In the past 24 hours, the market has seen many new popular coins and topics, which are likely to be the next wealth creation opportunities.

Authored by: Bitget Research Institute

Abstract

After a month of oscillating decline, the market has shown signs of rebound. The BTC spot ETF saw a slight net inflow for four consecutive working days at the end of last week, after a continuous outflow of funds. High market value new coins and ETH ecological tokens have shown strong rebounds. This week, the market is focusing on the progress of the ETH spot ETF and the US unemployment rate and non-farm data on Friday.

Sectors with relatively strong wealth creation effects: New coin sector (ZRO, ZK, LISTA), ETH ecology (ENS, SSV);

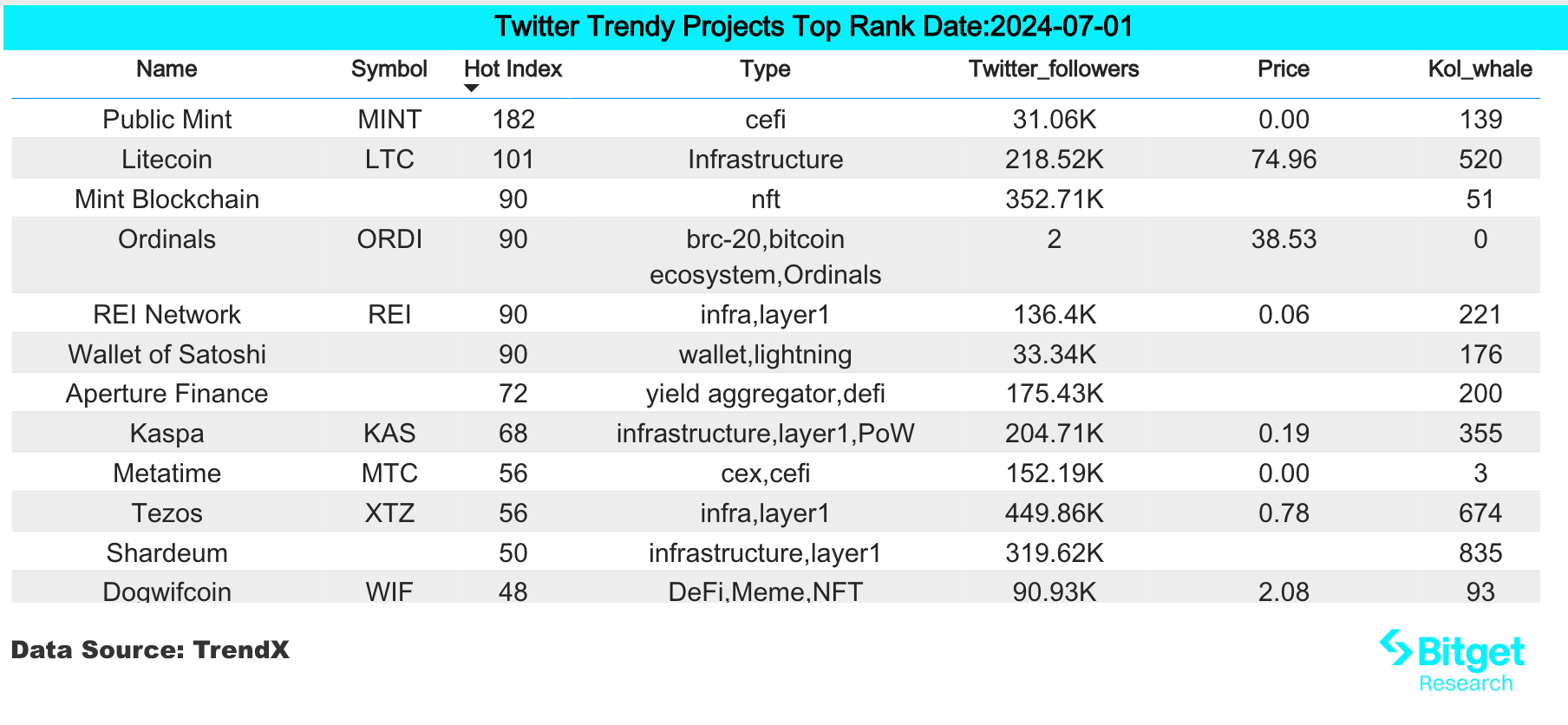

User hot search tokens & topics: Jumper Exchange, Kaspa, Daddy;

Potential airdrop opportunities: Karak, Li.Fi;

Data statistics time: July 1, 2024, 4:00 (UTC+0)

I. Market Environment

The BTC spot ETF stopped its net outflow last week and saw a slight net inflow for the past four consecutive working days. After a week of oscillating decline, BTC rebounded and surged to $63,000, recovering the previous week's decline.

Several macroeconomic data will be released this week, with the market focusing on the US unemployment rate and non-farm data on Friday. Over the weekend, sources said the SEC had returned the S-1 form to the ETH spot ETF issuer and requested a resubmission by July 8.

During the market rebound, new coins such as ZRO, ZK, LISTA, and ETH ecological tokens such as ENS showed significant increases, with ENS breaking to a new high in the past 29 months.

II. Wealth Creation Sectors

1) Sector Dynamics: New Coins (ZRO, ZK, LISTA)

Main reasons:

New coins rebounded from oversold conditions, with prices of high market value new coins such as ZRO and ZK far below market expectations under negative sentiment. As market sentiment gradually dissipates, investment and pricing are gradually returning to rationality, leading to a rapid recovery in ZRO and ZK during the rebound.

Factors affecting the future market:

Whether new coin projects such as LayerZero and ZKsync can take further actions to release positive news and stabilize coin prices, as well as the extent to which market sentiment is digested, will directly affect the prices of new coins.

2) Sector Dynamics: ETH Ecology (ENS, SSV)

Main reasons:

Sources said the SEC had returned the S-1 form to the ETH spot ETF issuer and requested a resubmission by July 8. Even if the ETH spot ETF is not directly approved in early July, it is highly likely to continue to release positive news.

Even in the market news on June 29, the US SEC's view that Lido and Rocket Pool staking projects are securities, leading to the decline of LDO and RPL, did not prevent the rise of ETH ecological tokens such as ENS and SSV during the market rebound, with ENS breaking to a new high in the past 29 months.

Factors affecting the future market:

The situation of the ETH spot ETF in the news will directly affect the price of ETH and the trend of well-known projects in the ETH ecology. In addition, whether the SEC will further consider including projects such as SSV in the range of securities after releasing the news that "Lido and Rocket Pool staking projects are securities" will also have a significant impact on the projects in this sector.

III. User Hot Searches

1) Popular Dapps

Jumper Exchange & Li.Fi:

Jumper Exchange is a multi-chain liquidity aggregator that supports cross-chain exchanges of most mainstream blockchains and gas fee exchanges, with technical support provided by LI.FI. The recent interaction between Jumper and Li.Fi protocols has seen a significant increase in market speculation, possibly indicating that the project parties have TGE and airdrop plans, leading users to interact more frequently.

2) Twitter

Kaspa

Marathon Digital Holdings recently announced its Kaspa (KAS) mining business. As of June 25, 2024, the company had mined 93 million KAS, worth about $15 million. Kaspa is the fifth largest proof-of-work (PoW) digital asset, characterized by decentralization and scalability. By deploying about 60 petahash of Kaspa ASICs in Texas, Marathon has successfully diversified its sources of income using existing infrastructure and expertise, and plans to fully operate in the third quarter of 2024.

3) Google Search & Regions

Global Perspective:

DADDY:

Solana-based token DADDY is a meme coin issued by well-known KOL Andrew Tate, mainly intended to counter the MOTHER token on the Solana chain and end the situation where there is only a mother and no father on the Solana chain. Andrew Tate has 9.54 million followers on Twitter, and the token quickly rose after its issuance. However, meme coins on the Solana chain have performed poorly, and investors are advised to invest cautiously.

Regional Hot Searches:

(1) There is a lack of hotspots in the Asian region, and no general pattern of hot searches in various regions has been found.

(2) The focus in the European and American regions has returned to mainstream memes, with "maga" appearing in hot searches in France, and "PEPE" appearing in hot searches in several European and American countries.

(3) Hot searches for ONDO have appeared in countries in South America and Europe. Ondo Finance is a financial protocol focusing on the RWA track, and its main business at this stage is to tokenize high-quality assets such as US Treasury bonds and money market funds within a compliance framework for investment and trading by users on the blockchain. Its recent price performance has been relatively strong.

IV. Potential Airdrop Opportunities

Karak

Karak is an Ethereum Layer2 with multi-chain advantages in re-staking. Its backer, Andalusia Labs, is a digital asset risk infrastructure provider that has raised $51.2 million, with investors including Panetra, Lightspeed Capital, Framework Ventures, and others. Staking in Karak can simultaneously earn "staking rewards + re-staking rewards + Eigenlayer points + staked LRT points + Karak XP."

Specific participation method: 1) Add the Karak network (can be added to the Karak Mainnet on chainlist); 2) Cross-chain the coins to the Karak chain (currently supporting rswETH, USDC, wETH), and stake in Karak Pools.

LI.FI

LI.FI is a multi-chain liquidity aggregation protocol that supports the exchange of any two assets by aggregating bridges and DEX aggregators from over 20 networks including Ethereum, Arbitrum, Optimism, Solana, Polygon, and Base.

The cross-chain infrastructure protocol LI.FI completed a $17.5 million Series A financing, with CoinFund and Superscrypt co-leading the investment, and participation from Bloccelerate, L1 Digital, Circle, Factor, Perridon, Theta Capital, Three Point Capital, Abra, and nearly 20 angel investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。