The design and application of the loyalty program fully demonstrate how it drives project and product development by incentivizing users.

Author: Translated by Kenton from Plain Language Blockchain https://mirr

Translated by Plain Language Blockchain

In the world of Web3, a new era of digital loyalty is emerging, powered by innovative loyalty systems. Since the groundbreaking loyalty program launched by Blur in 2022, various teams have adopted this new incentive paradigm and leveraged its advantages. With the introduction of each new loyalty program, projects continue to advance in the incentive design space, exploring new reward mechanisms and incentive behaviors. By 2024, a diverse loyalty program ecosystem has flourished, with each program adding unique colors to the evolving loyalty elements. This rapid evolution has created a rich landscape of reward mechanisms and target behaviors, providing unprecedented opportunities for user activation and retention. However, navigating the complexity of "loyalty economics" may be daunting for newcomers. This situation is about to change.

Based on conversations with loyalty issuers and an analysis of over 20 loyalty programs, this guide reveals the advantages, criticisms, and practical applications of loyalty economics, applicable to both new and existing issuers.

The first part introduces the basics of loyalty, while the second part provides a comprehensive overview of loyalty economics in Web3. Let's get started.

1. Part One: Loyalty Basics

What are loyalty points?

Essentially, loyalty points are a form of digital reward unit, whose value lies in its utility or convertibility into tangible benefits—whether it's exclusive access, product discounts, or direct monetary value. Project teams strategically deploy loyalty programs not only to foster loyalty but also to drive product adoption, enhance network effects, and accelerate product growth by shaping user behavior.

Why are loyalty points important?

Loyalty programs create a mutually beneficial relationship between brands and users. Companies gain loyalty, growth, and data, while users are rewarded for repeat usage. Well-designed loyalty programs help drive long-term engagement and deepen emotional connections, both of which are the foundation of product defensibility.

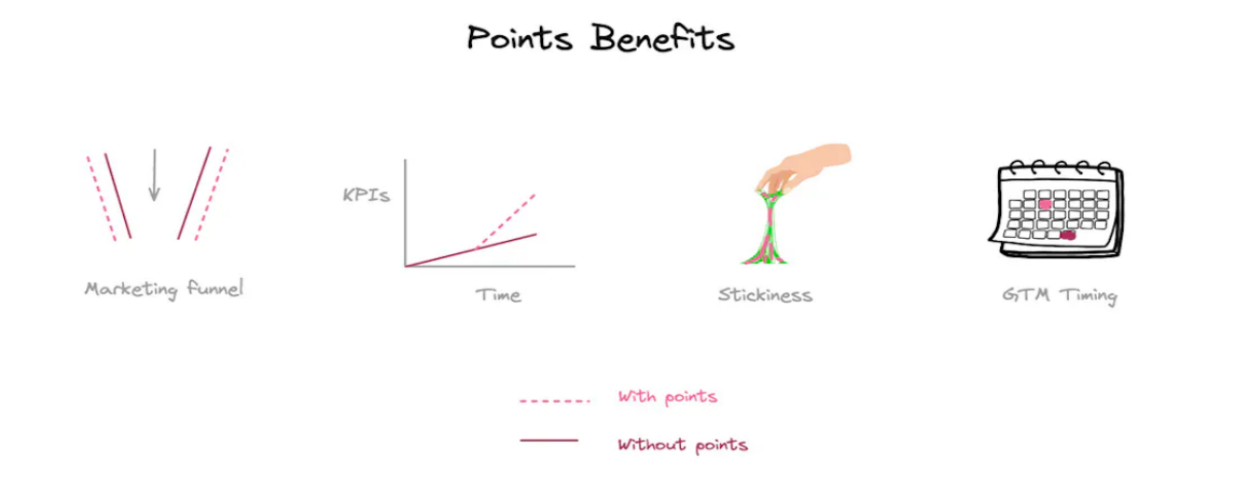

Overall, companies or projects in both Web2 and Web3 can benefit from loyalty programs in the following ways:

Marketing Loyalty points can expand the marketing funnel when combined with referral programs.

Growth Because loyalty points provide value, they reduce the effective price of products or services, enabling loyalty programs to increase conversion rates within the marketing funnel and drive key performance indicators (such as active user count) growth.

Stickiness/Loyalty Loyalty programs can increase product stickiness, leading to higher customer lifetime value (LTV) and lower churn rates. Research shows that loyal members spend an average of 27% more, so when the average LTV exceeds the cost of loyal members, product stickiness is achieved.

Market Entry Timing Dynamic loyalty programs can help products with network effects (such as social media platforms and financial markets) grow rapidly. By rewarding early adopters, companies can improve the user experience before the product reaches critical mass.

Users can also find the following practical value through loyalty programs:

Incentive Value This value can manifest as discounts, free products, exclusive access and privileges, and money.

Brand Identity Effective loyalty programs go beyond transactional rewards, making customers feel valued and emotionally connected to the brand. The pinnacle of loyalty is achieved when customers develop psychological ownership of the brand.

2. Part Two: Protocol Loyalty Economics

Traditional loyalty programs While loyalty programs have existed in the Web2 space for decades, their adoption in Web3 introduces new dynamics and opportunities. In Web2, we are familiar with loyalty programs such as Delta SkyMiles and credit card rewards like Chase Ultimate Rewards. These programs have successfully driven customer retention and spending, worth billions of dollars annually—sometimes even surpassing the revenue brought in by the company's core business! However, Web3 has elevated the concept of loyalty points to new heights.

The first Web3 project to introduce loyalty points was Blur in 2022, which triggered a chain reaction in the crypto space. Many projects followed suit, some reaching impressive scales.

For example, Eigenlayer's loyalty program, if its $1.8 billion TVL (total value locked) has a 10% annualized capital cost, would distribute loyalty points worth $180 million annually. Other notable programs include Ethena, LRT program (EtherFi, Swell, Kelp), and Blast.

In addition to the general benefits, Web3 projects have gained several unique advantages from loyalty programs:

Day One Incentives Projects can launch loyalty programs faster than tokens. This allows projects to provide user incentives immediately, driving growth from the outset. However, tokens require careful design, allocation planning, and timing considerations, which may be difficult to prioritize during protocol launch. Tokens are also products and cannot be rushed.

Token Conversion Potential Loyalty points can be designed to be convertible into tokens in the future, increasing their implicit monetary value. This allows teams to effectively "borrow" liquidity from future token generation events (TGEs) to fund current incentives.

Increased Flexibility Loyalty programs provide teams with flexibility to fine-tune TGE schedules, airdrop allocations, and incentive structures without hindering growth. This flexibility makes market entry strategies more effective. Furthermore, unlike governance-approved incentive programs, teams can freely adjust loyalty programs. While token governance is the ideal endgame, team flexibility can be a competitive advantage in the early stages.

Market Timing Tokens perform better in bull markets. Loyalty programs allow projects to build momentum and community during bear markets, preparing for successful token issuance when market conditions improve.

It is worth noting that these benefits are not limited to pre-TGE scenarios. Projects like Ethena and EtherFi captured similar benefits in their second season loyalty programs, even after token issuance.

3. Loyalty Program Design

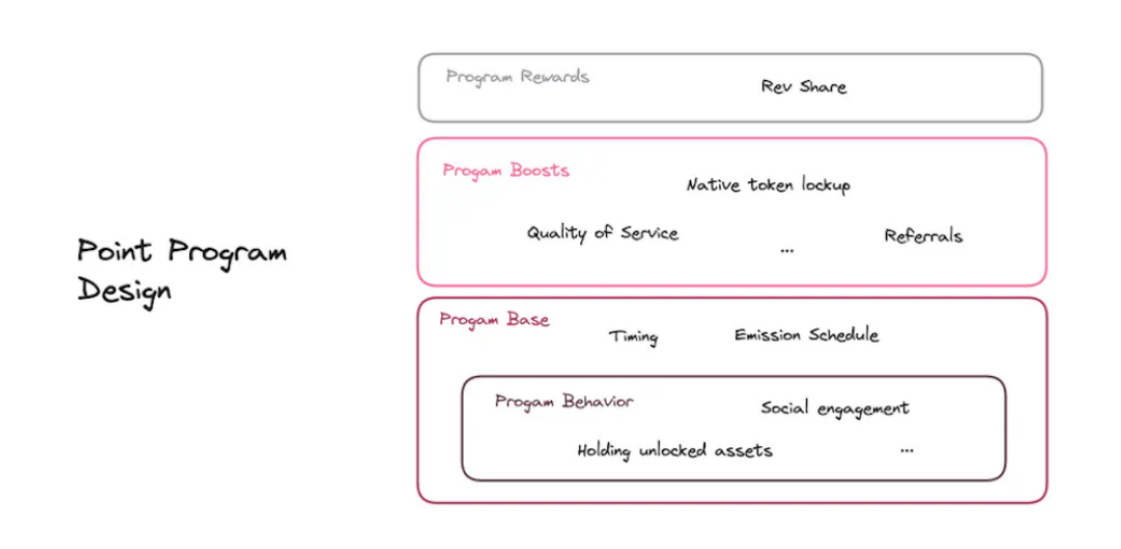

Loyalty programs in Web3 have evolved to include various complex mechanisms, many of which are used in combination. The most effective programs include behaviors, base, and boosts, and some are even beginning to experiment with program rewards. Let's delve into each part in detail.

1) Program Behaviors

Program behaviors detail user actions and actions that can earn loyalty points, such as depositing on L2 or trading on a new AMM. They include:

Holding Unlocked Assets Assets that users can freely access (e.g., LRTs, Pendle YTs, sUSDe collateral deposits on Ethena in Morpho).

Holding Locked Assets Assets that users need to wait for a period before they can withdraw (e.g., locked Ethena USDe, native re-staking on Eigenlayer, Karak, and Symbiotic).

Providing Liquidity Similar to unlocked assets, but with the risk of passive selling of deposited assets (e.g., Thruster LP position staked in Hyperlock).

Social Interactions Likes, shares, comments, and follows.

2) Program Base

The program base includes the most important details of the loyalty program, such as the loyalty point distribution schedule, timeline, and sometimes the airdrop scale. Most loyalty programs are divided into different seasons, each typically lasting 3-6 months, with each season having unique base terms.

Distribution Schedule The frequency and quantity of loyalty point accumulation.

Discrete Rewards One-time loyalty point allocations for specific actions. Applicable for incentivizing behaviors and marketing. For example, one-time rewards for listing NFTs within 14 days by Blur, one-time rewards for Twitter/Space activities by Lyra, and social interactions and referral rewards by Napier.

Continuous Rewards

Fixed Supply Distribution - The total supply of loyalty points is fixed throughout the program (e.g., Hyperliquid) or within a period/season (e.g., Morpho*). While both reduce user dilution, a fixed program supply provides the least uncertainty, while a fixed period supply allows the team to schedule distributions more flexibly. Teams typically use fixed supply distribution as a basis to provide additional assurance to users.

Variable Distribution - For example, Eigenlayer, all major LRTs, Ethena, etc. The total supply is variable and is a function of TVL. Participants accumulate points daily based on a certain dollar or ETH value, and the variable distribution schedule dynamically dilutes early depositors. While the expected airdrop payments (in dollars) attract new deposits, users hoping to avoid dilution must increase their participation in sync with the overall deposit growth. Teams favor this distribution schedule because it eliminates the operational complexity of ensuring fair point distribution to all participants. To reduce dilution of early users and create a sense of urgency, teams release a decreasing accumulation rate schedule (e.g., 25 points per day in July, 20 points per day in August, and so on).

Timeline The duration of loyalty point distribution.

Explicit vs. Ambiguous - Most projects provide a fixed loyalty program/season duration (e.g., 6 months), but some provide a range (e.g., 3-6 months). Teams seeking additional flexibility opt for an ambiguous timeline, although this may hinder growth.

Conditional - Some programs/seasons are designed to end early upon reaching key milestones. This increases the sense of urgency for participation if the expected season airdrop allocation is fixed. For example, Ethena set a $1 billion TVL milestone for the first season, which was achieved in just seven weeks.

*While Morpho distributes non-transferable $MORPHO tokens as incentives, its operation is similar to loyalty issuers.

3) Program Boosts

Program boosts are levers adjusted by the team to reward specific, targeted behaviors, allowing users to earn a higher relative share of loyalty points. Here is a list of different boost mechanisms:

Service Quality Boost Projects can improve the product quality for one user group (e.g., traders) by incentivizing the "service quality" of another user group (e.g., liquidity providers). For systems where users can differentiate themselves in "service," such as Univ3 pools, projects can allocate points based on a user's contribution to the product user experience (e.g., liquidity). For example, Blur rewards LPs who quote closer to the floor price of NFTs, while Merkl's incentive mechanism favors Univ3 LPs who quote competitively and earn more trading fees.

Referral Referring others and receiving a portion of their loyalty points (e.g., 10%). This helps with marketing and attracting high-volume users/whales. However, there is also a risk of Sybil attacks, as users may refer their own addresses. Some projects require a referral code to access the application to generate additional marketing buzz, although the conversion rate may decrease. Examples include Ethena and Blackbird.

Tiered Referral Boost An extension of a simple referral system. Users not only receive a share of their referrer's loyalty points (i.e., first tier) but also receive a share of their referrer's referrer's loyalty points (i.e., second tier). The goal is to encourage users to refer those who are expected to actively refer others. There is also a risk of Sybil attacks, as users may refer their own addresses. Examples include Blur and Blast.

Base Boost Projects can add amplification boosts to attract and nurture high-frequency users. The basic idea is that the base loyalty point accumulation rate increases with increased base usage, resulting in faster rewards. Non-high-frequency users will receive less compensation, making it difficult to attract them. For example, Aevo provides a base trading volume boost for traders.

Market Launch Boost Projects use launch boosts to attract liquidity and launch new markets before network effects take effect. Launch boosts typically have expiration dates but can also explore other thresholds. For example, some LRT projects (such as EtherFi) offer a two-week 2x launch boost for LPs when initializing new Pendle markets.

Loyalty Boost Providing additional points to users who commit to using the product (i.e., demonstrating use of product A instead of B). This is particularly effective for products that rely on network effects; as the network of competitors shrinks, the relative value proposition of the product is further enhanced. Blur leveraged this boost to quickly gain market share from OpenSea after its release. This boost works even better for NFTs, as their scarcity, especially when each owner typically has one unit, forces them to choose loyalty; but for fungible tokens, users can spread their balance across multiple addresses to avoid undue pressure.

Random Reward Boost Drawing inspiration from Skinner box experiments, some projects attract more participation and attention by rewarding uncertainty in size or timing. Blur's care package reward system uses a loyalty score to determine the rarity luck to reward care packages. While users do not know the absolute reward size, they know the relative quantity between each care package. Similarly, Aevo uses a "luck" trading volume boost system, where any user's trade may hit a trading volume boost, amplifying the reward for that trade; both projects use a tiered boost system, with the highest boost granted at the lowest frequency (e.g., 1% chance of receiving a 25x boost).

Leaderboard Boost To encourage competition among users, projects set leadership boosts for the top 100 loyalty point earners, concentrating ownership of loyalty points among the top-tier users, but this may lead to higher absolute key performance indicators as users compete. Although not widely publicized, Blur used this boost in the third season.

Native Token Lockup Boost Projects with native tokens provide boosts to loyalty point earners who demonstrate long-term belief. As this may reduce the circulating supply of tokens, the team should expect increased volatility of the token. Examples include $ENA from Ethena and $SAFE from Safe.

Total Value Locked (TVL) Boost Projects can incentivize user advocacy and marketing by rewarding loyalty point boosts based on TVL growth. Examples include 3Jane, whose AMPL-style loyalty program resets point ownership based on TVL, and Overload, which promises increased airdrop allocation upon reaching certain TVL milestones.

Group Boost Incentivizing social pressure and coordination to obtain a group boost. AnimeChain is the first project to attempt to share boosts through Squads.

Lockup Boost In addition to decaying base time schedules (rewarding past stickiness and aimed at getting users to participate early), some projects are beginning to experiment with boosts that reward future stickiness. Examples include EtherFi's StakeRank 1-2x boost and Hourglass's various term liquidity lockup 1-4x boosts.

4) Program Rewards

Finally, the program rewards are other immediate benefits beyond the expected airdrops. Speculation about future airdrops has been driving most of the demand for loyalty points, but some projects are attempting to provide additional utility for loyalty point holders, such as the ETH dividends provided to loyalty point holders by Rainbow Wallet.

While this part is still relatively small, I believe more teams will draw inspiration from Web2 mechanisms, such as product fee discounts, event access, and other perks, to try to reward loyalty point holders.

5) Bringing It All Together

The versatility of these building blocks allows for creative loyalty program designs. Once a team has clarified its objectives (user acquisition, product improvement, marketing, etc.), it can combine multiple building blocks sequentially or in parallel to achieve maximum effect. Here are some creative use cases that go beyond traditional "stake here" loyalty point strategies to increase TVL:

Ethena provides loyalty points to USDe holders and increases earnings for sUSDe holders.

Napier incentivizes social engagement and asset holders from other projects to increase partnerships and enhance marketing coverage.

Blur's GTM strategy leverages various loyalty point mechanisms in multiple airdrops to quickly establish supply and demand in the NFT market and rapidly gain market share upon public release. Their advanced strategy includes:

User acquisition - Airdrop 0 rewards private alpha testers to attract the most active NFT traders.

Launch supply - Airdrop 1 rewards new listings by existing NFT traders.

Building supply from loyal users - Airdrop 2, larger than Airdrop 1, rewards more listings and provides a boost for loyal listers transferring liquidity from other NFT markets to Blur.

Stimulating demand - Airdrop 3 rewards competitive bidding to incentivize trading volume.

After the project designs its loyalty program and listing plan, it will turn to program implementation. Loyalty point accumulation calculations, data pipelines, price feeds, and loyalty point data storage are all part of the loyalty program backend. Once the backend is completed, the project will focus on consumer-facing implementation, typically displaying user loyalty point balances and loyalty point leaderboards on a public dashboard. Many projects build their implementation from scratch, but some outsource the work to development companies and other infrastructure providers.

Next, when the project is ready for token generation and the first airdrop, they will explore methods to distribute tokens to their loyalty point holders. While this article does not cover airdrop mechanisms, the team should consider airdropping tokens in the form of options, fixed vs. dynamic allocation, linear vs. nonlinear distribution, ownership, lockups, Sybil prevention, and distribution implementation. Those interested in learning more can refer to this article for the latest information.

6) Criticisms and Shortcomings of Loyalty Programs

While loyalty programs have proven to be effective, they are not without controversy. Loyalty programs are a completely centralized incentive mechanism. Loyalty point accumulation calculations, data storage, program schedules, and standards are often opaque to users and typically stored in off-chain databases. Therefore, loyalty issuers must prioritize transparency as much as possible to build user trust. If users cannot trust the terms of the loyalty program, they will not value these points and will hastily chase temptations.

For legal reasons, teams preparing for token distribution cannot disclose upcoming airdrops or the allocation of loyalty points to holders, but they can invest in clear communication, timely disclosure of plan adjustments, and quick fixes in case of errors. EtherFi has set a good example in handling calculation errors.

Other public criticisms, such as being stingy with loyalty point allocations and easily susceptible to Sybil attacks in airdrop distributions, are actually unfair criticisms of loyalty programs, as the real issue lies in the airdrop plan. Loyalty points are just a precise way to incentivize and record how much "loyalty share" users have. Airdrop terms determine when, how, and what reward loyalty point holders receive.

As seen in Eigenlayer, users are not dissatisfied with their loyalty point balances. They are dissatisfied with the ratio of loyalty points converted to airdrops and the undisclosed claiming criteria. Deposits for 11 months only received 5% of the TGE, and loyalty point holders feel "farmed," with income well below the market average at the time. Additionally, many loyalty point holders were unexpectedly geoblocked and unable to claim their $EIGEN shares. While the team has complete discretion over token allocation, they can easily avoid the latter issue by geoblocking the product in advance. The same situation also occurred in Blast—users are not dissatisfied with their loyalty point balances. Blast airdropped 7% of tokens to loyalty point holders and required the first 1000 wallets to partially vest for 6 months. For a program of less than 6 months, this aligns with other airdrop seasons (e.g., Ethena, EtherFi, etc.).

While not a criticism of program design, loyalty point fatigue is increasingly prevalent in the ecosystem, as seen in public forums and private discussions with DeFi whales. Understanding the value of loyalty points takes time and effort. For each new program, users need to build an initial model and continually update their assumptions to ensure they get the best capital or behavioral return. With a flood of new loyalty programs entering the ecosystem, users struggle to keep up, leading to fatigue and lazy migration between loyalty programs. For example, imagine having two choices, 1000 units/day of loyalty point A or 2 million units/day of loyalty point B— which is more valuable? Is the more valuable one still valuable enough to justify the capital risk? The answer is not immediately clear. Projects that cannot immediately differentiate their loyalty program from all others will have less impact with their loyalty points.

The last important and rather insidious side effect of the loyalty point system is that it tends to mask Product-Market Fit (PMF). Loyalty points are a good guiding mechanism, but they carry the risk of masking organic interest that is crucial in finding PMF. Even after validating PMF, teams need to build enough organic appeal to find sustainability for their product/service before tightening incentives. Variant's Mason Nystrom calls it the "hot start problem." For pre-PMF teams, I recommend introducing loyalty points after validating PMF in a closed alpha program. For post-PMF teams, this is slightly more complicated, but Mason suggests that teams "take extra steps to ensure that token rewards are used for organic usage and drive important metrics like engagement and retention."

7) Future Outlook

Looking ahead, I expect loyalty program design to evolve to address the most pressing issues, such as program transparency and loyalty point fatigue.

To bring greater transparency in total loyalty point supply, distribution logic, and historical accumulation, future loyalty programs or parts of them will exist on-chain. Examples of on-chain loyalty point implementations include 3Jane's AMPLOL and Frax's FXLT points. Another loyalty software provider is Stack, which builds infrastructure to manage on-chain loyalty programs.

Addressing loyalty point fatigue presents a more complex challenge. While discussions on distinguishing program designs often focus on private chats and social media, the key to reducing fatigue may lie in empowering users to quickly and confidently assess the value of loyalty points. This ability will significantly simplify comparisons of various loyalty opportunities, making participation decisions simpler and less overwhelming. While not part of loyalty program design, secondary markets (such as Whales Market) can help users price loyalty points and reduce fatigue, although they are not yet sufficient to support most loyalty point exit strategies. However, as these markets mature, they are likely to become very valuable for price discovery, providing exit strategies, and creating a more dynamic loyalty point economy.

Conclusion

Loyalty points have become a powerful tool in the Web3 ecosystem, offering benefits beyond traditional loyalty programs. They enable projects to reward loyal and strong users, guide the development of network effects, and fine-tune their marketing strategies in a more predictable manner. This will lead to more effective product development and ultimately create value for end users.

As this field matures, I expect loyalty program design and implementation to further innovate. The key to success will be striking a balance between transparency and flexibility and aligning loyalty programs closely with overall project goals and user needs.

For builders and projects in the Web3 space, understanding and harnessing the power of well-designed loyalty programs may be a key factor in achieving sustainable growth. As we move forward, loyalty points are likely to continue to be a fundamental component of cryptographic incentive structures, shaping the landscape of DeFi and beyond.

Original article link: https://www.hellobtc.com/kp/du/07/5290.html

Source: https://mirror.xyz/kenton.eth/WLQ98TytJgxtdkcTevSlISbUKoFWex5Gw_TcW8u_SaY

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。