Original | Odaily Planet Daily

Author | Golem

A few months ago, the Bitcoin ecosystem was booming due to the trading of inscriptions and runes, with on-chain congestion leading to fees as high as hundreds of satoshis per byte. A large number of new projects and users from all walks of life actively entered this track. However, the cycle belonging to the Bitcoin ecosystem seems to be particularly short. Recently, the Bitcoin on-chain has fallen silent, and fees have returned to an average level of 10 satoshis per byte. Compared to the current hot TON ecosystem and Solana ecosystem, the Bitcoin ecosystem is cooling down (and once again approaching the undervalued zone).

So, can inscriptions and runes return to their former glory? What is the antidote to break the silence of the Bitcoin cycle? In this article, Odaily Planet Daily will briefly analyze the current situation of inscriptions and runes from a data perspective, and further explore what the ecological antidote might be.

Since the beginning of this year, inscriptions have gradually dropped to freezing point

Inscriptions were once the protagonist of the Bitcoin ecosystem and the most recognized asset issuance protocol with the most complete infrastructure construction on the mainnet. In the past year, although there have been countless new asset issuance protocols born in the Bitcoin ecosystem, such as Atomicals, Tap, Taproot Assets, etc., none of them have shaken the dominant position of inscriptions in the Bitcoin ecosystem.

However, since the second wave of the inscription market gradually ended in February of this year, followed by the further snatching of market heat by the Runes protocol, which had been preheated for half a year, inscriptions have already dropped to freezing point.

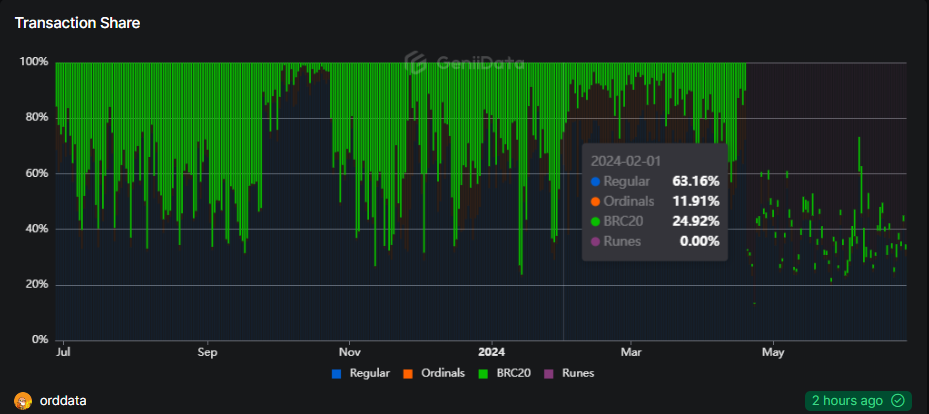

As shown in the Geniidata chart below, the second wave of the inscription market started in November 2023, with BRC20 and Ordinals accounting for an average of over 50% of the daily on-chain transaction share on the Bitcoin network. However, in February of this year, the market turned sharply downward, and the on-chain transactions of inscriptions languished, with regular Bitcoin transactions regaining over 60% of the transaction share on the chain. This also marked the end of the frenzy of the inscription market that lasted for more than 3 months.

The second wave of the inscription market ended in February

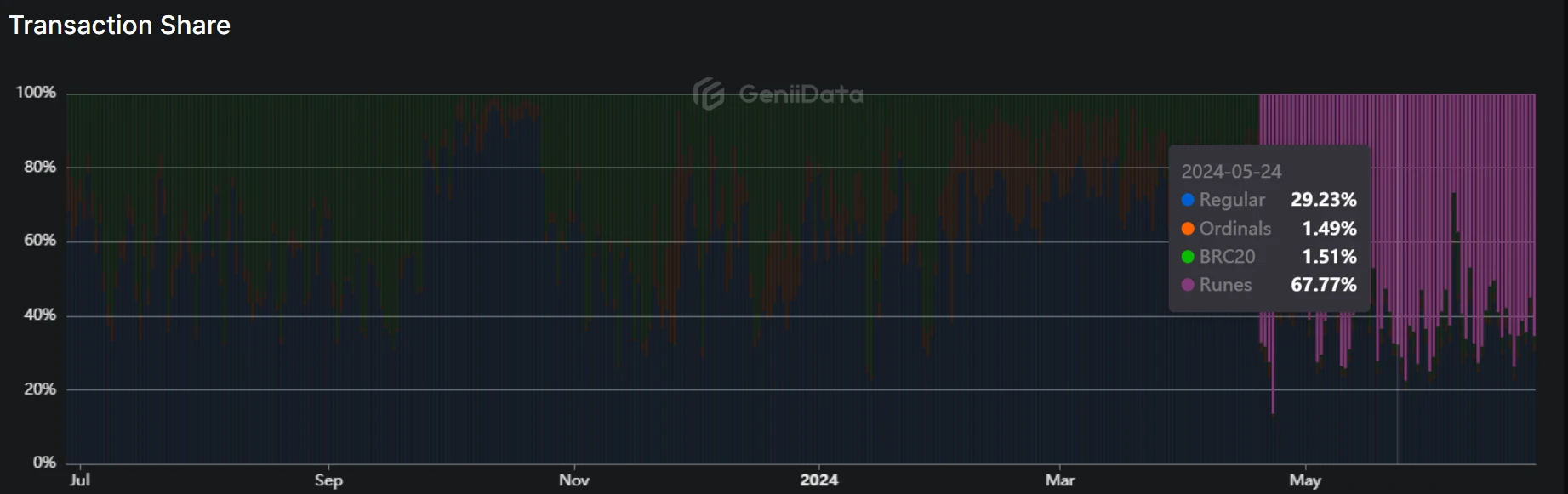

At the same time, with the Bitcoin halving on April 20, the Runes protocol was officially launched, and the Bitcoin ecosystem once again became lively. Many project parties, in order to compete for a leading rune number, raised on-chain gas to a level of over 2300 satoshis per byte, and the fierce competition also led to the highest daily transaction fee income for miners, reaching 1070 BTC/day.

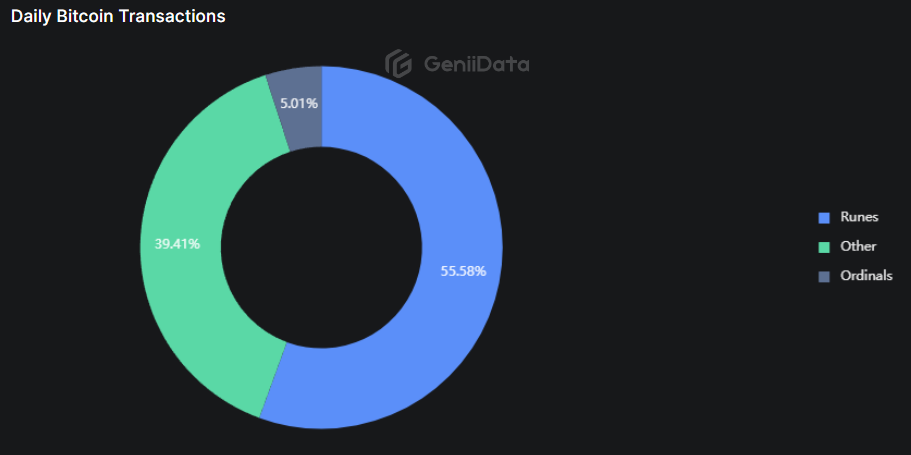

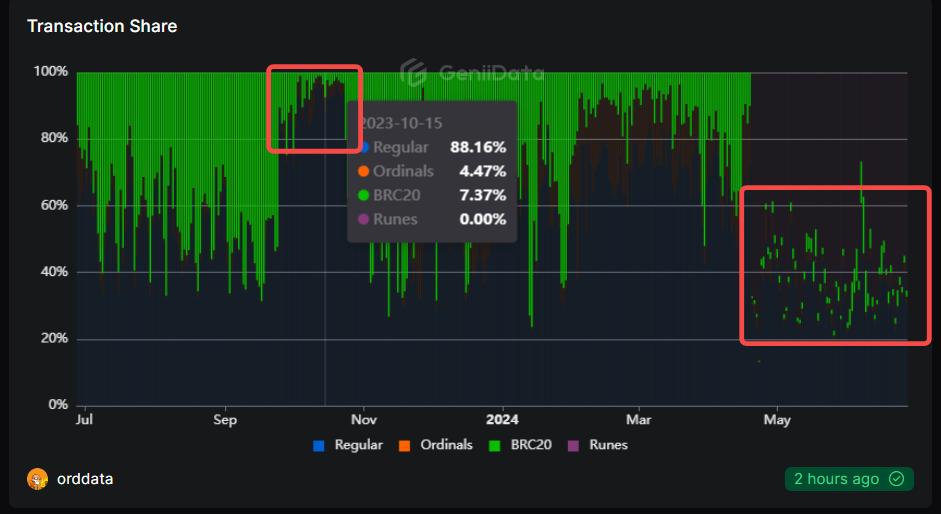

"Born of the same root, why are you in such a hurry to fight?" Although the founders of the inscription protocol and the rune protocol are both Casey, the heat of the rune protocol did not spread to Ordinals. As shown in the Geniidata chart below, since the launch of the Runes protocol, the daily on-chain transaction share of runes on the Bitcoin network has exceeded 50%, while the transaction share of Ordinals has further decreased, averaging only about 5% daily.

From a data perspective, the freezing point reached by inscriptions today is similar to that of October 2023, except that at that time, inscriptions were only silent for a little over a month, while this cycle, due to the addition of runes, has become increasingly difficult for inscriptions to regain their dominance.

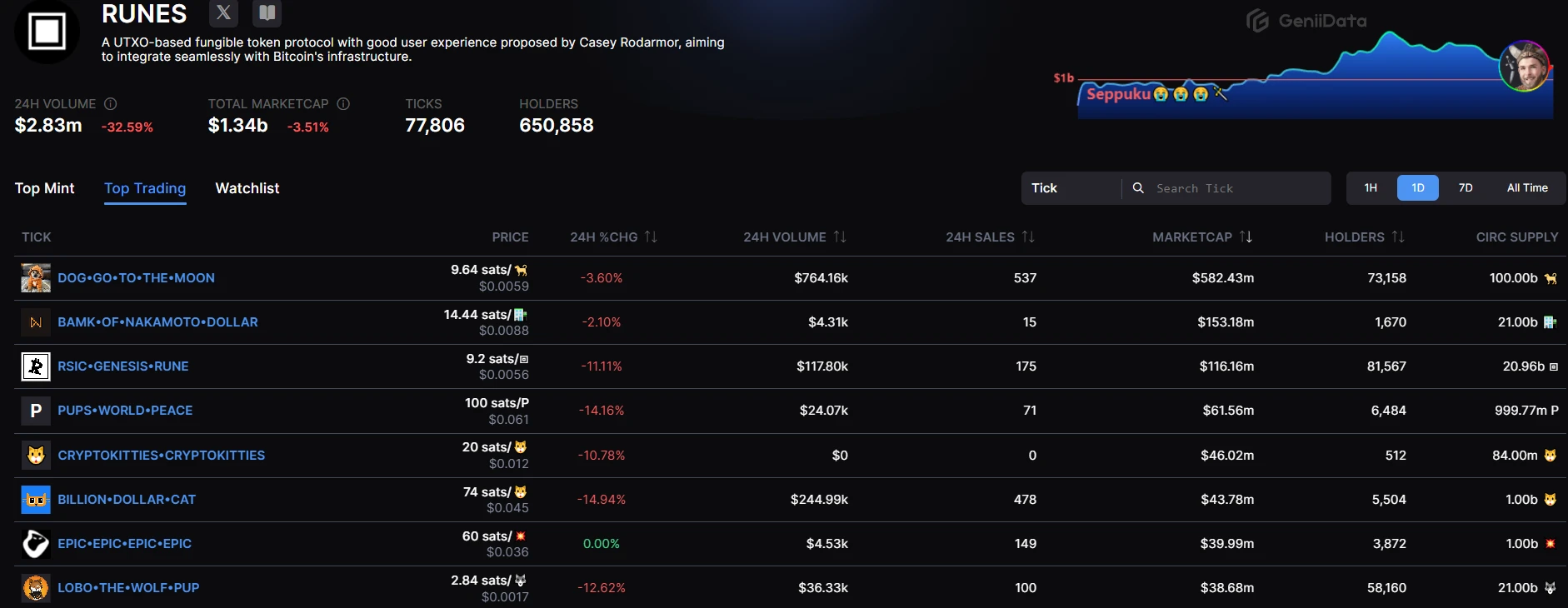

Runes are active on-chain, but the market is not good

Although runes have remained active on-chain since their launch, with a daily transaction share of over 50%, the actual market for runes is not good at the moment.

In the article "Rune market value hits a new high, but why are my friends and I losing money?," we concluded that even though the high market value of runes has led to a short-term boom in the primary market, there are still few people taking over these new assets in the secondary market, and 80% of the new targets will return to zero after being minted, with most of the funds concentrated in the top few rune projects.

However, after the new high in the market value of runes in early June, a subsequent oscillating decline began. Not only has the trading volume shrunk, but the top assets are also experiencing daily declines.

The fundamental reason for the contrast between the on-chain activity and the price market lies in the fact that the entire ecosystem is in a bear market, with no new funds entering, and only old players engaging in on-chain PVP. At the same time, on social media, players who are still persisting in the rune track have also summarized a set of methodologies:

Before engaging, check the total amount and overseas community atmosphere. If the total amount is too large and the current funds cannot be absorbed, there may be huge selling pressure without overseas community participation;

During the engagement, if lucky, one may encounter a blockage while on-chain fees rise, and the rising cost will make early minters profitable;

After the engagement, see if there are celebrities or project parties standing, and whether there is hope of attracting attention.

Essentially, this strategy is also a helpless move in the face of a deep bear market, with no new funds entering but still persisting.

New narratives and new gameplay are the antidote

So, in the situation where inscriptions have dropped to freezing point and the market for runes is not good, what is the antidote to break the silence of the Bitcoin ecosystem cycle? Based on past experience, the answer is new narratives and new gameplay.

Looking back at the bull market of the Bitcoin ecosystem, the first large-scale Bitcoin bull market from May to July 2023 was caused by BRC20, which was the first large-scale dissemination of the narrative of asset issuance in the Bitcoin ecosystem, attracting a large number of users, projects, and investors.

The second large-scale Bitcoin bull market from November 2023 to February of this year was caused by the narrative of BRC20 and the universally inscribable inscriptions, with the launch of top BRC20 assets such as ORDIs on Binance, breaking the inscriptions gameplay away from being confined to the chain, and the issuance of inscriptions on various chains transferring the wealth effect of inscriptions to various chains, thereby gaining a large amount of traffic and attention for public chains.

The brief third large-scale Bitcoin bull market in April 2024 was caused by the launch of the Runes protocol and the airdrop gameplay. The biggest innovation of the Runes protocol lies in creating a pre-mining and large-scale community airdrop gameplay. However, due to the preheating for nearly half a year, the Runes protocol went online for a month and quickly absorbed all the positive news and market sentiment, leading to the rapid end of this bull market.

In summary, it can be seen that each outbreak in the history of the Bitcoin ecosystem has been driven by new narratives, new gameplay, or new innovations. In each cycle, there will always be assets with odds that are extremely high, even exceeding the returns of previous top assets.

We currently need such innovations to break the silence of the Bitcoin ecosystem, attract new users and funds. Many projects are also trying various innovations, such as the first large-scale airdrop of 5-character BRC20 pizza by unisat and the recently discussed programmable runes.

According to past experience, the cycle rotation of the Bitcoin ecosystem is very fast, and there will always be new things appearing after a silence of 3-6 months. Counting the days, it's almost time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。