Author of the original article: Murphy, on-chain data analyst (X: @Murphychen888)

How much does the cost of mining affect the lower limit of BTC price?

Some friends have misunderstandings about whether "the cost of mining affects the price of BTC." They believe that in the current capital era, the proportion of BTC held by miners in the entire circulation market is very small, so whether miners sell or not does not affect the price trend of BTC.

Here I can talk about my personal opinion. First of all, the cost of mining does not affect the "upper limit" of BTC price, this is beyond doubt; but it will greatly affect the "lower limit" of BTC price. The logic behind this is not that miners will sell or not sell their chips at cost, but rather the psychological factors on the demand side of the market.

When the price of BTC is lower than the cost of mining, investors will consider that buying BTC in the secondary market at this time is much more cost-effective than investing millions of funds and time to obtain BTC through mining. Similar to a "taking advantage" mentality, taking advantage of the miners, thus triggering more market demand. Just like when we buy things, when we find that the production cost of an item is equal to or higher than the price, we feel more "at ease" buying it, feeling that we are taking advantage (not being taken advantage of).

Secondly, when the price of BTC falls to a certain extent, miners who cannot cover the cost will choose to withdraw some of their computing power, thereby reducing the difficulty. The decrease in difficulty reduces the cost of mining, the weakened market demand for "not taking advantage," thus the price continues to fall, computing power continues to exit… This enters a death spiral. Strong computing power is an important guarantee for the decentralization and system security of BTC. In extreme cases, no one is packaging, mining farms are closed, mining machines cannot be sold, and even asset security is threatened, which is not in the interest of everyone.

Therefore, the cost of mining will definitely affect the lower limit of BTC price under certain conditions!

So how to correctly measure the cost of mining? We can use a simple calculation model for deduction:

The cost of mining mainly includes 2 aspects: purchasing mining machines and later maintenance. Among them, the later maintenance cost mainly includes electricity cost and other (labor, factory, maintenance, loans, etc.) operating costs. We assume that the electricity cost accounts for 70%, and other costs account for 30%, plus the cost of purchasing mining machines, which constitutes the main cost of miners.

Hash rate price refers to the amount of BTC that can be generated per day per E hash rate (1E = 100w T) (including block rewards and transaction fee income), which is currently 0.809;

The unit electricity price is $0.053, I have selected 5 mining machines currently available in the market as samples, among which S19 XP Hyd was the main mining machine in the previous cycle, T21 is the main mining machine in this cycle, and S21 is currently sold on the official website as a futures, theoretically not yet deployed in large quantities. All mining machine parameters and prices are collected from the official website of Bitmain.

The above table is the result obtained from the calculation based on the above model. It can be seen that when the price of BTC is at $42,000, the profit margin of the main mining machine T21 is negative. This means that buying BTC in the secondary market at this time is more cost-effective than mining.

Coincidentally, the limit value of $42,000 is very close to the retracement limit value calculated by me in the article "From on-chain data analysis, what is the retracement limit of BTC price in this round of bull market?" published on June 23, which is not less than $43,000-$44,000.

When the price of BTC is below $56,500, the payback period for T21 is 48 months. Generally, the maximum service life of a mining machine is around 3-4 years. Even if the mining machine does not malfunction after 3 years, it will be replaced by a new mining machine due to its outdated energy efficiency. By then, the residual value of the old mining machine is almost zero, and it can only continue to shine and generate heat for miners with very low or even free electricity costs, or it will have to be sold as scrap metal. Therefore, for T21, which takes 48 months to break even, this price is not friendly at all. Assuming that the future price of BTC does not rise, it means that after working hard for 3 years to break even, miners will face elimination again. Who would be willing to do such business?

Therefore, from this perspective, BTC below $56,500 also has a certain cost-effectiveness, especially suitable for friends who like to make regular investments.

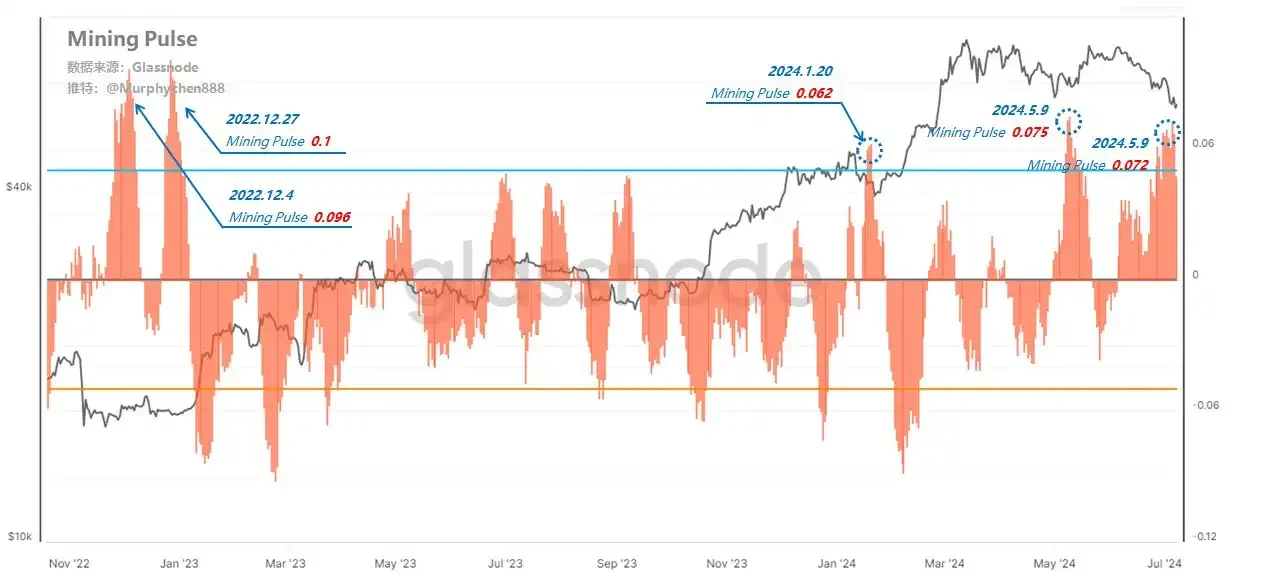

Update: Mining Pulse is an indicator that measures the speed of miners' mining. It mainly reflects the deviation between the 14-day average block interval and the target time (10 minutes). Specifically, Mining Pulse can help us understand the following points:

1. Deviation indicates speed difference:

Negative value indicates faster block time than the expected time, positive value indicates slower block time than the expected time.

2. Negative value indicates:

· Faster block time: If Mining Pulse shows a negative value, it means that the block is mined faster than expected.

· Hash rate growth: This usually occurs when the network's hash rate growth rate exceeds the difficulty adjustment rate. In other words, more computing power (miners) are joining, leading to a shorter block generation time.

· Network expansion: Indicates that the network's hash power is expanding.

3. Positive value indicates:

· Slower block time: If Mining Pulse shows a positive value, it means that the block is mined slower than expected.

· Hash rate decline: This usually occurs when the network's hash rate decline rate exceeds the difficulty reduction rate. That is, some miners may have shut down their equipment (exit computing power), leading to a longer block generation time.

· Miners offline: Indicates that some miners are offline, reducing the total hash power of the network.

As shown in the above figure, the larger the positive value, the closer the current BTC price is to the mining cost line, leading to a larger range of miner surrender. In this round of the cycle, from the bottom of the bear market to the present, there have been a total of 5 occurrences of Mining Pulse exceeding +0.05.

The 1st and 2nd occurrences were on December 27, 2022, and December 4, 2022, when the positive value was at the bottom of the bear market, and the price of BTC was around $16,000-$16,500. Mining Pulse reached 0.1, which means that the block was mined about 10% slower than expected, and a large number of miners surrendered, and the market entered a severe winter; usually, this is also a characteristic of the imminent appearance of the bottom.

The 3rd occurrence was after the ETF was approved in January 2024, when the price of BTC fell to $39,450; the 4th occurrence was after BTC broke through the $70,000 mark, and a large number of medium-term and short-term chips took profits, causing the price to fall to $58,200; the 5th occurrence is now, with Mining Pulse reaching 0.072;

Looking back at historical data, if you buy BTC near the mining cost line every time, it is equivalent to obtaining BTC at a cost lower than that of miners, and from a medium to long-term perspective, the certainty of obtaining returns is greater than the uncertainty of taking risks.

Note: The above calculation model is not an accurate statistical calculation of mining costs, and there is a certain degree of error, but it is closer to the real cost than the "shutdown price" that everyone sees online (the shutdown price usually only calculates electricity costs). If there are any omissions, professional miners are welcome to correct them!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。