Original Author: Christine Kim, Galaxy

Original Translation: Tao Zhu, Golden Finance

Introduction

Who manages Ethereum? Who decides when and what changes to make to the Ethereum protocol? How much influence do end users of the Ethereum protocol have on the actions and decisions of Ethereum core developers? In this report, Christine Kim elucidates Ethereum governance issues by comprehensively outlining the processes and institutions involved in the decision-making. She also discusses key events in Ethereum's history where coordination between developers and the broader Ethereum community was urgently needed and controversial.

Introduction to Ethereum

Ethereum is the world's largest blockchain, supporting over 4,000 decentralized applications (dapps) and attracting over 7,000 developers. With the adoption and development of Layer 2 scaling solutions such as Arbitrum, Optimism, and Polygon, the network is expected to further expand. As the world's first general-purpose blockchain, Ethereum has consistently led its Layer 1 competitors, boasting the highest market value and network security (defined by total staked value) of all general-purpose blockchains. Apart from Bitcoin, Ethereum is the most important and valuable blockchain in the crypto ecosystem, which is why changes to the Ethereum protocol and the process of making those changes have far-reaching implications for other parts of the crypto industry.

Like Bitcoin, Ethereum's governance process is off-chain, led by the Ethereum Foundation and conducted through online forums such as Discord, GitHub, Ethereum Magicians, and Zoom. ETH holders do not make any decisions through on-chain proposals or decentralized autonomous organization (DAO) voting. On one hand, this ensures that the governance process of pushing code changes to the Ethereum protocol is not influenced by large ETH whale holders and is not susceptible to malicious actors exploiting vulnerabilities in governance-related smart contracts. On the other hand, off-chain governance forms are difficult to audit and objectively assess, as the process is intentionally opaque, subjective, and unstructured.

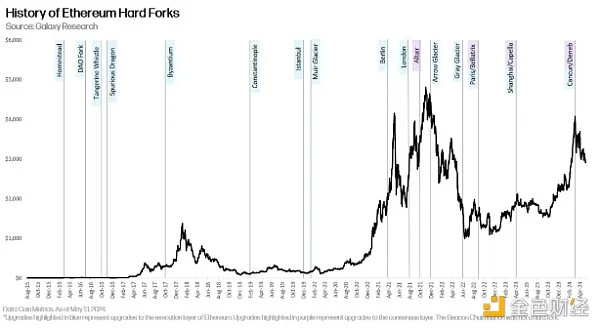

Unlike Bitcoin, Ethereum is adept at deploying hard forks, i.e., backward-incompatible upgrades that require coordination among thousands of users running and operating Ethereum software. Over the past 8 years and 19 hard forks, core developers have adjusted Ethereum's governance process to be more rapid and process-driven, heavily relying on a series of weekly calls, known as the "All Core Developers (ACD) calls," to discuss and track governance decisions affecting the Ethereum protocol.

This report delves into Ethereum governance, focusing on the processes, personnel, and forums involved in the decision-making. It then discusses seven case studies—DAO hard fork, Parity multisig bug, Constantinople upgrade, ProgPoW, Afrigate, Merge, and Shanghai upgrade—to illustrate the Ethereum governance process.

EIPP: Ethereum Improvement Proposal Process

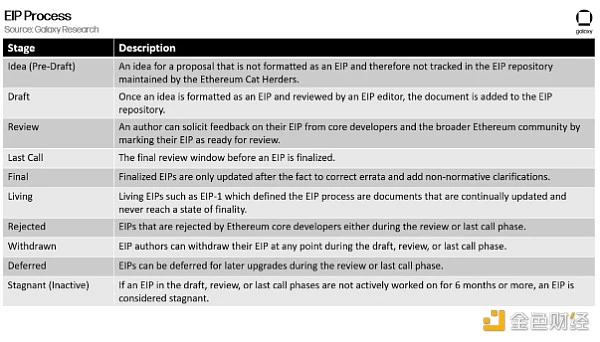

The official process for upgrading Ethereum is called the Ethereum Improvement Proposal (EIP) process. It is based on the Bitcoin Improvement Proposal (BIP) process, which is the standardized process for submitting code changes to the Bitcoin protocol. The BIP process, in turn, is inspired by Python's PEP-0001 process, which outlines the governance model for improving the Python coding language. BIP and EIP are documents that describe new features or changes to Bitcoin and Ethereum, respectively. Specifically, EIPs are formatted according to the guidelines and template defined in EIP-1.

EIPs come in three types.

Standards Track: Most EIPs are standards track EIPs, which specify code changes to Ethereum that require a hard fork, affect Ethereum's network layer or execution APIs, or introduce new application-level standards and contracts. Standards track EIPs are further categorized into the following: Core, Networking, Interface, and Ethereum Request for Comments (ERC).

Core: Refers to code changes that require a network-wide upgrade to activate.

Networking: Refers to improvements to Ethereum's peer-to-peer network layer, also known as "devp2p."

Interface: Refers to code changes that affect Ethereum client APIs and RPC specifications.

ERC: Refers to improvements related to the Ethereum application layer. Ethereum core developers are discussing separating ERC from EIP into a separate governance process.

Meta/Process: Meta EIPs do not propose changes to Ethereum's codebase but describe changes to processes (e.g., the decision-making process of EIPs).

Informational: Informational EIPs also do not propose changes to Ethereum's codebase. They provide general guidelines and information about Ethereum that users can choose to ignore or follow.

Anyone interested in Ethereum can propose an EIP at any time. EIPs are submitted to the Ethereum EIP GitHub repository and then reviewed by dedicated EIP editors for technical soundness and proper formatting. As of May 2024, there are five EIP editors. The names and GitHub usernames of these editors are as follows:

Alex Beregszaszi (@axic)

Gavin John (@Pandapip1)

Greg Colvin (@gcolvin)

Matt Garnett (@lightclient)

Sam Wilson (@SamWilsn)

These editors are appointed by current or emeritus EIP editors. New EIP editors will be considered on a rolling basis. The criteria for becoming an EIP editor can be found in EIP 5069: EIP Editor Handbook.

As part of the EIP process, authors need to create a "discussion" thread on the Fellowship of Ethereum Magicians forum before submitting an EIP draft to the EIP editors. This forum is a website where anyone can create and discuss topics related to Ethereum and Ethereum development. In addition to the Ethereum Magicians forum, EIPs can also be posted for discussion on other online forums, including Discord, ethresear.ch, and GitHub. If the proposed EIP is a core EIP, the EIP author will also present their proposal to the Ethereum client teams for discussion during the ACD calls. The Ethereum client teams are entities that build and maintain Ethereum client software.

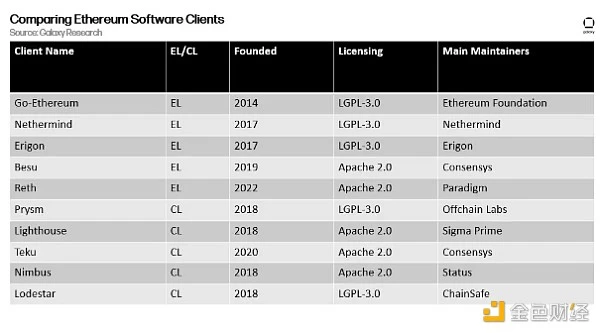

The five main Ethereum consensus layer (CL) clients are Prysm, Lighthouse, Teku, Nimbus, and Lodestar. The four main execution layer (EL) clients are Geth, Nethermind, Erigon, and Besu. Representatives from these nine teams meet weekly via Zoom to discuss EIPs and their implementation in Ethereum upgrades. After proposing an EIP at the weekly meeting (ACD call), the EIP author continues to collect feedback and review their proposal. The EIP author may modify their EIP based on feedback from the community and client teams. EIPs that have undergone this review process and gained support from client teams will be considered for implementation in future Ethereum upgrades. Due to the large number of EIPs, completing the review process for proposals does not guarantee implementation in the next Ethereum upgrade. Typically, Ethereum client teams must select from several technically sound and ready-to-implement EIPs based on the relative urgency and scope of the proposals to include in the next upgrade.

Over the past eight years, 61 core EIPs have been finalized and implemented on Ethereum, 57 core EIPs are currently in drafting or review, and 143 core EIPs have been withdrawn or deemed invalid. Based on these numbers, 23% of core EIPs proposed by developers have been activated in hard fork upgrades since the chain's inception.

In the next section of this report, we will further discuss the personnel and forums involved in the EIP process.

Personnel

There are countless different groups involved in Ethereum's governance. As the most decentralized general-purpose blockchain in the world, no single user, individual, or organization has the authority to change the protocol. However, overall, every user and stakeholder in the Ethereum ecosystem contributes to governance in various ways, whether by sharing their views on the network on social media, operating software, contributing code, or simply interacting with dapps on Ethereum. With no single company behind Ethereum, the ever-evolving and changing ecosystem of participants applies use cases to the protocol, generates interest in the protocol, and ultimately gives value to the protocol.

The collective will of Ethereum users is rarely homogeneous and becomes too large and undefined without broad generalizations. This report focuses on four specific stakeholder groups within the broader Ethereum community, referred to as the "Community" with a capital "C" in this report. The community is defined as an amorphous group of individuals and entities using, building, or developing on Ethereum. Within the community, there is the Ethereum Foundation, established as a non-profit organization to manage the growth and development of the Ethereum protocol by its original founders. We will then discuss the role of Ethereum client teams in the community. These are the developers building Ethereum software and are arguably the most important decision-makers in the EIP process. We will then define validator node operators, a relatively new stakeholder group on Ethereum, as the primary implementers of code changes. Finally, we will define dapp developers, who are the main users of Ethereum, shaping the network's use cases and providing feedback to client teams based on end-user needs, indicating which code changes should take priority.

Ethereum Foundation

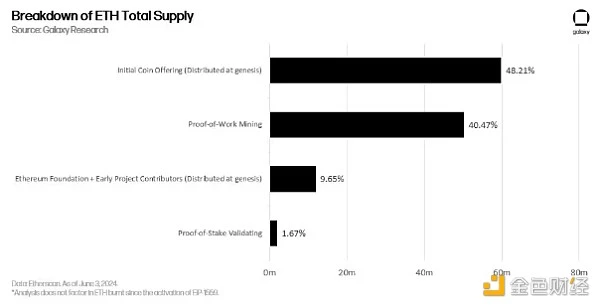

The Ethereum Foundation (EF) is the earliest and most well-known non-profit organization focused on Ethereum. It was created by Ethereum's original founders, including Vitalik Buterin, Gavin Wood, Joseph Lubin, and others. At its inception, the EF received the largest supply of ETH from the pre-mine of the genesis block, accounting for 12 million out of the total 72 million ETH allocation.

However, since 2015, the total amount of ETH held by the foundation has been decreasing over several market cycles, estimated to be less than 0.3% of the total ETH supply as of April 2022. Like Ethereum, the structure and processes governing the EF are difficult to define. Unlike traditional non-profit organizations, the Ethereum Foundation does not have a clear organizational structure or roles. As stated on the foundation's website, the role of the EF "evolves and changes shape with the development of the Ethereum ecosystem." More specifically, over the years, as the number of community stakeholders has increased, the prominent position of the EF in the community has gradually diminished, weakening the EF's centralized influence over more ecosystem participants.

As of May 2024, the EF continues to employ several Ethereum protocol researchers and developers in the community and leads the organization around ACD calls and the annual Ethereum developer conference Devcon. The scale of the organization in terms of staff numbers is unknown. The only members publicly listed on the foundation's website are Aya Miyaguchi (Executive Director), Vitalik Buterin (Ethereum Co-Founder), and Patrick Storchenegger (Board Member). The foundation's latest report on its operations and finances was released in April 2022.

Client Teams

Client teams build and maintain the software required to run and connect to the Ethereum network. Ethereum has nine main client teams, with only one directly maintained by the Ethereum Foundation. Here is the background of each Ethereum client team:

- Geth (EL): The oldest and most popular Ethereum software client, known as Go Ethereum or Geth, exclusively funded by the Ethereum Foundation. Geth is written in Golang and is considered the most battle-tested Ethereum client. The code is maintained by a team of 10 developers and is open source under the GNU Lesser General Public License (LGPL-3.0). The LGPL-3.0 license is a copyright open-source license that requires any changes made to the original code repository to be open source.

(By the way, the main difference between the LGPL-3.0 and Apache 2.0 licenses lies in derivative works. Under the Apache 2.0 license, the code can be forked and distributed without restrictions, while under the LGPL-3.0 license, derivative works of the code must remain free and open source. Additionally, software under the Apache 2.0 license can be combined with software under other types of licenses, while software under the LGPL-3.0 license can only be compatible with other GPL-licensed software. Generally, the Apache License 2.0 is a more permissive license, while the LGPL restricts use to specifically encourage open-source development.)

Nethermind (EL): Founded in 2017, Nethermind is the second most popular EL client for Ethereum, written in C#, and based on the open-source computer software framework called .NET Core. The team behind Nethermind is self-sustaining and was initially funded by the Ethereum Foundation. Over the years, the team has also received funding from the Ethereum community and independent contributors and partners through Gitcoin. In July 2021, Nethermind announced a strategic partnership with the Layer 2 scaling project Starkware. The Nethermind team consists of approximately 220 members from 55 countries. The Nethermind client is open source under the same license as Geth (GNU Lesser General Public License).

Erigon (EL): Erigon, formerly known as TurboGeth, is a branch of the Geth client that has been redesigned to improve synchronization speed and disk space efficiency. It was established in 2017 and completed its alpha version in July 2020. The Erigon team consists of 10 developers and has received funding from multiple contributors, including the Ethereum Foundation and BNB Chain. It's worth noting that the team also supports client software for other blockchains and sidechains, including BNB Smart Chain and Polygon. Additionally, the team has previously maintained an Ethereum client written in Rust called Akula and a client written in C++ called Silkworm. The team recently announced the creation of a new Ethereum CL client called Caplin. The Erigon client is open source under the same license as Geth and Nethermind.

Besu (EL): Besu, formerly known as Pantheon, is an Ethereum client designed for enterprise and institutional use. The project was initiated by the Ethereum venture studio Consensys in November 2018, and it was renamed and moved to a new GitHub repository owned by the Hyperledger Foundation in 2019. (Consensys is a member of the Hyperledger Foundation.) The internal development team at Consensys responsible for building and maintaining the client is called Consensys Quorum, formerly known as Pegasys. Besu is written in Java and is open source under the Apache 2.0 license. Consensys also sponsors the development of the Ethereum CL client Teku. As of October 2020, the Pegasys team (also known as the protocol engineering team) has over 70 members. In January 2023, Consensys announced a reduction in its workforce from 900 employees to approximately 800, a decrease of 11%.

Reth (EL): Reth, short for Rust Ethereum, is an experimental full-node implementation of Ethereum EL intended for broad use, including MEV searchers, bridgers, Layer 2, and RPC node operators. The Reth client is maintained by the crypto investment firm Paradigm, written in Rust, and open source under the Apache 2.0 license. Paradigm funds a core team of 8 developers to build Rust. However, the open-source code repository has over 90 contributors. In March 2024, the Rust team released Reth v0.2.0, the first major version in the client's beta release cycle.

Prysm (CL): Prysm is the most popular Ethereum CL client, written in Golang, and open source under the same license as Geth, Nethermind, and Erigon. It is maintained and developed by Prysmatic Labs, a blockchain infrastructure company founded in 2018 and initially funded by organizations such as the Ethereum Foundation, Gitcoin, Aragon, and Spankchain. In October 2022, the company was acquired by Offchain Labs, the company behind the Ethereum Layer 2 scaling project Arbitrum. Prysmatic Labs employs approximately 12 staff members.

Lighthouse (CL): Lighthouse is the second most popular Ethereum CL client, written in Rust, and licensed under the same license as Besu, Apache 2.0. The client is maintained and developed by Sigma Prime, an information security and software engineering company based in Sydney, Australia. Sigma Prime has received funding for its work on the Lighthouse client from the Ethereum Foundation, Consensys, Gitcoin, and other organizations. The company was founded in 2018 and has about 25 employees.

Teku (CL): Teku is maintained by the same team behind Besu (EL) and is an institution-focused CL client by Consensys. It is written in Java and open source under the same license as Besu and Lighthouse. Teku, formerly known as Artemis, was launched in 2020 and, like Besu, is built and maintained by the Pegasys team.

Nimbus (CL): Nimbus is written in Nim and licensed under the same conditions as Besu, Teku, and Lighthouse, designed to improve resource efficiency, allowing node operators to easily run Ethereum client software on resource-constrained devices such as mobile phones and laptops. The Nimbus team consists of 10 employees and is almost entirely funded by Status (a crypto wallet and Web3 browser) and the Ethereum Foundation. The Nimbus team also builds and maintains an EL client, also called Nimbus. The team was established in 2018.

Lodestar (CL): Lodestar is written in Typescript and licensed under the GNU Lesser General Public License v3.0, focusing on light client functionality for Ethereum. A light client is a node, a computer running Ethereum software and connecting to the Ethereum blockchain, that can easily sync to the chain without needing to download the full chain history from the genesis. The bandwidth and processing load to start a light client are significantly smaller than a full node. Lodestar is developed and maintained by ChainSafe, a blockchain development company headquartered in Toronto, Canada. The project was initially funded by Ethereum founder Vitalik Buterin in 2018. ChainSafe has since received funding from the Ethereum Foundation and Gitcoin, among other organizations. ChainSafe has over 100 employees.

Individuals contributing to Ethereum client software are often referred to as "core developers" of Ethereum. However, this term is also used to describe foundation employees and contractors focused on upgrade testing or general protocol research rather than client development. Generally, anyone actively contributing to advancing the Ethereum core protocol, whether through research, client development, or upgrade testing, is referred to as an Ethereum core developer. The term "core developer" is a hot topic in the community, as no individual or entity has the authority to define the term or prevent anyone in the community from freely using it.

Validator Node Operators

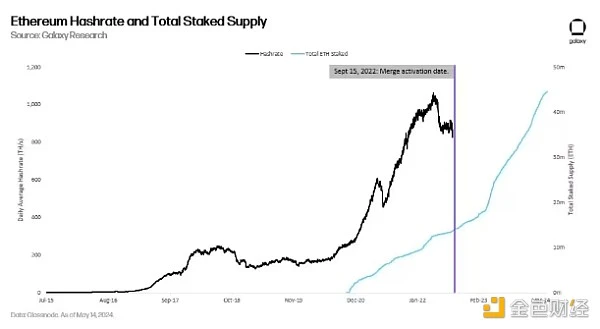

The only type of node operator rewarded with newly minted ETH is validator node operators. Since the merge, validators have replaced miners as the primary block producers on the network. A validator is created when staking 32 ETH on Ethereum. Once activated, validators are randomly assigned responsibilities, such as validating transactions and appending new blocks to the blockchain. In exchange for fulfilling these duties, validators earn rewards through network issuance, transaction fees, and maximum extractable value (MEV). The total amount of staked ETH on Ethereum by validators is a function of network security, ensuring that attacks on the network do not occur unless a malicious actor controls more than 33% of the total staked ETH.

Node operators are a group of individuals and entities who have the authority to implement or reject code changes made by client teams to Ethereum software. As background, when client teams make backward-compatible code changes to the software, the upgrade is called a "soft fork." Conversely, when backward-incompatible changes are pushed to client software, a "hard fork" occurs. All node operators must upgrade their software before a certain block height to avoid being kicked out of the network during the activation period of a hard fork. Intentionally not upgrading their software during a hard fork or running alternative backward-incompatible software will cause a permanent chain split. Validators running on only one version of Ethereum will be penalized for being inactive on another competing version. By gradually increasing penalties, the staked ETH balance of active validators on each version of Ethereum eventually becomes sufficient to drive the network forward.

In theory, node operators have the ultimate decision-making power over which code changes are implemented on Ethereum and which are rejected. However, in practice, the likelihood of a permanent chain split occurring on Ethereum due to disagreements among validator node operators is low for several reasons.

Ethereum has always had an ambitious roadmap, envisioning significant changes to the consensus protocol, fee dynamics, and user experience from the outset. The expectation of a constantly evolving codebase has set a precedent for validator node operators to normalize frequent upgrades rather than reject them.

The growth of the decentralized finance (DeFi) ecosystem, including oracles and stablecoins, as well as the L2 ecosystem, has increased the cost of forking Ethereum, as a permanent chain split would disperse on-chain liquidity and force multiple dapps and L2s that cannot operate on both networks to choose one network over the other.

Most of the ETH staked on Ethereum is staked by service providers representing users operating validator software. This means that the majority of users and entities earning rewards on Ethereum do not directly control nodes or represent their software upgrades. Stakers may be somewhat less actively engaged in tracking or participating in protocol development decisions compared to their engagement with staking services.

Despite these reasons, in Ethereum's history, validator node operators have had a strong influence on protocol upgrade decisions. For example, in the first upgrade after Ethereum transitioned to proof of stake, the interests of staked Ethereum users were a major factor in influencing the priority of ETH withdrawal. Additionally, before validators became the primary node operators on Ethereum, when nodes were primarily operated by miners, Ethereum experienced a permanent chain split despite having a very ambitious roadmap and the inevitable need for frequent upgrades to achieve it. This chain split resulted in Ethereum Classic, the first and only major chain split in Ethereum's history, occurring in the early days of Ethereum in 2016, before the development of the DeFi or L2 industries.

Validator node operators are an important stakeholder group on Ethereum responsible for executing hard fork upgrades prepared by client teams. Their role as code executors in the governance process is delicate and has been influenced by recent upgrades such as the merge and Shanghai (to be discussed in detail later in this report), as well as the legacy of miners, the former primary node operators of Ethereum, who executed upgrades for most of Ethereum's history until the end of 2022.

Dapp Developers

In addition to the EF, client teams, and validator node operators, the dapp layer of Ethereum is the next most important and influential focus group in driving code changes and hard fork upgrades. Dapp developers are the primary users of Ethereum, interacting with the Ethereum codebase to deploy smart contract code. Most end users interact with dapps through front-end user interfaces (UI) supported by wallet services, infrastructure providers, exchanges, or dapp developers themselves, rather than directly through the Ethereum blockchain. Because of this, the demands of dapp developers are sometimes at the core of driving Ethereum development, prioritizing certain code changes over others.

For example, the inclusion of EIP 1153 in the Cancun upgrade was primarily driven by the efforts of two dapp protocol teams, Uniswap Labs and Optimism Labs. EIP 1153 introduces new economically efficient smart contract operations TSTORE and TLOAD for storing data in transactions that are discarded from the Ethereum chain state after execution. During the ACD call discussing code changes, Mark Tyneway, co-founder of OP Labs, emphasized that EIP has the potential to save $3 million/year in gas costs for end users on Uniswap alone. EIP 1153 was initially proposed in June 2018 and later proposed for inclusion in the Shanghai upgrade in November 2022. The proposal was activated on the mainnet as part of the Cancun upgrade on March 13, 2024.

In addition to EIP 1153, in recent months, dapp developers have also been leading the charge on EIPs related to account abstraction. Account abstraction is a feature that allows smart contracts to have customizable and programmable authorization over initiating transactions. On Ethereum, only externally owned accounts (EOAs) can send and receive cryptocurrency. Unlike smart contracts, EOAs cannot execute code. Enabling account abstraction has been a long-term goal of Ethereum core developers and dapp developers, recently gaining attention through a backward-compatible EIP called ERC 4337. The proposal was initially put forward by Ethereum founder Vitalik Buterin in September 2021 and is currently in the draft stage but actively iterating with various client teams, EF researchers, and dapp development teams such as Matter Labs, Polygon, and Gelato.

It is difficult to quantify the impact of the dapp developer community on client teams, especially when the influence of developers also affects community sentiment. In addition to dapp developers, end users as well as ETH holders, exchanges, and other blockchain infrastructure providers play a role in advocating for code changes, albeit to a lesser extent. As further discussed in this report, client teams are not immune to signals from end users through Twitter and other social media forums. Additionally, individuals comprising client teams may also operate their own validator nodes and have ancillary projects building different types of dapps and on-chain services. Therefore, while the interests of each focus group (i.e., client teams, validator node operators, and dapp developers) may differ, the individuals comprising these groups often overlap, making it difficult to neatly categorize or define stakeholders participating in the Ethereum governance process.

Forums

The voices of stakeholders in the Ethereum ecosystem converge on a series of different forums. Some forums are specifically used to achieve consensus among client teams rather than aggregating consensus from stakeholders across the entire Ethereum ecosystem. The primary language used in these forums is English. This may be because, generally, English is considered the most globalized language with the largest number of users. For individuals and companies looking to participate in the Ethereum governance process, English is a key requirement. However, the EF is working to improve communication with non-English-speaking communities through translating Ethereum-related information into several different languages. The ethereum.org website operated by the EF has been translated into 55 languages. Additionally, the EF intentionally hosts Devcon events around the world to expand Ethereum's influence to non-English-speaking populations. In 2022, Devcon VI was held in Bogotá, Colombia.

Here is the translation of the provided text:

The following is a list of four main forums for discussing, organizing, and executing Ethereum development. In addition to these forums, community discussions around Ethereum are also shared on social media platforms such as Twitter and Reddit. However, while social media platforms are popular, they do not often host centralized in-depth discussions about Ethereum development or governance. Instead, Ethereum community members use them to share quick updates and information on Ethereum-related topics, which can spark discussions but are not formally recognized as key governance forums in the EIP decision-making process.

All Core Devs (ACD)

One of the most important decision-making forums for Ethereum protocol development is the ACD call. ACD calls are organized by the Ethereum Foundation and have been held since November 2015, just a few months after the launch of Ethereum. They are publicly recorded Zoom conference calls, lasting approximately an hour and a half. They are open to anyone in the Ethereum community, but the most frequent participants are EIP authors, client teams, Ethereum Foundation researchers, and the Ethereum Cat Herders. ACD calls are open to anyone interested and can be joined via live stream or directly on Zoom.

From 2016 to 2021, ACD calls were chaired by Ethereum Foundation staff member Hudson Jameson. During this time, ACD calls were held bi-weekly. Jameson has since stepped down as the chair of ACD calls and currently serves as an advisor to various Ethereum projects, including the development team behind Status, Chainlink, and Polygon, known as Matic Labs. Starting in 2021, Tim Beiko of the Ethereum Foundation took over as the chair of ACD calls. Meanwhile, from 2018 to 2022, Ethereum core developers focused on building the Ethereum proof of stake consensus protocol also organized bi-weekly calls. These calls were hosted by Danny Ryan of the Ethereum Foundation.

Since the launch of the merge in September 2022, ACD calls have been renamed and formalized into two separate series of meetings: All Core Devs Execution (ACDE) and All Core Devs Consensus (ACDC) calls. Each call is held bi-weekly, meaning there is now an ACD call every week. ACDE calls are hosted by Tim Beiko and focus on protocol-level changes for the Ethereum execution layer (EL). ACDC calls are hosted by Danny Ryan and focus on protocol-level changes for the Ethereum consensus layer (CL).

The restructured ACD call after the merge reflects the dual nature of Ethereum and the increased protocol complexity around protocol changes, as it involves more subject matter experts and network-specific client teams. ACD calls primarily discuss the technical merits of EIPs. While this is the goal, it is sometimes difficult to avoid discussions of moral or ethical considerations around decisions made during ACD calls, depending on the issues at hand. Over 250 ACD calls have been organized since 2015, with most being recorded live and available for review on YouTube.

ETHMagicians and Ethresear.ch

The agendas of ACD calls are often influenced by discussions and conversations posted on the ETHMagicians and Ethresear.ch forums. These forums are places for discussing EIPs in the conceptual or draft stage and circulating them for feedback. Additionally, these forums delve into in-depth discussions around non-technical issues of the Ethereum protocol, such as prioritizing EIPs and plans based on community sentiment. While both forums are equally active, ETHMagicians is a more general forum where almost any technical or non-technical topic related to Ethereum can be discussed. Ethresear.ch tends to showcase early research ideas about protocol technical code changes, which are then formalized and posted on ETHMagicians for broader community discussion.

ETHMagicians was organized by former Ethereum Foundation core developer Jamie Pitts and an anonymous developer of the Geth (EL) client "Lightclient". Ethresear.ch was organized by several Ethereum Foundation staff members, including Hsiao-Wei Wang, Justin Drake, Danny Ryan, and Vitalik Buterin.

Discord

For the daily coordination of active EIPs prepared for upcoming upgrades and providing emergency updates to client teams, there is a dedicated Discord chat where Ethereum core developers, researchers, and other members of the Ethereum community can coordinate development in real time. The Ethereum Research and Development Discord channel is a place for client teams and the broader Ethereum community to collectively address protocol issues, conduct research initiatives, and pose questions. During Ethereum upgrades, client teams use it as the primary communication channel to convey the health status of the Ethereum network and coordinate the launch of upgrades on the Ethereum test network. It is also a forum for exchanging and organizing community calls, which run concurrently with ACD calls, discussing technical details of proposals such as EIP 4844, proto-danksharding, and EIP process changes.

From 2015 to 2018, the primary channel for asking questions about the Ethereum protocol and participating in daily protocol development was through a chat room called Gitter. However, as the Ethereum community and the number of protocol contributors grew, a more complex method was needed to organize multiple chat rooms on one forum. Therefore, developers migrated communication to a shared Discord channel, which as of July 2023, provides over 50 independent chat rooms for various subtopics of Ethereum research and development. The Ethereum Research and Discord channel is the central hub for asynchronous discussions on ACD topics and for tracking the active work of implementing proposals presented on ETHMagicians or Ethresear.ch.

GitHub

Finally, the primary forum for drafting and documenting the status of the Ethereum codebase is GitHub. On GitHub, the organization page called "Ethereum" hosts hundreds of code repositories. These repositories contain code for protocol draft versions being developed by Ethereum researchers and client teams for upcoming upgrades, as well as the history of ACD calls and copies of final EIP proposals. The repositories also host specifications that not only detail the core Ethereum protocol but also include documentation on node APIs, the Solidity smart contract language, testing tools, and more.

The Ethereum core codebase (defined as EL and CL specifications) undergoes changes on a monthly basis. Ethereum Foundation client teams and staff are the primary individuals authorized to merge and update the Ethereum GitHub repositories. The actual changes to the Ethereum specifications (i.e., the execution of governance decisions affecting Ethereum code) occur on GitHub when critical decisions are made asynchronously on ACD calls or Discord. On GitHub, users can track changes to the Ethereum specifications and access the latest versions of the specifications. Merging code changes into the official Ethereum GitHub repository is one of the most important steps, marking the final determination and implementation of decisions made on other governance forums.

Although GitHub is the leading open-source code development platform among computer programmers, Ethereum developers have previously discussed the need to reduce reliance on this centralized platform, especially considering the potential for GitHub to restrict access to its platform under government pressure. Alternative decentralized development solutions that developers can explore in the future include Radicle and Mango. Furthermore, given that GitHub's version control system, git, is a permissionless protocol that does not require website hosting or management, the community is encouraged to host local copies of the Ethereum codebase on their devices. Additionally, one of the motivations for hosting discussions about code changes on ETHMagicians and Ethresear.ch is to replicate issues and pull requests from GitHub to several other platforms.

### Honor Tags

In addition to the main figures and forums mentioned above, there are several organizations and protocols that have had a meaningful impact on the development of Ethereum over the years.

The Ethereum Cat Herders

The Ethereum Cat Herders is a donation-funded group of individuals responsible for creating meeting notes, writing informational blog posts, conducting community outreach, and producing video content to educate the general public about Ethereum. The group was founded in January 2019 by prominent Ethereum community leaders such as former ACD chair Hudson Jameson and former core developer Lane Rettig. The group is led by Herder-in-Chief Pooja Ranjan, who is the founder of the blockchain publication website EtherWorld. The Cat Herders is a decentralized group of Ethereum "project managers" aimed at helping coordinate network upgrades and improve communication between client teams and the broader community. They conduct surveys and analysis of EIP activities and provide guidance on how to improve the governance process surrounding Ethereum code changes.

In addition to guiding the EIP process through project management, they also host EIP improvement calls and EIP office hours weekly to track the status of each EIP and guide them through the stages of discussion, drafting, review, final call, and finalization. They also host a weekly YouTube series, PEEPanEIP, introducing EIP authors and their proposed code changes. The Ethereum Cat Herders work closely with EIP editors to refine the EIP process and make changes based on group consensus.

Ethereum Protocol Guild

In addition to the Ethereum Foundation and the Ethereum Cat Herders, there is the Ethereum Protocol Guild, which is a smart contract application designed to help fund Ethereum core development. Anyone can send fungible tokens to the smart contract, which are then distributed to a registry of addresses owned by individuals who actively contribute to Ethereum protocol research or client development. As of June 2023, the Protocol Guild registry has 142 individuals from various client teams, including Geth, Erigon, Besu, Lighthouse, Lodestar, Nethermind, Prysmatic Labs, Teku, and Status. As of May 2024, the Protocol Guild has distributed over 17.8 million USD in funds, donated by major dapp projects such as Uniswap, Ethereum Name Service, Ether.fi, Nouns DAO, and Moloch DAO.

The Protocol Guild accepts funds from any address at any time. All funds are gradually allocated to the registry over time and distributed proportionally to members based on their active contributions to the Ethereum protocol. The Protocol Guild serves as an agent for assessing the growth of Ethereum core developers over time.

Optimism's Retrospective Public Goods Funding

A notable contributor to the Protocol Guild is the Optimism Collective. Optimism is the second most valuable L2 on Ethereum, second only to Arbitrum, with on-chain assets valued at 6.5 billion USD. Optimism was launched by a development team called OP Labs in 2021. OP Labs operates software that aggregates and orders user transactions in blocks called sequencers. While the intention is to decentralize this function over time, OP Labs has committed to using all profits earned by its sequencers through transaction fees to fund public goods experiments. All sequencer revenue belongs to the Optimism Foundation, a non-profit organization dedicated to developing the decentralized Optimism "Collective" (think of OP Collective as the Ethereum community version of Optimism).

The foundation reallocates the revenue to public goods projects selected by OP token holders and other Collective members through a bicameral governance model defined by Optimism. Since 2021, the Optimism Foundation and the broader Collective have reallocated over 40 million OP tokens to various public goods initiatives. The Protocol Guild has been the largest beneficiary of these allocations, receiving over 600,000 OP tokens in three funding rounds.

Gitcoin

Given the reduction in the Ethereum Foundation budget and the continued growth of end users and the dapp ecosystem, the Protocol Guild is committed to creating a long-term funding mechanism for public goods. Another example of a funding mechanism with long-term potential to support Ethereum core protocol development is Gitcoin. As mentioned earlier, several client teams such as Nethermind, Prysmatic Labs, Lighthouse, and Lodestar have relied on Gitcoin to receive partial funding. Gitcoin aims to support programmers and developers working on open-source software, helping them raise funds for their projects in cryptocurrency.

### Past Upgrades

Over the past eight years, Ethereum core developers have executed 19 backward-incompatible hard fork upgrades. These upgrades have varied in complexity, urgency, and controversy. One upgrade resulted in a permanent chain split, while another upgrade expelled an entire network stakeholder group from network participation. Each upgrade has impacted the Ethereum governance process, shaping it into the multifaceted process involving multiple individuals, organizations, and forums that it is today. In this section, we will discuss seven significant governance decisions in Ethereum's eight-year history and further examine the individuals, organizations, and forums that played a role in the decision-making process.

Consensus on Technical Issues

In most cases, Ethereum core developers intervene to drive and implement code changes through the EIP process. Additionally, they make execution decisions for the blockchain when unexpected and time-sensitive vulnerabilities require urgent action. One of the most controversial decisions in Ethereum's history is the DAO hard fork, stemming from an accidental flaw in the smart contract application DAO that affected many ETH holders. When determining the best way to address unexpected technical issues, Ethereum core developers are the primary voices in conceptualizing, proposing, and ultimately implementing solutions. In the case of the DAO hack, the solution implemented by Ethereum client teams resulted in a permanent chain split and created a new Ethereum protocol, demonstrating an important feature of Ethereum, its permissionless nature, allowing any user group to fork the codebase and launch a new version of Ethereum. The DAO hack also illustrates that Ethereum core developers are not always a homogeneous group with the same views on how the Ethereum codebase should evolve.

The following are three case studies describing how Ethereum stakeholders have reached consensus on technical issues:

Case Study 1: DAO Fork

What Happened: On June 17, 2016, The DAO, a smart contract protocol that controlled 15% of the total ETH supply at the time, was hacked, with approximately 70% of the funds stolen. The hack occurred less than a year after the launch of Ethereum. The DAO was intended to be a decentralized venture capital tool, allowing DAO token holders to vote on proposals and use the pooled capital to support various blockchain projects. The DAO was the first decentralized autonomous organization of its kind. The DAO project became the largest crowdfunding campaign in history at the time, raising $150 million from over 11,000 contributors.

The DAO was hacked using a vulnerability known as a reentrancy bug, which allowed a malicious actor to repeatedly withdraw funds from the smart contract for free. This occurred when the malicious actor made an external call from the target smart contract to another smart contract. The untrusted smart contract would then call back the original smart contract. Each time the hacker's contract initiated a call to the DAO contract, the DAO smart contract was unable to check and update its balance before approving the fund transfer, leading to the gradual draining of the DAO's assets. Upon discovering this vulnerability, the creators of The DAO attempted to preemptively use the same technique as the hacker to drain the DAO contract. The creators managed to salvage 30% of the DAO funds, but the remaining 70% remained under the control of the hacker.

Participants: The team behind The DAO project was a group of anonymous developers known as Slock.it. Slock.it envisioned The DAO as a fundraising mechanism to guide other dapp ideas, with one of Slock.it's most notable dapp ideas at the time being a decentralized application. Following the exploitation of the smart contract, the Ethereum Foundation played a significant role in the communication regarding the DAO hack. In a blog post on the Ethereum Foundation's blog, core developers of the Ethereum Foundation proposed ideas for the future development path after the DAO hack, such as implementing a soft fork to mitigate the impact of the hack on token holders. In 2016, miners were individuals running Ethereum nodes and securing the Ethereum blockchain. Therefore, they were also the primary supporters of any code changes by Ethereum core developers through software upgrades. Due to the controversial nature of the issue and the intense debate surrounding the immutability of smart contract code, it was difficult to reach a consensus on the best solution within the Ethereum community. Ethereum stakeholders, including ETH holders and dapp developers, shared their opinions on various forums such as Twitter and Reddit. However, decisions were primarily made through ACD conference calls, Gitter, and GitHub.

How It Was Resolved: Geth (EL) developer Peter Szilagyi proposed an initial suggestion for resolving the DAO hack issue through a backward-compatible soft fork in a blog post on the Ethereum Foundation's blog on June 24, 2016. However, the proposal was quickly abandoned after Ethereum core developers found that it could lead to a more widespread network DDOS attack. After several weeks of discussion, Ethereum core developers reached a consensus that the only technical solution to address the DAO hack fund loss issue was through a hard fork upgrade, which would allow Slock.it developers to reallocate all funds from The DAO to other smart contracts less susceptible to reentrancy attacks.

The proposal to initiate the hard fork upgrade was first put forward by Stephan Tual, the founder of Slock.it and a developer employed by the Ethereum Foundation at the time. This proposal sparked debates about the "code is law" principle and the extent to which Ethereum's blockchain integrity depended on adhering to this principle. Ethereum core developers organized a carbon vote on July 15, 2016, to decide whether to default to the logic of launching the hard fork in the next upcoming software client. The carbon vote was an on-chain mechanism where ETH holders could express their preferences for governance proposals by submitting zero-fee gas transactions. The DAO controversy marked the first time that Ethereum core developers relied on an on-chain carbon vote as a secondary measure to gather consensus. 4.5% of the total ETH supply participated in the vote, with 87% of the voting ETH supply supporting the default selection of the hard fork by node operators.

Approximately a month after the hack, the Ethereum client teams arranged for the hard fork. The proposal received support from major community leaders such as Vitalik Buterin and organizations like the Ethereum Foundation. Additionally, there was very low client diversity in Ethereum at the time. Despite there being six client implementations, 97% of node operators were running the Geth client, which made it easier to coordinate client upgrades among client teams.

By advancing the controversial hard fork proposal, client teams allowed miners and other node operators to decide whether to accept or reject their code changes. The hard fork was scheduled to be activated on July 20, 2016, a few days after the on-chain carbon vote. During the DAO hard fork, some Ethereum node operators did not upgrade their nodes, leading to a permanent chain split. The Ethereum version that did not accept the DAO hard fork upgrade is now known as Ethereum Classic. Over the years, Ethereum Classic has continued to evolve as a network alongside Ethereum. However, it has experienced multiple 51% attacks due to its lack of security and user participation. In the years following the DAO hack, Ethereum has surpassed Ethereum Classic in adoption, miner participation (i.e., hash rate), and most importantly, value.

After the DAO hard fork, one of the main reasons Ethereum continued to lead over Ethereum Classic was that most developers (i.e., client team developers) continued to develop on Ethereum rather than Ethereum Classic. Since its launch, Ethereum has been a blockchain with an ambitious development roadmap, and many investors and stakeholders have recognized the need for a strong development team to lead the way. During the DAO hard fork, the primary software development team was Geth, and there was consensus among Geth developers to execute the hard fork and return the DAO hack funds to The DAO creators, a consensus influenced by puppet leaders within the Ethereum Foundation at the time, such as Vitalik Buterin. This consensus between Geth developers and the Ethereum Foundation had a significant impact on the Ethereum community and the broader crypto industry's perception of the appropriate course of action for Ethereum.

Key Takeaways: The DAO hack significantly changed the approach of dapp developers to smart contract development. In a speech several months after the hack, Slock.it developer Lefteris Kaperelli explained that one lesson all dapp developers should learn from the DAO hack is that decentralized applications need to implement a "kill switch" to protect the application from unexpected hacks. The idea of implementability in immutable applications and the use of multisig wallets and governance structures to achieve veto power has become popular after the DAO hack and similar events. Today, most decentralized applications can be upgraded on Ethereum.

Regarding Ethereum governance, the DAO hack is the most controversial issue in Ethereum's history to date. It illustrates how Ethereum's governance mechanism progresses when the Ethereum community cannot reach a consensus. It highlights three main lessons learned:

The veto power in the Ethereum decision-making process falls on the Ethereum client teams, who decide on the changes to the Ethereum software. However, once an agreement is reached and the software is released, node operators can accept or reject the code changes. At the time, the primary Ethereum software client was Geth, and the Geth team, Ethereum Foundation, and Vitalik Buterin all supported the hard fork solution. Therefore, they released the necessary software upgrade and activated the Ethereum hard fork at block height 1,920,000.

The use of carbon voting illustrates how on-chain mechanisms can strengthen off-chain governance processes. Although carbon voting is not binding, meaning it does not have the power to change the decision-making process conducted by developers through ACD calls and Gitter, it does reinforce the Ethereum community's inclination to implement a hard fork.

Lastly, this case study demonstrates the ability and authority of Ethereum node operators to choose which version of the Ethereum protocol to run. Some chose to reject the DAO hard fork. However, as mentioned earlier in this report, the growth of the decentralized finance (DeFi) industry since 2016 has led to increased costs and technical difficulties in maintaining alternative versions of the Ethereum protocol, making it increasingly challenging for them to coexist.

Case Study 2: Parity Multi-Sig Vulnerability

What Happened: In November 2017, the widely used Ethereum multi-signature (multi-sig) wallet developed by Parity Technologies was accidentally exploited, resulting in the permanent freezing of 514,000 ETH worth over $320 million in over 580 user wallets. The exploit was brought to the attention of the Parity development team by "devops199" on GitHub, who claimed to have found a method to transfer control of the Parity multi-signature wallet's smart contract ownership. In an attempt to return ownership of the contract to the Parity team, Devops199 accidentally triggered the "kill() function" related to the Parity code, effectively freezing the balances of Parity multi-signature users. This devastating vulnerability was one of two major vulnerabilities discovered in Parity's multi-signature wallet in 2017.

Participants: Background: Parity Technologies was founded in 2015, with one of its founders being Ethereum co-founder Gavin Wood. Over the years, the company has built software clients for Bitcoin, Zcash, and Ethereum. At the time of the multi-signature vulnerability, the Parity software client was the second most popular Ethereum client used by node operators. Parity Technologies later ceased support for the Parity client in 2019, rebranding it as OpenEthereum and shifting its focus to building its own Layer 1 blockchain, Polkadot, which launched on the mainnet in May 2020.

Resolution: In order to unlock the frozen user funds, the Parity development team proposed EIP 999 in April 2018. EIP 999 aimed to restore the deleted code accidentally self-destructed by Devops199 through a hard fork upgrade. Despite the significant impact of the Parity multi-signature vulnerability on Ethereum users, the code changes were never implemented in the upgrade. After strong opposition and resistance to the proposed changes, Parity developers ultimately withdrew EIP.

Key Conclusion: Despite being the second most popular Ethereum client and EIP 999 being technically sound in the eyes of Ethereum core developers, the proposal was not implemented because its implementation would evidently lead to another permanent chain split. On April 26, 2018, Parity co-founder and CEO Jutta Steiner wrote in a blog post that the company "did not intend to split the Ethereum chain over EIP 999." The Parity multi-signature vulnerability is an important case study that highlights the limited influence of Ethereum client teams on the Ethereum codebase. While client teams are the most active participants in Ethereum's governance process, they tend to favor implementing code changes that most of the Ethereum community would support and avoid those that are likely to repeat the DAO hack event.

Similar to the DAO hack, the controversy surrounding EIP 999 centered on the debate over Ethereum's code immutability. However, this time, there was overwhelming consensus among Ethereum stakeholders outside the Parity client team to reject Parity's proposed code changes and preserve code immutability. Part of this consensus was reached through a week-long on-chain carbon vote, with 55% of voters opposing the activation of EIP 999. The use of another carbon vote to gauge broader community sentiment also sparked debates about the effectiveness of on-chain voting in Ethereum's governance process. Many Ethereum developers and ETH holders considered carbon voting inaccurate and ineffective due to the ability of ETH whales to manipulate the voting results with their holdings. In addition to the informal carbon vote (which historically has not had much legitimacy in the governance process), EIP 999 also went through the formal EIP review process, where Ethereum client teams and the broader Ethereum core developer community seriously discussed the code changes. Over the three months since its initial submission in April 2018, EIP 999 was rejected by multiple parties due to a lack of community support.

Case Study 3: Constantinople

What Happened: The sixth Ethereum upgrade, known as Constantinople, primarily reduced the block issuance from 3 ETH to 2 ETH and included some other minor technical improvements to the Ethereum codebase. The scope of Constantinople was finalized in August 2018, with a planned launch in January 2019. In addition to the block issuance reduction (also known as EIP 1234), other code changes included in the finalized scope of Constantinople were:

- EIP 145: Introducing a more efficient method of information processing called bitwise shifting.

- EIP 1052: Providing an optimization for the execution of large-scale smart contract code.

- EIP 1283: Introducing a fairer pricing method for smart contract data storage changes.

- EIP 1014: Laying the groundwork for some type of scaling solution based on state channels and "off-chain" transactions.

Less than 48 hours before the planned launch of the Constantinople upgrade, a blockchain security and auditing company called Chain Security discovered an error in the upgrade code. Upon careful examination, it was found that EIP 1283 would allow hackers to manipulate smart contract balances using repriced storage operations. The nature of this vulnerability was similar to the DAO vulnerability, as it could create opportunities for malicious actors to initiate reentrancy attacks on smart contracts.

Participants: Chain Security published a blog post on January 15, 2019, detailing the exact nature of the vulnerability. On the same day, Ethereum core developers discussed the next steps through Gitter and impromptu ACD conference calls. They quickly reached a consensus to pause the planned upgrade and decided on a new upgrade date and software patch at the next scheduled ACD conference call, which was to be held on January 18, 2019, three days later. During the ACD conference call, developers reached a consensus on the upgrade patch and rescheduled the hard fork activation for February 28. The Ethereum Foundation and Ethereum Cat Herders assisted in communicating these decisions to Ethereum miners and other node operators at the last minute. Both organizations published blog posts and reached out to community stakeholders, informing them of the last-minute changes to the hard fork plan.

Resolution of the Issue

Due to the technical nature of the issue, the Constantinople vulnerability was primarily addressed within the client teams. Ethereum core developers quickly brainstormed and found the most effective solution, which they implemented in their software clients. Unlike the DAO hack patch, the solution to the Constantinople vulnerability did not spark controversy, but it did raise concerns about the testing process for EIPs and emphasized the need to strengthen upgrade testing to ensure thorough checks of new code changes before deployment on the mainnet. Once the vulnerability was patched, a new hard fork date was determined, and Ethereum miners and other node operators successfully upgraded their hardware on February 28, 2019.

Key Takeaways: The resolution of the Constantinople vulnerability highlighted the community's ability to quickly unite and make immediate changes to the Ethereum protocol, especially for network security reasons. As the issue itself lacked controversy, Ethereum node operators were able to revert to the old version of the client software within 48 hours. Additionally, core developers successfully activated the patched version of the Constantinople upgrade in February 2019. The presence of errors in the original upgrade code did not deter Ethereum developers from executing the upgrade but instead encouraged them to focus more time and resources on testing for future upgrades.

Building Social Consensus

When issues stem from controversies surrounding Ethereum's social values, the decision-making process becomes more prolonged and cumbersome. The DAO vulnerability is an example of a technical failure in smart contract technology. However, the DAO hard fork represented a solution to the technical vulnerability that challenged the value of "code is law" on Ethereum, which is why it sparked high controversy and inaction among Ethereum core developers. In Ethereum's governance history, there are a few other examples where Ethereum core developers had to respond to social issues that were not technical but rather related to broader community values and beliefs.

In the following two case studies, Ethereum core developers deliberately chose to take a backseat in leading the development. They delegated much of the decision-making process to the broader Ethereum community, resulting in conflicting voices from various Ethereum stakeholders, leading to delays in issue and proposal resolutions. Since social issues on Ethereum involve a greater number of voices than the number of core developers, it is difficult to reach consensus and often results in uncertain outcomes.

Case Study 4: ProgPoW

What Happened: Programmatic Proof of Work (ProgPoW) is a proof-of-work mining algorithm designed to support less efficient miners and suppress the efficiency of professional miners. Professional miners are individuals or companies operating specialized mining machines called Application-Specific Integrated Circuits (ASICs). These machines are highly optimized to perform a single task and cannot easily be repurposed for other tasks. Graphics Processing Units (GPUs) are computers that can execute a range of different tasks, making them more widely used and cheaper to purchase. The goal of ProgPoW is to make Ethereum ASIC-resistant and prevent the centralization of mining hash power by ASICs. Over the years, the Bitcoin mining industry has been dominated by ASIC machines operated mainly by well-capitalized, publicly traded, and regulated companies.

In April 2018, three years after Ethereum's launch, mining hardware manufacturer Bitmain released the first Ethereum ASIC. The Ethereum community was concerned that the adoption of ASIC technology would inevitably lead to the centralization of hash power, which drove the research and development of ProgPoW. The algorithm was proposed by a development team called "IfDefElse" in May 2018 on Ethereum Magicians.

While the proposal was technically feasible in the eyes of Ethereum core developers, the Ethereum community had differing opinions on the effectiveness of the algorithm in preventing ASIC dominance. Given that ASICs are specialized machines, it is difficult to create a mining algorithm that cannot be optimized to some degree. Other blockchain projects in the industry (such as Monero, Ravencoin, Horizen, Ethereum Classic, etc.) have attempted to create ASIC-resistant mining algorithms, but their effectiveness records have been inconsistent. Given that ASICs were still in their infancy on Ethereum in 2018, the community also questioned whether the issue was truly urgent and whether developers should prioritize addressing it through a hard fork upgrade before other EIPs.

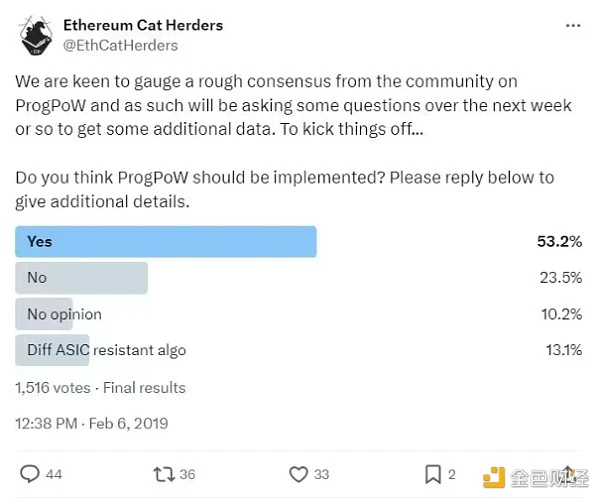

From February to March 2019, nearly a year after the initial EIP proposal, Ethereum client teams conducted multiple surveys with the assistance of the Ethereum Foundation and Ethereum Cat Herders to determine the level of support and consensus for ProgPoW.

Twitter poll hosted by Ethereum Cat Herders, aimed at assessing opinions on ProgPoW. Source: Twitter (@EthCatHerders)

The Ethereum Foundation organized two on-chain votes regarding ProgPoW. The design of the first vote was similar to the vote conducted before the DAO hard fork. It calculated the vote weight based on the amount of ETH held by token holders. The second on-chain vote aimed to survey Ethereum miners' opinions on ProgPoW by allowing individual miners and mining pools to input data into an additional field in the blocks they mined. Both votes indicated overwhelming support from miners for the code change. At the time, nearly half of the Ethereum hash rate participated in the second on-chain vote, with 77% of participating miners voting in support of ProgPoW.

Most Ethereum miners supported the ProgPoW proposal, as the majority of Ethereum miners at the time were GPU miners. However, dapp developers and other Ethereum stakeholders did not support ProgPoW, as they were concerned that the implementation of the algorithm might lead to network splits and devalue ETH. Throughout the debate, prominent Ethereum core developers such as Vitalik Buterin and members of the Geth team reiterated their neutral stance on the change and committed to implementing what the community deemed best. In multiple ACD conference calls, Ethereum core developers acknowledged the technical reliability of ProgPoW. Mining hardware manufacturing companies like Linzhi openly opposed the upgrade.

Participants: IfDefElse is a team of three developers, with two using pseudonyms and only one revealing their personal identity. The public member of IfDefElse is Kristy Leigh Minehan. At the time, she was the Chief Technology Officer of a blockchain infrastructure company called Core Scientific. Minehan participated in several ACD conference calls and Ethereum meetings to explain the ProgPoW algorithm, although the controversy surrounding the algorithm quickly led to Minehan fading from the public eye. In many instances, Minehan became the target of attacks and harassment due to her project. She was accused of being hired by Nvidia and AMD engineers to disrupt ASIC mining manufacturers. Minehan is no longer involved in ProgPoW work. She provides consulting for cryptocurrency companies such as asset management firm Valkyrie and cryptocurrency mining company Merkle Standard.

Resolution of the Issue

To address the community's concerns about the effectiveness of ProgPoW in countering ASICs, Ethereum Cat Herders announced that they would raise $100,000 to commission an independent third party to audit the ProgPow code. From March 2019 to September 2019, Cat Herders spent approximately six months fundraising and commissioned blockchain security company Least Authority to conduct the audit. In September 2019, the audit results were released. The audit confirmed that the ProgPoW algorithm was accurately designed and achieved the goal of encouraging greater resistance to ASICs, although it also warned that future hardware advancements could diminish the effectiveness of ProgPoW over time, as speculated. After the audit was released, Ethereum core developers agreed to incorporate the code changes into an upcoming hard fork. However, ongoing opposition from Ethereum community members, especially dapp developers, sparked controversy and hindered Ethereum core developers from prioritizing the inclusion of ProgPoW in the actual upgrade. The ProgPoW debate continued in the Ethereum community for about two years. In March 2020, during ACD #82, developers had a final public discussion about the code changes. During that conference call, developers expressed their concerns about the lack of support for ProgPow from the community and therefore decided to exclude it from the next hard fork.

Key Takeaways: ProgPoW did not address technical vulnerabilities, hacks, or issues affecting a large number of ETH holders or the security of the Ethereum network itself. The primary proponents of ProgPoW development were miners, whose voices have historically been weak and overlooked due to ongoing efforts to forcibly remove miners from the network by transitioning Ethereum to PoS since its inception. Whenever Ethereum core developers proposed changes to reduce block issuance (e.g., EIP 1234) or to alter miner rewards (e.g., EIP 1559), miners' opposition never swayed the opinions or sentiments of Ethereum core developers. Therefore, the governance process aimed at reviewing and advancing changes from a technical standpoint did not help ProgPoW get activated, and individuals supporting the change had no influence in the Ethereum ecosystem.

Despite on-chain voting and technical approval from Ethereum core developers, the ProgPoW debate illustrated that without broader community support from end users and dapp developers, a group of network stakeholders would be unable to effect change in Ethereum. Ethereum core developers were not opposed to code changes, but they found it difficult to prioritize controversial upgrades and sacrifice other relatively less controversial code changes that garnered more support from Ethereum end users. Additionally, as Ethereum core developers began shifting their focus towards PoS and the deprecation of mining algorithms from early 2021, the demand for ProgPoW gradually diminished.

Case Study 5: Afrigate

What Happened: It is not common for Ethereum core developers to be ousted from the Ethereum community. However, as mentioned in the previous case study, in some instances, intense social media harassment led to some EIP authors withdrawing from public discussions. Ethereum core developer Afri Schoedon was one such case, as he was a developer of the Parity client built by Parity Technologies. Parity Technologies was co-founded by one of Ethereum's co-founders, Gavin Wood, along with Vitalik Buterin and six others. In addition to the Parity Ethereum client, Parity Technologies also built another general-purpose blockchain called Polkadot. Schoedon had been a contributor to Ethereum's code since 2015 and was a key coordinator of Ethereum hard forks. On February 14, 2019, he tweeted that the Polkadot protocol was actively being developed:

Ethereum core developer Afri Schoedon jokingly created a meme for the Polkadot protocol. Source: Google Webcache

Within the next 48 hours, Schoedon faced harassment, criticism, and bullying for his tweet, which was clearly meant as a joke. Critics on social media accused Schoedon of having a "conflict of interest," despite Schoedon reiterating that he had never been directly involved in the development of Polkadot. Schoedon clarified on Twitter that his meme was meant to spark discussions around the development of Serenity, the name for Ethereum's transition to PoS at the time, and not to create a narrative of competition between Polkadot and Ethereum. However, the ongoing criticism led Schoedon to delete many of his tweets and eventually announce on February 19 that he would be leaving the Ethereum community. "I did not quit social media, I quit Ethereum. I did not go into hiding; I just left the community. I am no longer coordinating hard forks, building testnets, or contributing otherwise. I do not work for Polkadot, I have never worked for Polkadot, I worked for Ethereum. I do not hate Ethereum, I love it," Schoedon said in his final tweet before deleting his Twitter account.

Participants: While Schoedon was the primary participant in the event, after his departure, other Ethereum core developers and community members came to his defense. Schoedon continued to assist Ethereum Classic with upgrades to improve its compatibility with Ethereum. As of July 2023, he continued to contribute to Ethereum in a less public manner, coordinating Ethereum testnets and frequently using different pseudonyms.

Resolution of the Issue: In the ACD conference call the following month after the Twitter incident, Ethereum core developers announced that they were seeking a new hard fork coordinator to replace Schoedon's role. However, the search did not last long. Due to the lack of suitable candidates, developers agreed to divide Schoedon's role among multiple individuals. Since Schoedon's departure, the responsibilities of the hard fork coordinator (including setting hard fork dates, selecting EIPs for the hard fork, and leading upgrade testing) have been dispersed among multiple core developers and client teams. Additionally, in February 2019, 115 prominent members of the Ethereum community signed an open letter condemning the "harmful" behavior that led to Schoedon resigning from his role as an Ethereum core developer. The letter reiterated the necessity of standards and norms surrounding debates on Ethereum protocol development, aimed at promoting respect, freedom of speech, and privacy values among participants. Former ACD chair Hudson Jameson also hosted an AMA on Reddit to address the debate surrounding Ethereum leadership and accountability. In March, Ethereum client team ChainSafe held an in-person event in Paris to further discuss recognizing issues in the Ethereum governance process and propose improvements.

Main Content:

The departure of the prominent Ethereum core developer Afri Schoedon from the Ethereum community has sounded an alarm for Ethereum core developers, dapp developers, and end users, making them aware of the real impact of social media harassment on Ethereum governance. As a decision-making process that is off-chain and defined quite loosely, Ethereum core developers, while focused on technical issues and Ethereum-related affairs, are also unable to escape the pressure of social debates and leading Ethereum development. Online harassment, whether related to Ethereum or not, is harmful activity in any context, and it has a negative impact on the behavior and mindset of the targeted individuals. Given that Ethereum's decision-making process heavily relies on online media for discussion and debate, it is difficult to prevent such behavior. After all, this is not the only example of contributors to the Ethereum governance process being harassed and excluded in the community. However, Afri Schoedon's resignation has prompted a greater focus on the Ethereum governance process and the need to establish stronger norms and social values in this process to promote healthy and respectful dialogue among participants.

Consensus on the Proof of Stake Upgrade

Since its inception, Ethereum stakeholders have been eagerly anticipating the transition to the Proof of Stake (PoS) consensus protocol. Therefore, in the years leading up to the merge, there was almost no controversy or opposition within the community regarding the idea of upgrading Ethereum to PoS. However, at different times in Ethereum's history, there were disputes over the technical merits of achieving the transition through one method versus another. Additionally, in the first six years of Ethereum's existence, there were points of contention over the urgency of this upgrade and whether it took precedence over other initiatives, such as improving Ethereum's scalability and censorship resistance.

Once the Ethereum client teams resolved the technical debates around the transition to PoS and finalized the activation roadmap in the fall of 2022, Ethereum core developers and the broader Ethereum community almost unanimously welcomed this upgrade. The code changes involved in transitioning Ethereum from PoW to PoS were one of the most successful and transformative EIPs in Ethereum's history. No other upgrade had garnered as much community support and excitement as Ethereum's transition to PoS. The transition to PoS was a multi-year effort, initially relying on ETH holders to capitalize and bootstrap the protocol by staking ETH, with no guarantee of when the staked ETH could be withdrawn. Despite being delayed due to its complexity and often ridiculed and discouraged by members of the Bitcoin community and Ethereum miners, the eventual transition to PoS (referred to as the merge) solidified a strong narrative for Ethereum and its assets, known as the "ultrasound money" narrative.

The following case studies delve into the transition of Ethereum to PoS and the governance processes involved in two parts of the upgrade.

Case Study 6: The Merge

What Happened: The transition to PoS went through several iterations. It became the most delayed upgrade in Ethereum's history, initially expected to be ready two years after Ethereum's launch. The decision to merge the existing Ethereum codebase with the beacon chain (Ethereum's CL) was a difficult one, as many Ethereum client teams were working on upgrading Ethereum with the beacon chain replacing Ethereum. In 2018, the client teams building the transition to PoS were referred to as the Ethereum 2.0 teams. They worked alongside another group of developers dedicated to Ethereum's short-term plans, known as Ethereum 1x, from which ideas such as EIP 1559 and statelessness were developed. Throughout much of the history leading up to the merge upgrade, efforts to advance PoS were largely separate and ran parallel to the development of the Ethereum core protocol. The merge was initiated on September 15, 2022.

Participants: The main teams involved in achieving the merge were a new set of Ethereum client teams, many of which had not previously built and maintained existing Ethereum clients. Examples of these new client teams contributing to Ethereum's upgrade to PoS include Prysmatic Labs, Lighthouse, and ChainSafe. The launch of the Beacon Chain in December 2020 was primarily due to the efforts of these relatively new PoS-focused client teams. After the launch of the Beacon Chain, the CL client teams began to actively engage and involve the EL client teams in the transition. Ethereum Foundation researcher Danny Ryan was one of the main drivers of the merge upgrade plan. He continued to lead Ethereum's consensus layer development and served as the head of ACDC.

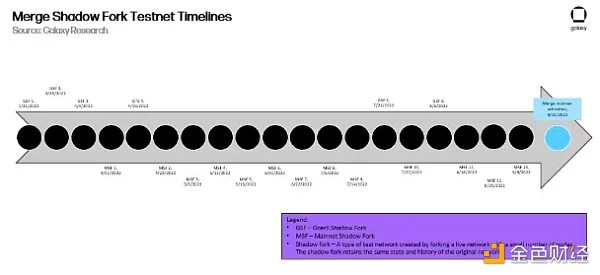

Resolution of the Issue: Prior to the activation date of the merge, an unprecedented amount of testing was conducted to ensure a smooth transition. Ethereum core developers organized over 25 different testnet releases for the merge. The following is an explanation of the shadow fork testnet releases organized by Ethereum core developers in the months leading up to the merge activation:

Additionally, in the weeks leading up to the merge activation, the Ethereum Foundation-funded bug bounty program was increased fourfold to $1 million, the highest amount ever funded by the organization. The merge required close coordination between CL and EL client teams and validator node operators, the latter of whom were less proficient in upgrading node software than miners. The nature of the upgrade also required more involvement from node operators to correctly configure client software in preparation for the merge. The Ethereum Foundation and Ethereum Cat Herders once again served as central points of contact for Ethereum stakeholders and educating the broader public about the nature of the upgrade. The merge did create a temporary fork in Ethereum, but none continued to have meaningful value or support a significant amount of dapp activity.

Main Content (continued):

Due to the merge, Ethereum's complexity doubled as the protocol is now a combination of two networks developing in sync. This requires a separate governance process to organize code changes proposed for each network (i.e., Ethereum's EL and CL). As mentioned earlier, there are two ACD conference calls every two weeks to discuss EIPs related to EL and CL. However, Ethereum software has other components, such as the engine API that affects EL and CL, and these components do not have a clear governance process for changes and updates. This has sparked new discussions about future updates to the EIP process to better organize changes to Ethereum, taking into account the protocol's dual-network structure. (These future changes to the EIP process will be discussed in more detail in the next section of this report.)

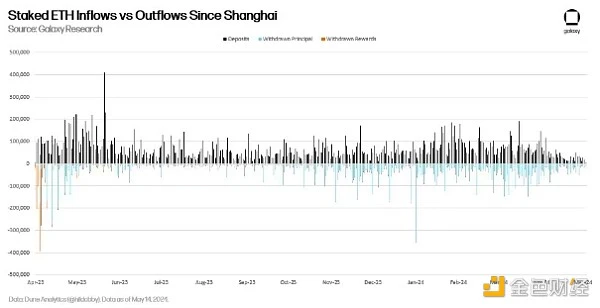

Case Study 7: The Shanghai Upgrade