Michael Saylor, the pro-bitcoin executive chairman of Microstrategy (Nasdaq: MSTR), discussed his BTC price prediction at the recent Bitcoin conference in Nashville, Tennessee.

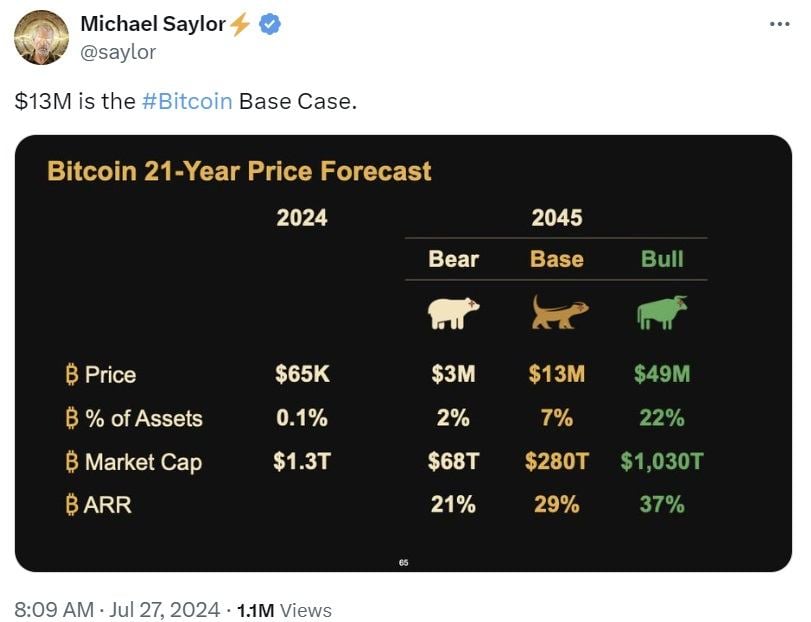

“Here’s my macro bitcoin forecast: 21 years, going out to the year 2045,” he said at the conference, showing a chart that he later shared on social media platform X on Saturday. He explained that by 2045, his base case for bitcoin’s price is $13 million while the bear case is $3 million and the bull case is $49 million.

The Microstrategy executive chairman highlighted the importance of Bitcoin in revolutionizing the global economy by replacing outdated 20th-century financial and physical assets with digital capital. He underscored bitcoin’s durability, immune to inflation, entropy, and other devaluation factors affecting traditional assets. Saylor advocates for adopting bitcoin as a primary treasury asset for individuals, corporations, and nations, emphasizing the potential for significant wealth accumulation and economic stability.

The Nasdaq-listed software development company has branded itself as the first bitcoin development company. In June, Microstrategy disclosed that its bitcoin holdings had grown to 226,331 BTC, valued at $8.33 billion.

Saylor argues that the U.S. government should hold the majority of the world’s bitcoin to strengthen the U.S. dollar, likening BTC to a critical future asset similar to historic acquisitions. He emphasized that the future of the country lies in cyberspace, with bitcoin being the “cyber Manhattan.” Drawing parallels, he noted the U.S. government’s significant gold reserves and land ownership.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。