Original Title: 《It’s time to talk about L2 MEV》

Author: sui14

Translation: Ladyfinger, BlockBeats

Editor's Note: This article provides an in-depth analysis of the impact of the Dencun upgrade on the Ethereum L2 network, revealing the positive outcomes of the upgrade in reducing transaction costs, increasing user activity, and asset inflows, while also pointing out the negative effects such as network congestion and high rollback rates caused by MEV activities. The article calls for community attention and joint development of MEV solutions adapted to L2 characteristics to promote the healthy development of the Ethereum ecosystem.

Introduction

In this article, we aim to provide a data overview of the current L2 status. We monitored the importance of the Dencun upgrade in March for the reduction of gas fees on L2, studied how activities on these networks have evolved, and emphasized the emerging challenges driven by MEV activities. In addition, we discussed potential barriers to developing MEV tools and solutions for L2.

The Good: Adoption of L2 after the Dencun upgrade

Gas costs reduced by 10 times

Gas fees on Ethereum L2 consist of two parts: the cost of executing transactions on L2 and the cost of submitting batch transactions to Ethereum L1. Different L2 gas fee structures and sorting rules vary due to their development stages and design choices. For example, Arbitrum operates on a first-come, first-served (FCFS) basis, processing transactions in the order they are received. In contrast, Optimism (OP Mainnet) and Base, as part of the OP Stack, use a priority gas auction (PGA) model, which combines L2 base fees and priority fees. Users can choose to pay higher priority fees to be included faster and appear earlier in the block. Understanding the fee structure is crucial for understanding the growth of the ecosystem and MEV dynamics.

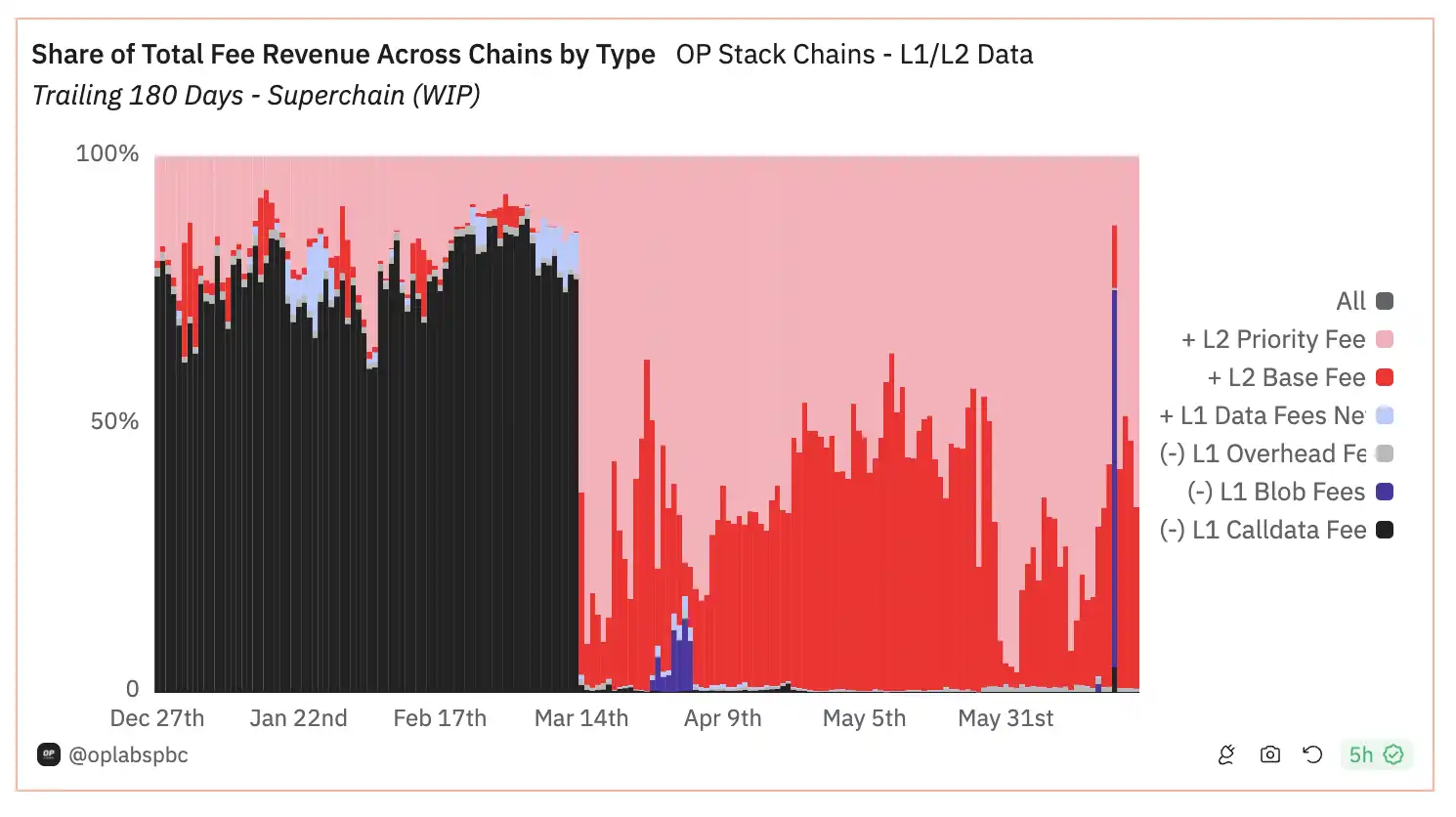

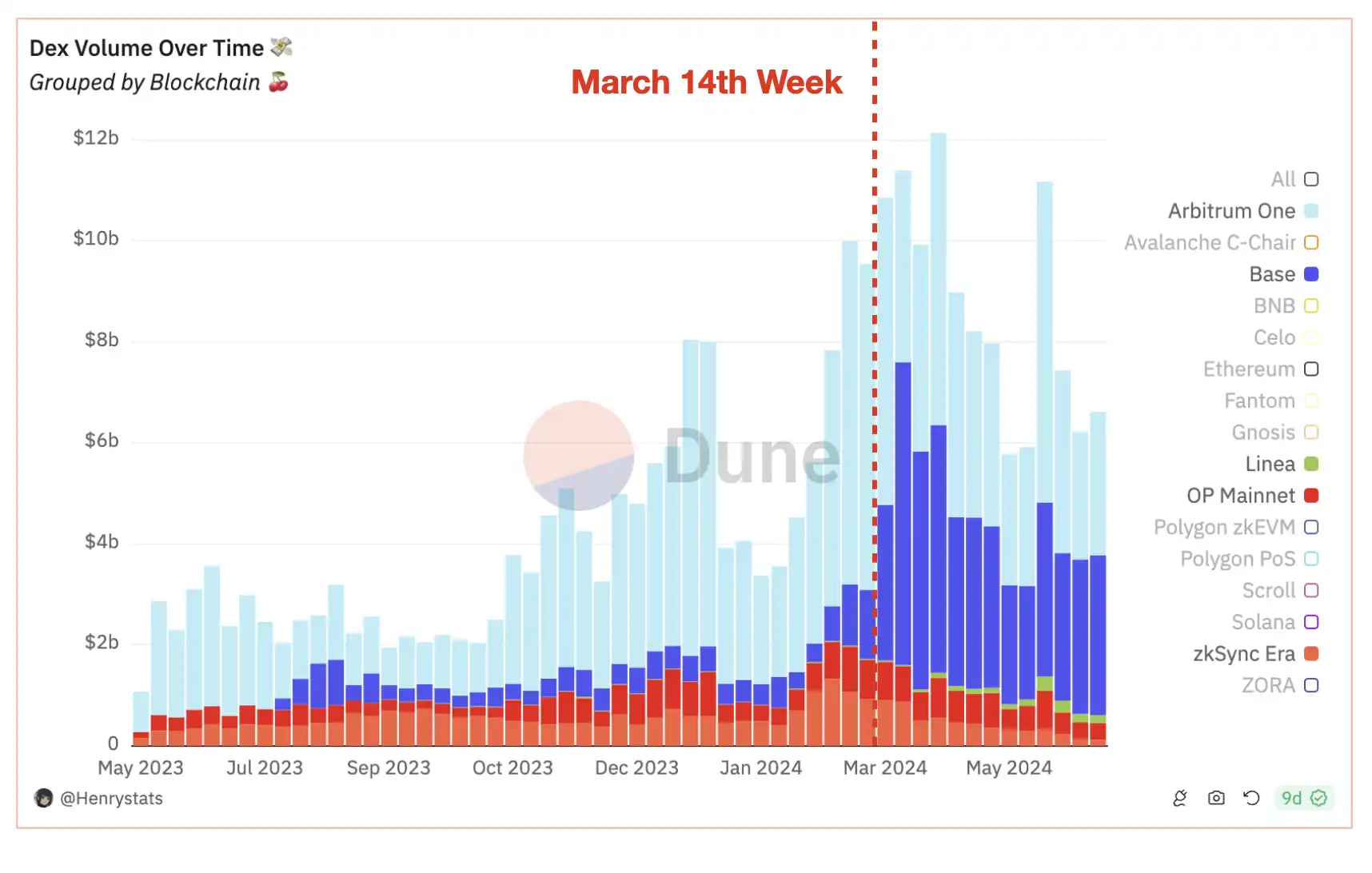

Historically, gas fees on Ethereum L1 have constituted the majority of the total fees users need to pay when trading on L2, accounting for over 80% of the cost, as shown by the black bars in the graph below. However, after the Dencun upgrade on March 14, L2 transitioned from using calldata to a more economical method, known as "blobs 1," for submitting batches to L1. This temporary storage includes its own gas auction, composed of blob base fees and priority fees.

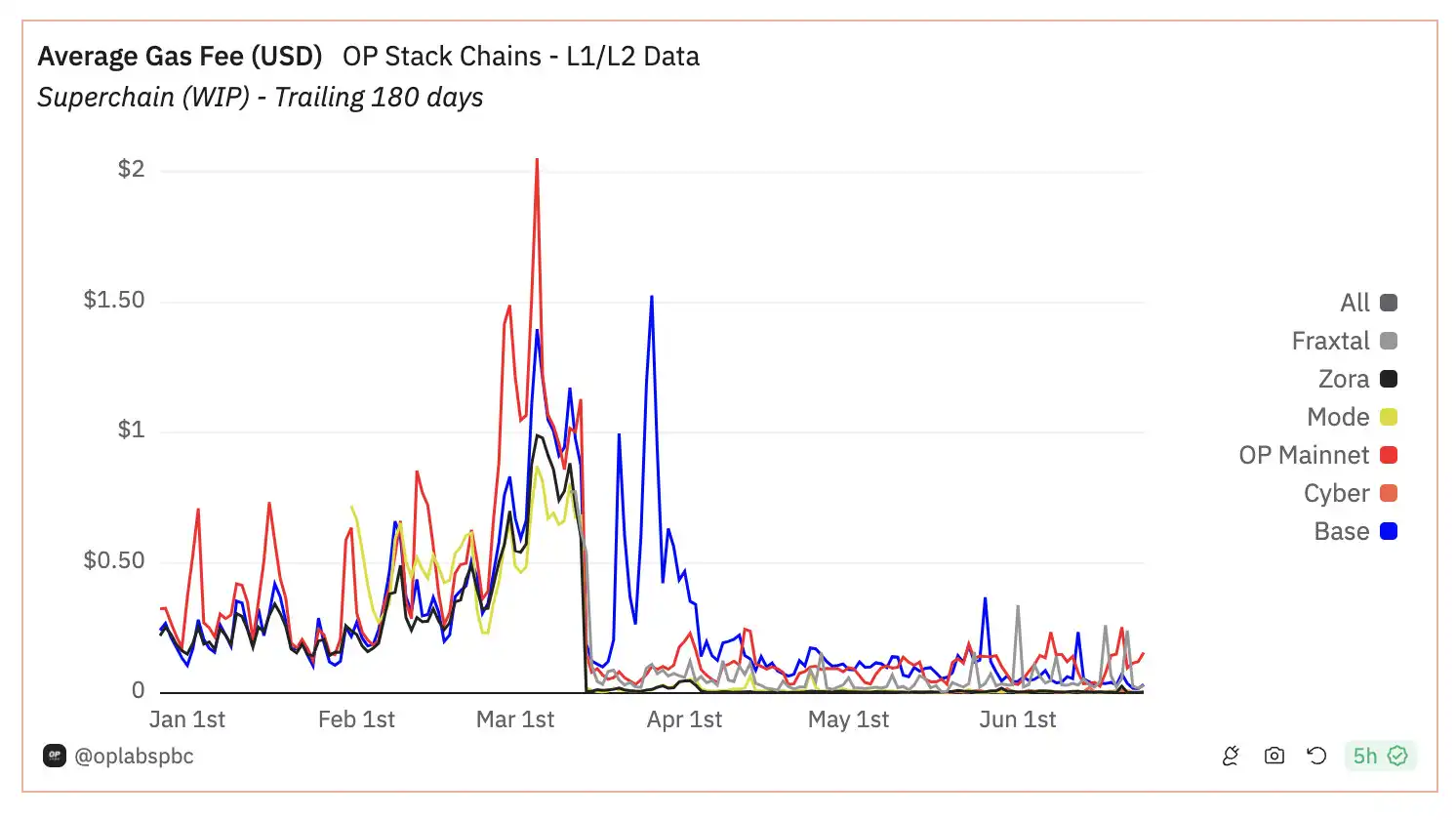

Since Dencun, the fees paid by L2 to L1 have significantly decreased— the chart shows a significant change in the gas cost breakdown of the OP Stack chain, with L1 costs plummeting from over 90% to just 1%, while L2 costs now account for 99% of the total cost. This shift has led to an overall approximate tenfold decrease in the average total gas fees on L2, for example, the average gas fee on OP Mainnet dropping from about $0.5 per transaction to $0.05.

Surge in activity on L2

Following the cost reduction, there has been a noticeable increase in activity and usage on L2, as evidenced by the surge in L2 gas fees in the graph above. It is worth noting that on March 26, the average gas fee on Base exceeded the pre-upgrade peak. To accommodate more transactions and reduce network congestion, Base increased its gas target from March 26 and made several adjustments thereafter.

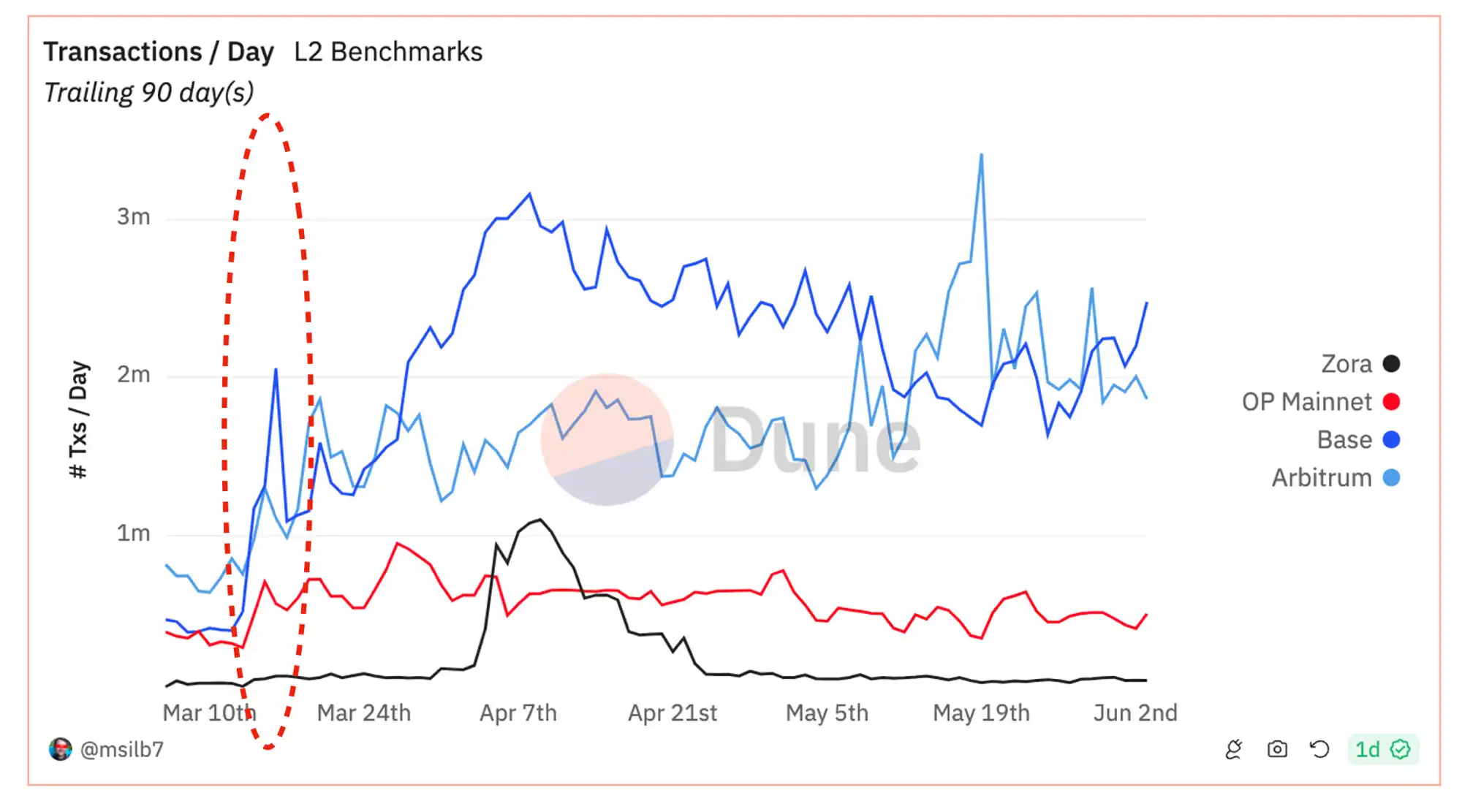

The chart below highlights the daily transaction volume on L2, showing significant growth on networks such as Arbitrum, Base, and OP Mainnet. In particular, the daily transaction volume on Base has quadrupled, now processing approximately 2 million transactions per day.

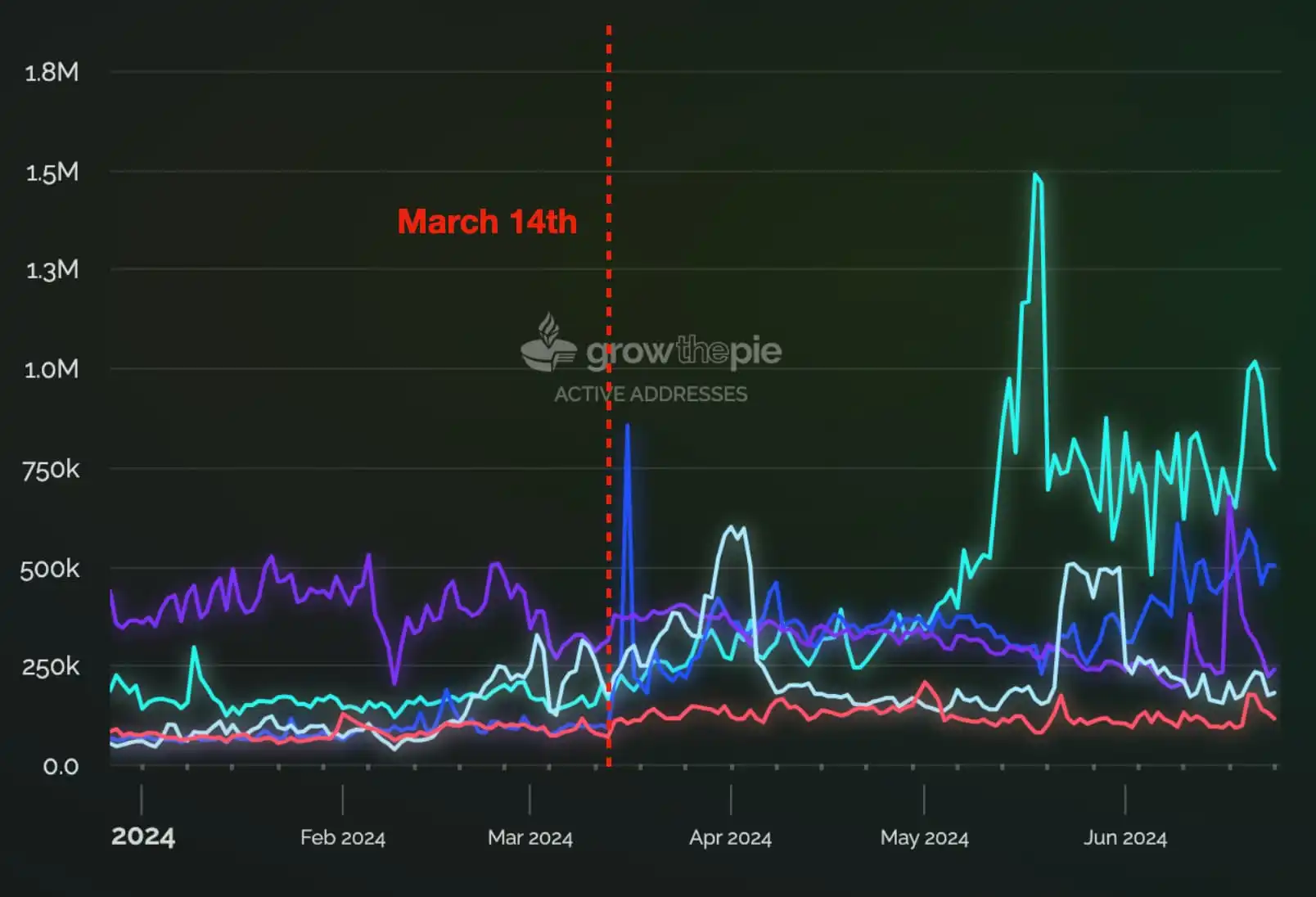

While it is difficult to determine whether this is the result of organic participation or influenced by incentive programs and Sybil activities, all major active addresses and DEX trading volumes on L2 have significantly increased since the EIP-4844 upgrade, especially on Base and Arbitrum, as a result of improved market conditions and the arrival of the memecoin season triggered by WIF on Solana since the end of last year.

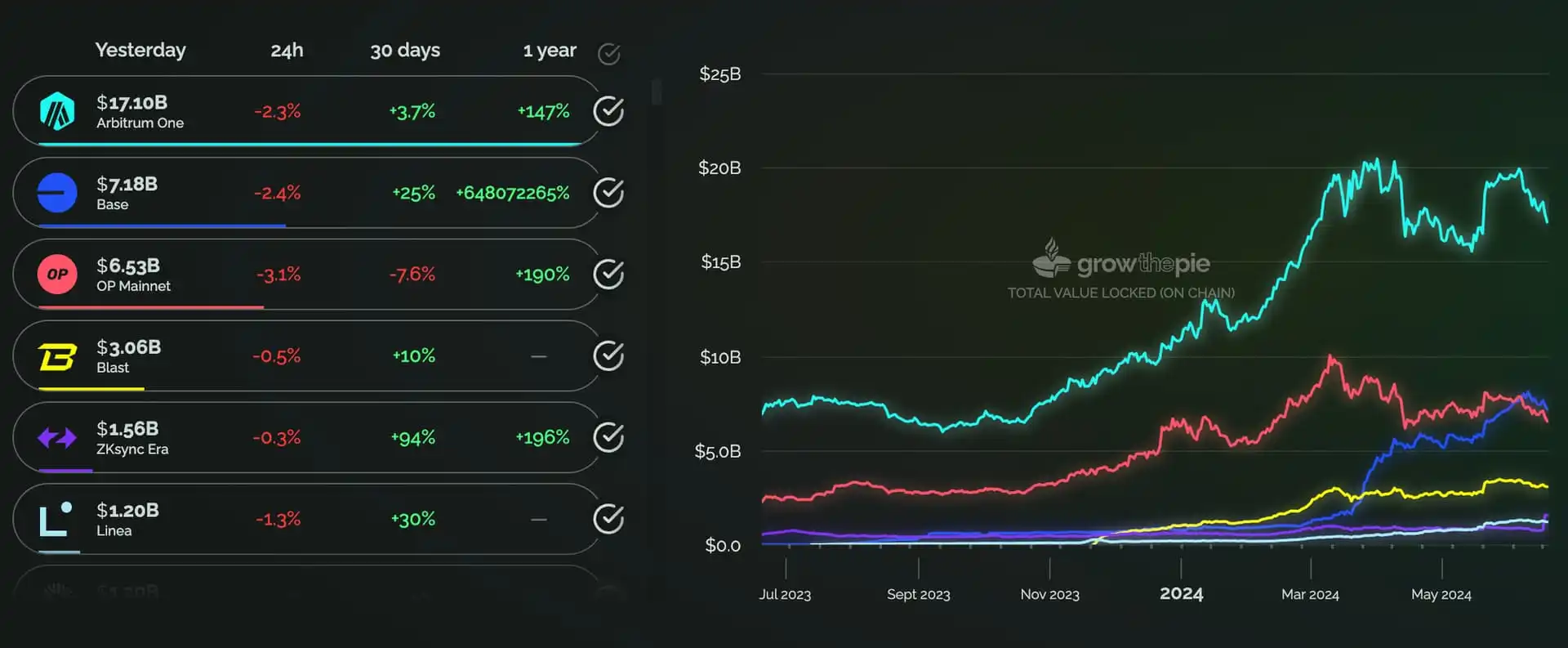

Inflow of assets into L2

With the improvement in market conditions and the arrival of the memecoin season triggered by WIF on Solana since the end of last year, TVL on L2 has continued to rise. It is noteworthy that Base has become the fastest-growing chain, with its recent total TVL surpassing that of OP Mainnet.

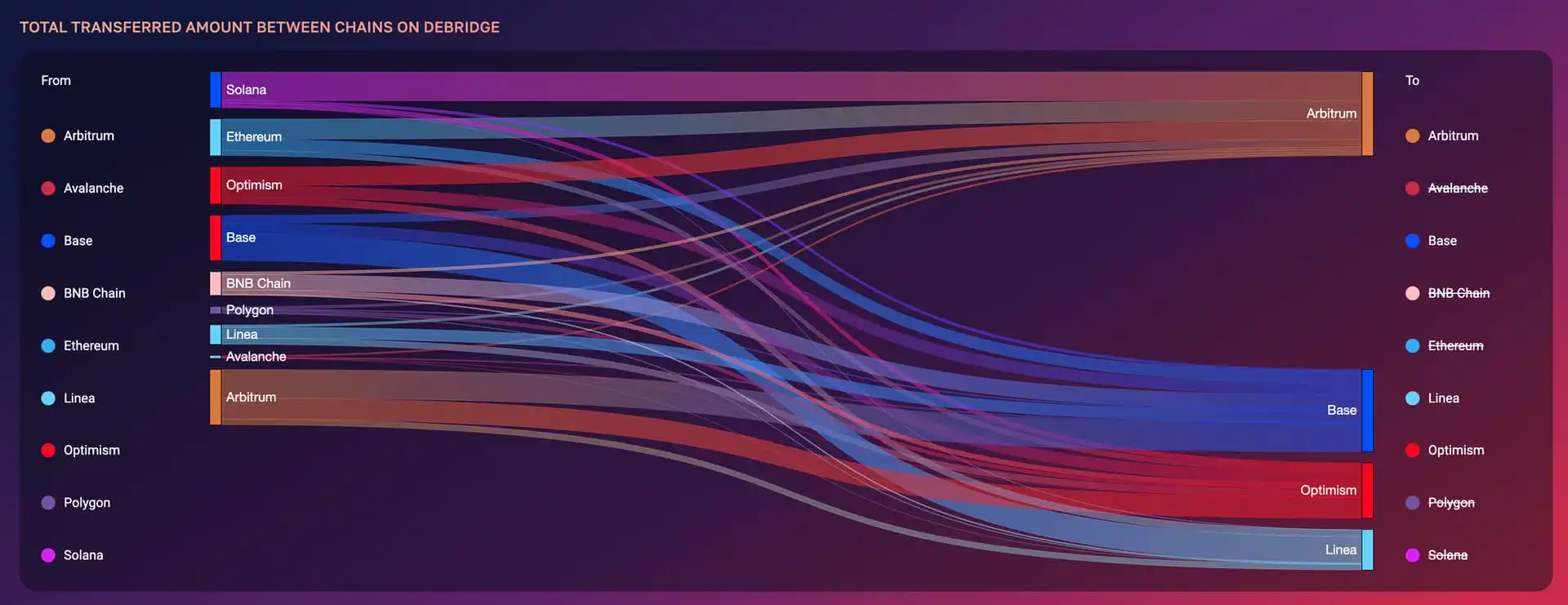

Since early March, Base has seen an inflow of approximately $1.5 billion in USDC, some of which is from Coinbase transferring funds from customers and businesses to Base. According to data from Artemis on 11 major bridges since January 2024, there has been an outflow of $14 billion from Ethereum to major L2s. Arbitrum leads with approximately $7 billion, followed by zkSync, Base, and OP Mainnet. Further data from Debridge Finance, a widely used cross-chain bridge in EVM chains and Solana, confirms that Arbitrum and Base are the top recipients of all outflows.

The Bad: As gas fees decrease, hidden MEV activities gradually increase

When we further examined the transactions, we noticed that bot trading activity is increasing gas fees and rollback rates on L2. In the next section, we will use statistical data from Base to conduct a case study and explore this issue more comprehensively, highlighting the impact of cheaper gas on L2 after the Dencun upgrade.

L2 after the Dencun upgrade: Similar to Ethereum without Flashbots, but lacking a transaction pool

Network congestion

Challenges began to emerge on March 26, when the average daily gas fees on the Base network briefly surged, exceeding the levels before the Dencun upgrade. However, on June 3, Base increased its gas target to 7.5M gas/second, compared to 2.5M gas/second during the Dencun upgrade, bringing the average gas cost back down to approximately 5 cents.

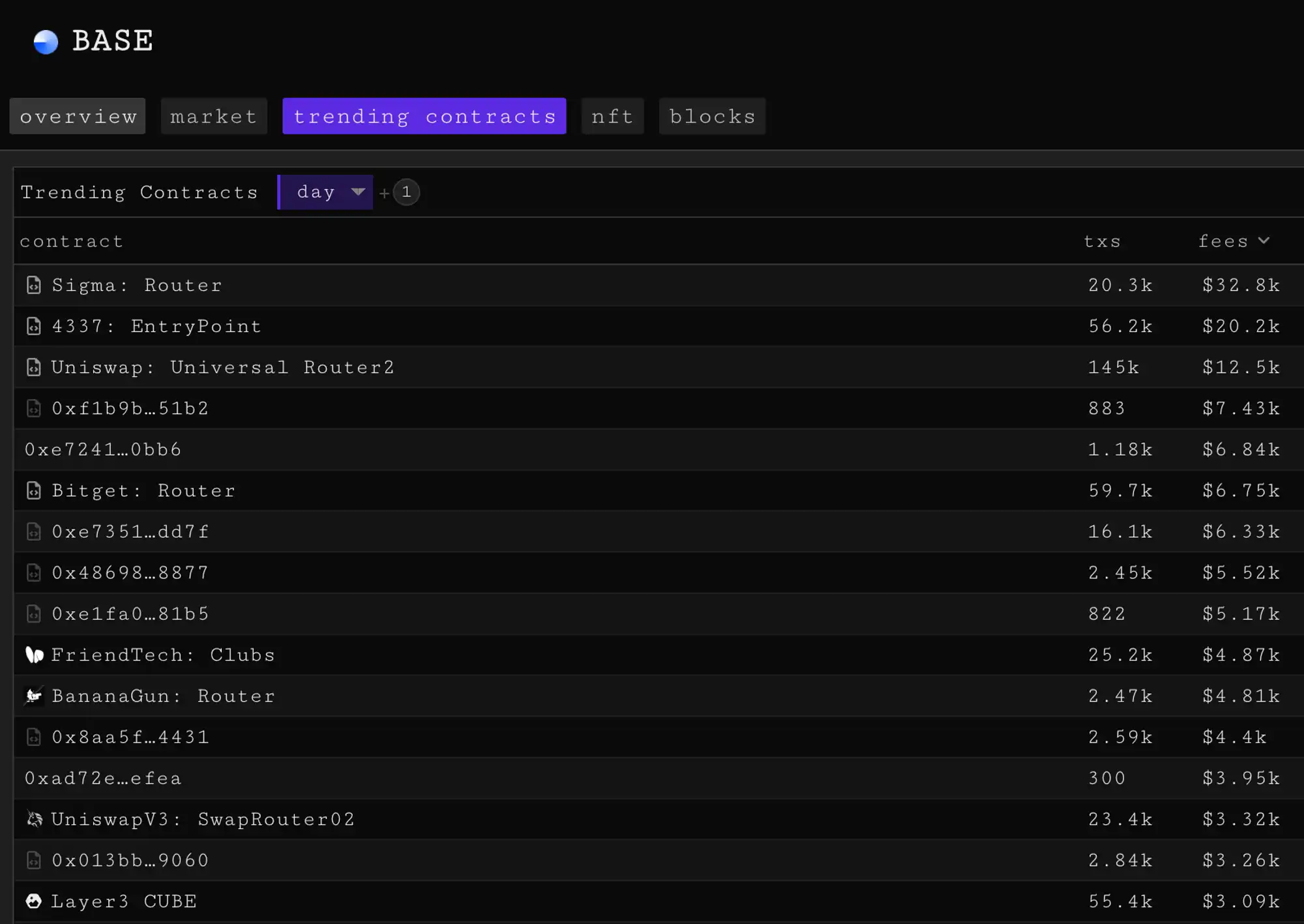

On the Base network, the contracts that consume the most gas include Telegram trading bots like BotSigma and Banana Gun, as well as digital wallets and DEXs such as Bitget and Uniswap. Additionally, many unmarked contracts are involved in activities such as token minting, meme coin trading, and atomic arbitrage. These contracts are ranked by gas fees on the Base network.

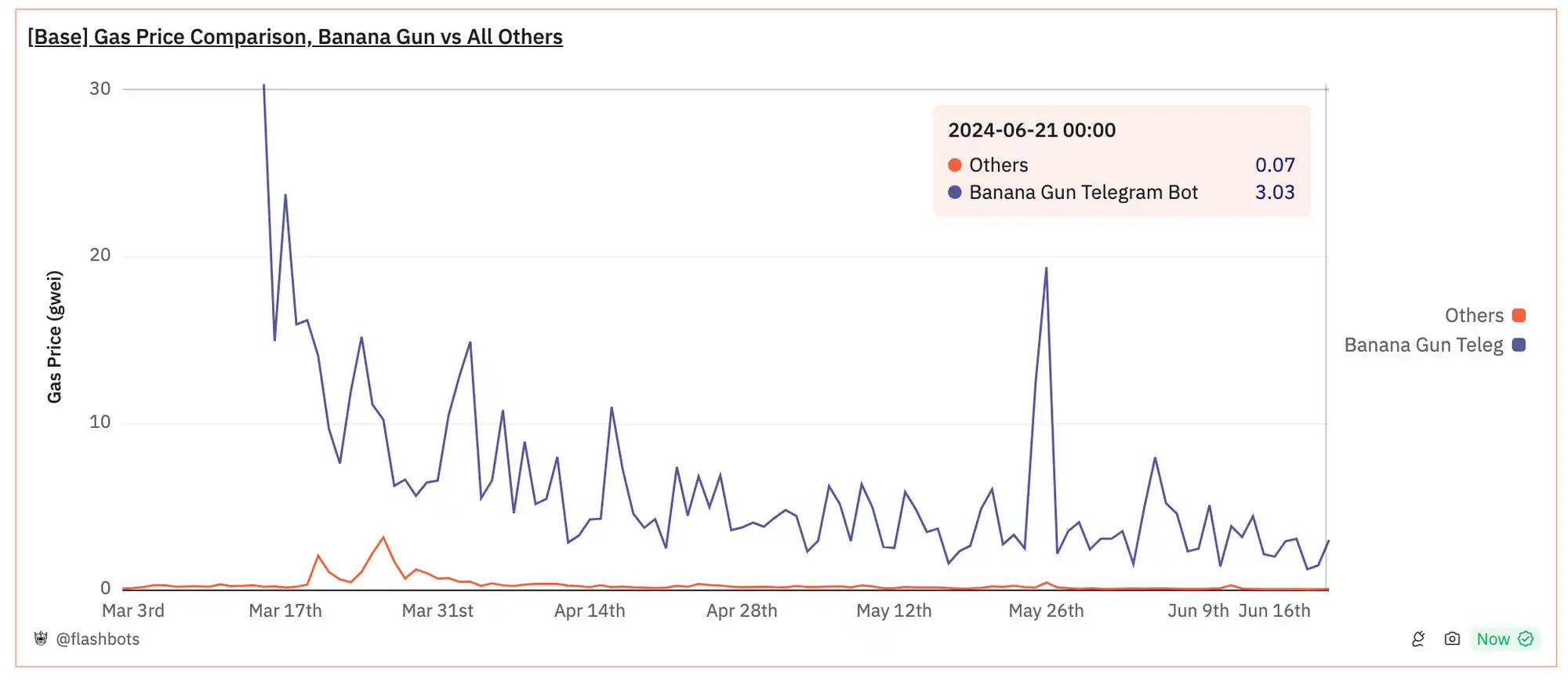

By comparing the behavior of popular Telegram bots like BananaGun, it is evident that the transactions they conduct generate significantly higher gas fees than regular transactions. After the Dencun upgrade, users executing transactions on the Base network using the BananaGun Telegram bot experienced a peak gas price of 30 Gwei. Although this rate later stabilized at around 3 Gwei, it was still 43 times higher than the gas fees for other transactions.

Daily gas prices on Base, comparison of Banana Gun transactions with other transactions

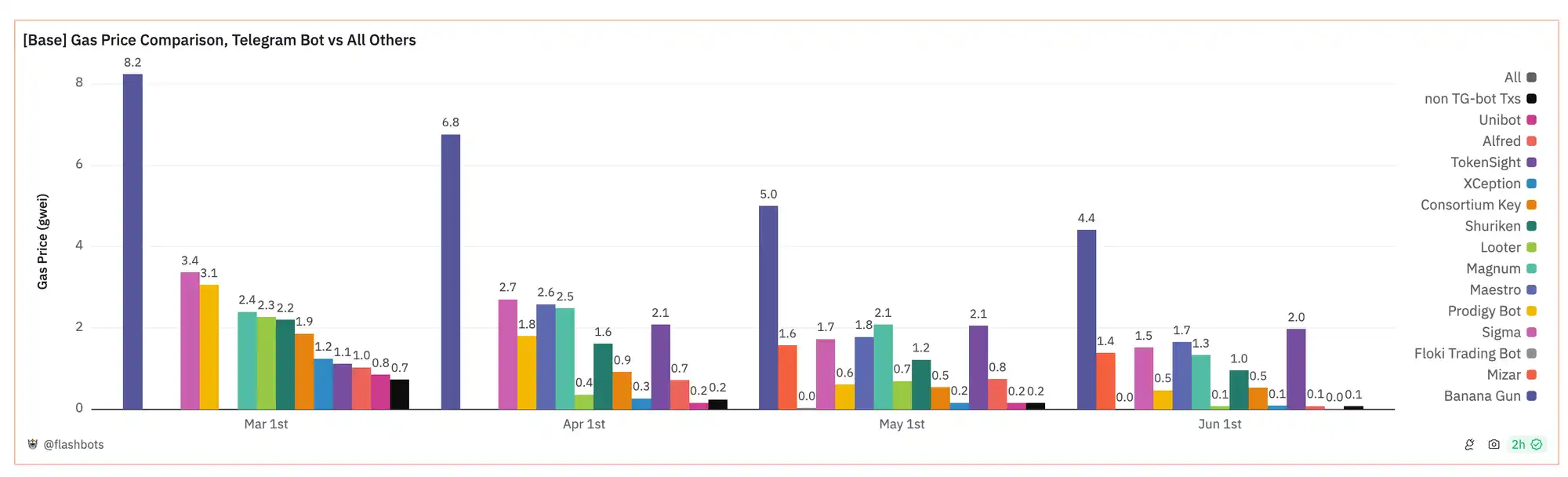

When analyzing the average monthly gas prices paid by all major DEX trading bots on the Base network and comparing them with non-Telegram bot transactions (represented by the black bars), it is clear that users using trading bots incur significantly higher gas costs. The following is a comparison of monthly gas prices on the Base network, showing the difference between all Telegram bots and other transactions.

Soaring rollback rates

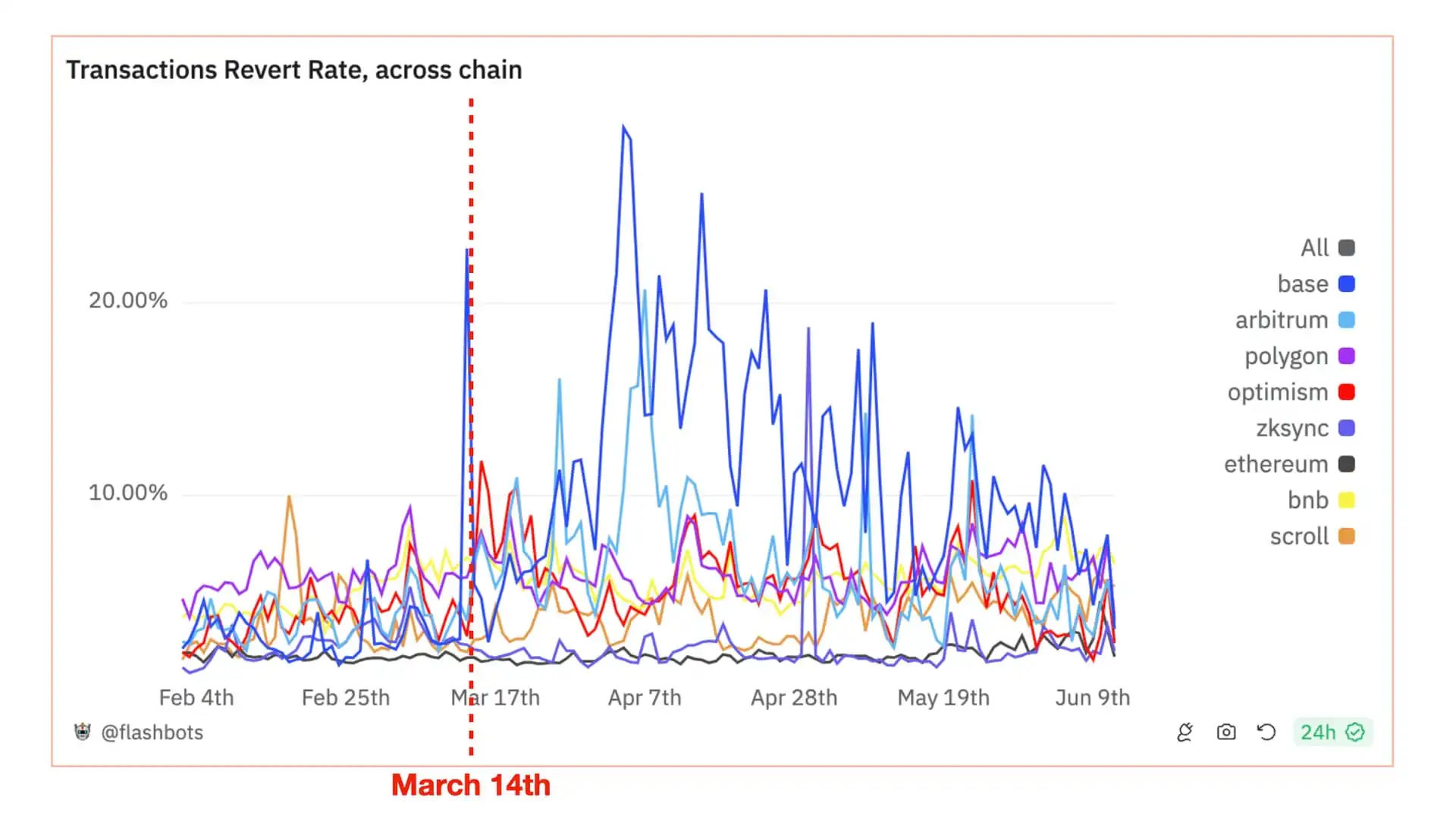

The rollback rate of transactions on a blockchain network is an important indicator of its health. We noticed that after the Dencun upgrade, especially on L2 networks like Base, Arbitrum, and OP Mainnet, the rollback rates have increased. Currently, the rollback rate on the Ethereum mainnet is approximately 2%, while the rollback rates on Binance Smart Chain and Polygon are between 5-6%. Before the Dencun upgrade, the rollback rate on Base was maintained at around 2%, but it sharply rose to about 15% after the upgrade, reaching a peak of 30% on April 4. At the same time, Arbitrum and OP Mainnet also experienced periodic spikes in transaction failure rates, fluctuating between 10% and 20%.

Cross-chain transaction rollback rates

Upon further analysis, we found that the high rollback rates on L2 networks do not always represent the actual experience of regular users. Instead, these rollbacks are likely caused by MEV bots. By using the following heuristic method (Query 2), we identified a group of router contracts that exhibit behavior similar to that of MEV bots— they show higher rollback rates when executing MEV extraction transactions:

Since the Dencun upgrade,

- Active routers: The contract has processed over 1000 transactions.

- Limited interaction EOAs: Less than 10 external owned accounts (EOAs) wallets have interacted as transaction senders.

- Sender distribution: Less than 50% of transaction senders have only sent one transaction, indicating that the user group does not exhibit a long-tail distribution. This suggests that routers are unlikely to be used by retail users.

- Behavioral pattern: Transaction history precisely covers 24 hours or shows multiple transactions in one block, indicating non-human behavior.

- Exchange concentration: Over 75% of successful transactions involve exchanges.

- Detected MEV transactions: Over 10% of successful transactions use atomic MEV strategies, as detected by hildobby's heuristic method.

Using these criteria, we detected 51 routers on Base, which likely represents a conservative lower bound estimate of bot activity on Base.

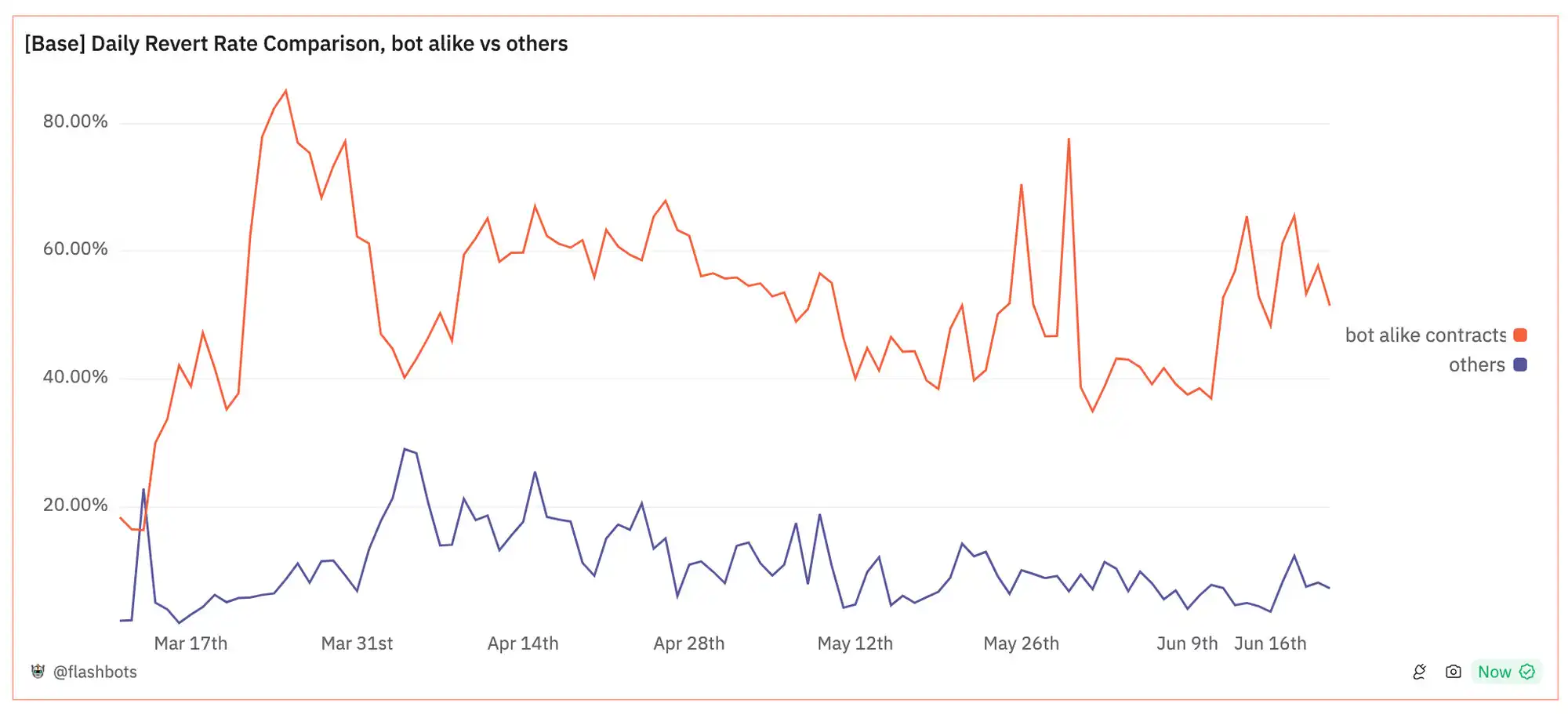

We divided all transactions processed by routers on the Base network into two groups and conducted a comparative analysis. The results show that the rollback rate difference between router contracts similar to bots and other transactions is significant: the average rollback rate of bot-like contracts reaches 60%, which is six times higher than the approximately 10% observed for other transactions.

Daily rollback rates on Base, comparison of bot-like contracts with other transactions

Based on the data above, we can infer that automated trading activities such as MEV bots and Telegram bots are likely a major contributing factor to the high gas fees and rollback rates on the Base network.

The single sequencer architecture of L2, combined with the lack of a public transaction pool, fosters a large number of MEV strategies utilizing sequencers, which are the main cause of network congestion. This congestion is particularly evident in L2 networks using the priority gas auction (PGA) mechanism, such as OP Mainnet and Base. The result is not only network congestion but also a significant waste of block space and gas fees due to rollback transactions and MEV searcher activities. This is similar to the situation on Ethereum before the emergence of Flashbots, with the difference being that the phenomenon of sandwich MEV does not exist on L2 due to the lack of a transaction pool.

How significant is the scale of MEV on L2?

Understanding MEV activity on L2 networks is crucial for assessing its impact. However, there is currently no widely accepted figure for L2 MEV data that has been verified through multiple sources and reliable methods. Additionally, compared to the Ethereum mainnet, L2 lacks real-time monitoring data provided by tools like mev-inspect, libmev, and eigenphi, which are crucial for measuring the total amount of MEV and miner profits.

Some of the L2 MEV datasets and research published to date include:

- Open dataset constructed by hildobby on Dune Analytics (Heuristic links: sandwich | sandwich | atomic arbitrage)

- Research paper "Quantifying MEV On Layer 2 Networks" by Arthur Bagourd and Luca Georges Francois, which quantifies MEV on Polygon, OP Mainnet, and Arbitrum using mev-inspect. This research was sponsored by Flashbots.

- Research paper "Rolling in the Shadows: Analyzing the Extraction of MEV Across Layer-2 Rollups" written by Christof Ferreira Torres, Albin Mamuti, Ben Weintraub, Cristina Nita-Rotaru, and Shweta Shinde, quantifying activities and discussing new MEV strategies on L2 utilizing the sequencer role and L2 batch confirmation delays.

In addition to the above resources, Sorella Labs will soon release their MEV data indexer tool Brontes, which will be an open-source repository available for Ethereum mainnet and L2. Flashbots and Uniswap Foundation are seeking funding to expand L2 MEV taxonomy and quantification. If you are working in this area or interested in collaboration, please contact the Flashbots Market Research team.

While further validation is needed, the dataset released by hildobby on Dune Analytics provides a valuable initial reference standard.

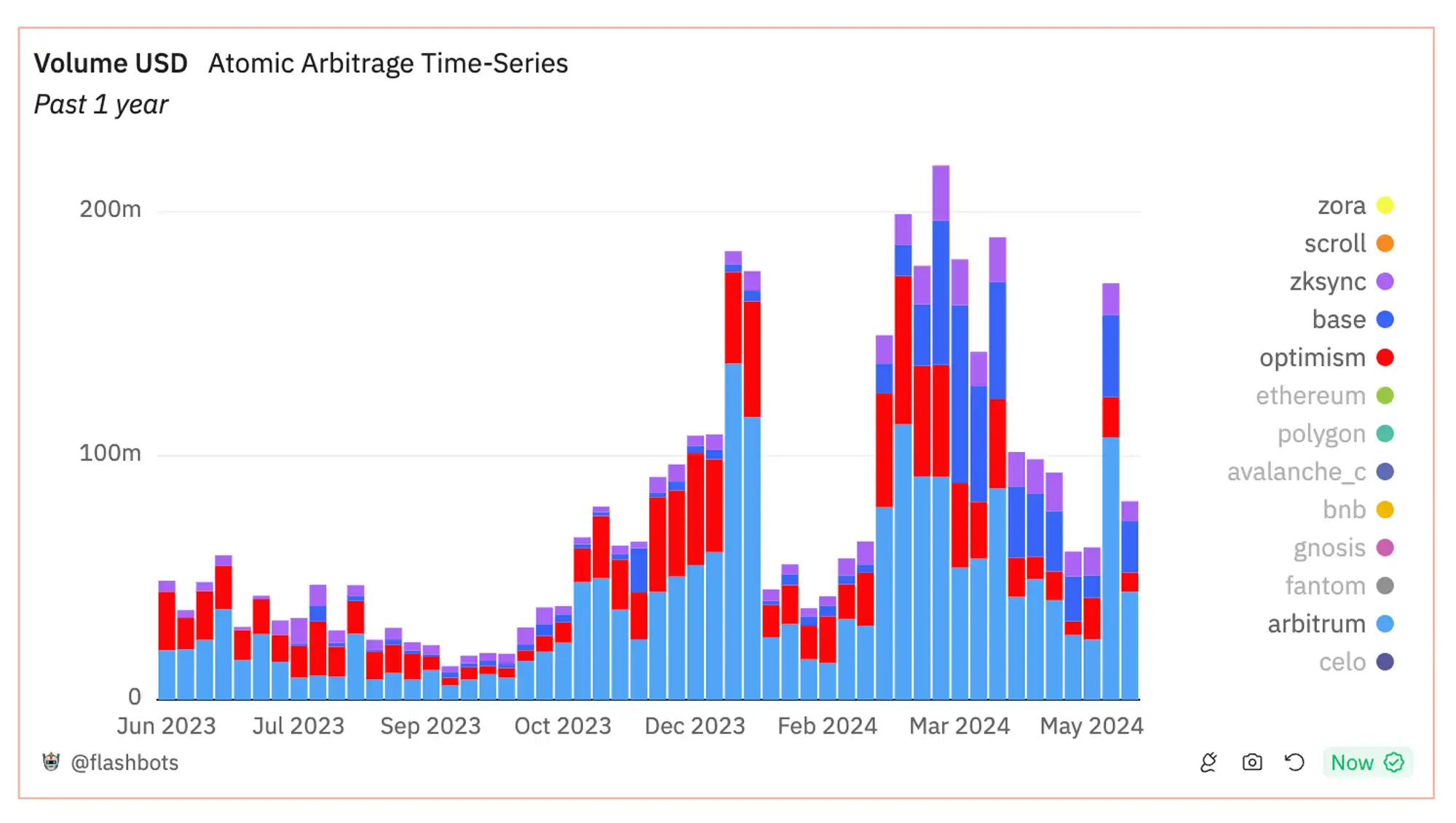

Atom arbitrage volume on L2 using the hildobby dataset

Source

In the past year, the volume of atomic arbitrage MEV transactions on six major L2 networks, including Arbitrum, OP Mainnet, Base, Zora, Scroll, and zkSync, has exceeded $36 billion, accounting for 1% to 6% of the total decentralized exchange (DEX) trading volume on each chain. Initially, this MEV transaction volume was primarily concentrated on Arbitrum and OP Mainnet, but it has gradually shifted towards Base and zkSync.

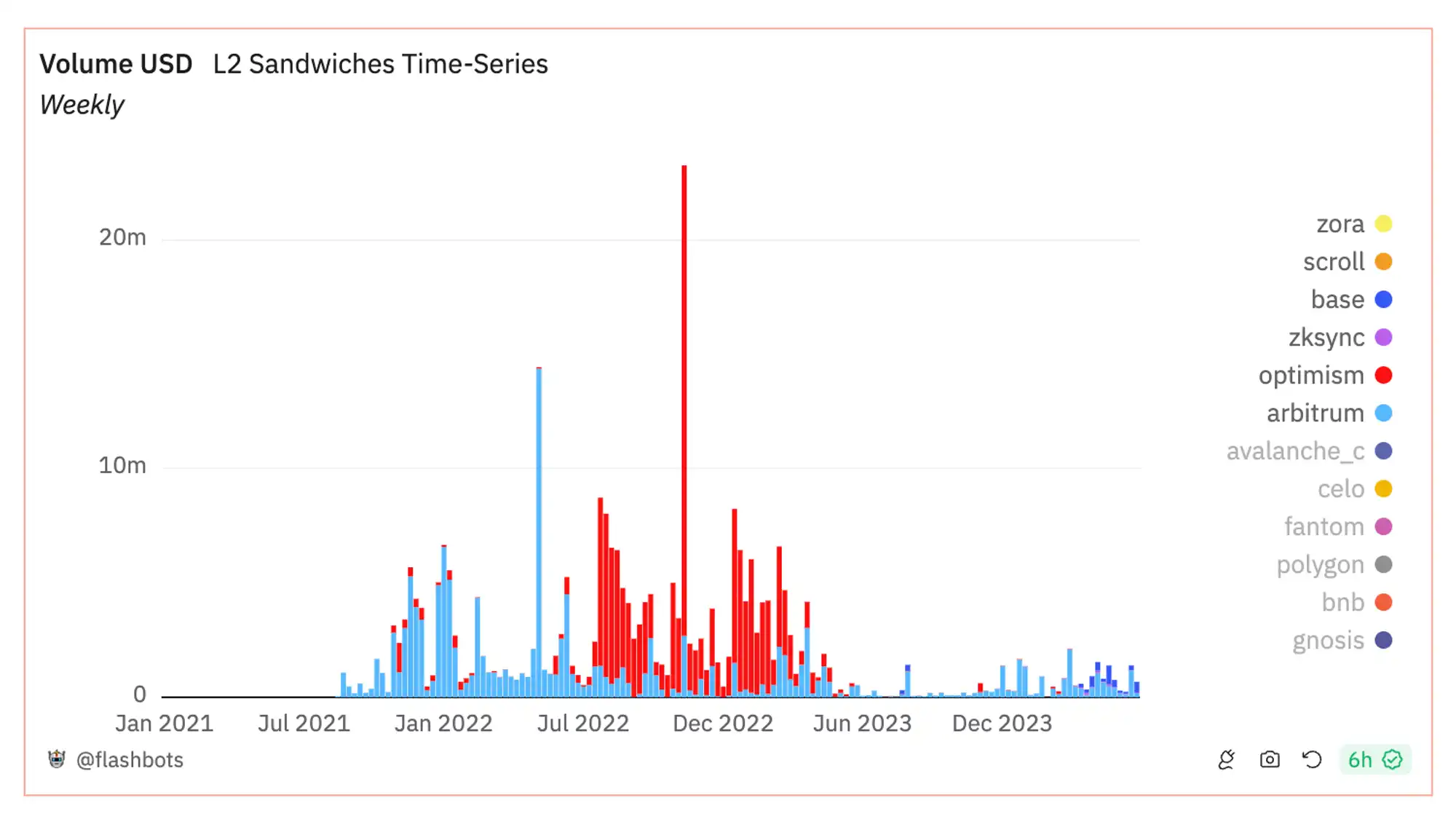

Compared to atomic arbitrage volume, sandwich attack transaction volume on L2 networks is significantly lower, in stark contrast to Ethereum, where sandwich attack transaction volume is four times that of atomic arbitrage. This difference is mainly due to the single sequencer setup on L2 networks and the absence of a transaction pool, which limits the ability of searchers to execute sandwich MEV using user transactions in the transaction pool, unless there is a data leak from the transaction pool or a sandwich attack initiated by a single sequencer. Therefore, on L2, atomic arbitrage, blind front-running, statistical arbitrage, and liquidation become more viable strategies for searchers.

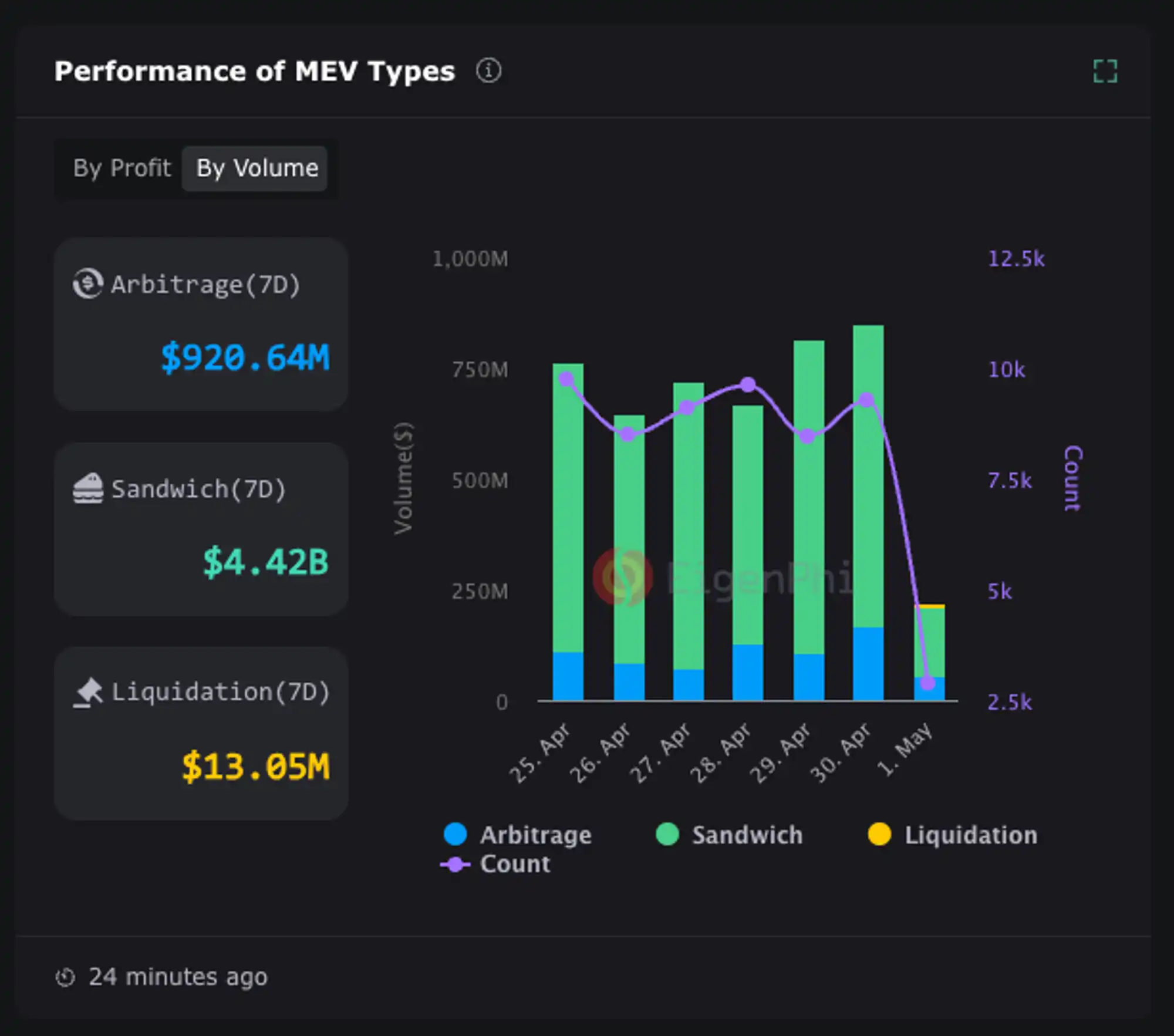

Ethereum MEV Size Breakdown

How much remaining MEV income is there in the MEV market on L2?

While it is difficult to precisely quantify the MEV market, we can examine numbers from other ecosystems with MEV solutions for size comparison:

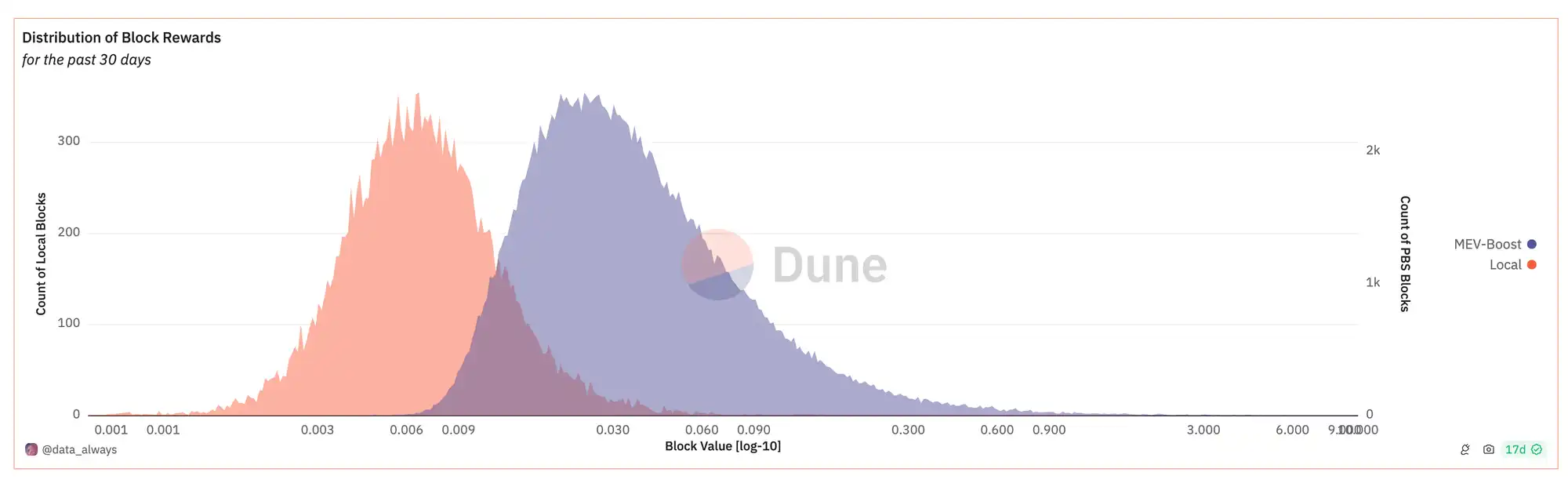

On Ethereum L1, annual validator income from MEV-boosted blocks is approximately $96.8 million (based on an estimated price of $3500/ETH); the median value of MEV-boosted blocks is four times the value of regular validator blocks.

Distribution of block rewards between regular blocks and MEV-boosted blocks

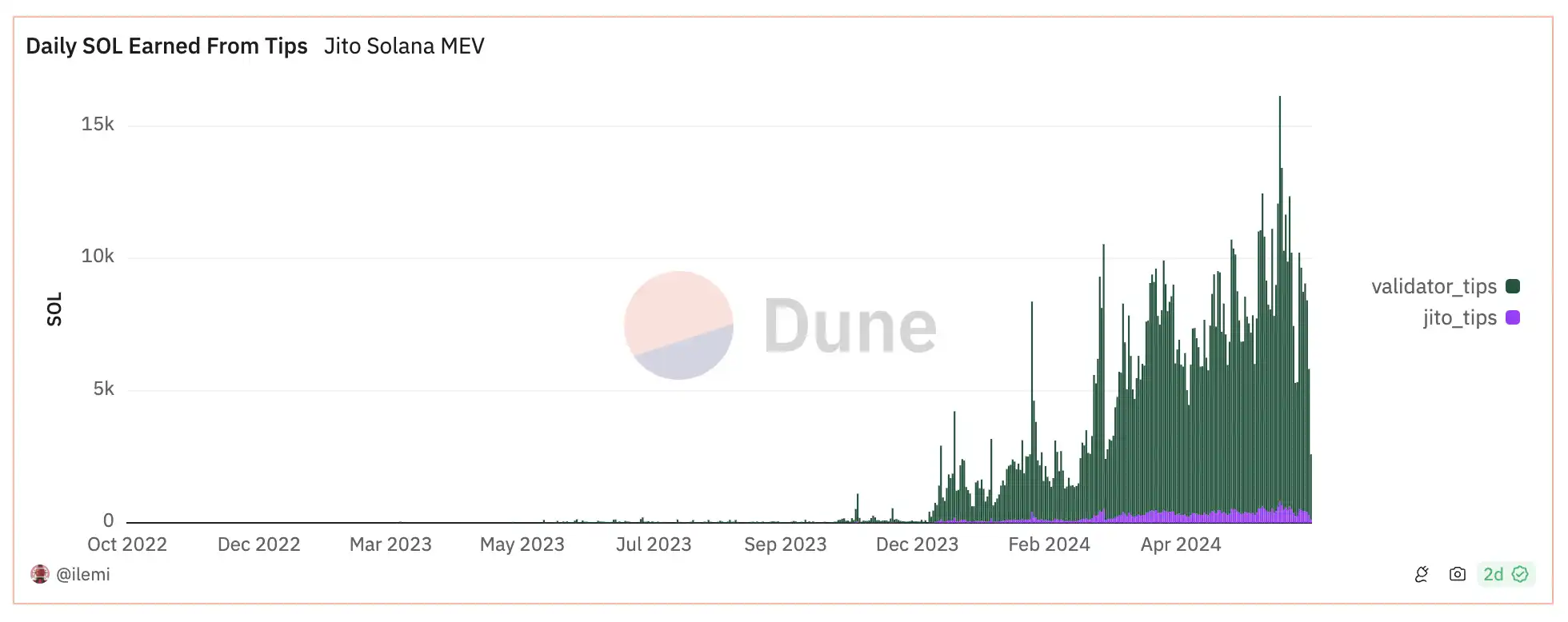

On Solana, validators collect additional MEV income from validator tips through Jito's bundling service, estimated to be approximately $338 million annually (based on an estimated price of $130/SOL for 50,000 SOL per week).

Daily tips earned through Jito bundling service, by validators and Jito Labs

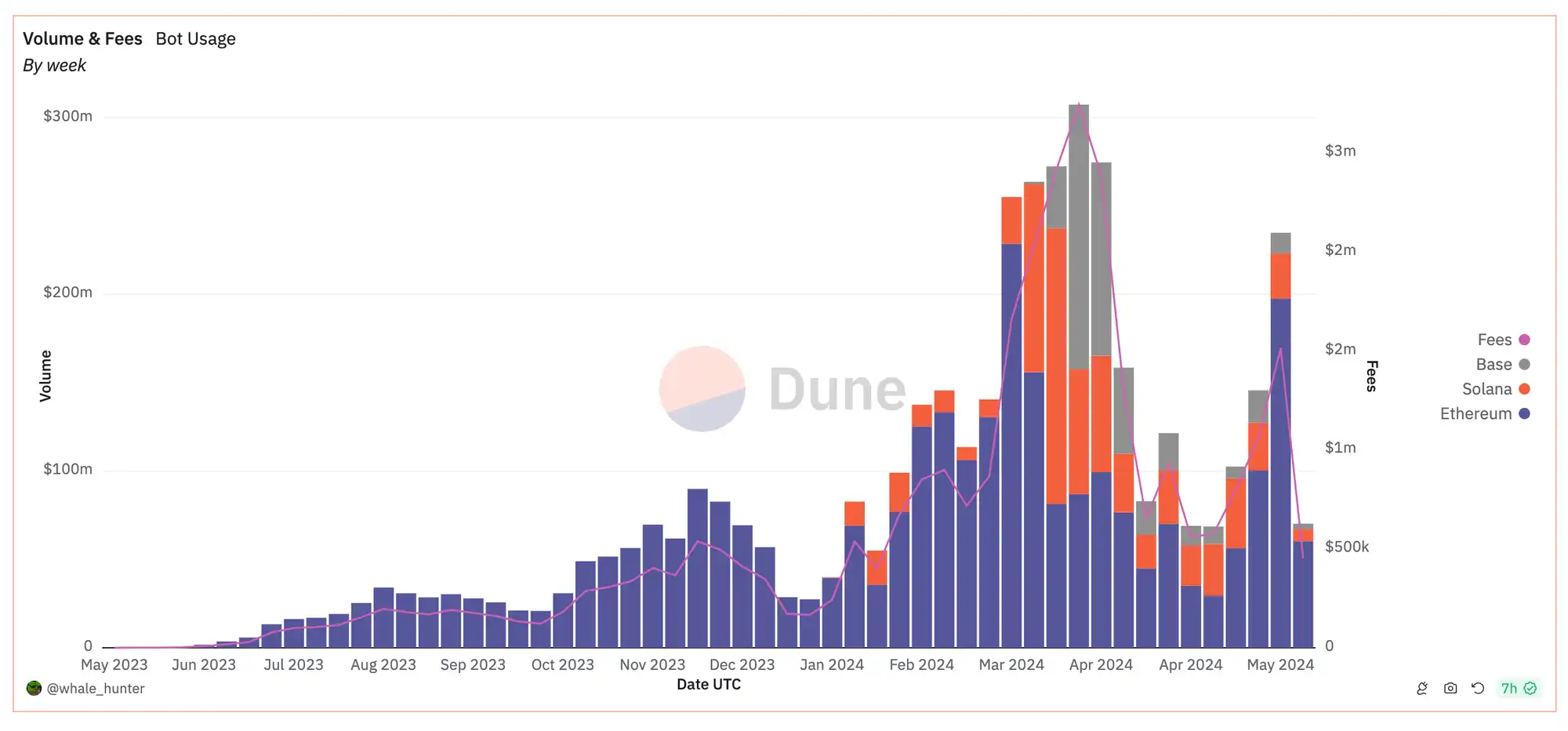

Although the exact total MEV volume on the Base network has not been disclosed, we can estimate the market size by observing the revenue of the Banana Gun Telegram Bot, one of the most active participants in the market. The trading volume of Banana Gun on Base's L2 network is roughly equivalent to that on Solana, generating over $1 million in daily trading volume on each chain, equivalent to over $10,000 in transaction fees per chain per day.

Banana Gun Telegram Bot, cross-chain volume and fees

Please note that the market share of the Banana Gun Bot on Solana may differ significantly from that on Base. For example, there are several other major Telegram bots on the Solana platform, such as Sol Trading Bot and BonkBot, while Base may support fewer Telegram bots. Therefore, the proportion of trading volume and MEV income for Banana Gun on Solana cannot be directly used to estimate the total MEV income on Base.

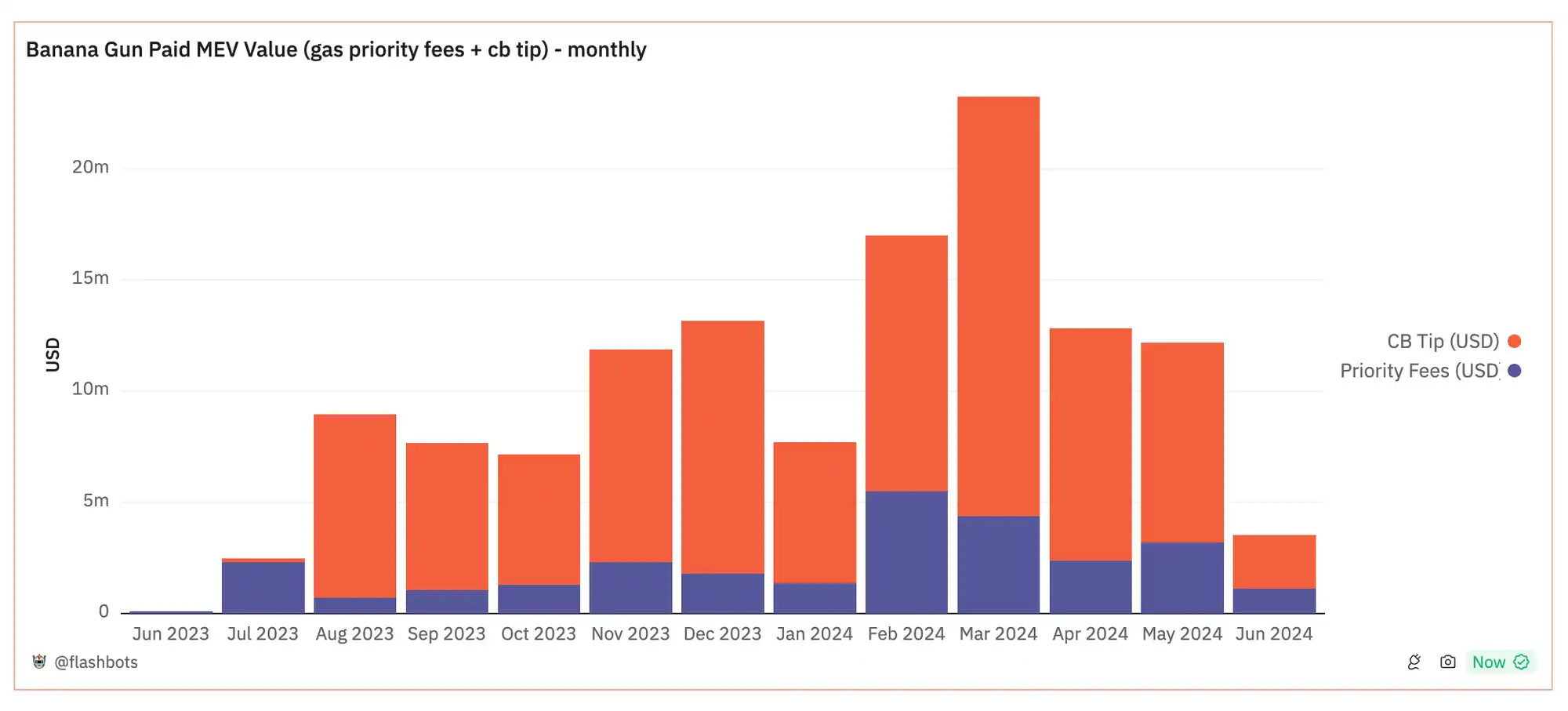

However, through another predictive method, we can see different results: in March, the Banana Gun Telegram Bot paid over $23 million to Ethereum's block producers and validators. Specifically, during the week of March 26 to April 1, the trading volume of Banana Gun on Base actually exceeded that on Ethereum, as indicated by the peak in the chart, implying a huge potential for MEV income on the Base network. This comparison of cross-chain trading volume reveals the growth prospects for Base in terms of MEV.

Of course, there are significant differences between Base and Ethereum in the MEV ecosystem. Compared to Ethereum, MEV competition on Base may not be as intense, which may lead to lower fees required by bots when bidding to validators. Nevertheless, meme coin trading bots that primarily rely on sandwich attacks and arbitrage mechanisms remain viable under Base's sequencer architecture.

Banana Gun Telegram Bot's MEV income paid to validators

Focus on MEV Issues in L2 Networks

Ethereum has developed a mature MEV ecosystem, equipped with infrastructure tools to serve participants at various levels of the supply chain. At the protocol level, MEV-boost allows validators to outsource block construction tasks through auction mechanisms. For searchers, bundling services provided by Ethereum block producers—similar to Jito Labs on Solana and FastLanes on Polygon—enable them to implement MEV strategies with rollback protection. These services ensure that block producers simulate transactions and only execute those that are guaranteed not to be rolled back. Additionally, private RPC services like Flashbots Protect provide ordinary users with a way to bypass public transaction pools and their potential risks. However, there is still significant room for improvement in developing MEV infrastructure comparable to this in current L2 networks.

Why the need to focus on MEV strategies and solutions in L2 networks?

The MEV phenomenon still exists in environments lacking transaction pools and plays a crucial role in maintaining market efficiency, particularly through the execution of strategies such as statistical arbitrage, atomic arbitrage, and liquidation to clear liquidity in outdated AMMs and lending markets.

However, the lack of mature MEV infrastructure, such as bundling services, may lead to some negative consequences. In the absence of transaction pools, many MEV strategies may degrade into spam strategies, leading to:

- Increased network rollback rates;

- Aggravated network congestion as a result.

By implementing bundling services, the focus of MEV competition can be shifted from the main chain to the auxiliary chain, effectively alleviating the high gas fee burden faced by users due to MEV bot competition. At the same time, searchers can enjoy higher profits due to rollback protection, reducing the risk cost of failure.

For L2 networks adopting shared sequencers, current mainstream solutions often require users to submit transactions to public transaction pools, which may lead to a resurgence of sandwich attacks. In this scenario, MEV protection tools like Flashbots Protect are particularly important, as they not only protect users from the threat of sandwich attacks but may also provide refunds for MEV or priority fees, ensuring users receive better transaction execution and more favorable prices.

The development of complex MEV infrastructure faces some unresolved challenges. Firstly, as more value flows to sequencers, the profit model for searchers will change over time, and marginal profits may decrease. This change may raise questions about the sustainability of long-term highly competitive search strategies. We expect market mechanisms to regulate this phenomenon, leading to common search strategies paying a larger but not full proportion of the value to sequencers, while less common strategies pay less.

Furthermore, existing MEV infrastructure, such as Ethereum's block construction market, is experiencing rapid evolution in order flow dynamics. To date, these factors have been major drivers of the centralization trend in the block construction market and the rise of private transaction pools on Ethereum L1. Ensuring the competitiveness and fairness of the block construction market remains an issue that needs to be addressed.

Finally, MEV solutions in L2 networks may need to be distinct from current Ethereum mechanisms, primarily due to the unique characteristics of L2: such as shorter block generation times, lower-cost block space, and relatively centralized governance structures. For example, Arbitrum has a block time of only 250 milliseconds, and it is currently unknown whether such a fast block generation rate can be compatible with existing MEV infrastructure. Additionally, the ample and economical block space provided by L2 has greatly changed the landscape of transaction search, making the spam problem more severe and in need of new resolution strategies. Furthermore, compared to other environments like Ethereum L1, governance in L2 is more centralized, which may allow for additional requirements to be imposed on MEV service providers, such as requiring block producers to avoid sandwich attacks on users to ensure market fairness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。