One of the hottest topics in the industry these days is the price of BNB, the leading cryptocurrency of the global virtual currency exchange Binance, which has surged to $720, breaking its all-time high. Another piece of news is that the once reserved cryptocurrency exchange Bybit suddenly opened registration for users from mainland China.

Bybit, Now Open

Bybit is a well-known cryptocurrency exchange established in 2018 and headquartered in Dubai. The company was founded by former forex traders and blockchain technology experts, dedicated to providing professional, intelligent, and intuitive trading experiences for global users.

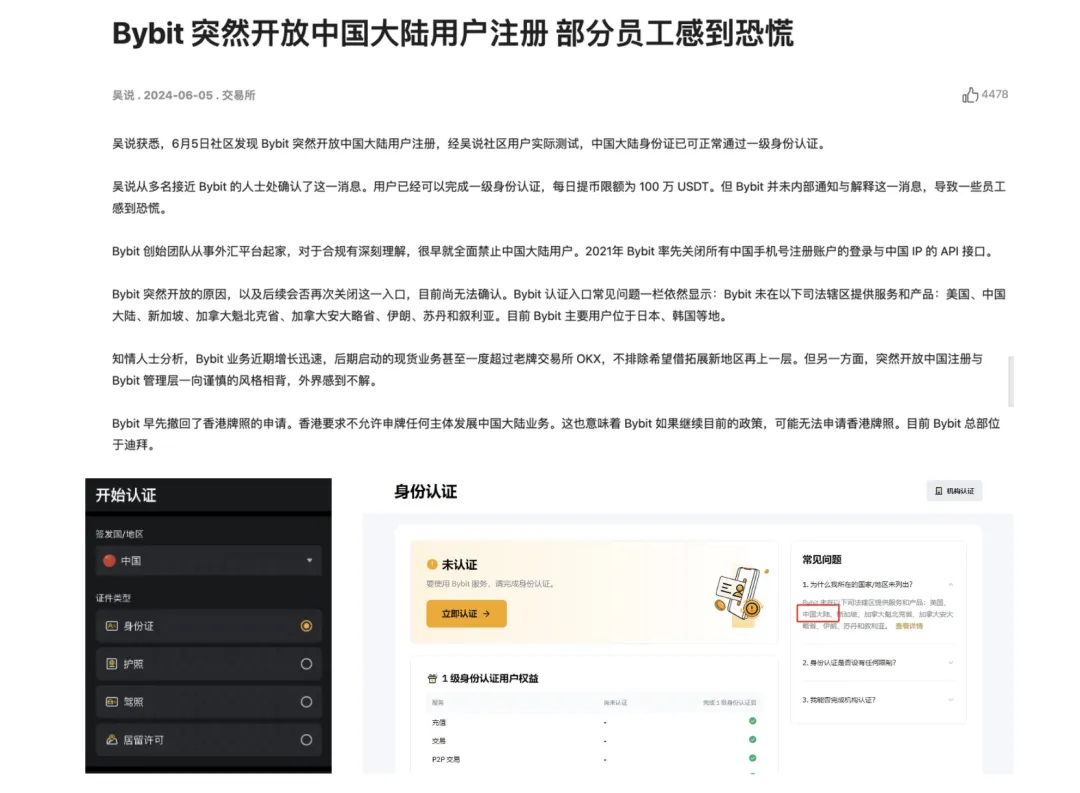

In 2021, Bybit initially prohibited the use by mainland Chinese users, closing all accounts registered with Chinese phone numbers and API interfaces with Chinese IP addresses. On June 5, 2024, Bybit suddenly opened registration for mainland Chinese users, and mainland Chinese ID cards can now pass first-level identity verification, with a daily withdrawal limit of 1 million USDT. This news, without internal notification and explanation, has caused panic among some employees.

Subsequently, Bybit issued a statement stating that the opening of registration for Chinese ID cards is to expand its service coverage to overseas Chinese communities, specifically those residing outside of China and other restricted jurisdictions. This move aims to meet the needs of Chinese expatriates and the international Chinese community. Bybit's business has grown rapidly recently, with its spot business surpassing that of the established exchange OKX at one point. Informed sources analyzed that Bybit hopes to further expand its market share by expanding into new regions, but this decision contradicts the cautious style of Bybit's management.

Bybit had previously withdrawn its application for a Hong Kong license because Hong Kong does not allow license applicants to develop mainland China business. Opening registration for mainland China may bring more users to Bybit, but it may also face stricter regulatory scrutiny and potential legal risks.

Compliant Exchanges in a Dilemma

Yesterday, a friend from the Hong Kong media South China Morning Post called me for an interview about this matter. I said the main reason is probably to capture more market share and make money. With leading exchanges like Binance as wolves in front and others like Bitget as tigers behind, second-tier exchanges actually have a harder time during this bull market. If they don't move forward, they will fall behind. Time is running out for altcoins, retail investors, and exchanges alike.

Friends in the industry who are involved in compliant exchanges are gradually realizing a problem: compliance is good, but too much of it is harmful. Compliance is a double-edged sword. With a license, it is indeed convenient for projects to boast and promote themselves, appearing to be powerful and strong. However, it also means restricting oneself, with fewer opportunities to make money.

Looking at the situation in Hong Kong, most of the entrepreneurs who were enthusiastic about applying for exchange licenses have recently withdrawn their applications. This is because they have already taken advantage of the hype by submitting the license applications, and actually paying for the license would be quite painful. After all, the current market environment in Hong Kong is not ideal, and obtaining a license does not offer a high cost-benefit ratio. Why bother doing it if it doesn't make money?

Not only in Hong Kong, but also in the context of tightening policies, regulatory efforts on virtual currency exchanges are continuously strengthening in various countries. For example, Singapore, Japan, and other places are strengthening regulatory requirements for virtual currency trading, requiring exchanges to implement stricter KYC (Know Your Customer) and anti-money laundering measures. This means that exchanges need to invest more resources to ensure compliance, while facing greater operational pressure.

For Bybit, choosing to open registration for mainland Chinese users is a risky attempt between huge market potential and strict regulatory environment. While the market potential is enormous, it also comes with significant risks. If the balance between market expansion and compliance requirements cannot be well maintained, serious legal and operational risks may be faced.

Betrayed Exchange Employees

Of course, the market landscape of virtual currency exchanges is not the main topic of discussion today. What's more important is the employees of these exchanges in China. I saw that Wu mentioned in the news that mainland employees are actually feeling a bit uneasy. Strictly speaking, according to China's regulatory policies, the employees of these exchanges in China actually face significant risks. According to the "Notice on Further Preventing and Dealing with the Risks of Speculation in Virtual Currency Trading" jointly issued by the Ministry of Public Security, the Supreme People's Procuratorate, the Supreme People's Court, and 10 other departments in September 2021 (referred to as the "9.24 Notice"), there are clear provisions regarding the business activities of virtual currency exchanges in mainland China.

The third paragraph of the first article states: "Overseas virtual currency exchanges providing services to residents within China through the internet also constitute illegal financial activities. For domestic employees of overseas virtual currency exchanges, … legal persons, non-legal persons, and natural persons providing marketing and promotion, payment settlement, technical support, and other services to them will be held accountable according to the law." In other words, hiring residents within China to provide marketing and promotion, payment settlement, technical support, and other services for overseas virtual currency exchanges will result in legal liability.

There are several terms that need further explanation:

"Domestic employees" are not narrowly defined as employees. In addition to signing formal labor contracts, those who sign labor service contracts, part-time contracts, or even those who have not signed contracts but provide labor results and receive remuneration for the exchange, all fall under the broad category of "employees." Even some "volunteers" who have deep involvement in the business of the exchange within China may be considered as employees, especially in criminal cases where substance is more important than form;

"Marketing and promotion" not only refers to sales and promotion services provided by exchange employees, but also includes significant legal risks for KOLs who provide promotional activities for overseas exchanges operating within China;

"Payment settlement" mainly refers to financial institutions or non-financial payment settlement institutions providing payment settlement services for exchanges. Although this aspect has been ostensibly prohibited within China, there are still many people conducting virtual currency transactions through bank cards, WeChat, Alipay, and other channels. Due to the large volume, it is difficult for these payment settlement institutions to be fully regulated. However, even before the "9.24 Notice," major banks, WeChat, Alipay, and other payment settlement institutions had already stated that they strictly prohibit users from using their payment settlement channels for virtual currency transactions, and once violated, they will bear corresponding contractual consequences (account freezing, cancellation, prohibition of opening new accounts, etc.). The greatest risk lies with some small and even black-market platforms that help overseas virtual currency exchanges conduct payment settlement within China. Once these platforms are caught by relevant authorities, the consequences are likely to involve criminal charges;

"Technical support" mainly focuses on providing network connection support (which usually involves the use of tools for circumventing internet restrictions), platform construction support, and operation support for overseas exchanges operating within China. Unlike marketing personnel, technical support positions require strong technical capabilities and are indispensable for exchanges operating within China, but this also means that the legal risks for these positions are to some extent higher than those for marketing personnel.

Some friends also say: Since this matter cannot be done, why have my friends who have worked in the Shanghai office of a certain exchange and the Shenzhen office of another exchange for several years not encountered any problems?

First, from the perspective of China's judicial and regulatory policies, it is indeed illegal for domestic employees of overseas virtual currency exchanges to provide services to residents within China. However, in reality, due to various factors such as law enforcement capabilities and enforcement costs, regulators have not taken any punitive measures against these individuals. If they really want to take action, they will certainly first target the leaders or key members for a higher cost-benefit ratio.

Second, some large overseas virtual currency exchanges have a significant presence, and as long as they operate compliantly overseas and keep a low profile within China (assuming they have business there), they generally will not attract the attention of judicial authorities. However, once there is a significant trading risk, especially when residents within China suffer major losses on the exchange, these domestic employees are often the first to be investigated.

Therefore, if one truly intends to be actively involved in an overseas virtual currency exchange and be a key player on the front lines, the practical advice from lawyer Honglin is to prepare for an overseas identity. After all, making money is temporary, but living freely is for a lifetime.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。