The popularity of cryptocurrencies in Japan currently leads the world. In addition, in recent years, Japan has gradually introduced a regulatory framework for the cryptocurrency industry, with policies focusing on industry guidance and encouraging industry development. Therefore, cryptocurrencies are becoming an important choice for Japanese users to make alternative asset investments.

Abstract

- Japan is one of the earliest markets to explore cryptocurrencies, and the current number of daily participants in the region's trading reaches around 350,000.

- Regulatory Environment: The Japanese government has long been aware of the importance of regulating cryptocurrencies and has successively studied and introduced relevant policies. Japan's cryptocurrency policy focuses on industry guidance and encourages industry development.

- Preference for On-chain Activities: Japanese users are familiar with NFT trading, DEX trading, and are enthusiastic about participating in on-chain task platforms, metaverse games, and other sectors.

- Trading Preferences: Japanese users prefer spot trading, mainly trading mainstream coins and local project tokens in Japan, and are keen on investing in older project tokens.

- Centralized Exchange Preferences: Unlike most regions, Japanese users have a relatively high demand for localized centralized exchanges. As for decentralized exchanges, Japanese users mainly use top decentralized exchanges on various public chains such as Uniswap and Pancakeswap. The most commonly used wallets are MetaMask, Bitget Wallet, Phantom, Trust Wallet, and Coinbase Wallet.

- Finally, based on the above analysis, Bitget Research Institute has made five major predictions for the future trend of the Japanese cryptocurrency market.

Introduction

Japan is a country with a rich historical and cultural heritage, known for its unique blend of traditional culture and modern innovation. Japan enjoys global reputation in technological innovation and finance, and its robust financial system and innovative financial technology give it an important position in the global economy. Japan is also one of the earliest countries to understand, pay attention to, and encourage the development of cryptocurrencies. In the field of cryptocurrencies, Japan is a pillar of the global market.

Cryptocurrencies in Japan currently lead the world in terms of popularity. In addition, Japan has gradually introduced a regulatory framework for the cryptocurrency industry in recent years, with policies focusing on industry guidance and encouraging industry development. Therefore, cryptocurrencies are becoming an important choice for Japanese users to make alternative asset investments.

This article provides a comprehensive overview of the current situation of the Japanese cryptocurrency market through in-depth market research, which not only helps Japanese users find their own ecological positioning and communities of common interest, but also helps Web3 project teams and cryptocurrency institutions better understand and develop the Japanese market.

I. Overall Market Situation

1. Regional Overview

In terms of the overall volume and acceptance of cryptocurrencies, Japan is at the forefront globally. According to Chainalysis' 2023 Adoption Index data, Japan ranks 18th globally, similar to the rankings of the UK and Canada, and ahead of major Western European countries such as France, Germany, and the Netherlands.

Looking at the sub-rankings of Japan's cryptocurrency Adoption Index, the region shows the characteristics of "similar adoption rates of CeFi and DeFi on a global scale, with P2P transactions far below the global average".

Japan exhibits two distinct features in the cryptocurrency market: "overall average" and "specific preferences".

Japan exhibits two distinct features in the cryptocurrency market: "overall average" and "specific preferences".

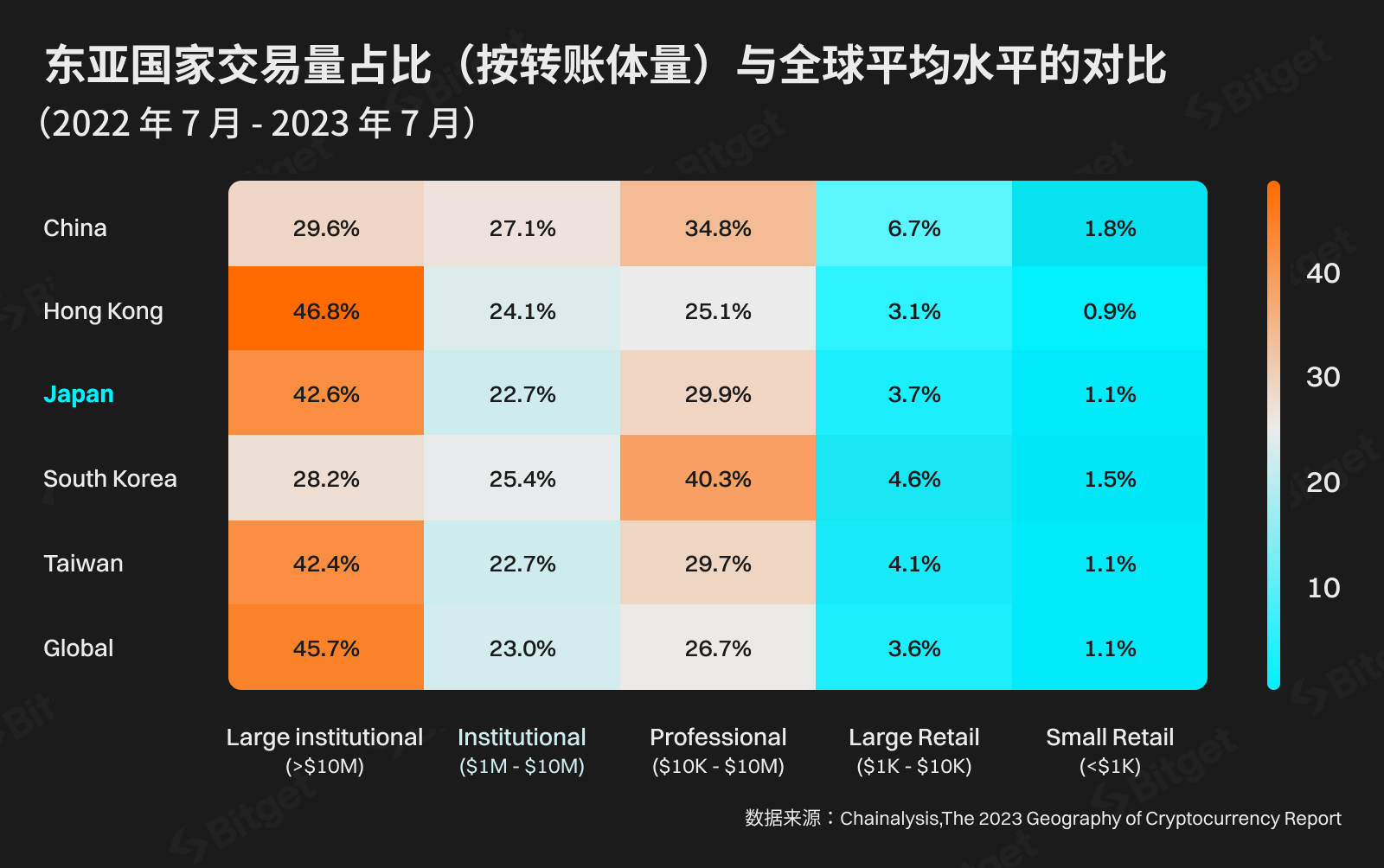

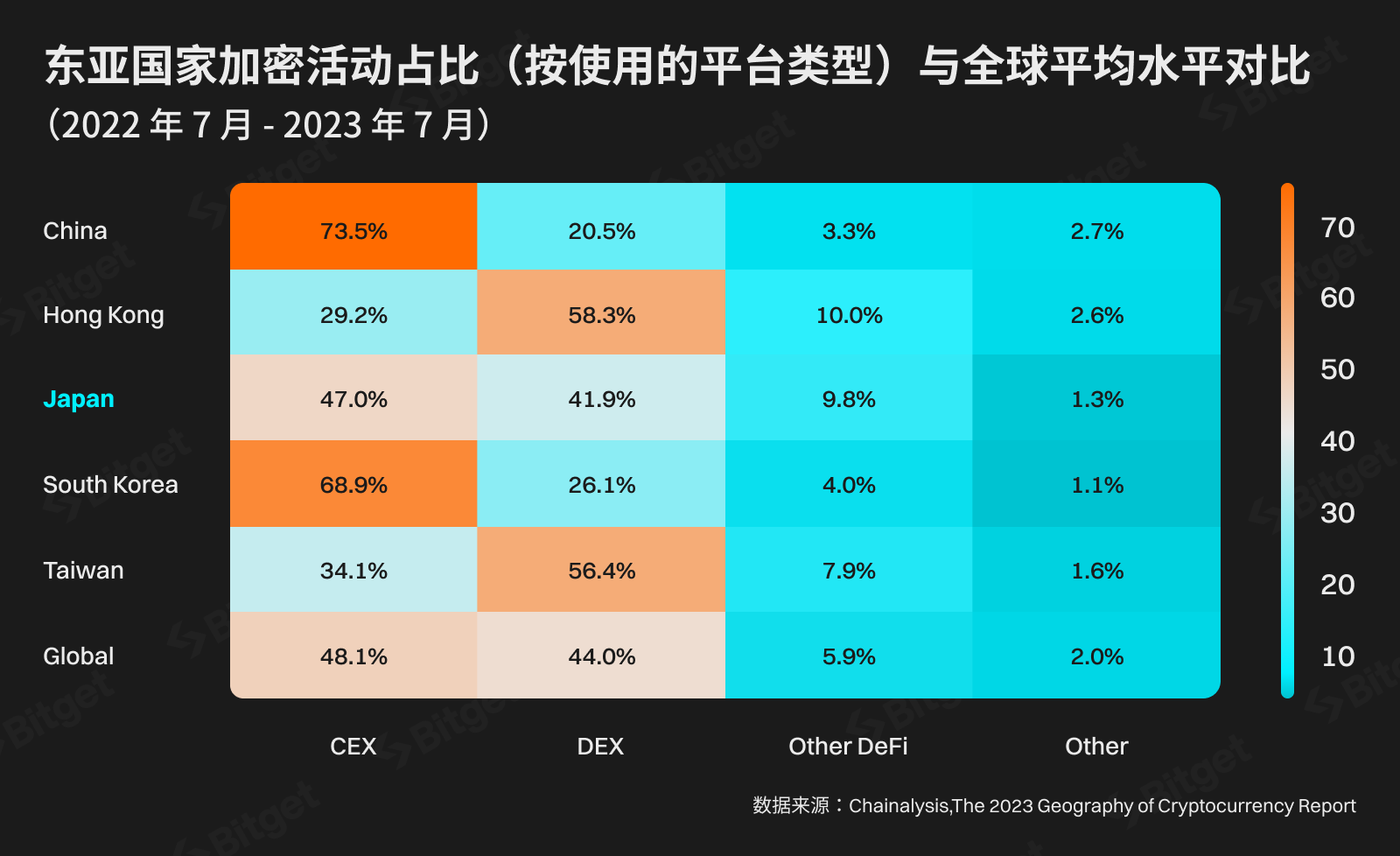

"Overall average" refers to the fact that among the distinctive East Asian countries, Japan's major indicators are closest to the global average: as shown in the following two charts, in terms of cryptocurrency transfer volume and types of platforms used, Japan's data is very close to the global average, while other East Asian countries show significant differences.

"Specific preferences" refers to the fact that while a large number of traders are chasing hot topics such as Solana Meme, AI, and DePIN, Japanese users still show relatively high enthusiasm for first-generation memes like SHIB and early blue-chip tokens like XRP and ADA.

In addition, Japan has strong local exchanges such as Bitbank, Bitflyer, and Coincheck, which dominate the local CEX market. Middle-aged and older traders show a stronger tendency to use these local exchanges.

In addition, Japan has strong local exchanges such as Bitbank, Bitflyer, and Coincheck, which dominate the local CEX market. Middle-aged and older traders show a stronger tendency to use these local exchanges.

2. Cryptocurrency Policies and Cultural Influence

2.1 Cryptocurrency Policies in Japan

Early regulatory attitude in Japan

As early as 2014, Japan experienced one of the industry's most serious setbacks— the global major Bitcoin exchange Mt. Gox was hacked and went bankrupt. This event resulted in retail investors losing up to 850,000 bitcoins.

In 2018, the domestic exchange CoinCheck in Japan was also hacked, resulting in users losing $534 million worth of virtual assets. Coincheck subsequently announced compensation for user assets. These two events highlighted the importance of introducing relevant laws to protect investor funds, maintain market stability, and regulate cryptocurrency assets. The Japanese government has since actively planned schemes to regulate virtual assets.

Current regulatory attitude in Japan

- In recent years, the Japanese government has introduced clear regulatory schemes to promote the reasonable and secure development of the cryptocurrency field, including:

- In 2017, Japan amended the "Payment Services Act" to bring cryptocurrency exchanges under regulation, implementing a licensing system supervised by the Financial Services Agency (FSA).

- Since 2021, Japan's cryptocurrency industry has been addressing the issue of the Travel Rule. At that time, the Japanese Financial Services Agency (FSA) required virtual asset service providers to implement the Travel Rule.

- In April 2022, the Japan Virtual Currency Exchange Association (JVCEA) introduced the Travel Rule into its self-regulation rules for virtual asset service providers.

- In October 2022, the Japanese government approved a cabinet resolution to revise existing laws to curb money laundering using cryptocurrencies in accordance with the guidelines of the Financial Action Task Force (FATF).

- In June 2023, Japanese lawmakers confirmed plans to implement stricter anti-money laundering (AML) rules for the cryptocurrency industry.

Overall, due to the Mt. Gox and CoinCheck incidents, the Japanese government has long been aware of the importance of regulating cryptocurrencies and has successively studied and introduced relevant policies. With the continuous introduction of regulatory policies, Japan's cryptocurrency regulation has become clearer and stricter. Japan's cryptocurrency policy focuses on industry guidance and encourages industry development.

2.2 Cultural Influence in Japan

The cultural traits of Japan are deeply rooted in its history. The cultural traits of Japan not only shape the daily life of Japanese society but also have a profound impact on its art, education, and business practices. The influence of Japanese culture in the cryptocurrency industry is mainly reflected in the following aspects:

Emphasis on Education: Education is extremely important in Japanese society, and both families and schools have high expectations for students. This has resulted in a relatively high average level of education among Japanese residents, and the users participating in the cryptocurrency market in Japan are generally highly educated.

Emphasis on Innovation: Japan is at the forefront of technology and innovation, and this spirit of innovation also permeates into the Web3 field, such as some innovative localized gaming projects.

Emphasis on Art: Japan has a rich artistic and literary tradition, and its anime culture and IP industry are well developed. Artists like Takashi Murakami have used art on the blockchain to achieve secondary creation and copyright protection, leading to a significant NFT user community in Japan.

3. Market Size

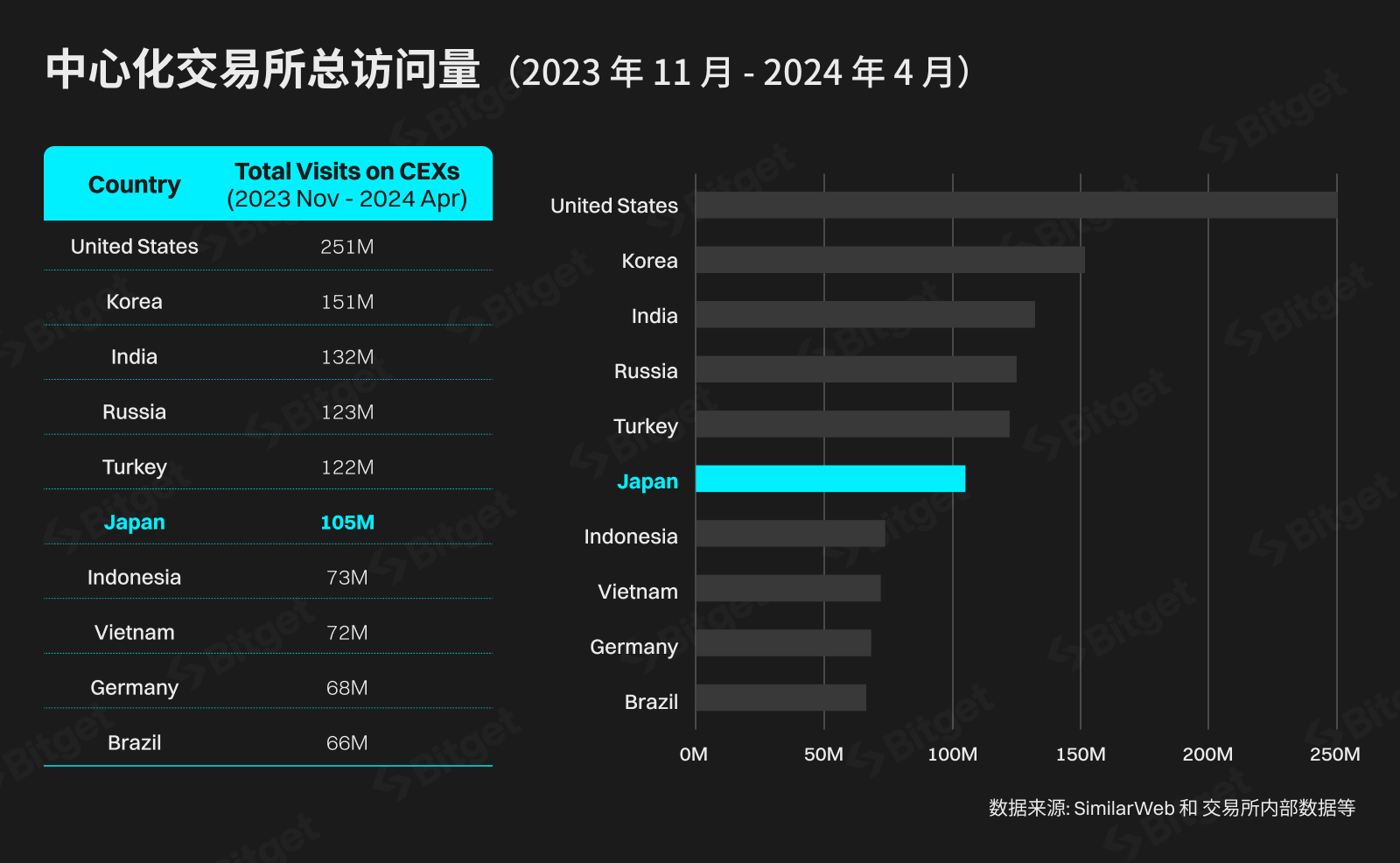

In the past six months, the total number of visits to CEXs by users in Japan is between that of Turkey and Indonesia, approximately two-thirds of South Korea's market size.

It is estimated that in April of this year, the daily number of Japanese users trading on CEXs ranged from 310,000 to 360,000.

II. Characteristics of Local Cryptocurrency Users

1. User Trading Habits

1.1 Overall Profile of Japanese Users

Image: Word cloud of cryptocurrency usage habits among Japanese users

Source: Google Hot Words

Japanese users have an open attitude towards cryptocurrency trading and project interaction, with the following characteristics:

- Japanese users have a very high acceptance of cryptocurrencies and hold a high global market share.

- Japanese users pursue hot asset sectors in the market, as reflected in keywords such as "Pepe," "AI," and "GPT."

- Japanese users are interested in on-chain asset interaction, especially in the NFT sector, and are concerned about "Wallet," "NFT," and "Blur."

1.2 Trading and Interaction Habits of Japanese Users

In terms of trading, Japanese users prefer spot trading, mainly trading mainstream coins (BTC, ETH, XRP, SOL, DOGE) and local project tokens in Japan. This situation is due to: 1. Legal restrictions in Japan, where local exchanges can only trade coins approved by the Financial Services Agency and derivative trading cannot exceed 2x leverage. As a result, some Japanese contract trading users and users trading in meme coins choose to trade on overseas exchanges. 2. The average English proficiency of Japanese users is not high, and they are not timely in understanding new projects. Instead, they focus more on buying older generation meme coins (e.g., SHIB, DOGE) to profit from continuous price increases. Additionally, Japanese users tend to be long-term holders, mainly because cryptocurrency gains in Japan are subject to taxation, with tax rates as high as 45%. Therefore, Japanese users focus on long-term investment returns rather than short-term profits.

In terms of application interaction, due to Japan's strong foundation in traditional gaming, many localized on-chain gaming projects in Japan tokenize in-game items and assets, forming NFTs, tokens, and other encrypted assets. Therefore, Japanese users are familiar with on-chain DEX trading, NFT transfers, and on-chain contract interactions.

In terms of payment and asset deposits and withdrawals, most users exchange cryptocurrencies on local exchanges for deposits, but some users also use fiat trading (P2P, third-party, card purchases, etc.). Japan has a relatively good crypto payment environment, with offline stores in bustling areas such as Roppongi and Ginza accepting BTC and ETH token payments.

2. Popular Sectors and Projects

(1) Popular Projects & Sectors

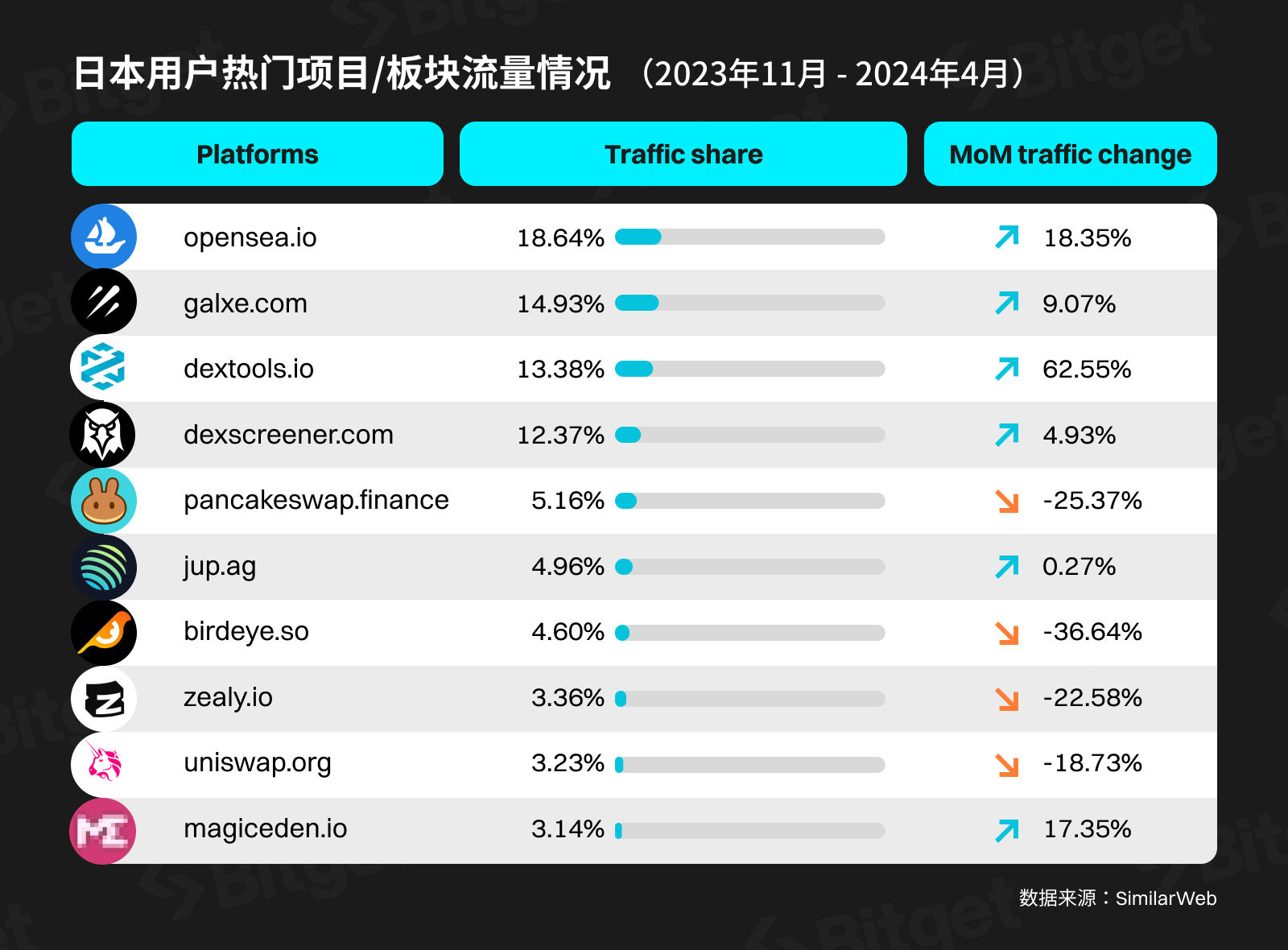

Japanese users have high participation in NFT trading, on-chain task platforms, on-chain trading, and Web3 games. Two of the top ten visited projects are NFT trading platforms (Opensea, Magiceden), indicating a high level of interest among Japanese users in NFT trading. This is followed by Web3 task platforms and DEX market trading platforms, indicating that Japanese users have a certain level of interest in participating in various project airdrops and trading on-chain assets.

Japanese users have high participation in NFT trading, on-chain task platforms, on-chain trading, and Web3 games. Two of the top ten visited projects are NFT trading platforms (Opensea, Magiceden), indicating a high level of interest among Japanese users in NFT trading. This is followed by Web3 task platforms and DEX market trading platforms, indicating that Japanese users have a certain level of interest in participating in various project airdrops and trading on-chain assets.

Additionally, some local projects in the Japanese market are favored by investors. For example, the relatively early blue-chip token Cardano (ADA), known as the "Ethereum of Japan," has gained high traffic in Japan. The Internet of Things platform JasmyCoin (JASMY), founded by former Sony employees, has begun promoting the narrative of "AI + IoT" and has seen a significant threefold increase in Q2 of this year, gaining high traffic in Japan. Furthermore, projects led by Japanese teams such as Astar (ASTR) and Oasys (OAS) have high visibility and trading demand locally.

It can be seen that in local Japanese projects, there is a lack of traditional DeFi projects, Layer2, and other infrastructure projects, and more focus is on extending Web2 businesses, such as the blockchainization of Web3 gaming projects, the Web3 transformation of Web2 IPs, and the Internet of Things. This makes Japanese local projects not very Crypto Native, but they are quite advanced in integrating blockchain technology with the real world and implementing practical applications.

(2) Cryptocurrency Topics Most Concerned by Japanese Users in the Past Three Months

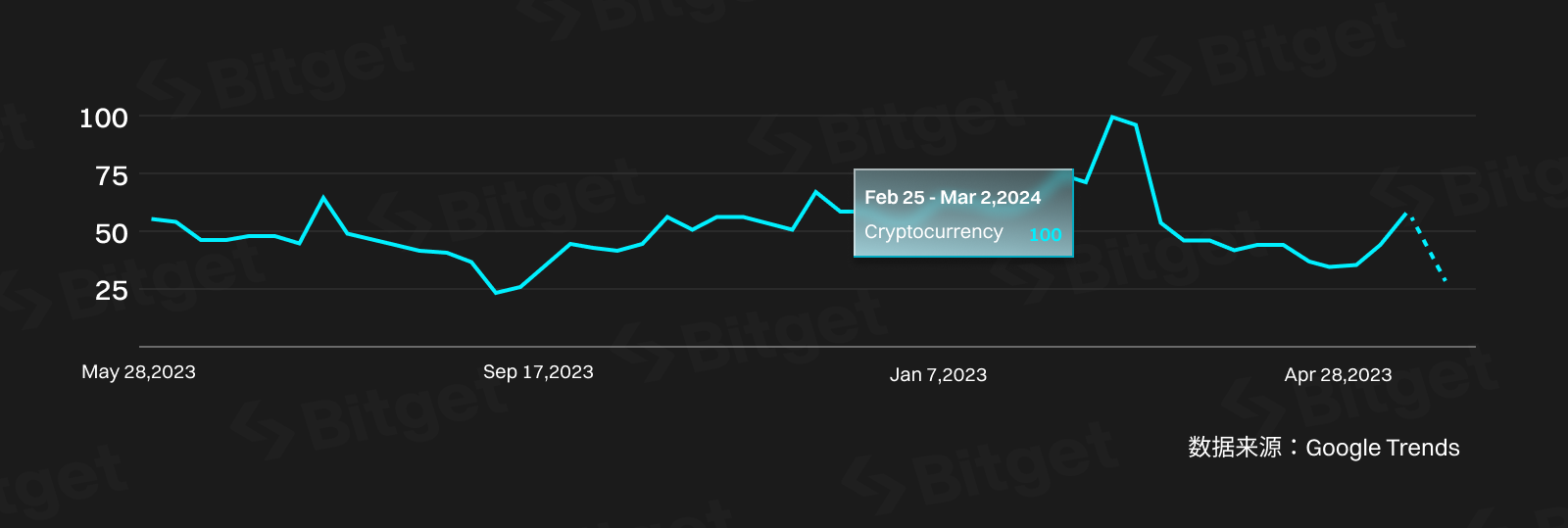

Looking at the search popularity of the term "Cryptocurrency" among Japanese internet users: the end of February to early March of this year was the period of highest interest in cryptocurrencies among Japanese internet users in the past year. This occurred during the rapid rise of BTC and testing of new highs.

Interestingly, the peak search volume for "Cryptocurrency" in Japan occurred earlier than in other regions, such as the United States, the United Kingdom, and the United Arab Emirates, which occurred from March 3 to March 9. This may indicate that Japanese internet users are more sensitive to the price of BTC.

In the past year, Japanese users have been keen on searching for:

- SHIB, DOGE, Solana, XRP, ADA

In the past three months (February 28 to May 28), the following terms have seen a surge in search popularity in Japan:

- PEPE, QUBIC, AEVO, NOT

From this, it can be seen that:

(1) Japanese users have a high level of interest in first-generation meme coins, including DOGE and SHIB. This may also indicate that Japanese users have a special fondness for dog-related meme images, as internal data from some exchanges shows that BABYDOGE is also one of the most traded meme coins by Japanese users. The latest generation of hot memes such as BOME and SLERF did not appear in the search trends.

(2) Japanese users are still keen on trading old blue-chip tokens such as XRP and ADA, which have not appeared on the top search trends in most other countries over the past year. Additionally, the collaboration between the Japanese financial giant SBI Group and Ripple has contributed to the sustained high traffic of XRP in Japan.

These two points also confirm the specific preferences of Japanese users in the cryptocurrency trading market.

3. Local Community and Social Media

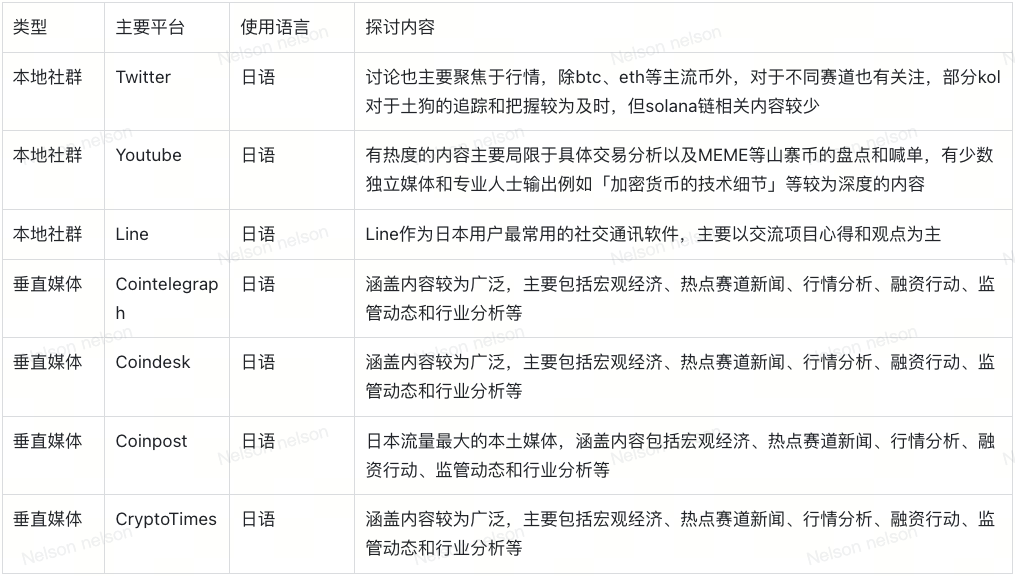

Local Community and Social Media

The main battleground for the local community in Japan is Twitter, YouTube, Line, and Telegram. The primary language used is the official language of Japan, Japanese, with some English content, but overall, Japanese content holds a dominant position. Compared to other countries, Japan favors vertical media, with Coindesk and Cointelegraph having dedicated Japanese websites with separate domains and full Japanese content. The most popular vertical media outlet is Coinpost, with a monthly visitation of up to 2.5 million, followed by Cointelegraph, which has a monthly visitation of around 1.5 million.

In terms of content, each channel has different levels of understanding and focus on blockchain, covering macroeconomics, hot industry news, market analysis, financing actions, regulatory dynamics, industry analysis, specific trading analysis, and even in-depth content on the technical details of cryptocurrencies, including meme coins.

Competition Landscape and Platform Advantages

1. Centralized Exchanges

In the past year, the traffic to CEXs by Japanese users has shown an upward trend, with a UV of 2.58 million in April 2024, representing an increase of approximately 17% compared to the previous year.

Coinbase and Kraken began to exit the Japanese market in Q1 2023, providing greater development space for local exchanges and other global exchanges. Japan has several strong local exchanges, such as Bitbank, bitFlyer, and Coincheck, which collectively hold over 42% of the CEXs traffic share, a significant difference from most European and Southeast Asian countries. These three local exchanges were established as early as 2014, earlier than several well-known international exchanges, and their early accumulation has laid a solid foundation in Japan.

Looking at the user profile, the male-to-female ratio of Japanese CEX users is approximately 3:1. In terms of age distribution, the number of users aged 18-34 is equal to the number of users over 35, with each group accounting for half. Interestingly, the younger age group of 18-34 prefers to use international exchanges, while the older age group of 35 and above tends to prefer using local Japanese exchanges.

In addition to the aforementioned local exchanges, Rakuten Wallet is also popular among users. As a CEX backed by the Rakuten Group, it not only supports cryptocurrency trading in Japanese yen but also supports the conversion of yen into Rakuten cash (R Cash), bridging the gap between cryptocurrency investment and daily life consumption, adding convenience for users.

2. Decentralized Exchanges

The top 3 DEX websites visited by Japanese users show significant differences compared to other regions: Pancakeswap > Jupiter > Uniswap. Japan is one of the very few regions where Uniswap does not rank first, and even has lower traffic than Pancakeswap, reflecting a relatively lower interest among Japanese users in ETH and Base chain transactions compared to tokens on the Solana and BSC chains.

Most users access these decentralized exchanges directly, with some using Google search and social media links to log in. This indicates that Japanese users place a strong emphasis on visibility when using decentralized exchanges and once they form a habit, they show a certain level of loyalty to the brand. Twitter plays a role in directing traffic, but its contribution is not high.

3. Wallets

In terms of wallet usage, the top 5 wallets in Japan are MetaMask, Bitget Wallet, Phantom, Trust Wallet, and Coinbase Wallet.

MetaMask, as one of the earliest wallets in the Ethereum ecosystem, has a good first-mover advantage and is very popular globally, not just in Japan.

Bitget Wallet has rapidly climbed to the second position in Japan, second only to Metamask, due to its keen market insights and rapid iterations. It currently supports over a hundred public chains and provides innovative liquidity aggregation algorithms for smoother trading experiences. It has recently added support for the Solana public chain, expanding users' awareness of on-chain dynamics on Solana, helping users quickly capture more on-chain alpha in the ongoing hot MEME market.

Phantom, as the most popular native wallet on the Solana network, has risen to the third position in Japan due to the recent popularity of the Solana ecosystem. It has accumulated a large user base and formed a strong traffic matrix with high-quality ecological projects in the current Solana market, leading to rapid user growth.

Trust Wallet, launched in 2017, has a good first-mover advantage and its simple and user-friendly design aligns with the habits of Japanese users, making it popular among users.

Coinbase Wallet, despite Coinbase announcing its exit from the Japanese market in January 2023, is still being used by many users in Japan due to its association with Coinbase, making it a popular choice.

Conclusion

Japan is known for its unique blend of traditional culture and modern innovation, and its rapid acceptance of new things compared to most countries. It is one of the earliest countries to understand, support, and encourage the development of cryptocurrencies. This report primarily investigates the cryptocurrency market in Japan from three main aspects: "Overall Market Situation," "Characteristics of Local Cryptocurrency Users," and "Competition Landscape and Platform Advantages."

From the overall market perspective, Japan's overall volume and acceptance of cryptocurrencies are at a leading position globally, ranking 18th in the world. The "daily active users" of Japanese users on centralized exchanges is approximately 350,000, which is equivalent to the user base in Turkey.

From the perspective of regulation and cultural influence, due to the "Mt. Gox hacking" incident, the Japanese government early on realized the importance of regulating cryptocurrencies and has successively studied and implemented relevant policies. As Japanese society values education, innovation, and the arts, Japanese users generally have a high level of education and a relatively high level of interest in blockchain games and NFTs.

Japanese users are generally familiar with cryptocurrency trading and interactions with on-chain projects, and they have the following characteristics:

- Japanese users prefer spot trading, mainly trading mainstream coins and local Japanese project tokens.

- Japanese users have a high level of interest in first-generation meme coins, including DOGE, SHIB, and are also enthusiastic about early blue-chip coins such as XRP and ADA.

- Japanese users have high participation in NFT trading, on-chain task platforms, on-chain transactions, and Web3 games.

In terms of competition landscape and platform advantages, localized exchanges hold over 42% of the market share, much higher than in Western Europe, Southeast Asia, and other countries and regions. There is not much difference in the data of decentralized exchanges, and usage habits are concentrated on top public chain decentralized exchanges such as Solana, BSC, and Ethereum. In terms of wallets, MetaMask, Bitget Wallet, Phantom, Trust Wallet, and Coinbase Wallet are the top 5 wallets used by Japanese users.

Finally, based on comprehensive research by the Bitget Research Institute, looking ahead to the second half of 2024, we expect the following developments in the Japanese market for readers' reference:

- With the introduction of global compliance policies and the listing of cryptocurrency ETFs in the United States, more institutional users and retail investors in Japan will participate in cryptocurrency market investments.

- The cryptocurrency adoption rate among Japanese users will continue to increase, maintaining a position in the global top 20. The daily active users (DAU) participating in cryptocurrency trading in the Japanese market is expected to increase from 350,000 in 2024 to around 500,000 by the end of 2024.

- Japanese users will continue to be enthusiastic about participating in localized projects, such as blockchain games, and their participation in NFTs and on-chain task platforms will continue to increase.

- 1-2 projects in the Japanese region that develop on-chain games may receive capital support and become important global cryptocurrency projects.

- Wallets with trading aggregation functionality and NFT trading will gain more favor among Japanese users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。