Author: Frank, PANews

Solana has recently been leading in various dimensions of data. Previously, PANews introduced the rapid development and pattern of its ecological liquidity pledge track. In addition to these front-end projects, the validators behind Solana have always seemed relatively mysterious. How much can validators earn on Solana? What level of investment is required? PANews has conducted some research on this business.

Solana adopts a consensus mechanism that combines Proof of History (PoH) and Proof of Stake (PoS). Token holders can stake their tokens to the validators of their choice. The more staked tokens a validator has, the higher the proportion of blocks they lead, and stakers can also receive block rewards in proportion.

Typically, validators can decide to charge stakers a commission of 8% to 10%. Those who choose not to charge a commission and have a more stable network are more favored by stakers.

There are two types of validation nodes on Solana: those that participate in voting and accounting, and RPC nodes. RPC nodes can provide data access interfaces for developers and applications, with lower configuration requirements. However, RPC nodes do not directly participate in network validation and therefore cannot receive block rewards.

Compared to RPC nodes, validation nodes have higher hardware requirements for bandwidth speed, memory, and storage. Therefore, they are generally deployed in data centers around the world and are not easily accessible to ordinary users.

Minimum cost of $60,000 per year

Specifically, the main costs for validators are as follows.

Hardware:

Hardware costs are one of the biggest costs for becoming a Solana validator. The recommended configuration by the Solana official is a 12-core/24-thread CPU, 256GB/512GB of memory, and over 1TB of disk space. This configuration far exceeds that of a typical home computer, especially in terms of memory, with the price of this item alone generally exceeding tens of thousands of dollars. In addition, a stable 1GB transfer bandwidth is also required. Therefore, most validators choose to rent servers. According to Helius's article, the rental cost is between $370 and $470. The annual cost is approximately between $4,500 and $5,600.

The cost of bandwidth often depends on the amount staked. The more times a validator leads blocks, the higher the cost of bandwidth.

On-chain voting:

Solana requires on-chain voting to reach consensus, and the transaction fees generated by these voting transactions are the same as other transactions on the network. In each epoch (432,000 slots), validators need to vote, and the price of each voting transaction is 0.000005 SOL (voting is a privilege and does not have associated priority fees). This translates to a total cost of approximately 2-3 SOL per epoch. Given that an epoch usually spans 2 to 3 days (generally close to 2 days), the annual cost of voting transactions is approximately 300-350 SOL, equivalent to about $54,600 to $63,700 at the current price of $182. When SOL prices are higher, this cost usually becomes one of the largest costs.

In summary, the minimum annual cost on Solana is approximately $60,000. This level of investment is not small for ordinary users, and it does not include the cost of server maintenance and other expenses.

Profitability may be negative

Although the investment is not small, what about the income for validators?

Solana validators' income comes from several parts: inflation income, block rewards, and MEV.

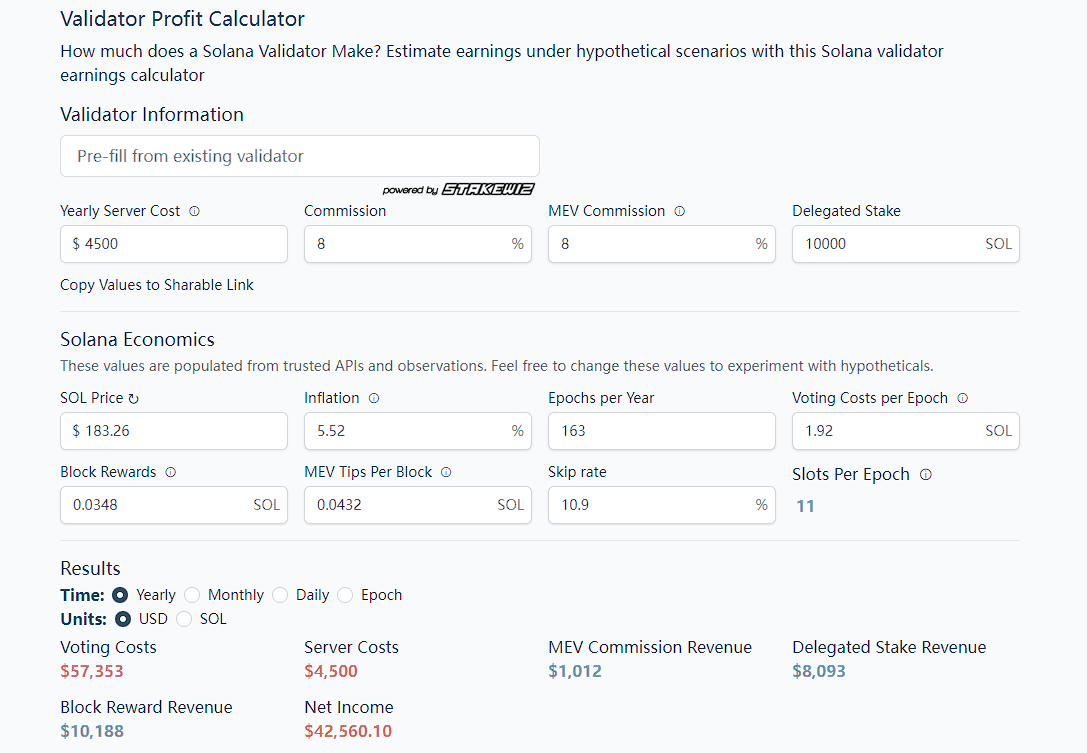

Inflation income: Inflation income is the SOL token reward obtained by participating validators. The initial inflation rate of SOL tokens was set at 8%, and then reduced by 15% each year. The validator's inflation income is also related to the overall staking ratio of the network. The lower the overall staking ratio, the higher the validator's staking income. The current comprehensive inflation income is 5.52%. Based on the general 8% commission charged by validators, staking 10,000 SOL tokens currently yields approximately $8,000 in staking income per year.

Block rewards: Each validator has a certain probability of becoming a block leader, and the number of times they are elected also depends on the amount of staked SOL. For example, with a stake of 10,000 SOL, the number of times elected per epoch (generally 2 days) is approximately 11 times. The annual income from this part is approximately 52 SOL (the current average block reward is approximately 0.0332 SOL), equivalent to about $9,400.

MEV rewards: MEV refers to "Maximal Extractable Value," which refers to the profit obtained by validators through the ability to include, exclude, or reorder transactions in the blocks they generate. On Solana, validators designated as leaders can fully control the packing and scheduling of blocks. Searchers can send bundled packages to leaders through an off-chain auction mechanism to be included in blocks, while paying a certain fee. If a validator runs the Jito-Solana client, they can receive this part of the profit. However, this income also depends on being elected as a leader multiple times. Currently, the average MEV reward per block is approximately 0.0427 SOL. In the Jito client, this income is generally shared with stakers. Calculated based on an 8% commission charged by validators, the income from staking 10,000 SOL tokens in this part is approximately $970 per year.

Based on this calculation, if the staked amount is only 10,000 SOL, the annual comprehensive cost is at least $60,000, while the income is approximately $18,370, resulting in a loss of $41,630. It seems to be a trade that only results in losses.

However, the main reason for this loss is the insufficient staking of SOL. If the staked amount of SOL tokens is increased to over 32,300, the loss can be turned into a profit.

Currently, there are 2,724 validation nodes on Solana, with 857 validators having staked amounts reaching 32,300 SOL. According to this calculation, the remaining over a thousand validators are operating at a loss. However, the Solana Foundation also has related support plans. For new validators, those who enter the Delegation Program and have a total staked amount of less than 100,000 SOL will receive a 1:1 match for staking SOL. However, based on this, validators still need to strive for a minimum of 15,000 SOL in staking. If they have to stake from their own pockets, this investment is currently no less than $2.73 million.

The maximum validator income reaches $14 million

For mature validators, their income is already a substantial profit. Take Helius, who has just become the largest validator, for example. Currently, the staked amount of tokens entrusted to Helius is 13 million SOL. Helius does not charge any inflation or MEV commission, and this part of the income is fully returned to stakers. In this case, Helius's block rewards will reach $14.05 million per year. If Helius also charges an 8% commission, the income will increase by another $14 million. Perhaps it is by giving up this part of the income that Helius has attracted more stakers to stake their tokens with them.

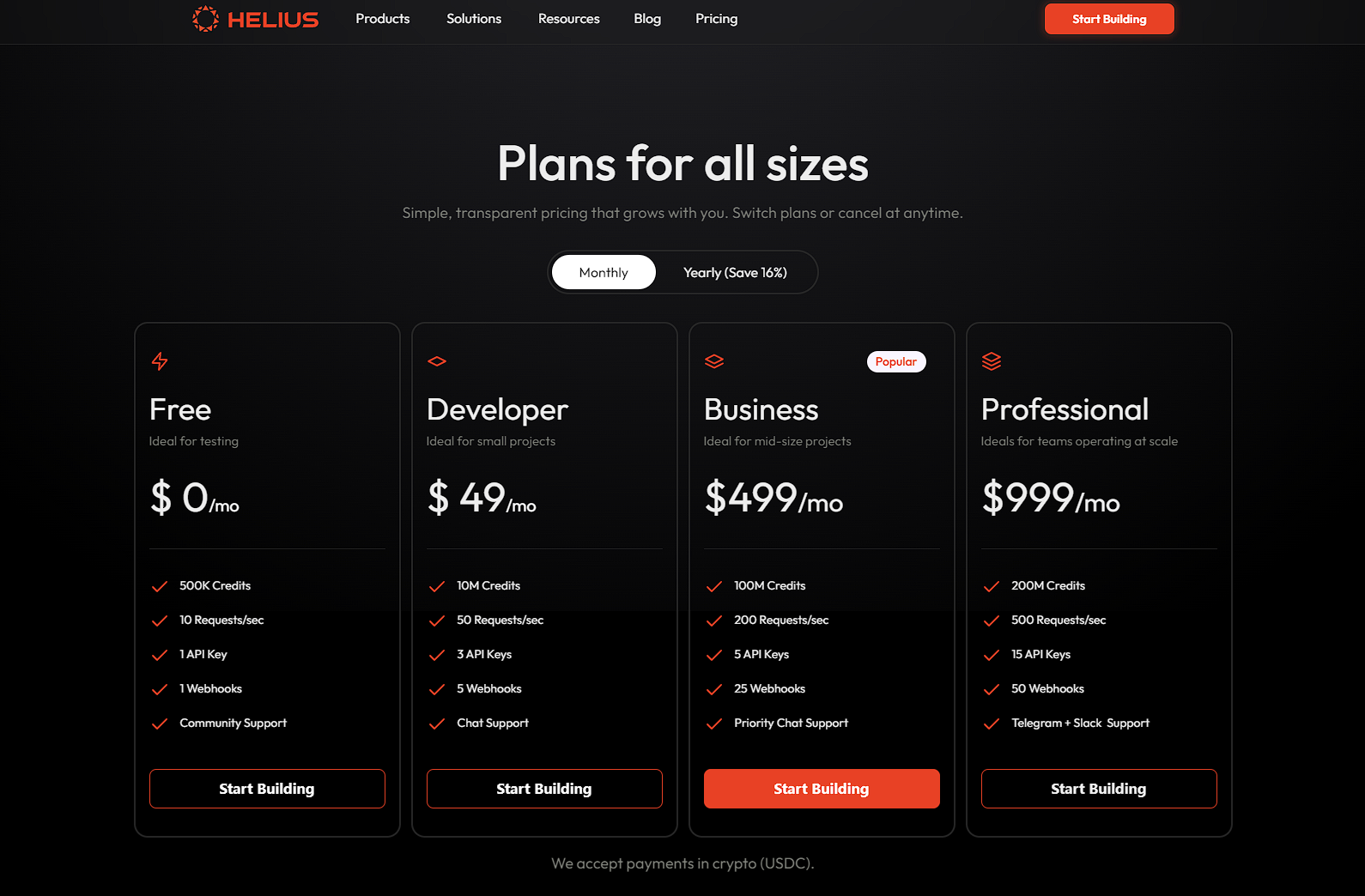

Moreover, large validators like Helius do not rely solely on block rewards for their business. Helius also generates income by providing RPC node services and API access. The current subscription standards range from $49 to $999 per month, and Helius has become one of the main RPC service providers in the Solana ecosystem.

Difficult to profit solely from staking

For users who stake their tokens with these validators, they typically receive an annualized return of between 6% and 8%. However, this stable income is not guaranteed, and they often face the risk of a decline in SOL token value, penalties for unstable validator servers, and the risk of individual malicious validators quietly increasing their commission rate to 100%. However, based on the data, the staking ratio on the Solana chain is approximately 65.7%, which is leading among public chains. It seems that staking has become the collective choice of SOL token holders. However, this investment strategy is only viable in a market with an expectation of rising SOL token prices. If the cost of holding SOL tokens is too high, it is easy to wipe out all profits and turn them into losses in a downturn.

Overall, both in terms of financial reserves and technical complexity, there is a certain threshold for validator income on Solana. However, for those who have a certain appeal and financial strength within the ecosystem, becoming a validator is indeed a relatively stable source of income. However, the high threshold has also led to increasing concerns about Solana becoming more centralized or being monopolized by a small group. For ordinary users, relying solely on staking and sharing MEV rewards is also difficult to be a reasonable means of resisting asset volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。