Author: Nian Qing, ChainCatcher

Last night, Blast officially opened the airdrop application. In the recent "Airdrops are Dead" sentiment sparked by ZKsync and LayerZero, Blast and its founder, Tieshun Pacman, were unsurprisingly criticized by the community. The main criticisms are as follows:

- The token claiming process is frustrating

- The token price after listing is lower than expected, resulting in lower profits for users participating in staking

- Addresses in the top 1% of the activity ranking need to wait for a 6-month linear unlocking period

Specifically, before users can claim the airdrop, they are required to watch a mandatory video lasting tens of minutes, in which founder Pacman will provide a detailed introduction to Blast's token economics and development plans. Additionally, after watching the video, users must also download a mobile app to obtain 4 clues in order to finally claim the tokens.

Furthermore, prior to listing, Blast had multiple analysts valuing the token, with even the most pessimistic valuations being above $0.03. However, after the token was launched, Blast's FDV was only around $2 billion. In comparison, L2 solutions such as Arbitrum and Optimism had FDVs of nearly $10 billion upon release (which also to some extent indicates that retail investors are no longer willing to support high FDV VC coins).

But in comparison to the token price, some users who participated in large staking amounts expressed that their airdrop benefits were very low. For example, Christian, co-founder of NextGen Venture, stated that he deposited over $50 million in Blast but only received an airdrop worth $100,000. Christian also angrily accused Blast of being a scam project and called Pacman a "serial scammer." The "big brother" of Blast's points, @beijingduck2023, staked around $10 million and, with a total of 281.2 billion points and 1.22 million gold points, only received 64,000 BLAST tokens, worth just over a thousand dollars. Additionally, large holders (top 0.1% addresses, about 1000 addresses) also need to wait for a 6-month linear unlocking period.

However, objectively speaking, Blast's negative reviews in the community are much fewer compared to the recent ZRO and ZK airdrops. User X @CryptoWoodBro mentioned that 7% of the first-phase Blast airdrop was allocated to staking points, and 7% to gold points. Staking points can be automatically earned by simply holding, suitable for large capital; while gold points require studying the rules of various projects and deep involvement, suitable for small capital retail investors. Additionally, some rules allow points to double or inflate, so the Blast airdrop essentially takes care of the interests of retail investors, providing them with the opportunity to "bet big with small stakes" and "get rich through hard work."

The Era of "Quick and Easy" is Long Gone

Although Blast's handling of the airdrop slightly dampened the discussion of "Airdrops are Dead" due to the absence of "witch hunts" and the consideration of some fairness (specifically catering to some retail investors), its token-based airdrop still does not represent the future of Web3 projects.

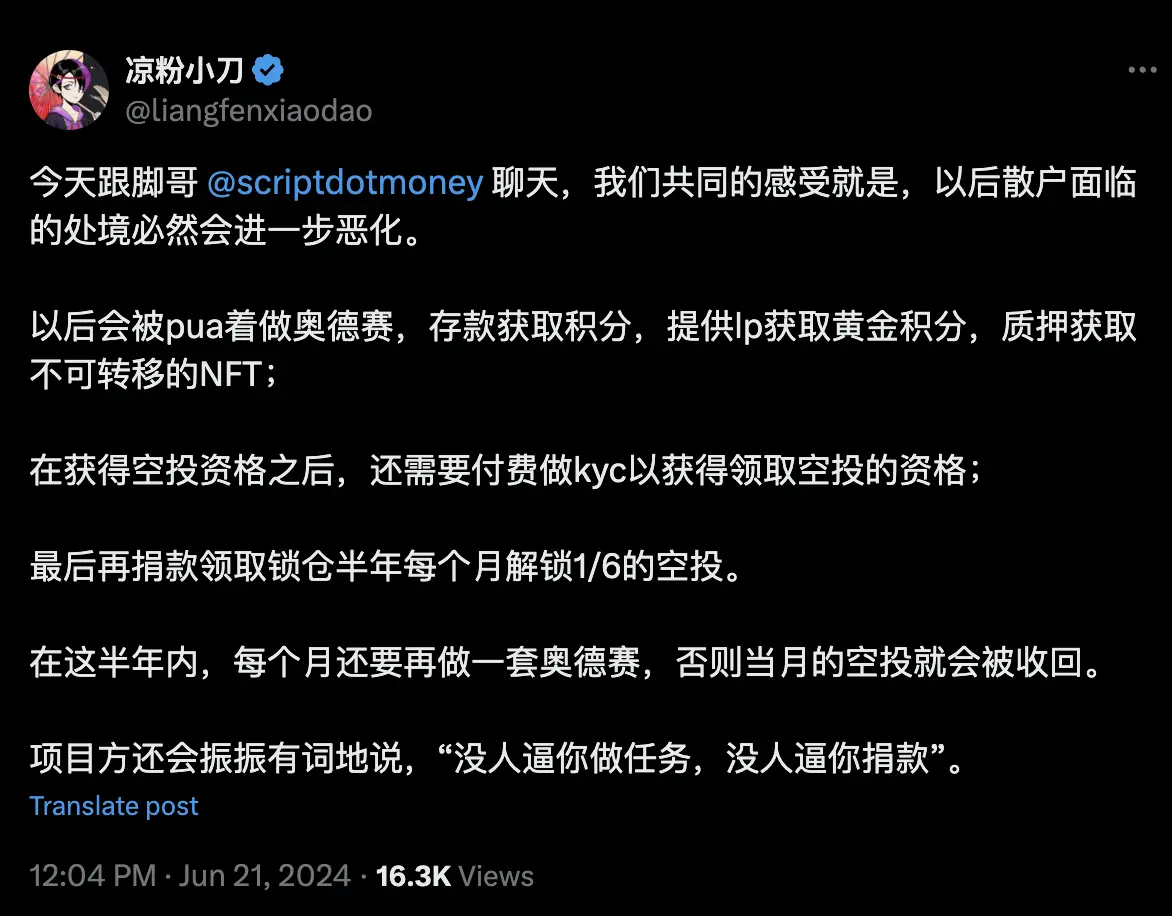

Blast had previously received criticism for its token-based gameplay. In March, the new token-based gameplay launched on the Blast mainnet was accused of being PUA. The new rules required users to migrate ETH points to the mainnet to enjoy a 10x inflation, but the migration required paying over $50 in gas fees, which was too costly for small retail investors. Additionally, users found that the inflation factor after migration was a random number between 0 and 10x. Although Blast later officially fixed the bug, it left behind complaints about the opaque point calculation rules. Previously, the official also secretly issued a large number of gold points to certain Dapps.

Related Reading: "Insiders Trapped by Points: Insider Trading, Big Players Taking All, Airdrop Qualifications Stripped"

When the community was discussing the token-based gameplay, some people expressed that whether this round of token-based PUA ends or not largely depends on Blast's performance after launch. If Blast's price is much lower than expected, the token-based airdrop PUA will naturally "extinct." Many OGs and KOLs have also vowed "not to participate in token-based interactive activities in the future." But even if Blast fails, does it mean the extinction of token-based airdrops?

Despite long-standing complaints about token-based systems in the community, earning points is still the common marketing and incentive method for current Web3 projects.

Several well-known unreleased projects, such as:

Scroll released the Scroll Marks user points statistics rules on May 15, mainly tracking the bridge data and gas burning data of users since the release of the Scroll mainnet on October 10, 2023. Later, the project will distribute airdrops based on Scroll Marks;

Linea launched the first phase of the Linea Surge points program (Volt 1) on May 17, which will run for 6 months (6 Volts), with three main ways to earn points: ecosystem points, referral points, and early adoption and historical contribution points;

Backpack started an account trading volume points system in February, and the points ranking will be an important reference for future airdrop qualifications or Launchpool projects;

In addition, several projects such as KIP Protocol, KiloEx, Swell, and Puffer Finance have also launched points activities. Will projects without point-based incentives be better? Not necessarily. The situation for retail investors will become increasingly difficult, and without point-based systems, users will also find it difficult to escape tasks such as running nodes, completing tasks on third-party platforms, participating in staking LPs, and purchasing NFTs with no actual value.

Even though the internal competition among project airdrops has reached its peak, it does not mean the end of the airdrop era. The "quick and easy" era has temporarily come to an end, marking the official entry of "industrialized airdrops," turning users into "Web3 product testers" with a certain capital and professional knowledge, emphasizing deep involvement.

Airdrops are Not Dead, Why Do Project Parties and Retail Investors Not See Eye to Eye?

Project parties can never satisfy everyone, but why does this year's airdrop seem to bring out particularly negative emotions?

The most important reason for this situation is the overall downturn in the market. Although this round brought about a rise in the price of BTC and some altcoins due to the BTC ETF, there hasn't been much new capital inflow into the crypto market. It's mainly a rotation between new concept sectors. After being repeatedly hit by overvalued, low-circulating "value coins," retail investors have finally lost interest and chosen not to FOMO buy. The game of stock funds between VCs, project parties, exchanges, and retail investors has caused a significant drop in the prices of most projects after the airdrop, as there weren't many people to unload the tokens. Additionally, after "value coins" lost their wealth creation effect, it's also difficult to attract new users.

Furthermore, airdrops are no longer a good business for both project parties and users. The industrialization of airdrops has created an irreparable cognitive gap between project parties and users.

The best airdrop in history is Uniswap, and no one can refute that. However, no one can replicate the airdrop feast that only the pioneers can have. The so-called "good" is made up of three factors that are now impossible to achieve: users did not have high airdrop expectations for the project party, the interaction threshold was extremely low, and the airdrop value was high.

The "wealth creation effect" brought about by airdrops has led to the industrialization of airdrops, gradually widening the cognitive gap between project parties and users.

For project parties, airdrops are seen as a sign of product-market fit, with many project parties believing that their products can meet existing market demands (but how many Web3 projects actually have real use cases and core value?). Airdrops are a reward for actual users of the product. This mindset directly leads to the arrogance of project parties, as Bryan, the founder of LayerZero, responded to "mandatory donations" by saying, "If you don't want to donate, then don't claim the tokens. This is not something you own, it's something provided by others." For project parties, airdrops have become a form of "charity" to users.

For users, the result of the industrialization of airdrops is the default expectation that every project will conduct airdrops, and as "workers" or "farmers," they participate, investing technical expertise, time, and costs to help build the ecosystem and increase the project's data and valuation, and therefore deserve corresponding rewards.

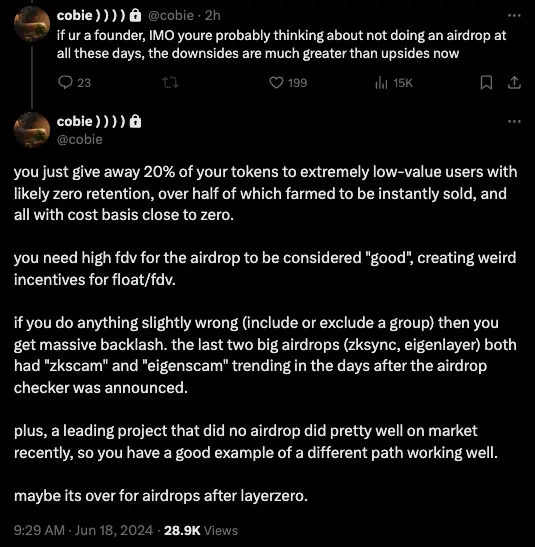

From the results, for project parties, setting a low airdrop threshold means attracting "low-value" users, with the risk of token dumping after release. Users with short-term and low value airdrops will quickly withdraw funds and move liquidity to the next "farm." For users (especially retail investors), even with small capital, they have actually incurred costs during the interaction process, and often face the risk of being "anti-lurked" due to the opaque airdrop rules of project parties.

Hayden Adams, the founder of Uniswap, advocates for shaping a culture that rewards early adopters, with fairer and more widespread value distribution, and simpler self-adoption, making the public willing to try new things, and achieving early liquidity and early price discovery. The "perfect airdrop" may only be achieved once, after all, Web3 is not a utopia.

Airdrops Need to be Redefined

Meow, co-founder of Jupiter, recently proposed a viewpoint in the discussion surrounding LayerZero's airdrop, stating that "Airdrops are gifts. Not rewards, not a loyalty program, not a growth strategy. It's that simple. If you ask what you can get from it, it's no longer a gift, losing its meaning and betraying the original sincerity." He further explained that this is to help protocol developers think about how to conduct airdrops.

He mentioned that we need a clear definition for the next airdrop. Airdrop is airdrop, incentive is incentive, reward is reward, growth is growth. The confusion of all these terms has led to the problems that exist in airdrops today.

In fact, I agree more with his later point. Clearly defining it is actually more conducive to solving the aforementioned problems and bridging the cognitive gap between project parties and users. Perhaps, project parties should separate the budget for user growth and the budget for airdrops as gifts.

Crypto KOL Cobie discussed the "death of airdrops," stating that the current state of airdrops is difficult to meet the needs of users, and its reputation is easily damaged by minor mistakes. Project parties may consider trying better ways to list, such as not conducting airdrops.

Binance co-founder He Yi also recently stated that the infighting between rug pull studios and L2 projects has turned into a farce, and the era of rug pulling may be coming to an end. As an ordinary investor, the ICOs of 2017, IEOs of 2021, rug pulling, and even the strategies of 2023 may not be suitable for today's market.

In the "industrialized" era of airdrops, perhaps we really need to redefine airdrops and redesign the rules based on this.

Although there is no absolutely perfect airdrop or incentive method, the most important thing for project parties to note is that what users need most is fairness, fairness, and fairness!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。