Author: Robert John

Translation: Shanooba, Golden Finance

If you have been involved in the cryptocurrency field, you may have heard about the heated discussions surrounding NFTs. These non-fungible tokens have caused a sensation in the digital world, turning everything from digital art to virtual real estate into valuable assets. Among the many platforms hosting these digital treasures, two names have stood out: Solana and Ethereum. So, what's the deal, and why are we comparing these two platforms? Let's analyze.

Overview of the NFT Market

NFTs are unique digital assets verified using blockchain technology. Unlike cryptocurrencies like Bitcoin or Ethereum, which are identical and interchangeable, each NFT is one-of-a-kind. This uniqueness gives NFTs value, making them ideal for representing ownership of digital items such as artwork, music, and even tweets.

So, why are NFTs important? They have fundamentally changed the concept of ownership in the digital realm. Artists and creators can now sell their work directly to consumers without intermediaries and earn royalties on future sales. This new model provides unprecedented opportunities for digital creators and collectors.

Leaders in the Current NFT Space: Solana and Ethereum

When it comes to platforms hosting these NFTs, Ethereum has unquestionably been the dominant player. It was the first to introduce smart contracts to blockchain, which are crucial for creating and trading NFTs. Ethereum's ecosystem is vast, and many of the most valuable and famous NFTs are hosted on its blockchain.

But hold on, there's a new contender now—Solana. In the past month, Solana has made headlines for its explosive growth in the NFT space. Known for its speed and low transaction fees, Solana has quickly become a favorite among NFT creators and traders. In just 30 days, Solana minted 32 million NFTs, while Ethereum only minted 1 million. This remarkable difference clearly indicates that Solana is rapidly gaining attention.

Creating an NFT collection on Solana is a good idea because its high transaction speed and low fees make the minting process efficient and cost-effective. Additionally, Solana's growing active community provides a supportive environment for new projects to gain visibility and attention.

Why This Comparison Matters?

So, why should we care about the competition between Solana and Ethereum? Firstly, understanding the dynamics of the NFT market can provide valuable insights into industry trends. It's not just about which platform is better; it's about understanding the strengths and weaknesses of each platform and how they cater to different needs within the NFT ecosystem.

For example, Ethereum's established reputation and widespread adoption make it the preferred choice for high-value NFTs and projects requiring strong security. On the other hand, Solana's speed and low costs make it the ideal choice for creators needing to mint a large number of NFTs quickly and economically.

Impact on Investors, Creators, and Collectors

For investors, understanding which platform is gaining attention can help make investment decisions. If Solana continues its upward trend, investing in its native token (SOL) could yield substantial returns. Similarly, understanding market trends can help collectors make wise choices when purchasing NFTs.

For creators, platform choice can significantly impact their reach and profitability. Solana's low fees mean that a larger portion of the sale price goes directly to the creator, which is a huge advantage for many artists. Conversely, Ethereum's user base and higher sales volume may mean that their NFTs receive greater exposure and command higher prices.

Solana Surpassing ETH

Let's get straight to the point. If you've been closely following the NFT space, you'll know that significant changes have recently occurred. Solana has surpassed Ethereum in the NFT market in the past month. So, how did this happen? Let's delve into the details.

Numbers Don't Lie: Solana's NFT Boom

First, let's talk numbers. In the past 30 days, Solana minted a staggering 32 million NFTs. In comparison, Ethereum only minted 1 million NFTs during the same period. Solana leads by 31 million NFTs. This is not just a small victory; it's a huge leap, highlighting Solana's disruptive impact on the NFT market.

The number of NFTs minted on Solana demonstrates its efficiency and speed in handling large-scale operations. Solana's blockchain design can process thousands of transactions per second, making it a powerful platform for NFT creators needing to quickly mint and manage a large number of digital assets.

Top Players: Notable NFT Collections on Solana

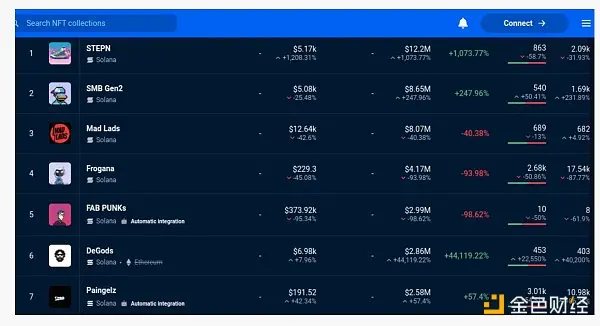

Now, let's focus on some top NFT collections driving Solana's rise. Leading the way are STEPN, SMB Gen2, and Mad Lads. These collections have not only attracted significant attention but also brought substantial trading volume, reinforcing Solana's dominant position in the NFT space.

Interestingly, two high-profile projects, y00 ts and DeGods, which recently migrated to Solana, did not make it into the top five collections. This indicates that while projects are migrating to Solana, it's the emerging and native projects that are the primary driving force behind the platform's success. The diversity and vibrancy of Solana's NFT ecosystem clearly demonstrate the vitality and expansion of its community.

Ethereum's Response

While Solana has attracted significant attention, we also need to look at Ethereum's response. Despite being surpassed in the number of NFTs minted, Ethereum still maintains an advantage in other key areas.

Sales Comparison

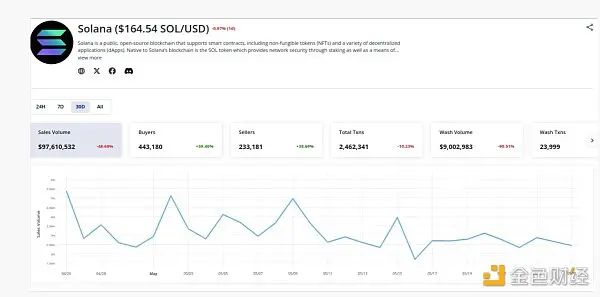

When we look at sales figures, Ethereum continues to demonstrate its market strength. In the past month, Ethereum's NFT sales reached an astonishing $193 million, whereas Solana's sales amounted to $99 million. This difference indicates that, despite Solana's lead in quantity, Ethereum's NFTs still trade at higher prices and enjoy greater recognition.

This disparity in sales figures indicates that Ethereum remains the preferred platform for high-value NFT transactions. Ethereum's reputation and its large network of buyers and sellers have contributed to these higher sales figures. This serves as a reminder that, despite Solana's rapid rise, Ethereum's dominant position in the NFT market has not diminished.

Dynamics of Buyers and Sellers

Another important aspect to consider is the number of active buyers and sellers. In this regard, Solana once again demonstrates its advantage, with significantly more participants in the NFT market. This increased activity indicates a more active and engaged community, which is crucial for the continued growth and innovation of the NFT space.

Having more active participants on Solana means higher liquidity and more opportunities, which is good news for creators and traders alike. This reflects a vibrant market where NFTs are not only being minted in large numbers but also actively bought and sold. This level of engagement is crucial for nurturing a healthy and thriving NFT ecosystem.

Impact of Market Dynamics and User Engagement

So, what does this mean for the future of NFTs on Solana and Ethereum? First, Solana's ability to mint a large number of NFTs and attract a significant number of active participants indicates its advantage in capturing market share, especially for creators looking for an efficient and cost-effective platform.

On the other hand, Ethereum's high sales figures emphasize its continued dominance in value and reputation. For collectors and investors looking for high-value NFTs, Ethereum remains the top choice. Meanwhile, Solana's rapid growth and high activity make it an ideal platform for emerging projects.

Price Performance: SOL vs. ETH

Now, let's talk about the exciting price performance. Solana (SOL) and Ethereum (ETH) are two giants in the cryptocurrency space, and their price movements always attract attention. In the past month, SOL has shown impressive upward momentum.

Bullish Market for SOL

In the last 30 days, the price of SOL has risen by 2.5% to reach $169.30. This increase is not just a random fluctuation but reflects a broader bullish trend, sparking discussions among investors. When the price of a token rises, it typically reflects growing confidence and interest from traders and investors. For SOL, this increase has pushed its market value to over $76 billion, which is no small feat.

This price increase has also had a positive impact on investor sentiment. The weighted sentiment index, measuring overall investor sentiment towards an asset, has shown an increase. More and more people are talking about SOL, and the sentiment is very positive. This is crucial because market sentiment often drives future price movements. When people are optimistic about an asset, they are more likely to buy, further driving up the price.

Impending Bearish Signals

But hold on, it's not all sunshine and rainbows. Despite the bullish market, there are still some bearish signals to watch out for. According to Coinglass data, Solana's long/short ratio has decreased in the past 24 hours. This ratio is a key indicator of market sentiment and trader behavior. A low ratio indicates more traders are interested in shorting the asset, which means they are betting on the price to fall.

So, why is this important? If the trend of decreasing long/short ratio continues, it may signal a market correction. Traders may start selling their positions, leading to a price decline. This reminds us that while short-term gains are exciting, the cryptocurrency market is volatile, and trends can change rapidly.

Competitive Advantages

Now, let's delve into what sets Solana apart and why it's attracting so much attention.

Solana's Advantages: Speed, Scalability, and Community

One of Solana's biggest advantages is its speed. The blockchain can process thousands of transactions per second, far exceeding Ethereum's current capacity. This speed is crucial for NFT creators and traders needing fast and efficient transaction processing. No one likes to wait for transactions to complete, especially when dealing with time-sensitive assets like NFTs.

Then there's the issue of transaction fees. Solana's fees are significantly lower than Ethereum's. Lower fees mean more creators and traders may use the platform, allowing them to retain more profits. For those minting or trading NFTs, this could be a game-changer.

Another factor favoring Solana is its growing and active user base. The more people using the blockchain, the more active and dynamic the ecosystem becomes. Solana's community is not only large but also highly engaged, providing a strong and supportive environment for new and existing projects.

Ethereum's Enduring Appeal

Despite Solana's advantages, Ethereum still holds significant advantages in several areas. Ethereum has a mature market and a robust infrastructure built and tested over many years. This longevity and reliability make it the preferred platform for many high-value NFT projects.

Ethereum's ecosystem is vast, with a multitude of tools, applications, and services supporting NFT creation and trading. This infrastructure provides a level of security and reliability that new platforms like Solana are still striving to achieve.

Additionally, Ethereum is undergoing the Ethereum 2.0 upgrade, aimed at addressing some scalability and fee issues. These upgrades may make Ethereum more competitive and potentially address some criticisms that have allowed platforms like Solana to gain traction.

Conclusion

While Solana has performed well in the NFT space, Ethereum remains the top choice for many high-value NFT projects due to its stable market position and robust infrastructure. The Ethereum 2.0 upgrade is expected to address its current scalability and fee issues, further solidifying its market position. For new creators and projects looking to enter the NFT market, Solana's high transaction speed and low fees offer an attractive option. By creating NFT collections or establishing a marketplace on Solana, creators and businesses can leverage its technical advantages for efficient, cost-effective operations and engage with an active community to ensure project success.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。