Author: Alex Xu, Mint Ventures

Aave is one of the projects that the author has been paying close attention to for a long time. Yesterday, its governance team ACI released a draft of the new Aave economic model on the community forum, announcing expected upgrades to various aspects such as value capture of Aave tokens and protocol security modes. This article focuses on this influential proposal and mainly addresses the following 4 questions:

- What are the main contents of this proposal?

- Potential impacts of each main content

- Timetable and triggering conditions for the implementation of this proposal

- How this proposal may affect the price of Aave tokens in the medium to long term

Original proposal: [TEMP CHECK] AAVEnomics update

I. Core Content of the AAVEnomics Proposal

The full name of the proposal is [TEMP CHECK] AAVEnomics update, which is in the early stage of the community proposal, the "temperature check" stage, released 15 hours ago by ACI, who can be understood as the governance representative of the Aave official team. ACI is also the main brain and main coordinator of community governance. Their important proposals are generally communicated extensively with other governance representatives and professional service providers before they are released, so the probability is very high.

The main content of the [TEMP CHECK] AAVEnomics update is as follows:

1. Introduction of Aave's current good operating status and ample financial reserves

The project is in a leading position in the lending field, with income levels far exceeding project expenses, and the reserve funds are mostly in ETH and stablecoins, thus providing an opportunity to update the economic model and initiate protocol income distribution.

2. Bad debt handling mechanism update: The original "safety module" gradually exits the stage, and the new safety system Umbrella is launched

- Aave currently provides reserves for potential protocol bad debts, which is called the "safety module." This reserve is currently composed of three parts:

- Pledged Aave, currently valued at $275 million

- Pledged Aave native stablecoin GHO, currently valued at $60 million

- Pledged Aave-ETH LP, also a major source of on-chain liquidity for Aave, currently valued at $124 million

- The newly launched "Umbrella" safety system will replace the original safety module. Specifically:

- The bad debt reserve of the system will be managed by the new aToken module, the funds of which come from users' voluntary deposits. Users not only receive the original deposit interest income but also additional security subsidies, which come from Aave's protocol income.

3. New role of Aave tokens and initiation of protocol profit distribution

- The Aave pledge module still exists, but the pledged Aave no longer serves as a risk reserve fund, but has two functions:

- It can receive surplus profits beyond the funds needed for protocol operations, and the Aave financial team will repurchase Aave from the secondary market and distribute it to the pledgers through community governance proposals on a regular basis.

- Pledged Aave can obtain "Anti-GHO," which can be used to offset GHO stablecoin debts or directly pledged into the GHO pledge module, allowing Aave to also generate profits from GHO.

4. Changes to the GHO pledge module

The original GHO pledge module needed to guarantee the overall bad debts of the Aave protocol, but after the change, it only guarantees the bad debts of the GHO portion.

5. Others

- Aave token liquidity no longer depends on the Aave-ETH incentives in the pledge module, but is managed by the ALC (Aave Liquidity Committee).

- The conversion of the protocol's original token Lend to Aave will be terminated, and tokens not exchanged on time will be allocated to the treasury.

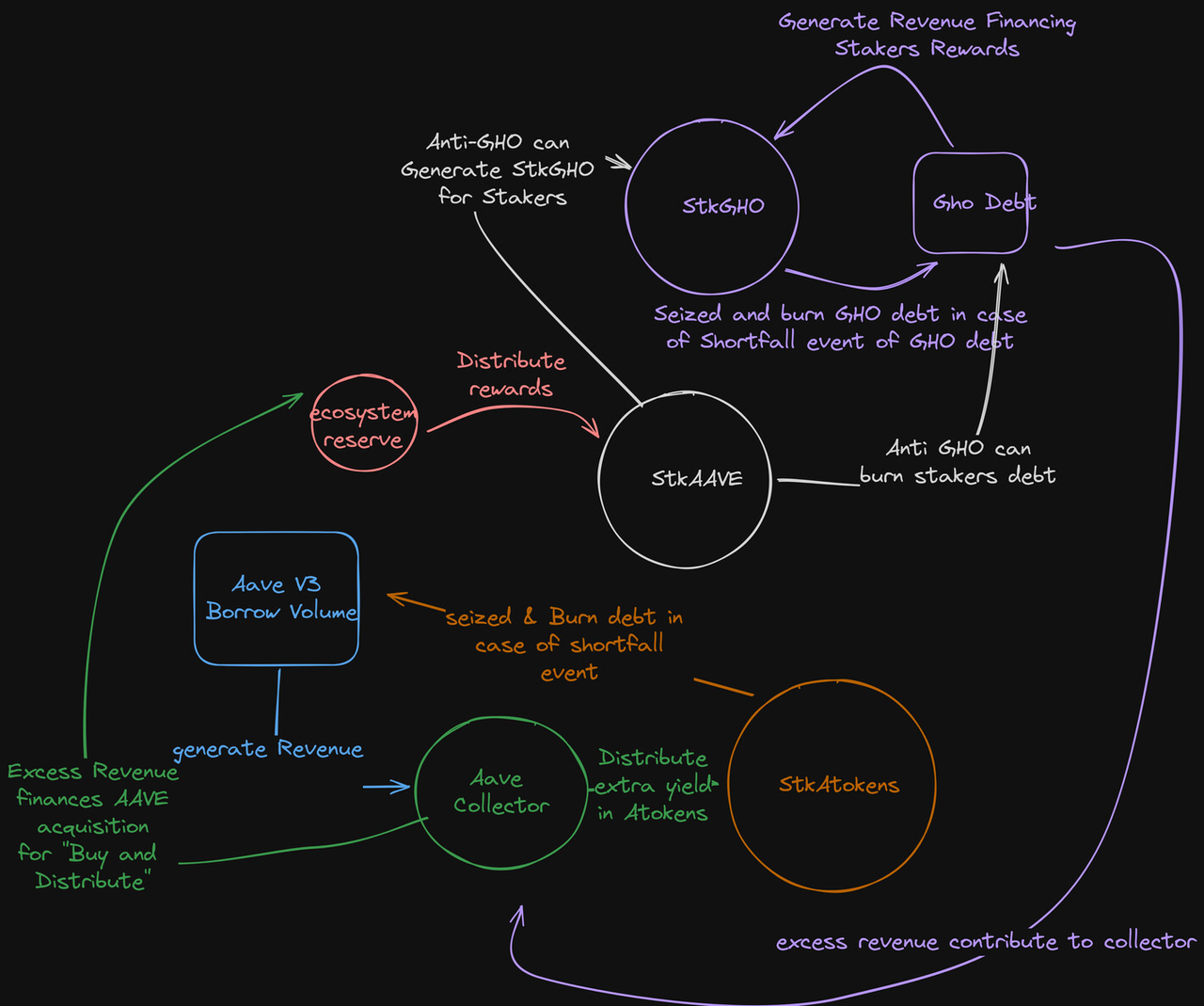

The relationship diagram of Aave's new economic model can be seen in the following link:

II. Impact of the Proposal Content

There are two main impacts:

- Aave tokens have a clearer value capture and further reduced selling pressure, further linked to the protocol's good development

- Value capture comes from: repurchase of protocol interest income + feedback of GHO interest income

- Reduced selling pressure comes from: the cessation of the pledge module, which also means that Aave will use stablecoins and ETH from protocol income as expenditure tokens, replacing the production of Aave tokens, which will directly reduce the selling pressure of Aave and make Aave more scarce.

- The introduction of the Umbrella safety module makes the structure of the protocol more flexible, further optimizing protocol incentives, raising the upper limit of governance on protocol security, and proposing higher governance requirements

- The original Aave safety module relied solely on Aave emissions for incentives, with little flexibility. The Umbrella safety module is similar to Eigenlayer's AVS model, a modular, customizable incentive module based on asset category, time, and capacity.

- This also means that Aave's risk team, in addition to asset size, interest rate curve, LTV, and other risk indicators, has another indicator to evaluate and formulate.

III. Timetable and Preconditions for the Implementation of the Proposal

ACI stated that the implementation of the proposal will be carried out gradually in three stages (three governance proposals) based on different preconditions.

Stage One: Changes to the pledge mechanism and GHO mechanism

- GHO pledge is only responsible for guaranteeing the bad debts of the GHO debt portion

- Aave and Aave-ETH pledge modules are changed to "legacy safety modules" and continue to play a guarantee role before being replaced, with a cooling-off period set to 0 for Aave pledges

Preconditions: Met

Execution time: This proposal has obtained sufficient community feedback, and the main community developer of Aave, BGD Labs, has approved the Umbrella upgrade.

Stage Two: Update of Aave token functions, gradual launch of the new economic model

- End the function of pledging Aave to obtain GHO interest discounts

- Launch of the Anti-GHO function, pledging Aave can obtain Anti-GHO

- Terminate the exchange of Lend for Aave

Preconditions:

- GHO scale reaches $175 million (currently around $100 million)

- Secondary liquidity of GHO can reach "a trading volume of $10 million has less than 1% impact on the price." Currently, a trading volume of around $2.1 million has an impact of 1% on the price of GHO.

Stage Three: Activation of Aave fee switch, initiation of buyback

- Close the traditional safety module

- Activate the aToken mode of the Umbrella safety module, where users can provide collateral for the system with their deposits and receive additional rewards

- Aave's financial service provider will initiate Aave's buyback and distribute it to Aave pledgers through governance and gradually achieve automation

Preconditions:

- The average net asset value of Aave's income pool in the past 30 days is sufficient to cover the expenses of existing service providers for 2 years

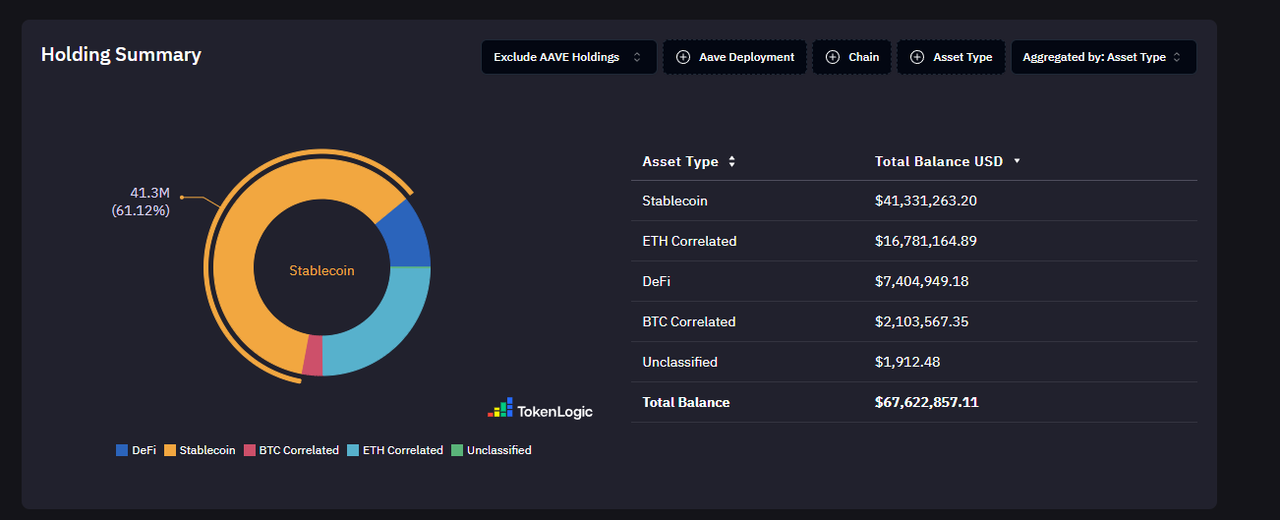

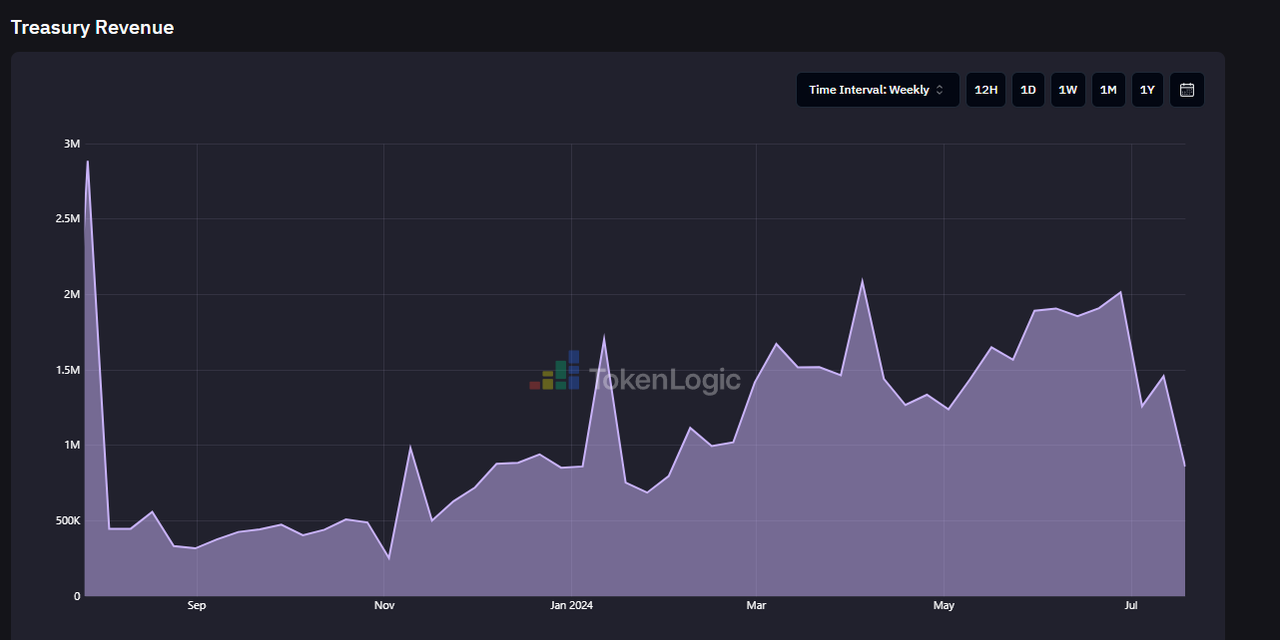

*Currently, the total assets in Aave's treasury excluding Aave tokens are approximately $67 million (61% in stablecoins, 25% in Ethereum, 3% in BTC), and Aave's annual expenses in 2024 are approximately $35 million (data provided by ACI). If the expense level in 2025 is similar, the expenses for two years would be $70 million. Considering that Aave's weekly income this year has been around $1-2 million, the two are already quite close, and it will take about a month to reach that level.

Composition of Aave's treasury funds, source: https://aave.tokenlogic.xyz/treasury

Composition of Aave's treasury funds, source: https://aave.tokenlogic.xyz/treasury

Aave's protocol income, source: https://aave.tokenlogic.xyz/revenue

Aave's protocol income, source: https://aave.tokenlogic.xyz/revenue

- Aave's protocol annualized income in the past 90 days has reached 150% of all protocol expenses since the beginning of the year, including the AAVE buyback budget and umbrella safety module expenses.

*The budget is defined, allocated, and adjusted quarterly by Aave Finance service providers.

Overall, Phase One is already ready for launch, Phase Two is expected to take a few more months (depending on the liquidity committee's budget and commitment to GHO liquidity), and the timing of Phase Three's launch is difficult to predict, as it is influenced by specific budget plans, market conditions, and income. However, considering Aave's strong income level at the moment, meeting the criteria should not be too difficult.

IV. How Will This Proposal Impact the Price of Aave Tokens in the Medium to Long Term

In the long run, this proposal explicitly links the development of the Aave protocol with Aave tokens for the first time. The lower limit of Aave tokens has a buyback support, and holders have cash flow income, which is beneficial for the price of Aave.

However, considering that the implementation of this proposal will take time and will be carried out in stages, and the proposal was just released less than a day ago, specific terms still need to be discussed and modified. Therefore, the value capture of Aave tokens is a gradual and long-term process.

If the proposal is successfully implemented, as one of the largest DeFi projects, Aave's standardized and transparent governance, and its support for token holders may further attract the favor of value investors. These investors may come not only from the cryptocurrency industry but also from Web3 newcomers from traditional finance backgrounds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。