Author: Peng Sun, Foresight News

Without DePIN, ZKP would probably be beyond the reach of ordinary people for a lifetime. In recent years, ZKP has been criticized for its slow proof generation speed and high verification costs. However, the emergence of DePIN has changed everyone's way of thinking, making ZKP a low-threshold ecosystem that everyone can participate in. Many cryptographic companies have improved the efficiency of ZKP proof generation through hardware acceleration, but few have focused on the other important component of the ZK proof system, Verifier. Currently, there are only Cysic, Aligned Layer, and Lumoz on the market as ZK verification layer projects.

Cysic has not made significant progress in the verification layer, and compared to Aligned Layer, Lumoz is actually a modular computing layer and ZK-RaaS platform, solving the computational cost and centralization issues in the ZKP proof generation and verification process, and providing the ability for project parties to easily launch chains. In addition to the Prover Network, Lumoz further opens the verification layer to ordinary users, with its zkVerifier aiming to achieve decentralized verification and reduce L2 Gas costs.

Recently, Lumoz completed a strategic round of financing with a valuation of 3 billion US dollars and started selling zkVerifier Nodes. The node pre-sale and whitelist registration activities have ended, and the whitelist sale round (June 25) and public sale round (July 3) are about to begin, with the mainnet expected to go live in the third quarter. Today, Foresight News will interpret the sale of Lumoz zkVerifier nodes and the operating mechanism behind them.

Modular Computing Layer: What is Lumoz?

We have heard of modular DA layers and settlement layers, but what is a modular computing layer? Modularization has long divided monolithic blockchains such as Ethereum into settlement layers, consensus layers, execution layers, and DA layers based on different functions. With the widespread adoption of ZKP, the decentralized computing layer (proof layer + verification layer) has gradually become a major focus.

Lumoz (formerly Opside) is a modular computing layer and ZK-RaaS platform, with NanFeng as its co-founder and CEO, a graduate of Tsinghua University, and the core team has invested nearly 5 years in the research and development of ZK technology. As a ZK-RaaS platform, Lumoz provides a modular computing layer for ZK Rollup, using a hybrid PoS and PoW consensus mechanism, and introducing a zkVerifier node network. Since its launch, the ZK-PoW mechanism has attracted participation from 145 miners worldwide, with over 20,000 testnet verification nodes. Overall, Lumoz's modular computing layer solution eliminates the need for project parties to consider the construction and operation of the ZKP system, reducing the difficulty of issuing ZK-Rollup for project parties.

Currently, the Lumoz community has a scale of millions, with a total ecosystem TVL of over 4 billion US dollars. Lumoz RaaS services now support more than 20 L2 chains, including Merlin Chain, HashKey Chain, ZKFair, Ultiverse, and Matr1x.

In terms of financing, Lumoz recently completed a strategic round of financing with a valuation of 3 billion US dollars, with participation from IDG Blockchain, OKX Ventures, HashKey Capital, Polygon, NGC Ventures, Kronos, KuCoin Ventures, Gate Ventures, G Ventures, MH Ventures, Summer Ventures, Aegis Ventures, and others. In April 2024, Lumoz completed a Pre-A round of financing with a valuation of 12 million US dollars for 6 million US dollars. In April 2023, Lumoz (formerly Opside) completed a seed round of financing of 4 million US dollars.

zkVerifier: How does Lumoz reduce Gas fees for users?

So, what exactly is the zkVerifier being sold by Lumoz? What is its purpose? What problems does it solve? Let's start with the ZK proof system.

ZK Proof System: Prover and Verifier

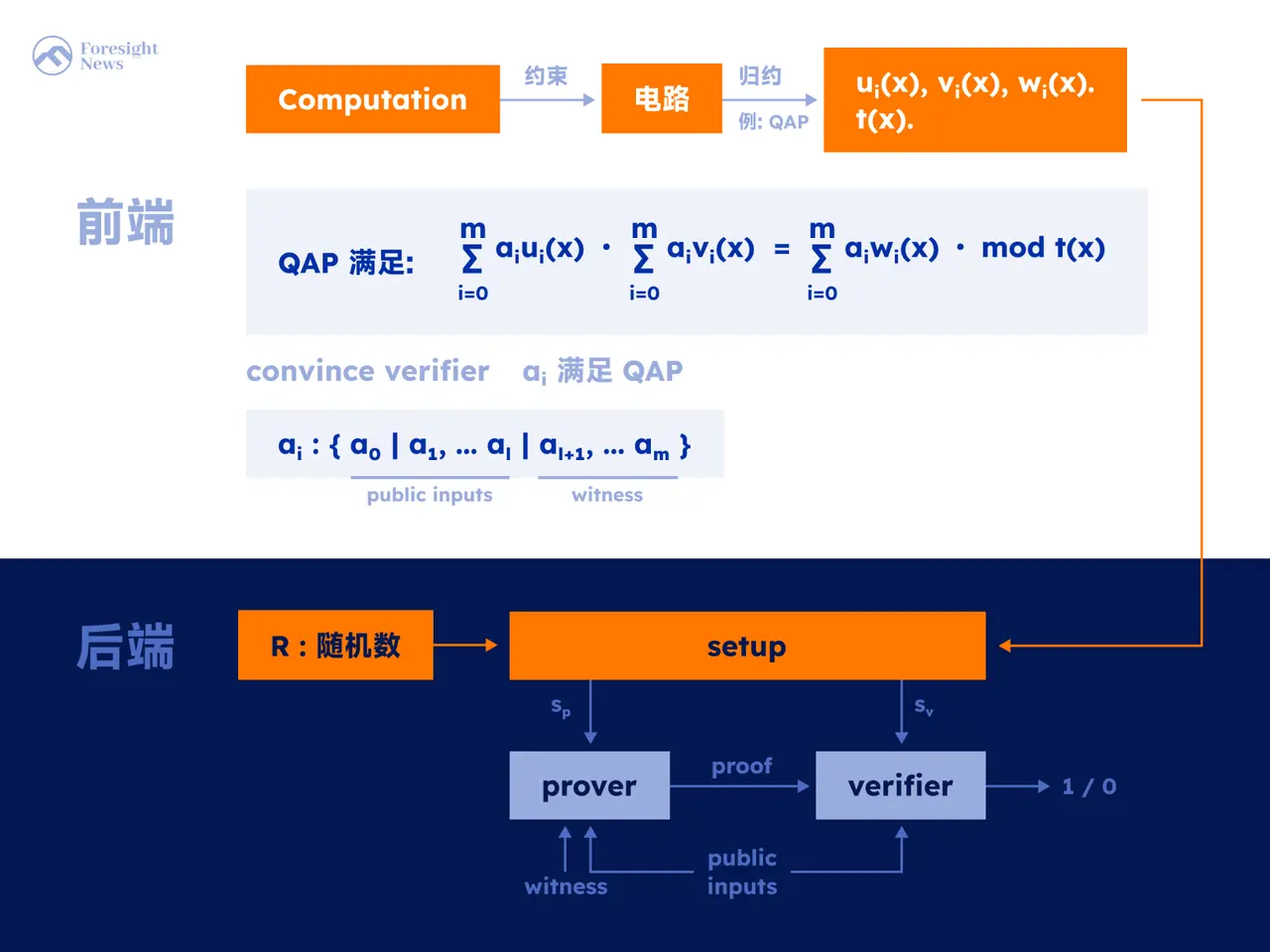

In fact, the so-called zkVerifier is the Verifier in the ZK proof system. In the ZK proof system, proof generation and verification are carried out by the Prover and Verifier. After completing the "arithmeticization" on the front end, the two are responsible for generating and verifying ZKP proofs to prove the authenticity and reliability of the data to the other party without revealing the actual data. Projects like Cysic and Ingoyama are using hardware to provide computational power to the Prover to speed up proof generation. The generated ZK proof then needs to be verified by the Verifier to verify the authenticity of the data.

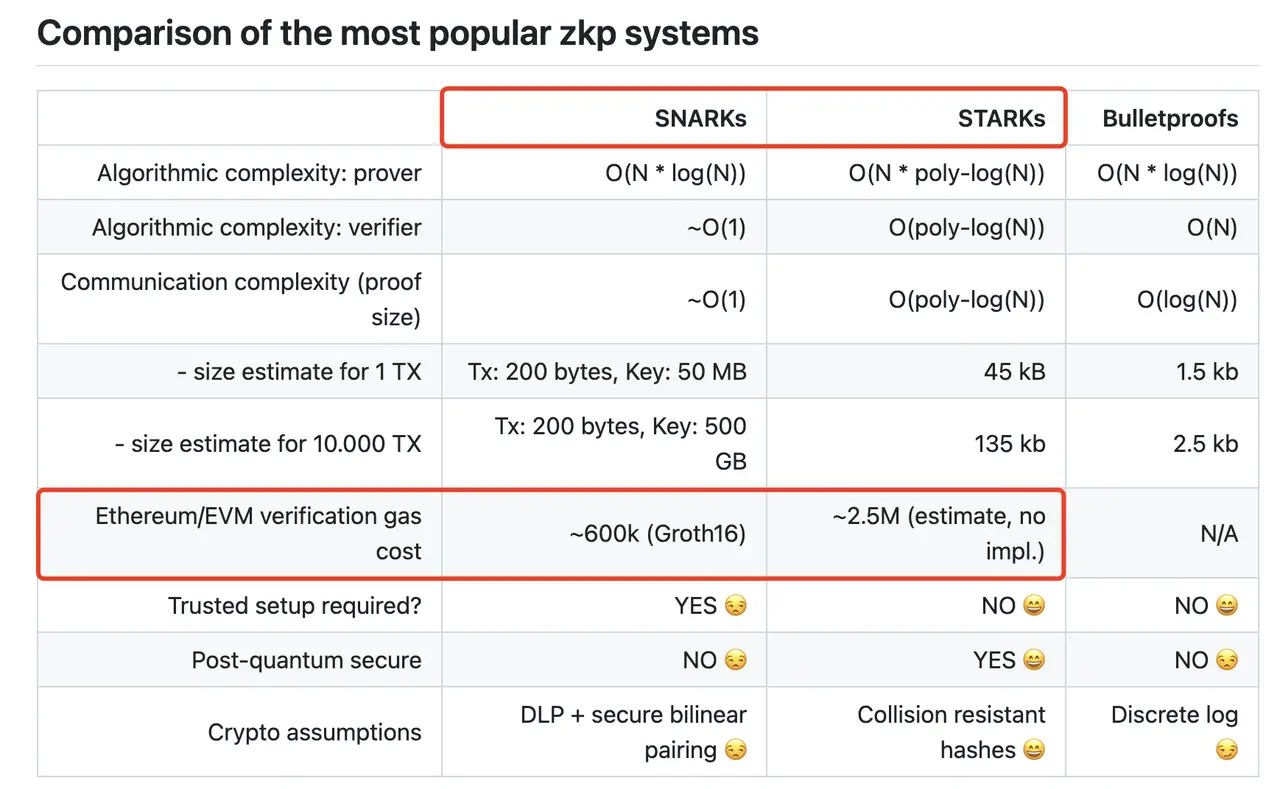

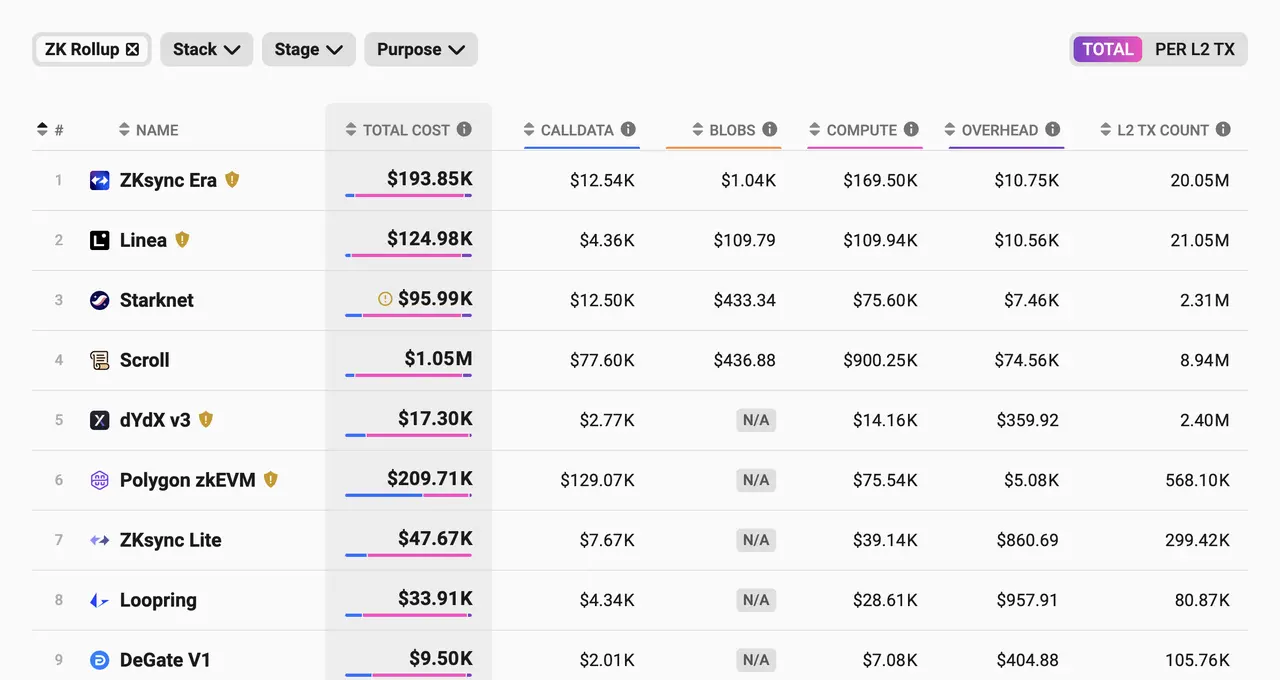

Bing Ventures has analyzed the cost structure of ZKP, pointing out that the cost advantage of ZKP is an over-exaggerated fantasy. In reality, ZKP includes hardware costs, computational costs, verification costs, and storage costs, among others. Communication costs and computational costs are the core components. Communication costs refer to the cost of exchanging information between the prover and verifier, while computational costs refer to the cost of the prover and verifier performing calculations. In Ethereum, verification calculations need to compete for block space with other DApps, and network congestion can lead to higher costs. Matter Labs has pointed out that zk-Rollups on Ethereum require about 600,000 Gas to verify a zk-SNARK, while zk-STARK requires about 2.5 million Gas.

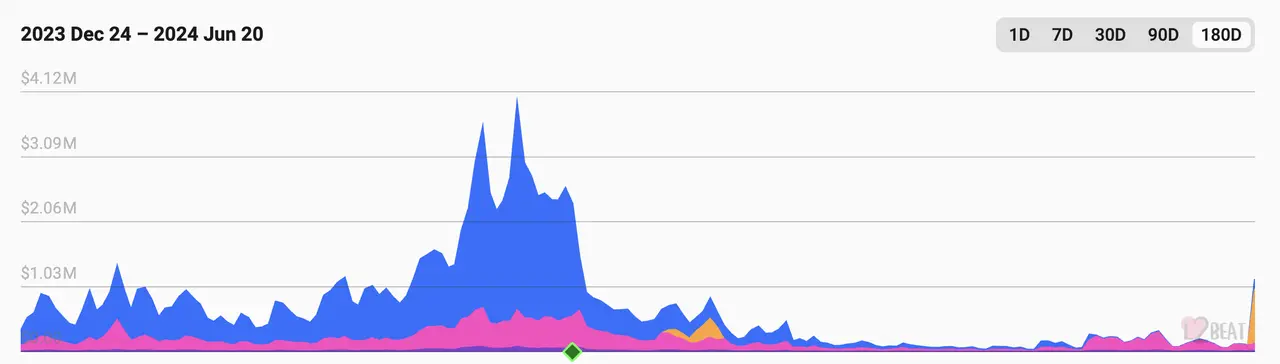

More importantly, the verification cost of ZKP is directly borne by the user. According to L2BEAT data, before the London upgrade, Ethereum L2 costs were mainly for storage (blue), but after using Blobs, they were mainly for computation (red).

After the London upgrade, ZK Rollup computation costs accounted for an average of about 80% of the total cost.

Therefore, in addition to improving ZK proof generation efficiency, it is also necessary to improve verification efficiency and reduce Gas costs. Currently, most ZK-Rollup projects have not made optimization improvements at the verification layer.

Lumoz Architecture and Operating Mechanism

Lumoz is a pioneer in the decentralized verification layer of ZKP. It is actually a shared secure AVS computing layer based on EigenLayer. Its basic architecture includes EigenLayer AVS, EVM chain, Lumoz AVS oracle, Lumoz Chain, zkProver, and zkVerifier. The responsibilities of each component are as follows:

- Lumoz uses the EigenLayer standard to build AVS, ensuring the economic security of the Ethereum mainnet through Ethereum re-staking.

- EVM chain: Lumoz supports Polygon zkEVM, Polygon CDK, ZKStack, Scroll, and other EVM chains.

- Lumoz AVS oracle: Responsible for retrieving and storing data from EVM-compatible chains to ensure data availability and integrity.

- Lumoz Chain: The core management layer of the computing layer, responsible for task scheduling, reward distribution, managing zkProver and zkVerifier, including but not limited to the process of adding and removing nodes.

- zkProver: Nodes that execute specific computing tasks.

- zkVerifier: Nodes that verify the execution results.

In terms of its specific operating mechanism, Lumoz adopts the ZK-PoW mechanism and a "commit first, verify later" two-step submission algorithm. The zkProver network, composed of miners, provides computational power for ZK-Rollups to execute multiple ZKP generation tasks in parallel. The ZK-PoW V2.0 version further optimizes the computational process of proof generation, significantly improving efficiency and solving the centralization problem of Prover. Lumoz extends from the proof generation layer to the verification layer, introducing zkVerifier to verify the ZKP generated by zkProver.

In other words, Lumoz builds a decentralized verification network for Verifiers. zkVerifier nodes aggregate, compute, and verify data, covering various fields such as blockchain transaction data and AI model training data to ensure data accuracy and computational correctness. By uploading verification results and computation results to the blockchain, zkVerifier nodes not only ensure the transparency and traceability of the entire computation process but also reduce verification costs.

Due to the relatively low hardware requirements of zkVerifier nodes, ordinary users can join the Lumoz network and participate in the operation of verification nodes using a lightweight client. Currently, Lumoz has completed early verification, with over 20,000 testnet verification nodes, and is working towards achieving large-scale low-cost verification. In other words, with the lower barrier to entry, the more users participate in Lumoz's ZK computing network, the more decentralized the ZKP Verifier verification becomes, and the lower the verification costs for users.

At the same time, zkVerifier nodes have long-term sustainability. In addition to ZKP computing tasks, users can also provide computational verification services for massive AI data.

The sale and returns of zkVerifier nodes

Currently, most projects selling nodes on the market are doing so just to sell nodes, but these nodes have a long payback period and are not of high actual value. However, Lumoz's zkVerifier is an important component of the ZK Endgame and is indispensable for the blockchain industry and users. In Lumoz's token economics, the total supply of MOZ is 10 billion, with 25% of the tokens allocated to zkVerifier nodes, and the expected returns and ROI are also considerable.

Node Sale

Let's first look at the node sale situation. Lumoz started selling zkVerifier node NFTs on June 17, with a limit of 100,000 nodes divided into 10 tiers, available on a first-come, first-served basis. The node sale is divided into three rounds: pre-sale round (June 17, 15:00), whitelist round (June 25, 15:00), and public sale round (July 3, 15:00), with a starting sale price of 200 USDT.

The pre-sale round was only open to users with pre-sale invitation codes, with the highest returns, and has ended. Tiers 1-4 are sold out, with 40,151 nodes successfully sold, and the real-time FDV exceeds 40 million US dollars. Users who want to continue participating in Lumoz nodes can start purchasing Tier 5 and above nodes in the whitelist round on June 25, 15:00. Users with whitelists can enjoy a 10% price discount. If they did not participate in the pre-sale round (June 17) and missed the whitelist qualification, they can participate in the public sale round (July 3).

The node NFT license supports free buying, selling, and transferring. When a zkVerifier node transfers its held license to another party, the node will no longer be eligible to receive any form of rewards from the Lumoz network.

Lumoz has also set up a refund mechanism. The refund window will open 6 months after the TGE starts, with the duration to be determined. If users are dissatisfied with the nodes for any reason, they can apply for a refund without giving a reason, and Lumoz will refund 80% of the initial payment amount. At that time, users will need to return all the tokens produced and the node NFT.

In addition, to encourage more users to participate in the node network, Lumoz has launched an invitation incentive program. If the invitee purchases a node NFT, the inviter will receive 7% of the amount paid. If the invitee further invites others to purchase nodes, the inviter will receive 3% of the amount paid.

Pre-TGE: Airdrop of Points

Before the mainnet goes live, Lumoz will provide a reward of 40 million points to zkVerifier node NFT holders. Over a period of 40 days from June 25 to August 4, 100,000 points will be distributed daily. These points will be evenly distributed to users who hold and stake zkVerifier node licenses, and after the TGE, users can exchange these points for Lumoz mainnet tokens.

For node license staking, Lumoz has also introduced a "team system." Node holders can choose a team or create their own team, with a maximum of 50 members per team. The team levels are divided into iron, bronze, silver, gold, platinum, and diamond. The more node licenses a team stakes, the higher the level and the greater the weight of the points.

Post-TGE: Mining Returns and Payback Period

The MOZ rewards for nodes will be released over a period of 36 months, with tokens being released once per Epoch (approximately 1-2 minutes) during the release period, based on the number of online nodes and their staking status in that Epoch. As seen in the chart below, the more nodes online simultaneously, the lower the monthly release rewards. For example, if there are 10,000 nodes online simultaneously, the earnings per node for the first month would be 6944 MOZ. Considering that 40,000 nodes have already been sold in the pre-sale round, and with the future launch of the mainnet, there will be even more nodes online, resulting in decreasing monthly MOZ rewards for each node.

As for the expected return rate and payback period, if we conservatively calculate based on the current latest valuation of 300 million USD, assuming 10,000 nodes are online simultaneously in the first month, running a node for one month would yield 208 USD. If a Tier 1 node is purchased, it would break even in one month, and the return in six months would be 4374 USD, with a net return rate of over 20 times. If a user purchases a Tier 5 node in the whitelist round, the cost would be 350 USD, breaking even in one and a half months, with a return of over 12 times in six months. If 50,000 nodes are online simultaneously, the payback period for a Tier 1 node would be 2 and a half months, with a return of 4.3 times in six months; for a Tier 5 node, the payback period would be 4 months, with a return of nearly 2.5 times in six months.

Recently, the Aethir node sale was very successful, with a market value of about 3 billion USD. Let's use Aethir as an example for comparison. The price of an Aethir Tier 1 node is 500 USD, and the current daily node earnings are 31.44 ATH, calculated at the current price of 0.07 USD, the monthly earnings would be 66 USD, taking 7.5 months to break even. Overall, based on a valuation of 300 million USD, the payback period for Lumoz nodes is significantly shorter, and the returns are higher.

Additionally, as Lumoz is also a RaaS platform, future nodes can receive multiple rewards such as potential token airdrops from new chains in the Lumoz ecosystem, including Merlin Network, ZKFair Network, Orange Network, and others.

Node Operation Requirements

As mentioned earlier, zkVerifier nodes have relatively low hardware requirements, requiring devices with 4 cores or more CPU, 8GB RAM, and 16 Mbit/s bandwidth to run the nodes. Users can bind the license to run the node for mining, or delegate the NFT to other nodes for mining.

References:

- 1. Kyle Liu: "Is Low Cost of ZKP a False Proposition?," Bing Ventures, Dec 25, 2023;

- 2. ZeY: "Lumoz Research Report: Modular Chain Launch, Greatly Reducing ZKP Computing Costs," SevenUp DAO, June 18, 2024;

- 3. Peng Sun: "When ZKP Meets DePIN, How Does Cysic Bring PoW Back to Ethereum?" Foresight News, April 26, 2024.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。