Original Author: 思维怪怪

As Bitcoin has recently emerged from a downtrend, the decentralized AI sector has also begun to show signs of recovery.

According to CoinGecko data, the overall market value of decentralized AI rose by 17.7% last week, reaching $30.7 billion.

In addition to the overall market recovery, decentralized AI is also expected to benefit from the following potential positive factors:

· Trump's deputy Vance supports open-source AI: On July 16, former U.S. President Donald Trump announced the selection of Ohio Senator J.D. Vance as his running mate for the 2024 presidential election. Vance, a strong supporter of the cryptocurrency industry and a proponent of artificial intelligence development, may bring about favorable policies if he is successfully elected as the next Vice President of the United States.

· Grayscale Decentralized AI Fund: On July 17, Grayscale announced the launch of the Grayscale Decentralized AI Fund LLC. Mainstream investors can now gain exposure to decentralized AI projects through the purchase of traditional securities. The emergence of such funds may attract more capital and attention to the decentralized AI field, driving the development of the entire industry. Currently, the fund's token basket includes Bittensor ($TAO), Filecoin ($FIL), Livepeer ($LPT), Near ($NEAR), and Render ($RNDR).

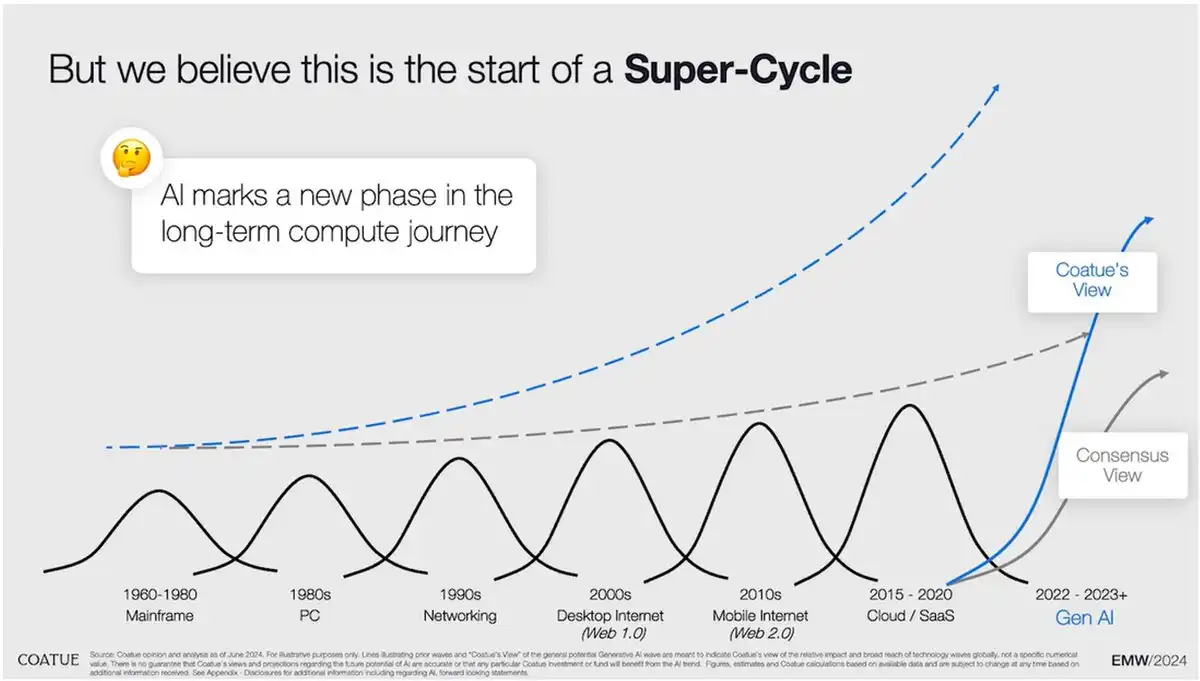

· The super cycle of AI: Hedge fund Coatue has always had a better understanding of macro and cyclical trends than its peers. In this year's Investor Deck, they firmly believe that AI may trigger a growth curve larger and steeper than any previous cycle, known as the "super cycle." On July 17, Anthropic, the developer of the Claude chatbot, completed a round of financing of over $750 million. On July 18, OpenAI announced the launch of the new artificial intelligence model GPT-4o mini. Every major news release from the traditional AI industry is adding fuel to the narrative of decentralized AI.

Although decentralized AI has emerged this year, it has not yet gained recognition from mainstream centralized exchanges. Binance has only listed the leading project Bittensor in the decentralized AI sector this year. Many good decentralized AI targets have relatively small market values, so it is currently more convenient to purchase them on the chain. BlockBeats has compiled some small-cap decentralized AI projects that have shown good rebound momentum and sparked community discussions recently. Readers are advised to keep an eye on them in the future:

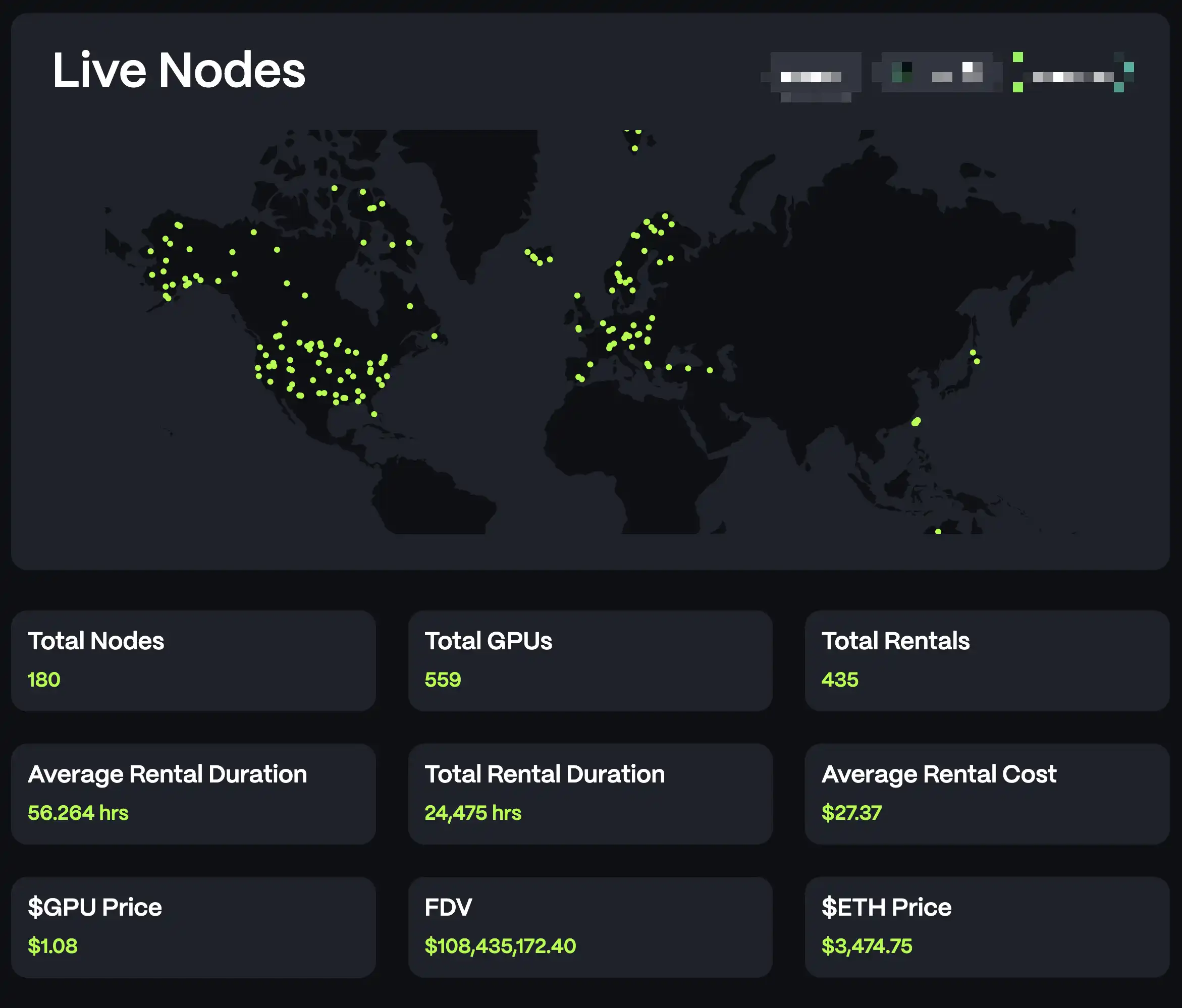

Node AI ($GPU)

Price: $1.09, 7-day increase of 76.4%

Market value: $108 million

Node AI is a GPU computing power leasing project on Ethereum. The platform currently has 567 GPUs with a total leasing duration of 24,000 hours. $GPU holders can share the platform's leasing income by staking tokens. Node AI is building an L1 blockchain designed for task allocation between nodes. It is worth noting that Node AI is a community project with fair launch, and the team's operations rely on trading fees (5% buy/sell tax) and income generated from GPU leasing. On June 22, Node AI ($GPU) was listed on MEXC.

Virtuals Protocol ($VIRTUAL)

Price: $0.06, 7-day increase of 87.5%

Market value: $61.55 million

Virtuals Protocol is an AI agent protocol on the Base chain, aiming to provide seamless plug-and-play AI agent solutions for game developers. The project previously launched an Audio-to-Animation (A2A) subnet on Bittensor, which may have been removed by Bittensor due to the poor quality of the generated content, but this does not necessarily mean the project is not viable.

In addition to the regular business of building better AI agents and collaborating with more games, Virtuals Protocol also plans to launch two noteworthy projects: Simulation World and Initial Agent Offering (IAO).

The concept of Simulation World is to enable on-chain AI autonomous trading. To this end, Virtuals Protocol recently released 100 free AI Land for casting. There are currently no more details revealed, but it looks very imaginative.

IAO is an innovation that combines Ora Protocol's IMO and Bittensor's Dynamic TAO. Under the IAO mechanism, anyone can create a new AI agent by locking 50,000 $VIRTUAL tokens and receive the initial shares of this new AI agent ($agent tokens). Others can improve the AI agent by making contributions to earn $agent tokens and share the income generated by this new AI agent. In addition, LPs of the top three $agent token pools can receive $VIRTUAL token emissions from the Virtuals Protocol treasury.

Qubic ($QUBIC)

Price: $0.0000024, 7-day increase of 46%

Market value: $261 million

Qubic is an AI public chain that uses the UPoW (Useful Proof of Work) consensus mechanism, initiated by Sergey Ivancheglo, the founder of IOTA and NXT (https://twitter.com/c___f___b)). This project combines both "mining" and "AI" layers, and more details can be found in the article "Old mining coin QUBIC transforms into an AI public chain, far more than just the next KAS".

Spectral ($SPEC)

Price: $8.38, 7-day increase of 40.2%

Market value: $88.28 million (actually only $42.73 million)

Spectral is a platform aimed at endowing smart contracts with learning and decision-making capabilities and providing an environment to generate autonomous on-chain agents.

Spectral's products include:

· Spectral Syntax: a tool that can convert natural language intent into executable code, allowing users to create on-chain agents.

· Spectral Nova: a decentralized network that directly provides AI reasoning to smart contracts.

These two products are integrated through Inferchain (a common layer between agents).

It is worth noting that Spectral's investor lineup is very impressive, including Polychain, Galaxy, ParaFi, Circle, Jump, Gradient, Franklin Templeton, Samsung, and others. Team members also come from companies such as Coinbase, Loopring, and Scroll, serving in senior positions, as partners, and advisors, including developers.

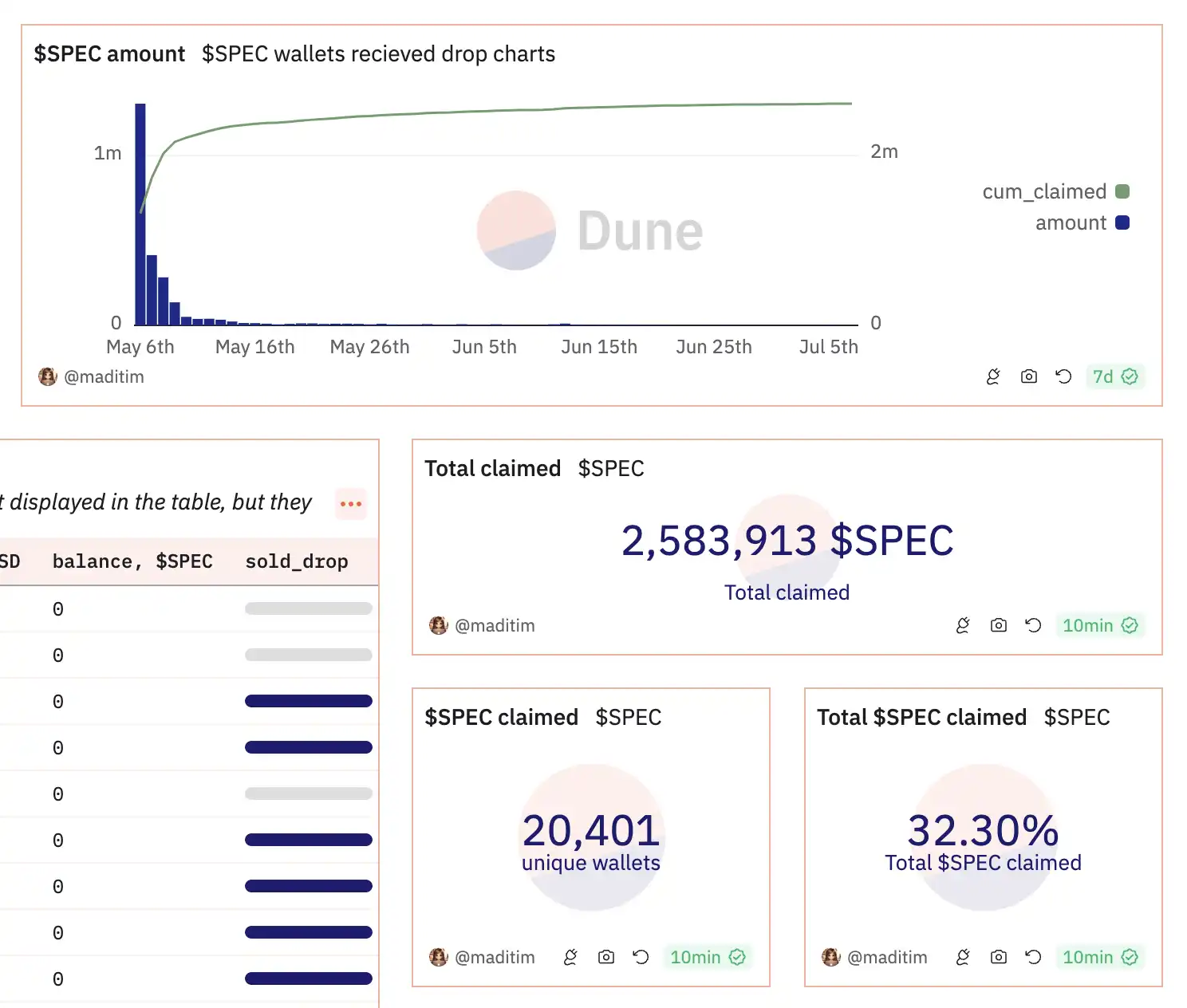

The circulating supply of $SPEC shown on CoinGecko is 10.52 million tokens, but the actual circulating supply is only half of that. Firstly, the token shares of investors and the team have a one-year cliff, meaning there will be no selling pressure from insiders until June 5, 2025. Secondly, the $SPEC tokens in circulation are either airdropped or used for market making. Due to the extensive airdrop range of Spectral, many people are unaware of their airdrops. The current airdrop claim amount is only 2.58 million tokens, less than 32.3% of the total airdrop amount of 8 million tokens, and may remain at this level for a long time. Therefore, there are still 5.42 million airdropped tokens of $SPEC that have not entered circulation, and the actual circulating supply is only 5.1 million tokens, corresponding to only half of the stated market value, which is $42.73 million.

Zero1 Labs ($DEAI)

Price: $0.2875, 7-day increase of 33.9%

Market value: $28.04 million

Zero1 Labs aims to create an open and inclusive DeAI ecosystem, providing a platform for developers to build, distribute, and monetize AI applications.

Zero1 Labs' products include:

· Keymaker: an open platform aimed at simplifying the development and deployment of decentralized AI (DeAI) applications. It integrates over 20 DeAI multimodal tools, providing a permissionless DeAI marketplace, discovery platform, and unified API interface.

· Cypher: a PoS-based decentralized AI application chain. The platform encourages users to contribute data and receive token rewards, focusing on training highly specialized AI models and efficiently allocating models through smart coordination mechanisms.

· Zero Construct Program (ZCP): an incubator program that provides funding and support for promising open-source DeAI projects. Projects currently incubated include the AI application layer Seraphnet and the cross-chain fair launch platform Nexus.

It is worth mentioning that the Cypher mainnet will go live at 8 a.m. on September 30th Beijing time. Both the Zero1 Labs project itself and the projects it incubates are still under construction. Token holders can only stake $DEAI tokens. The current total staked token amount is 19.96 million, accounting for 20% of the actual circulating supply.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。