Original Authors: Victor Ramirez, Matías Andrade, Tanay Ved

Original Translators: Lynn, MarsBit

Key Points

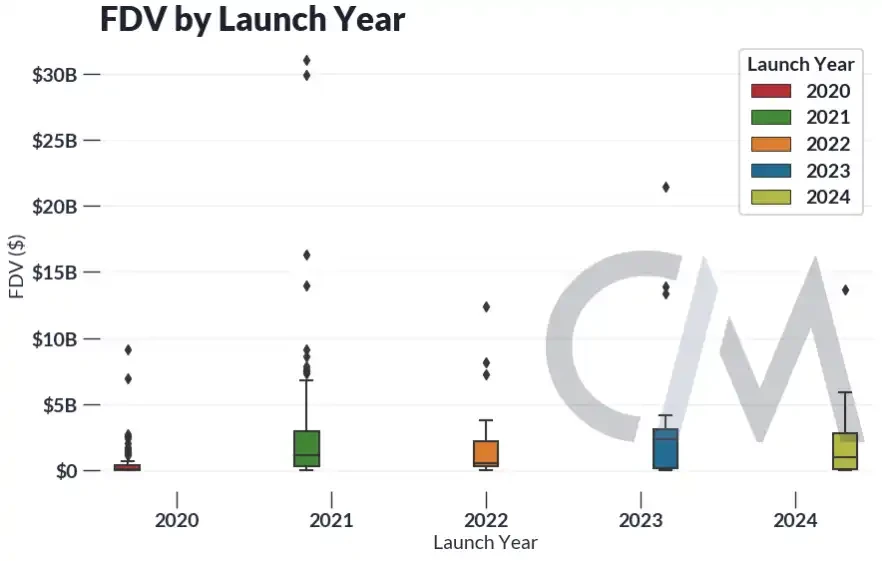

In recent years, the launch of FDV has been different: the median in 2020 was 140 million USD (DeFi protocols), soaring to 1.4 billion USD in 2021 (NFTs, games), dropping in 2022 (L2 to 800 million USD). It rebounded in 2023 and 2024 (to 2.4 billion USD and 1 billion USD), featuring alt L1 and Solana projects.

FDV overlooks short-term market impacts; therefore, circulation (public supply) is crucial. Tokens with high FDV and low circulation, such as World Coin (8 billion USD vs. 340 billion USD FDV), may distort true valuations.

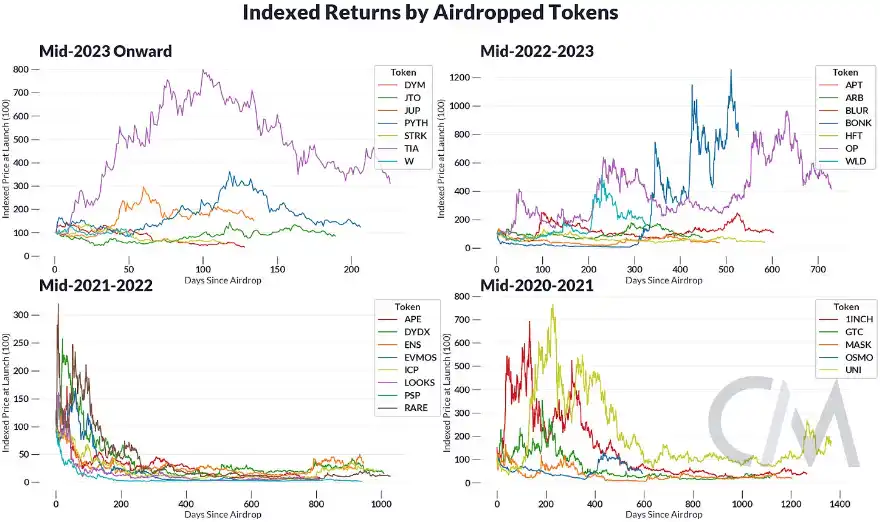

Airdropped tokens to promote protocol adoption are often quickly liquidated by recipients. While initially profitable, most airdropped tokens tend to depreciate in the long term, with exceptions like BONK (approximately 8x return).

Introduction

One of the most debated topics in the cryptocurrency field is token economics, which refers to how token supply is distributed within a system. Token economics represents a balancing act that can appease different stakeholders while ensuring the current and future value of a project.

Cryptocurrency projects adopt various token economic schemes to incentivize certain behaviors within their respective ecosystems. A portion of token supply is unlocked to the public so that users can have "shares" of the project, and tokens can undergo price discovery. To incentivize project development, a portion of token supply can be locked for early investors and team members, usually at discounted prices and before public market trading. Some projects even utilize airdrops to reward users with tokens based on key behaviors (such as providing liquidity for decentralized exchanges, voting on governance proposals, or bridging to layer 2).

In this week's network status, we delve into the different factors of project token economics and their impact on token valuation and on-chain activities.

Understanding Fully Diluted Valuation (FDV)

To understand the subtle differences in token valuation, we will explain some commonly used valuation metrics. The circulating market cap of an asset uses only the token's circulating supply, excluding the supply allocated to early investors, contributors, and locked for future issuance. The circulating market cap measures how the market perceives the current valuation of the token. The free float supply is the tokens that can be traded on the public market. Fully Diluted Valuation (FDV) is the asset's market cap after all tokens have been circulated, hence "fully diluted." FDV serves as a proxy for how the market perceives the token's future valuation.

The release of FDV can imply how the market measures the future value of a project after its release. Below is a chart of FDV covering multiple crypto tokens, divided by the year of project release.

Source: Coin Metrics Market Data Summary, Network Data Pro

Compared to later projects, the median FDV of tokens released in 2020 was relatively low (140 million USD), but included blue-chip protocols born during the DeFi summer, such as Uniswap, Aave, and notable L1s like Solana and Avalanche. In 2021, the median FDV of releases soared to 1.4 billion USD, mainly including NFT and game projects, such as Gods Unchained, Yield Guild Games, and Flow. In 2022, the release FDV declined, led by Apecoin's release and early L2 tokens like Optimism. In 2023 and 2024, the release FDV rebounded to 2.4 billion USD and 1 billion USD, including a new wave of alt L1s like Aptos and Sui, and the rise of Solana projects like Jupiter and Jito.

Not All FDVs Are Created Equal

While FDV can be used to measure long-term value, it does not consider the short-term market dynamics that liquidity and supply shocks may bring. Therefore, it is important to consider the circulation or supply available to the public in relation to FDV.

Tokens with high circulation (e.g., Bitcoin) relative to total supply have strong liquidity, with market participants expecting no supply shock due to token issuance—because over 90% of Bitcoin has already been mined. Tokens with low circulation relative to total supply mean that most of their FDV lacks liquidity. Therefore, tokens with high FDV and low circulation may represent inflated and false total valuations. An extreme example of high FDV and low circulation tokens is World Coin, with a market cap of approximately 8 billion USD, but an FDV of around 340 billion USD—a difference of 50 times.

Overall, we see that the industry standard is to unlock around 5-15% of token supply to the community, with the remaining portion locked for teams, investors, foundations, grants, or other unlocking activities. Projects launched before 2022 often have a more diversified distribution.

Source: Coin Metrics Labs

Tokens with high FDV and low circulation have long been scorned by the crypto community. A historical example is FTX's token FTT, where FTX counted its illiquidity shares as assets to offset its liabilities, thereby inflating its balance sheet. Token projects launched with high FDV and low circulation have been criticized as tools to enrich early investors and other insiders at the expense of retail investors. This may lead to market sentiment turning nihilistic, resulting in a large influx of retail liquidity into memecoins, which often initially offer a larger share of their supply to the public.

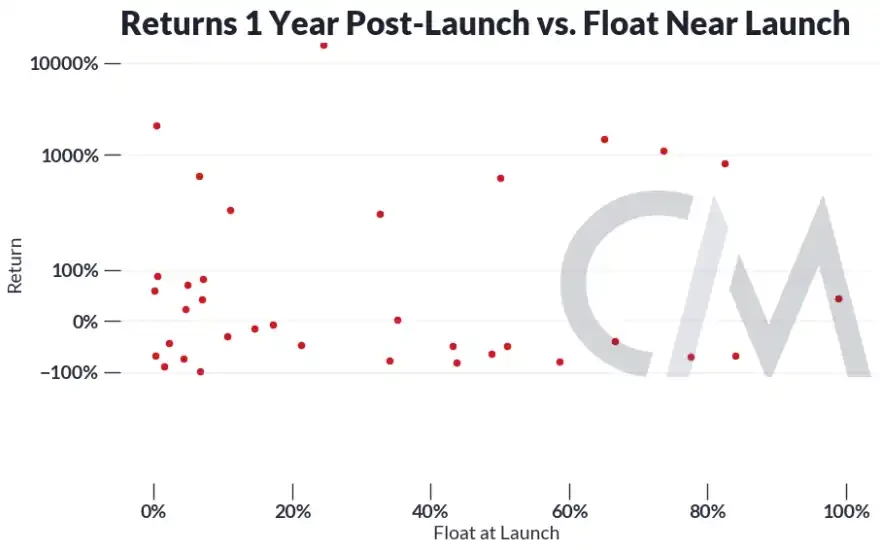

But Is Low Circulation the Sole Reason for Depressed Price Trends?

Source: Coin Metrics Market Data Summary, Network Data Pro

We found that, generally, the circulation at the time of issuance does not significantly impact the token's appreciation in the first year after issuance. This is consistent with our previous research findings, indicating that sudden circulation shocks do not consistently influence price direction.

Airdrops and Protocol Activity

Some protocols utilize airdrops to distribute tokens to the community and mitigate the risk of low circulation. Airdrops reward early users of the protocol by providing tokens based on expected behaviors that promote the protocol's development, similar to a crypto stimulus check for early users. In a previous SOTN, we found that most addresses quickly liquidate the airdropped tokens.

While airdrops can bring unexpected windfalls, most airdropped tokens tend to lose their long-term value.

Source: Coin Metrics Market Data

Based on the first day of trading after the airdrop, only about 1/3 of tokens have maintained their value since the first airdrop. The average return rate for holding airdropped tokens to date is -61%. However, some airdropped tokens have appreciated, such as BONK (approximately 8x return).

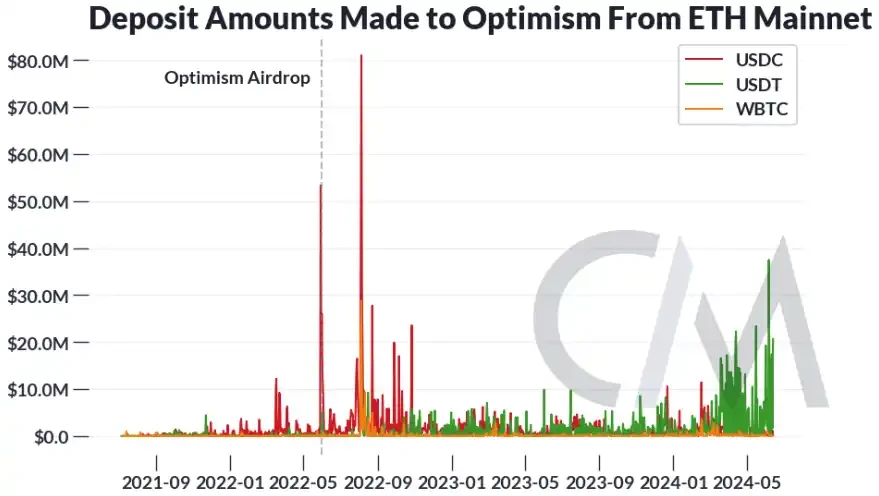

Token rewards are ultimately just a way to incentivize network activity, but do they really lead to actual usage? Measuring real economic activity can be tricky, as each protocol has different purposes and metrics to measure those purposes. As an illustrative example, we can take Optimism (a layer 2 project) and use the amount deposited into the network as a rough proxy for user activity.

Source: Coin Metrics' Network Data Pro, Coin Metrics Labs

After the airdrop, we see a surge in deposit requests to Optimism's Gateway Bridge. In the second year, activity gradually decreases, aligning with the overall decline in crypto activity. In short, airdrops may drive usage of the protocol in the short term, but whether they can create real, sustainable long-term growth remains to be seen.

While the implication of airdrops can incentivize early usage of the protocol, it does not necessarily lead to sustained user activity. The emergence of airdrop farming further complicates the situation, as it is a way for users to gamify protocol rules by generating excess activity on-chain in order to earn tokens. Recently, airdrop farming has become increasingly industrialized with the advent of vampire farms, where a few participants create multiple on-chain identities to generate activity on a large scale. This results in project teams distributing rewards to mercenaries who do not have a long-term vested interest in the network.

Protocol teams have started to identify and block rewards for sybils as a countermeasure against sybil attacks. It is worth noting that LayerZero is offering sybils self-identification in exchange for a small portion of their allocation, but they may not receive any tokens. With the large-scale airdrops of EigenLayer and LayerZero on the horizon, it remains to be seen whether airdrops will achieve the expected results, or if projects will completely cancel them.

Conclusion

In many ways, cryptocurrencies expose the motivations of every market participant. Token economics can be seen as the art of leveraging these motivations to cultivate the success and sustainability of protocols. Allocating token supply, incentivizing behavior, and ensuring long-term value is a delicate balance, handled differently by each project. It will be interesting to see how users and teams continue to adapt as market forces evolve and new paradigms emerge.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。