作者:Zen,PANews

7 月,沉寂的韩国虚拟资产市场正式复苏,迎来了一次「量价齐升」的爆发行情。截至 7 月 24 日晚 8 点,韩国市占率排行第一的加密货币交易所 Upbit 24 小时交易量突破 102 亿美元,涨幅达 94.5%;市占率排行第二的 Bithumb 也同样迎来暴涨,24 小时交易量突破 32 亿美元,涨幅达 61.5%。

就在这一波狂热之前,市场底层的流动性已经悄然积聚。据 CryptoQuant 数据,7 月 13 日至 19 日,Upbit、Bithumb、Coinone、Cobbit、Gopax等韩国五大加密货币交易所的稳定币交易额达到 2.226 万亿韩元(约 16.2 亿美元)。

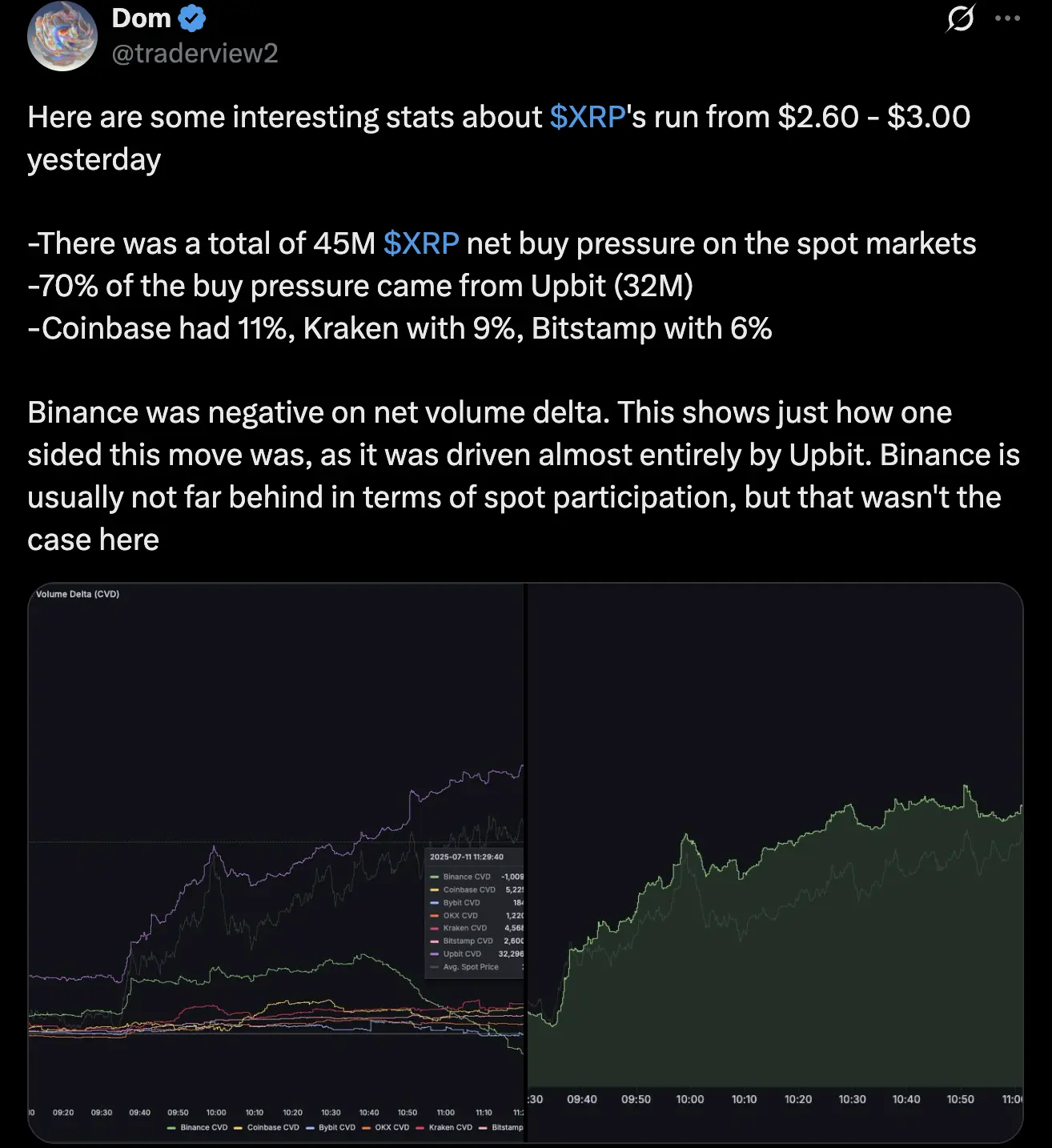

韩国投资者高涨的交易热情,在7月11日疯狂购入XRP代币时就已开始显现。

根据分析师Dom在社交媒体平台X上分享的数据,该代币价格当天在几个小时内从 2.60 美元上涨至 3.00 美元,现货市场 XRP 净买入压力总计 4500 万,其中 70% 来自 Upbit(3200 万),Coinbase 占 11%,Kraken 占 9%,Bitstamp 占 6%,此番上涨几乎全由韩国买盘推动。

总市值排名紧随比特币、ETH 之后的 XRP,可谓是韩国投资者最喜欢的虚拟资产,约有全世界交易金额的 15% 来自该国。该代币于 7 月 18 日突破了 3.6 美元大关,时隔半年再次超过了 1 月 16 日创下的历史最高价。截至 7 月 24 日,XRP 价格约为 3.16 美元,在 Upbit 的 24 小时交易额达到 22.8 亿美元,稳居平台最热门资产之首。

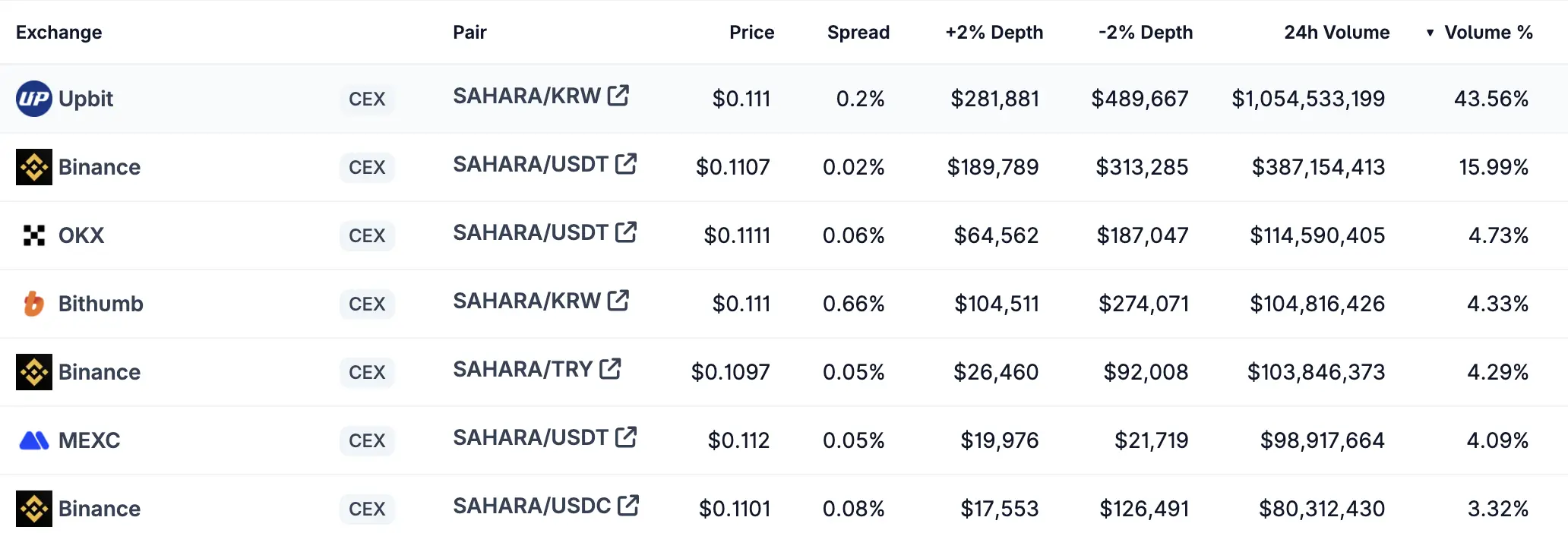

7 月 23 日,「AI 原生」全栈区块链平台 Sahara AI 的 SAHARA 代币掀起了第二波高潮。据 PANews 报道,SAHARA 单日最高涨幅高达 86%,在 Upbit 的现货市场成交额排名第三,占据全平台交易量的 8.76%。今日,韩国投资者依然延续了对 SAHARA 的交易热情。截至 7 月 24 日晚 8 点,其过去 24 时的交易量达 23 亿美元,现货交易有 43.56% 来自 Upbit,另有 4.33% 来自 Bithumb。

当 SAHARA 代币突破 0.16 美元迎来历史新高后迎来下调,链上金融的可验证自动化层 Newton Protocol 的 NEWT 代币开始登场接力。

NEWT 受韩国买盘推动的程度比 SAHARA 更甚。截至 7 月 24 日晚 8 点,该代币 24 小时上涨超 70%,其过去 24 时的交易量达 17.8 亿美元,该代币的现货交易有 57.07 来自 Upbit,另有 4.99% 来自 Bithumb。足以见得韩国加密散户的集中度与爆发力。

除了上述代币外,偏爱山寨币的韩国加密投资者对也推动了 Hyperlane、Babylon、HUMA、LISTA、MERL 等代币的上涨。

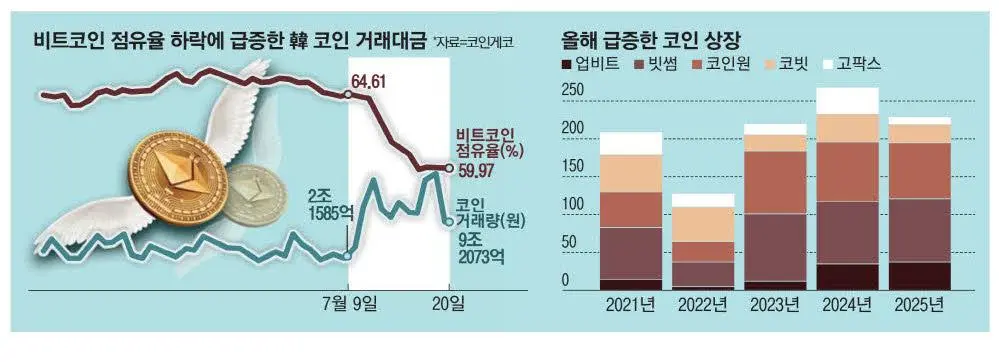

此外,在比特币站上历史高位、ETH 东山再起,以及监管环境不断优化的背景下,韩国交易所的上币节奏也明显加快。

据韩媒《Maeil Business Newspaper》报道,截至 7 月 21 日,韩国五大虚拟资产交易所 Upbit、Bithumb、Coinone、Cobbit、GoFox 共计上架了 229 种韩元虚拟资产,占去年全年 268 种韩元虚拟资产的 85.44%。Upbit 和 Bithumb 今年分别上架了 37 种和 84 种韩元虚拟资产,超过了去年的上架数量(分别为 35 种和 82 种)。照此趋势发展,Upbit 和 Bithumb 很可能在今年上线近五年来最多的加密货币。

这股「上币热」不仅为投机资金提供了更多落脚点,也让市场热点不断更迭。而密集的资金涌动和快速轮动,也伴随着显著的波动风险:XRP 和 SAHARA 曾短期回调逾 10%,合约爆仓单密集,若流动性突然逆转,价格将面临剧烈震荡。

CryptoQuant 分析师也曾警告称,在山寨币热潮最终到来之际,韩国投资者的行为将发生巨大变化。因此,在新资金流入激增的背景下,韩国投资者对山寨币的狂热程度往往超过海外市场。因此,在小额投资中,FOMO 在这种环境下扮演着至关重要的角色,有时会给储蓄部分带来巨大风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。