Once successful, the project will, like its name "Babylon" implies, establish an aerial garden or even a metropolis on top of the Bitcoin network.

Author: @Webi_Tree

TL; DR

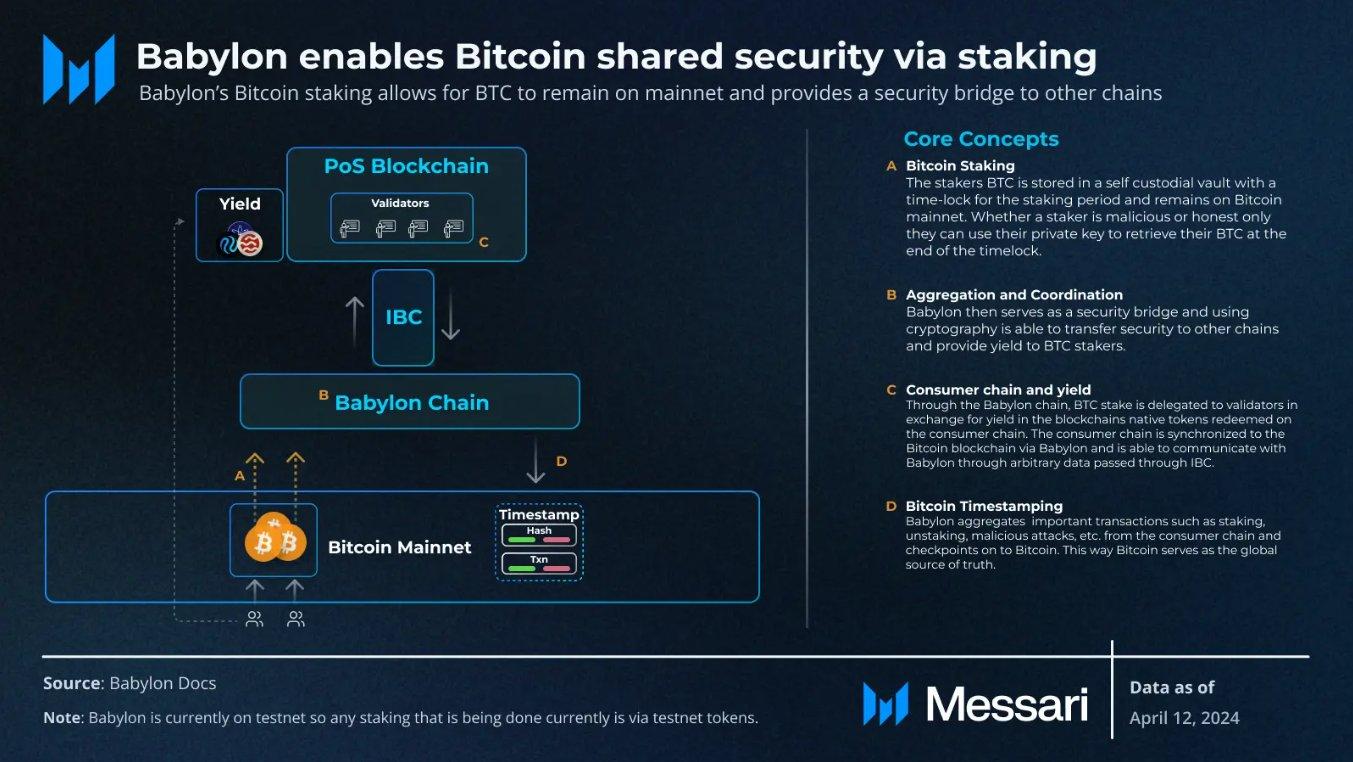

Babylon is a staking protocol, with its core component being a POS public chain compatible with Cosmos IBC, which can lock Bitcoin on the Bitcoin mainnet to provide security for other POS consumption chains, while also earning staking rewards on the Babylon mainnet or POS consumption chains.

The project is in the fields of Bitcoin ecology, Bitcoin programmability, Bitcoin Layer 2, Bitcoin staking, re-staking, shared security, modularity, Cosmos ecology, etc., aligning with the mainstream narrative of the current cycle and having a strong narrative.

The project team has strong technical strength, with core technical personnel and advisors having a deep technical background.

The current total financing amount of the project is not less than $96.8 million, with a high financing amount and participation from multiple institutions.

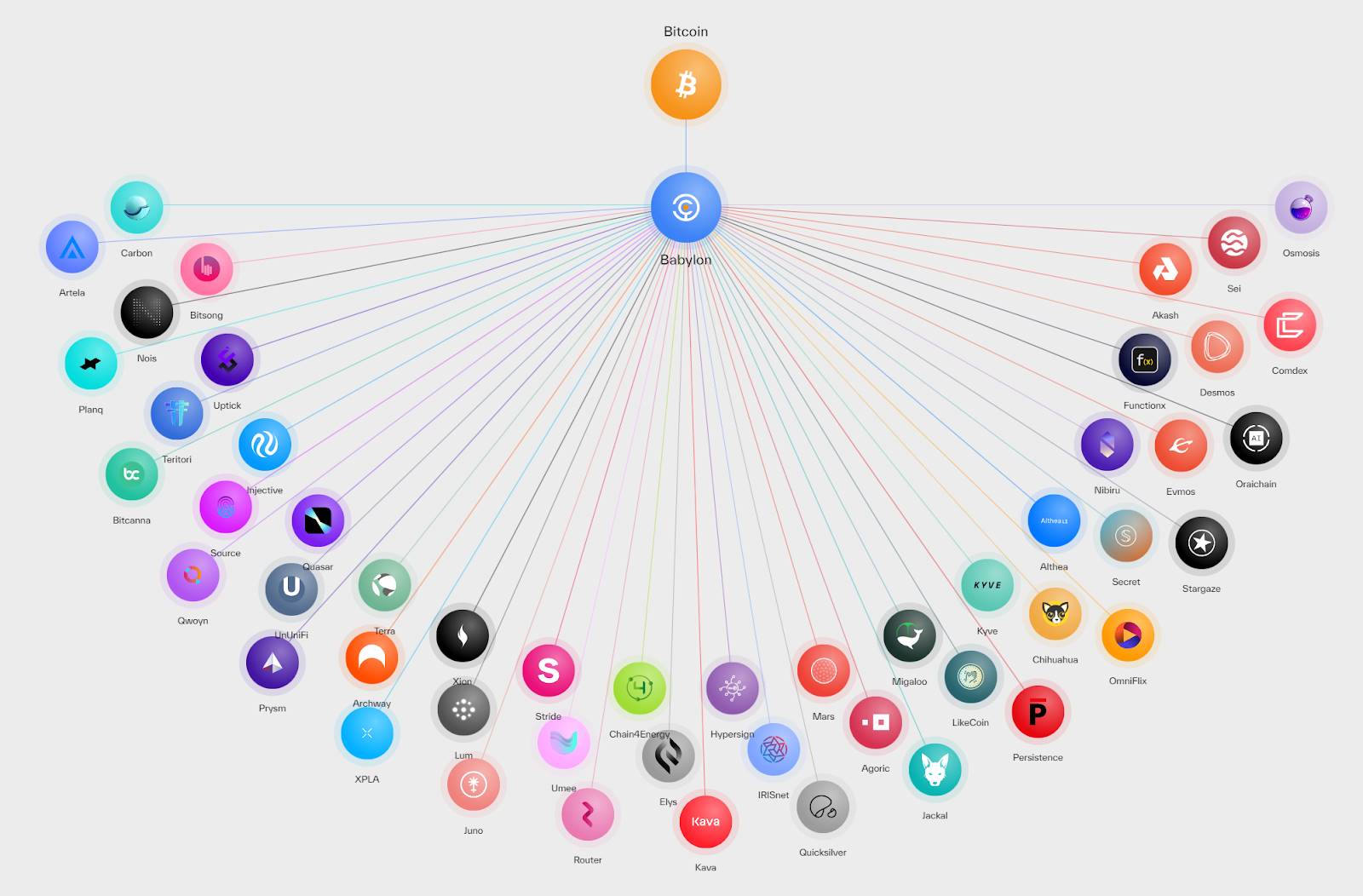

The project has a rich ecosystem, having established partnerships with over 60 Cosmos application chains, wallet service providers, Bitcoin L2, DeFi protocols, and rollup service providers, among many other projects.

The project is currently in the testing phase, with the mainnet not yet launched, and the token economic model not yet disclosed.

The project faces risks of narrative logic and narrative not being recognized by the market, insufficient staking demand, and leverage risks.

1. Project Introduction

The Babylon protocol is a Bitcoin staking protocol that allows users to lock Bitcoin on the Bitcoin network to provide security for other POS consumption chains, while also earning staking rewards. Babylon enables Bitcoin to utilize its unique security and decentralization features to provide economic security for other POS chains, facilitating the rapid launch of other projects.

The core of the Babylon protocol architecture is the Babylon blockchain, a POS blockchain built on the Cosmos SDK that is compatible with Cosmos IBC, capable of aggregating and communicating data between the Bitcoin chain and other Cosmos application chains.

The Babylon project was established in February 2023, and the mainnet has not yet been launched, remaining in the testing phase with no token issuance.

This research report will focus on the project's fundamentals from a narrative perspective, analyzing the project's team, financing, technology, ecosystem, economic model, competitive landscape, development status, and risk factors.

2. Narrative of the Project

In the crypto world, narratives refer to mainstream viewpoints, stories, or beliefs related to the crypto industry, cryptocurrencies, or crypto projects that can influence public understanding and evaluation. In speculative investment tracks like the crypto world or Web3, narratives are often driven by technological advancements and socio-economic events, playing a crucial role in influencing market sentiment, price fluctuations, and the acceptance of technology, and can even determine the success or failure of an industry, track, or project. In highly speculative sectors like meme coins, the importance of narratives often outweighs fundamentals. Narratives can attract market attention, mutually influence a project's fundamentals, or drive positive development of a project's fundamentals, or keep a project in a cold state for a long time. Therefore, this article will start by analyzing the Babylon protocol from a narrative perspective.

Since 2023, many Ethereum liquidity staking/restaking protocols such as Lido and EigenLayer have attracted substantial funds. EigenLayer utilizes the security and decentralization features of ETH assets to provide security for other POS chains, allowing them to avoid building protocols from scratch and not having to endure the early high inflation of token issuance. EigenLayer has achieved success, attracting a TVL (Total Value Locked) of over $13 billion in just 5 months, with continuous growth, and the valuation of its governance token $EIGEN is expected to be between $3 billion and $15 billion.

Bitcoin's current market value is approximately $1.4 trillion, three times higher than ETH's $445 billion market value. If the success of EigenLayer is replicated on Bitcoin, it will unlock the liquidity of trillions of dollars in Bitcoin and create a new liquidity market, attracting a large influx of funds.

Babylon, a Bitcoin staking protocol, is expected to develop new use cases for Bitcoin, breaking free from the old narratives of "digital currency" and "digital gold." It also enables Bitcoin to, like ETH, utilize its unique security and decentralization features to provide economic security for other POS chains, while allowing Bitcoin holders to earn rewards, enabling more protocols to achieve rapid launch.

The Babylon protocol will also create a market for secondary staking of Bitcoin, extending the application scenarios of Bitcoin and the Babylon protocol.

Meanwhile, the modular narrative of Ethereum remains strong, with various DAO projects constantly launching, such as Celestia, EigenDA, Near DA, and Eclipse. Babylon is also implemented in a modular manner, integrating as a module into other POS networks, thus having a modular narrative.

On the other hand, the Bitcoin ecosystem is in a period of explosive growth, with a large number of projects emerging, including Layer 2, and continuous increases in VC financing, attracting market attention. At Messari Research's quarterly "Narrative Games" conference, the narrative of Bitcoin programmability received the highest score. Investors and developers are constantly seeking new ways to unlock Bitcoin programmability. The Bitcoin staking protocol undoubtedly meets this demand, serving as a dedicated layer 2 for staking Bitcoin, and staking itself will also increase the demand for Bitcoin usage. Therefore, the timing of the Babylon protocol's emergence is opportune, being in the spotlight of the track, laying a foundation of heat for the early development of the project.

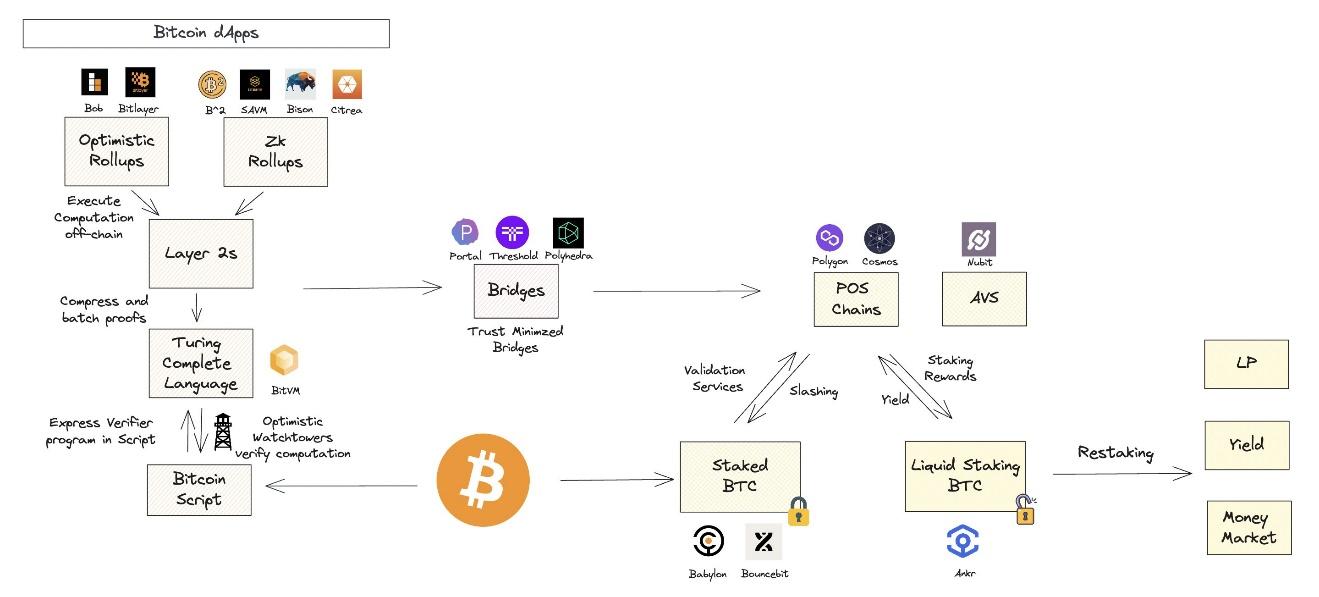

In summary, the problems that the Babylon protocol can solve include: the low financial return rate of Bitcoin; the limited application scenarios of Bitcoin; and the inability to scale the security of the Bitcoin system. The Babylon protocol is in the fields of Bitcoin ecology, Bitcoin programmability, Bitcoin Layer 2, Bitcoin staking, as well as re-staking, shared security, modularity, and the Cosmos ecosystem, aligning with mainstream narratives and having a strong narrative.

3. Team Background, Financing Situation

3.1 Team Background

According to the official website disclosure, the Babylon team consists of 32 technical personnel and advisors, with a strong technical strength, and they frequently participate in various Web3 and project marketing activities, indicating a high level of team enthusiasm. The backgrounds of several core team members are as follows.

Co-founder David Tse holds a Ph.D. in Electrical Engineering from the Massachusetts Institute of Technology and has worked at AT&T Bell Labs. Tse has researched information theory and its applications in wireless communication, machine learning, energy, and computational biology. He was awarded the Claude E. Shannon Award in 2017 and was elected as a member of the National Academy of Engineering in 2018.

Co-founder Mingchao (Fisher) Yu holds a Ph.D. in Telecommunications from the Australian National University and has developed theories and algorithms in network information theory and coding, with a special focus on wireless communication.

The team's advisors include Sunny Aggarwal, co-founder of Osmosis Lab, and Sreeram Kannan, founder of Eigenlayer, serving as strategic advisors.

3.2 Financing Situation

On May 22, 2023, Babylon announced the completion of a $8.8 million seed round, led by IDG and Breyer Capital. The announcement can be found here.

On December 7, 2023, Babylon announced the completion of an $18 million Series A financing round, led by Polychain Capital and Hack VC, with participation from Framework Ventures, Polygon Ventures, Castle Island Ventures, OKX Ventures, Finality Capital, Breyer Capital, Symbolic Capital, IOSG Ventures, Web3.com Ventures, GeekCartel, Dovey Wan, Chain Fund Capital, Cluster Capital, L2 Iterative Ventures, ABCDE Labs, Kingsley Advani, and others. The announcement is available here.

On February 27, 2024, Binance Labs announced an investment in Babylon, with the amount undisclosed. The announcement can be found here.

On May 30, 2024, Babylon announced the completion of a $70 million financing round, led by Paradigm, with a total of 30 institutional participants. The announcement is available here.

As of June 1, 2024, Babylon has disclosed multiple rounds of financing, with a total amount exceeding $96.8 million.

Looking at the Bitcoin ecosystem, from March 1, 2023, to May 31, 2024, there were 143 financing rounds related to the Bitcoin ecosystem, with a total amount exceeding $2.3 billion. After 2024, there were 85 financing rounds, with a total amount exceeding $945.3 million. This is in comparison to the financing rounds related to other ecosystems during the same period. During the same timeframe, there were 727 financing rounds related to the Ethereum ecosystem, 121 for Solana, 50 for Cosmos, and 82 for Avalanche. It is evident that the number of financing rounds related to the Bitcoin ecosystem is relatively high, reflecting the optimism of some institutions and VCs towards the Bitcoin ecosystem.

A simple comparison of Babylon's financing situation with other related projects can provide a rough valuation of the project. The table shows that compared to other Bitcoin Layer 2 projects, Babylon has a higher financing amount and a large number of institutions participating, but most of the financing institutions are second-tier VCs. In comparison to Ethereum re-staking projects like Eigenyer, the financing institutions and amounts are fewer, and there is even a certain gap in the financing situation compared to Ethereum Layer 2 projects like Arbitrum and Optimism.

However, it is worth noting that compared to Ethereum Layer 2 projects, many Bitcoin Layer 2 projects have opaque disclosure of financing data, such as only disclosing financing institutions while hiding the amounts, as seen with Binance Labs' investment in Babylon and the undisclosed amount for B square. This raises investor suspicions about whether the project is colluding with investors to inflate the project valuation or promising certain tokens to large institutions to endorse the project, thereby benefiting from a profitable exit.

Another noteworthy phenomenon is the deep involvement of Chinese teams or capital in many Bitcoin ecosystem projects, especially Bitcoin Layer 2 projects. Projects with core teams of Chinese descent include Babylon and Merlin Chain, while funding from Chinese sources includes Binance Labs, ABCDE, OKX Ventures, HashKey Capital, HTX Ventures, MEXC Ventures, Bixin Venture, IDG Capital, Waterdrip Capital, and others.

4. Technical Principles

4.1 Project Logic

The goal of Babylon is to create a Bitcoin staking protocol that utilizes the security of the Bitcoin network to share economic security with POS networks, while reducing the time and cost for POS chains to build a trusted network from scratch.

A trusted Bitcoin staking protocol should have several characteristics:

- Security, decentralization, and resistance to censorship. The protocol should provide "trustless" staking, support delegating staking, and enable restaking.

- Slashable. If a staker behaves improperly, their locked Bitcoin will be slashed.

- Free redemption. As long as the staker complies with the staking protocol, they should be able to freely redeem (withdraw) Bitcoin, even if all other stakers on the POS chain are dishonest. There should be no censorship during redemption.

To achieve these goals, the Babylon protocol has created a Babylon blockchain network compatible with Cosmos IBC, connecting the Bitcoin blockchain and IBC-compatible PoS chains, and providing them with Bitcoin-based timestamp services. It achieves staking Bitcoin on the Bitcoin chain and distributing rewards on the Babylon chain through "remote staking." It also simulates Bitcoin contracts to enable staking, redemption, slashing, and other functions. Mechanisms such as accountable assertions and finality gadgets are used to slash malicious users, and the Bitcoin timestamp protocol is used for redemption. Babylon has also built a platform that allows the construction of Bitcoin re-staking protocols on its network.

4.2 Protocol Architecture

The main goal of the Babylon protocol's architecture design is to provide scalability for more networks and protocols through the Babylon protocol. The architecture of the Babylon protocol is divided into three levels: 1. Bitcoin network layer; 2. Control layer; 3. Data layer.

The Bitcoin network layer is located at the bottom layer, providing timestamps for all POS chains connected to the Babylon protocol. The Bitcoin network has four characteristics: 1. High decentralization and robustness (extremely simple), with a script language that is not Turing complete and cannot execute complex smart contracts; 2. The data structure is based on the UTXO model, not on accounts; 3. The chain's security does not require staking Bitcoin to maintain.

The control layer is a middleware consisting of the Babylon blockchain network, connecting the Bitcoin network, Cosmos Hub, and the data layer. The Babylon blockchain network is the core of the entire Babylon protocol architecture, with a consensus mechanism of POS (actually DPOS). Its main functions include providing timestamp services based on the Bitcoin network for PoS chains, synchronizing the state of PoS chains with the Bitcoin chain, running a market to match Bitcoin staking rights and PoS chains, and tracking staking and validation information, and recording the finality signatures of PoS chains.

The project has not yet disclosed the maximum number of mainnet validation nodes, and the number of nodes will affect the decentralization of the mainnet. The role of the Babylon protocol is to act as an intermediary between POS networks and the Bitcoin network, ensuring the confirmation of transactions within a block on the Bitcoin blockchain, providing additional security.

The Babylon blockchain network is built on Cosmos-SDK and is compatible with Cosmos-IBC, efficiently aggregating timestamps from any number of Cosmos SDK chains, enabling data aggregation and communication between the Bitcoin chain and other Cosmos application chains. The project hints at future communication with any POS chain.

There is an IBC message passing layer between the Babylon mainnet and POS chains, consisting of IBC relayer nodes. IBC relayer nodes are computer nodes running relay clients, providing cross-chain message passing services to enable communication between the control layer (Babylon chain) and the data layer (POS application chain).

The data layer consists of various POS consumer chains seeking to use the economic security of Bitcoin through the Babylon protocol. These POS consumer chains need to meet certain conditions, including being open to IBC connections with Babylon and running the corresponding Babylon protocol modules.

A comparison of Babylon's architecture with Eigenlayer reveals that the role of the Babylon protocol is similar to Eigenlayer, acting as middleware connecting the underlying network and the upper-layer network. The POS consumer chains in the Babylon ecosystem correspond to AVS in Eigenlayer.

Here's an analogy to help understand the architecture of Babylon and Eigenlayer. If the Bitcoin mainnet and the Ethereum mainnet are compared to the Android operating system, then the Babylon and Eigenlayer protocols can be compared to WeChat or Alipay, while the POS consumer chains on Babylon and the AVS on Eigenlayer can be compared to mini-programs on WeChat or Alipay. The Bitcoin mainnet and Babylon together provide security for POS consumer chains, similar to how the Android operating system and WeChat together provide a secure operating environment for mini-programs.

4.3 Technical Implementation Principles of Staking Contracts

4.3.1 Staking Mechanism of Babylon

Staking refers to the act or process of locking a certain amount of tokens as a validator in a POS or its variant blockchain network, participating in activities such as transaction validation, block production, consensus, and network security maintenance, and ultimately receiving rewards. Staking also refers to the act or process of locking a certain amount of tokens to receive rewards, similar to the "staking mining" in DeFi. The "staking" in a POS network mentioned in this article refers to the former; whereas the consensus mechanism of the Bitcoin network is POW, and there is no staking mechanism, so the "staking" in the Bitcoin network refers to the latter. Since ordinary users cannot operate a POS blockchain network validator node on their own, they often participate in network maintenance and rewards through liquid staking or delegating staking.

The Babylon protocol allows Bitcoin holders to lock their Bitcoin in a Bitcoin mainnet contract address controlled by the Babylon multisig contract, while providing staking validation services for other networks. The protocol will slash malicious users on the Bitcoin network and distribute rewards on the Babylon chain or POS consumer chains. This mechanism is called "remote staking."

This remote staking method is very similar to Eigenlayer's staking method and can be compared to the staking method in the previous section.

Babylon did not adopt the "lock-map-mint" cross-chain bridge model, choosing not to cross-chain Bitcoin to the Babylon chain for staking, but instead opted for remote staking. This is because the introduction of a cross-chain bridge would introduce additional security assumptions. The advantage of remote staking over cross-chain staking is that it can eliminate the trust assumption for the cross-chain bridge, but it still cannot achieve "trustless" staking, as the security of the locked Bitcoin depends on the security of the staking contract on the Babylon chain, and both the staking contract and the cross-chain bridge contract belong to the same level of security, thus there is no fundamental difference between the two.

On the other hand, Bitcoin clients verify Bitcoin transactions by executing scripts (a set of computer instructions) written in a script language. The Bitcoin script language is a stack-based programming language that is not Turing complete and can hardly execute complex smart contracts. Therefore, smart contracts such as staking contracts on the Bitcoin network can only be expressed through Bitcoin scripts. Thus, there is a need for a device to convert high-level smart contract languages into Bitcoin scripts, ultimately outputting UTXOs that can be read by Bitcoin clients and recorded on the chain.

The Babylon protocol uses a Bitcoin covenant emulator to execute staking contracts. Bitcoin covenants are a series of Bitcoin scripts that can implement simple smart contract functions such as staking, redemption, slashing, and more. The covenant emulator is a daemon program that functions like a virtual machine (VM), providing an execution environment for contract code and hardware, translating the contract code into Bitcoin scripts for execution, and ultimately outputting UTXOs for on-chain recording, thereby introducing smart contracts to the Bitcoin network to increase its programmability. The emulator is run by members of the covenant committee. The emulator code is open source and has been released and updated on February 8 and April 2, 2024, respectively.

The Bitcoin covenant emulator has many similarities with the Ethereum Virtual Machine (EVM) and the Bitcoin Virtual Machine (BitVM) developed by Bitlayer. The basic functions of the three are similar, but the core difference is that the covenant emulator's functionality is simpler, mainly used to limit Bitcoin spending through preset rules and can only implement simple smart contract functions such as staking, redemption, slashing, while BitVM and EVM are more powerful and can support complex smart contracts.

The role of the committee is to protect the Babylon POS system from attacks by Bitcoin stakers and validators, which will be achieved through multi-signature (multi-signature) co-signing of transactions. The public keys used by committee members for multi-signing will be recorded in the genesis file of the Babylon blockchain.

The project team has not yet disclosed the identities of committee members or the number of multi-signatures. The identities and number of committee members will be closely linked to the project's governance plan, and the actual authority and number of multi-signatures will also leave the decentralization of the entire protocol in suspense.

4.3.2 Slashing Mechanism of Babylon

To ensure security, a technical solution for shared security must allow for the punishment of improper behavior in the underlying chain or consumer chain, usually by slashing the staked tokens that provide security for the underlying chain. Slashing is a punishment mechanism in a POS blockchain or protocol, where the staked tokens of a validator or staker are fined for improper behavior, such as double spending, downtime, invalid block production, etc. Slashing is an important mechanism for maintaining network or protocol security, ensuring that validators act in the best interest of maintaining the protocol's security rather than engaging in malicious behavior.

The Babylon protocol implements automatic slashing of Bitcoin through accountable assertions and finality gadgets.

Accountable assertions are a cryptographic concept that uses EOTS to punish malicious signers. EOTS (Extractable one-time signatures) refers to the leakage of a private key when a signer signs two messages with the same private key. EOTS can be implemented using Bitcoin Schnorr signatures. Finality gadgets are a concept in consensus mechanisms, acting as an additional consensus protocol layer on top of the Bitcoin consensus protocol, providing additional security. When a staker engages in improper behavior (e.g., double spending), Babylon will send a proof, leading to the exposure of the staker's private key, resulting in partial or complete confiscation of the staker's Bitcoin by the Babylon protocol, a process known as "automatic slashing."

4.3.3 Redemption Mechanism of Babylon

The Babylon protocol uses the Bitcoin timestamping protocol to implement unbonding of Bitcoin, while also defending against long-range attacks. The Bitcoin timestamping protocol is a time-stamping technology that allows any data to be sent to Babylon to generate a Bitcoin timestamp, providing timestamps for POS chains to enhance their integrity and security, such as defending against long-range attacks. The timestamping protocol uses the Bitcoin chain as the timestamping layer, the Babylon chain as the checkpoint aggregation layer and data availability (DA) layer, and other POS chains as the security usage layer.

Through the Bitcoin timestamping protocol, Babylon supports fast redemption to maximize the liquidity of Bitcoin. This is an advantage of the Babylon protocol compared to other staking protocols. The redemption time for Bitcoin will be approximately 1 day. This time is relatively long compared to Bitcoin's 10-minute block time. However, it is much faster compared to the 7-day challenge period of Optimism Rollups, the approximately 10-day redemption period of ETH, and the 21-day redemption time of most POS networks in the Cosmos ecosystem.

Long-range attack refers to a type of attack that a POS chain may encounter, where an attacker creates a chain longer than the original main chain from the genesis block and alters the entire (or part of) transaction history to replace the original main chain.

4.3.4 Finality Mechanism of Babylon

Finality refers to the state where transactions on a blockchain are in an unchangeable state. The finality of a blockchain network based on POW, such as Bitcoin, belongs to probabilistic finality, requiring confirmation of multiple blocks to achieve finality, resulting in a longer confirmation time. On the other hand, most networks based on the POS consensus mechanism, including the Babylon mainnet, use economic finality, resulting in a shorter confirmation time. To prevent the transaction speed and finality of the Babylon network from being limited by Bitcoin's finality, the Babylon protocol mainnet introduces finality provider (FP) nodes to achieve fast finality and prevent forking attacks. The function of FP nodes is similar to the sequencer in Ethereum Layer 2, where before each block of the Babylon mainnet is submitted to the Bitcoin mainnet, FP nodes will verify transactions, package blocks, and sign each L2 block. With the presence of FP nodes, the finality of the Babylon mainnet only takes a few seconds. FP nodes will be operated by the FP node committee and will run the FP Daemon program.

Whether FP nodes can possess decentralized and censorship-resistant characteristics and how to avoid the centralization issues of Ethereum Layer 2 sequencers still need further discussion. The identities and numbers of the FP node committee, similar to the covenant committee, will also determine the decentralization and censorship-resistant characteristics of the entire protocol.

4.4 Summary

From the system architecture and technical principles of Babylon, it can be seen that the Babylon protocol is not innovative in terms of technology; it is essentially a replication of protocols such as Ethereum Rollup and Eigenlayer on the Bitcoin network.

The Babylon protocol uses various technical means to minimize the security assumptions of the protocol as much as possible. However, the security, decentralization, censorship resistance, and scalability of the entire Babylon protocol will be determined by the weakest link in the entire protocol, including the consensus mechanism of the Babylon network, the security of staking, redemption, and slashing contracts, the authority and number of multi-signatures, the identities and numbers of the covenant committee and FP node committee, and the security of IBC relayer nodes. Clearly, attacking the Babylon network is easier than attacking the Bitcoin network. The security of POS consumer chains ultimately depends on their own security, not the security of the Bitcoin network or the Babylon protocol. Therefore, the claim of "trustless" in the Babylon whitepaper still has many implicit assumptions.

5. Ecosystem

The blockchain ecosystem refers to the collection of all elements related to a blockchain project, including the project itself and all stakeholders such as developers (project team), maintainers (miners and validators), investors, collaborators, users, media, and exchanges. The number and scale of ecosystem applications are key factors in the success of a project, and a complete and thriving ecosystem helps achieve positive network effects for the project and the entire ecosystem.

As of April 27, 2024, Babylon has partnered with over 60 Cosmos application chains, which will be interconnected with the Babylon mainnet through IBC after its launch. Additionally, Babylon has established partnerships with numerous wallet service providers, Bitcoin L2, DeFi protocols, Bitcoin re-staking protocols, and rollup service providers, among many other projects, all of which will provide strong support for Babylon's development. Notable ecosystem partners include Cosmos Hub, Osmosis, Talus, Akash Network, Injective, Sei, Stride, B Squared Network, and Nubit.

The Bitcoin staking and re-staking protocols collaborating with Babylon mainly include StakeStone, Uniport, Chakra, Lorenzo, and Bedrock. StakeStone is a multi-chain liquidity staking/re-staking protocol currently integrating Bitcoin re-staking functionality based on Babylon. UniPort network is a zk-Rollup application chain built on the Cosmos SDK, serving as a Bitcoin-related asset re-staking protocol within the Cosmos ecosystem, and is currently collaborating with Babylon to integrate Bitcoin re-staking functionality for assets including BRC20, Ordinals-NFT, ARC20, Runes, and RGB++. Chakra is a ZK-based Bitcoin re-staking protocol integrating with Babylon, allowing the mapping of Bitcoin from the Babylon protocol to other ecosystems through Chakra. Lorenzo is a Bitcoin re-staking protocol built on Cosmos Ethermint, with its core component being an application chain within the Cosmos ecosystem. Bedrock is a multi-asset re-staking protocol built on Ethereum, enabling users to lock WBTC on Ethereum, mint uniBTC, and map the same quantity to the Babylon chain to earn staking rewards.

It is evident that Babylon's ecosystem extends beyond the Cosmos ecosystem and continues to expand horizontally. Once these ecosystem applications are fully deployed, they will create a "sky garden" for Bitcoin.

Babylon is integrating itself into the Cosmos ecosystem rather than establishing an Ethereum Layer 2, Polkadot parallel chain, or Avalanche subnet. This is partly because only IBC currently has the capability to securely and efficiently transmit arbitrary messages between different POS networks and nodes. Additionally, the Cosmos ecosystem already has over 90 existing application chains that can collaborate with Babylon, eliminating the need to build consumer chains (AVS) and upper-layer applications from scratch, as in the case of Eigenlayer. Furthermore, Babylon can share liquidity with other application chains within the Cosmos ecosystem through IBC while retaining autonomy over its own protocol, whereas in other ecosystems, it would have to sacrifice some autonomy.

Babylon implies the ability to provide secondary staking for any POS chain in the future. However, this would require a new cross-chain messaging protocol to integrate other POS chains into IBC, introducing new security assumptions. Fortunately, these new protocols are already under development, such as the Composable protocol, which is attempting to connect Ethereum, Polkadot, Solana, NEAR, TRON, and Cosmos. Another protocol, LandslideAVAX, is attempting to extend IBC to subchains within the Avalanche ecosystem. The completion of these projects will facilitate the expansion of Babylon's ecosystem.

Figure 3: Babylon Ecosystem Map

Figure 3: Babylon Ecosystem Map 2

6. Economic Issues

Babylon has not yet issued its own tokens or disclosed its token economic model. The future economic model of the project will focus on the functionality, supply, distribution (whether it belongs to a "low circulation, high inflation" model), and incentive schemes of Babylon's native token $BBN. Therefore, this chapter does not discuss token economic issues and will focus on economic issues related to Bitcoin staking rewards, protocol demand, and leverage.

6.1 Staking Rewards in Babylon

Babylon allows Bitcoin holders to lock their Bitcoin on the Bitcoin chain to provide security for POS consumer chains. In return, the POS consumer chains pay a "protection fee," often in the form of rewards through partial issuance of the native token. Babylon also rewards stakers. Therefore, stakers' earnings come from rewards in Babylon's native token ($BBN) and the inflation rewards of the native token of the POS consumer chain. This is similar to EigenLayer. The staking rewards for Bitcoin will depend on the amount of locked Bitcoin and the number of POS consumer chains borrowing security from the Bitcoin network through the Babylon protocol. The more POS consumer chains connected to Babylon, the higher the staking rewards for Bitcoin.

DefiLlama data shows that the current locked amount of Bitcoin exceeds $10 billion, mainly concentrated in the lending sector, with annualized yields (APY) ranging from 0.01% to 1.25%, indicating very low returns. Many locked Bitcoin assets are wrapped or cross-chained, adding centralized trust assumptions and technical risks. Bitcoin holders hope to earn higher returns on their idle Bitcoin while bearing lower risks and fewer trust assumptions.

Celsius Network once promised Bitcoin holders an annualized yield of 8% before its collapse in 2021, attracting the participation of 43,000 Bitcoins. It is evident that high yields are highly attractive to Bitcoin holders. In fact, the primary driver of incremental growth in the crypto market comes from new users' desire for high yields.

For most POS chains, the staking yield of their native tokens ranges from 3% to 15%, which is more than 50 times higher than the lending yield of Bitcoin. Currently, the staking yield for $BBTC is approximately 4%. The initial staking yield on the Babylon protocol is also expected to be within this range. This will be a significant temptation for holders seeking high yields, significantly increasing the demand for Bitcoin staking.

6.2 Demand for Babylon

Unlike Ether and other altcoins, there are many long-term Bitcoin holders (HODLER) in the market who are not willing to use Bitcoin for DeFi-related activities. According to Coinshares data from March last year, the idle rate of Bitcoin is high, with 25% of the circulating supply of Bitcoin idle for over 5 years, and 67% idle for over 1 year. More than 66% of Bitcoin in circulation is in an idle state. Therefore, if the staking rate is too low, it will severely impact the project's development.

On the other hand, looking at the lockup amount and yield curve of the Lido protocol, it is evident that after opening ETH withdrawals in May 2023, despite the increasing lockup amount, the yield decreased from 7% to around 4% within a year. EigenLayer is also facing a serious yield crisis. EigenLayer has a TVL of over $15 billion, but the demand for AVS is less than 10% of its lockup amount. This means that the staking yield for ETH will be lower than expected, and there will be a loss of lockup after opening ETH withdrawals. The Celestia protocol sells Data Availability (DA) services to other Rollup networks, providing economic security. The value of its native token $TIA comes from the demand for its security by Rollup. However, the value capture capability of the Celestia project remains uncertain.

It can be argued that projects like Eigenlayer have ample supply on the security and liquidity staking/re-staking side, but the demand for security consumption must match in order for the project to achieve economic closure and avoid a death spiral. Therefore, the long-term success of such projects depends on the continuous increase in the number of high-quality protocols willing to pay for security.

Therefore, for Babylon, it is worth considering that, similar to ETH liquidity staking/re-staking protocols, the initial stage of the project is expected to see a continuous increase in Bitcoin staking. However, if there is not enough staking demand, the staking yield will inevitably decrease. When the yield decreases to a certain level, it will reduce the willingness of Bitcoin holders to participate, leading to a bottleneck in the project's development, or even a downturn. The sustainable development of the project depends on the size of the Bitcoin staking amount and yield, with the yield ultimately depending on the increasing number of POS consumption chains and their development status. Matching the demand side of staking with the supply side will be the key for the project to overcome the bottleneck, presenting a long-term challenge to the project's business expansion. The project should also consider how to build a stronger moat to counter users' speculative tendencies and prevent loss after users mine the "first block."

6.3 Leverage Risk of Babylon

In Eigenlayer, ETH undergoes liquidity staking and re-staking, which is equivalent to adding leverage, amplifying both returns and risks. The same principle will also be reflected in Babylon, where Babylon will use staking and re-staking to create leverage on the price of Bitcoin. This slight leverage will not affect the price during a bull market. However, when a bear market arrives, the entire market will deleverage, and this leverage will have a significant impact on the prices of ETH, Bitcoin, and even the entire cryptocurrency market.

7. Development

Key events in the development of the Babylon project are as follows:

In February 2023, the Babylon project was established, and its Twitter account went live.

On May 22, 2023, Babylon announced the completion of a $8.8 million seed round, led by IDG and Breyer Capital.

On July 13, 2023, Babylon released a litepaper.

On September 11, 2023, the Bitcoin staking waitlist went live.

On December 7, 2023, Babylon announced the completion of an $18 million Series A funding round, led by Polychain Capital and Hack VC.

On February 27, 2024, Binance Labs announced an investment in Babylon, with the amount undisclosed.

On February 28, 2024, the Babylon testnet went live, and Signet BTC (SBTC) test tokens were made available. The testnet mainly implemented two functions: the Bitcoin timestamp protocol and the Bitcoin staking protocol. As of March 1, the cumulative number of participants in the test staking reached 100,000.

On March 14, 2024, Babylon distributed 97,329 Bitcoin Staking Pioneer Pass NFTs to early testnet participants via the OKX exchange on the Polygon chain.

On April 27, 2024, Babylon announced that its protocol has partnered with over 60 Cosmos application chains, including Ethereum RAAS provider AltLayer, Bitcoin L2 protocol Lorenzo Protocol, Bison Labs, Nubit, and others.

On May 17, 2024, Babylon established partnerships with numerous projects, including wallet service providers, Bitcoin L2, DeFi protocols, and Rollup service providers.

On May 28, 2024, Babylon Testnet-4 went live.

On May 30, 2024, it was announced that Babylon had completed a $70 million funding round, led by Paradigm, with a total of 30 institutional participants.

The Babylon protocol is currently in the testing phase, with no announced mainnet launch date, development roadmap, or protocol governance solution. However, its governance will follow the Cosmos SDK governance rules. The token economic model has not been disclosed. However, from its development trajectory, it is evident that the Babylon team continues to establish partnerships with other projects, and the project's ecosystem development is steadily progressing, with increasing funding amounts, indicating a positive development momentum.

8. Overview of the Race Track and Competitive Landscape

The Babylon protocol is in the race track of Bitcoin ecology, Bitcoin programmability, Bitcoin Layer 2, Bitcoin staking, as well as re-staking, shared security, modularity, and the Cosmos ecosystem. This chapter will select three race tracks for an overview.

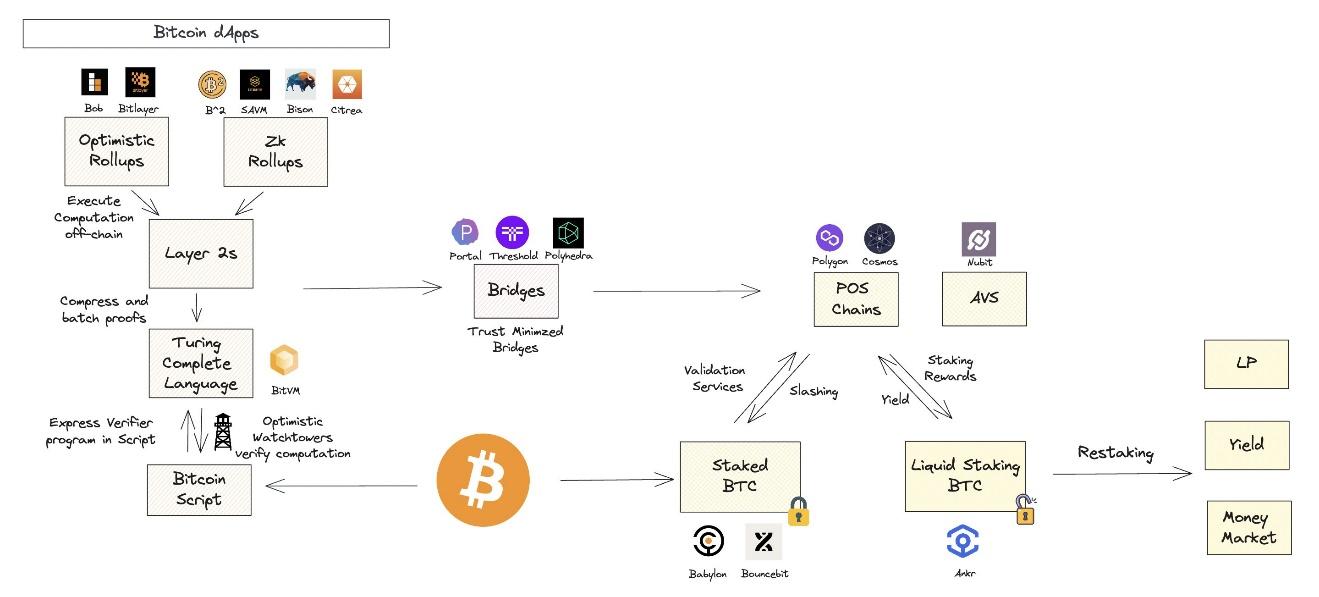

8.1 Shared Security and Re-staking Track

Shared security is a technical solution that allows the security of one blockchain network to be derived from another network. It can be understood as a lower-level network "leasing" some security to an upper-level network. Common technical solutions for shared security include Avalanche's Subnets, Cosmos' replicated security, Polkadot's parachains, Ethereum's Layer 2, and Eigenlayer's Restaking. These technical solutions can be classified into two categories based on their technical principles: (1) re-staking solutions, including Avalanche's Subnets, Cosmos' replicated security, Polkadot's parachains, and Eigenlayer's Restaking, which allow the validation nodes of one network to participate in the consensus of another network (such as block production). (2) Checkpoint solutions, including Ethereum's Layer 2 and Babylon.

As mentioned earlier, the Babylon blockchain is built on the Cosmos-SDK and is compatible with Cosmos-IBC, capable of aggregating timestamps from Cosmos SDK chains. Cosmos is an independent decentralized network ecosystem of parallel blockchains, mainly including the Cosmos Hub and currently over 90 POS application chains compatible with IBC. In the Cosmos ecosystem, liquidity between chains can be securely and efficiently shared through IBC, and the cooperative relationships between chains are greater than competitive relationships. Therefore, Babylon can mutually promote with other Cosmos application chains, collectively creating a thriving Cosmos ecosystem.

Another shared security solution, EigenLayer, has deep roots with Babylon. It allows ETH stakers or holders of ETH liquidity staking tokens (LST) to re-stake LST in EigenLayer's smart contracts, thereby extending the security of the Ethereum mainnet to other networks and earning additional rewards. The Eigenlayer protocol itself is a middleware between the Ethereum mainnet and AVS, with core components including restakers, operators, active validation services (AVS - a Layer 2 network built on Eigenlayer), and AVS consumer applications (Dapps built on AVS). The operational logic of the protocol is as follows.

Users re-stake BETH or LST (stETH, mETH, swETH, ETHx, etc.) from the Ethereum mainnet to the contracts of EigenLayer operators. The operators match the users' tokens with corresponding AVS (such as sidechains, DA layers, oracles, cross-chain bridges, shared sorters, etc.) to provide a secure network for these AVS, while the AVS pays fees to the re-staking users. If re-staking users behave improperly, the operator contract will reduce the staked tokens. Therefore, EigenLayer can "lease" some security of the Ethereum network to AVS through re-staking, reducing the construction cost of AVS networks. The trust in AVS comes from the security of the Ethereum economy and Eigenlayer. Honest staking work is rewarded, while improper behavior is penalized. The value of the staked tokens determines the level of trust.

For Eigenlayer's middleware, the value of the staked tokens (ETH) determines the level of trust. As the value of Bitcoin is higher than that of ETH, it can be assumed that, under the same staking amount, Babylon is expected to provide higher economic security and trust levels to its POS consumption chains than Eigenlayer's middleware. In other words, for Babylon's consumption chains to achieve the same economic security as Eigenlayer's middleware, they only need lower inflation or to pay less fees to the stakers. This is where the Babylon protocol excels over Eigenlayer in terms of economics.

The advantages of shared security solutions include: (1) enhancing the security of upper-level networks by extending some security from lower-level networks; (2) facilitating the deployment of new networks by building on a secure and mature network foundation; (3) improving the efficiency of capital utilization by allowing token stakers to participate in the maintenance of multiple PoS chains without deploying additional capital.

However, as the classic investment principle goes, "the greater the odds, the greater the risks," this applies equally to shared security solutions. These technical solutions often require compromises on decentralization and security. For example, when the entire system is under pressure, it increases systemic risks globally and also increases the risks of deploying contracts. Re-staking and liquidity staking solutions can increase the centralization risk of the system, as the entire underlying network and upper-layer applications can be controlled by fewer validation nodes. The risks of checkpoint solutions (such as Ethereum Layer 2) are often related to the failure of sorters and state validity, and multi-signature withdrawals make Layer 2 networks unable to resist censorship. The entire shared security solution also leads to problems such as redundant development and dispersed liquidity.

In fact, many Web3 projects have a certain degree of centralization issues, such as the security of Polygon POS being determined by a 5/8 multi-signature, and Lido's node operators being selected through a whitelist system, among others.

Centralization threatens the censorship resistance and trustworthiness of a protocol. Therefore, any blockchain and Web3 project should strive to avoid, or even completely eliminate, centralization throughout its development process, especially in the case of Babylon's committee and multi-signature issues. An ideal decentralized protocol should be decentralized in terms of technology, economics, law, and governance.

8.2 Bitcoin Ecosystem and Bitcoin Layer 2 Track

For many years, Bitcoin has been known as "digital gold" and a "store of value," but due to its lack of programmability, it has not had a robust ecosystem and has been criticized. In March 2023, the launch of the Ordinals protocol opened the door to Bitcoin programmability and unleashed the Pandora's box of the Bitcoin ecosystem. Subsequently, the BRC-20 token standard, Atomical protocol, Runes protocol, BRC100, SRC20, BRC420, Taproot Asset, RGB protocol, and others emerged. In April 2024, the halving of Bitcoin production further stimulated the frenzy of Bitcoin ecosystem development and investment.

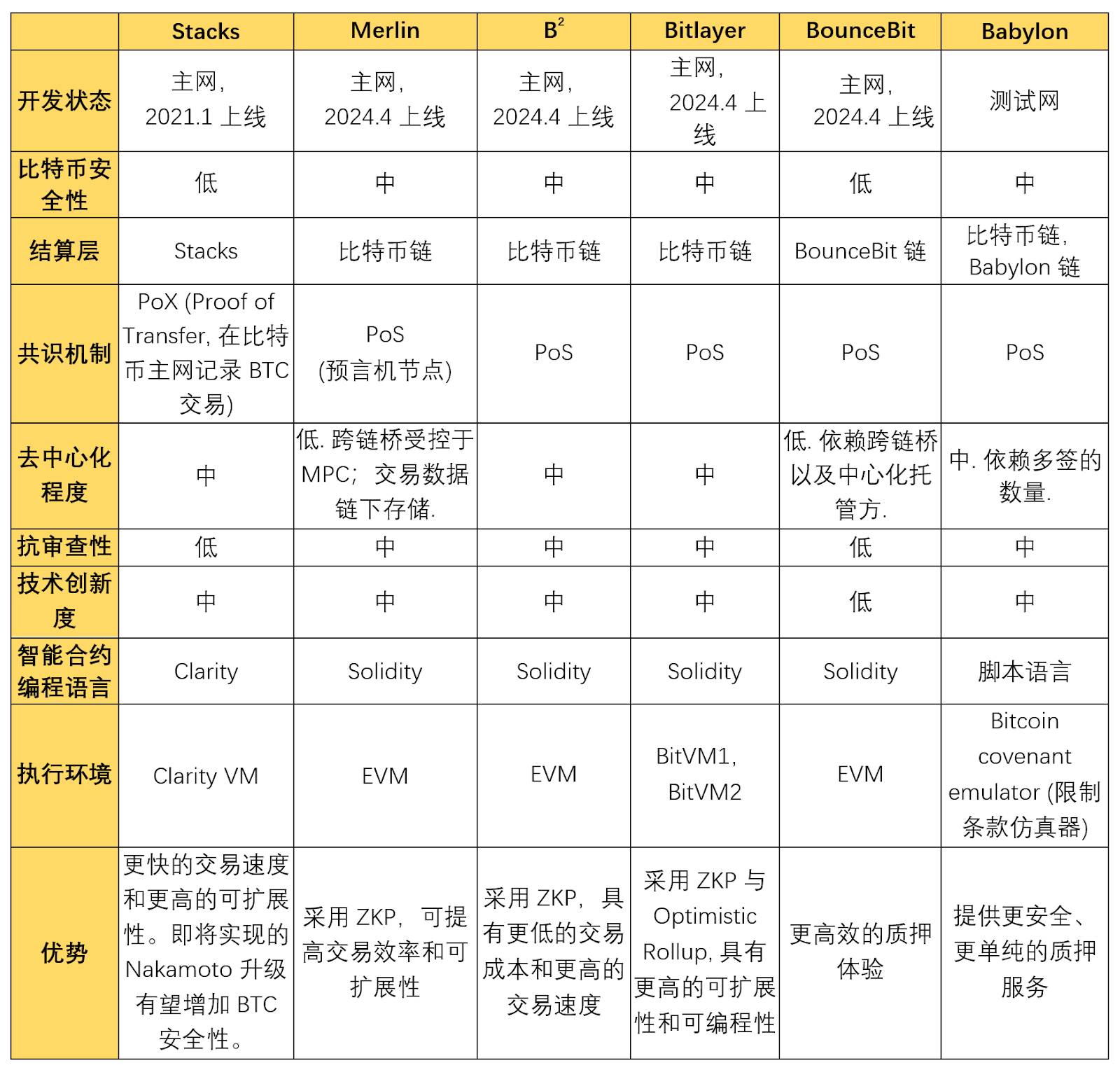

The mainnet of the Babylon protocol can be seen as a Bitcoin Layer 2 Rollup dedicated to staking. As of now, there are already dozens of Bitcoin Layer 2 projects in a flourishing stage, with several high-profile projects including Lightning Network, Stacks, Taro Protocol, Liquid Network, B squared (B2) Network, Bitlayer, Merlin Chain, Arch Network, Nervos Network, and others. Among them, Stacks is an early Layer 2 smart contract platform built on the Bitcoin network, operating similarly to Ethereum Layer 2. B2 is a Bitcoin Layer 2 project compatible with EVM, providing a platform for Turing-complete smart contract transactions, directly integrating smart contracts into the Bitcoin ecosystem. Bitlayer uses a Bitcoin Layer 2 based on BitVM, employing layered virtual machine technology and zero-knowledge proofs to support various computations. Merlin Chain is a Bitcoin Layer 2 solution integrating ZK-Rollup, decentralized oracle network, data availability layer, and fraud proof modules. Arch Network is a Bitcoin-native application platform that directly introduces smart contract functionality into the Bitcoin network using a Rust-based zero-knowledge virtual machine, ArchVM. Nervos Network has also expanded to Bitcoin Layer 2, using a custom module Cell Model to store state and CKB-VM to execute transactions, thereby increasing the programmability of the Bitcoin network. Additionally, software company StarkWare recently announced plans to build a STARK-based Bitcoin Layer 2 through a video and article.

For Bitcoin Layer 2 projects, commonly considered technical indicators include protocol security, decentralization, censorship resistance, scalability, execution environment (EVM compatibility), throughput, transaction fees, and more. The technical indicators of several high-profile Layer 2 projects are compared in the table below.

Table 2: Comparison of technical indicators of Bitcoin Layer 2 projects

As mentioned earlier, from March 1, 2023, to May 31, 2024, the total number of financing activities related to the Bitcoin ecosystem reached 143, with a total amount exceeding $2.3 billion; of which, there were 85 financing activities after 2024, with a total amount exceeding $945.3 million. The development of all these projects and the large amount of financing activities directly prove that the Bitcoin ecosystem is in an explosive period. The emergence and launch of Bitcoin staking protocols will undoubtedly attract a lot of attention, laying the foundation for the early development of Babylon in terms of popularity and funding.

8.3 Bitcoin Staking Track

In the Bitcoin staking track, in addition to the Bitcoin re-staking protocols such as StakeStone, Uniport, Chakra, Lorenzo, Bedrock, and others collaborating with Babylon, there are also projects such as Stroom DAO - an EVM-compatible Bitcoin Lightning Network re-staking protocol; SataBTC - a Bitcoin re-staking protocol based on Stacks, currently in the startup stage; Botanix - an EVM-compatible Bitcoin Layer 2 and staking protocol; Solv Protocol - a multi-chain yield and liquidity protocol that can convert staked WBTC on Arbitrum, M-BTC on Merlin, and BTCB on BNB Chain into interest-bearing assets solvBTC; Pell Network - a Bitcoin staking and re-staking aggregation protocol that integrates native Bitcoin and BTC LSD services, and has already integrated services from Bitlayer, BounceBit, Merlin, and BNB Smart Chain.

Figure 5: Illustration of projects related to the Bitcoin ecosystem

BounceBit protocol is another Bitcoin staking protocol with high similarity to Babylon, which will be the focus of the following discussion. The core function of the BounceBit protocol is to serve as a foundational component to support other re-staking protocols and allow Bitcoin stakers to earn rewards on multiple networks (currently including the Ethereum mainnet and BNB Chain). The core components of the BounceBit protocol are an EVM-compatible POS blockchain - BounceBit blockchain, and a Bitcoin cross-chain bridge and oracle.

The BounceBit mainnet adopts a dual-token staking verification mechanism, requiring stakers to simultaneously lock Bitcoin (native BTC, WBTC on Ethereum, BTCB on BNB Chain) and BounceBit's native token $BB to participate in network validation. The locked Bitcoin will be cross-chain wrapped into BBTC of the BounceBit chain. The locked native Bitcoin, WBTC, and BTCB will be custodied by institutions such as Mainnet Digital and Ceffu. The current staking yield for $BBTC is approximately 4%.

As of April 11, 2024, BounceBit has completed three rounds of financing totaling over $6 million. On May 13, 2024, the BounceBit mainnet went live and completed the airdrop of the native token $BB. As of May 10, 2024, the BounceBit TVL is approximately $1 billion, with a total user count of 215,480.

8.3 Bitcoin Staking Track

In the Bitcoin staking track, in addition to the Bitcoin re-staking protocols such as StakeStone, Uniport, Chakra, Lorenzo, Bedrock, and others collaborating with Babylon, there are also projects such as Stroom DAO - an EVM-compatible Bitcoin Lightning Network re-staking protocol; SataBTC - a Bitcoin re-staking protocol based on Stacks, currently in the startup stage; Botanix - an EVM-compatible Bitcoin Layer 2 and staking protocol; Solv Protocol - a multi-chain yield and liquidity protocol that can convert staked WBTC on Arbitrum, M-BTC on Merlin, and BTCB on BNB Chain into interest-bearing assets solvBTC; Pell Network - a Bitcoin staking and re-staking aggregation protocol that integrates native Bitcoin and BTC LSD services, and has already integrated services from Bitlayer, BounceBit, Merlin, and BNB Smart Chain.

Figure 5: Illustration of projects related to the Bitcoin ecosystem

BounceBit protocol is another Bitcoin staking protocol with high similarity to Babylon, which will be the focus of the following discussion. The core function of the BounceBit protocol is to serve as a foundational component to support other re-staking protocols and allow Bitcoin stakers to earn rewards on multiple networks (currently including the Ethereum mainnet and BNB Chain). The core components of the BounceBit protocol are an EVM-compatible POS blockchain - BounceBit blockchain, and a Bitcoin cross-chain bridge and oracle.

The BounceBit mainnet adopts a dual-token staking verification mechanism, requiring stakers to simultaneously lock Bitcoin (native BTC, WBTC on Ethereum, BTCB on BNB Chain) and BounceBit's native token $BB to participate in network validation. The locked Bitcoin will be cross-chain wrapped into BBTC of the BounceBit chain. The locked native Bitcoin, WBTC, and BTCB will be custodied by institutions such as Mainnet Digital and Ceffu. The current staking yield for $BBTC is approximately 4%.

As of April 11, 2024, BounceBit has completed three rounds of financing totaling over $6 million. On May 13, 2024, the BounceBit mainnet went live and completed the airdrop of the native token $BB. As of May 10, 2024, the BounceBit TVL is approximately $1 billion, with a total user count of 215,480.

[5] Babylon Protocol Litepaper (Chinese version), https://docs.babylonchain.io/papers/btc_staking_litepaper(CN).pdf

[6] Bitcoin Covenant Emulator Client Github Repository, https://github.com/babylonchain/covenant-emulator/

[7] Bitcoin Staking Contract Technical Document, https://x.com/babylon_chain/status/1787909109595128065

[8] Babylon Project Official Twitter, https://twitter.com/babylon_chain

[9] Babylon Project Official Medium, https://medium.com/babylonchain-io

[10] Babylon Research Report - Messari, https://messari.io/report/babylon-bitcoin-shared-security-and-staking

[11] Babylon GitHub Repository, https://github.com/babylonchain/babylon/tree/dev

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。