Authors: Joyce, Sky

Three months ago, in the first phase of the incentive program launched by io.net on March 1st, io.net's founder and CEO Ahmad Shadid stated in an interview that the token was expected to go live on April 28th. Even as io.net's GPU supply surged in the following month, io.net's CMO Garrison stated in an interview in early April that "io.net" would still proceed with the token release as planned, coinciding with the release of Nvidia's financial report, which would be an appropriate timing."

However, on April 25th, the io.net team announced in the Telegram group that the trading platform requested the TGE of io.net tokens to be postponed until after April 28th. Now, a month has passed since the original time, and the release date for io.net's token is still undetermined. However, after the snapshot, the community seems to have lost interest in io.net.

Since the start of the mining incentive program, io.net has undergone drastic changes in the past three months, initially gaining popularity and being seen as the star project of this bull market round. However, the project's data has been repeatedly questioned for falsification, and the founder has been exposed for a controversial history, leading to a large number of users forming a "condemn io.net" rights protection group. Although the token has not yet gone live, many users still believe that the high return expectations have been dashed, but "overall, io.net is a good project."

After all, everyone understands that outside of io.net, the market has shifted. Ten days ago, amid dissatisfaction in the community with "high FDV" projects, Binance announced a modification to its listing rules, beginning to support small and medium-sized crypto projects, aiming to provide opportunities for more small and medium-sized projects with good fundamentals, organic community bases, sustainable business models, and industry responsibility, in order to drive the development of the blockchain ecosystem. And today, following the token delay, io.net announced that the third phase of the mining activity will commence on June 1st.

Unprecedented Traffic

Looking back, the explosion of io.net two months ago was inevitable. Since February, AI has become the recognized wealth code in the crypto community. Nvidia's stock continued to hit new highs, OpenAI launched revolutionary new products, and WLD multiplied several times in just a few days, with a multitude of AI tokens outperforming the vast majority of race tokens.

Well-equipped, retail investors queuing up

According to the usual story development, this round should have produced some new AI projects, and lucky early community users would reap hundredfold benefits. Adhering to the principle of "buy new, not old," among the many AI projects, io.net appeared to be the most "reliable" project.

Generally, the community commonly divides the integration path of AI and Web3 into three sub-directions: computing power, algorithms, and data. Two months ago, many new AI projects emerged, with GPU leasing being the most favored positioning among the projects. For most retail investors, it is difficult to understand the positioning and development space of such projects in the combination of AI models, applications, and encryption technology at the popular science level. However, Nvidia's continuous rise has made everyone realize the necessity of "computing power," giving io.net's chosen direction a natural advantage in user awareness compared to other projects.

Essentially, the decentralized computing power projects currently emerging belong to the Depin category, and Depin projects on Solana experienced a frenzy in the market last year. The combination of AI, Solana, and Depin made io.net a "chosen project." In addition to choosing the right track, io.net also had deep cooperation with Render Network in the early stages. At that time, RNDR was in an upward cycle, rising from less than $4 to $13 in two months.

In February and March, there were hardly any KOLs promoting io.net on social media. However, since io.net launched the two-month Ignitio.netn incentive program on March 1st and directly announced the token's launch date—after April 28th, a large number of users flocked to io.net. A user who participated in io.net early on told BlockBeats, "The number of Discord community members increased tenfold in a week."

On March 5th, io.net announced the completion of a $30 million Series A financing round led by Hack VC, with other lead investors including Multicoin Capital, 6th Man Ventures, Solana Ventures, OKX Ventures, Aptos Labs, Delphi Digital, The Sandbox, and other institutions. Multicoin Capital had a glorious track record in the Depin field, having participated in the early financing of Helium Mobile (MOBILE). In addition, individual investors included Solana co-founder and CEO Anatoly Yakovenko, Sandbox co-founder and COO Sebastien Borget, and Animoca co-founder and executive chairman Yat Siu.

With the backing of powerful VCs, technical challenges in the process of decentralized computing power implementation and whether there is sufficient and appropriate demand to pay for users and platforms are not within the consideration of participants. "From the user's perspective, I'm not afraid of whether you will succeed or not, it depends on how well you tell your story."

The technical entry barrier for io.net is not low. BlockBeats observed that at the beginning of the activity, Discord was filled with bug feedback, and the project team specifically opened a channel "support ticket" to receive and address user-submitted issues. Early participants in io.net told BlockBeats that the "high entry barrier" was also one of the reasons they were optimistic about io.net, which meant "less competition" and the ability to obtain more chips. However, what the community did not expect was that various io.net mining tutorials would become popular across the internet.

io.net user Zhu Rui (pseudonym) detailed his experience to BlockBeats. When he first attempted to participate, Zhu Rui found that his device did not meet the requirements listed on the official website and gave up. However, he later found that more and more people around him were mining io.net, with many people showing off multiple Mac minis, "I have a friend… who has a lot of Mac minis… I don't know what they're for…"

Perhaps as a precaution against "lurking studios," io.net did not disclose the details of the points system, only stating that points would be related to factors such as machine online time, bandwidth rating, GPU performance, and device rental time. In addition to contributing their own devices, participation in the Galaxy Mission and Discord activity levels would also bring varying points, but more users chose to purchase more devices and come fully prepared.

Not wanting to miss out, Zhu Rui began to consider joining. He carefully studied the configuration plans circulating in the community, first considering directly buying Mac minis, "This strategy is suitable for players with a small number of graphics cards, because it is troublesome to configure more than 100, and requires dedicated personnel in a dedicated venue for maintenance. Just like a mining farm, it is a heavy asset. However, there are also benefits, as they can be sold second-hand at half price after use, or switched to mine other projects." During his research, he speculated that there might already be a tendency for this direction to become popular, "The price of buying a Mac mini on Pinduoduo was 2100 RMB earlier, and two weeks later it was already 2800."

In addition to purchasing Mac minis, some users also chose to rent cloud servers. "There are domestic and foreign ones. Domestic ones are generally in some computing centers, with a cost of about 150u-200u for a single 3080ti card." The cost of overseas ones is higher, "Google Cloud's single card price is about 1400u per month, requiring an annual rental of 50 or more; Tencent Cloud is often out of stock, with no inventory; AWS's single card price is around 2400u per month, requiring 8 or more."

Zhu Rui ultimately chose the "boutique" route and obtained over 200 T4 single-card machines from a small overseas cloud service provider, with a monthly rent of 400U per machine. In addition, he also equipped 15 A100 8-card machines, with a monthly rent of 1200U per machine. Over the course of a month, Zhu Rui had to spend around $98,000 on equipment alone.

In addition to equipment costs, Zhu Rui also made thorough preparations for witch detection. He purchased hundreds of IPs and manually changed the passwords of 100 Google mail accounts he bought, spending a week setting up all the devices.

Zhu Rui represents a larger-scale user of io.net. For small and medium-sized retail investors, after successfully "entering" by setting up their devices, they face a series of challenges.

One io.net user recalled to BlockBeats that after going through the complex configuration process, users still had to deal with a series of issues. Devices connected to io.net often went offline, and it was difficult for users to determine whether their devices were online. "It's possible that your front end shows the device is online, but in reality, it's offline. We had no choice, so we ended up writing a script to automatically restart the connection every day to deal with this issue."

In addition to the high financial cost, io.net users also need to constantly check the status of their devices. For those who are unable to write scripts, they can only reconfigure manually. In a configuration tutorial on YouTube with over 10,000 views, the airdrop blogger was also at a loss about this issue, stating, "If you can't see the device's running status on the official page after completing these configurations, I suggest going through the entire process again."

The high maintenance cost is actually part of io.net's design. The official explanation is that repeatedly making users reconfigure is to filter out witch accounts. In the later stages of the activity, this frequency has been greatly reduced. At the time, some users also interpreted this as a positive signal, after all, "the bigger the storm, the more expensive the fish." For "battle-hardened" Web3 players, as long as the later returns are substantial enough, the early physical and mental investment is worth it.

"Cloud service providers are all mining io.net"

The popularity of io.net has not diminished despite users' complaints about the high maintenance cost. A video title from two months ago by YouTube blogger "Alex Crypto Diary" may be the most fitting explanation of the situation at the time: "【io.net】The most reliable combination of computing power and encryption in the AI X Crypto track. Two weeks ago, we planned to mine io.net with 600 machines, and two weeks later, the dream of the data center was shattered! But there is no doubt that this is the best project in the same field before the release of Gensyn."

In the video, blogger Alex explained the reason for the "shattered data center dream." Originally, they planned to deploy 800 devices and estimated that the computing power could account for about 1%-2% of the entire network. They had found a data center overseas and were negotiating prices when io.net suddenly became popular. All the overseas cloud service providers they had previously contacted asked them if they were mining io.net, and the data center they had previously negotiated pricing with doubled their quote.

io.net's rise has made domestic and foreign cloud service providers that have bought empty machines or raised prices the biggest winners in this wave of popularity.

Currently, there is no specific profit figure for cloud service providers in this wave of unexpected fortune brought about by io.net. Alex once stated in a tweet that the leading overseas cloud service provider Amazon Cloud generated $40 million in revenue from providing io.net mining services. Although there were more doubts in the comments about this figure, if we consider the tens of thousands of GPUs displayed on the io.net front end at the time, this figure may not be an exaggeration.

Not only have overseas cloud service providers benefited, but several users interviewed by BlockBeats expressed the same understanding: "All domestic cloud service providers are mining io.net."

A cloud server provider with data center resources, who does not serve retail investors, using the pseudonym "Xiaoju," revealed to BlockBeats, "Looking back now, renting machines for io.net is the easiest business I've ever done." When asked about the specific rental scale, Xiaoju said, "As long as you have enough machine resources, it's very simple to rent out machines for a few million a month, and it's not difficult to rent out tens of millions. It's possible to make an effort to rent out hundreds of millions of machines. All the domestic and overseas clouds, all the machines are sold out, and almost all the data centers in China have been rented out. At the time, all the machine merchants in the market raised prices, and whether you rent or not, if you don't rent, someone else will rent them soon."

In addition, because the devices supported by io.net also include Apple's Mac mini, "those who grabbed the airdrop bought up all the Mac minis worth billions on Pinduoduo, and the Mac minis on Xianyu also increased in price by a few hundred yuan."

Even in April, when the first phase of the io.net incentive program was more than halfway through, users continued to try to purchase more devices. Xiaoju recalled, "After April, I didn't rent out machines anymore, but many people still approached me to rent them. I replied that it's not cost-effective to rent for a month, and even if you rent, you'll basically end up losing money. Don't do it, it's too much trouble."

Misplaced Expectations

Looking at the stories that have unfolded in the crypto industry in the past, users who invested in io.net seem to have miscalculated the formula. Faced with the risk of being counter-lurked, there are inevitably many emotions. However, for a Web3 project, the io.net project team itself has not done too much "evil," continuously improving the interactive experience and being able to respond relatively quickly in the face of controversy. However, various problems have indeed occurred, and over the past three months, io.net has often found itself in an awkward position.

After the first phase of the points was announced, many users received very low points because their machines were not online during the snapshot period, and there were some rights protection actions directed at the io.net project team in the community. Zhu Rui recalled that on May 3rd, someone on Twitter initiated a "Struggle Against io.net" space, which attracted over 1,000 users without any preheating, and the WeChat group was filled with rights protection information.

Unintelligible points

Unlike other projects with transparent points systems, it seems that io.net never intended to release a points panel from the start. BlockBeats once asked a user close to the io.net project team about the issue of front-end statistical points in early March, and he speculated, "It may be due to a lack of manpower. If I have the opportunity, I will suggest it to them."

Over the two months since the io.net points program started, there have been constant voices questioning the accuracy of the GPU quantity displayed on the io.net platform. The most attention was given to the doubts raised by community member Martin Shkreli on May 13th. He posted several tweets on Twitter questioning the accuracy of the io.net front-end data and received a personal response from io.net founder Shadid.

In his tweets, he believed that the platform's displayed earnings did not match the actual situation. For example, he found that the platform's daily earnings were always $1.1 million, but the number of online clusters was very low, and the total calculation time on the platform always showed 88 hours, and so on. After receiving Shadid's explanation, Martin Shkreli then released his own calculations of the specific daily earnings indicators. Shadid's response mainly revolved around errors in data statistics indicators, such as the difference between average daily earnings and cumulative earnings, and that earnings were not calculated for clusters of other specifications.

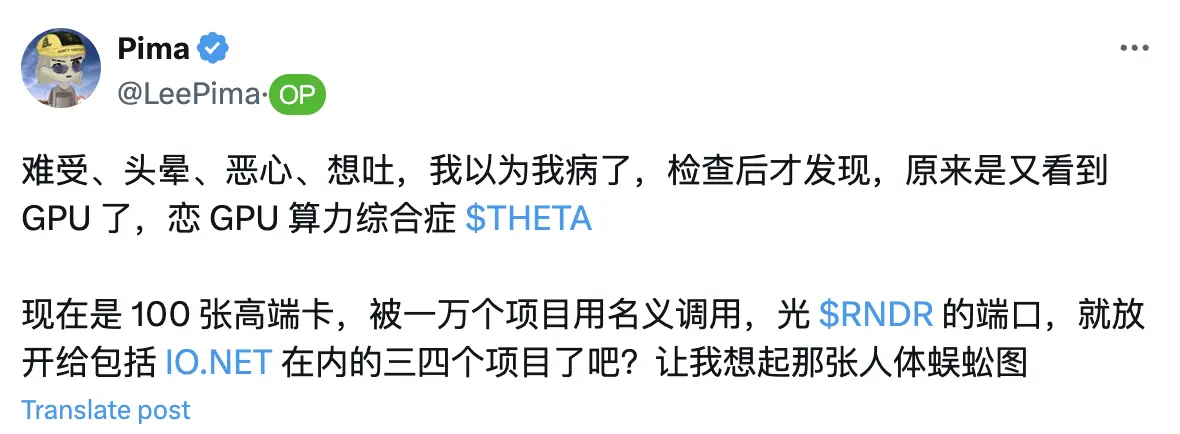

A founder of ContinueCapital, Pima, pointed out two months ago that several current decentralized AI projects are calling each other's ports and "sharing computing power." An early anonymous user of io.net also explained to BlockBeats that the devices provided by users on io.net may be rented on Render Network, and vice versa. In early April, the io.net front end displayed a quantity of available GPUs of around 200,000, while Render Network's available GPUs were around 3,700.

In this situation, it may be more challenging to calculate the points accurately, testing technical capabilities. Investment firm Mint Ventures mentioned in their analysis of io.net the issues that need to be addressed in achieving decentralized computing power, including engineering verification, parallelization, and privacy protection. The technical obstacles involved in parallelization include considering decomposing AI tasks, data dependencies, and communication costs between devices.

Objectively speaking, some users did indeed encounter the situation of purchasing "fake card" shard machines. Xiaoju explained to BlockBeats, "At that time, the machine rental market was chaotic. In theory, the market was in great need of machine resources, but there were many machine merchants who could provide as many machines as you wanted. In reality, they were selling virtual machines as real machines to you. For example, they could use one 4090 to virtualize an unlimited number of cards, allowing merchants to make money at zero cost. These machines are easily identified in the end and are not distributed due to being caused by witches."

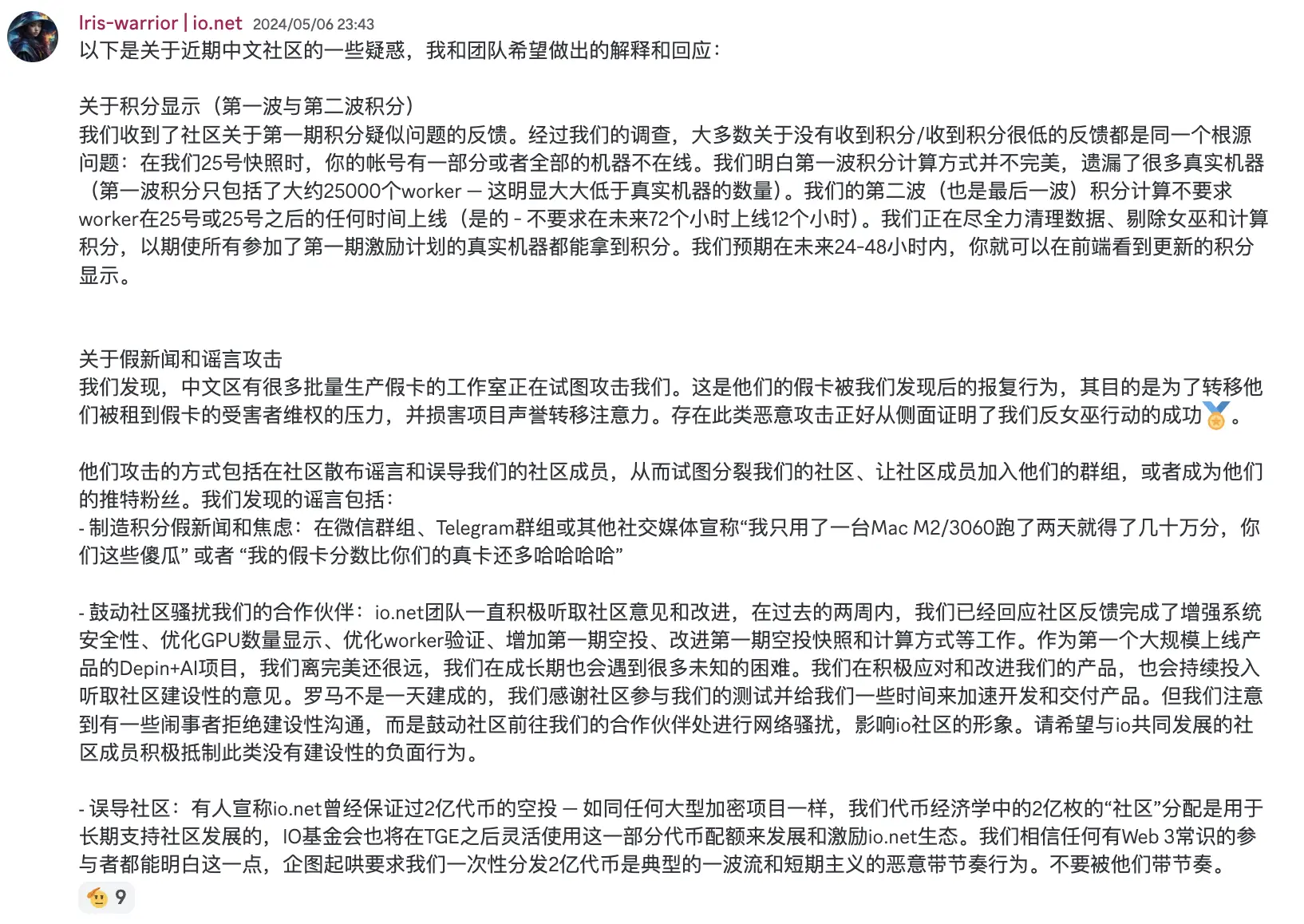

Faced with the "condemnation" from the entire network, the io.net team issued a lengthy response in Discord. They stated that they would conduct a second round of points calculation, excluding witches and retaining genuine users. In addition to the points dispute, the team also stated that the community was facing "fake news and rumor attacks," pointing out that it was driven by the fake card studio.

Regarding the issue of data pollution caused by fake cards, feedback from different io.net users to BlockBeats all mentioned that this issue had been present for a long time. "Two months before io.net announced the points, I knew that a group of people were creating a large number of fake cards. I went to the data center at the time to report it, but the official did not respond to me. I often saw others reporting this issue, but it did not attract the attention of the official until they said they would start identifying fake machines when they began calculating the points. It was too late," Xiaoju told BlockBeats.

ImbaTrader also recalled, "In the early days, there were only a few thousand people on Discord, and at that time, a student claiming to be from a certain university in the United States questioned the falsification of the GPU device quantity displayed on the io.net front end, but no one responded to this matter."

However, on the other hand, the ambiguous points did provide enough room for the io.net project team to adjust the chip allocation according to the situation. After "too much trouble" became the key phrase in io.net-related discussions, the community members generally reflected a situation of "low points for big holders." "Small accounts (one or two machines) have more points than my dozen high-end GPU big account. Observing, small accounts generally have higher points, while accounts with many devices have lower points, which seems to be suppressing big holders and supporting retail investors." After the second points update, some users found that their points had tripled.

Regardless of how the points are distributed, the total amount of tokens given to miners remains unchanged at 32 million tokens. And it seems that the project team "holds" a significant portion of these mining devices.

A user expressed to BlockBeats in early March, "I think many of the A100s inside may be machines belonging to the project team." However, considering that device records are not on the chain, the community also questioned the possibility of front-end data falsification by io.net.

In a video posted on YouTube in April, blogger Alex Crypto Diary recounted that they originally observed the GPU device quantity on the io.net front end to be between 60,000 and 80,000. One night, it suddenly increased to 140,000 to 150,000. They found that the GPU device quantity displayed on the front end increased by several thousand every half hour, and suddenly there were over 20,000 additional 4070s. Considering that the online status of devices from real users is not stable, it is hard to believe that the linear growth in numbers is not due to actions by the project team.

A few days ago, Asa, the head of io.net in the Asia region, participated in a space where he responded to community users' questions about "inconsistent front-end and back-end data, and centralized device data recording." Asa responded, "Decentralized technology stack improvements will be implemented later. The workload of our technical team in the past month is equivalent to that of the past three months."

The strict measures against witches, delayed identification of fake cards, and opaque points inadvertently raised the participation cost for genuine users who wanted to interact properly. In addition to economic costs such as traffic and electricity, "it both PUA you to hang on for a long time and does not tell you the actual points, so everyone has put in a lot of effort, and the rebound afterwards will be so significant." User Liu analyzed in response to the rights protection actions initiated by the community before the issuance of io.net tokens.

Unfavorable Chips

Xiaoju deeply felt, "For me personally, losing money on io.net is a small matter. io.net is the most torturous project I've ever been involved in. I would lose connection several times a day, and after all the machines went offline, it would take several hours to maintain them, and after maintenance, they would go offline again. In short, io.net is the most torturous project I've ever been involved in, a shadow over blockchain."

From the perspective of the project team, the criticized high maintenance threshold is actually for the management of low-quality nodes. Garrison Yang, Chief Operating Officer of io.net, mentioned in a podcast interview that when discussing the airdrop process, they specifically introduced the management of low-quality nodes, "We have introduced 'time score' and 'reputation score.' Each node on io.net has a reputation score, and clients can see the time a node has been available, the time it has been online, and other performance indicators to help make decisions. We constantly ping each node, and if a node does not respond, it is considered unavailable. If it is unavailable, it will not receive rewards."

In the team's vision, "The incentive in the crypto economy is straightforward: if a node is available, it provides better service to the demand side and is hired more frequently, earning more rewards. As long as the node maintains availability and performance when hired, the demand side will obtain the required computing power, a win-win situation." Although this setting later led to one of the controversies faced by io.net.

Based on valuation, token share, total points, and off-market prices, most users, except for early participants, feel that they will not make much profit on io.net. "About a month before the airdrop points were announced, I roughly knew that it would be counter-lurked, because the airdrop is limited, but the machines are unlimited," "Based on the off-market price and the ratio I estimated, in the worst case, I would lose about half, and in the best case, I would break even at most."

However, despite this, Xiaoju believes that the problem with the project team lies in the technical loopholes that have appeared, rather than intentional malice. "The machines are all rented, and io.net has never taken a penny from retail investors." Not only Xiaoju, but early users and major participants interviewed by BlockBeats have also expressed continued optimism about io.net to varying degrees. In the video, Alex mentioned, "Although I don't recommend participating again, I still think io.net is a project worth paying attention to."

"Although we were also counter-lurked, my money was not paid to io.net. First of all, everyone needs to understand this issue," Alex explained to BlockBeats in an interview, "Generally, when you interact with a project, the money cost you invest is taken by the project team, and the project team then decides how to allocate the chips in their hands. But the problem with io.net is that in the process they set up, there are not only retail investors and the project team, but also cloud service providers, retail investors, and the project team. Retail investors pay the money to the cloud service providers, and the cloud service providers do not pay the money to io.net, so from start to finish, io.net pays only for labor costs, operating costs, and the continuously rising expectations of everyone."

A VC member who participated in the io.net investment process told BlockBeats that they were looking for AI projects at the time, and their partner fund introduced them to the io.net project. It took about a month and a half from the initial contact with io.net to the decision to invest. "It showed strong early performance, including various technical documents and the partnership with Render. Among the targets we looked at, io.net was a relatively good one. However, io.net was relatively expensive at the time, with a valuation of $3 billion, so we didn't make an immediate decision. It wasn't until the secondary market valuation went up that this valuation became appropriate."

The investor told BlockBeats that the return on investment from io.net fell far short of their psychological expectations and the actual situation. Originally, they expected that in a good environment, the FDV could reach $5 billion, with an expected profit space of about 10 times. In addition, informed sources told BlockBeats that some investors had early mining equipment running on io.net at a lower cost.

Regarding the various situations that arose later, "In this regard, there is actually no way to control it, we can only observe the later development," said the investor. Technical shortcomings and investor scandals will not be reasons to exit.

Where is the PMF?

The timing of io.net's token issuance has not been determined yet. Although they no longer expect high returns, Zhu Rui and most users still believe that "io.net itself is a good project." "In the crypto industry, product logic is not very important. If you follow the fud logic of io.net, how many crypto products can be deeply investigated?" Zhu Rui told BlockBeats, "After being fud, io.net has also reorganized its product structure, which I think is a good thing. Now that the market is warming up, delaying the token issuance is better than issuing tokens a month ago in a bear market."

The decentralized concept of ownership of assets, which has been evolving for more than a decade, and the AI revolution, where "AI represents productivity, and Web3 represents production relations," no one can deny the enormous imaginative space created by the collision of these two. From VCs to retail investors, there are high expectations for the development of the AI concept.

However, objectively speaking, as a hot narrative of this bull market, the charm of Web3xAI comes from the explosive innovation of AI productivity outside the crypto community. Compared to project categories such as DeFi and Gamefi from previous years, which have distinct crypto characteristics and traceable valuation models, the AI track is completely different. In the research reports of major research institutions, this direction seems to still be in the stage of "describing imaginative space and categorizing existing projects."

ImbaTrader, an early user of io.net, told BlockBeats, "I think the high narrative expectations of io.net may be more due to the web3 market's strong desire for this narrative, rather than the excellence of the io.net project itself."

Questioning of technical expertise and product logic is a situation that all Web3 projects will encounter. The real challenge that io.net needs to address is that in the community's reputation, io seems to have transitioned from being the "top narrative" project of the year to a "VC-backed high FDV" project.

However, the AI narrative still has unquestionable vitality. In an environment of increasingly tight computing power, with io.net continuously refining its own product, it still has significant scale and financial advantages in decentralized computing power. For AI projects, there is already a huge demand for funding, and denying project development solely because of "high FDV" is somewhat one-sided.

In the Web3 world, how to navigate the hot trend is a question that every project needs to consider. Whether to "embrace the bubble" or "seek the sword in the boat," only time can provide the answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。