The issuer of virtual currency conducting "liquidity withdrawal" (also known as "Rug Pull") is a highly controversial act.

Authors: Huang Peng, Mao Jiehao, Senior Lawyers at Shanghai Mankun Law Firm

According to The Paper, "post-00s" college student Yang launched a virtual currency abbreviated as BFF on a foreign public chain and became embroiled in a legal whirlpool due to the withdrawal of liquidity - the procuratorate accused him of issuing false virtual currency and misleading others to recharge 50,000 USDT, and then quickly "withdrawing funds," causing losses to others. On February 20, 2024, the People's Court of Nanyang High-tech Industrial Development Zone in Henan Province ruled in the first instance that Yang was guilty of fraud and sentenced him to 4 years and 6 months in prison, and imposed a fine of 30,000 yuan. On May 20, 2024, the case was retried in the Intermediate People's Court of Nanyang City.

As the first case to enter the judicial process due to liquidity withdrawal, this case has attracted attention from the cryptocurrency and legal industries. So, why does "liquidity withdrawal" constitute "fraud"? First, Mankun Law Firm will take everyone back to review the event.

01 Event Review

- According to The Paper's report

The trigger of this event was that Luo charged liquidity to the pool and exchanged a large amount of BFF coins, and then Yang withdrew the liquidity, causing the price of the coin to plummet and Luo to suffer losses. So what is "liquidity withdrawal"?

02 Liquidity Withdrawal in Cryptocurrency Trading

Liquidity Pool and Its Operation Principle

The liquidity pool is one of the core mechanisms on decentralized finance (DeFi) platforms, allowing users to provide liquidity by depositing encrypted assets into the pool to support the smooth operation of decentralized exchanges (DEX) and other DeFi applications. The foundation of the liquidity pool is the Automated Market Maker (AMM) model, which automatically executes trades through smart contracts, allowing users to trade directly in the pool without the need for traditional order book matching, ensuring that the market has enough buyers and sellers, and reducing the friction of the traditional order book model. The assets in the liquidity pool usually exist in pairs. For example, in this case, Yang added liquidity to the pool, which simultaneously contained the BFF issued by Yang and BSC-USDT, forming a trading pair. Since anyone can become a liquidity provider, AMM makes market-making easier.

The liquidity reserve is a set of funds that liquidity providers deposit into smart contracts. When investors execute trades on AMM, they no longer need traditional counterparties. Instead, investors execute trades based on the liquidity in the pool. When buyers make purchases, they do not necessarily need sellers, as long as there is enough liquidity in the reserve.

When trading based on a certain liquidity pool is active, the fluctuation of the price may be significant due to the "depth" and "shallowness" of the liquidity pool. In such cases, setting the "slippage" can facilitate better trading.

Characteristics of Liquidity Pools

Efficient Trading: The AMM model ensures smooth trading without the need for traditional order book matching.

Decentralized Management: All trades are executed through smart contracts, reducing reliance on centralized institutions.

Profit Opportunities: Liquidity providers earn income through trading fees and liquidity mining.

Impermanent Loss Risk: LPs may face impermanent loss when asset prices fluctuate.

Widespread Participation: Anyone can become a liquidity provider, lowering the entry barrier.

Role of Liquidity Providers

Liquidity providers (LPs) are users who deposit assets into the liquidity pool. In return, they receive LP tokens representing their shares, which can be used to earn a portion of trading fees. When someone trades in the pool, the fees they pay are distributed proportionally to all liquidity providers. Therefore, a well-functioning liquidity pool usually has multiple users injecting funds to provide liquidity.

In this case, the liquidity of BFF was provided by Yang alone. As the issuer, the main purpose of providing liquidity is to ensure that the virtual currency has sufficient depth and liquidity in the market, thereby attracting more traders and investors. However, if the liquidity in the pool is provided solely by the virtual currency issuer or a few individual users, the risks associated with liquidity withdrawal need to be considered.

Liquidity Withdrawal

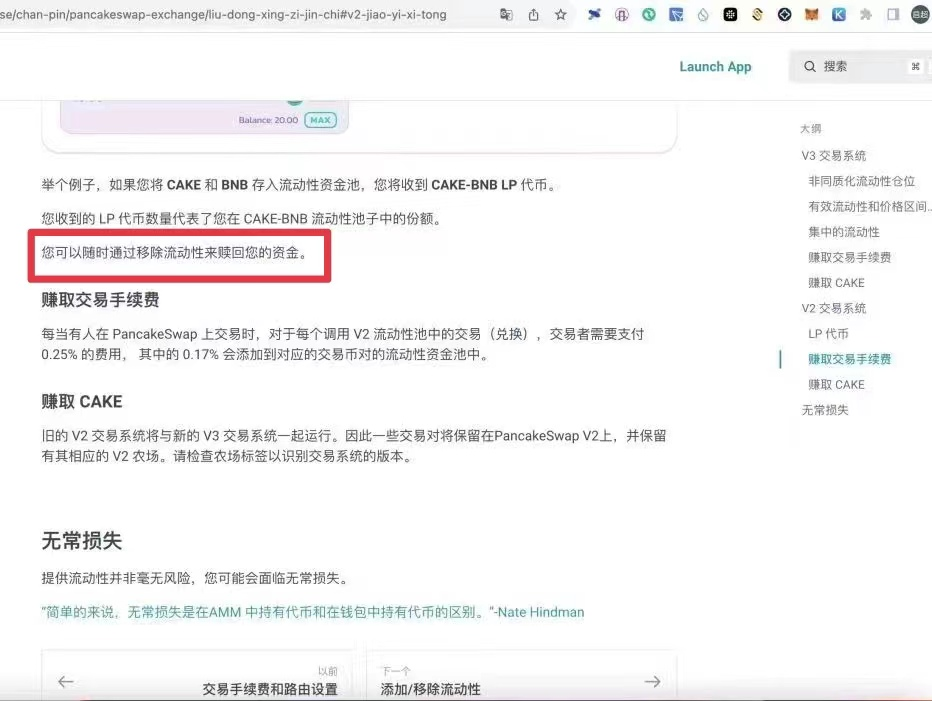

In cryptocurrency trading, "liquidity withdrawal" refers to the process of withdrawing the virtual currency assets you have provided from decentralized exchanges (DEX) or other liquidity pools. In some projects, the provider of the liquidity pool may lock the pool for a certain period or make it permanently irrevocable. However, according to the rules of the trading platform involved in this case, the liquidity pool in question is in a state where liquidity can be withdrawn at any time, leading to the situation where users inject funds into the pool and the issuer immediately withdraws the liquidity.

- Image source: The Paper

It is worth noting that the issuer of virtual currency conducting "liquidity withdrawal" (also known as "Rug Pull") is a highly controversial act.

- Image source: TabTrader Team

The act of the issuer of virtual currency withdrawing liquidity typically involves the sudden withdrawal of funds by the issuer or the main liquidity provider from the liquidity pool, resulting in a sharp reduction in the remaining funds in the liquidity pool, a drastic price drop, and even the inability to carry out large transactions, which may directly lead to severe losses of funds for other liquidity providers and traders. For example, in this case, Yang's withdrawal of liquidity led to a significant price drop, and Luo was only able to redeem 21.6 BSC-USDT in the end.

Some jurisdictions may consider "Rug Pull" as market manipulation or fraud, and the issuer may face legal action and penalties. However, there have been no reported cases of liquidity withdrawal, and this is the first case in China where a case has been reviewed due to liquidity withdrawal. Therefore, during the first instance, the procuratorate and defense lawyers engaged in intense debates.

03 Controversy: Fraud or "Normal" Operation?

In normal DeFi practices, the withdrawal of liquidity by regular participants can be considered as exiting, a normal operation. However, in this case, Yang, as the token issuer and the creator of the liquidity pool, and the main liquidity provider, differs from regular exits.

So, was his behavior fraudulent? First, let's take a look at the definition of fraud - usually refers to the act of causing the victim to misunderstand by fabricating facts or concealing the truth, leading to the transfer of a large amount of property. Regarding this definition, the prosecution and defense debated whether it constituted fraud in the first instance.

The People's Procuratorate of Nanyang High-tech Industrial Development Zone accused:

The defendant Yang created a virtual currency with the same name as the one issued by Qu Dong Future and the same promotional materials.

He recharged 300,000 USDT coins as bait, luring the victim Luo to recharge 50,000 USDT coins. Yang, together with his own 300,000 USDT recharge, withdrew a total of over 350,000 USDT coins.

Luo's loss was 50,000 USDT coins. After multiple exchanges and conversions between BSC-USD, USDT, USD, and RMB, the prosecution accused Yang of defrauding Luo of 330,000 yuan.

The defense lawyer argued:

- Although the virtual currency issued by Yang has the same English name as the one issued by Qu Dong Future, this does not prove that it is a fake BFF coin, because the BFF coin issued by Yang has a unique and unchangeable contract address and can be exchanged normally.

- On virtual currency platforms, coins with the same name are abundant. In this case, before Yang issued the BFF coin, several related entities had already issued multiple BFF coins with the same name.

- Qu Dong Future did not issue BFF coins; they issued BFFT and BFFA coins.

- Luo is an experienced player and should have a clear understanding of the speculative nature and risks of virtual currency trading.

- Virtual currency investment activities are not protected by law, and both parties are engaged in illegal financial activities. Even if investors incur losses, they should not be protected by law. The determination of the first-instance court belongs to "indirectly supporting the exchange transactions between virtual currency and legal tender."

- According to the transaction records, Luo redeemed less than 21.6 BSC-USD coins in less than 7 minutes, and then "bottomed" Yang's BFF coins three times. However, Luo reported being deceived to the public security organs. As of the trial, the BFF coins issued by the defendant had significantly appreciated due to increased liquidity. Luo's wallet with the ending 3A22 still holds 72,381.7198 BFF coins, which can be exchanged for 64,065.7134 USDT coins. "Regardless of whether the virtual currency is considered property, in terms of the increase in USDT quantity, Luo has not incurred any losses."

- The first-instance court determined: "According to relevant policies in our country, this virtual currency does not have the attributes of legal tender, but in real life, based on its stability, it can be traded on many international trading platforms and bring economic benefits. Its property attributes cannot be denied." Therefore, the 50,000 USDT coins involved in the case were converted into the value of RMB as a sentencing factor.

- As for whether the victim later bought or sold the BFF coins, the current value of the coin according to the trading rules of the gambling platform, and how much value it holds, it does not affect the fact that Yang Qichao's fraud has been completed.

Virtual currency, as an emerging industry, has always been controversial in terms of judicial and regulatory aspects. Due to the inherent lag of the law, there is currently no definitive legal support for the rapidly changing cryptocurrency industry. Therefore, how to protect the property interests of citizens and coordinate various regulatory policies for cryptocurrencies within the current criminal law system tests the wisdom of the judicial authorities.

04 Mankun Lawyer's Viewpoint

Although the trading of virtual currencies is prohibited in China, and various related financial activities are classified as illegal, there are still a large number of Chinese players and users continuing to participate in trading activities through overseas markets. In such a situation, should the interests of Chinese citizens who suffer losses due to improper actions such as "liquidity withdrawal" be protected? If they are protected, does it imply the tacit recognition of protecting virtual currency as legitimate property? Does it indirectly support the exchange transactions between virtual currency and legal tender? Does it indirectly promote virtual currency trading?

Similar dilemmas not only test Chinese regulatory agencies but also test regulatory agencies worldwide. The virtual currency market, based on the value concept of "decentralization," cannot actually escape various centralized regulatory systems in reality. A "decentralized" system without governance capabilities will only turn the cryptocurrency market into a lawless and barbaric place governed by the law of the jungle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。