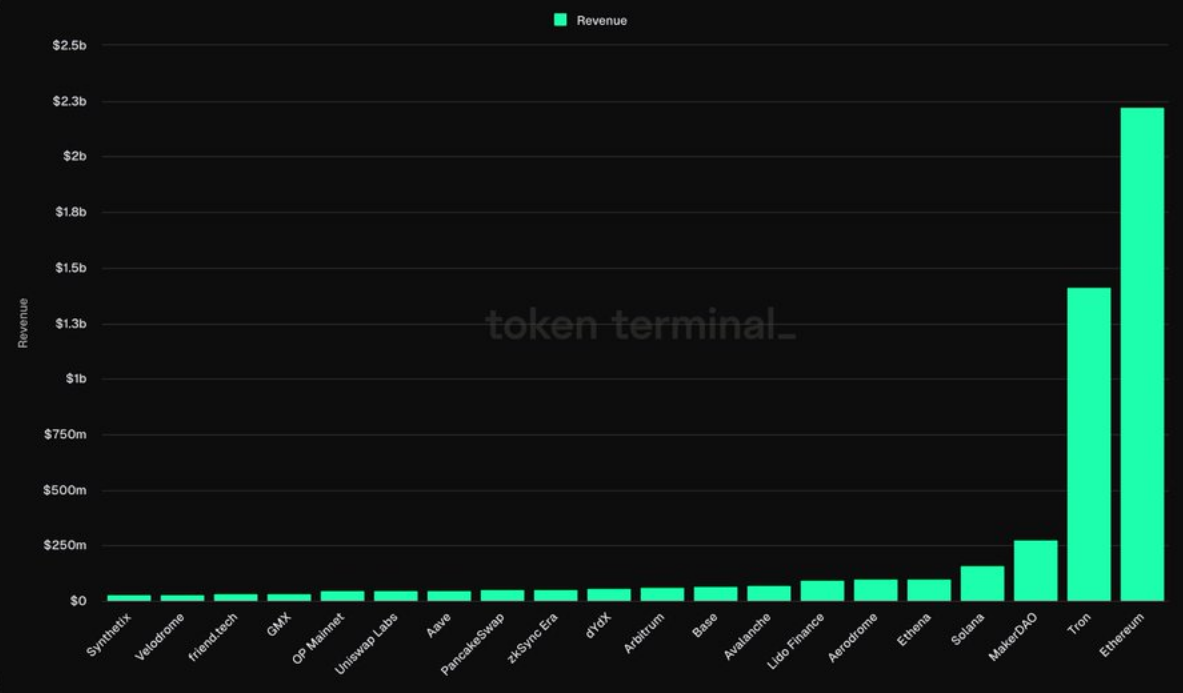

The above figure shows the data supporting the most income-generating L1 and L2 networks. Today, we will explore the top four L1 and L2 networks ranked by income and analyze how much income these blockchains actually retain.

In this article, we define income as: Total income minus token issuance.

1. Which L1 blockchains are profitable?

1) Ethereum

In terms of income, @Ethereum is far ahead of all other blockchains, including L1 and L2, with income reaching $2.2 billion in the past year.

However, despite substantial income, Ethereum recorded a net loss of $15 million.

What's going on? This loss is mainly due to the issuance of new tokens outpacing income, resulting in negative growth since the second half of 2023, following a strong performance in income. This can largely be attributed to the migration of transaction activity to L2, reducing fees directly paid to this global computer. Therefore, despite a large volume of transactions and network activity, this migration has led to a decrease in Ethereum's income.

2) Tron

The relatively unknown giant @trondao ranks second in total income, with income reaching $1.4 billion in the past year.

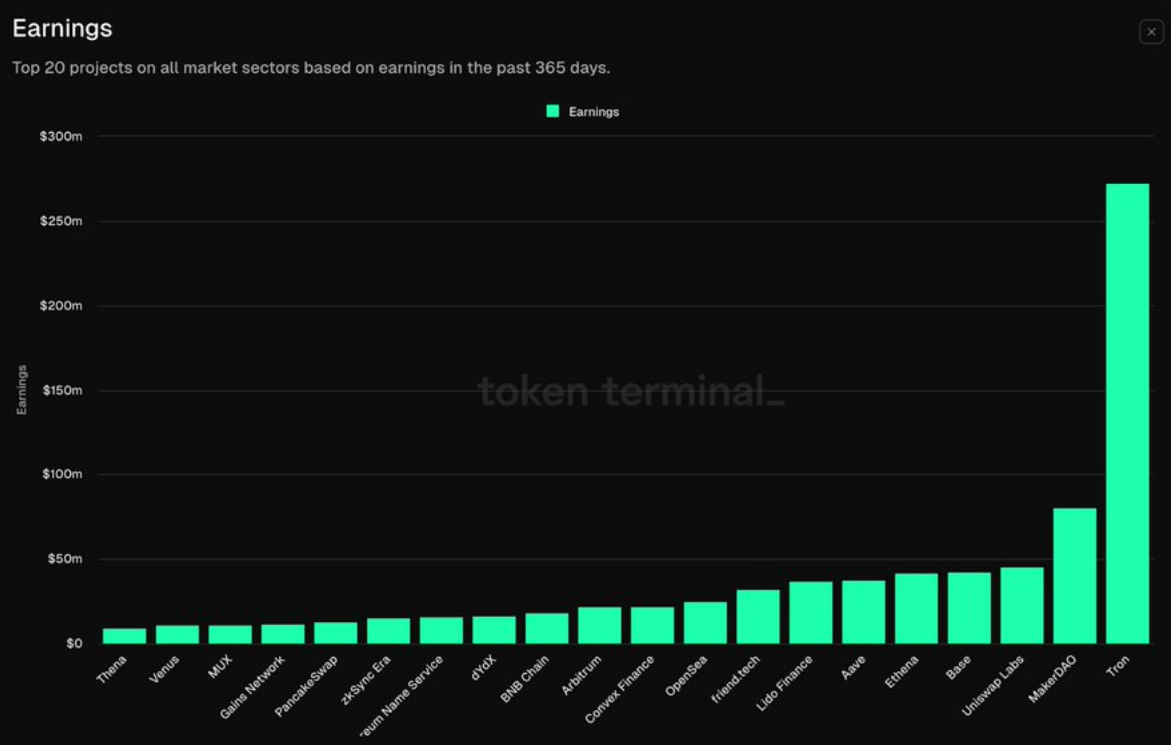

Tron's success is directly attributed to its extensive stablecoin activity on the network, ranking second only to Ethereum in stablecoin quantity. This is particularly significant as it is widely used in developing economies such as Argentina, Turkey, and high-inflation African countries. While some may label it as a "one-trick pony," this "trick" translated into $271 million in income over the past year, making it the most profitable blockchain to date.

3) Solana

@solana is also one of the top-ranked protocols in terms of income, with income reaching $157 million in the past year.

Solana's popularity stems from its status as a hub for meme coins, capital growth from airdrops, technical upgrades addressing spam issues, and support for leading trends such as artificial intelligence, all contributing to its significant attention and strong income in this cycle. However, this growth has not translated into actual income. Considering the tokens issued to stakers and operational costs, Solana recorded a massive net loss of $2.53 billion over the past four complete quarters, completely offsetting its income, leaving it deeply in the red.

4) Avalanche

L1 @avax, with its own meme coin fund, ranks fourth with an income of $69 million.

Avalanche is known for its subnets expansion solution and focus on gaming, and its upcoming major upgrade ACP-77 will improve subnet deployment and management experience, potentially increasing income. Nevertheless, the chain still faced a net loss of $86.06 million in the past year, mainly due to token issuance and operational costs, indicating a long road ahead.

2. Which L2 blockchains are profitable?

1) Base

Despite being less than a year old, L2 Base, launched by Coinbase, has quickly emerged with an income of $66.6 million through OP Stack.

Notably, @base successfully retained 63% of this income, earning a net $42 million during the same period. This success can be attributed to two key factors:

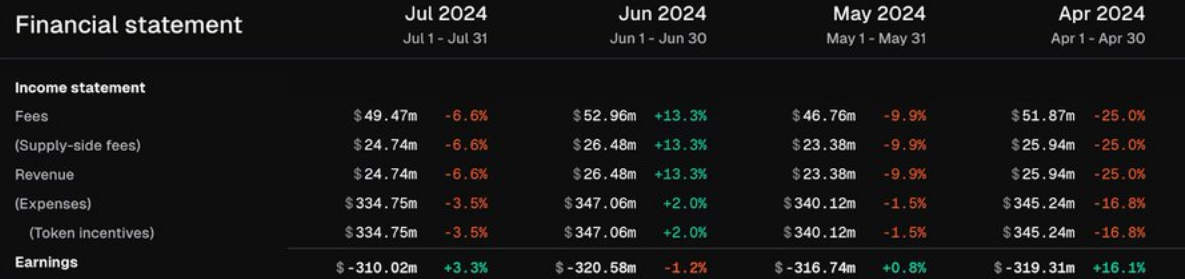

First, Base introduced blob through EIP-4844, significantly reducing costs, decreasing from $9.34 million in the first quarter of 2024 to $699,000 in the second quarter of 2024.

- Secondly, Base does not have a native token, making it more competitive and avoiding distribution-related costs faced by other L2s.

2) Arbitrum

Arbitrum, with the largest Total Value Locked (TVL) in L2, has generated $61.14 million in income over the past year.

As a hub for DeFi, leading DeFi protocols such as @GMXIO and @pendlefi have settled on @arbitrum, and its SDK also provides primary infrastructure for L3s such as @SankoGameCorp, @degentokenbase, and @XAI_GAMES. While income has not reached the level of Base, Arbitrum achieved $21.8 million in income over the past year, especially with an outstanding performance in the second quarter, when its fees dropped to just $613,000, compared to $20 million in the first quarter.

4) zkSync Era

As one of the leading zero-knowledge (ZK) technology-driven L2s, @zksync Era has generated $53.3 million in income over the past year.

Since the airdrop in June 2023, the network's TVL has significantly increased, adding approximately $850 million in value to the chain through ZK technology, although this amount gradually decreased as users sold airdropped tokens. However, the chain remains profitable, earning $15.3 million in net income over the past year and $17.5 million over the past four complete quarters. Despite ranking only eighth in L2, zkSync's profitability makes it the third most profitable L2.

5) OP Mainnet

As the core of Superchain, @Optimism has generated $44.6 million in income over the past year through sorting fees on its main chain and projects such as @zora and Base within the network.

In the second quarter of 2024, Optimism network activity reached record levels. The daily active addresses grew to 121.6K, a 37% increase, and despite a sluggish market, the daily trading volume also increased to 601K, a 28% increase. Like other L2s, EIP-4844 contributed significantly to this growth, as the reduction in fees increased network activity, leading to Optimism's net profit growing by over 150%.

However, Optimism is still deeply in the red, suffering a net loss of $239 million over the past year due to retroactive airdrops, incentive programs, and operational costs.

3. Narrative and Fundamentals

When analyzing this data, please remember that, just like in traditional finance (TradFi), profitability only tells part of the story. No one bets trillions based on Nvidia's current financials, but the narrative behind it drives its growth.

For cryptocurrency buyers, narrative-based investments are often the default choice, seeking outsized returns when engaging in high-risk operations. However, it is still important to remember that some networks have built substantial businesses on today's activities.

A deeper exploration of the income and profits of top L1 and L2 networks can provide a deeper understanding of the fundamental health of these networks and their position in the competitive landscape.

Original article link: https://www.hellobtc.com/kp/du/08/5334.html

Source: https://x.com/BanklessHQ/status/1819044375944442343

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。