Author: Balaji Srinivasan, former CTO of Coinbase

Translation: 0xjs, Golden Finance

No election can repay the US's $175 trillion debt. Only the printing press can.

Because as Musk, Dalio, and others have realized… the Western world is heading towards a sovereign debt crisis more severe than 2008. Just as they have been lying about Biden's senility, they are also lying about the state of the economy. So they will print a lot of money.

Look at the data, and you can judge for yourself.

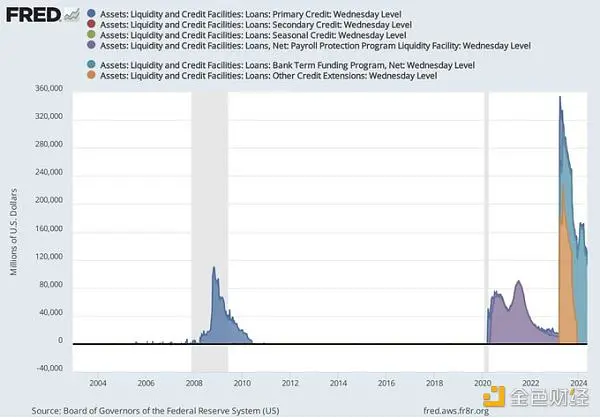

1. Emergency loans exceed 2008 levels

First, did you know that the emergency loans issued by the Federal Reserve in 2023 exceed those during the 2008 financial crisis? Due to the US government first selling tens of billions of dollars in bonds to financial institutions, and then devaluing them through unexpected rate hikes, the banking system was able to survive.

Just look at this chart from the Federal Reserve. The blue protrusion at the bottom left is the loans during the 2008 crisis. The purple represents COVID. The giant orange/blue-green monster on the right represents the banking crisis in 2023. See how much higher it is compared to 2008?

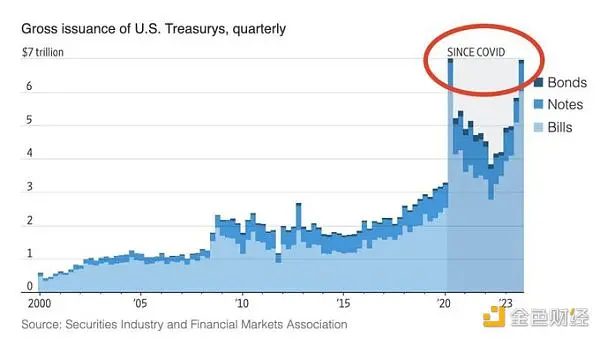

2. Borrowing exceeds the COVID-19 period

Second, did you know? During the "Biden prosperity" period, the US borrowing exceeded that during the COVID-19 period? Let's not even discuss whether the COVID-19 period should be considered a financial crisis. At least the borrowing rate during the COVID-19 period was around 0%. But now, the US government has borrowed historic amounts of money during peacetime… and at a rate as high as 5%! This is the behavior of a desperate person maxing out their credit card.

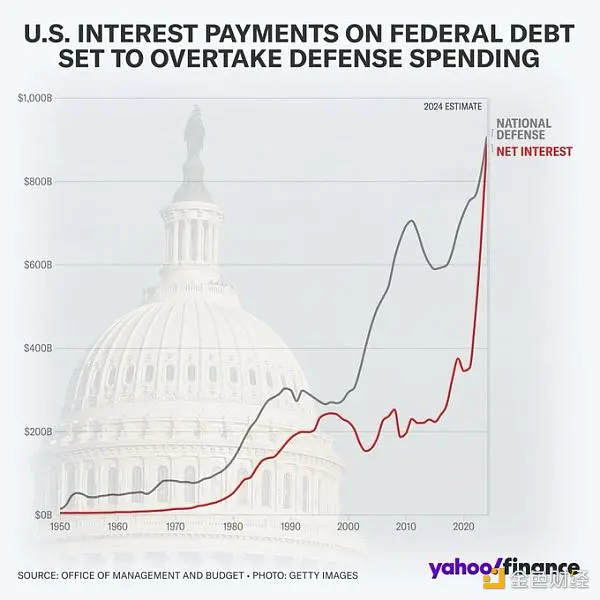

3. Interest payments exceed defense spending

Third, did you know that all this borrowing has made interest payments on the national debt the government's largest single expenditure? Surpassing defense, social security, or any other expenditure. By 2024, the primary use of all tax revenue (and printed dollars) is to pay bondholders. Yet, in the past few years, anyone buying US bonds (or other bonds) has almost disappeared. It's payback time for all the wars and all the welfare. The time to pay is now.

4. Further devaluation of the US dollar

Fourth, did you know that the US dollar has devalued by at least 25% in just four years? You may have experienced this firsthand through inflation. But Larry Summers estimates that the decline in purchasing power is even greater, reaching an annual average of 18% when factoring in the significant increase in loan repayments due to rising interest rates. Within four years, this devaluation figure will far exceed the 25% decline in the value of the US dollar.

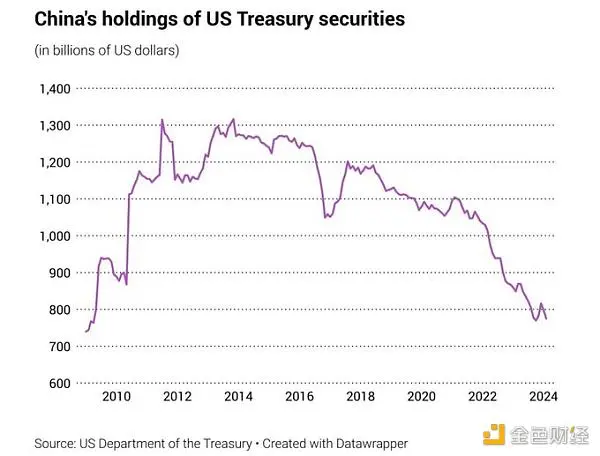

5. China further selling US Treasury bonds

Next, did you know that China (the largest foreign buyer of US Treasury bonds) has been accelerating the sale of US Treasury bonds? This is a bit technical, but China is an "external investor" in the US, much like a new venture capitalist investing in your tech company. Even if they only purchase 5% of your equity (or in this case, debt), they set the price for everyone else. And indicate strong external demand, which comes from those who don't have to buy. But now, external demand is collapsing:

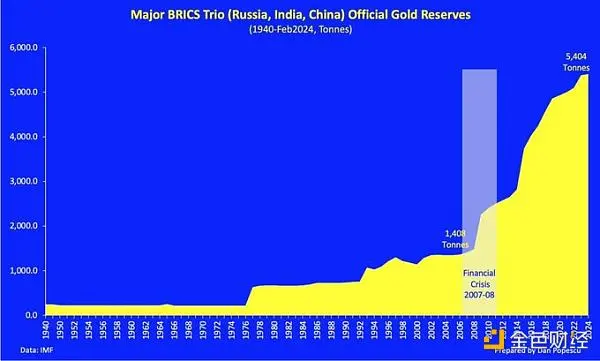

6. BRICS countries buying more gold

But isn't the US dollar a store of value? If not buying US Treasury bonds, what are other countries buying? China leads most countries outside the US. These countries have begun hoarding historic amounts of gold, while Western countries have been selling gold. Take a look:

7. De-dollarization more than ever

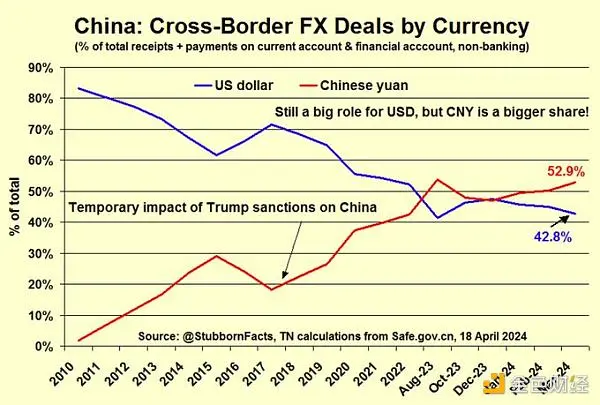

So, how about the US dollar as a medium of exchange? Well, China— if you didn't know, it's the top trading partner for most countries in the world— has just shifted to conducting cross-border foreign exchange transactions in renminbi.

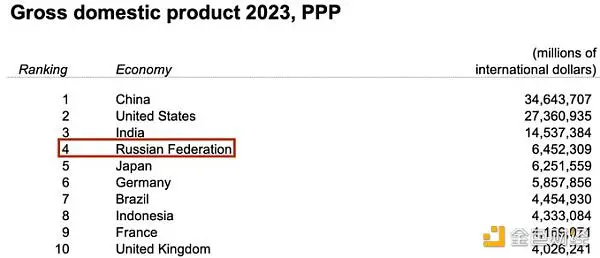

8. Sanctions less effective than ever

Well, can't the US dollar continue to be used as a weapon of sanctions? Don't other countries need access to the US financial system? In fact, they don't. All sanctions against Russia actually hurt Europe more than Russia. Europe needs Russia's oil and gas, but Russia has other customers. Therefore, according to World Bank data (not Russian sources!), Russia has just surpassed Japan to become the world's fourth-largest economy in terms of GDP at purchasing power parity.

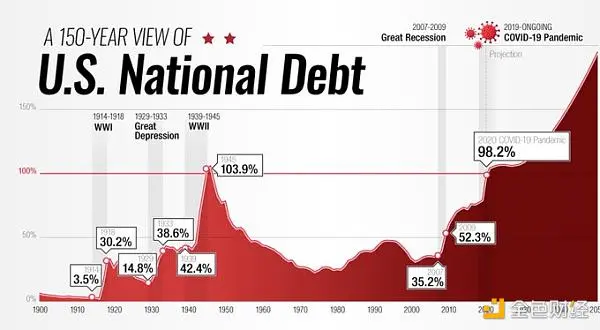

9. Peacetime debt approaching World War II levels

But what about the US military? Can't it eventually wage war to protect the US dollar? This is a long topic, but please look at the chart below. Today, the US is ostensibly in "peacetime." But its debt is comparable to that during World War II:

Similarly, this is another topic, but the US has neither the funds nor the manufacturing base to sustain continuous military action against opponents like China. You can't fight with your factories— especially when you're broke.

10. Real debt exceeds that of any empire in history

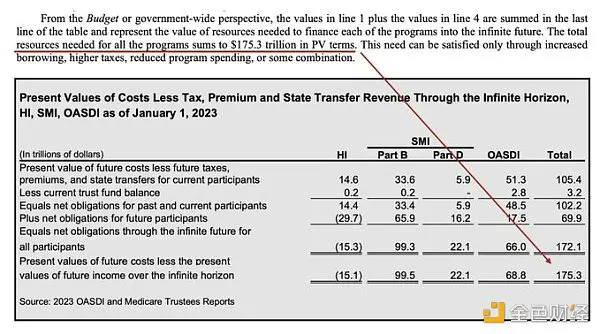

Finally, perhaps the most important figure in this entire topic is $175.3 trillion. When you consider all benefits such as social security and Medicare, this is actually the true debt of the US. And this figure itself is rapidly increasing. Don't take my word for it, believe the US government's financial report in February 2024:

The $175.3 trillion aligns with the approximately $200 trillion figure used by Druckenmiller, who considers all factors to represent the total liabilities of the US government. Of course, we are currently in the realm of monopoly money, because:

a) The entire federal government only had revenues of about $20 trillion last year

b) This figure itself is affected by deficit spending

c) Since 2020, the US dollar has actually declined by about 25%

d) If liquidated, the "177 trillion dollars" in asset value would plummet

e) …or if a financial crisis occurs, or both,

then the $175 trillion debt cannot be repaid. The US government has almost no money to repay its debts. It has made commitments to everyone (from allies to retirees) that it simply cannot fulfill. Continuing to wield power in this dereliction will become very bad, and most people cannot truly understand it.

The US dollar is becoming less important

In short: I haven't even started yet. I can show more charts and videos from bond, real estate, and tech investors from around the world who see what's happening.

But if you're honest, the status of the US dollar is rapidly declining. It is no longer the indispensable asset it once was. In summary:

a) China doesn't need the US dollar for trade, they use the renminbi instead of the US dollar.

b) BRICS countries don't need the US dollar for savings, they buy gold instead of US Treasury bonds.

c) Russia doesn't need the US dollar to survive, it is the fourth-largest economy excluded from the US economy.

d) However, the US needs as many countries as possible to accept the US dollar, because its borrowing levels exceed those of the COVID-19 period, World War II, and any empire in history.

So, what will happen next? I have some ideas, but first we need to agree on what is happening.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。