Translation:

Plain Language Blockchain

Our framework in the cryptocurrency field shows that despite the significant increase in Bitcoin prices, the performance of this asset class has been uneven so far this year. Similar to the public equity market, the returns of cryptocurrencies this year lack breadth. We are pleased to introduce the Grayscale Research Top 20, which is our high-potential token selection for the next quarter. These crypto assets are selected based on the Grayscale research team's considerations of upcoming catalysts, market trends, and specific token fundamentals. Some assets in our Top 20 list have high price volatility and should be considered high risk. With the potential approval of Ethereum ETP, we expect to focus on the Ethereum ecosystem this quarter.

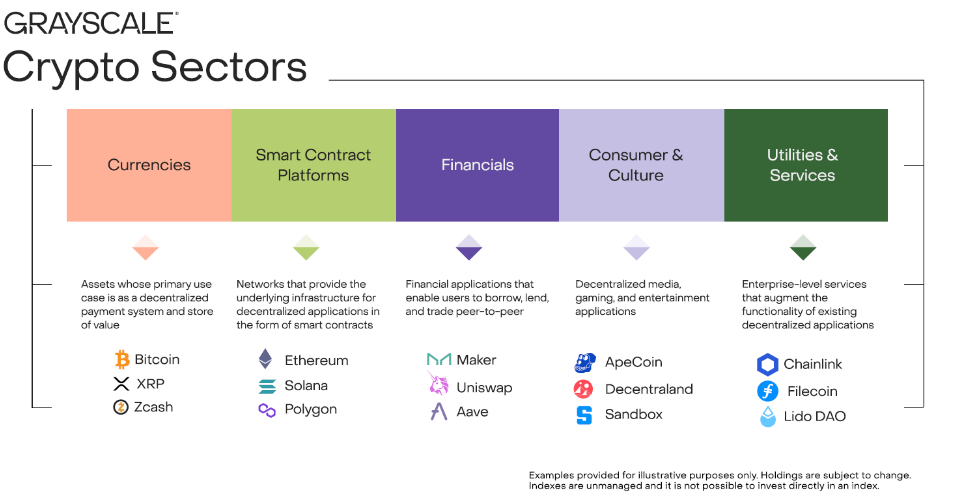

Navigating the cryptocurrency asset class may be challenging, which is why Grayscale created Crypto Sectors - a framework for a comprehensive understanding of investable crypto assets and their relationship with underlying technologies. Crypto Sectors provides investors with a roadmap similar to common tools in traditional markets and aims to help investors better understand and manage the evolving cryptocurrency asset class. Additionally, we have collaborated with FTSE Russell to develop the FTSE Grayscale Cryptocurrency Industry Index series to measure and monitor the cryptocurrency market.

Grayscale Crypto Sectors divides the digital asset space into five different sections:

(i) Currency (ii) Smart Contract Platforms (iii) Financial (iv) Consumer and Culture (v) Utility and Services

The tokens in these five cryptocurrency sectors are associated with unique use cases and investment risk exposure. Therefore, their valuation is influenced by different fundamental and technical driving factors.

- Crypto Sectors divides the digital asset market into five sections.

So far, cryptocurrency returns have been narrow.

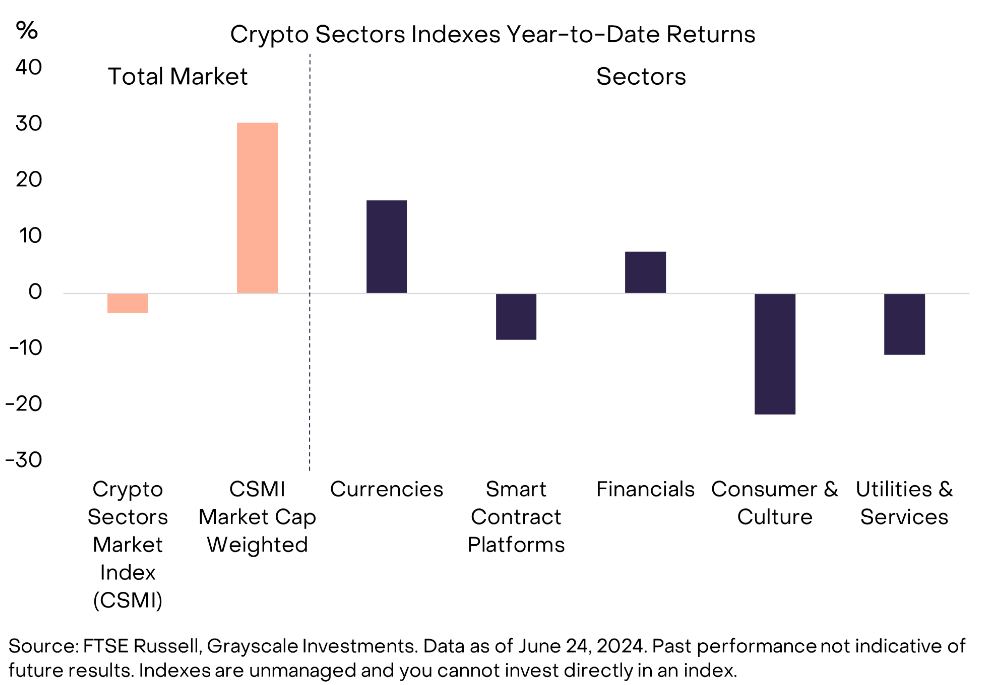

Since 2024, despite the approximately 50% increase in Bitcoin prices, our Cryptocurrency Sector Market Index (CSMI) has actually decreased by about 3% (see the figure below). The assets in the five cryptocurrency sectors and the overall CSMI are square root weighted by their market value to reduce Bitcoin's dominance and better represent a wider range of assets in the industry. By market value weighting, the CSMI has grown by 30%, reflecting Bitcoin's significant increase and its share in the total market value (about 60%).

The best-performing sector among the five market sectors is the currency cryptocurrency industry, reflecting Bitcoin's outperformance, while the worst-performing sector is the consumer and culture cryptocurrency industry, mainly due to the softness of assets related to video game applications this year.

- Despite the significant increase in Bitcoin, performance has been uneven so far.

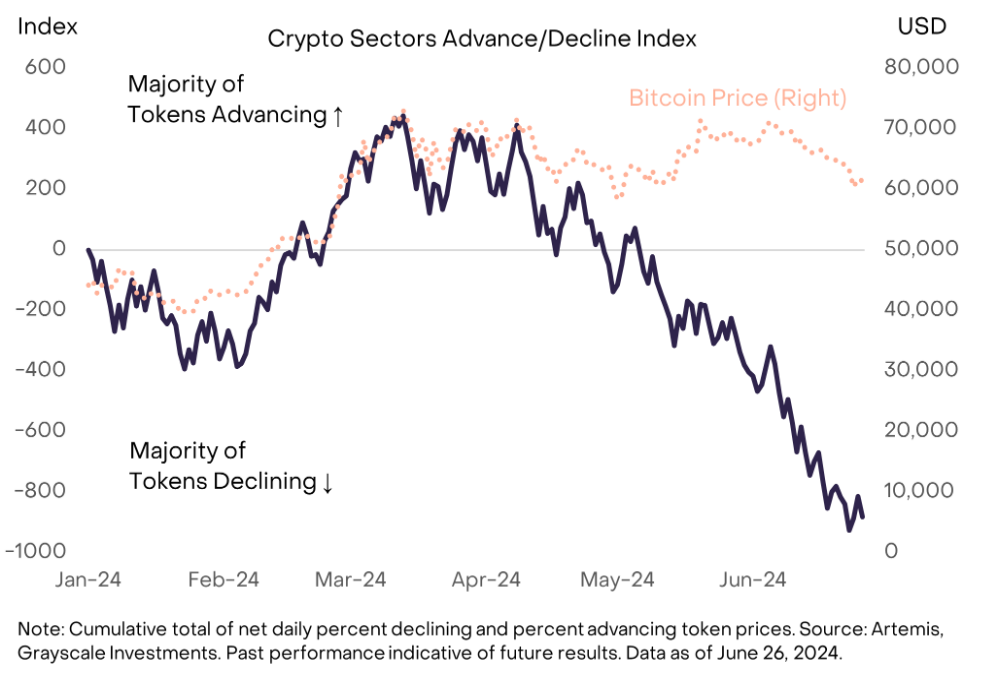

The significant difference in returns between Bitcoin and the entire cryptocurrency market indicates a lack of breadth in returns this year, similar to the dominance of a few large tech companies in the US equity market. Using the cryptocurrency industry framework, we can create a market breadth indicator similar to other market applications. For example, 3 shows an "up/down" index, where we track the net percentage of price increases and decreases in the cryptocurrency industry each day, and then calculate the cumulative total over time.

According to this indicator, market breadth in the cryptocurrency market peaked at the end of March/beginning of April 2024 and has since declined. So far, despite the significant increase in Bitcoin, only about 30% of cryptocurrency industry token prices have increased.

- Market breadth has declined since March/April.

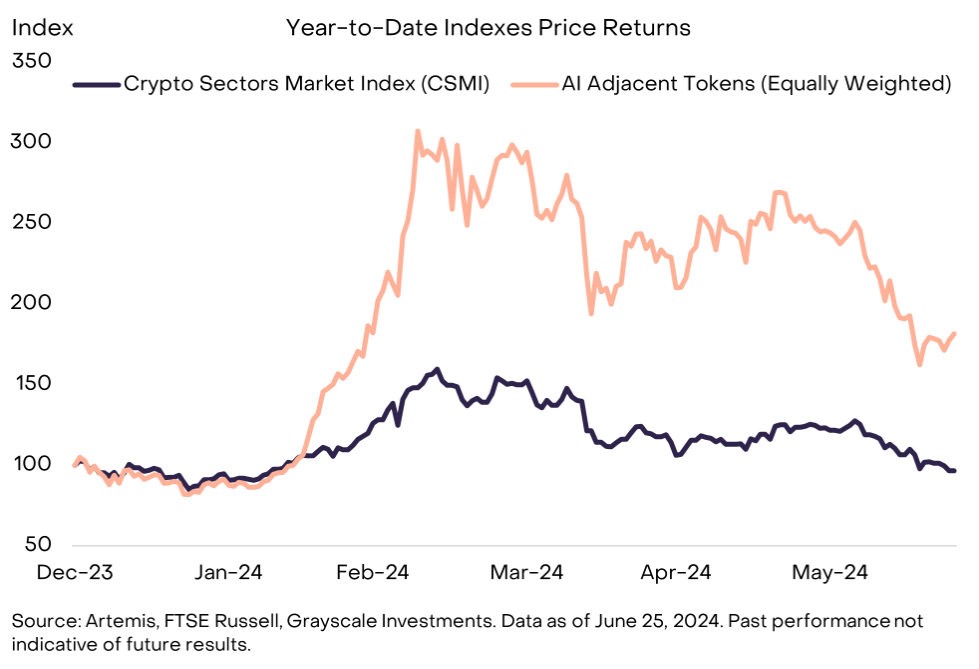

There has been a relative bright spot in assets related to artificial intelligence (AI) technology, which can be found in the smart contract platform cryptocurrency industry and the utility and services cryptocurrency industry. These protocols aim to address issues related to artificial intelligence (such as robots and deep fakes, privacy, model verification), provide essential resources for AI development (such as computing, storage, data), and/or provide a common platform for AI-related services (for more detailed information, please refer to our report "The Emergence of Synergy between Artificial Intelligence and Cryptocurrencies").

So far, a basket of equally weighted AI-related cryptocurrency industry tokens has grown by 80% compared to the overall cryptocurrency market, which has slightly declined (see 4).

- AI-related tokens outperform others.

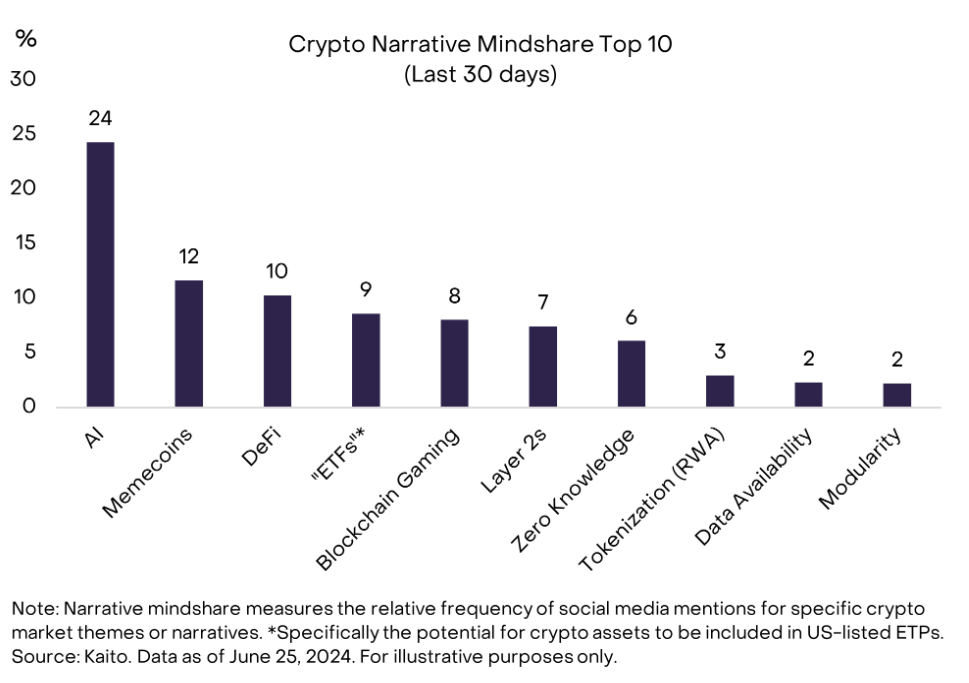

In addition to artificial intelligence, market participants have also focused on various other themes, which have to some extent affected the relative performance of the cryptocurrency industry. To enhance our understanding of market trends, Grayscale Research incorporates data provider Kaito's "narrative attention" indicator. These data measure the frequency of specific cryptocurrency market themes or narratives mentioned on social media, helping to assess the crypto assets driven by communities of believers and supporters who often express their views on social media platforms. For example, in the past month, artificial intelligence remains a dominant theme, followed by exchange-traded fund (ETF) trading platforms - tokens that could be short-term catalysts for exchange-traded products (commonly known as "ETFs") - and Memecoin and blockchain-based games (see 5). Although market focus may change, themes are usually persistent, so the narrative attention indicator may provide clues for market performance in the coming months.

- Artificial intelligence remains a dominant market theme.

Looking ahead: Focus on Ethereum.

In the next quarter, Grayscale Research expects the cryptocurrency market to be dominated by the approval of the US market spot Ethereum Exchange-Traded Products (ETP). At the end of May, the US Securities and Exchange Commission (SEC) approved several issuers' 19b-4 form applications to list these products on US exchanges. Additionally, SEC Chairman Gensler recently indicated that regulatory authorities may approve the remaining applications at some point this summer. Therefore, although the timing is still uncertain, for our market analysis, Grayscale Research assumes that these products will begin trading in the third quarter of 2024. Similar to the launch of the spot Bitcoin ETP in January 2024, the Grayscale research team also expects these new Ethereum products to generate meaningful net inflows (although less than Bitcoin ETP) and potentially support the valuation of tokens within the Ethereum ecosystem (for more details, please refer to our report "The Current State of Ethereum").

The Ethereum ecosystem has several unique characteristics, and the launch of spot Ethereum ETPs may highlight these features. For example, the Ethereum network pursues a modular design concept, where different blockchain infrastructure components collaborate to provide a more optimized end-user experience and reduce costs. Additionally, Ethereum is the home of the largest decentralized finance (DeFi) ecosystem in the cryptocurrency space and is also the home of most tokenized projects (for more details, please refer to our report "The Public Blockchain and Tokenization Revolution"). If the approval of ETPs stimulates interest and adoption of Ethereum, we may also see increased activity and valuation support for some Layer 2 tokens (such as Mantle), Ethereum DeFi protocols (such as Uniswap, Maker, and Aave), and other assets necessary for the Ethereum network (such as Lido, a staking protocol).

In addition to the approval of the US spot Ethereum ETP, Grayscale Research expects various themes in the current market to continue to receive attention in the next quarter, especially the potential intersection of blockchain technology and artificial intelligence. One such asset in this category is Near, created by the co-founder of the "Transformer" architecture, which powers AI systems like ChatGPT. Near is one of the leading smart contract platforms in terms of daily active users and has gained significant adoption in practical applications outside of finance. However, Near has recently emphasized its AI expertise, publicly disclosing efforts to develop "user-owned AGI" led by a former OpenAI research engineer advisor. Decentralized GPU markets like Render and Akash may also benefit from the continued preference for AI assets in the market.

In addition to major market themes, many projects seem to benefit from their own unique adoption trends, whether due to innovative technology or integration with platforms that provide room for user growth. Two notable examples are Toncoin and Pendle. The TON blockchain is a smart contract platform associated with the Telegram messaging platform, with significant growth in user numbers, transaction volume, and fee revenue. Pendle Finance is a relatively new DeFi protocol that allows users to customize their yield farming strategies. While this is not a new trend, we also believe that the Solana network is experiencing organic adoption growth, benefiting from a compelling user experience (for more details, please refer to our Solana Building Block report).

Finally, the cryptocurrency market may continue to differentiate between relatively low inflation and relatively high inflation tokens. Despite Bitcoin's maximum total supply and relatively low annual inflation rate, many tokens in our cryptocurrency sector do not share this structure. In fact, in many cases, the circulating supply of tokens is relatively low, while the monthly or annual supply inflation ("unlocking") is relatively high. In these cases, even if a project is experiencing user adoption and revenue growth, the growth in supply may dilute existing token holders. Examples include well-known Ethereum Layer 2 networks like Arbitrum and Optimism, which, despite experiencing user adoption, have relatively poor returns for their native tokens, possibly due to high growth in circulating supply.

- Grayscale Research's Top 20 List

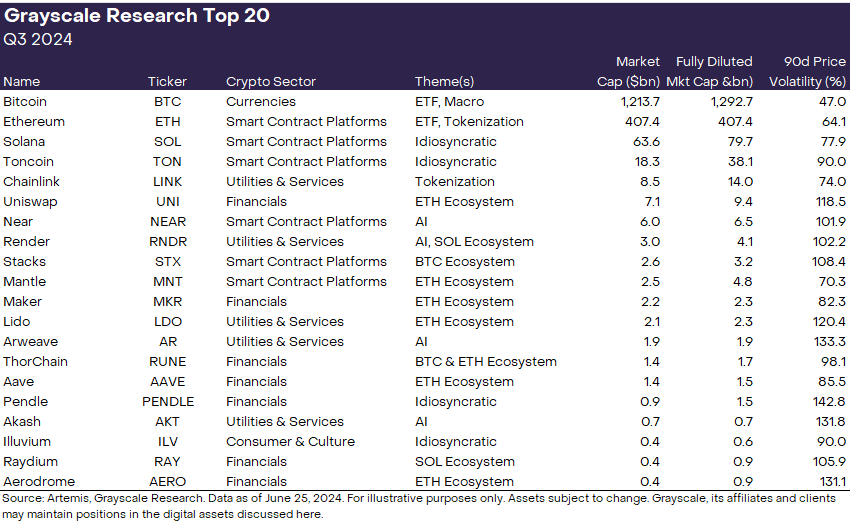

To highlight tokens with high potential in specific cryptocurrency sectors, we have released Grayscale Research's Top 20 list (see Table 6 in the appendix). This Top 20 list represents a diverse range of assets in the cryptocurrency sector that, in our view, have high potential in the next quarter for reasons including:

(i) Immediate catalysts or hot topics (ii) Favorable adoption trends for specific protocols (iii) Low or moderate token supply inflation

The selection of these assets is intended to represent short-term market prospects and may not include assets with high market value that do not have immediate catalysts and/or continuously improving fundamentals. We intend to update Grayscale Research's Top 20 list every quarter. Some of the listed assets have high volatility (as indicated in the rightmost column of Table 6) and should be considered high-risk assets.

Appendix 6: High Potential Assets in the Third Quarter of 2024

Original article link: Grayscale Research Insights: Crypto Sectors in Q3 2024

Source: Grayscale Research

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。