Author: Hyphin

Translator: Yangz, Techub News

Perhaps, buying Bitcoin is ultimately the best choice.

Despite the continuous positive trend in mainstream coins and US stocks, confidence in altcoins seems to be at an unusually low level. The expectations instilled in previous cycles have left many investors disappointed with the performance of altcoins in this bull market, with portfolio returns stagnating.

Current Situation

The market sentiment in the cryptocurrency industry often changes unpredictably. Firstly, investors tend to exaggerate various market news, especially when they are heavily invested in a certain token. Secondly, investors' perceptions of certain tokens can change at any time. Therefore, sentiment on social media cannot be relied upon as a reliable indicator of market prospects. What we can do is to plot relevant data on charts and conduct hypothetical analysis to determine the severity of the current situation.

By tracking indices and comprehensive charts of various global indicators, we can gain a rough understanding of the entire market, which helps in identifying the majority of the value and its changes within the industry.

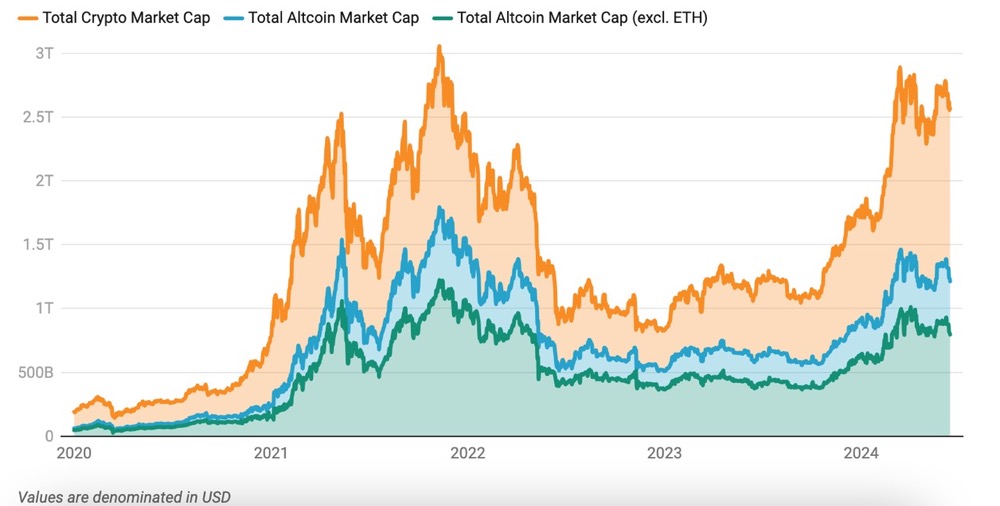

Data on the global cryptocurrency market value from 14759 types of cryptocurrencies across 1129 exchanges; Source: CoinGecko

Over the past year and a half, the total market value of cryptocurrencies has significantly increased, but the volatility has been surprisingly low. Although Bitcoin has reached a historic high, the overall market still lags behind the frenzy of 2021, mainly because altcoins have not kept up with the growth of Bitcoin. The funds flowing into speculative assets are less than expected, catching many people off guard.

To better illustrate this phenomenon, we can plot a comparison chart of Bitcoin and altcoin markets (excluding Ethereum) to show Bitcoin's continuous appreciation.

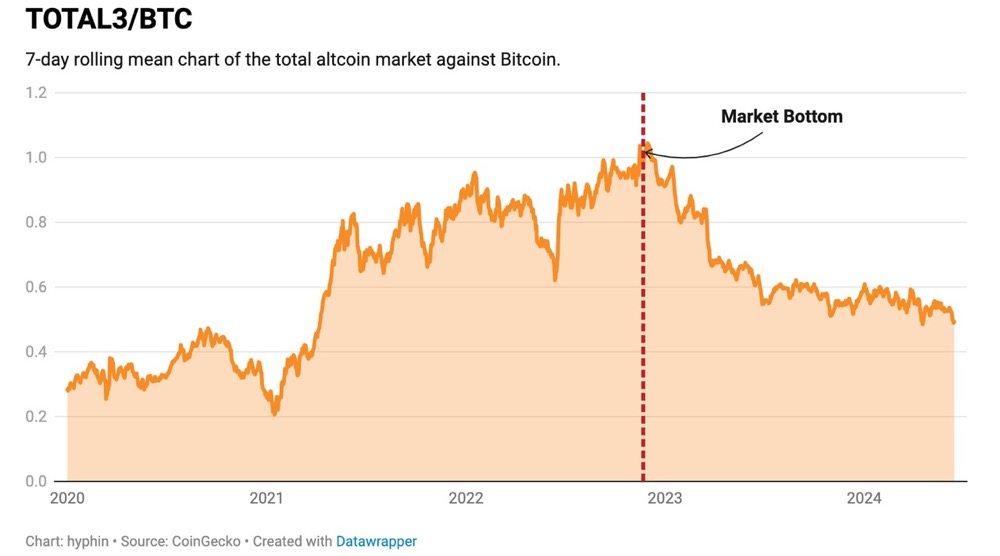

Comparison of the 7-day rolling average of the total market value of altcoins to the market value of Bitcoin

Undoubtedly, in this bull market, Bitcoin has stolen the spotlight and has been occupying an increasing market share during its rise, leaving altcoins far behind. In previous cycles, altcoins attempted to catch up with Bitcoin, but now it has become a pipe dream. The cascading decline in liquidity has restrained any possibility of starting the next altcoin season across the entire market.

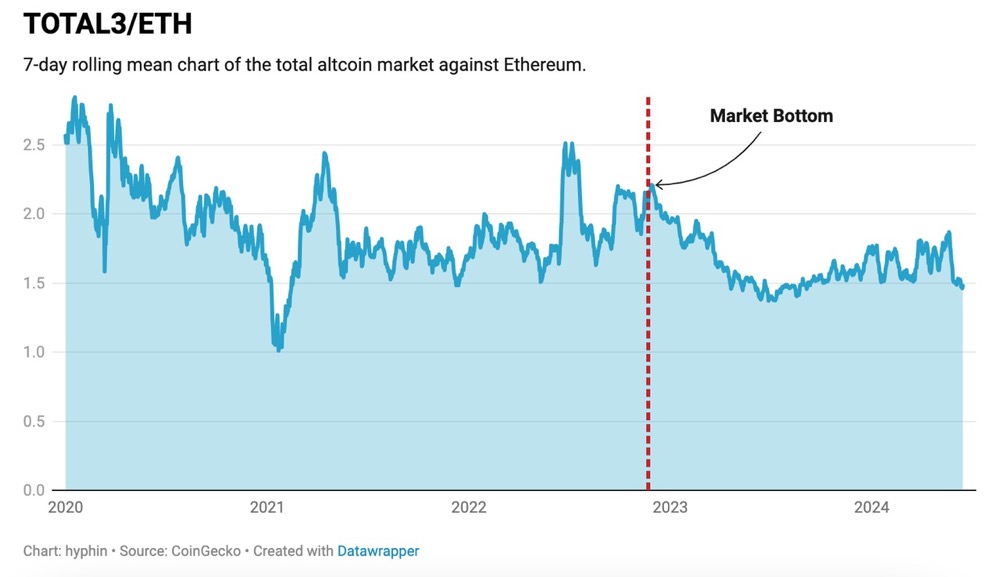

Comparison of the 7-day rolling average of the total market value of altcoins to the market value of Ethereum

Despite Ethereum being ridiculed for its lackluster price trend, it still maintains its leading position. Speculators who seek opportunities in on-chain ecosystems rather than memecoins or tokens priced in stablecoins have had a relatively easy time in this "purgatory-like" market. We extend our sincerest condolences to investors who have fallen into the Ethereum Beta scam.

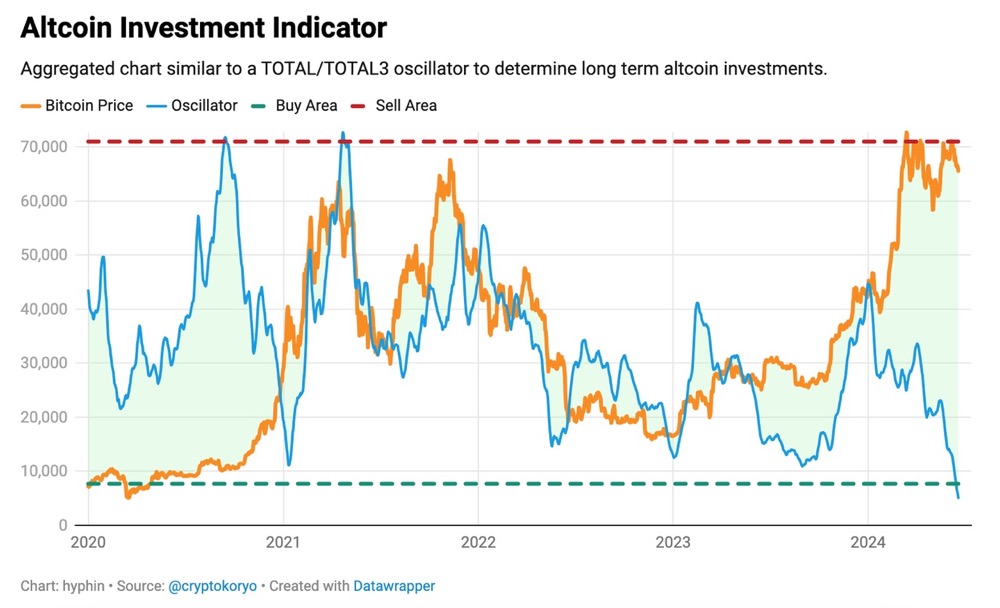

Furthermore, the altcoin investment indicator, widely used to identify favorable conditions for entering or exiting the altcoin market, has been sending worrisome signals, indicating that the general perception of market dynamics may not be applicable to the current situation.

Altcoin investment indicator: A summary chart similar to the TOTAL/TOTAL3 oscillation indicator, used to determine long-term altcoin investments

It has been proven that the correlation between mainstream assets and other altcoins helps determine the current state of the market. A lower oscillation indicator value (blue line) combined with the continuously rising Bitcoin price is usually seen as a buying opportunity for altcoins, as people believe that altcoins are undervalued at this time and will eventually follow the upward trend. However, recent data shows that the bullish cycle for altcoins has become short-lived and weak, forcing investors to make short-term investments rather than uncertain longer-term investments.

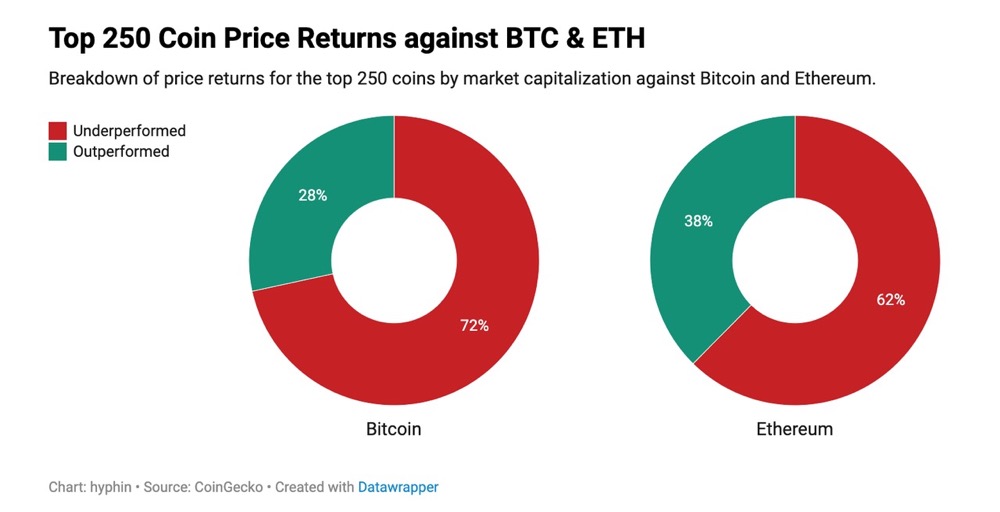

As shown in the following chart, although many tokens are considered to have high potential for appreciation, they ultimately fail to bring about excess returns.

Comparison of the price returns of the top 250 altcoins by market value to Bitcoin and Ethereum

Compared to the two major assets (Bitcoin and Ethereum) that are considered overvalued and to some extent overlooked by participants, the performance of the top 250 altcoins by market value is disappointing, further dampening market sentiment.

Finding Opportunities in the Downtrodden Altcoin Market

It is easy to see that the market landscape has changed over time, and it is more important than ever to identify trends and narratives to overcome the indices. The era of irrational surges has long gone. The dispersion of liquidity and the decline in trading volume have also concentrated most of the gains in a few areas. Although general indicators indicate that the appreciation of altcoins as a collective is minimal, this performance also masks the differentiated growth of individual asset groups within the altcoin market.

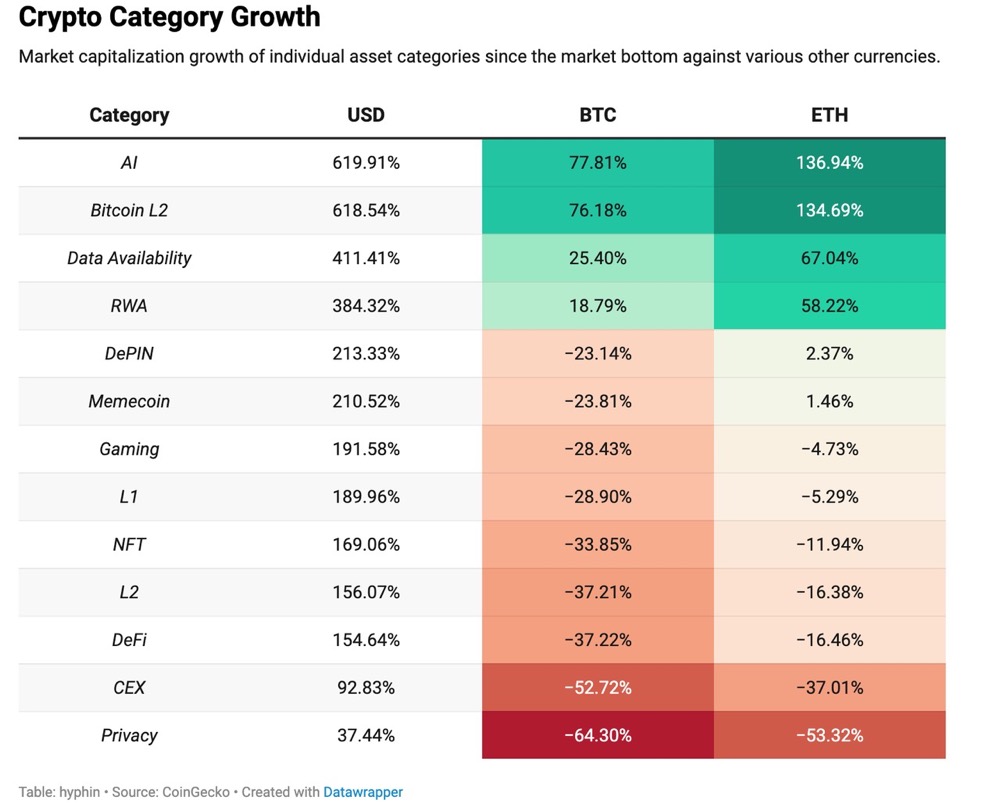

Market value growth of individual asset categories relative to other currencies since the market bottomed out

By closely observing the market value changes of various mature token categories since the rebound began, it can be seen that most mature categories of tokens have fallen below the benchmark. On the other hand, emerging areas with abundant opportunities, attractiveness, and new developments have performed well. It is important to note that any industry may have outliers, and the growth of specific categories can only vaguely represent the performance of the assets covered.

To review everything that has happened so far and find corresponding opportunities, we can focus on analyzing some relevant categories and measure the price returns of their most valuable assets.

Method of calculating price returns: (Current price - Initial price) / Initial price * 100. To account for recently launched products that rank high in their track, the initial price is queried from November 21, 2022, or the first entry on CoinGecko. The current price is the price queried at the time of writing this article (June 18, 2024).

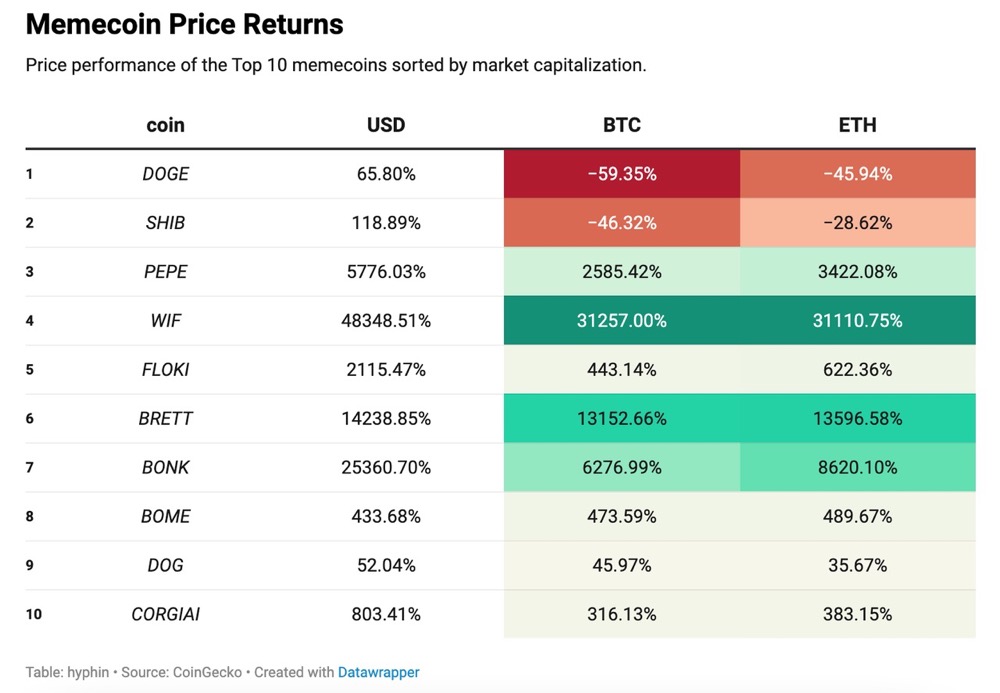

Memecoin

Memecoin is undoubtedly one of the themes of this cycle. In the past year, there have been more investors who have become overnight millionaires by investing in memecoins than lucky winners of the lottery. Similarly, there have been losses from investing in memecoins that are comparable to the taxes collected by tax authorities.

Price performance of the top 10 meme coins by market value

In terms of percentages, the total valuation of memecoins has not changed significantly as expected, as tokens like Dogecoin and Shiba Inu occupy nearly half of the memecoin market share, yet the gains are minimal. Apart from some successful tokens on Ethereum, most memecoin activities have occurred on Solana and the recent Base. The three memecoins with the highest returns and newly ranked in the top ten by market value are from Solana, with two of them even exceeding five figures.

DeFi

When it comes to DeFi, it brings to mind income, fundamentals, and the financial future. As more people join on-chain transactions, metrics such as protocol usage, trading volume, and total locked value are increasing, but can these data bring about a new DeFi Summer? Not really.

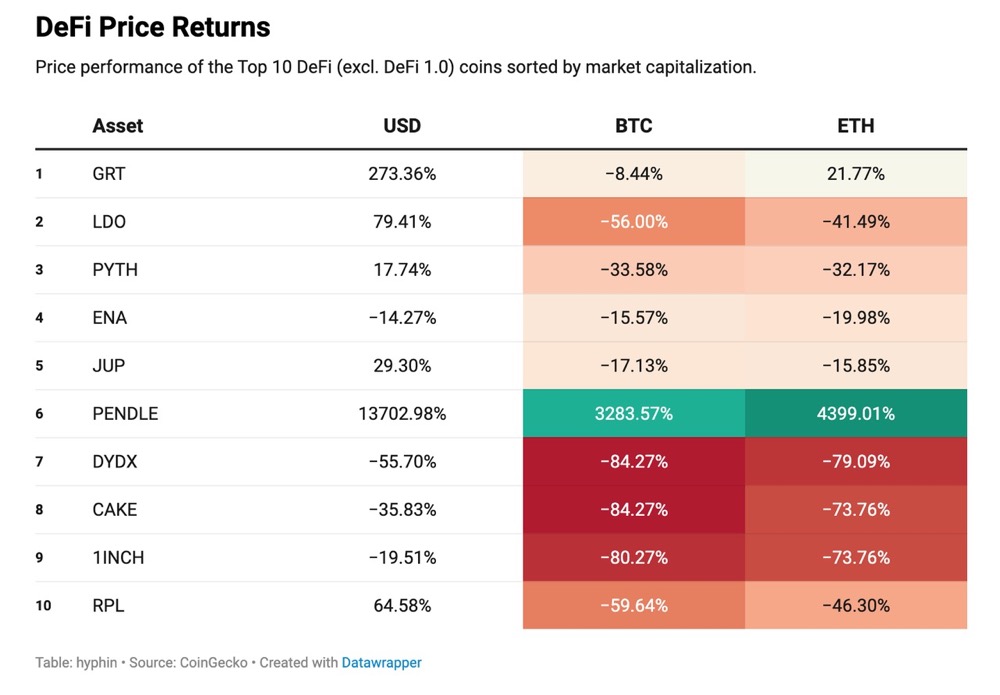

Price performance of the top 10 DeFi tokens (excluding tokens from the DeFi 1.0 era)

Setting aside innovation and product-market fit, the price returns of current DeFi tokens (excluding those from the 1.0 era) are simply dismal. Except for Pendle and The Graph, other projects have performed poorly. In recent years, liquidity mining has seen massive growth and adoption as an important track, but governance tokens representing liquidity have not seen growth. Additionally, tokens associated with decentralized exchanges have had the worst price performance, with only Jupiter showing an increase.

Although the data in the table is concerning, the industry's pioneer, the tokens from the DeFi 1.0 era, is even more surprising.

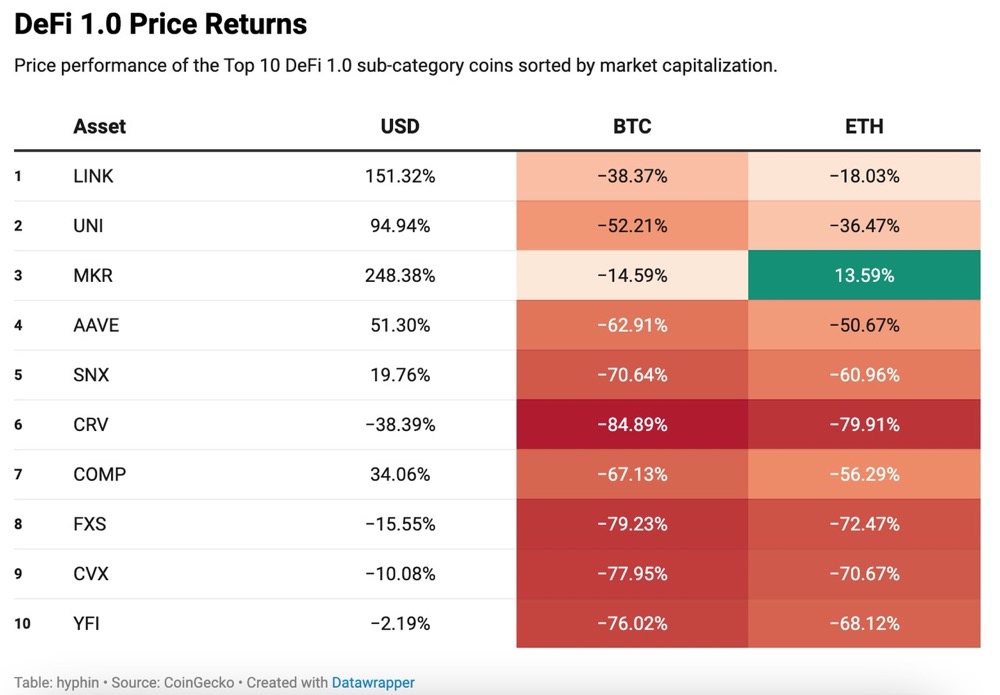

Price performance of the top 10 DeFi 1.0 tokens

Protocols from the DeFi 1.0 era have high valuations, income, and usage, but it has been proven that their performance in this cycle will not be ideal unless income strategies are adopted to offset token depreciation. A recurring issue causing poor performance of DeFi protocol tokens is the lack of practical use cases for the tokens, apart from liquidity mining. Perhaps fee conversion could be a lifeline, providing actual income for users rather than diluting the value of their holdings through token releases, thus creating significant buying pressure for the tokens.

L1

So far, L1 tokens have been the most popular and frequently traded category among speculators, and they are the facade of the cryptocurrency industry. Led by Bitcoin and Ethereum, L1 tokens have always shown a stable price trend. The progress in this field has given rise to numerous alternative solutions vying for market dominance, and their success is closely related to their ability to promote ecosystem prosperity, such as attracting technically skilled builders and capturing a large user base for continuous interaction. In some cases, L1 tokens can stand in the market based solely on technical specifications.

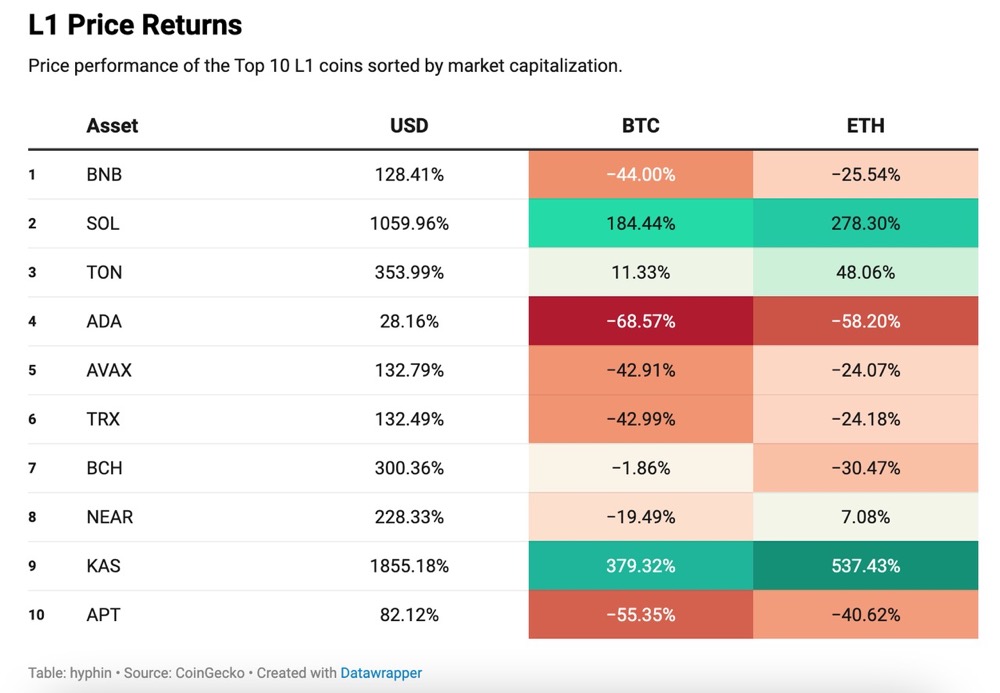

Price performance of the top 10 L1 tokens

Many projects in the table have successfully doubled their price returns compared to USD, but only three projects have surpassed the leaders of the L1 track, namely Bitcoin and Ethereum. Solana is not only hailed as the "top player" in the L1 track in this cycle due to its returns, but it has also quickly become one of the most used chains in the market and a worthy center of memecoins. With Binance Smart Chain failing to replicate the shitcoin craze similar to the previous surge, Solana has replaced BSC. It is worth noting that although Kaspa lacks mainstream attention and has relatively low trading volume, its returns have exceeded those of Solana.

L2

To address issues such as scalability and high transaction fees, Rollup has become an indispensable part of the on-chain ecosystem.

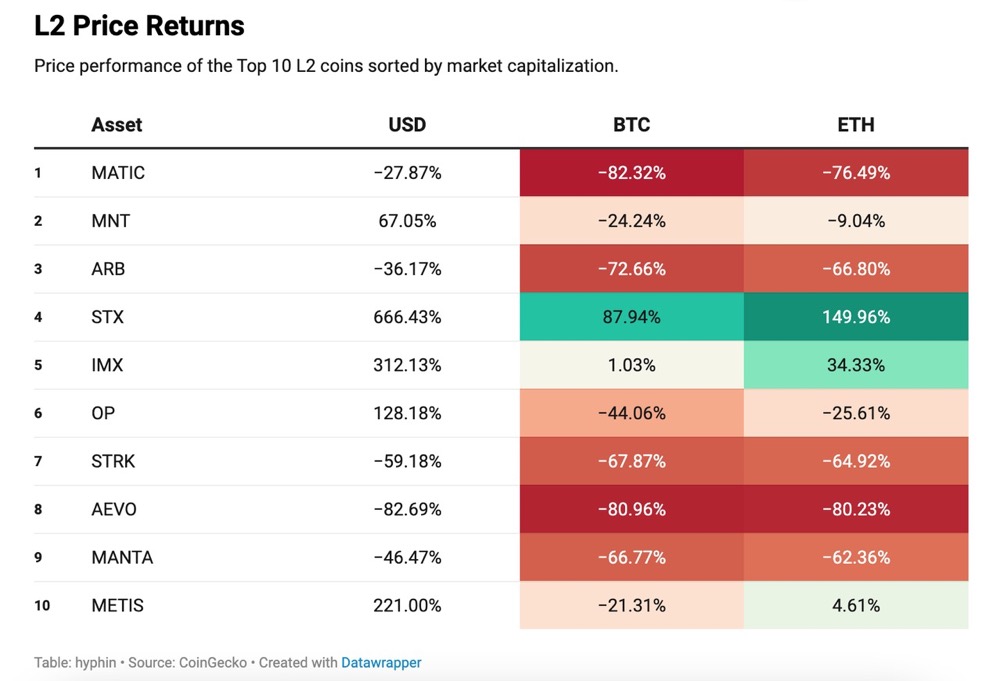

Price performance of the top 10 L2 tokens

Unlike the underlying layers they utilize, the returns of L2 have been mediocre, with low-circulation, high-valuation VC chains like Starknet and Arbitrum deeply mired in losses. New concepts related to zero-knowledge and Bitcoin infrastructure have achieved considerable value growth.

Conclusion

Faced with the harsh market reality and various liquidation emails, one cannot help but think that the investment opportunities for altcoins have passed. Clearly, at this juncture, it will become increasingly difficult to surpass the investment returns of Bitcoin and Ethereum if one cannot keep up with the narrative trend. However, unless you are constantly monitoring the market or have enough influence, it is impossible to seize every trend. In today's market conditions, the industry is filled with negative sentiment, which also means that investors need to rebalance their portfolios and consider risks. The future of the altcoin market is still uncertain, but it should not get any worse.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。