Many people think that the airdrop era may have come to an end, the reason being that zkSync has already concluded. This may be a bit of a stretch. SUI, a public chain that everyone has been optimistic about for 23 years, has not issued any airdrops. Many people have been on SUI for years and have not received any results, but this does not prevent Starknet from issuing airdrops. 90% of zkSync accounts did not receive airdrops, but this will not affect the development of future projects.

So there is no need to worry that the airdrop industry is over. It is just transitioning from its previous extensive form to a more refined and meticulous approach. We only need to build and improve our own means of production. As long as we interact with fair projects, there should be no problem with turning things around.

So, in the second half of 24, where should we focus and what should we do?

We will answer this question in the following text. The main content of this article includes:

- Da Mao will still be in the ETH system

- What are the big ETH holders doing?

- What is the reason why millions of people have joined Scroll?

- Stakestone, a leading project, practical operation tutorial

I. ETH is still mainstream

The Layer2 narrative is not over yet, and several large public chains are still in development. We have always said to grab airdrops, focusing on public chains. As long as public chains do not act maliciously, they are all good opportunities. Many people's funds have been in ETH on-chain and have participated in many project interactions.

Actions speak louder than words, let's look at the data:

The current supply of Ethereum is 1.2015 billion, lower than yesterday's 1.2016 billion, and lower than a year ago at 1.2023 billion. Compared to yesterday, it has changed by -0.00%, and compared to a year ago, it has changed by -0.06%.

The current staking rate is 27.47%, 0.51% higher than the 26.96% on May 20th. In the past 20 days, many people have chosen to stake.

Last week's ETH inflation: 8,768.69 ETH, weekly destruction: 9344.52 ETH, on-chain circulation is relatively active.

We all know that the highest gas fee consumption is for cross-chain transactions. From the data, it can be inferred that many projects have been transferring ETH to other chains recently.

II. Where is ETH flowing to?

The community needs liquidity, and funds will not flow to other directions for no reason. If there is not enough attraction, these funds can also earn +3% annualized on-chain staking.

So let's see where ETH is flowing to?

In addition to flowing to exchanges for cashing out, more funds are flowing to Layer2. Combining etherscan data and the weekly data of ETH Bridge to L2, we can see that the funds are flowing mostly to: Arbitrum, Optimism, Polygon, zkSync, Base, linea, scroll…

Alright, so our direction for the second half of the year is clear: grab these public chains that have not had snapshots yet, and keep up until they issue airdrops.

I have deployed many of the projects mentioned above. Due to the recent dynamics of Scroll, the popular project Stakestone has launched many activities on it. So, let's see if Scroll is worth grabbing and if Stakestone can be a good opportunity for us to benefit from?

III. The necessity of interacting with Scroll airdrops

I have written many tutorials about Scroll before, but have not analyzed the data. Let's take a look at the Scroll data.

The data for Scroll started to soar in May, with a 211.11% increase in TVL and a 30.4% increase in the number of users in the past 3 months.

Real-time TPS monitoring data also shows that Scroll is quite active.

So, I believe there is a necessity for interaction.

Let's see how to grab it:

(1) Scroll Airdrop Rules

On May 15th, Scroll released the Scroll Marks user points statistics rules, mainly to track the bridge data and gas burning data of users since the launch of the Scroll mainnet on October 10, 2023.

Later, the project will issue airdrops based on Scroll Marks (which we consider as points).

Eligibility criteria (meeting any one will earn points):

- Previously bridged ETH, wstETH, and STONE to Scroll (more bridging assets will be available later)

- Burned 5u of gas on the Scroll network

The "Gas" column shows the snapshot from April 29th. Don't be discouraged by this time, this is the data for Session Zero, and there will be a Session One later. Whether there will be a Two or Three is currently unknown, but Session One is definitely there, so if you want to grab it, you have to do it early.

Let's take a look at the data indicators, so we will have a better direction.

(2) Scroll Marks Data Indicator Analysis

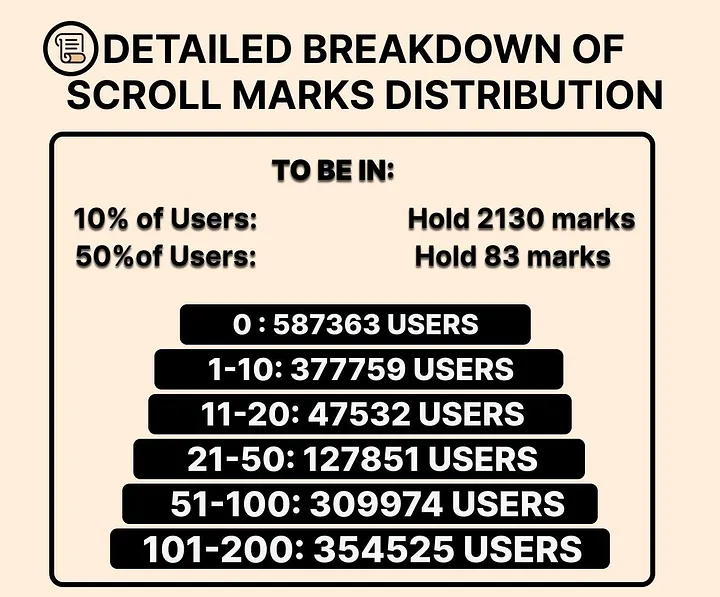

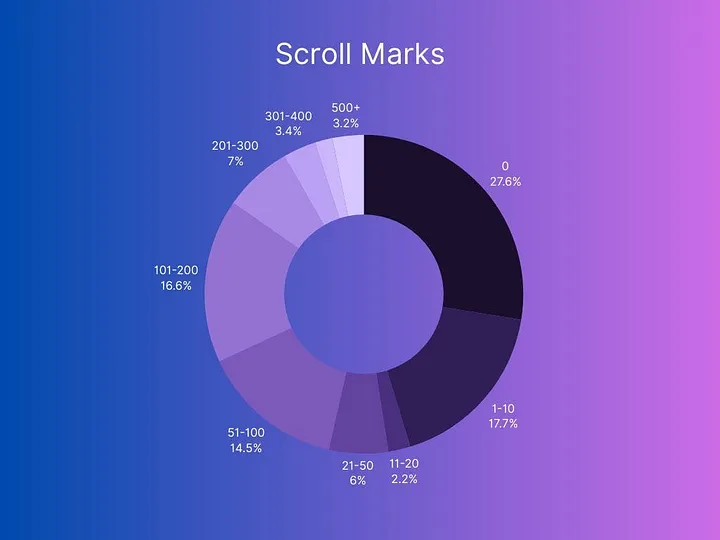

Scroll Marks currently tracks 2,521,556 valid addresses, with the following ranges:

- 0 marks: 587,363 addresses

- 1–10 marks: 377,759 addresses

- 11–20 marks: 47,532 addresses

- 21–50 marks: 127,851 addresses

- 51–100 marks: 309,974 addresses

- 101–200 marks: 354,525 addresses

- 201–300 marks: 148,814 addresses

- 301–400 marks: 71,384 addresses

- 401–500 marks: 37,850 addresses

- 500+ marks: 67,782 addresses

- Among the 2.5 million addresses, nearly 590,000 users have a Mark of 0.

- Most users fall within the 1–10 Mark range.

- 50% of people have only 83 Marks.

- To enter the top 10%, you need to hold 2130 Marks.

So the direction is clear: strive to bring your points into the top 10%. This way, you won't have to worry about the Scroll official diluting your points with Session One/Two/Three later, and you can receive a higher allocation.

(3) How to Increase Points

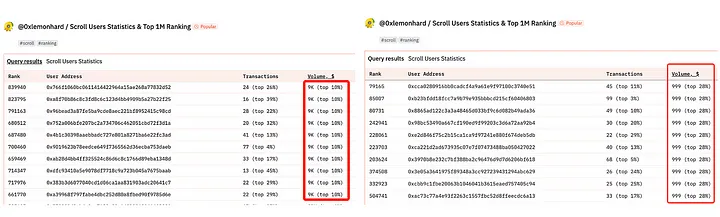

For public chains, the way to increase points is to calculate transaction volume, and your ranking can show you where you stand.

Transaction volume ranges are as follows:

- TOP 10%: 9000U

- TOP 30%: 999U

- TOP 50%: 99U

With various indicators and data standards, we now know what to do.

The Scroll official website provides a simple tip: bridging ETH, wstETH, and STONE to Scroll will earn you points, and bridging assets carries much more weight than burning gas.

So if you want to take the easy route and enter the top 10% while minimizing wear and tear, you can simply bridge 0.3–0.4 STONE, complete the first two sessions, and then increase your transaction volume. This way, your chances of success will be much higher.

III. Why Choose STONE?

There has been a detailed analysis of Stakestone, so I won't repeat the details of the dual investment in Binance and OK. We just need to know that when the token goes online in the fourth quarter, it will be listed on one of the exchanges.

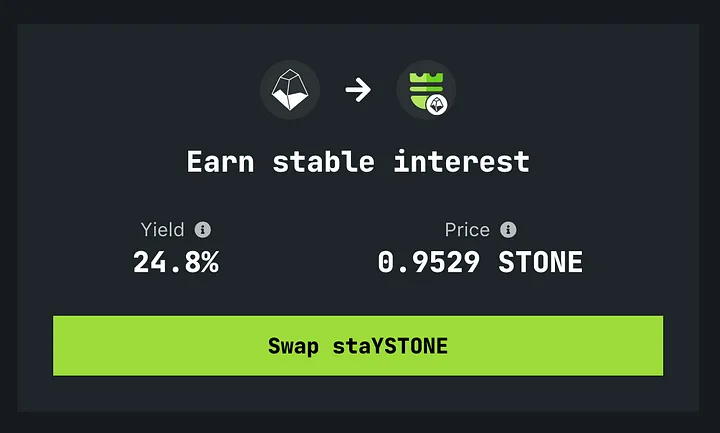

(1) Stakestone Staking Returns Surpass All ETH Assets

STONE's PT returns on Tranchess are higher than all ETH assets, including LRT, at 24.8%. The expected airdrop pricing has surpassed other ETH assets, including LRT:

This is just one type of return. Now let's see how to benefit from multiple sources.

(2) Stakestone's Multi-Benefit Approach

✅Key point: The only staking protocol with no barriers to deposit and withdrawal, STONE is the only asset on Scroll that generates ETH.

?Multi-benefit approach: STONE points + Scroll points + Scroll ecosystem airdrops + Eigenlayer points + Carrot points (points from the router project) + POS staking returns.

Minimum funds: Unlimited, airdrops are limited by TVL, the more you deposit, the more benefits you receive.

(3) Practical Steps

Step One: Transfer ETH from the exchange to the Ethereum wallet (if the wallet already has ETH or other assets on-chain, skip to the next step)

- Visit the official website: https://carnival.stakestone.io/r?code=0E257

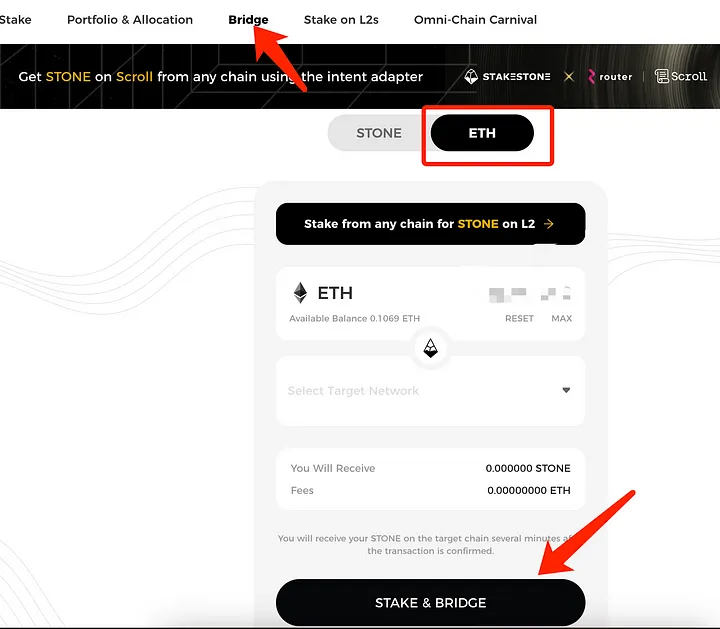

Step Two: Bridge ETH to Scroll (Method One)

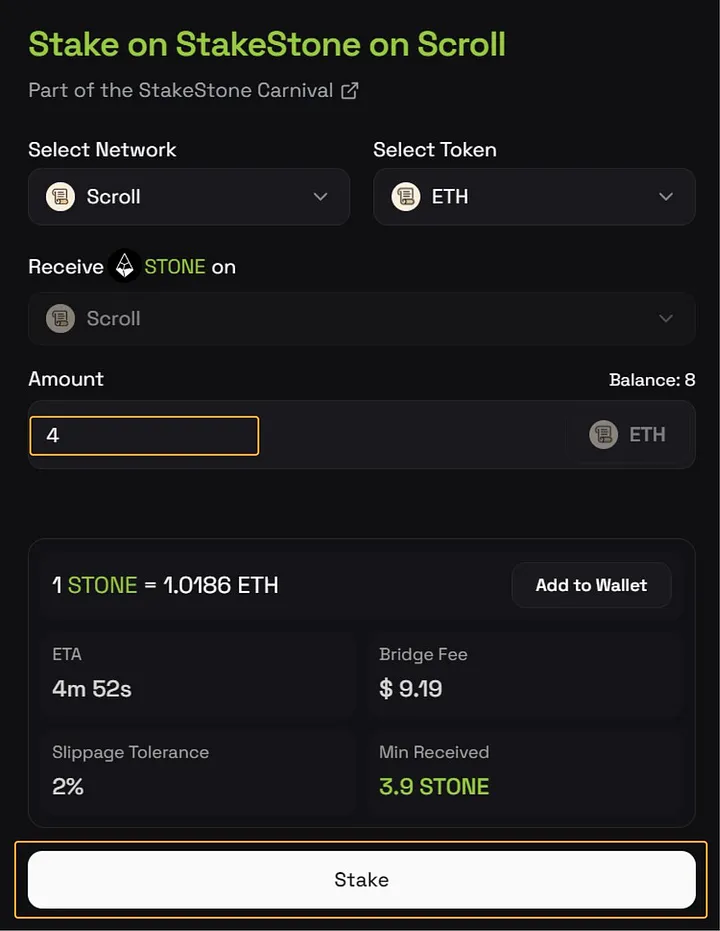

- Use stake and bridge to directly convert ETH to STONE and bridge it to Scroll.

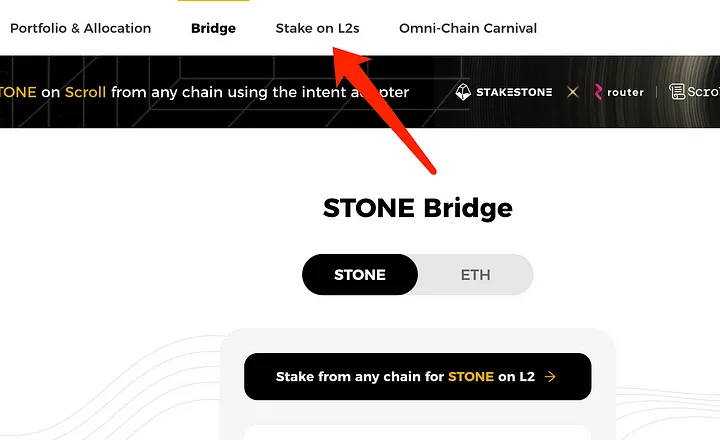

Bridge ETH to Scroll (Method Two)

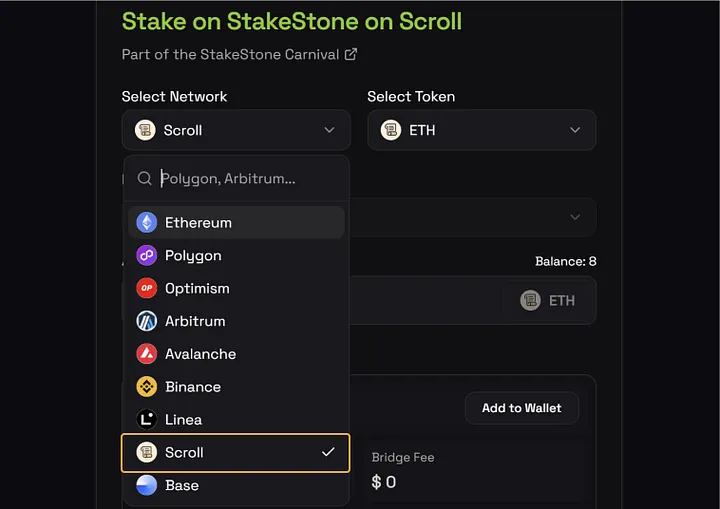

- Click on "stake on L2"

Here, you can convert assets on the Scroll chain or on other chains into STONE on Scroll.

Step Three: Stake ETH

Enter the amount of assets you want to stake, click "stake," and complete the staking process.

Larger amounts may take 4–5 minutes to complete the transaction.

After staking, you can check the status of your points here: https://carnival.stakestone.io

This concludes today's tutorial on benefiting from multiple sources.

StakeStone is a provider of Manta technology. Many bloggers like to talk about project financing when analyzing projects. While project financing can indicate that a project is highly favored by capital, if we don't understand what the project is about, you may not know how to continue making money from the project.

In the Web3 investment circle, there is a saying: it's better to look at the narrative than the financing. The stronger the narrative, the greater the opportunity. I have done in-depth research on StakeStone before, and the project is very strong. If you are interested, you can take a look, and you may find it to be a potential project.

Stakestone will be the standard for ETH identity

Stakestone will be the standard for ETH identity

Stakestone will be the standard for ETH identity

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。