Author: Alana Levin, Partner at Variant Fund

Translation: 0xjs, Golden Finance

Roughly every six months, I write an internal reflection on the current state and future development direction of cryptocurrencies. I think it's worth sharing my most recent one for public reading.

This article is divided into three parts: what's working, other things that have happened (or are happening), and new things I'm looking forward to.

I try to base most of the analysis on data, but it's undeniable that my opinions are inadvertently revealed. I hope this is an interesting article. If the response is positive or the feedback is productive, I will consider sharing more of these internal reflections in the future.

Existing Effective Products

The good news is that many things are working and progressing well. The development of these things—many of which I call "big ideas" because they can effectively change the status quo—should create new opportunities, which are the secondary effects of their success.

For clarity, I use the term "what's working" to refer to projects or trends that show sustainable product-market fit, are expanding the crypto market, or both.

So, what factors currently seem to be working or growing? I have listed 10 factors that I believe are showing signs of "what's working" (not an exhaustive list):

- Stablecoins

- Bitcoin as an alternative asset

- Farcaster, an early but growing social network

- Asset creation

- Community-created and trained AI models

- Solana

- Ethereum

- Zora

- Coinbase

- On-chain exchanges

- Bonus: Blackbird

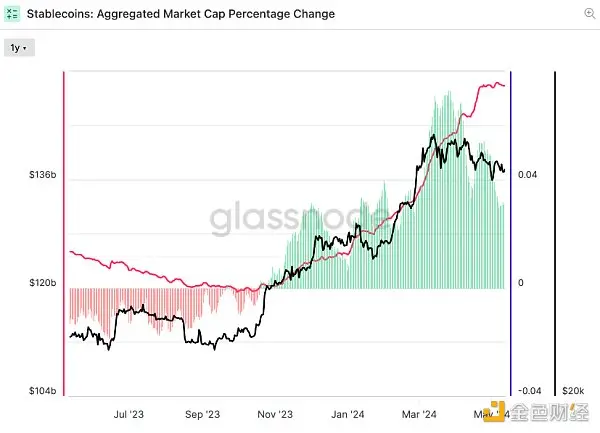

1: Stablecoins

The on-chain stablecoin supply has seen a net inflow of approximately $25 billion so far this year. Overall, the inflow has been positive since November 2023. The permissionless global use of the US dollar continues to have strong product-market fit.

2: Bitcoin as an Alternative Asset

Less than 12 Bitcoin spot ETFs were approved in January. As of early June, the value of Bitcoin spot ETFs exceeded $80 billion. (I follow trackers from Blockworks and The Block for data).

Gold seems to be a powerful analogy for understanding institutional allocation to Bitcoin: whether you think the asset represents a hedge against inflation, it is an alternative to traditional stocks, and its value has to some extent gained social consensus. Some may argue that Bitcoin is much better than gold—because it is easier to transfer, has a known supply limit, and this asset is being adopted on the balance sheets of some companies and countries—so the market value of Bitcoin may one day surpass that of gold.

In the private market, the first quarter saw a surge in projects aimed at expanding the utility of Bitcoin. These projects include (many) Bitcoin smart contract layers, on-chain lending protocols, and exploring how to use Bitcoin's economic security budget to help protect other chains. I guess any results from these developments may emerge in the second half of this year.

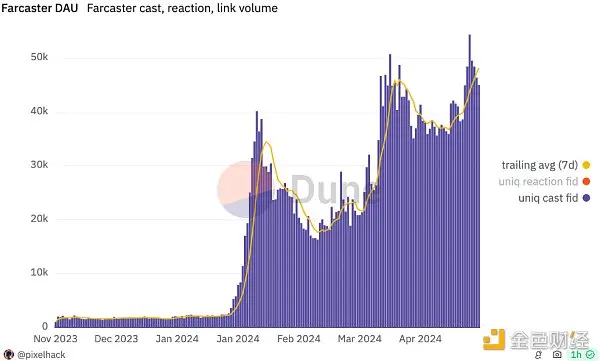

3: Farcaster

Farcaster is a social network built on an open protocol track and is beginning to enjoy meaningful growth.

The turning point came at the end of January when Frames was launched. Frames are components similar to mini-programs, where people can directly share and interact in the social message stream of the Farcaster client.

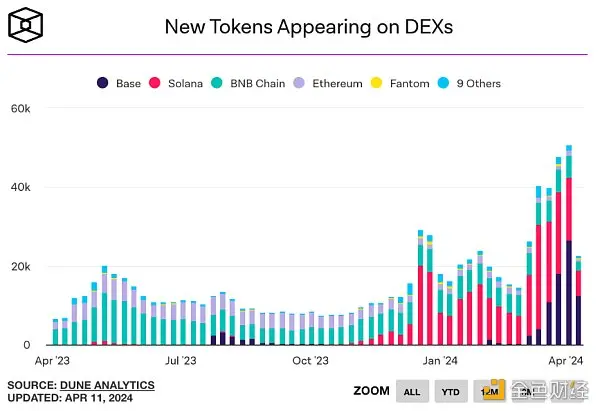

4: Asset Creation

The number of newly created tokens continues to increase. One way to track this trend is to look at the number of new tokens appearing on decentralized exchanges (DEX). Activity seems to be mainly driven by asset creation on Base and Solana.

Especially on Solana, there have been over 10,000 new tokens created daily in the past few weeks.

Source: SolScan

Many of these new assets appear in the form of meme coins. I wouldn't describe myself as an active participant in the meme coin space, but I do recognize that there is a very real and actively engaged user base showing enthusiasm for participation.

It is worth noting that the emergence of these new assets has brought about some unexpected but productive byproducts for the broader ecosystem. For example, we have seen more experimentation with new tools, such as Solana's token extensions. A token called $BERN utilizes Solana's new token extensions to innovate token economics: if someone sells their tokens, 5% of the transaction will be burned (as a mechanism for redistributing to the remaining holders). The popularity of $BERN has become a mandatory feature for wallets adopting token extension standards—these standards are productive because they can enable complex payment splits, confidential transfers, and more. Without $BERN, who knows how long it would take to adopt token extensions.

Overall, my main point is that asset creation seems to be a trend that is gaining momentum. Regardless of your opinion on these assets, having the right to issue and trade them is still a great choice in the flow of value.

5: Community-Created and Trained AI Models

Clearly, we are moving towards a world with abundant LLM opportunities, low creation costs, and a wide range of choices. In that world, where does value accumulate?

I believe value comes from scarce resources. Therefore, in a world with abundant computing, content, and tools, the question becomes: what is scarce? One of the answers is taste and attention. The difficulty lies in the fact that taste and attention are quite intangible resources. Even if we can measure them (e.g., "screen time" can be used as a measure of attention), it is difficult to measure these metrics in dollars.

We are beginning to see crypto working by tightly integrating finance with taste and attention activities. Specifically, community-created and trained AI models have some productive outputs—such as goods or services that can be sold or licensed (e.g., art, movies, intellectual property, etc.)—that can reward participants. For models with subjective outputs, community participants act as taste makers by training the models based on their cultural preferences. The motivation to choose good taste is strong: the better the output, the higher the potential sale.

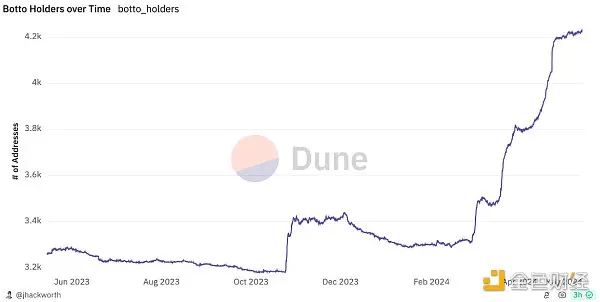

We are starting to see some of these appear in a real and effective way. Botto is my favorite example. It is an autonomous artist, and $BOTTO token holders can help train the model every week.

Botto's artwork is of high quality, and the prices of Botto's works at weekly auctions continue to rise, which is evidence of its growing network of participant owners:

I believe we will start to see more community-created and trained AI models, especially as known and effective examples (such as Botto) become more prominent.

Some businesses are addressing attribution challenges from the top down through litigation, data licensing agreements, or a combination of both. If we assume that the current state represents less than 1% of model-based output five years from now, there is clearly room for other attempts to solve attribution problems and allocate contribution value. Cryptocurrencies provide a unique and valuable solution. Cryptography strengthens economic and creative attribution. Meaningfully, it also allows anyone from anywhere to participate.

Chris Dixon reflected in an old blog post:

"There's a saying: 'The future is already here—it's just not evenly distributed.' An obvious follow-up question is: if the future is already here, where can I find it?"

Community-created and trained models are an area of some small but continuously developing projects we are working on, pointing the way to a broader future.

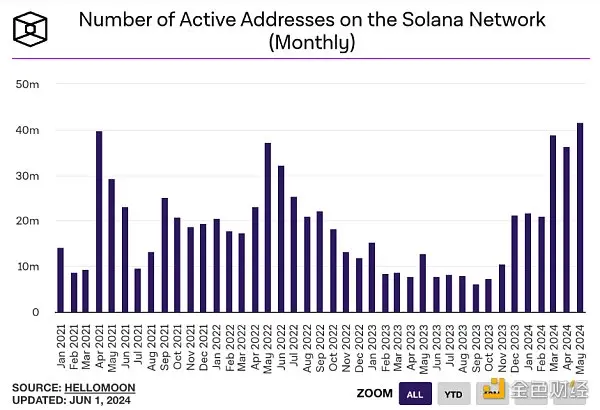

6: Solana

The daily active addresses interacting with Solana are 2-3 times higher than the same period last year, roughly consistent with the peak activity period of 2021. The number of monthly active addresses has increased 3-4 times during the same period and reached a historical high in May 2024:

The network has also started generating meaningful fee income, beginning to prove the hypothesis that Solana's low fees will be offset by greater user activity/quantity.

Conclusion: Solana's development trajectory indicates that some things are working and working in a meaningful way. Solana will continue to exist.

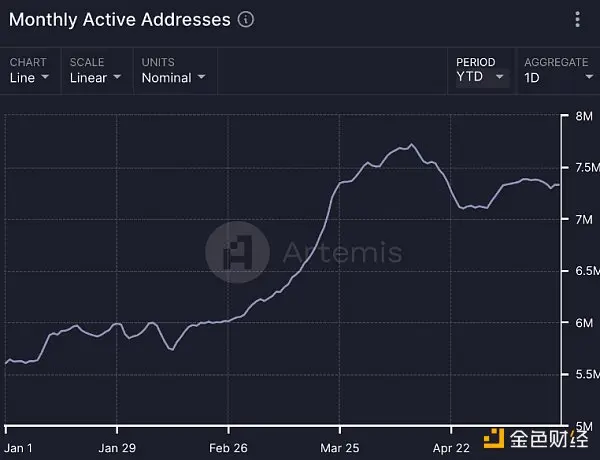

7: Ethereum

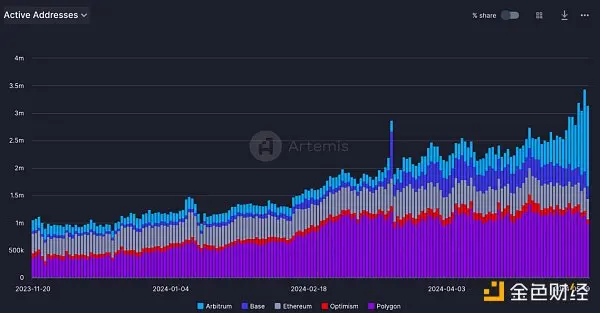

The Ethereum ecosystem has also made significant progress. There are two ways to describe this growth: focusing on Ethereum itself, and looking at the Ethereum chain system as a whole (including the Ethereum roadmap).

The number of monthly active addresses on Ethereum itself has also seen significant growth. The 30-day moving average has increased by about 30% year-to-date, only about 10% lower than the peak in 2021.

Taking a more comprehensive look at the Ethereum ecosystem also shows significant signs of growth. I have summarized the daily active addresses of the five major Ethereum blockchains (Ethereum, Arbitrum, Base, Optimism, and Polygon) in the chart below. These five blockchains were selected in part because they have rich application ecosystems and developers.

Key point: Ethereum has always been one of the most important ecosystems in the cryptocurrency field.

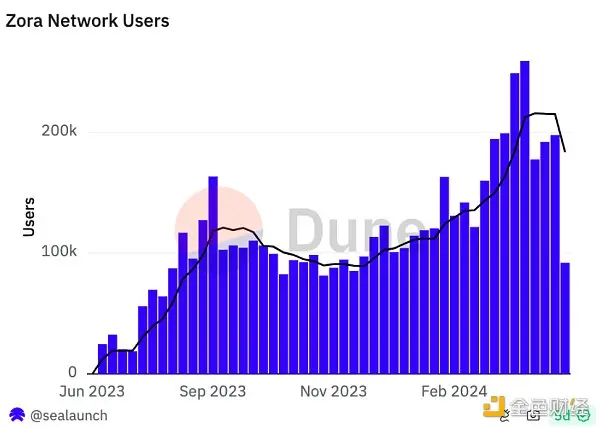

8: Zora

Zora Chain (also known as Zora Network) has been online for nearly a year. During this time, the network has been looking for a foothold. The number of weekly active users has grown by about 60% year-to-date, recently breaking the new high of 250,000. The chain's profit margin has also reached about 34%, meaning Zora can retain about one-third of the ETH users spend on transaction fees.

Zora Chain helps validate the view that applications with sufficient distribution can begin to vertically integrate with other parts of the stack (such as block space) to unlock more attractive economic benefits.

9: Coinbase

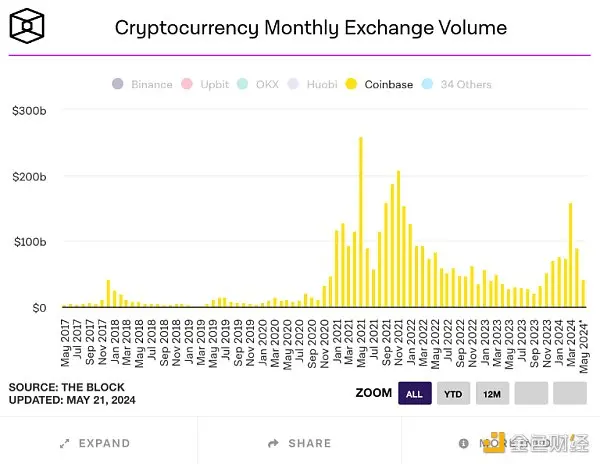

Coinbase has also had a strong start this year. It is listed as the custodian for 8 out of 11 Bitcoin spot ETFs. The exchange business continues to make progress—trading volume reached a high of $157 billion, a number not seen since November 2021.

Transaction fees still account for a large portion of Coinbase's revenue. In the first quarter, the platform's transaction fee revenue exceeded $1 billion (about two-thirds of its quarterly revenue).

But it is also worth noting that Coinbase continues to diversify its sources of income, no longer relying solely on transaction fees. Blockchain reward income and custody fee income have doubled from last year. Stablecoin income is close to $200 million, offsetting (slightly) lower interest rates due to the growth in USDC circulation. The user base of Coinbase's membership suite, Coinbase One, has exceeded 400,000. Coinbase's Layer 2 protocol Base generates millions of on-chain fees monthly.

Coinbase's success proves that (until recently) many assumptions about building meaningful new business models around cryptographic primitives are true.

10: On-chain Exchanges

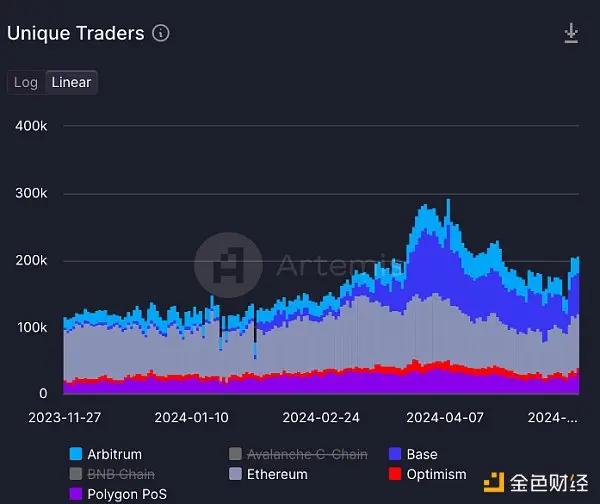

On the main Ethereum chain, the number of unique users (traders) on Uniswap has increased by about twice in the past six months.

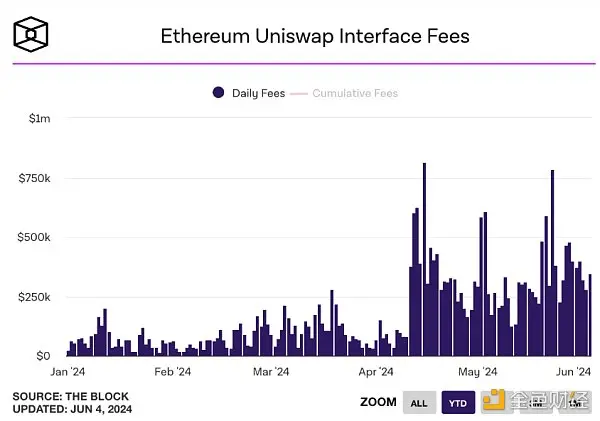

One definition of a successful protocol is that successful businesses can be built on top of it. We see this in on-chain exchanges, such as the revenue growth brought by Uniswap Labs' interface:

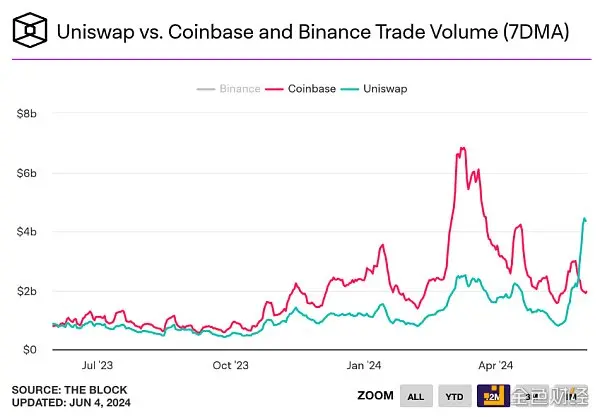

The 7-day moving average of Uniswap protocol's trading volume recently surpassed that of Coinbase:

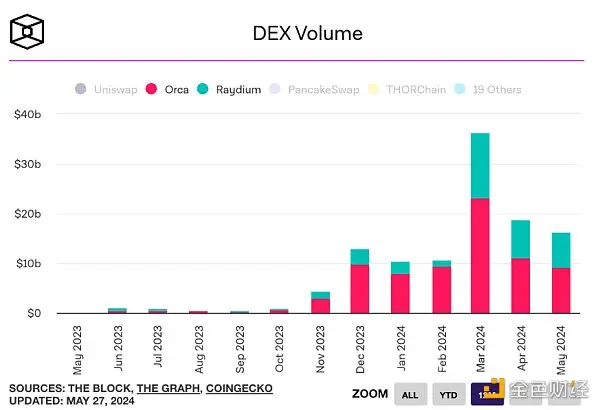

Importantly, we see the growth of on-chain exchanges not only happening on Ethereum. On Solana, the leading two DEX—Orca and Raydium—have also seen significant growth:

On-chain protocols facilitate hundreds of billions (even trillions) of value exchanges per month, which is no joke. Protocols and interfaces are very real revenue-generating projects. In the case of centralized institutions (such as interface businesses), I hope we can see some of these profits reinvested in improving security, robustness, and user experience.

11 (Bonus): Blackbird

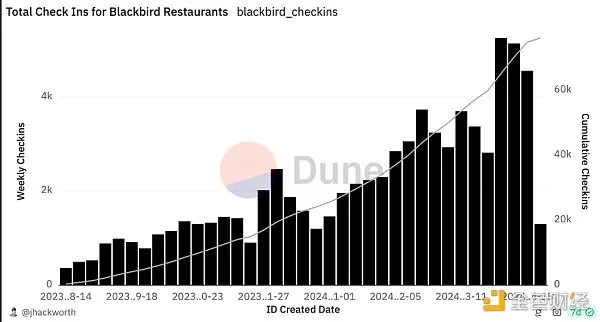

Blackbird is a loyalty and rewards program for the restaurant industry, built using cryptography. When users check in at restaurants associated with Blackbird, the application mints an NFT for them—this is a digital artifact of their visit and a data point for restaurants in the network to understand customer dining habits. Today, Blackbird primarily exists in New York City.

The daily check-ins of Blackbird's user base continue to grow.

Personally, Blackbird has changed my dining habits: in the past, I usually let my friends choose where we should eat, but now I have become more proactive in recommending places for us (and primarily using the Blackbird app to guide where might be an interesting dining spot).

Other Happenings

Other noteworthy trends in the past two quarters include the rise of social finance and the surge of new chains (mainly L2 and L3 in the Ethereum ecosystem). While it may be too early to say whether they are truly effective, it is worth noting that these trends are having a significant impact on user behavior on-chain and how developers are shaping their business models.

#1: Growth of Socialfi Apps

A large number of financialized social ("Socialfi") apps have emerged. Several of them have generated millions in fees. Friendtech and FantasyTop are two of the most popular apps I know of. Clearly, some users find these apps engaging and are willing to participate. Offering new things on-chain to users is a good thing.

I am skeptical about the sustainability of some of these business models. Speculation alone seems insufficient to drive long-term success. But that's okay. Some of these apps may only need slight adjustments to achieve more sustainable business models. Attracting attention—even if driven by speculation—also provides an opportunity to monetize this interest in multiple other ways. However, the crucial second step is certainly the most difficult part.

#2: Surge of New Chains

We are also seeing the launch of many new chains (especially L2 and L3). For these chains in the Ethereum ecosystem, the underlying technology does not seem to be a substantial differentiator. Instead, branding and community prevail. Coinbase's launch of L2 Base may be a microcosm of a strong brand. Even without direct token incentives to attract talent as other chains reportedly have, the chain has a (rumored) growing developer ecosystem.

So far, we see chains attempting differentiation in three ways:

- Underlying technology. For example, integrated chains vs. modular chains, or Optimistic Rollup vs. ZK-Rollup.

- Chain economics. Canto is the first chain in recent years to attempt to redistribute transaction fees to developers in the ecosystem. Blast and Berachain are currently trying various other types of revenue generation and economic distribution. The sustainability of these measures is currently unclear—both from a macroeconomic perspective and in providing long-term competitive advantages.

- Branding and community. The culture and/or reputation of a chain can be a halo that attracts developers: it may enhance the view of developers receiving more help (from the community or other developers) when building in the ecosystem, it can provide reputation protection in the eyes of certain consumers ("no one gets in trouble for choosing a MacBook"), and/or the values advocated by the chain's community may align with the developers' own ideologies.

Mature blockchains embody all three elements. As examples of the "proven" two blockchains I highlighted above: Ethereum and Solana. Ethereum pioneered the EVM, implemented EIP-1559 (a mechanism to redistribute part of the transaction fees to ETH holders), and developed a strong developer community and ethos around its technology. Solana popularized integrated blockchains, was the first to make low fees commercially viable, and has a community that truly forged ahead during the economic downturn in 2022-2023.

My assumption is that the next wave of blockchain differentiation will come from external integrations. Examples could include seamless access to other sources of funds (e.g., Coinbase accounts), wallet KYC screens, or verifying that someone is human. This is a very broad design space, and I am excited to explore it more deeply.

Looking Ahead

Looking back over the past six months, my main takeaway is that we are still talking about things that were discussed 6-12 months ago, but they are more mature in terms of "proven" effectiveness. As these mature, many platforms should and will transition into platforms that create opportunities, which is a byproduct of their success. Growth brings growing pains, and these pains create space for third parties to provide solutions.

Predicting the growth of these major platforms can also provide a foundation for thinking about future directions. I am most interested in new distribution forms and better building blocks.

New Distribution and Better Building Blocks

Exciting growth vectors in distribution include: larger-scale Farcaster, Telegram applications with more powerful wallet functionality, and interfaces like World App continuing to attract more people (currently reaching 10 million).

There are also many exciting new building blocks. Coinbase has launched a smart wallet that allows users to pay directly from their Coinbase accounts. Reservoir's Relay protocol helps improve the experience of bridging funds between chains, making the "one-click" checkout experience on-chain finally possible. World ID continues to develop, potentially providing a way to verify identity between humans and smart entities. And more.

This may sound a bit vague. When I read about things that seem more like abstract hopes than realities, I sometimes feel frustrated, so I will try to illustrate what these building blocks and new distribution channels can achieve with a specific example here.

Take modern advertising, for example, a market worth billions of dollars that involves almost every business. I guess that despite decades of improvements, attribution and targeting are still inefficient. Now imagine what "advertising" on Farcaster would look like:

- Companies can send coupons directly to the wallets of targeted customers (because every account has an associated wallet).

- Coupons could be based on mentions of similar products in posts created by consumers, or posts that users like.

- Companies can operate with confidence because the data will always remain open and accessible (i.e., no need to worry about APIs being shut down or prices being raised), allowing companies to invest in improving the effectiveness of this distribution channel.

- Budget is only spent when consumers convert to sales (i.e., use the coupon).

Overall, this seems to be a win-win for both businesses and consumers, and it is made possible by an open social graph, embedded payment channels, and verifiable digital identities.

Mature Blockchains Point to the Future

Another noteworthy takeaway from the "proven" part is that there are now several reliable and continuously evolving ecosystems (Ethereum, Solana, Bitcoin). These three ecosystems compete on unique differentiators, and each ecosystem's strengths bring continuous improvement pressure to the other ecosystems. For example, Solana's success in low fees and high throughput has driven continuous innovation in Ethereum at the base layer and L2. Similarly, Ethereum's multiple clients may set a goal for Solana to achieve client diversity (e.g., the upcoming Firedancer client). Bitcoin was the first to achieve true institutional adoption but has begun to experiment with new programmable elements (using Ordinals, Runes, and potential OP_CAT upgrades). Broadly speaking, I summarize it as each ecosystem continually attempting to achieve roughly the same functionalities as the other ecosystems. Observing the current positions of each ecosystem—and the positive relative features displayed by their peers—can serve as a guide for each ecosystem's potential attempts at improvement.

This feels very positive. I am a tennis fan, so I will use a tennis analogy. If Federer, Nadal, and Djokovic were not competing with each other, they might not reach the same level of play. Each pushes the others to raise their own level, and the result is that tennis is really great. I think today we are seeing the same situation in the crypto field on different chains. Everyone is making faster and greater progress because there is pressure for improvement. The result is that the entire industry is expected to achieve net gains.

Some New Ideas

There are still many ideal infrastructures and applications to be built. I am interested in some as-yet undeveloped and potentially promising areas:

- Different forms of credentials. Credentials (certificates, proofs, etc.) are valuable resources placed on the chain: putting credentials on a public ledger is beneficial for marking the issuance time and for verifying the issuer. An example of such a credential could be workplace verification—a receipt issued by an employer, proving that someone has worked at a company for a period of time. In the crypto industry, I have seen many attempts at credentialing. I believe the key here is to identify credentials with genuine economic value—such as employment verification—and focus on those markets.

- Price Differentiated Assets (PDA). These commodities have real economic value, but there is a significant difference in the willingness of market participants to pay. Restaurant reservations are a good example. There has been a recent article circulating online about the underground reservation market in New York: popular reservations are being attacked by bots and resold on an exclusive secondary market for thousands of dollars. In my view, if people believe that this financialization is inevitable, then making these "assets" as transparent and accessible as possible seems beneficial for both diners and restaurants. Restaurants can more easily view the transfer history of reservations, while more potential consumers can participate. Tokenizing reservations could even achieve some form of programmatic price ceiling or revenue sharing with the restaurants. This is just one example. There are more markets where assets with fundamental economic value are mispriced or inefficiently priced due to opaque or limited channels for market entry.

- New forms of token distribution. There are many opportunities to incentivize people's existing behaviors through token rewards, as a byproduct of activities they would already engage in. Blackbird is the first and most prominent example: dining out is already a common activity, but the existence of Blackbird rewards may have already changed some users' choices of dining locations and frequency. This can be more broadly applied to areas where people already spend time and money but lack consistency or loyalty in consumption activities. Specifically, I would look for categories where businesses can benefit from some form of alliance or collaborative effect (more data/insights on consumer behavior between businesses), and there is a significant opportunity to increase customer loyalty (through push-style incentives).

Certainly, whether these ideas have unique "proven" effectiveness is a pending question. They have mostly left a strong impression on me, as these ideas have been around for a while but have not been fully explored (hence worth further experimentation).

Conclusion

This reflection represents many of the recent developments I believe have occurred in the cryptocurrency space, but importantly not all. It does not touch on areas that may (or should) be involved, including the growth of permanent storage solutions (such as Arweave), the maturation of DeFi protocols into true financial platforms (such as Morpho), and the impressive push by Telegram for TON.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。