False fans, content brushing, and robot accounts have made Polkadot's marketing budget a disaster for KOL placement.

Author: Jack, BlockBeats

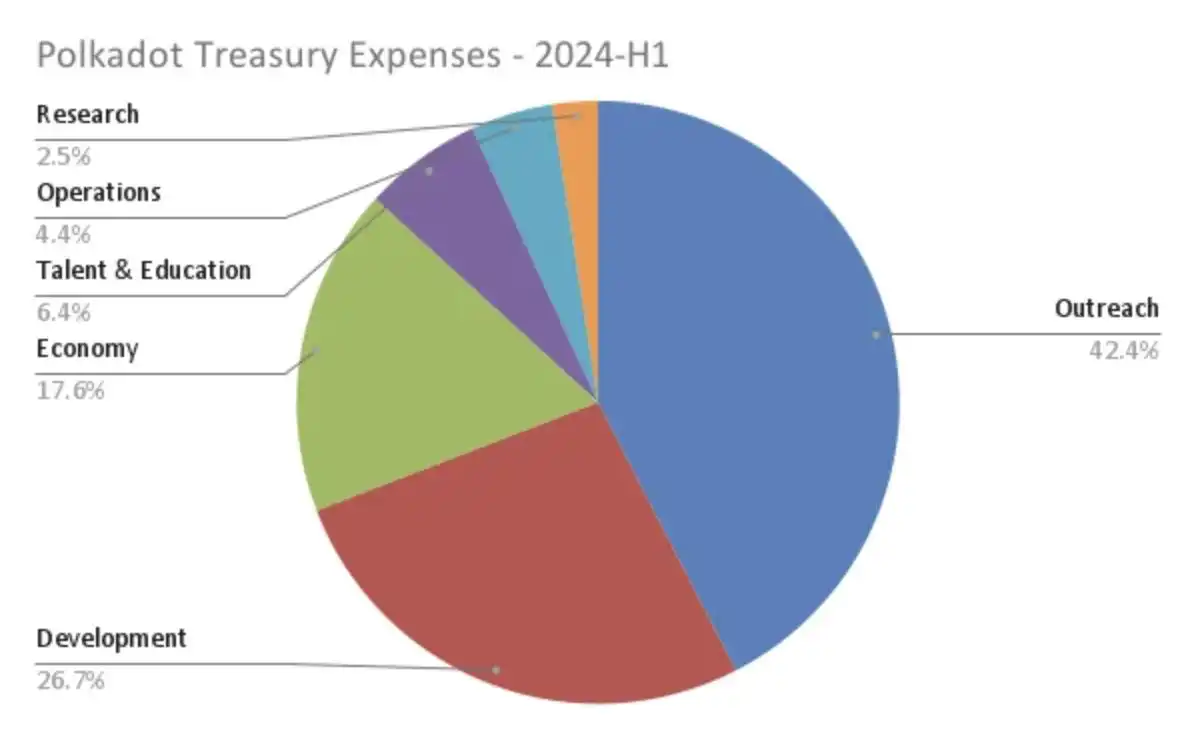

On June 29th, a Polkadot community member released the Polkadot Treasury Operations Report for the first half of 2024, revealing that the Polkadot Treasury had spent a total of 87 million USD. At the current spending rate, these reserves would only be enough to support the Polkadot Treasury for another 2 years.

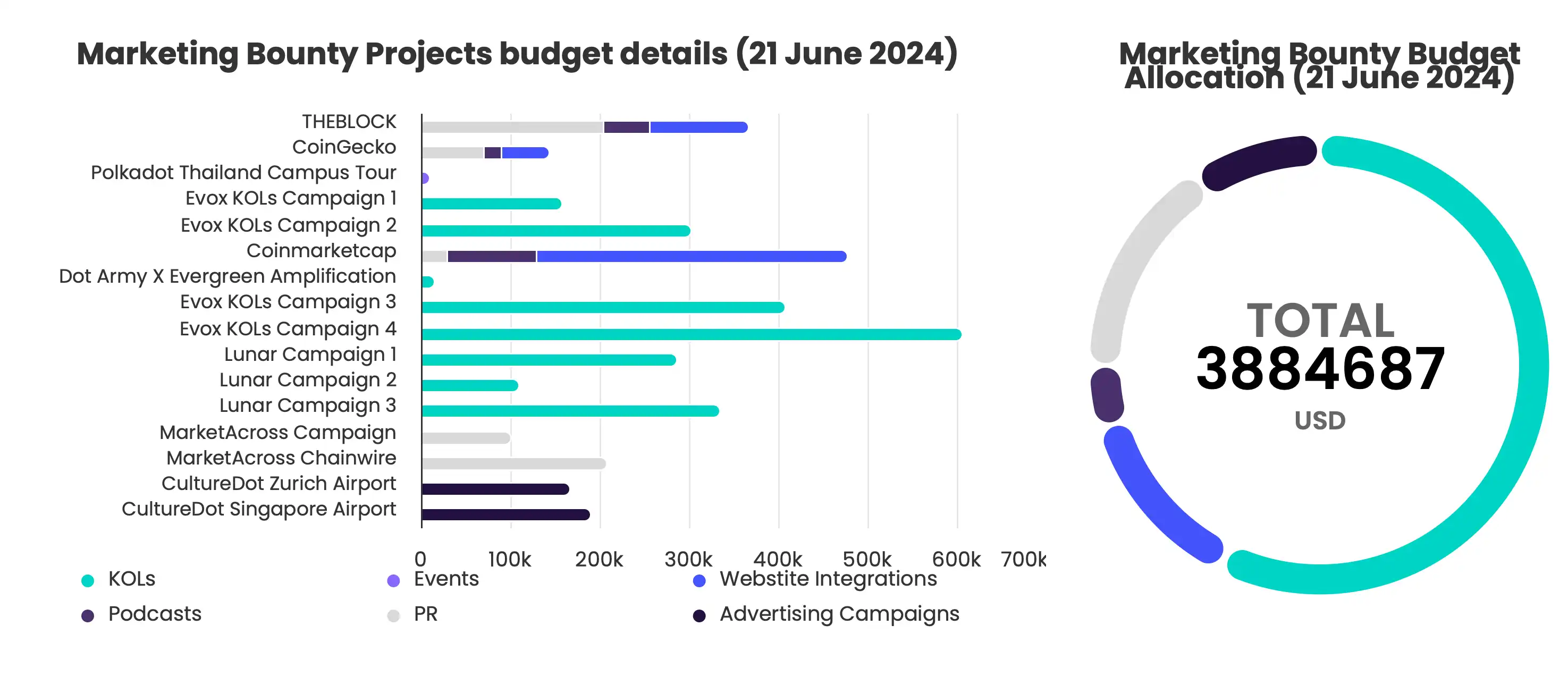

What surprised the community was that a significant portion of the treasury was spent on promotion, with 37 million USD allocated. This accounted for the majority of the treasury's expenditure. This included advertising expenses of 21 million USD, including sponsorship fees of 10 million USD, marketing and public relations companies of 4.9 million USD, digital advertising of 4 million USD, and event expenses of 7.9 million USD, including event expenses of 4.5 million USD, business development of 3.9 million USD, and media production of 3.2 million USD.

In response, BlockBeats obtained the relevant receipts for Polkadot's marketing activities and analyzed the budget allocation for the first half of the year.

KOL Placement Disaster: False Fans, Content Brushing, Robot Accounts

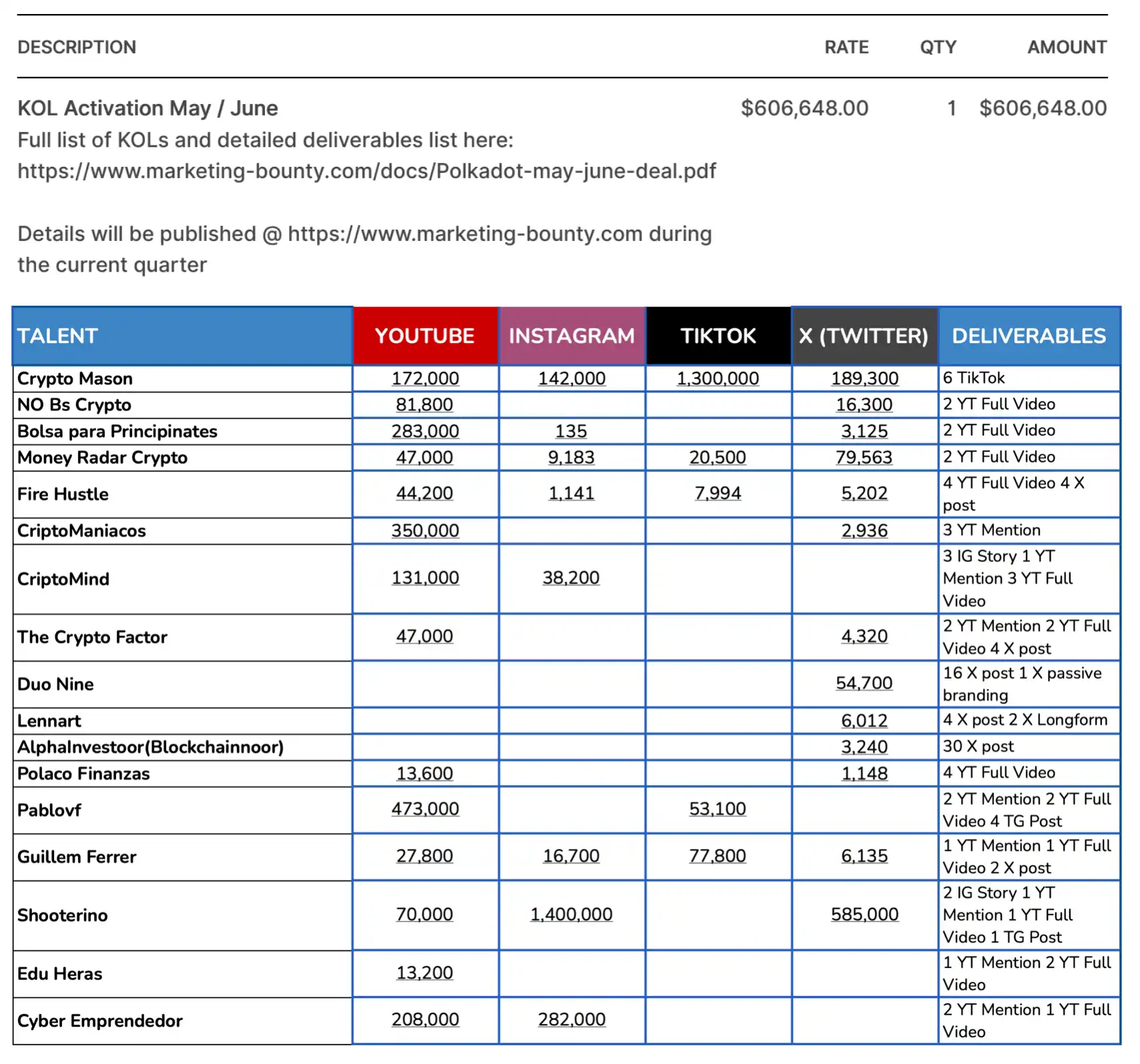

According to some statistics published on the Market Bounty website, KOLs played a significant role in Polkadot's marketing activities, exceeding half of the overall budget. Based on the KPI data for content placement, the effectiveness of these KOL placement activities seemed good, with a total of over 15 million views, over 570,000 likes, and 60,000 replies.

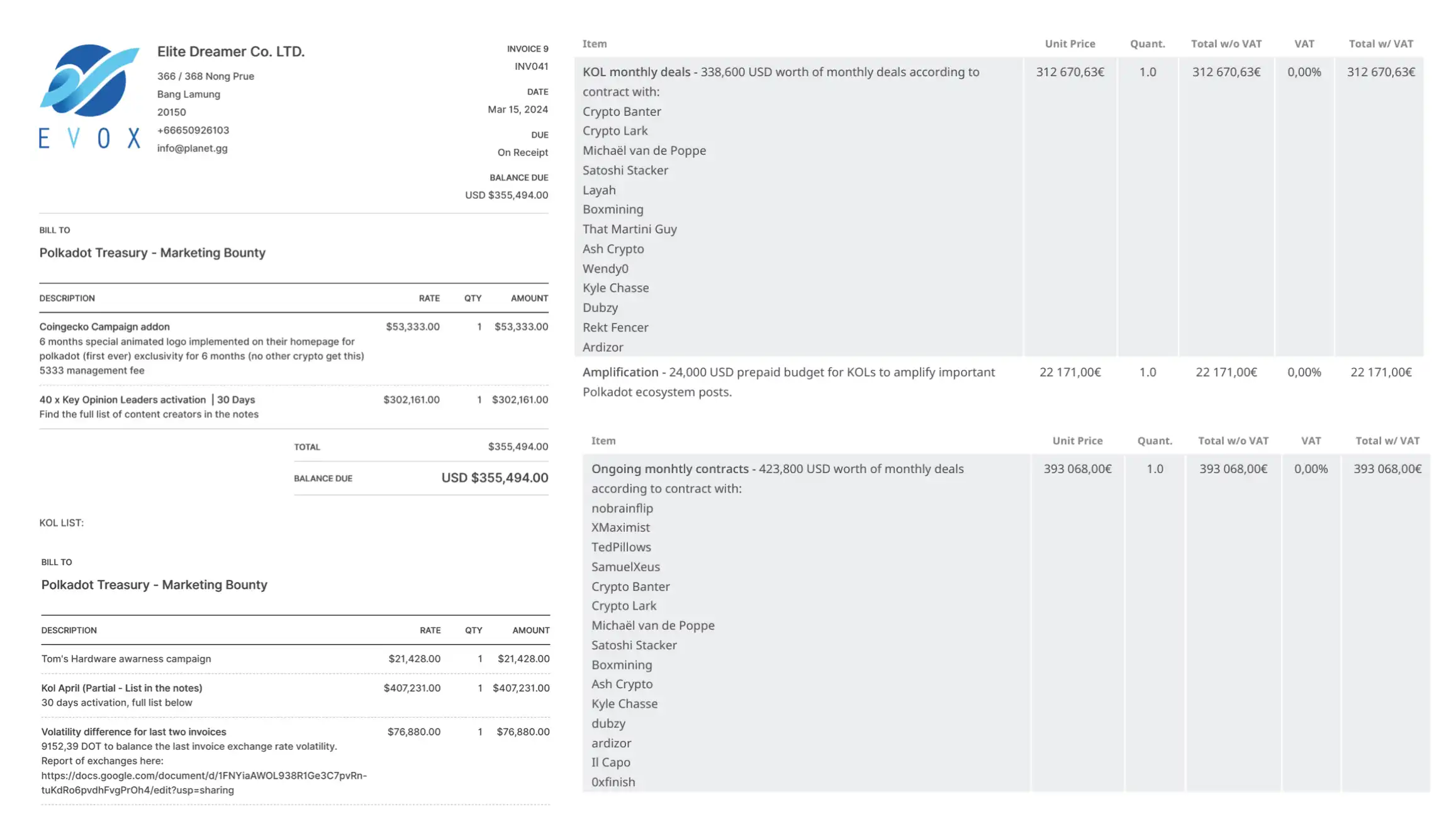

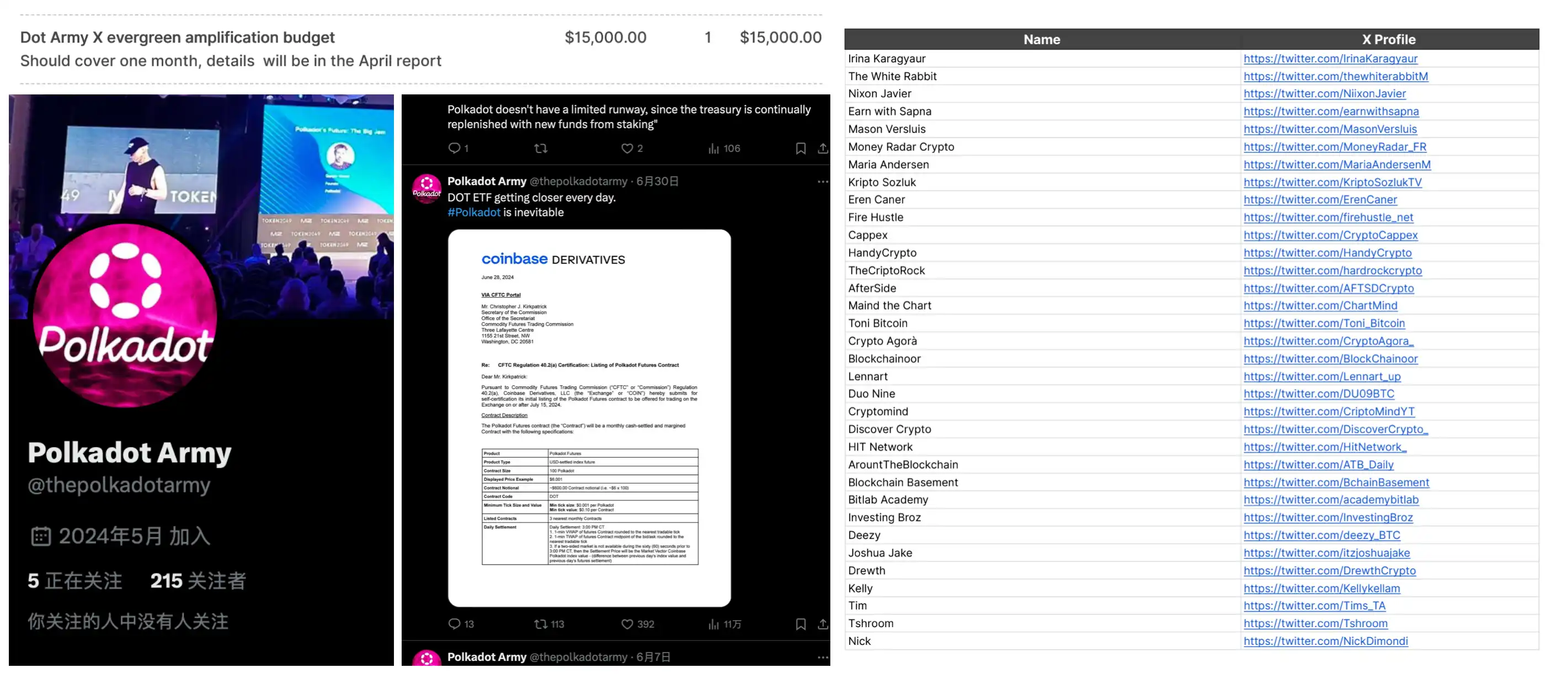

In the first quarter, Polkadot's ecological KOL promotion activities included four "Evox promotion activities" targeting North America and three "Lunar promotion activities" targeting Europe, with an average KOL budget of around 300,000 USD for each promotion activity, lasting about 30 days. The Evox activity included approximately 30 to 40 KOLs, while the Lunar activity had significantly fewer KOLs, around 15. There was also a community account, Dot Army, with a single budget of 15,000 USD.

However, BlockBeats found that after conducting in-depth research on the actual quality of the content placement based on the KOL list, most of these so-called "Content Creators" were found to be engaging in "wool shearing." Many KOLs inflated their fan numbers, promotional content, and reply content, resulting in excessively high costs.

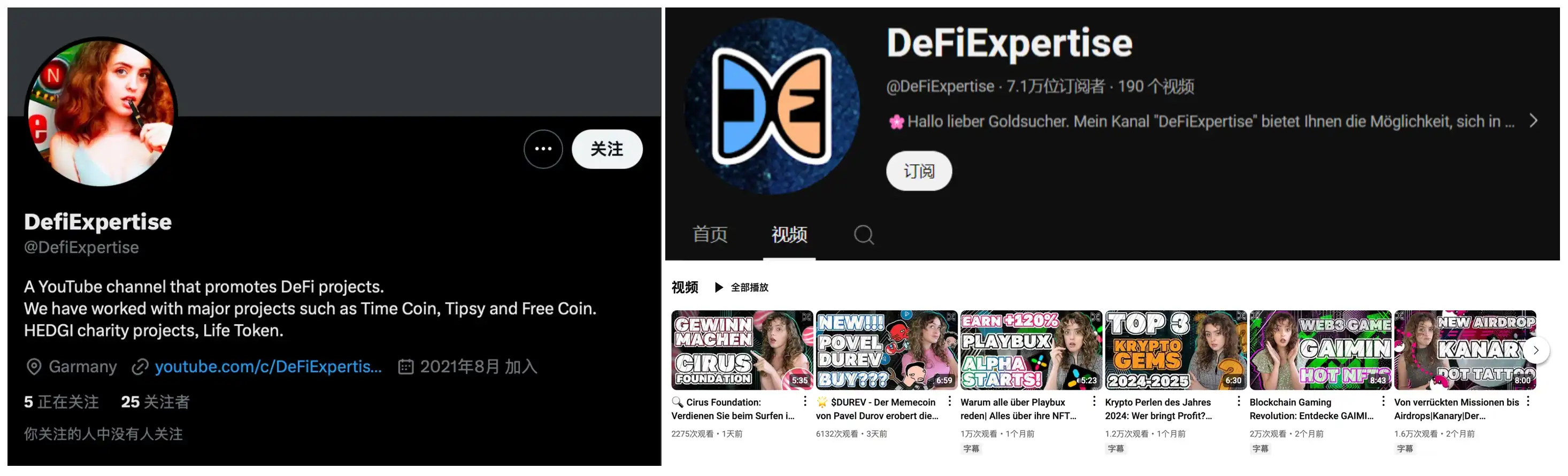

For example, a KOL with the handle @DeFiExpertise had only 25 followers, but their YouTube channel had over 70,000 subscribers. Upon closer inspection, it was found that they had posted fewer than 10 videos, and the account had been active for less than 3 months. If the time of registration or activity start is calculated based on the release time of the first video, it coincides with the start of the Evox activity.

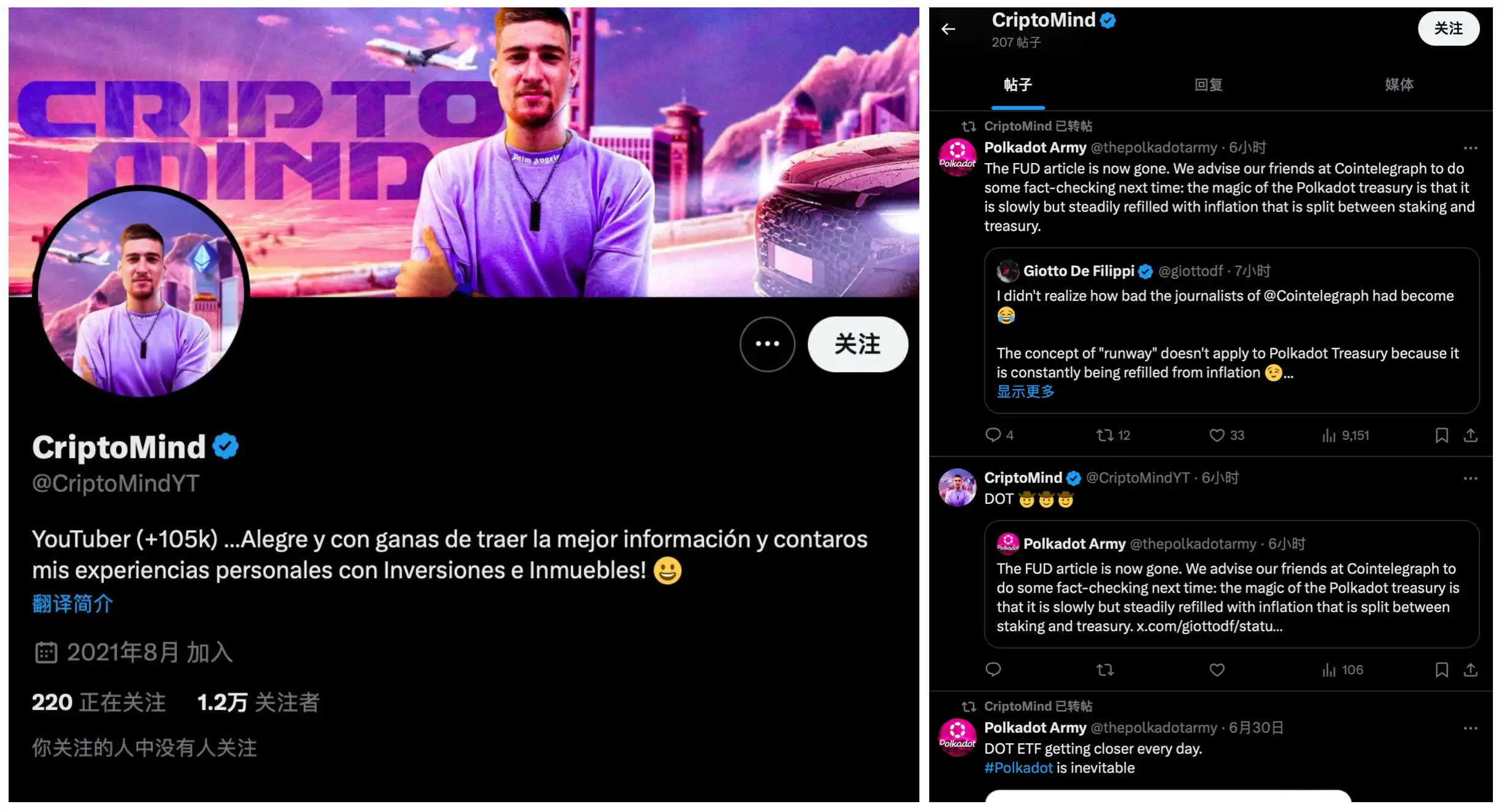

Another KOL with the handle @CriptoMindYT had 12,000 followers, but their follower list barely overlapped with that of ordinary crypto Twitter users. Upon checking their follower list, it was found that most were robot accounts. Additionally, this account almost exclusively focused on "customized KOL" for Polkadot, with almost all tweets related to Polkadot. Apart from a few retweets of Polkadot Army and official Polkadot tweets, most tweets had only around 200 views.

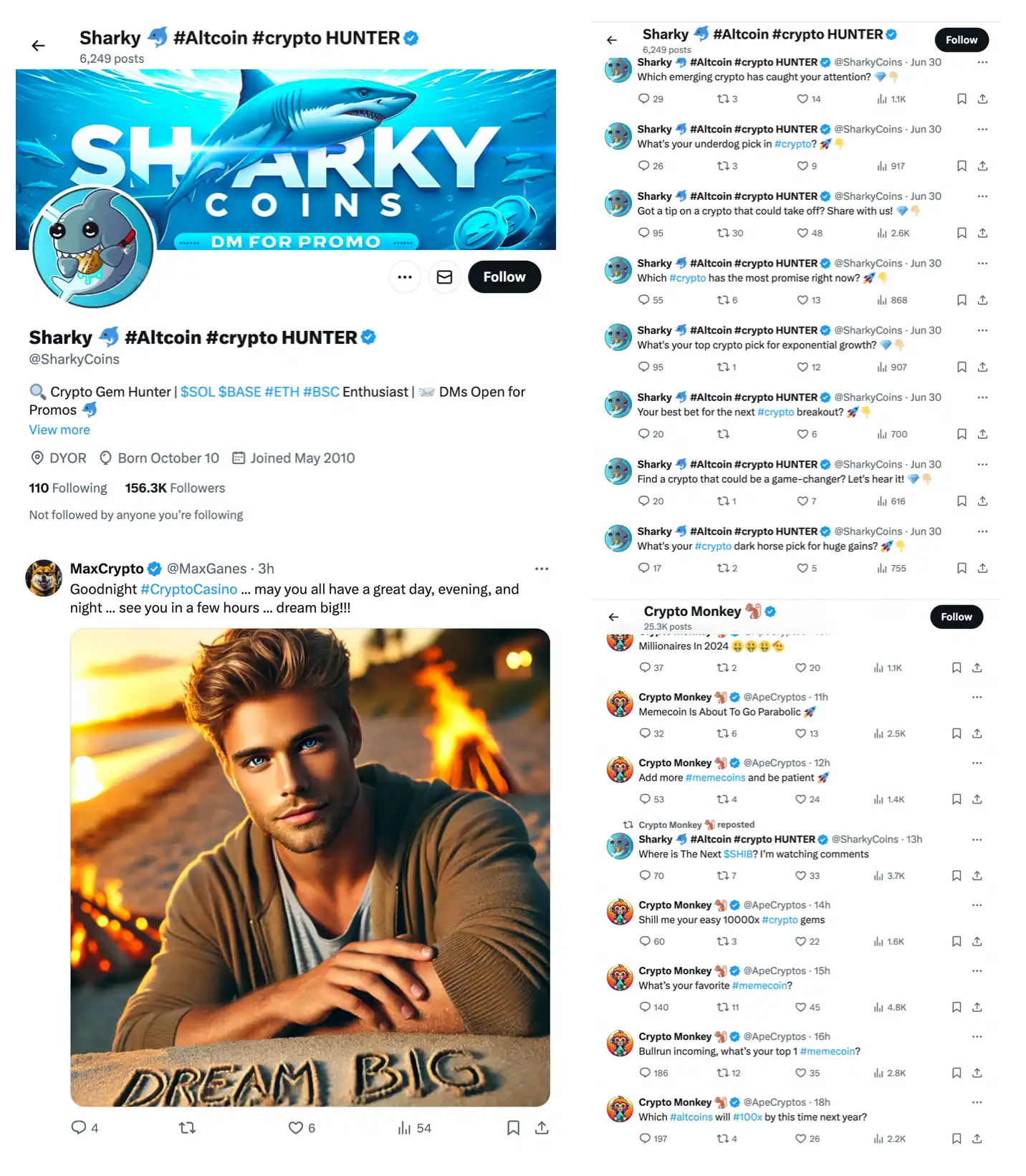

There was also a KOL with the handle @SharkyCoins, whose operating style and content were almost identical to @ApeCryptos. They would post a dozen or more meaningless short sentences every day and would retweet each other's tweets, raising suspicions that these KOL accounts might be from the same robot account studio. Similarly, @MaxGanes, who focused on mass-producing tweets, had posted over 100,000 tweets in total, creating nearly 20 illogical tweets with AI-generated images every day.

Additionally, there were many KOLs focused on "perpetual gains," promoting 20-50 targets in each tweet. There were even many "one-time KOLs," such as @DegenHardy and @TheCrypomist, who were still on the KOL list in April but had been deactivated by the time of writing. Accounts like @CryptoEmily had already changed their names…

The separate listing of "DOT Army" in the placement budget was also intriguing. It included an "official community account" and a service package of around 30 KOLs, with a monthly fee of 15,000 USD. The Dot Army community account often had tweets with extremely high views, such as a tweet about "DOT ETF" on June 30th, which reached 110,000 views. However, upon checking the account details, it was found that it had only around 200 followers. It was discovered that these high-view tweets were the main retweet targets of the "listed KOLs." Among the accounts in its KOL service package, over 90% showed "you have no followers" in their profiles.

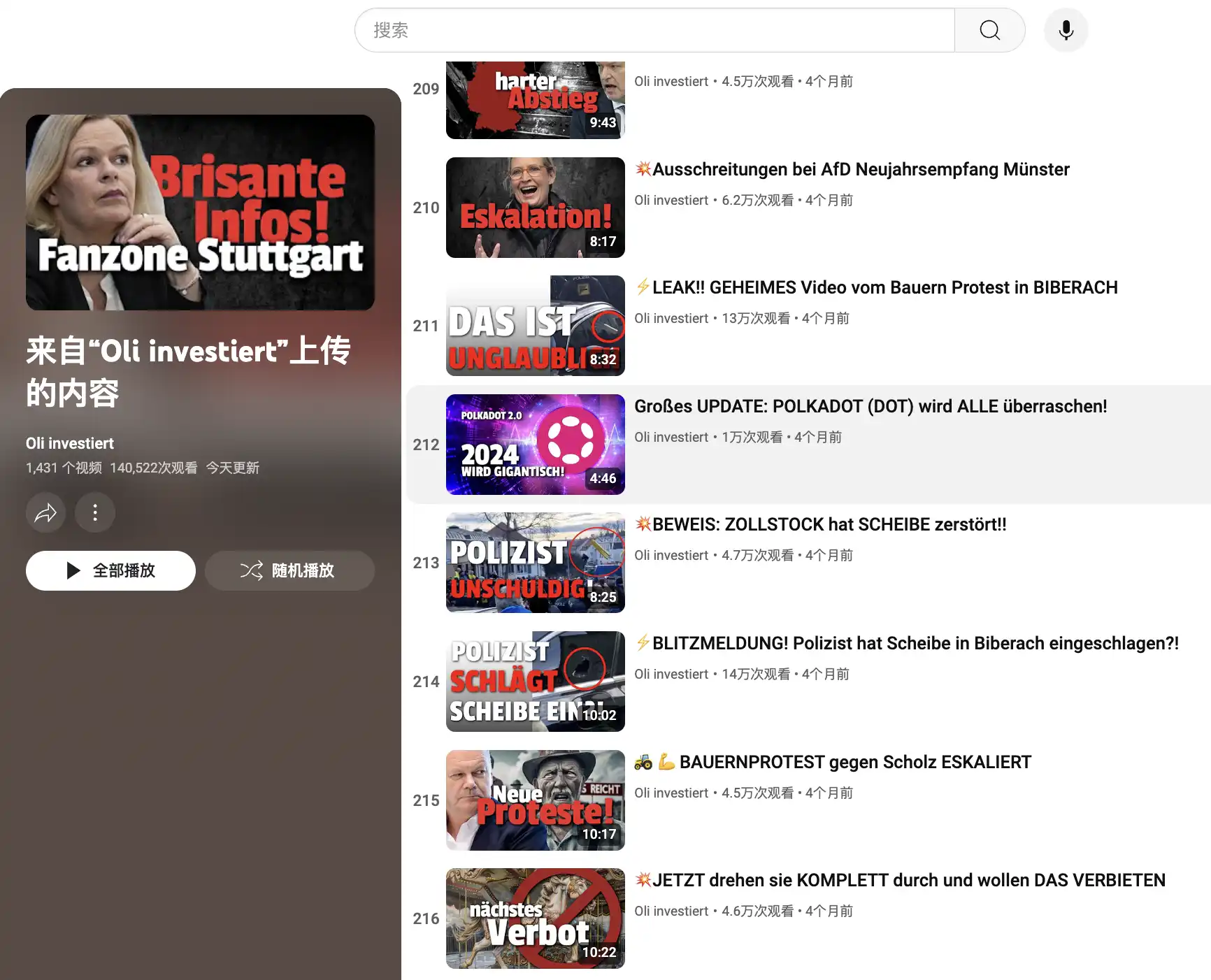

In addition to crypto Twitter, Polkadot's KOL promotion also focused heavily on YouTube channels, but many of the YouTube channel bloggers in the placement scenarios often had a mismatch in audience demographics with crypto users. For example, the German YouTube blogger MilkRoad's channel mainly focused on general investment, with little relevance to the crypto industry, and most videos had only a few hundred views. The content about Polkadot and DOT tokens was awkwardly inserted into these videos, with less than 500 views in 4 months.

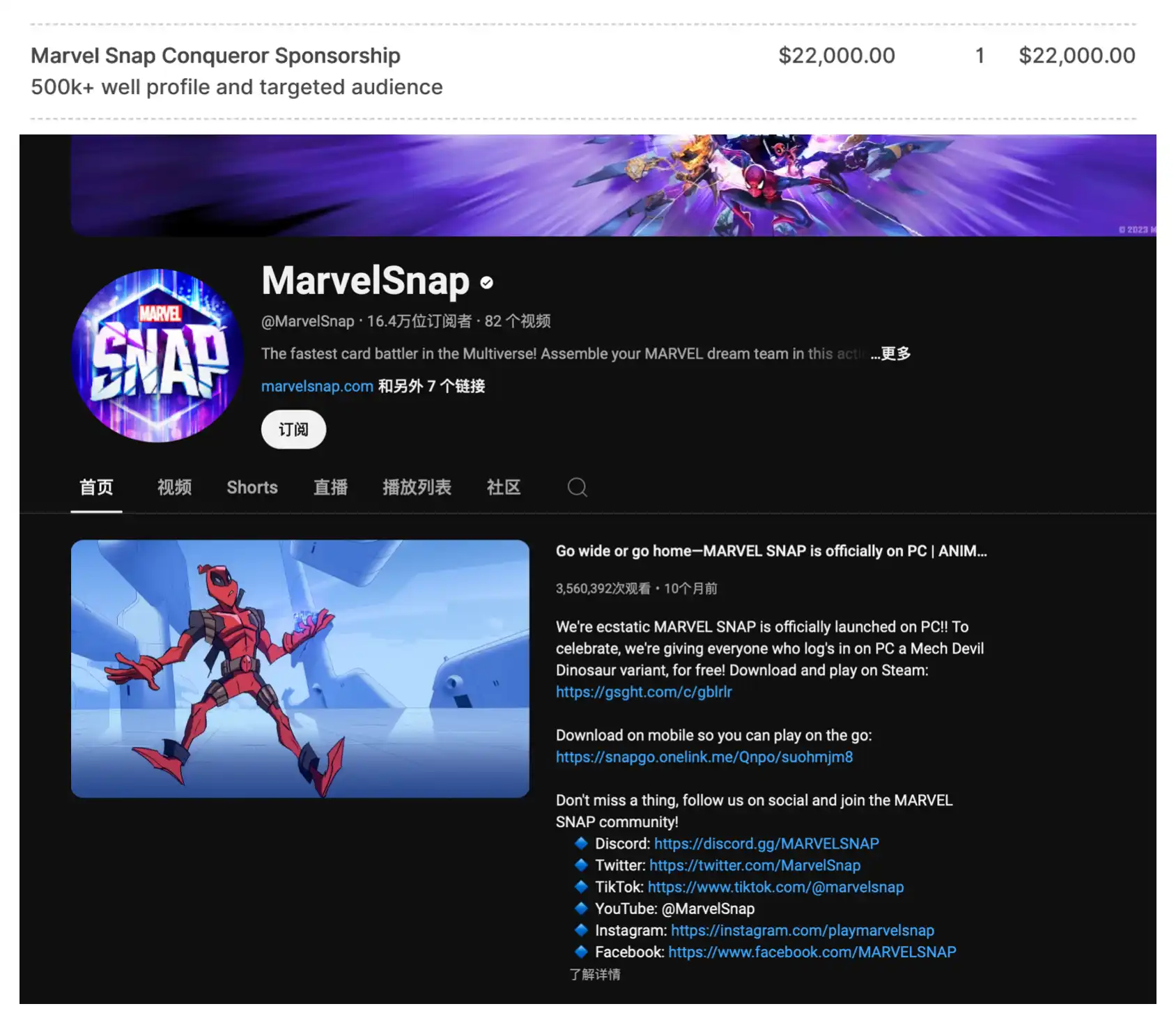

In May, they even chose to place ads on the Marvel Snap gaming channel, which had no connection to crypto at all, with the explanation in the bill being "precisely targeted high-net-worth audiences."

Surprisingly, it seems that the Polkadot governance and foundation are not very concerned about the ineffective placement of their KOL budget. After a quarter of KOL promotion activities, they raised the KOL budget for the second quarter, with a budget of up to 600,000 USD for a single KOL promotion activity between May and June. However, it can be seen that the new promotion plan has submitted more detailed reports to the governance regarding the specific traffic assessment and requirements for KOLs.

It is also evident that Polkadot's KOL placements are mainly targeted at the European and American markets, with significant spending, but there is minimal placement targeting the Asian market. BlockBeats reported last September that the PolkaWorld Chinese community, due to the rejection of its official funding proposal, suspended operations for half a month. Not long ago, Polkadot introduced a new governance framework, OpenGov, but PolkaWorld believed that the new treasury management mechanism led to the repeated rejection of funding applications from many long-term contributors and organizations, forcing them to leave the Polkadot ecosystem. It seems that governance efficiency may only be one aspect of the problem.

"Logo Addiction" and "Media VIP"

In addition to KOL promotion, media placement and platform displays account for a high proportion of the budget, as shown on the Market Bounty website as "PR" and "website integrations." In addition, Polkadot seems to have some "addiction to placements," allocating exorbitant budgets in unexpected places, leaving people puzzled.

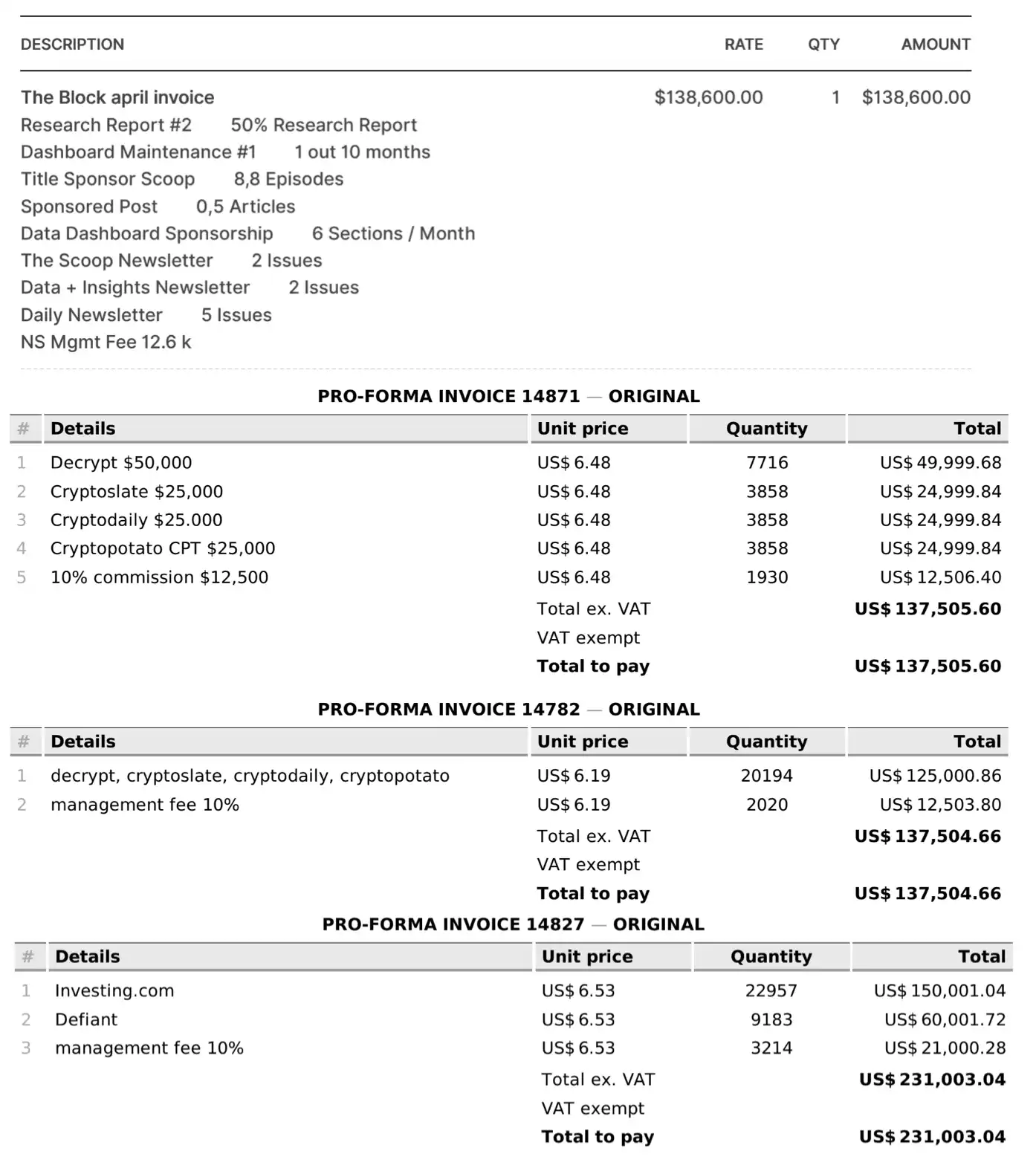

In media PR placements, the exorbitant fees of The Block stand out. Several research reports and sponsored articles, plus one billboard maintenance, cost 138,000 USD, including a management fee of 12,000 USD. Other crypto media such as Decrypt, Defiant, and Cryptoslate are bundled into PR services, with the governance entity named Community Project receiving payments and charging a 10% management fee, with each PR promotion costing around 150,000 USD.

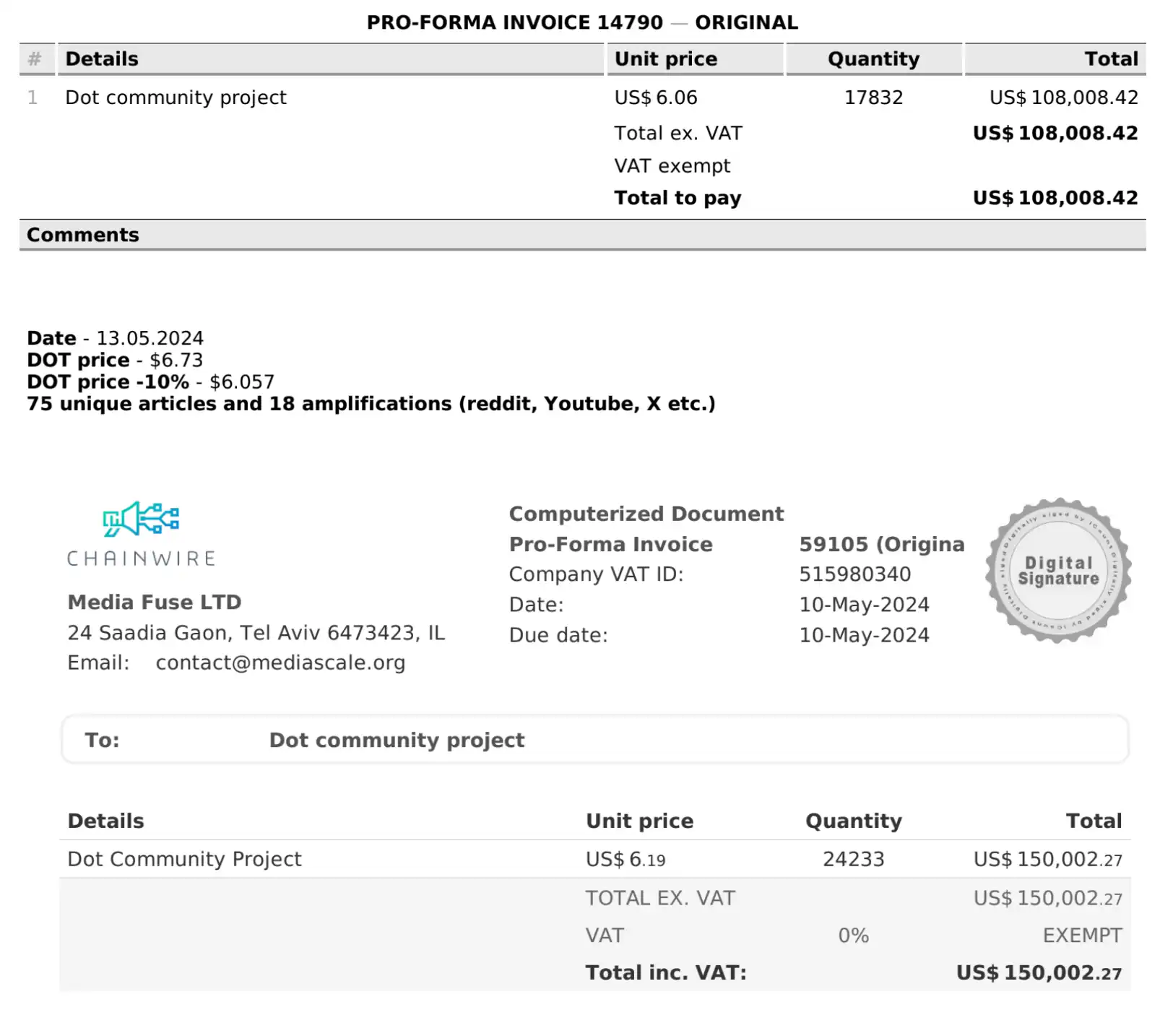

Some PR promotions are directly allocated to Community Project, with specific requirements clearly stated: arranging 75 articles and distributing content through 18 different channels, costing 100,000 USD. Additionally, there is an unspecified service content for Chainwire media PR costing 150,000 USD.

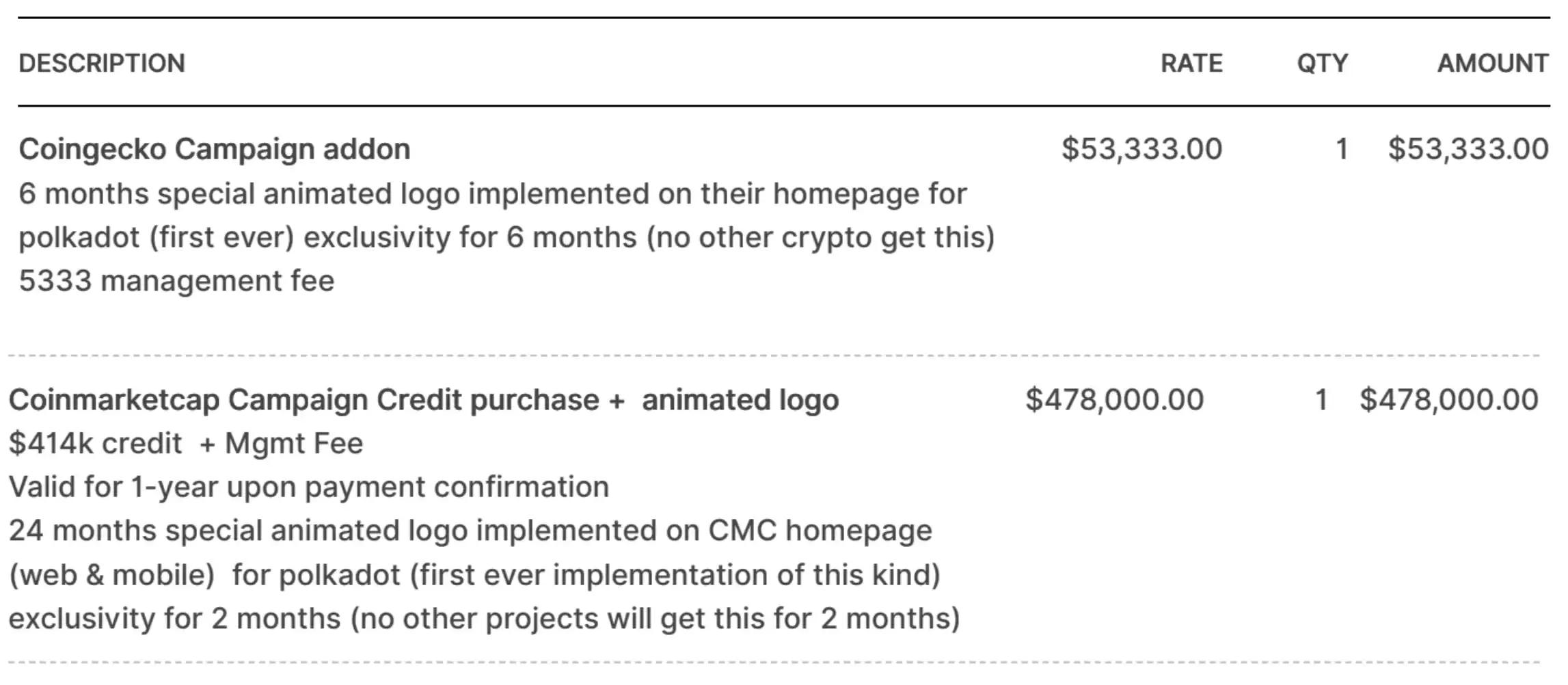

Furthermore, Polkadot seems to have a fondness for logo displays, purchasing exclusive logo dynamic display services on the two major crypto price websites, Coingecko and Coinmarketcap. The cost of a six-month exclusive logo dynamic display on Coingecko was 50,000 USD, while the cost for a two-year logo dynamic display on Coinmarketcap, including management fees, was nearly 480,000 USD, twice the average cost of Coingecko.

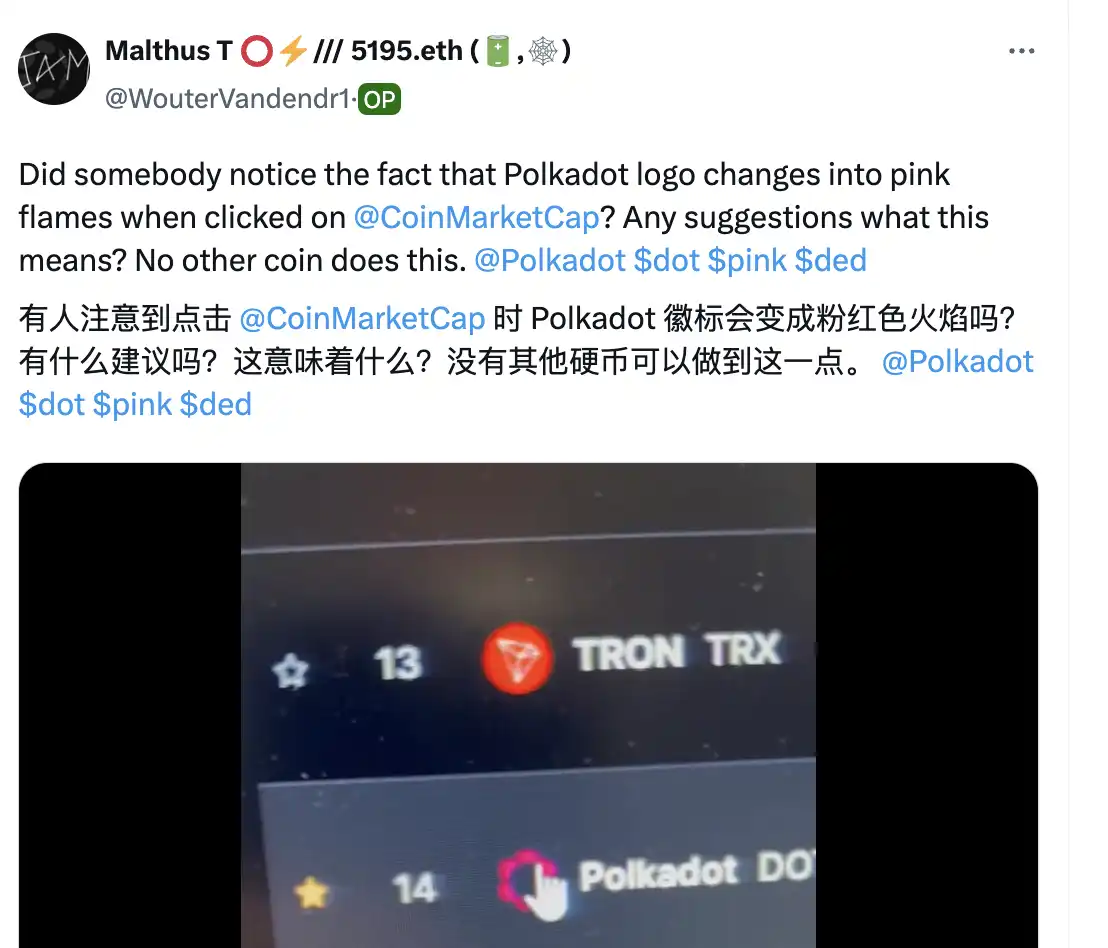

Despite the noticeable changes, the increased attractiveness of DOT itself has had minimal effect. Two months ago, someone asked on X, "Why did the Polkadot token logo on Coinmarketcap turn into a pink flame?" The first reply in the comments was, "So what? Are you going to buy coins for a GIF?"

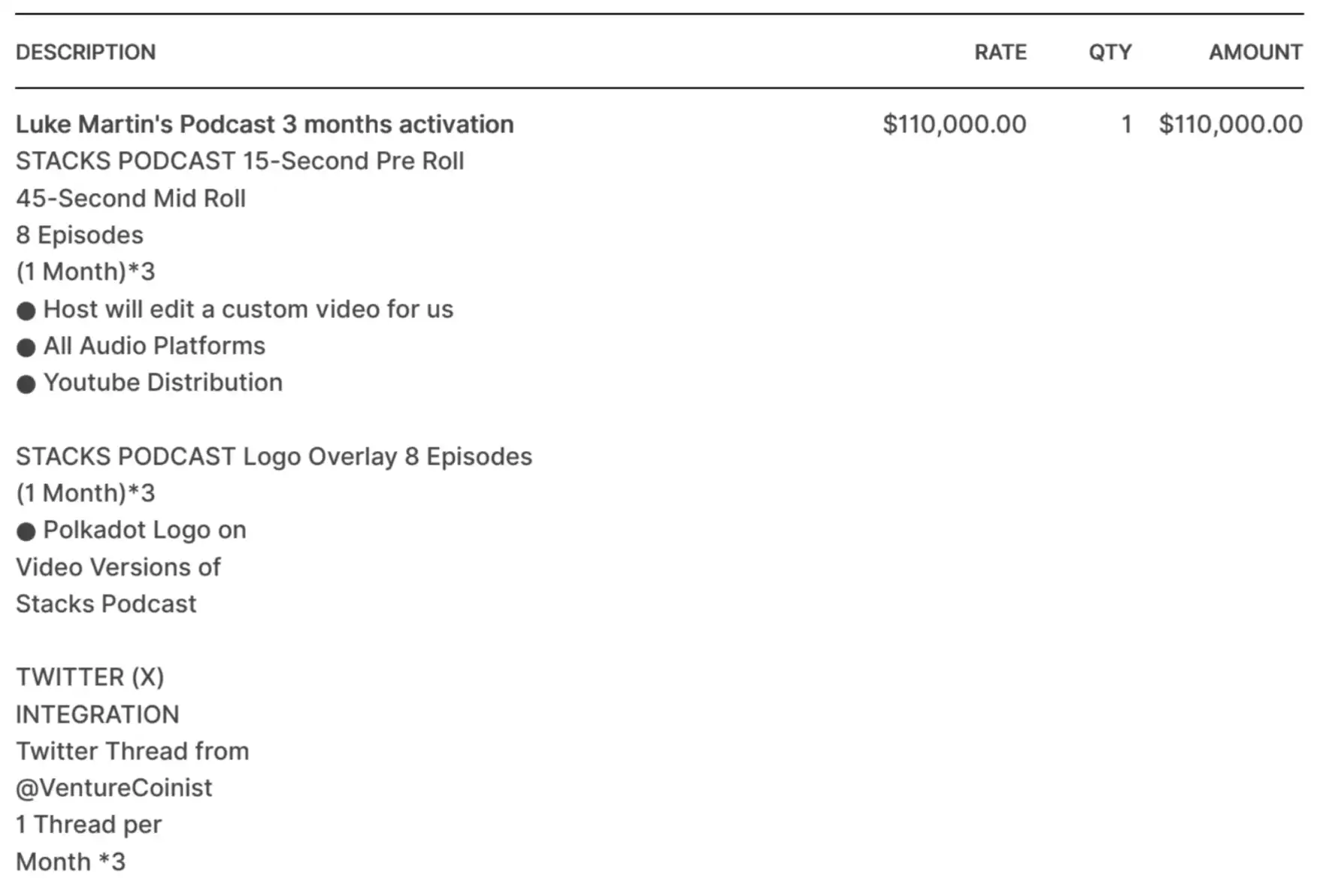

The logo display in podcast videos also involved significant spending, with the placement of just 8 episodes costing 110,000 USD.

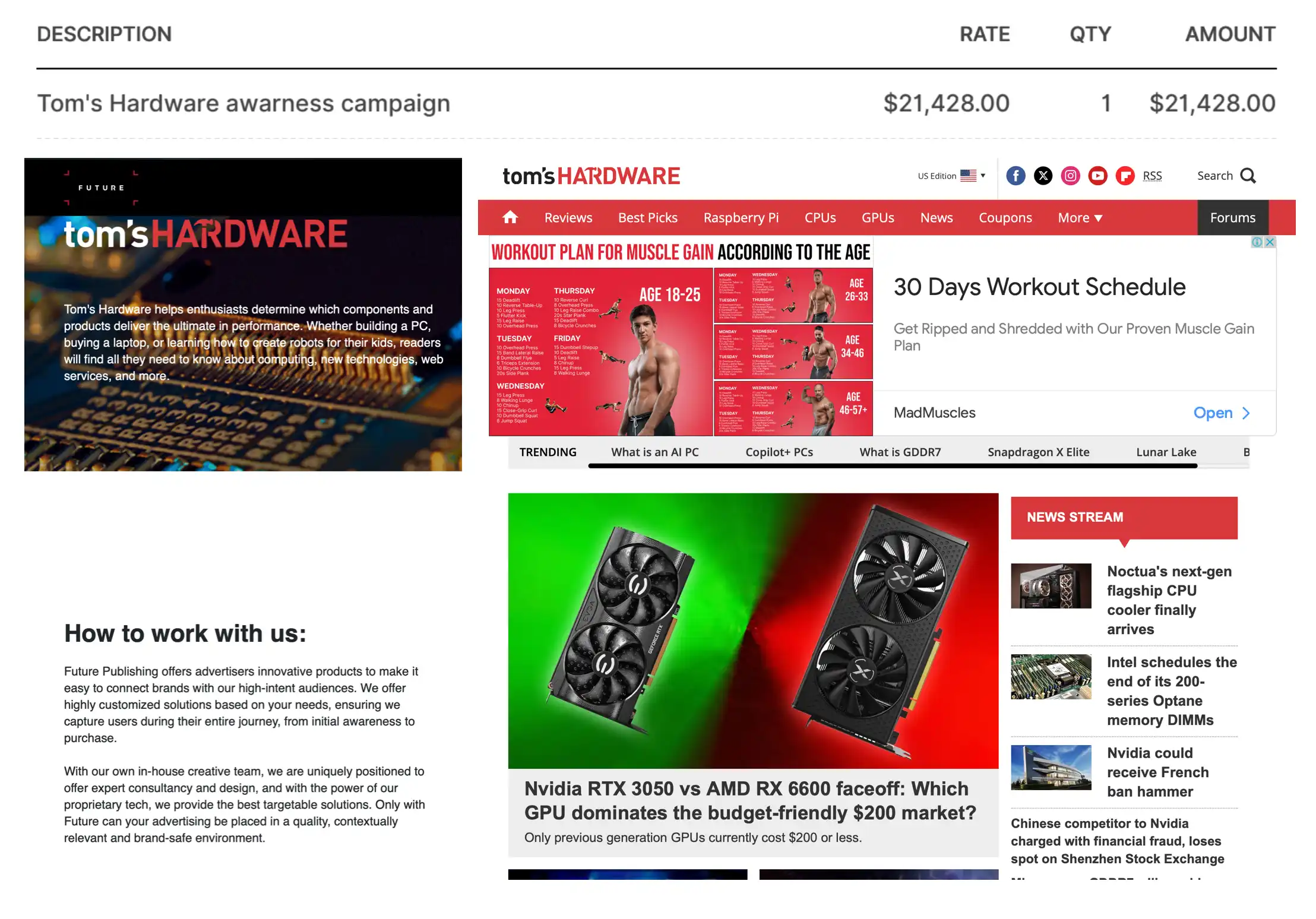

In addition to these "conventional placement channels," some perplexing placements were found in Polkadot's budget bill. For example, through the PR intermediary company Future, they spent 20,000 USD to increase Polkadot's brand awareness on the PC hardware website Tom's Hardware.

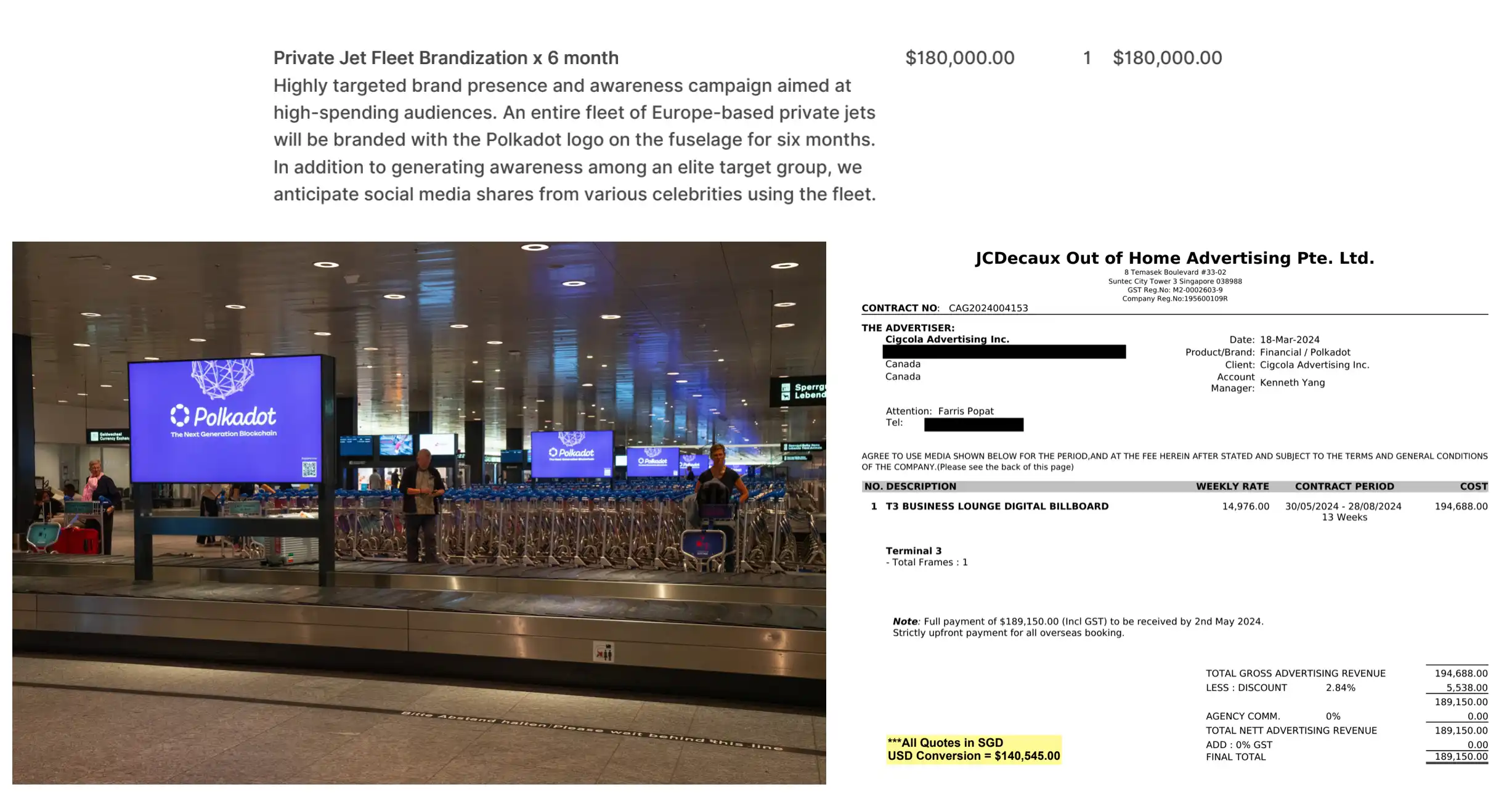

Another budget item involved printing the Polkadot logo on private planes in Europe, with a promotional expense of 180,000 USD planned for "continuous logo exposure on a fleet of private planes in Europe for 6 months," with the reason given as "highly targeted brand promotion and awareness activities for high-spending audiences"…

In comparison, the advertising screen placements at Singapore Airport and Zurich Airport seemed relatively more reasonable, but the costs were still somewhat excessive, with a single advertising screen in a terminal at Singapore Airport costing 189,000 USD.

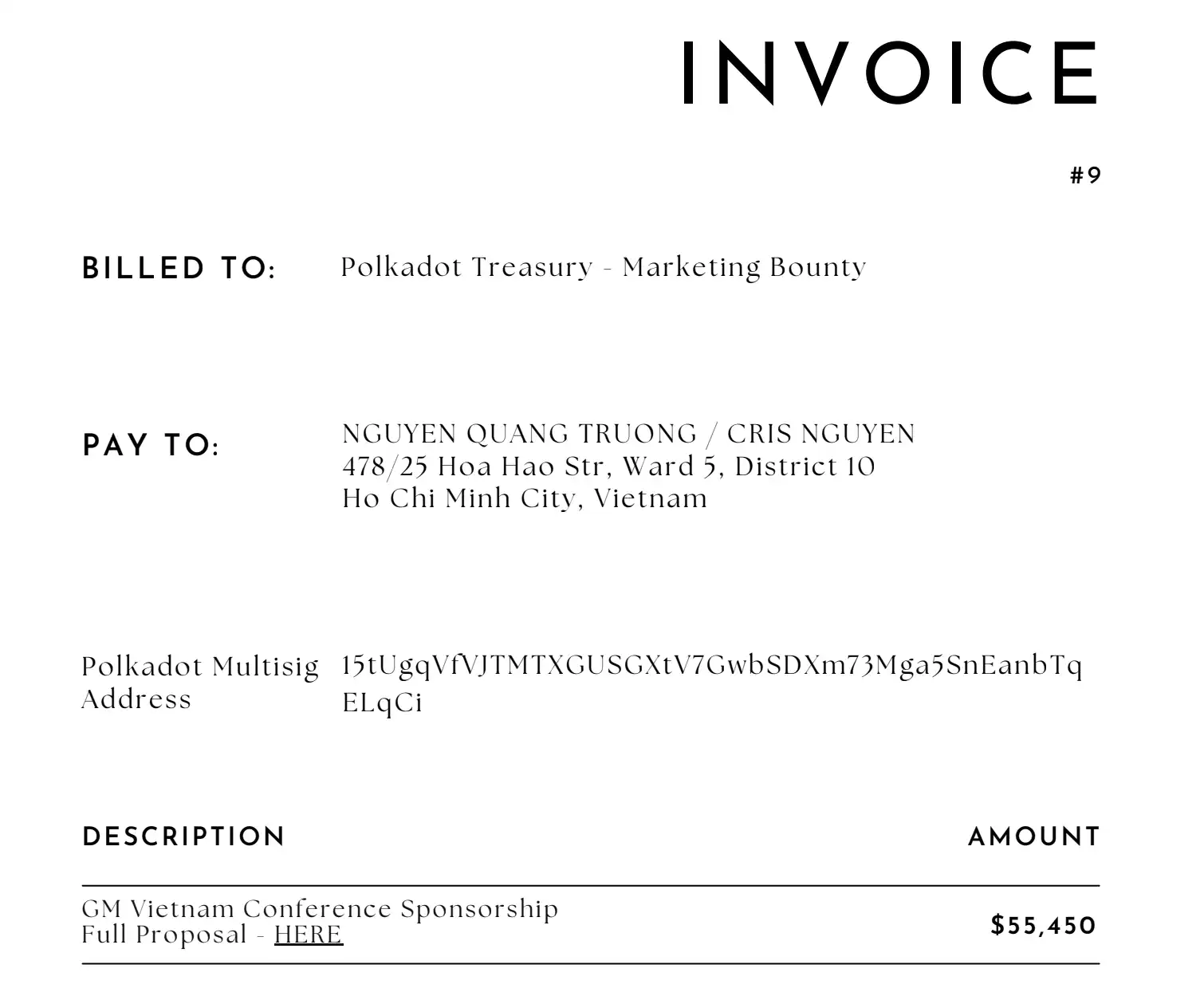

This inflated pricing is also reflected in Polkadot's event sponsorship costs. During the Web3 event in Vietnam a few months ago, Polkadot spent 50,000 USD on sponsorship. As a comparison, the platinum sponsorship during the Ethereum Montenegro EDCON was around 50,000 USD, and this amount could also give you the opportunity to negotiate with Vitalik in a VIP room.

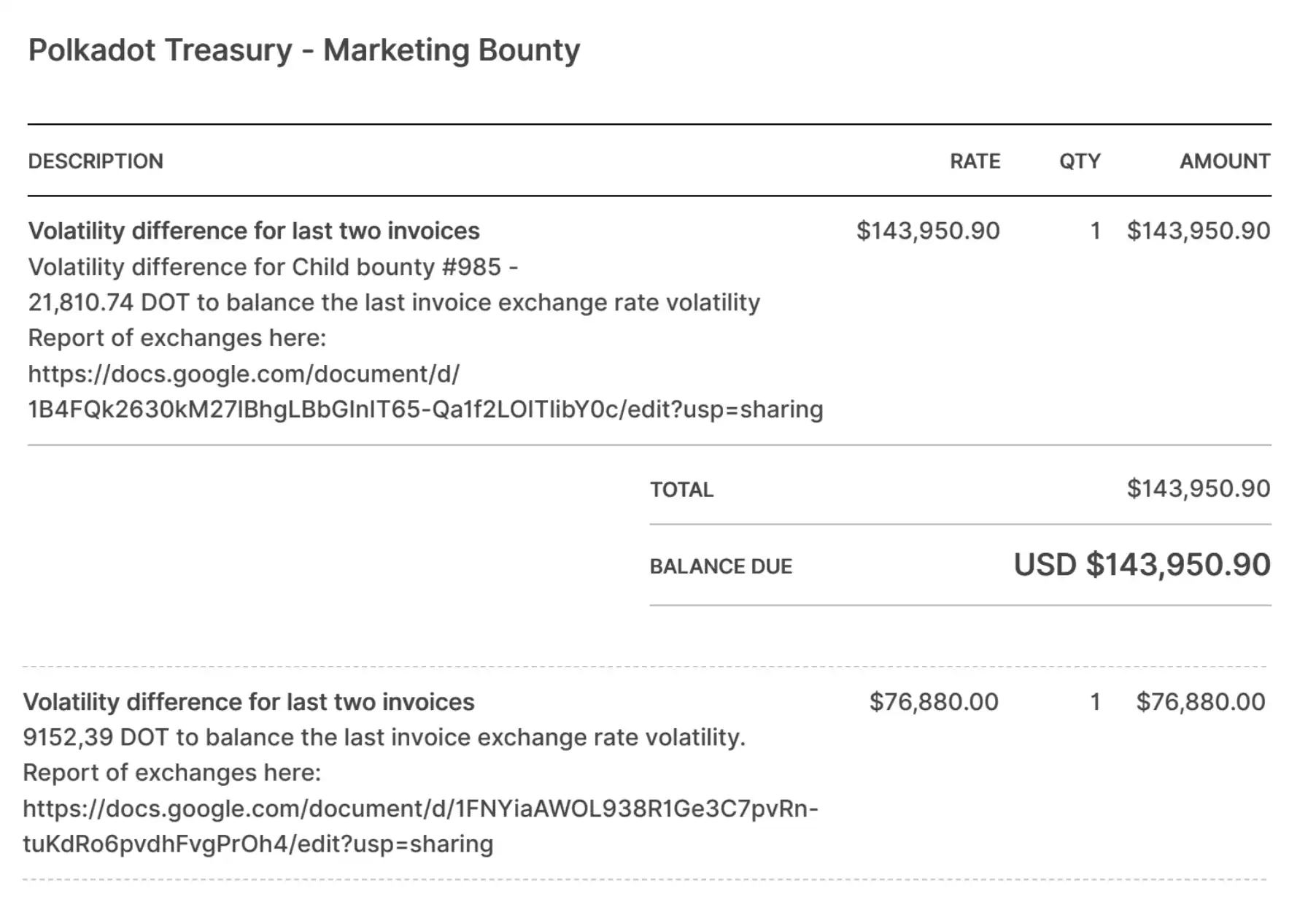

Interestingly, since Polkadot's budget expenses are mostly settled in DOT, but the recipients mostly price in USD, in the event of coin price fluctuations, there is often an item in Polkadot's budget bill for "price difference adjustment," which often amounts to 100,000 USD.

KOL brushing and wool shearing, have you considered this business?

Is Polkadot really that naive? It seems like an obvious "intelligence tax" to anyone with common sense, yet Polkadot continues to blindly spend money. Odaily reported yesterday, mentioning that the Polkadot community believes that "Polkadot's greatest value lies in its treasury," but in reality, the crypto industry is not lacking in operational and marketing strategies.

Regarding the exorbitant budget for Polkadot, the community is not lacking in the saying of "big players emptying the treasury," although unconfirmed, there are indeed cases of exploiting loopholes in the treasury for arbitrage in decentralized governance projects and organizations. Previously, during research on the Nouns community, Lu Dong learned that some community members used flattery to persuade DAO initiators and Nouns' main holders to vote for their high-priced but low-cost and low-benefit promotion proposals. In the case of RookDAO, arbitrageurs directly controlled the protocol's treasury by purchasing a large number of tokens, staging a "treasury battle" in the crypto community.

"KOLs and foundation or team individuals may have undisclosed agreements, which has been the case in previous cycles," a person familiar with crypto market promotion told BlockBeats. Although large projects like Polkadot usually follow open governance, many small project foundations consist of only a few people, and many decisions are directly made by the CEO, giving decision-makers many opportunities to take advantage of the situation.

However, in the case of Polkadot, it seems somewhat difficult for individuals to carry out such "secret transactions" because the proposal, voting, and foundation payments are all publicly visible. However, this does not prevent the governance community from "playing dumb," as today's crypto market promotion, centered around Twitter, is indeed full of "intelligence taxes" and "wool shearing."

For example, the KOL account above has almost no flaws in terms of the number of followers, tweet views, and interactions. It is almost impossible for ordinary people to detect that this is a batch of fake accounts, except for the flaws in the follow list. "These accounts are usually written by a studio in batches, and they are very realistic in terms of browsing, replying, and liking," a former KOL studio practitioner told BlockBeats, stating that with AI tools, it is even more difficult to discern the authenticity and quality of KOL promotion content.

However, many times, small projects choose to outsource to studios out of necessity. According to a practitioner with relevant experience, when small projects negotiate with top KOLs, either the KOLs are not interested or willing to work, or they quote high prices, making it difficult to reach an agreement. Additionally, messages between KOLs spread very quickly. When a team negotiates with one KOL, other KOLs quickly become aware and immediately demand the same price. However, for an effective TGE, at least 100 to 150 KOLs must be engaged, and if the project lacks strength, it is easy to fail in negotiations, so they have to resort to outsourcing.

However, there are ways to address this. Jesse, who specializes in KOL promotion, told BlockBeats that many projects did not initially engage KOLs but focused on building a community, and the organic spread effect was also very good. In addition, it is possible to manually screen and supervise the studio's promotion work, and the most effective method is to check the followers list and comments section of KOLs to see if they are mainly bots. "Or you can find reputable and reliable agencies, such as some mainstream media and top KOLs, who have their own KOL matrix and generally have transparent pricing, and won't cheat you," Jesse said.

However, being able to discern fake accounts is one thing, and being willing to discern them is another. A source told BlockBeats that from KOL promotion to foundation market reports, there is a feedback mechanism responsible for oversight. After receiving a task, PR companies or KOL studios need to submit a good promotion data report to the project or foundation, and the project needs to prove to VCs that they are "still working." This means that the effectiveness of the promotion is not truly included in the accountability system. In some cases, after the project foundation hires a market manager for the Asia-Pacific region, the manager may outsource the promotion work to a studio and produce false reports. "Sometimes, the manager's fake account-generated data report looks better and cheaper than the real one, so if the manager chooses a KOL who does genuine promotion, they may have to explain to the foundation why the data is not as good as others."

"Many project teams don't want to do the work, they just want to siphon money from the treasury. I know some projects that only started to do promotion after being warned and delisted by exchanges, but in these cases, they don't really care about the actual benefits, after all, legitimate expenses can't be traced," a practitioner familiar with the situation told BlockBeats. In some cases, KOLs are just a tool for the team to empty the treasury. According to a source, sometimes the performance indicators for KOLs may come directly from investment VCs. "Many times, exchanges, retail investors, and even fund LPs have been taken advantage of, and of course, LPs don't care about losing that little money."

Whether it's the sky-high FDV valuation by VCs or the project's exorbitant promotion budget, many long-standing issues in the crypto market have erupted in the recent downturn. Jesse told BlockBeats that often the responsibility does not lie with individuals, "not everyone wants to do evil, it's just that the system is too naive and gives everyone the motivation to arbitrage." Clearly, the market is entering an adjustment period, which may not be a bad thing. Without breaking, there can be no establishment, and perhaps "squeezing the pus" is a necessary step before the start of a new bull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。