Author: Weilin, PANews

On June 20, the Australian Securities Exchange (ASX) listed its first Bitcoin spot ETF, issued by the US asset management company VanEck, named VanEck Bitcoin ETF with the code VBTC. VanEck's seed investment is approximately 985,000 Australian dollars (about 657,000 US dollars). From the first day's performance, the ETF's trading volume reached $1.3 million on the first trading day.

ASX holds a 90% share of the Australian stock market, making it the largest securities exchange in the country. The listed VBTC is a feeder fund of the VanEck Bitcoin ETF HODL, which is valued at $647 million in the US market. The fund is registered with the Australian Securities and Investments Commission (ASIC) and is regulated as a "registered managed investment scheme." What positive impact will this development bring to the market?

Early approval breaks expectations, VBTC joins the competition

Bloomberg previously reported that the Australian Securities Exchange may approve the first batch of spot Bitcoin ETFs before the end of 2024, but the approval came earlier than expected.

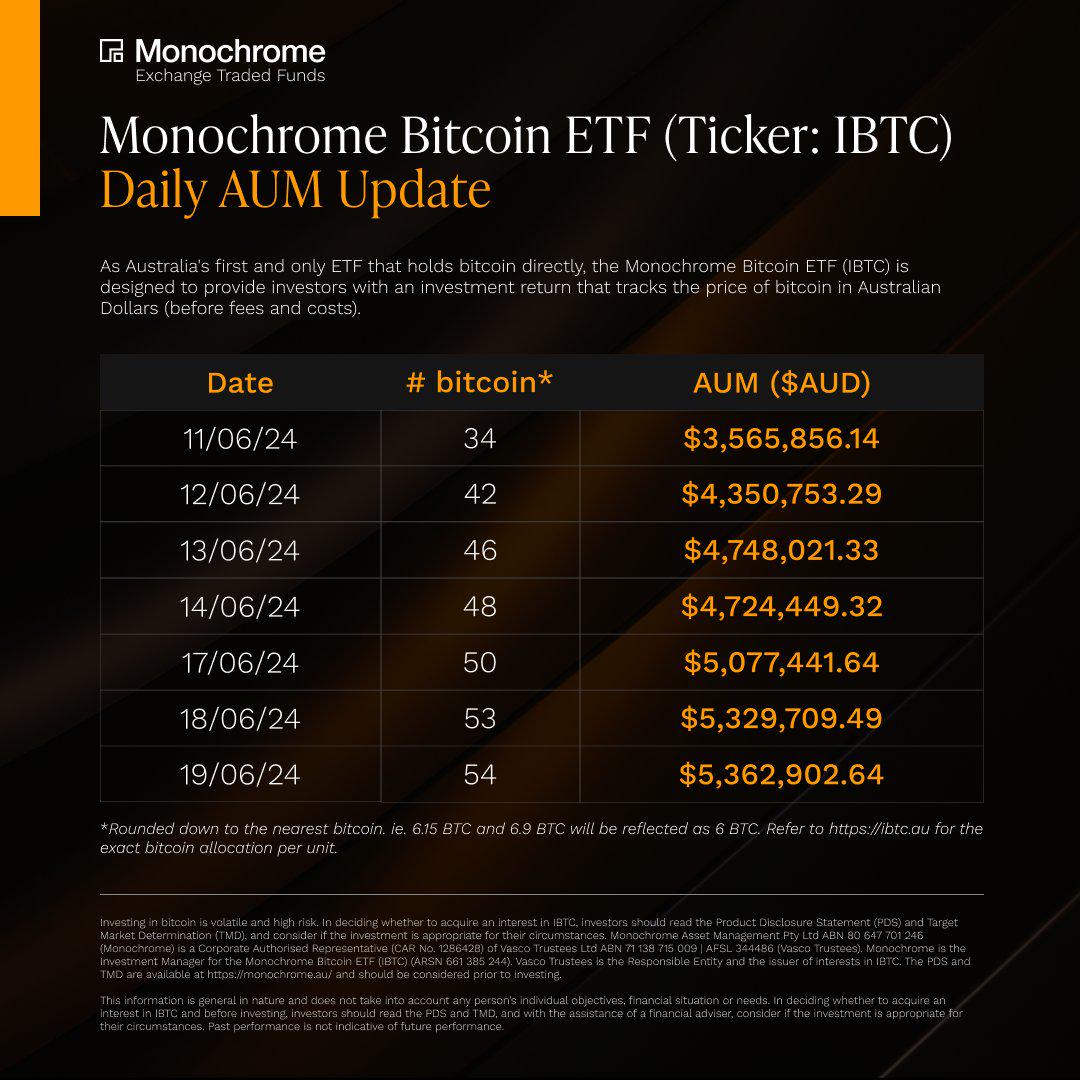

Previously, ASX's competitor, the Australian CBOE, launched the Bitcoin spot ETF (EBTC) in April 2022 in collaboration with Global X and 21Shares. EBTC does not directly hold Bitcoin. In June of this year, CBOE also launched the Bitcoin spot ETF (IBTC) issued by Monochrome Asset Management. Jeff Yew, CEO of Monochrome, stated that IBTC is the first Bitcoin spot ETF in Australia to directly hold Bitcoin. As of June 18, EBTC's AUM was 106 million Australian dollars. As of June 19, IBTC's daily AUM was 54 BTC, approximately 5.36 million Australian dollars.

Meanwhile, a spokesperson for ASX stated that only VanEck has currently obtained approval to list a Bitcoin ETF on the exchange, while applications from other issuers are still pending.

BetaShares Holdings Pty, headquartered in Sydney, and another local company, DigitalX, are also in line for listing.

Lisa Wade, CEO of DigitalX, stated that the company's application for a spot Bitcoin ETF is progressing smoothly and is closely cooperating with ASX. She added that, in addition to Bitcoin, DigitalX may also launch an Ethereum ETF on ASX. She said, "Ethereum is receiving a lot of attention. We are just waiting for the support of ASX and ASIC."

Fee competition emerges, VBTC's first-day trading volume reaches $1.3 million

VanEck's product disclosure statement shows an annual management fee of 0.59%. In comparison, Global X's Bitcoin ETF has a management fee of 1.25%. However, Global X has already reduced the fee of its Bitcoin ETF from 1.25% to 0.59%, matching VanEck's offering. In contrast, the iShares Bitcoin Trust Fund listed in the US charges 0.25%.

Competition among exchanges is also ongoing. In April of this year, Monochrome Asset Management, headquartered in Brisbane, canceled its pending application to list a Bitcoin ETF on ASX and instead chose to go to the Australian Securities Exchange, where the ETF was officially listed this month.

On the other hand, VanEck's application has been in progress for over three years. Since early 2021, the investment giant has been working to introduce a spot Bitcoin ETF to ASX. In February of this year, VanEck once again submitted the application to ASX.

Arian Neiron, head of VanEck Asia-Pacific, stated, "We have a long and deep tradition in gold investment, so value storage investment is deeply rooted in our genes. We see Bitcoin as a form of digital gold."

Arian Neiron, head of VanEck Asia-Pacific

As early as 2022, the Australian CBOE approved an ETF launched by asset management company Cosmos Asset Management. Also in the same year, Canada-based 3iQ Digital Asset Management launched Bitcoin spot ETF and Ethereum spot ETF in Australia, namely 3iQCoinShares Bitcoin (BTC) Feeder ETF and 3iQ CoinShares Ether Feeder ETF. These two ETFs are registered in Australia and are "feeder funds," providing investors with the opportunity to invest in the 3iQ CoinShares Bitcoin ETF and 3iQ CoinShares Ether ETF listed on the Toronto Stock Exchange. The underlying assets of these two Canadian ETFs are BTC and ETH held in cold storage by the Gemini cryptocurrency exchange.

In addition, 3iQ's Bitcoin spot ETF and Ethereum spot ETF are custodied on the second-largest market in Australia, Chi-X (now Cboe), rather than ASX, as there were some regulatory difficulties with blockchain and cryptocurrency-related stocks listed on the Australian exchange at that time.

However, in 2022, all three ETFs were delisted within less than a year due to insufficient demand and poor performance.

With the increasing popularity of Bitcoin and virtual asset investment products, reports suggest that Australia's $2.3 trillion retirement fund market may drive funds into these ETF products. Jamie Hannah, Deputy Head of Investments and Capital Markets at VanEck Australia, stated that about a quarter of the country's pension assets are held in self-managed retirement plans, making individuals able to choose investment products themselves, and this group is likely to become purchasers of Bitcoin spot ETFs.

Compared to other markets, the US Securities and Exchange Commission approved the listing of the first 11 spot Bitcoin ETFs on January 10, with a daily trading volume of $1.7 billion as of June 18. Hong Kong also listed six virtual asset ETFs for Bitcoin and Ethereum on April 30, with a daily trading volume of $3.28 million for three Bitcoin spot ETFs as of June 19.

From the first day's performance, ASX's first Bitcoin ETF achieved a trading volume of $1.3 million on the first trading day. The total trading volume of the first 10 ETFs in the US reached $4.5 billion on the first day, with an average of approximately $450 million per fund. Although significantly lower than the first-day performance of US spot Bitcoin ETFs, interest in Bitcoin ETFs in Australia is increasing, and a new trend is impacting more markets.

Despite differences in market size, VanEck is optimistic about the growth prospects of its ETF in Australia, expecting it to follow a similar path to the spot Bitcoin ETF in the US. "Although the Australian market is much smaller than the US, and most of our fund inflows come from retail investors rather than institutional investors, we may follow a similar path," expressed Jamie Hannah, Deputy Head of Investments and Capital Markets at VanEck Australia.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。