The bustling world is all for profit; the bustling world is all for profit! Hello everyone, I am your friend Lao Cui Shuo Bi, focusing on the analysis of cryptocurrency market trends, striving to deliver the most valuable market information to the majority of coin friends. Welcome the attention and likes of the majority of coin friends, and refuse any market smokescreen!

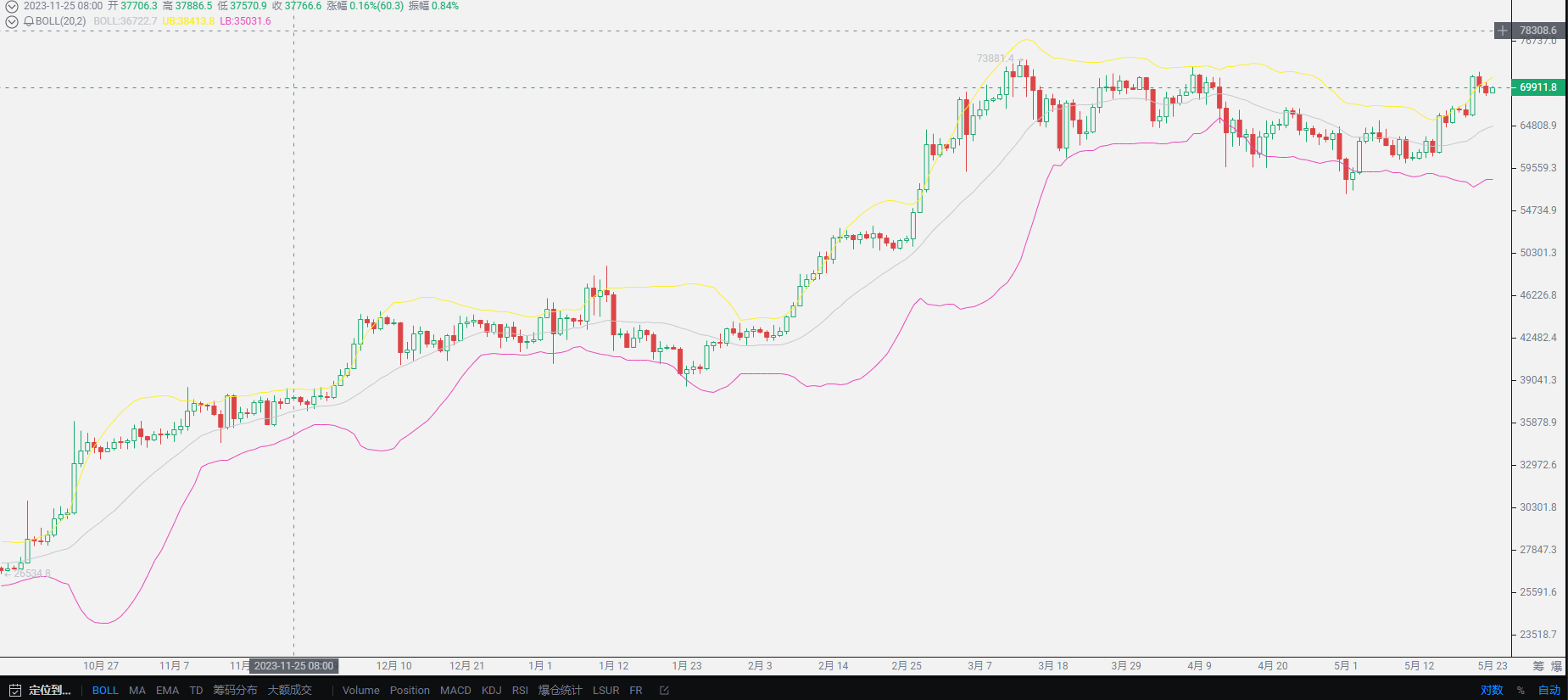

The reversal of the market always catches people off guard. I believe everyone is waiting for Lao Cui's analysis of the future market. After careful analysis and consideration of some news, I have made my own judgment. For the future market, the most important thing is still tomorrow's announcement. After reading the analysis of many peers, it is unanimously believed that the driving force behind this round of rise comes from the signal of Ethereum's listing. Lao Cui agrees with this, but still maintains my own opinion. The main driving force behind this round of rise must come from the listing signal, but you can observe that when the listing signal of Bitcoin ETF arrives, there is not much growth until it is fully listed, and the bull market signal begins to be released. The listing of Ethereum cannot be directly compared with Bitcoin, so there must be another hidden story behind it.

First of all, it is the exchange rate issue that Lao Cui has been asking everyone to pay attention to. Currently, it seems that USDT has started to compete for the 7.2 level, which Lao Cui has always emphasized as a prerequisite for the arrival of the bull market. The recent growth of Ethereum and Bitcoin is definitely due to the decline in the exchange rate, which once fell to around 7.15. This allowed the market to release some funds and intervene in the currency circle. Secondly, it is the accumulation of funds. The current existing amount of funds in the market will not support a significant decline in Bitcoin and Ethereum. Especially in Bitcoin, a large amount of funds has been gathered, with the most prominent fund movement being the entry of traditional funds, indicating that the currency circle is no longer dominated solely by Grayscale. The dispersion of giants is even more of a driving force for the rise in the currency circle.

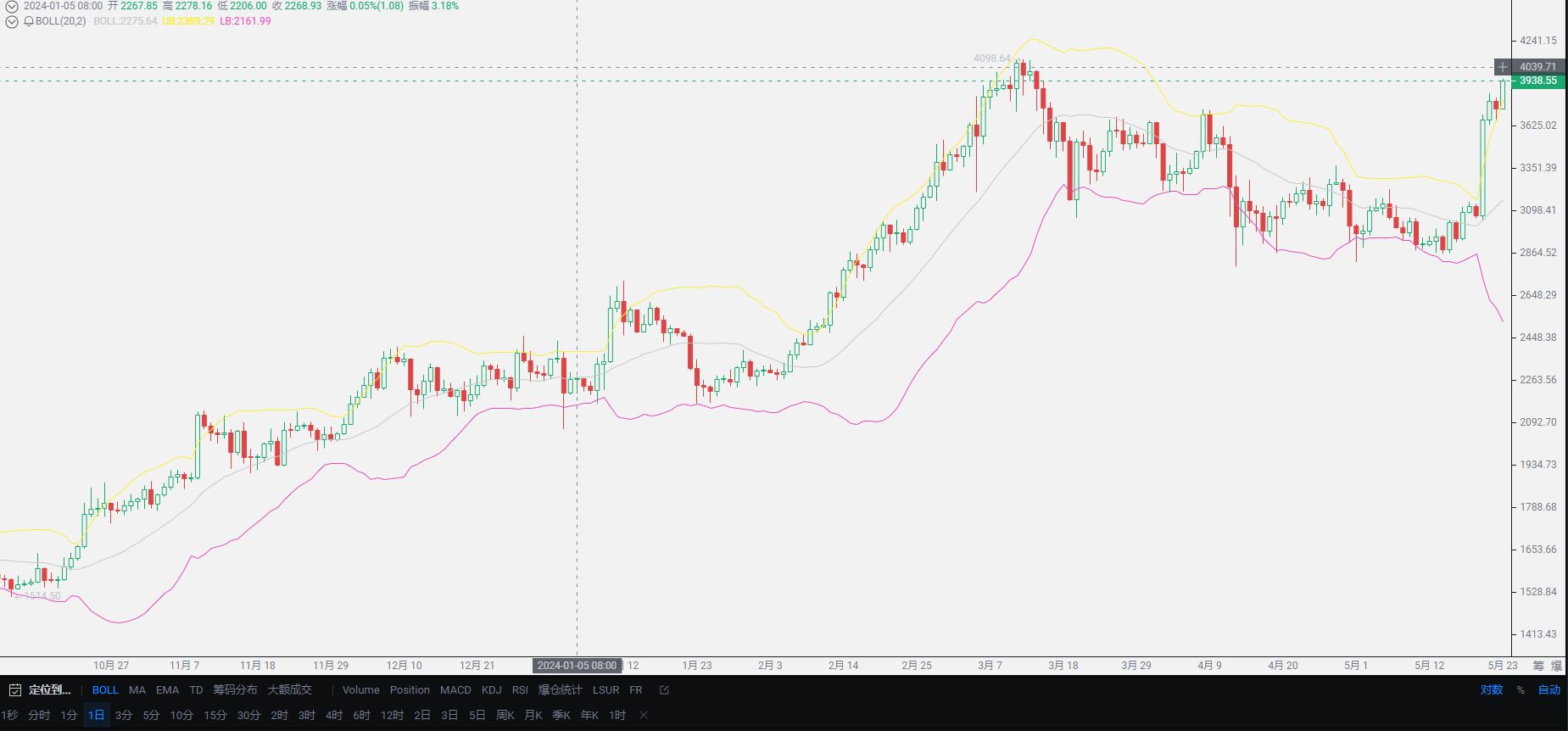

Why ignore the growth of the market, based on the signal of Ethereum's listing. Everyone should be clear that the listing signal does not mean formal listing. The amount of funds gathered by Ethereum is not traditional funds. It can be said that the early arrival of this round of growth is unpredictable for everyone. Although Lao Cui mentioned earlier that growth would come at the end of May, the high position is indeed beyond Lao Cui's expectations. The probability of Ethereum's approval was decided temporarily, showing a somewhat irresponsible attitude. It is precisely the appearance of this market that has filled the market with its unique charm. It has also attracted a wave of external fund inflows. The above paragraphs can be considered as hindsight, and now we will get to the point, how will the future market develop?

For the future market, the focus that everyone needs to pay attention to has now shifted back to the announcement of the listing. Currently, the timing and favorable conditions are in place, with both timing and favorable conditions. As long as there is no denial, the probability of the announcement of the listing being announced on time will likely continue the upward trend of the market. The only concern for Lao Cui is that the unusual accumulation of funds in this round is quite unusual. The news of Bitcoin's listing did not cause much of a stir, and it was not until the listing was imminent that it caused a surge. For us, the early accumulation of funds is more like they have received some kind of confirmation, and internal news from the United States has leaked out. The signal of the listing has basically come true, coupled with the assistance of the exchange rate, this round of rise is very advantageous for Ethereum.

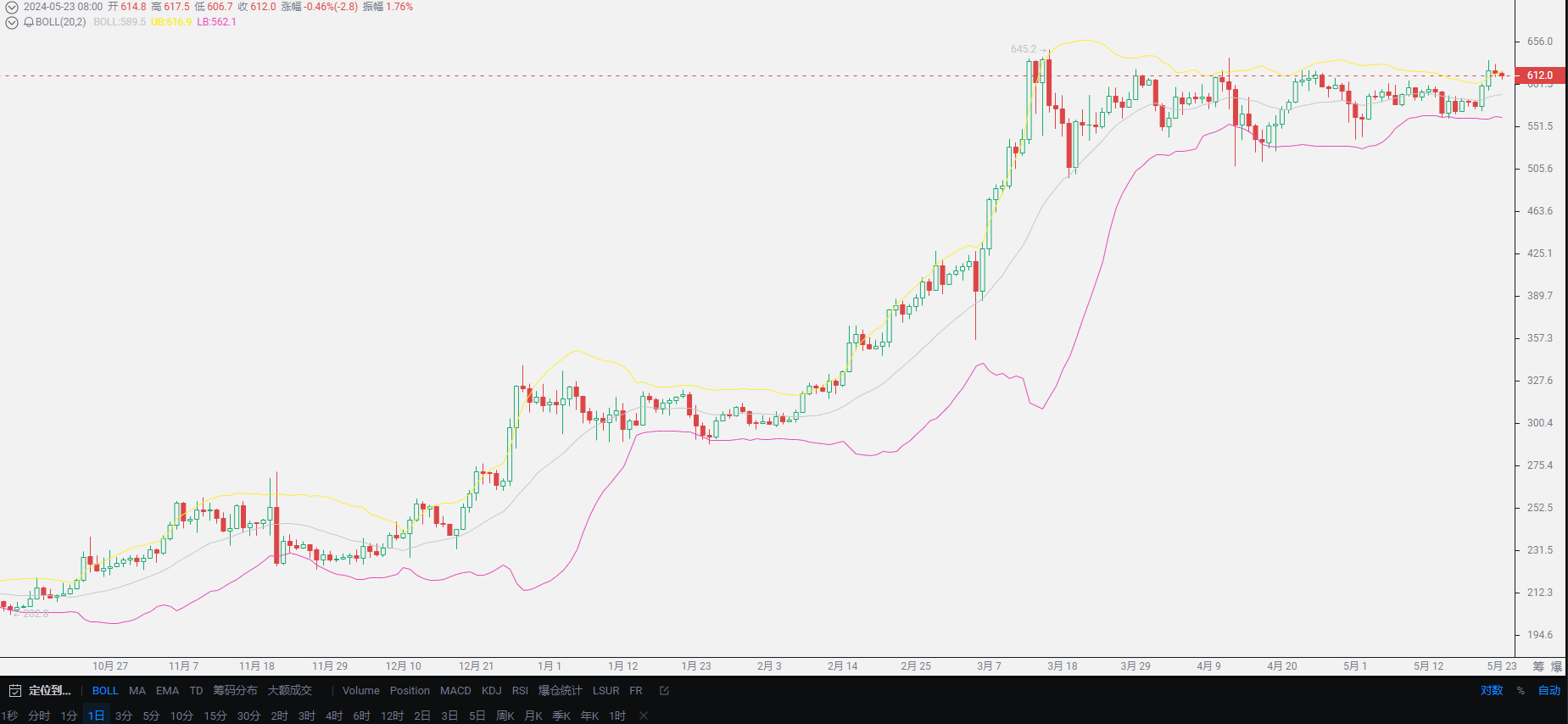

The current dominant advantage lies in the long direction. Many friends should not always think of going against the trend. As long as it is a long-term growth, it should be in line with the timing. For those who want to lay short positions, wait until after the announcement to make a decision. After the announcement is approved, this round of growth will not continue indefinitely. What needs to rise has already continued to grow. Do not have overly high expectations for the future market. The remaining market trends will mostly revolve around harvesting. From this paragraph, everyone should understand that the growth of Ethereum has almost continued for nearly 800 points. The overall global economic situation will not support such a high position. Currently, there is still space above, and in the short term, it will continue to move in the direction of the long side. However, from a long-term perspective, the downside space of the entire currency circle is greater than the upside space. This trend will continue until Ethereum is officially listed and the aspect of interest rate reduction comes, only then will there be a complete reversal. Currently, it can only be considered as a minor disturbance.

As mentioned earlier in the article, the future trend of Ethereum is definitely better than that of Bitcoin. Congratulations to everyone who has been holding spot positions, as you have held Ethereum below 3000 for a long time. For Lao Cui's goal, a profit of 500 points from spot Ethereum is already satisfactory, and you can grasp the remaining profit space on your own. The era of Ethereum reaching four thousand will come, but whether it can stabilize is a topic that needs attention. Although Ethereum is currently maintaining a growth trend, traditional funds have not entered in large numbers, there are measures to bottom fish, but there has been no change in the trend of funds. Spot users can exit in batches without being greedy. Lao Cui's proposition has always been not to look for absolute highs, and to exit when there is a relative high point that can make a profit, and Lao Cui will notify everyone when to re-enter. If you have any detailed questions, you can ask Lao Cui directly. This article does not involve specific price points and does not provide any investment advice.

Original article from public account: Lao Cui Shuo Bi. For assistance, please contact Lao Cui directly.

Lao Cui's message: Investment is like playing chess. Masters can see five steps, seven steps, or even a dozen steps ahead, while those with lower skills can only see two or three steps. The high-level players consider the overall situation, plan for the general trend, and do not focus on every single move, but aim to win the game in the end. The lower-level players fight for every inch, frequently switching between long and short positions, only fighting for short-term gains, and frequently end up in trouble.

This material is for learning and reference only and does not constitute buying or selling advice. Buying or selling based on this material is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。