In a market where all participants are tired of the narrative and aesthetics of public chain performance, how does MegaETH stand out?

Author: Deep Tide TechFlow

Infrastructure never sleeps, chains are more than applications.

While the market is tormented by the airdrop PUA of various king projects, the primary market is still running on the road of "creating kings".

Last night, another explosive L1 lineup emerged - MegaETH, with a seed round financing of $20 million, led by Dragonfly, with participation from Figment Capital, Robot Ventures, Big Brain Holdings, and angel investors including Vitalik, Cobie, Joseph Lubin, Sreeram Kannan, Kartik Talwar, and others.

Top VCs leading the investment, industry giants like Vitalik acting as angel investors, and the project name directly including ETH… In the limited attention crypto market, these labels are all about giving the project "orthodoxy".

From the official project description, MegaETH can still be summarized with a familiar word - fast.

The first real-time blockchain, lightning-fast transaction transmission, sub-millisecond latency, and over 100,000 transactions per second…

In a market where all participants are tired of the narrative and aesthetics of public chain performance, how does MegaETH stand out?

We dug into MegaETH's white paper to find the answer.

Many chains, but none can achieve "real-time"

Assuming aside from the narrative and hype, why does the market need a blockchain called MegaETH?

MegaETH's own answer is that simply creating more chains cannot solve the scalability problem of blockchain. The current L1/L2s face common problems:

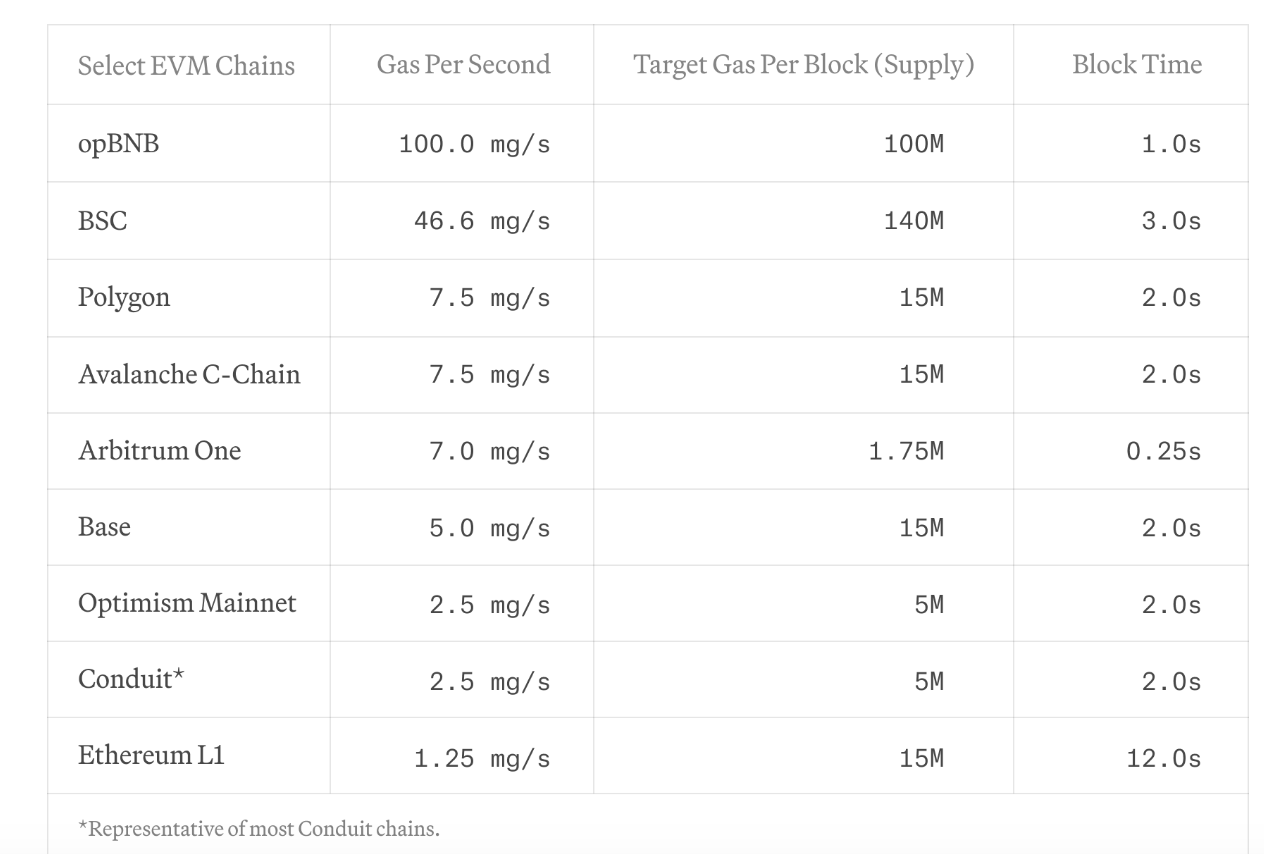

All EVM chains show low transaction throughput;

Secondly, due to scarce computing power, complex applications cannot be deployed on the chain;

Finally, applications requiring high update rates or fast feedback loops are not feasible within long block times.

In other words, all existing blockchains cannot achieve:

Real-time settlement: Transactions are processed immediately upon reaching the blockchain and results are almost instantly published.

Real-time processing: Blockchain systems are able to process and verify a large number of transactions in a very short time.

What does this real-time capability mean in practical application scenarios?

For example, high-frequency trading requires the ability to place and cancel orders within milliseconds. Or real-time combat or physical simulation games require the blockchain to update states at a very high frequency. Obviously, current chains cannot achieve this.

Node specialization, real-time performance

So, how does MegaETH plan to achieve the "real-time" mentioned above? In short:

Node specialization: By separating transaction execution tasks from the responsibilities of full nodes, consensus overhead is reduced.

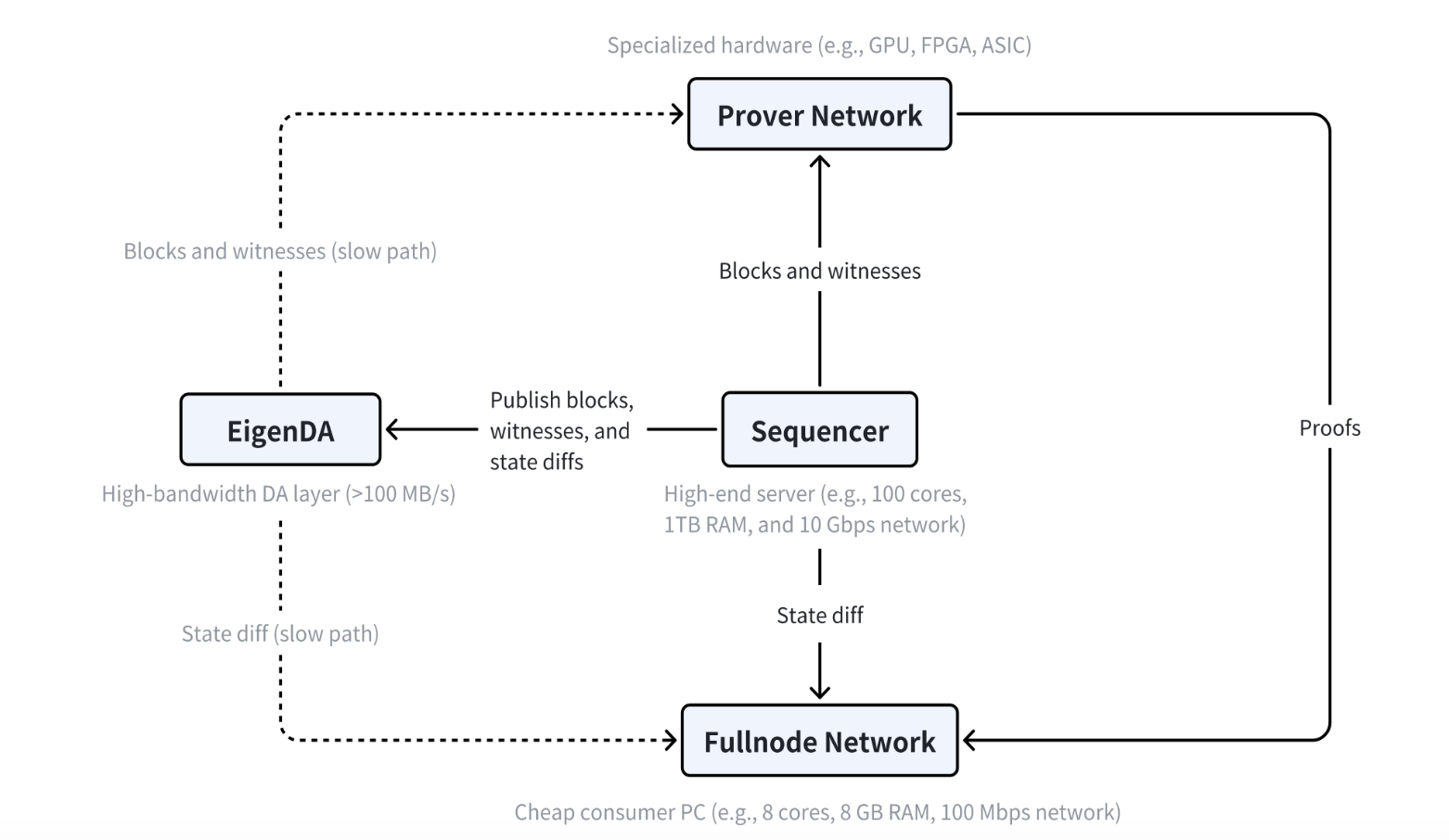

To be more specific, MegaETH has three main roles: sequencer, prover, and full node.

In MegaETH, only one active sequencer processes transactions at any given time, with other nodes receiving state differences via a p2p network and updating their local state without re-executing transactions.

The sequencer is responsible for sorting and executing user transactions. However, MegaETH only has one active sequencer at any given time, eliminating consensus overhead during normal execution.

Provers use a stateless verification scheme to verify blocks asynchronously and out of order.

A simplified workflow of MegaETH is as follows:

Transaction processing and sorting: User-submitted transactions are first sent to the sequencer, which processes these transactions in order and generates new blocks and witness data.

Data publication: The sequencer publishes the generated blocks, witness data, and state differences to EigenDA (data availability layer) to ensure that this data is available in the network.

Block verification: The Prover Network retrieves blocks and witness data from the sequencer, verifies them using dedicated hardware, generates proofs, and returns them to the sequencer.

State update: The Fullnode Network receives state differences from the sequencer, updates local state, and can verify block validity through the Prover Network to ensure the consistency and security of the blockchain.

Measure first, then execute

From other parts of the white paper, MegaETH also realizes that while the "node specialization" approach is good, it does not mean that it can be easily put into practice.

When building the chain, MegaETH has a good idea: measure first, then execute. That is, conduct in-depth performance measurements to identify the real problems of existing blockchain systems before applying the node specialization approach to solve these problems.

So, what problems did MegaETH measure?

The following section may be a bit technical and may be skipped if not interested.

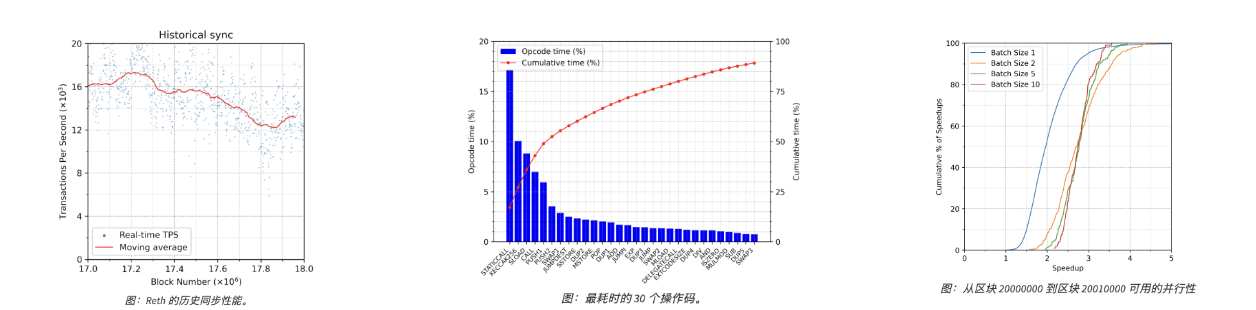

Transaction execution: Their experiments show that even with a powerful server equipped with 512GB of memory, the existing Ethereum execution client Reth can only achieve about 1000 TPS (transactions per second) in real-time sync settings, indicating significant performance bottlenecks in transaction execution and updates in the existing system.

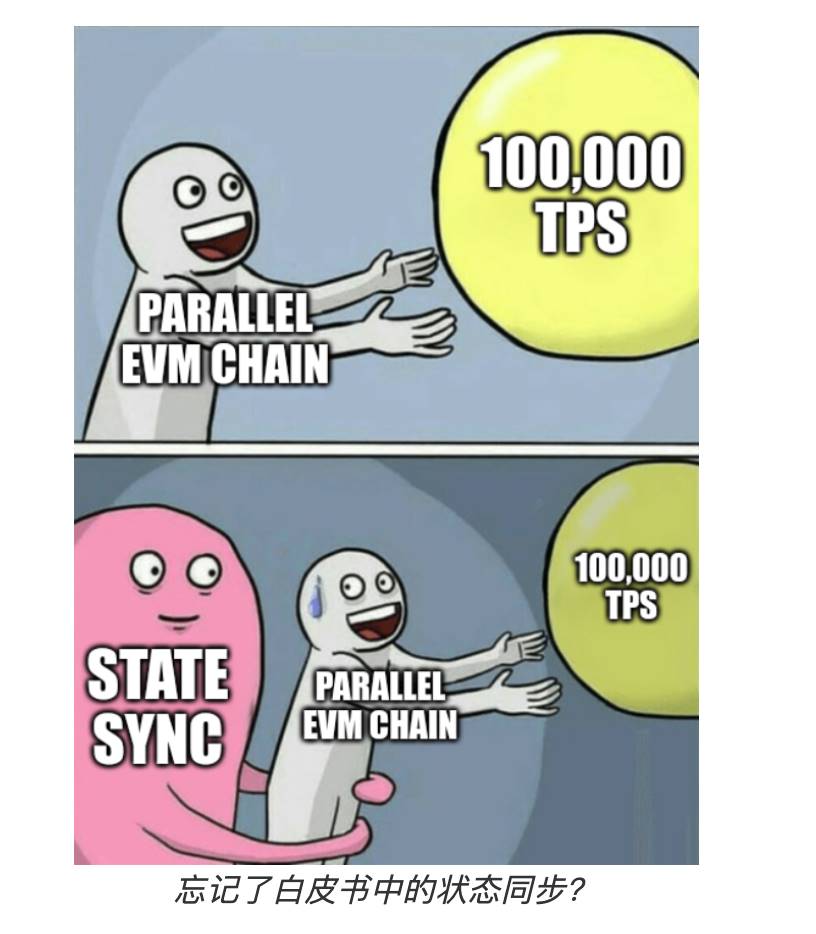

Parallel execution: Despite the popularity of the concept of parallel EVM, there are still some unresolved performance issues. The acceleration effect of parallel EVM in actual production is limited by the parallelism of the workload. MegaETH's measurements show that in recent Ethereum blocks, the median parallelism is less than 2, even if multiple blocks are combined, the median parallelism only increases to 2.75.

(A parallelism of less than 2 means that in most cases, less than two transactions can be executed simultaneously in each block. This indicates that most transactions in the current blockchain system are interdependent and cannot be processed in parallel on a large scale.)

Interpreter overhead: Even with a faster EVM interpreter, such as revm, its speed is still 1-2 orders of magnitude slower than local execution.

State synchronization: Synchronizing 100,000 ERC-20 transfers per second requires 152.6 Mbps of bandwidth, and more complex transactions require even more bandwidth. Updating the state root in Reth consumes 10 times more computing resources than executing transactions. In other words, current blockchain resource consumption is quite high.

After measuring these issues, MegaETH then begins to address them, which helps to better understand the logic of the solution mentioned earlier:

- High-performance sequencer:

Node specialization: MegaETH improves efficiency by assigning tasks to specialized nodes. The sequencer node is dedicated to transaction sorting and execution, while full nodes are responsible for state updates and verification, and prover nodes use dedicated hardware to verify blocks.

High-end hardware: The sequencer uses high-performance servers (e.g., 100 cores, 1TB memory, 10Gbps network) to process a large number of transactions and quickly generate blocks.

- State access optimization:

Memory storage: Sequencer nodes are equipped with a large amount of RAM, capable of storing the entire blockchain state in memory, eliminating SSD read latency and speeding up state access.

Parallel execution: Although the acceleration effect of parallel EVM in existing workloads is limited, MegaETH optimizes the parallel execution engine and supports transaction priority management to ensure that critical transactions can be processed promptly even during peak periods.

- Interpreter optimization:

AOT/JIT compilation: MegaETH introduces AOT/JIT compilation technology to accelerate the execution of computationally intensive contracts. While the performance improvement of most contracts in production environments is limited, these technologies can significantly enhance performance for specific high-computing demand scenarios.

- State synchronization optimization:

Efficient data transmission: MegaETH has designed an efficient method for encoding and transmitting state differences, enabling the synchronization of a large number of state updates in bandwidth-limited situations.

Compression technology: By using advanced compression technology, MegaETH can synchronize state updates for complex transactions (such as Uniswap exchanges) within bandwidth limitations.

- State root update optimization:

Optimized MPT design: MegaETH adopts an optimized Merkle Patricia Trie (e.g., NOMT) to reduce read/write operations and improve the efficiency of state root updates.

Batch processing technology: By batch processing state updates, MegaETH can reduce random disk IO operations and improve overall performance.

The above information is quite technical, but looking beyond these technical details, it is evident that MegaETH has a strong technical foundation and a clear motivation:

By publicly sharing detailed technical data and test results, it aims to enhance the transparency and credibility of the project, allowing the technical community and potential users to have a deeper understanding and trust in its system's performance.

Elite team, frequently favored?

While interpreting the white paper, it is evident that although MegaETH's name may seem exaggerated, the documentation and explanations often reveal a rigorous and overly detailed technical nerdiness.

Public information shows that the MegaETH team seems to have a Chinese background, with CEO Li Yilong coming from Stanford with a Ph.D. in computer science; CTO Yang Lei holds a Ph.D. from MIT, and CBO (Chief Business Officer) Kong Shuyao holds an MBA from Harvard Business School and has work experience at several industry institutions (ConsenSys, etc.); the advisors have overlapping resumes with the CBO and also come from prestigious institutions like New York University.

With all four team members coming from top U.S. universities, their influence and resources are self-evident.

Previously, in the article "Graduates as CEOs, Pantera Leads $25 Million Investment in Nexus, What's the Story?", we introduced that the CEO of Nexus, although a recent graduate, also comes from Stanford and seems to have a solid technical background.

Top VCs indeed seem to favor tech talents from top schools, and with Vitalik's participation and the inclusion of ETH in the name, both the technical narrative and marketing effects are likely to be maximized.

In the current situation where the old "kings" are fading, projects are struggling, and the market is in a state of uncertainty, MegaETH is clearly poised to bring about a new wave of FOMO.

We will continue to keep an eye on more information about the project's testnet and interactions.

Join the official TechFlow community

Telegram subscription group:

Official Twitter account:

English Twitter account:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。